Overview

Understanding the difference between interest rates and APR in mortgages is essential for your financial journey. The interest rate only reflects the cost of borrowing the principal amount. In contrast, APR encompasses the interest rate along with additional fees and costs associated with the loan. This broader perspective provides a clearer picture of your total borrowing expenses.

Recognizing this distinction is crucial, as it can significantly influence your financial decisions. Different fees can lead to varying APRs, even when interest rates appear similar. We know how challenging this can be, and we’re here to support you every step of the way. By grasping these concepts, you can make informed choices that align with your family’s needs.

Introduction

Navigating the complexities of mortgage financing can often feel overwhelming, especially when trying to understand the terms “interest rate” and “APR.” We know how challenging this can be. These two concepts are crucial in determining the total cost of borrowing, yet they are frequently misunderstood. By exploring the essential differences between these terms, you can gain valuable insights that not only clarify your mortgage options but also empower you to make informed financial decisions.

What happens when a seemingly low interest rate hides higher hidden costs? This article delves into the critical distinctions between interest rates and APR, revealing how these factors influence mortgage affordability and your overall financial health. We’re here to support you every step of the way as you navigate this important journey.

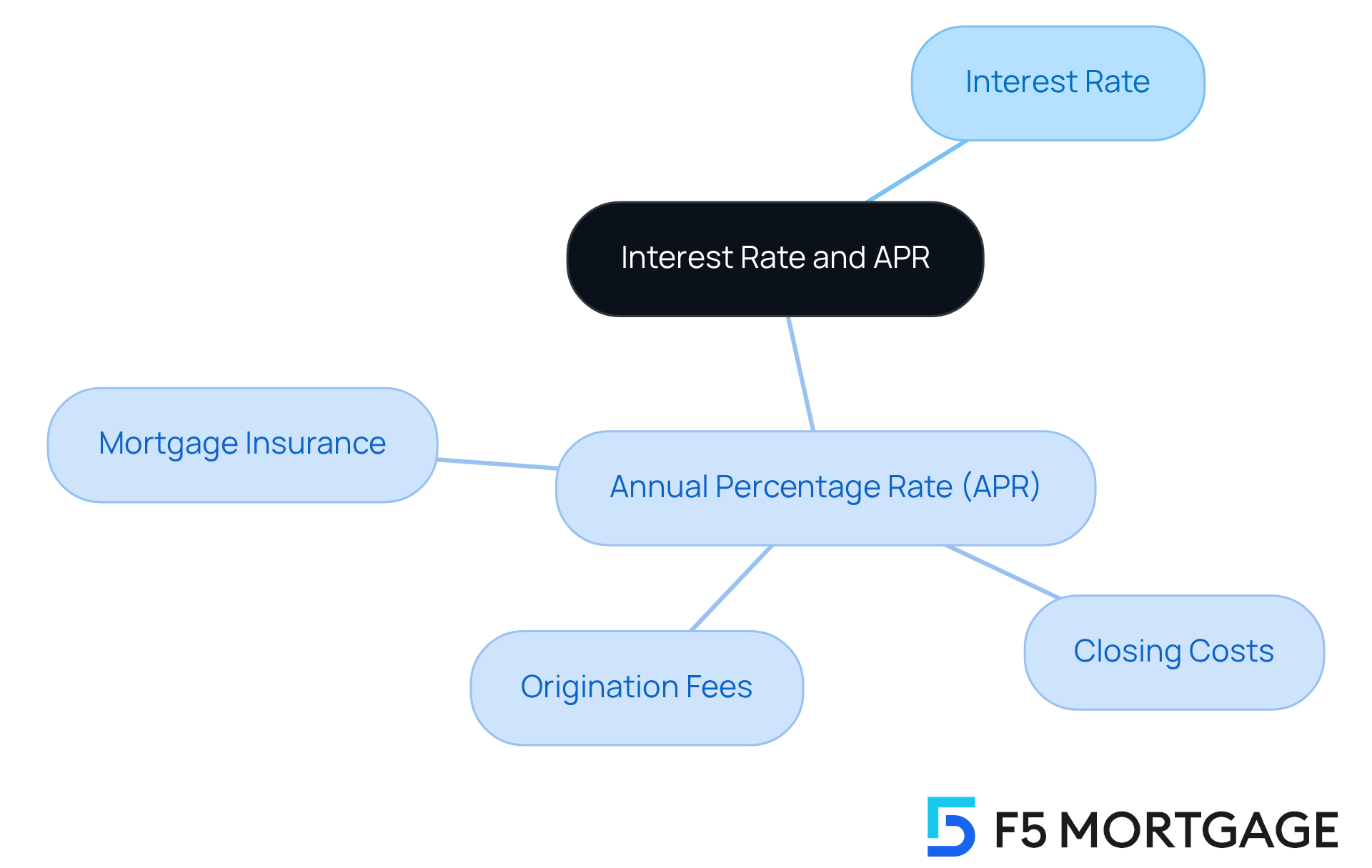

Define Interest Rate and APR

Understanding the costs associated with borrowing can feel overwhelming, and we know how challenging this can be. The percentage is the portion of the borrowed sum that a creditor imposes on a debtor for utilizing their funds, typically expressed as an annual figure. This figure directly influences your monthly mortgage payments and the overall expenditure of financing over time.

But there’s more to consider. The Annual Percentage Rate (APR) illustrates the difference between rate and APR, as it encompasses more than just the interest percentage. It includes any extra expenses or charges related to acquiring the financing, such as:

- Origination fees

- Closing costs

- Mortgage insurance

This highlights the difference between rate and APR as a more comprehensive measure of the actual expense of borrowing. It reflects the total cost of the loan expressed on an annual basis, empowering you to make informed decisions.

By understanding these terms, you can better navigate the mortgage process and feel more confident in your financial choices. We’re here to support you every step of the way.

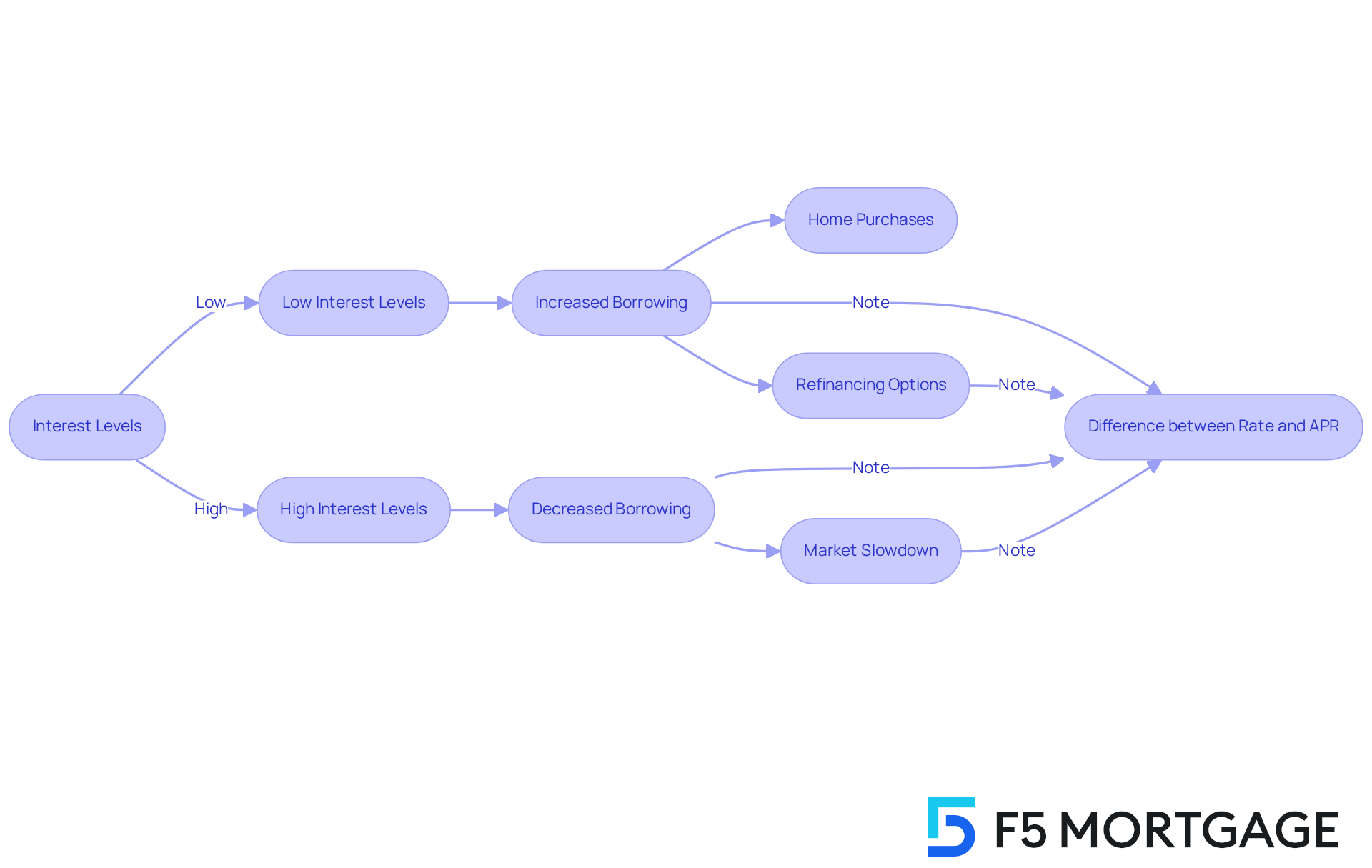

Contextual Importance of Interest Rates and APR in Mortgages

Interest levels and the difference between rate and APR are significant factors in the mortgage market, influencing both lender practices and borrower decisions. We understand how challenging it can be to navigate these waters. When interest levels are low, borrowing becomes more economical, encouraging families to consider home purchases and refinancing options. Conversely, elevated interest levels can discourage prospective buyers, leading to a slowdown in the housing market.

Moreover, grasping the difference between rate and APR is crucial for borrowers. It provides a clearer perspective on the overall cost of a mortgage, empowering families to make informed choices when evaluating financing proposals. This understanding can make a real difference in their financial well-being. We’re here to support you every step of the way as you explore your options in mortgage financing.

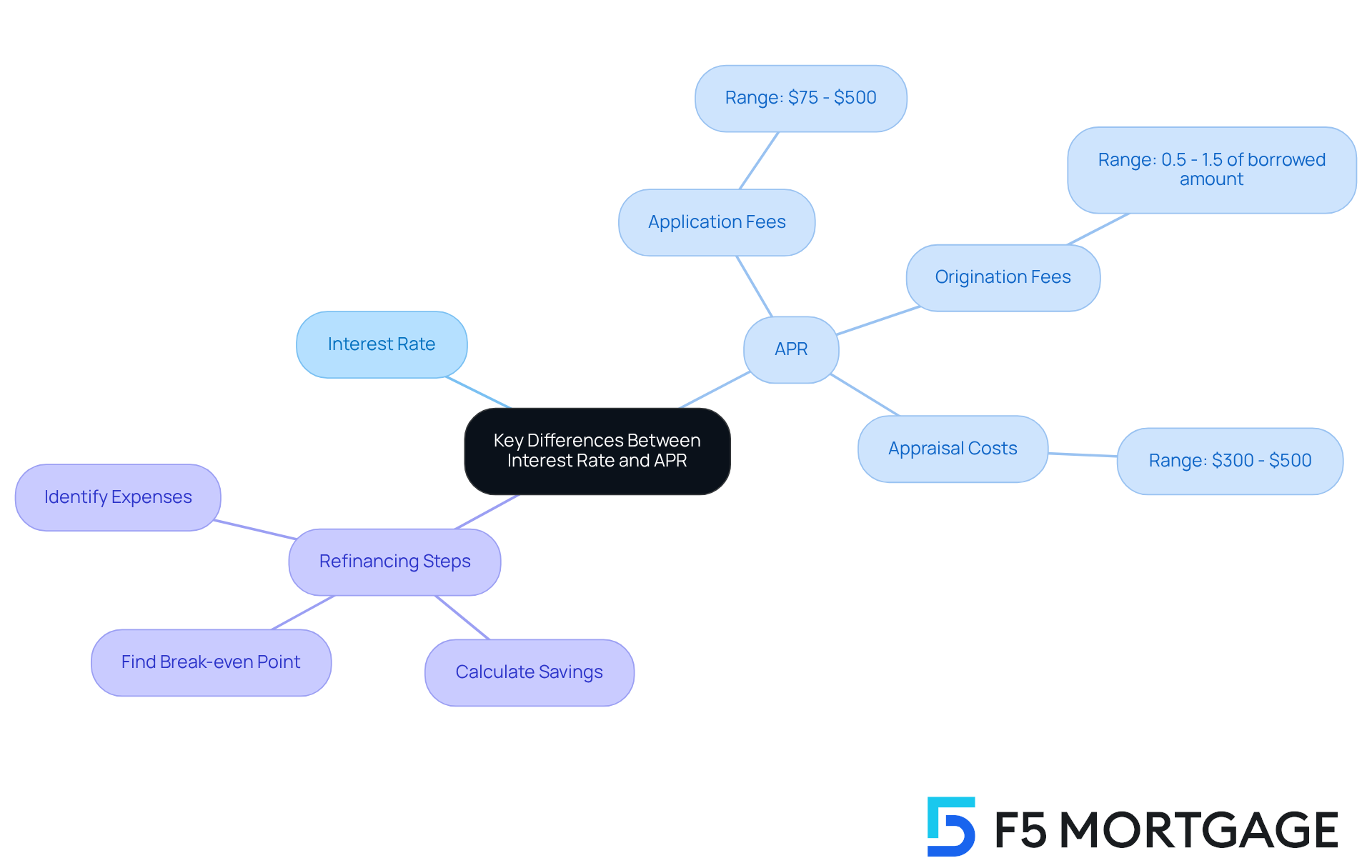

Key Differences Between Interest Rate and APR

Understanding the difference between rate and APR is crucial for making informed financial decisions. The cost of borrowing is simply the percentage of the principal sum, while APR provides a broader view, including any additional charges or fees associated with the loan. These can include:

- Application fees (ranging from $75 to $500)

- Origination fees (between 0.5% and 1.5% of the borrowed amount)

- Appraisal costs (typically between $300 and $500)

Imagine this: you find a loan with a low percentage but high fees. Surprisingly, it could have a higher APR than another loan with a slightly higher percentage but lower fees. This distinction is vital for borrowers like you, as it significantly impacts the total cost of your mortgage. When comparing loan offers, it’s important to understand the difference between rate and APR. This way, you can determine which option is truly more beneficial for your financial future.

Moreover, understanding the costs related to refinancing, such as title insurance and attorney fees, is essential for figuring out your break-even point. To help you navigate this process, here are three simple steps:

- Identify all your refinancing expenses, including closing costs and fees.

- Calculate your monthly savings by subtracting your new monthly payment from your current payment.

- Divide your refinancing expenses by your monthly savings to find out how many months it will take to reach that break-even point.

By carefully assessing your refinancing expenses and monthly savings, you can make choices that align with your financial goals. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

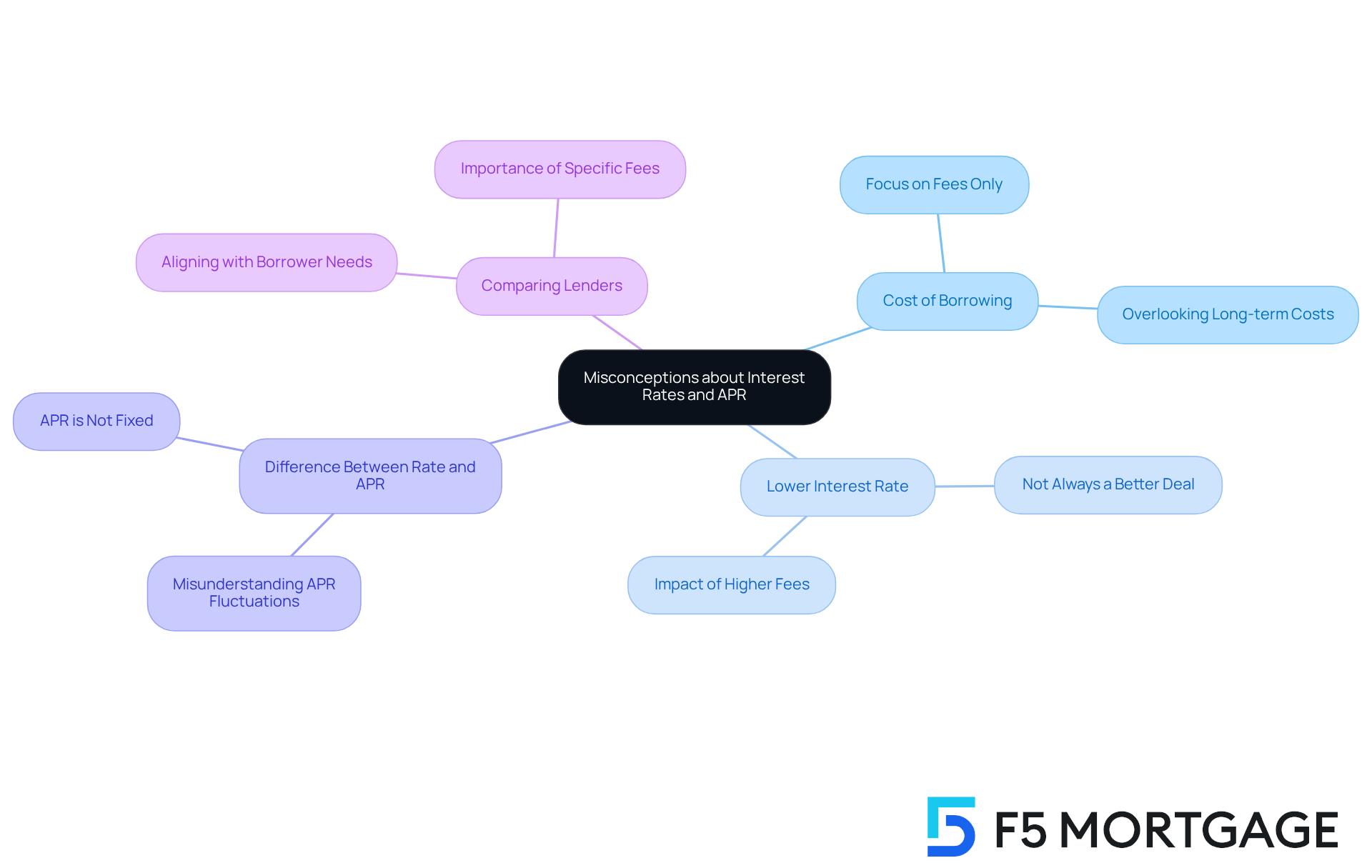

Common Misconceptions About Interest Rates and APR

One prevalent misunderstanding we often encounter is that the cost of borrowing is the only factor to consider when assessing a mortgage. Many borrowers focus solely on the fee, overlooking the difference between rate and APR, which is significant. This oversight can lead to unexpected expenses over the life of the loan.

Another common misconception is that a lower interest rate always means a better deal. However, this may not hold true if higher fees lead to a greater difference between rate and APR. Additionally, some borrowers mistakenly believe that the difference between rate and APR is non-existent, viewing APR as a fixed number. In reality, it can fluctuate based on the loan terms and the borrower’s financial profile.

Understanding these misconceptions is vital for making informed choices in the mortgage process. We know how challenging this can be, and we’re here to support you every step of the way.

When searching for lenders, it’s essential to compare specific fees, expenses, and conditions to ensure they align with your needs. F5 Mortgage offers attractive pricing and personalized support, making it a wonderful option for families looking to improve their homes. Locking in your mortgage rate with F5 Mortgage can also provide peace of mind as you navigate the complexities of securing a loan.

Conclusion

Understanding the distinction between interest rates and APR is essential for anyone navigating the mortgage landscape. We know how challenging this can be. While the interest rate represents the cost of borrowing money, APR provides a more comprehensive view by including additional fees and expenses associated with the loan. This knowledge empowers borrowers to make informed decisions, ensuring that they select the most beneficial financial options for their circumstances.

Throughout the article, we’ve highlighted key points, emphasizing the importance of recognizing how interest rates and APR impact overall mortgage costs. From the influence of low or high rates on the housing market to the common misconceptions that can lead to costly mistakes, each aspect underscores the necessity of thorough research and understanding. Borrowers must assess not just the interest rate but also the fees that contribute to the APR to gain a complete picture of their mortgage expenses.

Ultimately, being well-informed about the differences between rate and APR can significantly enhance financial well-being. As families explore mortgage options, they are encouraged to compare specific costs and seek guidance from reputable lenders. By doing so, they can navigate the complexities of mortgage financing with confidence, making choices that align with their long-term financial goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is an interest rate?

An interest rate is the percentage of the borrowed sum that a creditor charges a debtor for using their funds, typically expressed as an annual figure.

How does the interest rate affect borrowing costs?

The interest rate directly influences your monthly mortgage payments and the overall expenditure of financing over time.

What is the Annual Percentage Rate (APR)?

The APR is a more comprehensive measure than the interest rate, as it includes not only the interest percentage but also any extra expenses or charges related to acquiring the financing.

What additional costs are included in the APR?

The APR includes costs such as origination fees, closing costs, and mortgage insurance.

Why is understanding the difference between interest rate and APR important?

Understanding the difference helps borrowers gauge the total cost of the loan on an annual basis, empowering them to make informed financial decisions.