Overview

Understanding the interest rates associated with home equity loans is crucial for many families. We know how challenging it can be to navigate borrowing costs and monthly payments. These rates can significantly impact your financial decisions, especially when considering leveraging your property equity for various needs.

Several factors play a role in determining these interest rates:

- Credit scores

- Loan-to-value ratios

- Market conditions

These are just a few elements that can influence what you pay. Recognizing how these factors work together can empower you to make informed choices.

Ultimately, being aware of how interest rates affect your financial situation is essential. We’re here to support you every step of the way as you explore your options and find the best solutions for your family.

Introduction

Understanding the intricacies of home equity loans is essential for homeowners looking to leverage their property’s value. We know how challenging this can be. These loans not only provide access to funds for renovations and debt consolidation, but they also come with varying interest rates that can significantly impact your financial decisions.

As you navigate the complexities of borrowing against your equity, a critical question arises: how do fluctuations in interest rates affect your monthly payments and overall affordability? This article delves into the key factors influencing interest rates for home equity loans and explores the implications for borrowers in 2025.

We’re here to support you every step of the way.

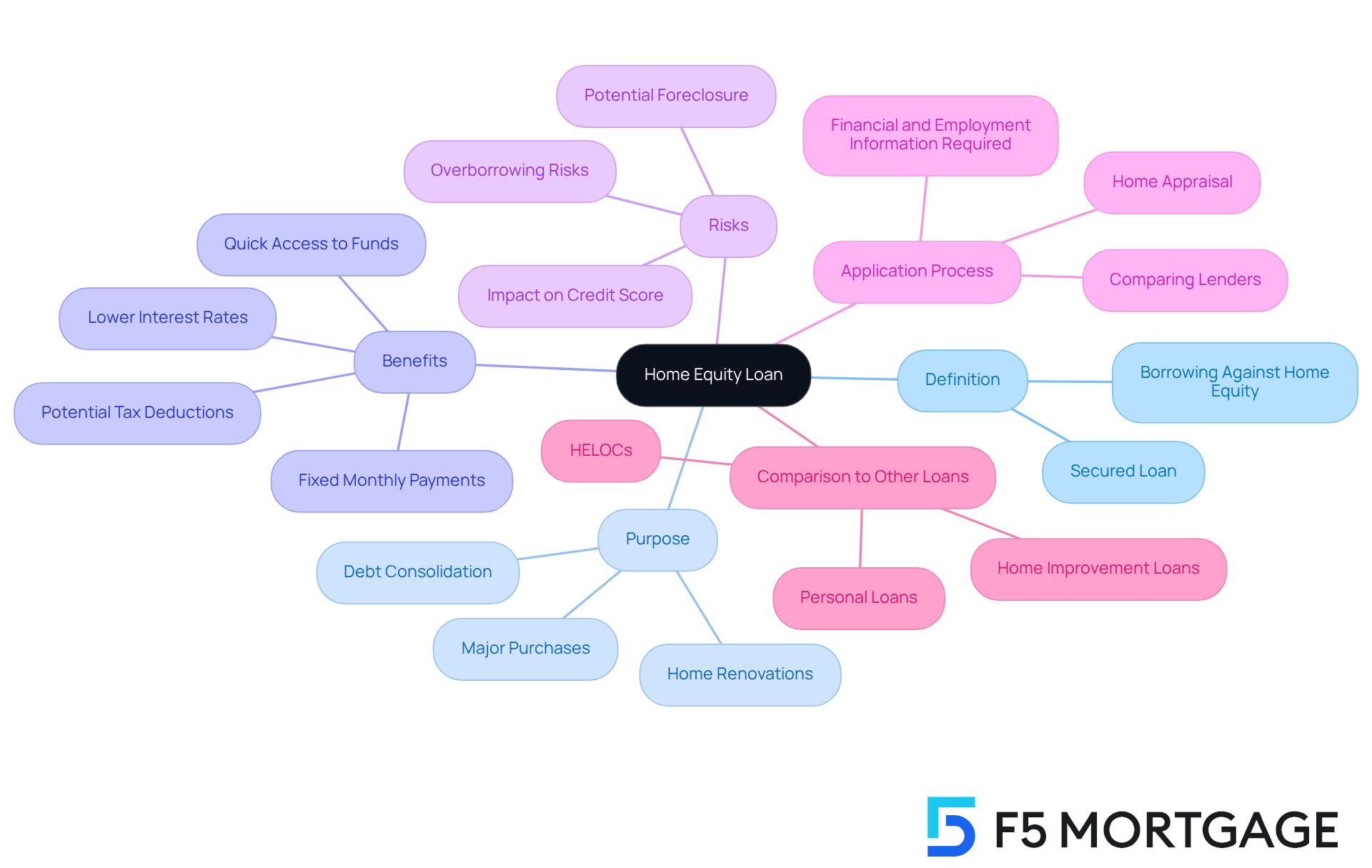

Define Home Equity Loan and Its Purpose

A property equity financing option offers a valuable opportunity for property owners to borrow against the value accrued in their asset. This value is essentially the difference between the property’s current market worth and the remaining mortgage balance. The primary goal of this financing is to provide property owners with access to funds for various needs, such as renovations, debt consolidation, or major purchases. Since these loans are secured by the property itself, it’s important to understand that failing to repay could result in the lender seizing the house as collateral. However, this security often leads to more favorable conditions, including a lower interest rate for home equity loan when compared to unsecured financing.

In 2025, the average equity borrowing amount is expected to range from five to six figures, reflecting the substantial equity many property owners have built up. For example, homeowners frequently use these loans for renovations that can enhance property value, like kitchen remodels or bathroom upgrades. These improvements not only increase comfort but can also provide a return on investment when selling the property.

F5 Mortgage is dedicated to offering attractive terms and user-friendly technology to simplify the refinancing process, making it easier for homeowners to access their equity. With a swift closing time of under three weeks, homeowners can quickly secure the funds they need. Additionally, property owners may benefit from eliminating private mortgage insurance (PMI) through refinancing, particularly in markets with significant property appreciation trends like California. This can be accomplished by recalculating the new loan-to-value (LTV) ratio based on the home’s increased value.

Home value financing options are particularly beneficial for individuals looking to fund substantial projects without impacting their current mortgage rates. As industry experts suggest, these financial products can provide a stable solution for homeowners planning long-term improvements. Moreover, utilizing a residential value credit for significant property enhancements may allow property owners to receive tax deductions on interest, as indicated by the IRS.

However, it’s crucial to remain aware of the risks associated with property ownership financing, such as the potential for foreclosure if payments are missed. The application process for property value financing is similar to applying for a mortgage, requiring the submission of financial and employment details. Property owners are encouraged to compare various lenders, including F5 Mortgage, to ensure they secure the best offer. With credit card interest rates currently exceeding 22% on average, the becomes a more appealing option for debt consolidation.

In summary, understanding the purpose and benefits of property value loans can empower property owners to make informed financial decisions. We know how challenging this can be, and we’re here to support you every step of the way.

Explain the Importance of Interest Rates in Home Equity Loans

Interest levels play a vital role in property financing, influencing both the cost of borrowing and monthly payments. We understand how a lower interest rate for home equity loans can ease financial burdens, resulting in more manageable monthly payments for homeowners looking to tap into their home’s value. Conversely, a higher interest rate for home equity loans can significantly increase the total cost of borrowing over time, which is a concern for many. As of July 30, 2024, the average residential financing interest was about 8.25%. This reflects the financial landscape of 2025, where many homeowners view their properties as crucial financial resources amid recession fears.

The interest rate for home equity loans can change based on:

- Market conditions

- The Federal Reserve’s monetary policy

- Individual factors like credit scores and loan-to-value ratios

Recognizing these dynamics is essential for homeowners considering the interest rate for a home equity loan against their properties, as it can greatly impact their financial health and future planning. JP Kelly, SVP of Mortgage at MeridianLink, notes, “Homeowners acknowledge the possibilities of home financing, but many remain on the sidelines because of financial uncertainty and insufficient knowledge about their choices.”

Moreover, a recent study revealed that over 47% of mortgaged residential properties are considered rich in value, presenting a growing opportunity for homeowners to leverage their assets strategically. Yet, despite this potential, 54% of homeowners hesitate to utilize their assets, primarily due to high borrowing costs and concerns about repayment terms. This is where F5 Mortgage can make a difference. By comparing prices, costs, and terms, homeowners can uncover competitive options that suit their needs.

It’s crucial for homeowners to connect with a trusted lender like F5 Mortgage. We’re here to support you every step of the way, providing clarity and guidance to help you make that align with your long-term financial goals.

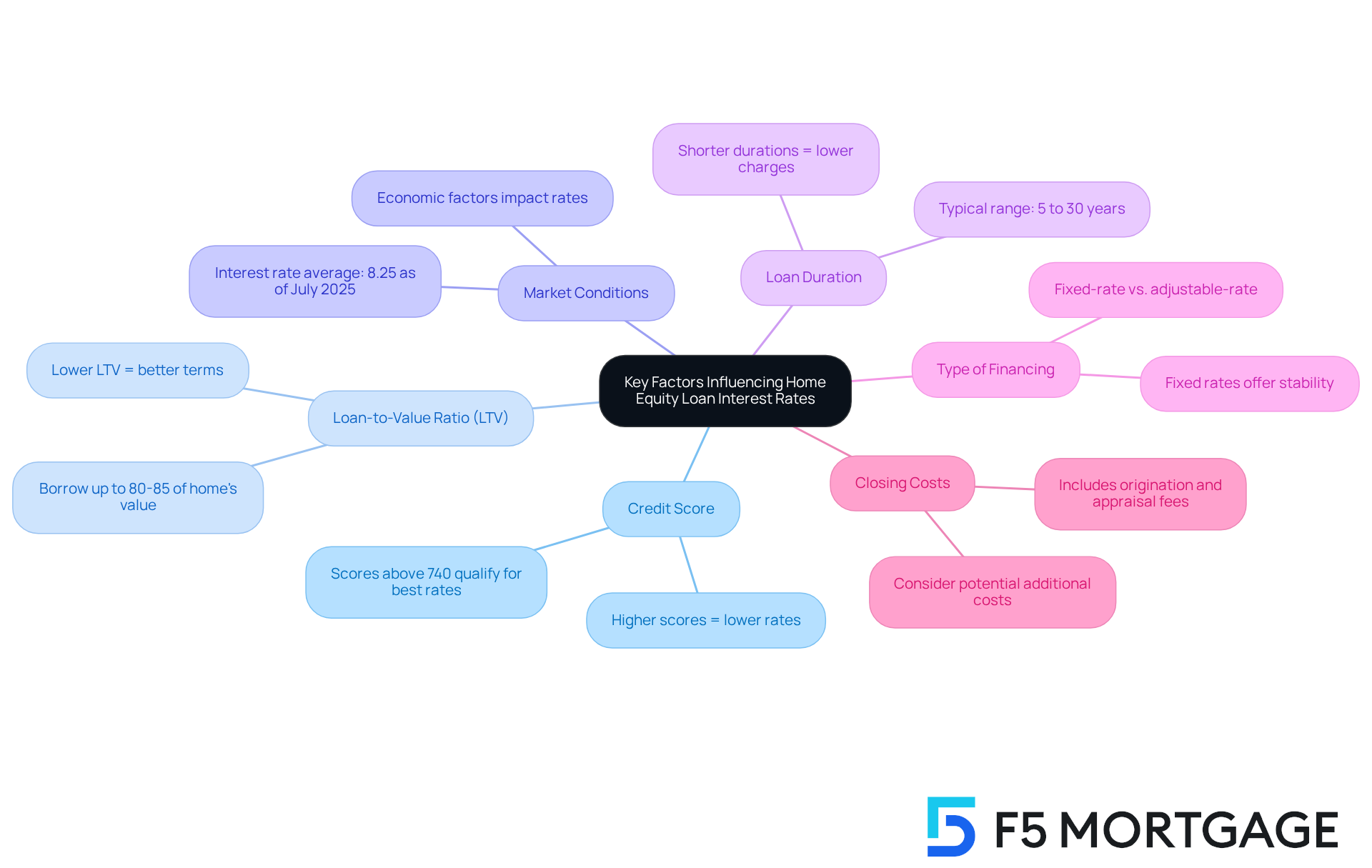

Identify Key Factors Influencing Home Equity Loan Interest Rates

When considering a , several essential elements can significantly influence the interest rate for .

- Credit Score: We understand how crucial your credit score is. A higher score often leads to lower interest charges, indicating to lenders that you’re a less risky borrower. If your score is above 740, you may qualify for the best rates, while lower scores could mean higher costs.

- Loan-to-Value Ratio (LTV): This ratio compares the amount you wish to borrow to your property’s assessed value. In 2025, most borrowers can secure up to 80-85% of their home’s worth. A lower LTV suggests you have more ownership in your property, which can lead to better terms.

- Market Conditions: Economic factors, like inflation and the state of the housing market, can greatly impact interest levels. As of July 30, 2025, the interest rate for home equity loan averages 8.25%, providing an opportunity for homeowners to secure favorable terms. Once your application is approved, locking in your mortgage terms can protect you from market fluctuations during processing.

- Loan Duration: The length of your loan also plays a role in the interest charged. Generally, shorter durations come with lower charges compared to longer ones. Home financing options typically range from five to 30 years, with fixed interest rates offering stability against future increases.

- Type of Financing: It’s essential to understand the difference between fixed-rate and adjustable-rate mortgages. Fixed-rate loans often start with higher initial rates, while adjustable-rate mortgages may begin lower but can change over time. Knowing these differences can help you make informed choices about your property value credit.

- Closing Costs: Lastly, don’t forget to consider potential closing costs associated with property value loans. These may include origination fees, appraisal fees, and other related expenses.

By keeping these factors in mind, you can navigate the complexities of property financing more effectively and enhance your financing options.

Analyze How Interest Rates Impact Monthly Payments and Loan Affordability

Interest levels directly impact the monthly payments on home equity financing, particularly concerning the interest rate for home equity loans, and we know how challenging this can be for homeowners. For instance, borrowing $50,000 at an interest rate of 5% for 15 years results in a monthly payment of roughly $395. However, if the interest rate rises to 8%, the monthly payment increases to about $432. This $37 difference may seem minor at first glance, but it accumulates to significant extra expenses over time. For example, a $100,000 property-backed loan at a 7.60% interest rate leads to a monthly payment of $664.63, illustrating how variations in loan amounts and interest rates can greatly affect monthly payments.

Moreover, the interest rate for home equity loans can limit the amount of capital homeowners feel comfortable utilizing, as they may hesitate to take on larger payments. This can hinder their ability to fund property enhancements or consolidate debt effectively. With the currently as low as 6.99%, it’s crucial for property owners to carefully consider how these figures influence their financial capacity and borrowing decisions. As of June 16, 2025, the average rate for a 15-year fixed mortgage was 5.97%, providing a useful context for understanding home equity financing.

Understanding how the interest rate for home equity loans impacts monthly payments is essential for homeowners to assess their financial capabilities and make informed borrowing choices. Once your application is approved with F5 Mortgage, locking in your mortgage rates can protect you from market fluctuations during the processing period, ensuring you secure the best possible terms for your financing. As LendingTree’s chief consumer finance analyst, Matt Schulz, notes, there’s reason to be optimistic that home equity loan rates may decrease in the coming months, potentially impacting borrowing strategies.

It’s also important to recognize that some demographics may face barriers to refinancing, complicating their financial decisions in today’s market. We’re here to support you every step of the way as you navigate these challenges and make the best choices for your financial future.

Conclusion

Understanding the intricacies of interest rates for home equity loans is essential for homeowners looking to leverage their property’s value. These loans provide a significant opportunity to access funds for various needs. However, the interest rates associated with them can greatly influence the overall cost of borrowing and monthly financial commitments. By grasping the nuances of how interest rates operate, homeowners can make informed decisions that align with their financial goals.

This article delves into several critical factors that affect the interest rates for home equity loans, including:

- Credit scores

- Loan-to-value ratios

- Prevailing market conditions

Even a slight change in interest rates can lead to substantial differences in monthly payments, highlighting the importance of securing favorable terms. Additionally, the potential benefits of using home equity loans for renovations or debt consolidation are discussed, showcasing their role in enhancing financial flexibility.

Ultimately, the significance of understanding interest rates in the context of home equity loans cannot be overstated. As homeowners navigate their financial landscapes, being well-informed about how these rates impact borrowing decisions is crucial. Engaging with trusted lenders and exploring competitive options can empower homeowners to utilize their property’s equity effectively. We know how challenging this can be, and we’re here to support you every step of the way, ensuring you make choices that support your long-term financial well-being.

Frequently Asked Questions

What is a home equity loan?

A home equity loan is a property equity financing option that allows property owners to borrow against the value accrued in their asset, which is the difference between the property’s current market worth and the remaining mortgage balance.

What is the primary purpose of a home equity loan?

The primary purpose of a home equity loan is to provide property owners with access to funds for various needs, such as renovations, debt consolidation, or major purchases.

What are the risks associated with a home equity loan?

The main risk associated with a home equity loan is that if the borrower fails to repay the loan, the lender could seize the house as collateral.

How do home equity loans compare to unsecured financing?

Home equity loans are often secured by the property itself, which typically leads to more favorable conditions, including lower interest rates compared to unsecured financing.

What can homeowners use home equity loans for?

Homeowners frequently use home equity loans for renovations that can enhance property value, such as kitchen remodels or bathroom upgrades, as well as for debt consolidation or major purchases.

What is the expected average equity borrowing amount in 2025?

In 2025, the average equity borrowing amount is expected to range from five to six figures, reflecting the substantial equity many property owners have built up.

How can refinancing impact private mortgage insurance (PMI)?

Homeowners may benefit from eliminating private mortgage insurance (PMI) through refinancing, particularly in markets with significant property appreciation, by recalculating the new loan-to-value (LTV) ratio based on the home’s increased value.

What is the application process for a home equity loan?

The application process for a home equity loan is similar to applying for a mortgage and requires the submission of financial and employment details.

Why might homeowners consider a home equity loan for debt consolidation?

Home equity loans may be more appealing for debt consolidation due to their lower interest rates compared to credit card interest rates, which currently exceed 22% on average.

What potential tax benefits are associated with home equity loans?

Utilizing a residential value credit for significant property enhancements may allow property owners to receive tax deductions on interest, as indicated by the IRS.