Overview

This article highlights seven effective steps to enhance your mortgage credit score, focusing on crucial actions like:

- Making timely bill payments

- Reducing credit card balances

- Checking credit reports for inaccuracies

We understand how challenging this can be, and these strategies are backed by evidence showing that a higher credit score can lead to significantly lower mortgage rates and better loan options. Ultimately, this can make homeownership more affordable and accessible for you. We’re here to support you every step of the way.

Introduction

Understanding the nuances of mortgage credit scores is essential for anyone looking to secure favorable loan terms. We know how challenging this can be. A higher score can lead to lower interest rates and better borrowing conditions, potentially saving thousands over the life of a mortgage. However, many individuals remain unaware of the steps they can take to improve their scores and the significant impact this can have on their financial future. We’re here to support you every step of the way.

What strategies can you implement to enhance your mortgage credit score and unlock the door to better lending options?

Understand the Importance of Your Mortgage Credit Score

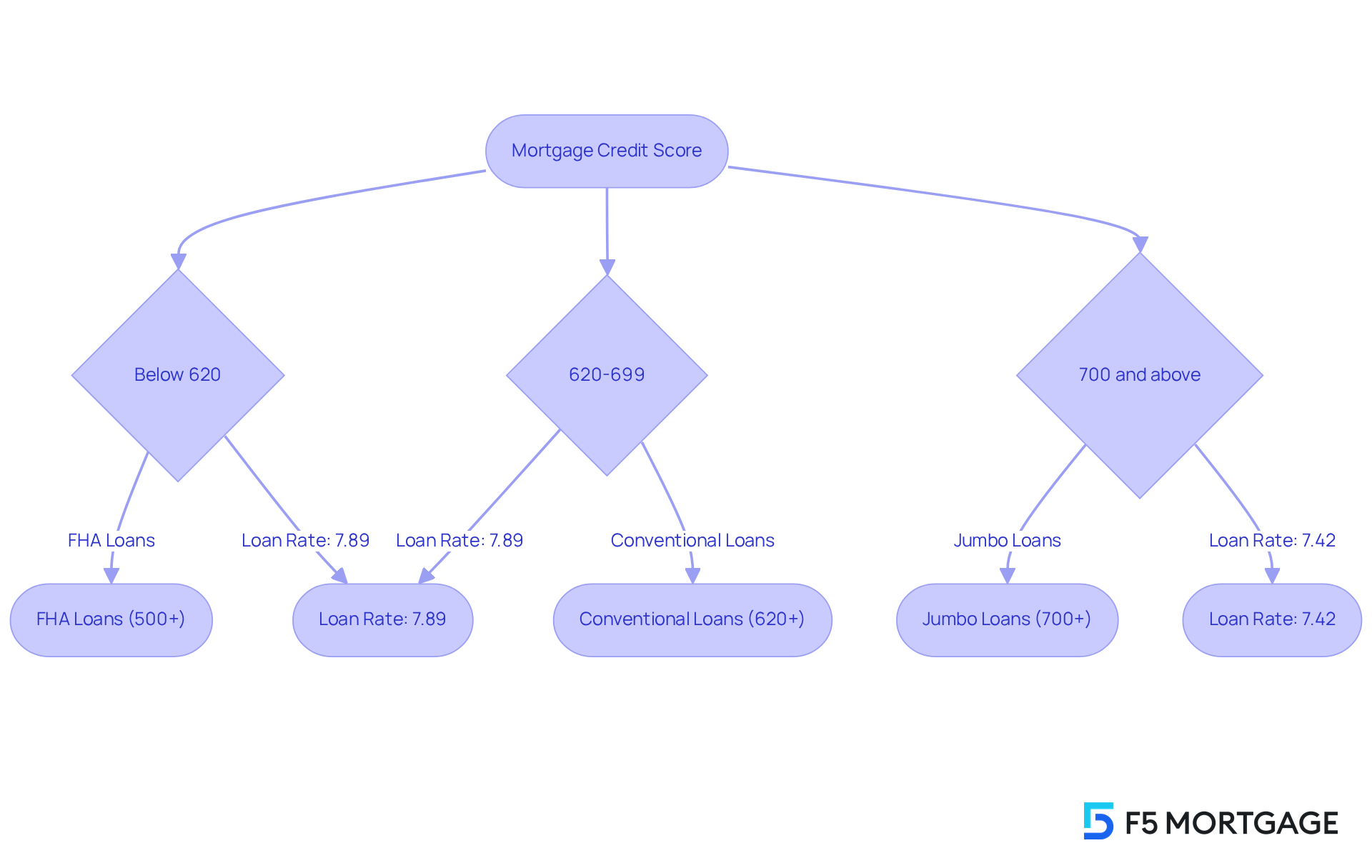

Your is crucial in how lenders assess your financial reliability. We know how challenging this can be, but an increased mortgage credit score can significantly lower your home loan rates and improve your borrowing conditions, potentially saving you thousands over the life of your loan. For instance, individuals with a rating of 700 might secure an average loan rate of 7.42% as of January 3, 2025. In contrast, those with ratings below 620 could face rates as high as 7.89% for a conventional financing option. This striking difference underscores the importance of striving for a higher rating.

Moreover, maintaining a healthy mortgage credit score not only enhances your chances of obtaining a favorable mortgage agreement but also expands your access to various lending options. For example:

- FHA loans are available to borrowers with ratings as low as 500, provided they can make a larger down payment.

- Conventional loans typically require a minimum rating of 620.

- Jumbo loans necessitate a rating of 700 or above.

The benefits of a high rating extend beyond just home loan rates; they can also lead to reduced auto insurance costs and better card rewards. By taking proactive steps to improve your mortgage credit score—such as paying bills on time, lowering utilization, and disputing inaccuracies on your report—you can unlock substantial long-term savings and better housing options. In fact, consumers could save up to 1% in interest on home loans with improved ratings, further emphasizing the importance of financial management.

In summary, understanding the impact of your mortgage credit score is vital for effectively navigating the home purchasing process. By focusing on enhancing your mortgage credit score, you can secure better loan rates and conditions, making your journey to homeownership smoother and more affordable. If you’re looking to track your financial history, a 3-bureau report can be obtained for $19.95 monthly via Equifax Complete Premier, providing valuable insights into your financial standing. Furthermore, F5 Mortgage’s fast and efficient closing process ensures that you can secure your mortgage with ease.

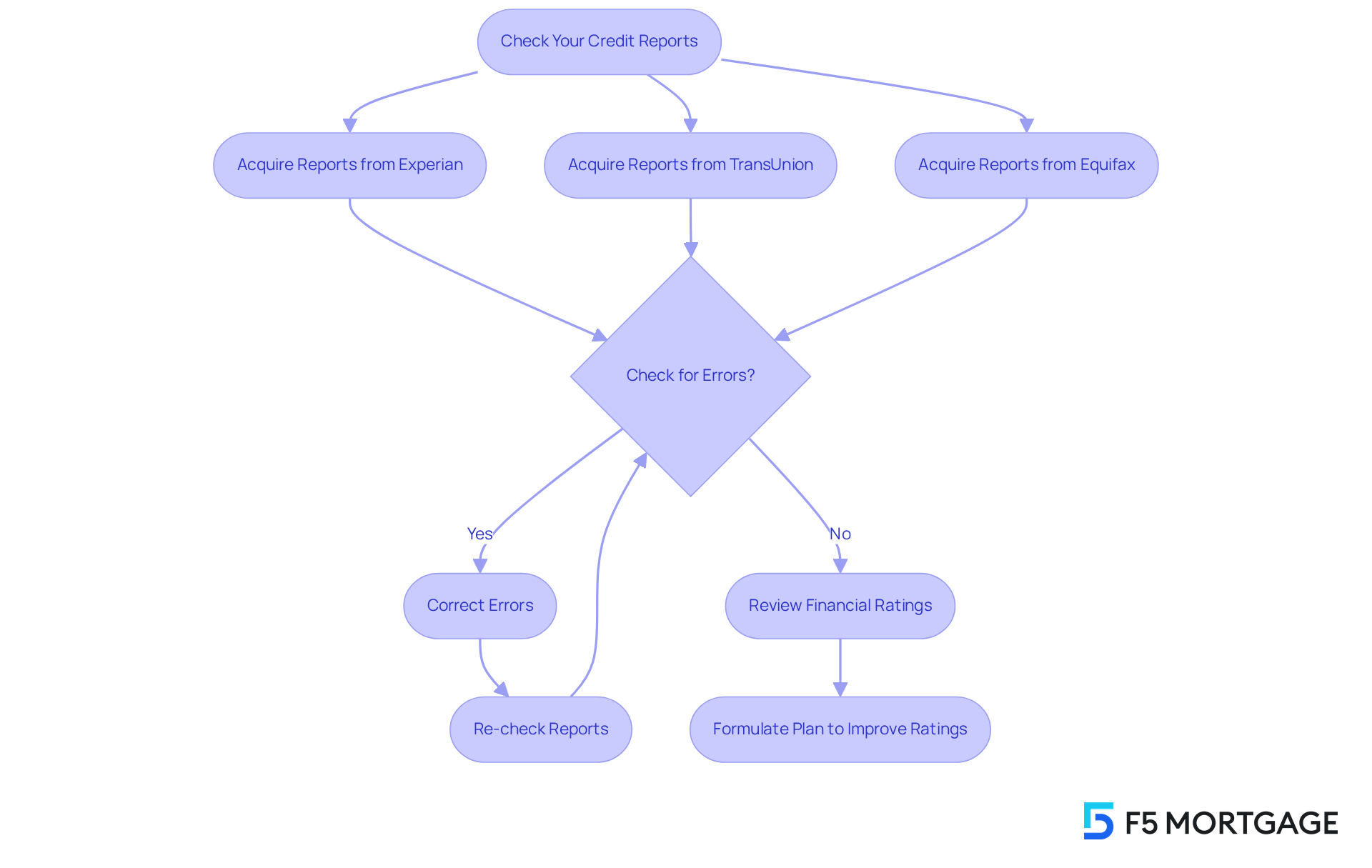

Check Your Credit Reports and Scores

Begin by acquiring your reports from the three primary agencies: Experian, TransUnion, and Equifax. You are entitled to from each bureau every year, enabling you to track your financial health without incurring costs. It’s essential to examine these reports thoroughly for any errors or outdated information that could adversely affect your results. We know how challenging this can be. A recent study showed that almost half of consumers reviewing their reports discovered inaccuracies, with more than a quarter facing significant errors that could damage their financial reputation. While small errors such as misspelled names or incorrect addresses usually do not influence financial ratings, it’s still crucial to rectify them.

Reviewing your financial ratings is essential, as they may vary among agencies. Grasping your current financial position is the first step in formulating a plan to enhance it. Many people have effectively improved their financial ratings after recognizing and challenging errors in their reports. For instance, correcting mistakes regarding unpaid accounts that were truly resolved can lead to a significant rise in scores, ultimately enhancing your mortgage credit score and providing access to better mortgage rates and terms.

Consistently examining your financial reports not only aids in spotting mistakes but also empowers you to take charge of your monetary future. With the appropriate information, you can tackle issues proactively, ensuring that your financial profile accurately represents your behavior. This diligence is especially crucial, as negative financial information can restrict access to credit cards, loans, and even employment opportunities. If you face difficulties with reporting organizations, remember that you have the option to submit a complaint to the FTC. Additionally, F5 Mortgage offers valuable resources such as a comprehensive home buyer’s guide and refinancing guides to assist you in your mortgage journey. We’re here to support you every step of the way.

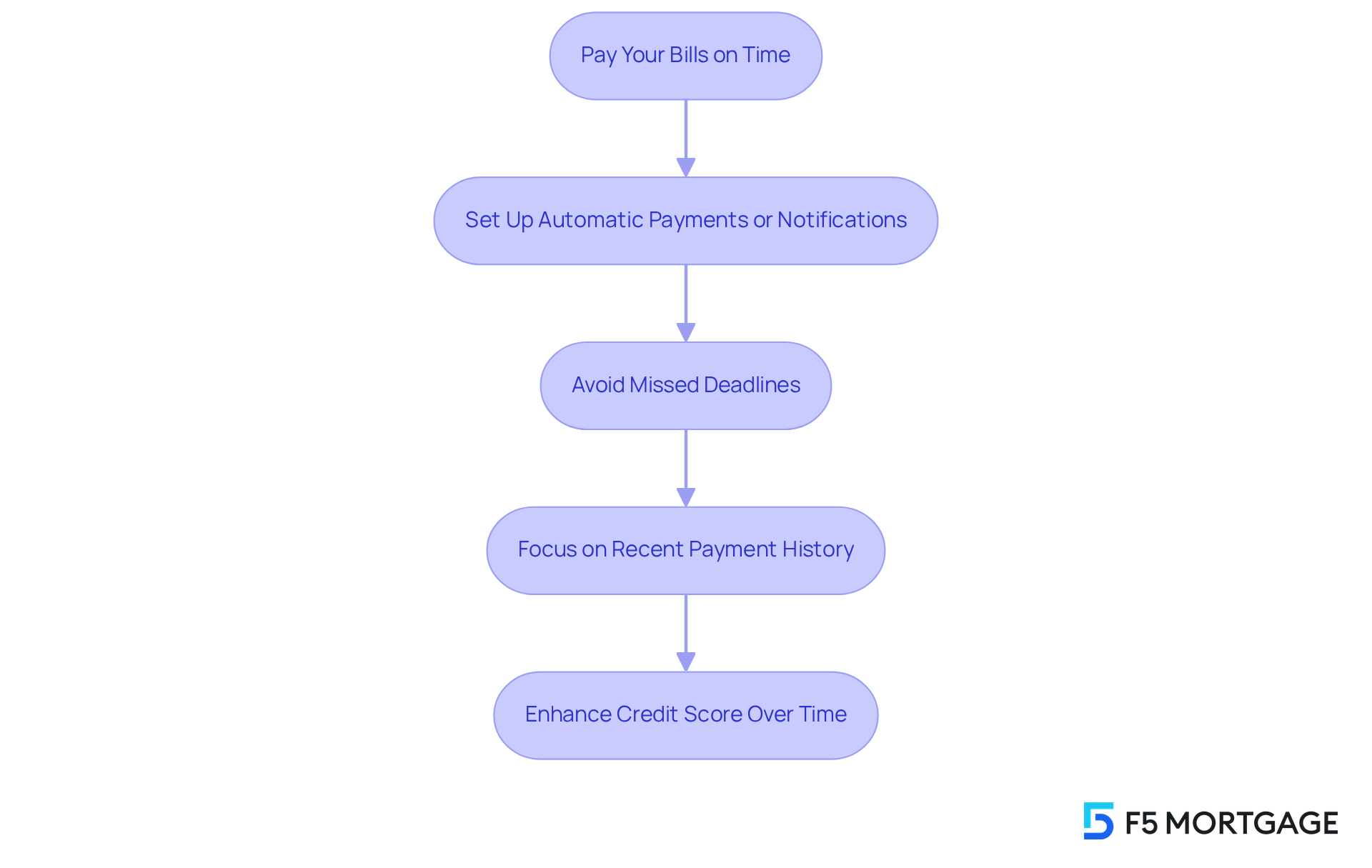

Pay Your Bills on Time

We understand how challenging it can be to manage your mortgage credit score, but one of the most effective ways to enhance it is by paying your bills on time. Delayed payments can significantly harm your mortgage credit score, which is why it’s important to consider setting up automatic payments or notifications. These tools can help you and avoid missed deadlines.

If you’ve faced missed payments in the past, don’t be discouraged. Focus on making prompt payments moving forward. Remember, your recent payment history has more influence on your mortgage credit score than older data. By prioritizing timely payments, you can take control of your financial future and enhance your mortgage credit score over time. We’re here to support you every step of the way.

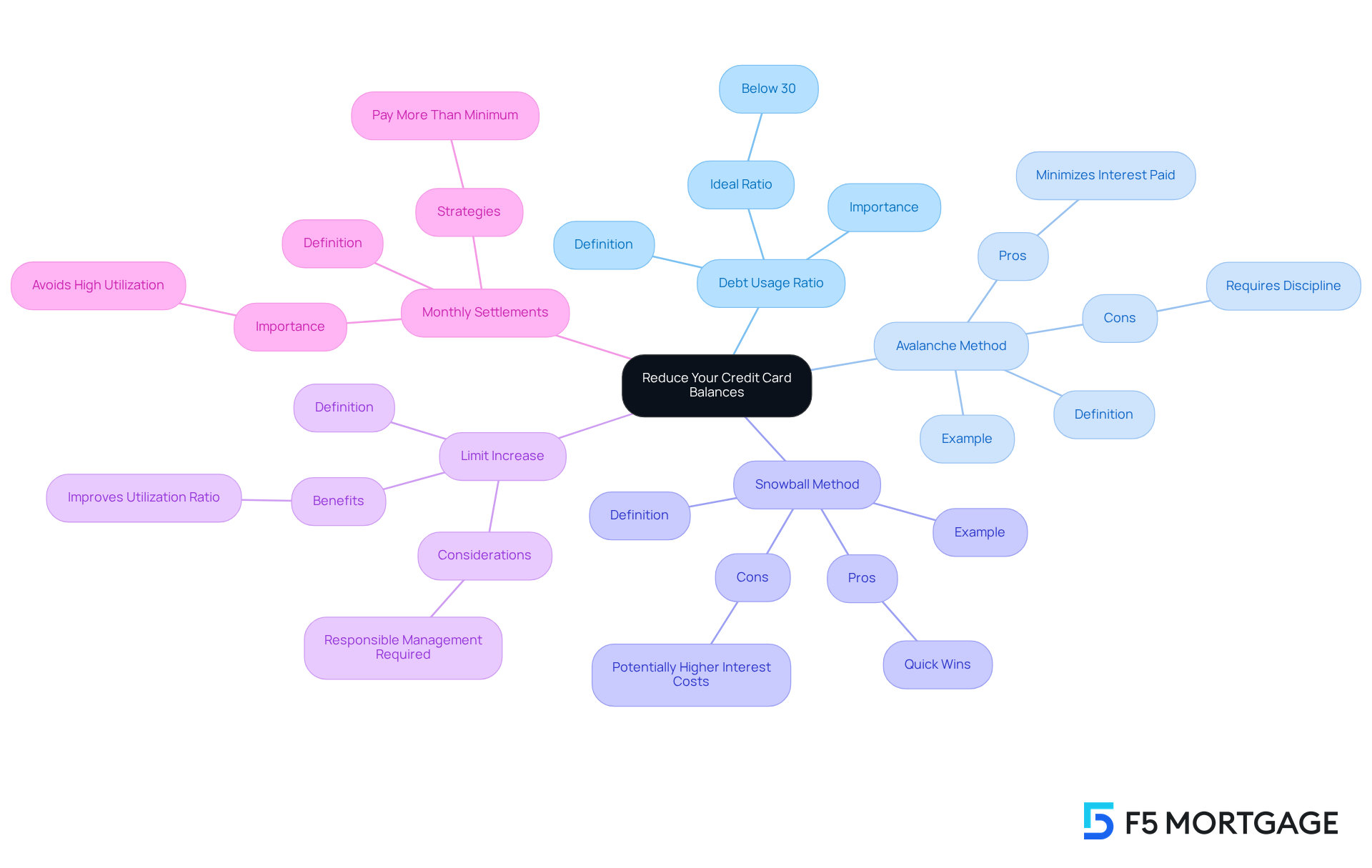

Reduce Your Credit Card Balances

Debt usage, which refers to the proportion of your card balances to your limits, plays a crucial role in assessing your credit score. We know how challenging it can be to manage finances, so it’s important to strive to . If your balances are currently high, it’s essential to devise a strategy for reduction.

One effective approach is the avalanche method, where you prioritize paying off the card with the highest interest rate first. This helps minimize the amount of interest paid over time, easing some of the financial burden. Alternatively, consider the snowball method, which focuses on paying off the smallest balances first. This approach can provide quick wins that motivate you to continue your debt repayment journey. For instance, personal finance writer Stacie Heaps successfully eliminated over $260,000 in debt using the snowball method, which allowed her to see immediate progress and stay motivated.

Moreover, think about asking for a limit increase, as this can enhance your borrowing ratio if handled responsibly. For example, if your total accessible funds are $15,000 and you owe $4,500, your usage ratio is at 30%. Maintaining a low mortgage credit score not only indicates responsible financial management but also makes lenders more inclined to approve new applications with favorable terms. Remember, an elevated borrowing ratio can indicate significant dependence on loans, which may obstruct eligibility for new financing or loans.

It’s essential to settle your card balances each month. Maintaining a balance from month to month can raise your usage ratio and adversely affect your rating. Furthermore, retaining old or seldom-used cards can assist in preserving available limits and reducing overall utilization. By applying these strategies, we’re here to support you every step of the way in effectively lowering your card balances and seeing a substantial enhancement in your rating.

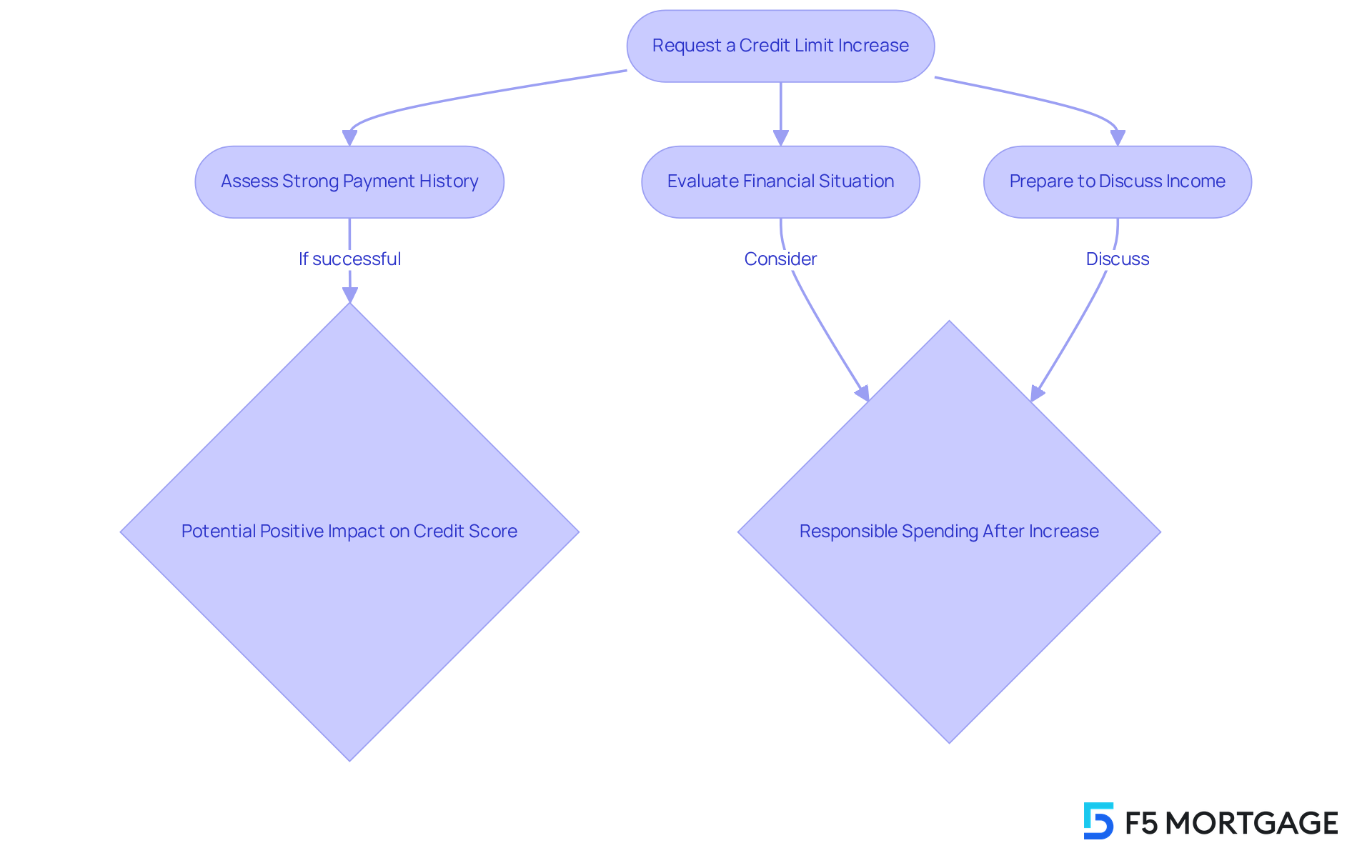

Request a Credit Limit Increase

If you maintain a strong payment history with your card provider, we know how beneficial it can be to consider asking for a limit increase. This strategic step can significantly lower your borrowing ratio, which is crucial in assessing your credit rating, as long as you manage your spending carefully. Many individuals who have successfully modified their limits often report enhanced ratings due to lower utilization rates. This demonstrates the tangible benefits of this approach.

When making this request, be prepared to discuss your income and any relevant changes in your that support your case. An increased borrowing limit can positively affect your score, but it’s essential to uphold responsible spending practices afterward. We’re here to support you every step of the way. Financial specialists emphasize that keeping a balance between raised borrowing limits and responsible expenditure is vital for your long-term financial well-being.

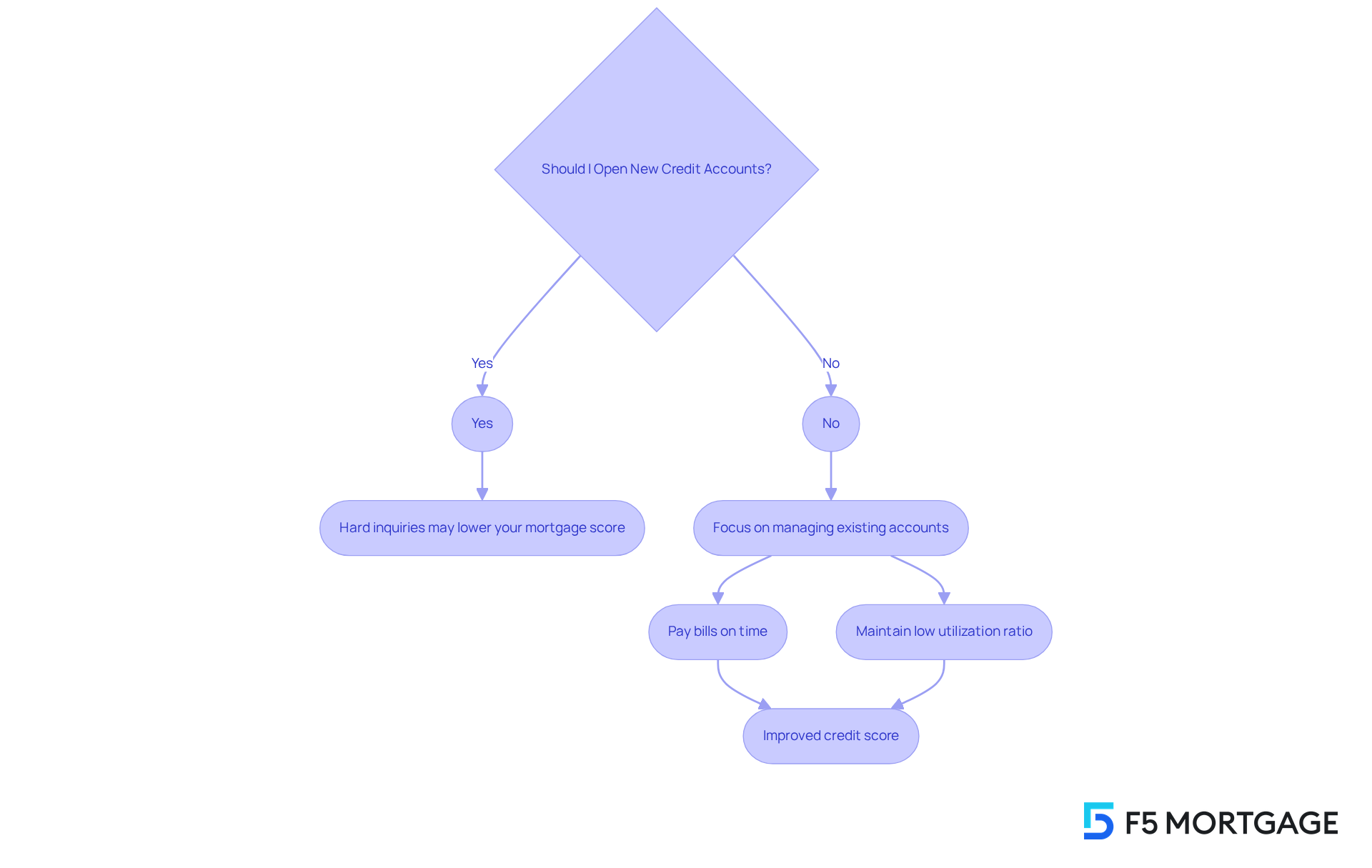

Avoid Opening New Credit Accounts

We understand how tempting it can be to open new accounts in the hopes of increasing your available funds. However, it’s important to recognize that this often results in hard inquiries on your credit report. These inquiries can temporarily lower your mortgage credit score and linger for up to two years, potentially complicating your mortgage application process.

Instead, let’s focus on the responsible management of your existing accounts. Paying your bills on time is one of the most effective ways to maintain a healthy financial profile, as timely payments have a positive impact on your rating. Additionally, keeping a low utilization ratio is essential for your financial health.

If you feel it’s necessary to create a new account, consider postponing that decision until your rating improves. This approach not only safeguards your financial well-being but also , positioning you more favorably when seeking a mortgage.

As Benjamin Franklin wisely noted, ‘Beware of little expenses; a small leak will sink a great ship.’ By prioritizing your current financial management and regularly reviewing your report for errors, you can avoid unnecessary pitfalls and enhance your financial standing. Remember, we’re here to support you every step of the way.

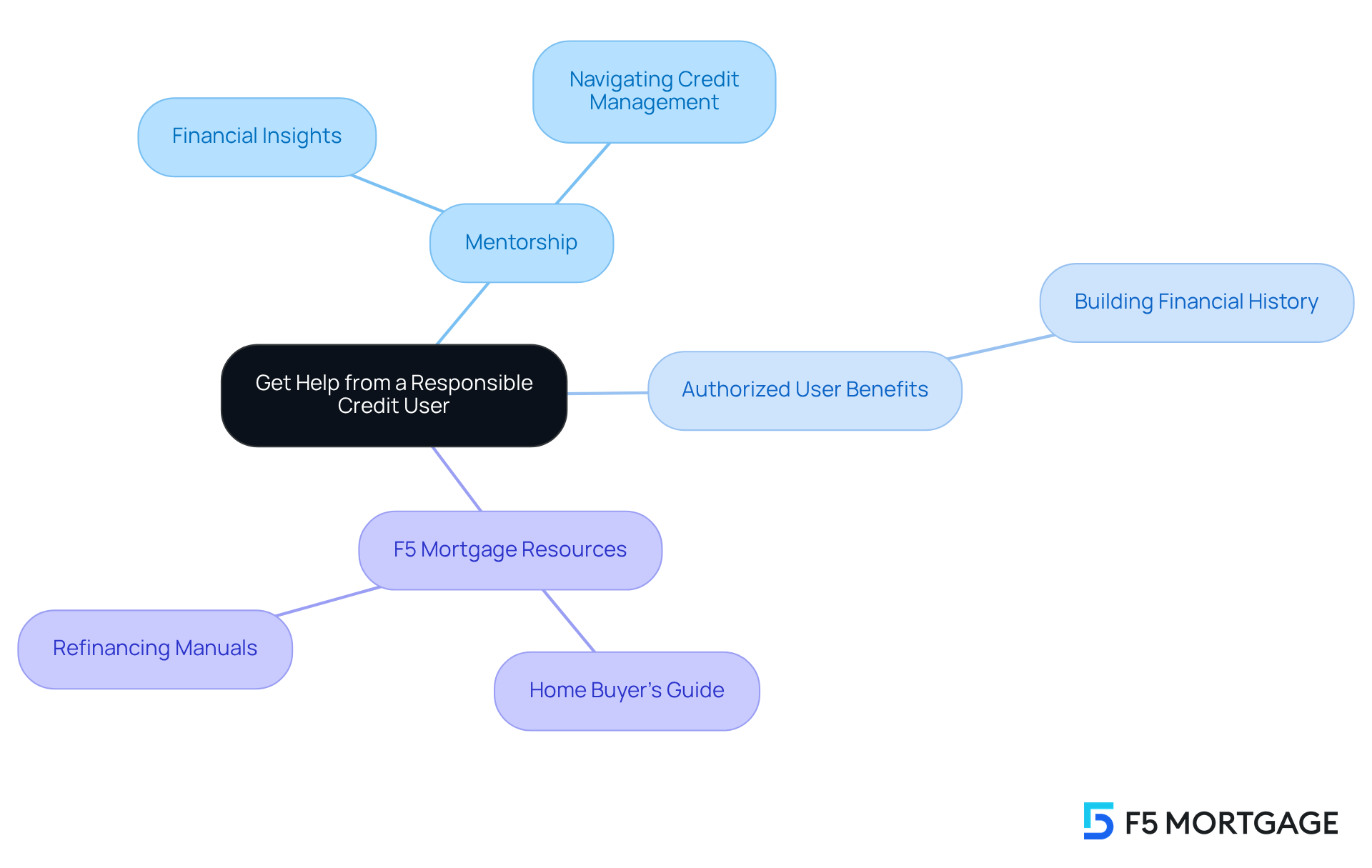

Get Help from a Responsible Credit User

Consider reaching out to a responsible borrower, like a family member or friend who has a solid financial background. They can offer valuable insights into managing finances, budgeting, and improving credit ratings. Furthermore, being added as an authorized user on their credit card can help you build your financial history, as long as they maintain good financial habits. This kind of guidance can be crucial on your journey to improving your loan score.

At F5 Mortgage, we understand that combining competitive rates with personalized service and a commitment to a stress-free mortgage process can truly enhance your home buying experience. Utilizing resources such as F5 Mortgage’s and refinancing manuals can further support your efforts in managing your finances effectively.

Remember, mentorship not only creates a nurturing environment but also plays an essential role in navigating the complexities of credit management. We know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Improving a mortgage credit score is essential for anyone looking to secure favorable loan terms and interest rates. We know how challenging this can be, but by understanding the significance of this score and taking actionable steps to enhance it, you can unlock substantial financial benefits. A higher mortgage credit score not only leads to lower interest rates but also expands access to various lending options, ultimately making homeownership more achievable and affordable.

Key strategies for improving your mortgage credit score include:

- Regularly checking credit reports for inaccuracies

- Ensuring timely bill payments

- Reducing credit card balances

- Responsibly managing existing credit accounts

Each of these steps plays a crucial role in shaping a positive financial profile that lenders consider when evaluating loan applications. Additionally, seeking guidance from responsible credit users can provide valuable insights and support throughout the improvement process.

Ultimately, taking control of your mortgage credit score is a proactive way to enhance financial stability and open doors to better lending opportunities. By prioritizing your financial health and implementing these strategies, you can not only improve your credit score but also pave the way for a more secure and prosperous future in homeownership. Embrace this journey towards financial empowerment and make informed decisions that will benefit you for years to come.

Frequently Asked Questions

Why is my mortgage credit score important?

Your mortgage credit score is crucial as it helps lenders assess your financial reliability. A higher mortgage credit score can lead to lower home loan rates and better borrowing conditions, potentially saving you thousands over the life of your loan.

What are the average loan rates associated with different mortgage credit scores?

As of January 3, 2025, individuals with a mortgage credit score of 700 might secure an average loan rate of 7.42%, while those with scores below 620 could face rates as high as 7.89% for conventional financing.

What are the minimum credit score requirements for various types of loans?

FHA loans can be obtained with scores as low as 500 with a larger down payment. Conventional loans typically require a minimum score of 620, while jumbo loans necessitate a score of 700 or above.

How can a high mortgage credit score benefit me beyond loan rates?

A high mortgage credit score can lead to reduced auto insurance costs and better credit card rewards, in addition to securing better home loan rates.

What steps can I take to improve my mortgage credit score?

To improve your mortgage credit score, you can pay bills on time, lower your credit utilization, and dispute any inaccuracies on your credit report.

How much can I save on home loans with an improved mortgage credit score?

Consumers could save up to 1% in interest on home loans with improved mortgage credit scores, highlighting the importance of effective financial management.

How can I check my credit reports and scores?

You can obtain your credit reports from the three primary agencies—Experian, TransUnion, and Equifax. You are entitled to one free report from each bureau every year.

What should I look for when reviewing my credit reports?

When reviewing your credit reports, check for any errors or outdated information that could negatively impact your credit score. It’s essential to correct any inaccuracies, especially significant errors.

What can I do if I find inaccuracies in my credit report?

If you find inaccuracies in your credit report, you can challenge these errors. Correcting mistakes, such as unpaid accounts that were resolved, can lead to a significant rise in your credit scores.

What resources does F5 Mortgage offer for mortgage assistance?

F5 Mortgage provides valuable resources including a comprehensive home buyer’s guide and refinancing guides to support you throughout your mortgage journey.