Overview

This article presents seven compelling reasons to consider a local mortgage broker for your home financing needs. We understand how challenging this process can be, and we want to help you navigate it with personalized service and local expertise.

Local mortgage brokers can secure better rates for you, simplifying the often daunting paperwork. They also provide tailored loan options that cater to your unique situation. By choosing a broker, you’re not just getting financial assistance; you’re enhancing your overall experience, making home financing more accessible and efficient.

Imagine having someone by your side who understands the local market and can guide you every step of the way. With a local broker, you gain a partner committed to your satisfaction. This support can make a significant difference in your journey toward homeownership.

Ultimately, we’re here to support you in making informed decisions that benefit your family. Let’s take this important step together, ensuring you feel confident and empowered throughout the mortgage process.

Introduction

Navigating the mortgage landscape can often feel like a labyrinth, filled with intricate details and daunting decisions. We understand how overwhelming this process can be for aspiring homeowners. The choices you make can significantly impact your financial future. This article explores the compelling reasons why enlisting the help of a local mortgage broker can be a game-changer. These professionals offer personalized solutions that cater to your individual needs.

What advantages do these brokers provide that make them indispensable in your home financing journey? How can their expertise alleviate the stress associated with securing a mortgage? We’re here to support you every step of the way, ensuring you feel empowered and informed as you embark on this important journey.

F5 Mortgage: Personalized Mortgage Solutions for Your Home Financing

At F5 Mortgage, we understand how challenging navigating the mortgage process can be. That’s why we excel in providing customized loan consultations tailored to your unique financial situation. Our dedicated team, including skilled loan officers like Alyssa and Jeff, ensures that you receive the red carpet treatment. We’re here to assist you through the financing process with ease and confidence.

We offer a diverse array of loan options—fixed-rate loans, FHA loans, VA loans, and jumbo loans—so you can find the solution that aligns with your home financing goals. This not only simplifies the loan process but significantly enhances your satisfaction. In fact, our remarkable 94% satisfaction rate speaks volumes about our commitment to making your experience smooth and stress-free.

Clients have shared their appreciation for our attention to detail and efficiency, with testimonials highlighting our fast loan closings in under three weeks. Research shows that organizations adopting personalization strategies can achieve 20% higher customer retention rates, underscoring the importance of customized consultations in fostering long-term relationships.

Moreover, our finance experts play a crucial role in your homebuying journey, offering essential guidance that enriches your overall experience. As the demand for personalized services continues to grow, we prioritize tailored consultations that address your unique needs. Remember, we’re here to support you every step of the way.

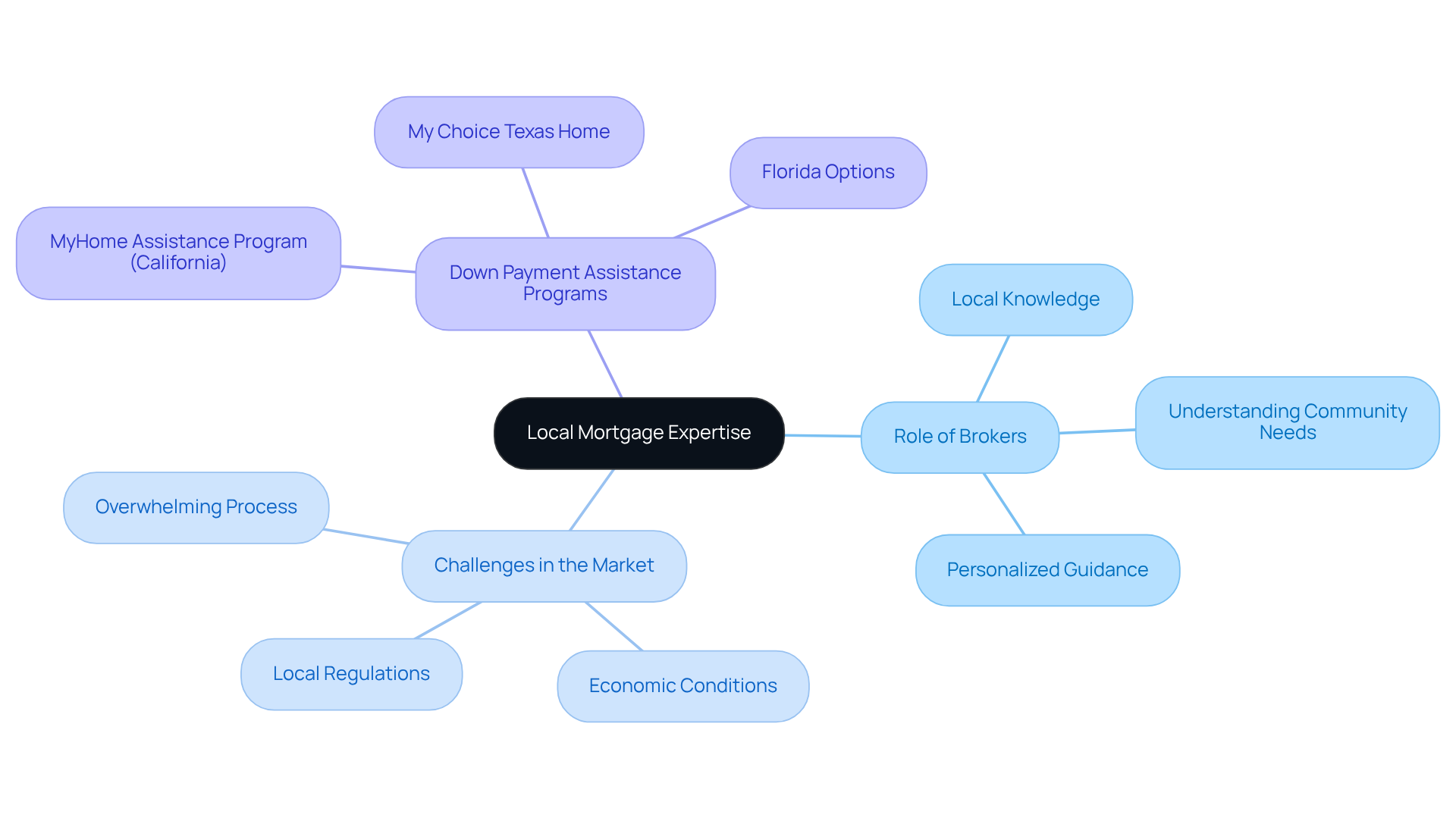

Local Expertise: Understanding Your Community’s Mortgage Landscape

Navigating the mortgage process can feel overwhelming, especially when considering the unique challenges families face in today’s real estate market. A mortgage broker near me who has local knowledge understands the subtleties of your community, including property values, local regulations, and economic conditions. This expertise allows brokers to offer personalized guidance that truly reflects your specific needs and opportunities.

At F5, we know how challenging this can be. Our dedicated team combines extensive experience with a personal touch, ensuring a stress-free process through user-friendly technology and expert guidance. We are here to support you every step of the way, as a mortgage broker near me who is knowledgeable about local lending practices and ready to assist you in navigating various financial situations.

We can help you access down payment assistance programs, including:

- The MyHome Assistance Program in California

- The My Choice Texas Home program

- Several options available in Florida

These resources are designed to empower you on your home financing journey.

Contact us today to learn more about how we can assist you. Together, we can make your dream of homeownership a reality!

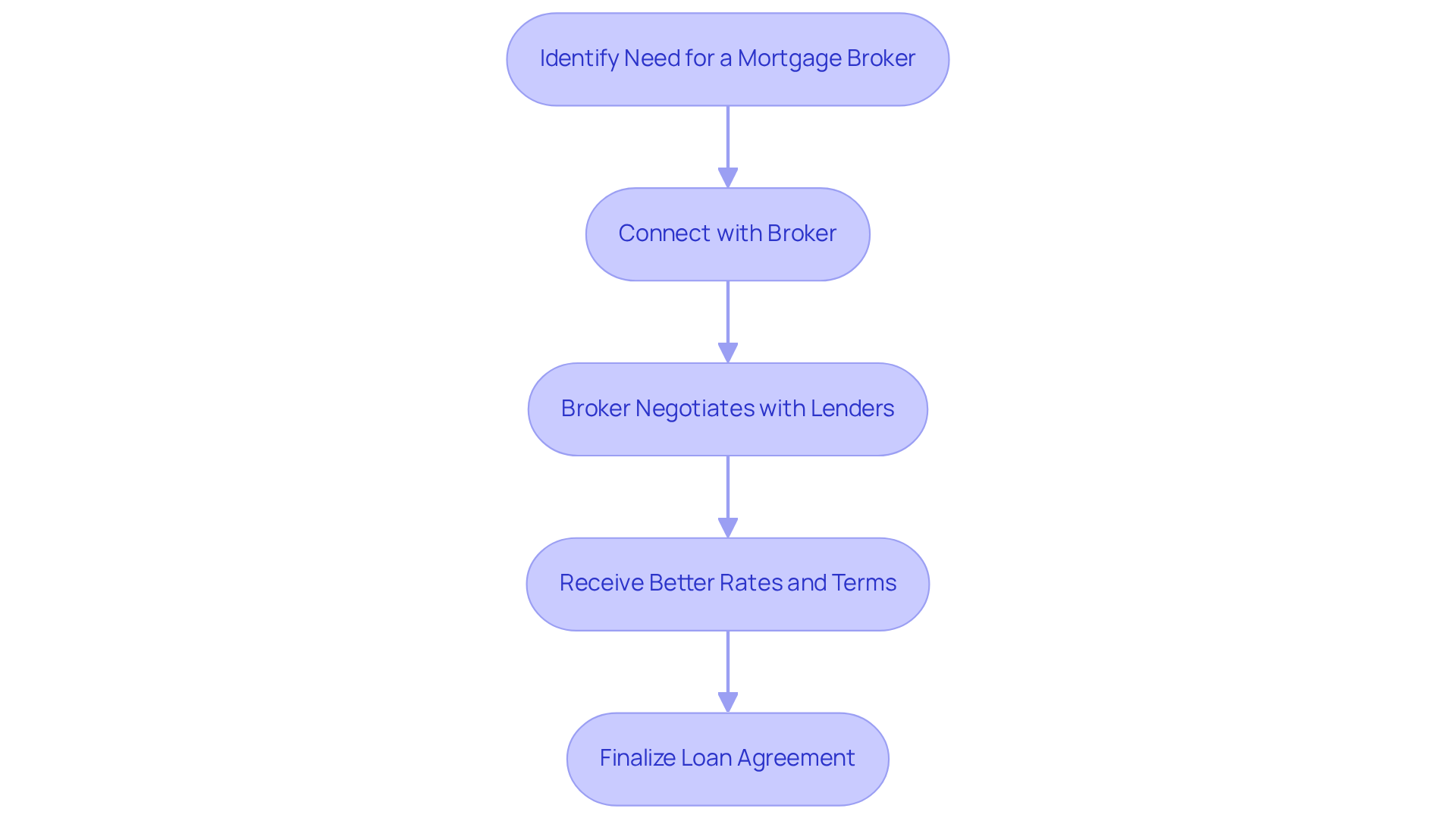

Negotiation Power: Brokers Secure Better Rates and Terms

Navigating the mortgage process can feel overwhelming, but a mortgage broker near me, such as F5 Mortgage, is here to help. With strong negotiation skills and established connections with a variety of lenders, they advocate effectively for you. Working with a mortgage broker near me often leads to and more favorable loan conditions than you might achieve on your own.

By acting as intermediaries, agents simplify the complexities of lender negotiations. They ensure you have access to the most beneficial financing options available. In fact, statistics show that borrowers who use a mortgage broker near me can save significantly. For instance, even a small 0.5% difference in interest on a $375,000 loan could mean roughly $9,400 in savings over five years.

Moreover, agents are adept at negotiating terms that include reduced charges and flexible repayment options, enhancing your overall loan experience. F5 Mortgage stands out with its extensive network of over two dozen lenders, offering a broader range of options and improved terms for you.

Real-life case studies reveal that many individuals report positive outcomes when working with intermediaries. This highlights the importance of their expertise in navigating the financial landscape. While some may find it challenging to establish a new connection with an agent, the streamlined process and potential for securing the best financing agreements make choosing a mortgage broker near me a wise decision.

We know how challenging this can be, but remember, we’re here to support you every step of the way.

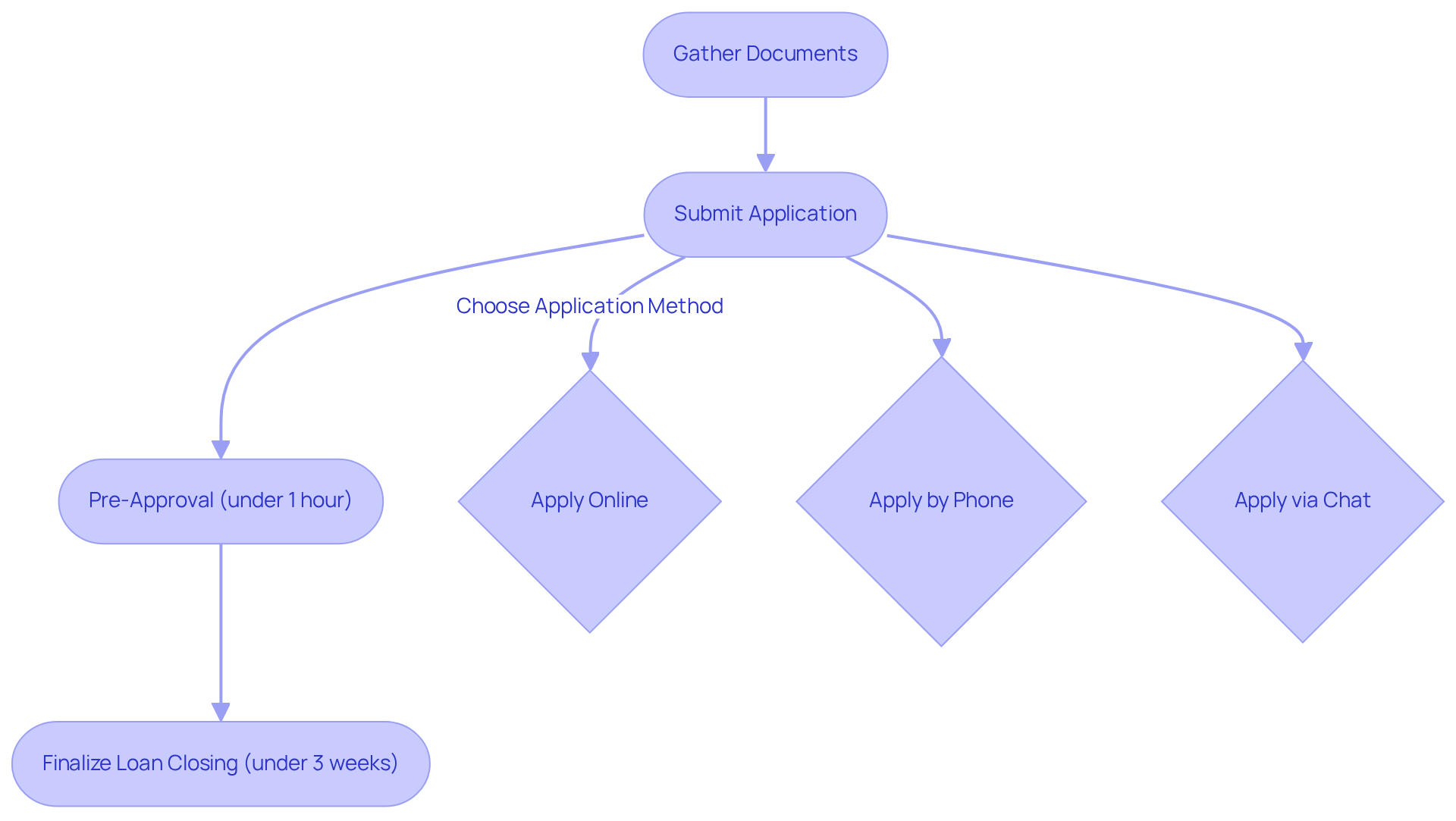

Simplified Process: Brokers Streamline Mortgage Paperwork

Navigating the mortgage process can feel overwhelming, but one of the key advantages of collaborating with a loan broker is their ability to simplify the paperwork. We understand how daunting it can be to gather and submit all the necessary documents. That’s where brokers come in—they , ensuring everything is completed accurately and on time. This not only saves you precious time but also significantly reduces the chances of mistakes that could delay your mortgage approval.

At F5 Lending, we prioritize your experience by utilizing easy-to-navigate technology to streamline the application process. Whether you prefer to apply online, by phone, or via chat, we’re here to support you every step of the way. Our efficient approach often achieves pre-approval in under an hour, reflecting our commitment to providing a stress-free experience. Plus, we typically finalize loan closings in under three weeks, allowing you to move forward with your plans without unnecessary delays.

Diverse Loan Options: Brokers Offer Tailored Financing Solutions

Navigating the world of loans can feel overwhelming, but near me is available to help. They have access to a wide range of financing options, allowing them to offer tailored funding solutions that meet your unique needs. For example, F5 Mortgage partners with over two dozen leading lenders, providing a selection that includes:

- Conventional loans

- Government-backed loans

- Specialized programs

This extensive variety empowers you to find the most suitable financing for your financial situation and homeownership goals.

Recent trends show a growing reliance on government-backed loans, especially among first-time homebuyers and those with lower credit scores. These loans often come with favorable terms, making them an attractive choice for many families. By leveraging their relationships with multiple lenders, a mortgage broker near me can guide you toward these advantageous options, ensuring you receive the best possible rates and terms.

Consider the success stories, such as F5’s commitment to client satisfaction and quick closing times. With a customer satisfaction rate of 94% and a history of assisting over 1,000 families, F5 Mortgage exemplifies how customized financing solutions can lead to positive outcomes in the lending sector. Financial consultants emphasize the importance of tailored assistance in navigating the complexities of home financing, highlighting the invaluable support agents provide. Ultimately, the ability of intermediaries to customize financing options not only enhances your experience but also fosters a more inclusive and accessible lending market. We know how challenging this can be, and we’re here to support you every step of the way.

Personalized Service: Building Trust with Your Mortgage Broker

Building a trusting relationship with a loan broker is crucial for . At F5, our brokers prioritize personalized service, taking the time to understand each individual’s unique financial situation and goals. This dedication fosters open communication, ensuring that you feel supported throughout the mortgage process.

One satisfied customer shared, “F5 Mortgage handled my financial needs exceptionally well,” while another remarked, “If you’re looking for speed & convenience, F5 Mortgage is for you.” By nurturing trust and providing tailored solutions, our agents can effectively meet the needs and preferences of those they represent, guiding you through a seamless and stress-free journey to homeownership.

We know how challenging this can be, and we’re here to support you every step of the way. Let us help you achieve your homeownership dreams with confidence.

Ongoing Support: Brokers Guide You Through the Mortgage Journey

The connection with a loan broker extends well beyond the initial loan closing. At F5 Mortgage, we understand how challenging this process can be, and we emphasize continuous assistance. Our dedicated brokers guide individuals through the complexities of their financing throughout its duration. This commitment ensures that you are well-equipped to handle future refinancing needs or changes in your financial situation.

By nurturing long-term partnerships, F5 Mortgage empowers you with resources and expert guidance, enabling you to make informed choices regarding your home financing options with the help of a mortgage broker near me. Our loan officers excel in communication, providing a personal touch that makes every customer feel valued and understood. We know that establishing trust and offering ongoing education are crucial for sustaining these relationships.

For instance, our intermediaries frequently conduct webinars and educational sessions, positioning themselves as trustworthy financial resources, ready to assist you when refinancing becomes essential. Client testimonials reflect our dedication: “Everything went very smoothly!” says Alley Cohen, highlighting the satisfaction of our clients.

As the lending landscape evolves, having a committed intermediary like F5 can greatly facilitate your transition during crucial financial periods. This underscores the significance of these , as we are here to support you every step of the way.

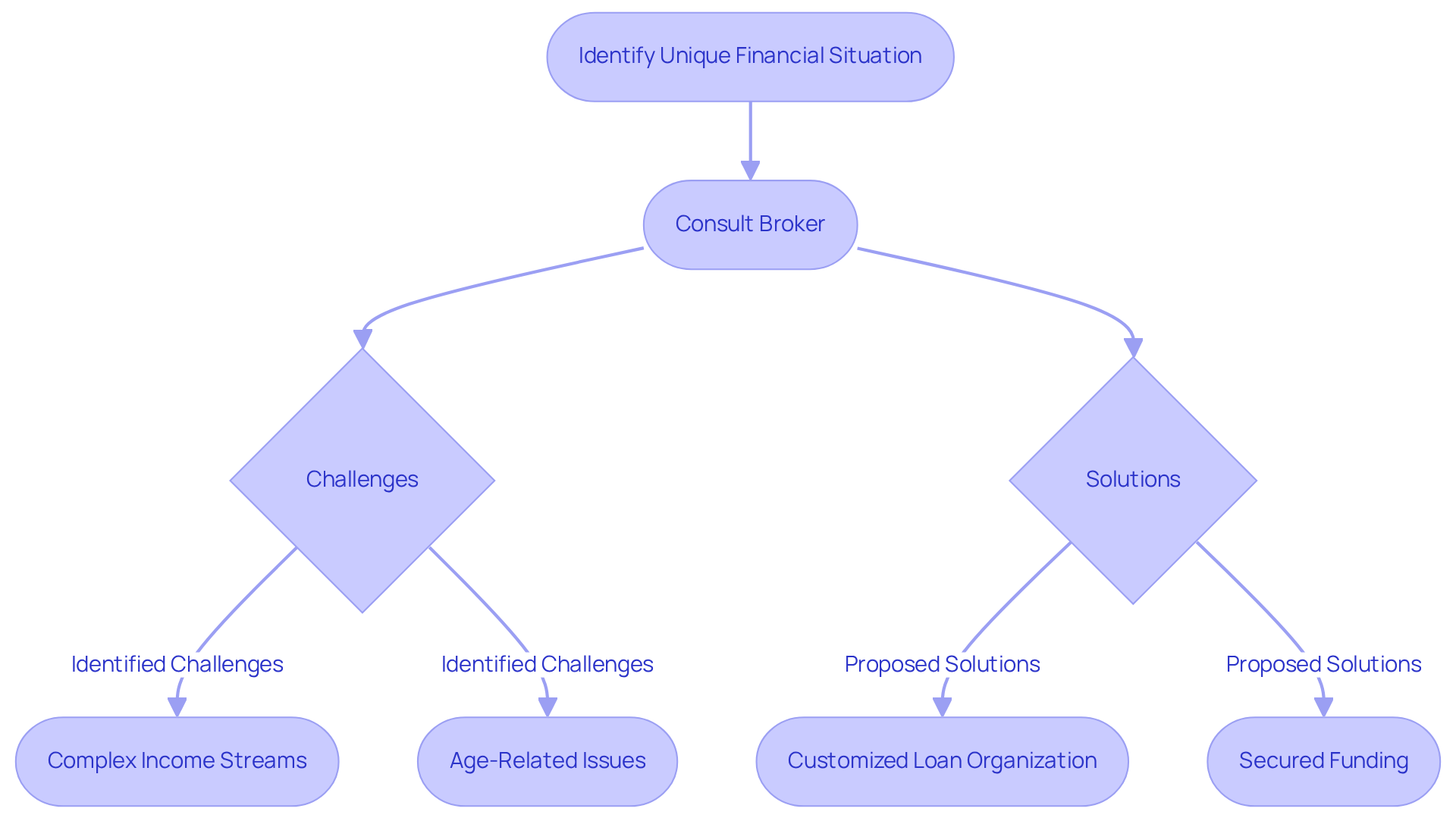

Expert Guidance: Navigating Unique Financial Situations with a Broker

We understand that clients face unique financial situations, especially self-employed individuals or those with unconventional income sources. In these circumstances, the expertise of a loan broker can be invaluable. At F5, our brokers excel in navigating the complexities associated with diverse financial profiles, providing tailored solutions that truly reflect your specific needs.

Consider a recent case involving a couple aged 60 and 69 who were seeking a £300,000 loan to purchase their £910,000 dream home. They encountered challenges due to their age and complex income streams from pensions and business dividends. After being let down by another agent, they found hope with F5 Finance. We organized a customized loan with a flexible building society that was ready to meet their requirements, including an overage clause on the property.

This example highlights how intermediaries can secure funding that meets the distinct needs of clients, ensuring they receive the essential support throughout the loan process. Moreover, recent data show that loan approval rates for alternative income sources have increased by 15% over the past year, emphasizing the growing flexibility of agents in today’s lending landscape.

By leveraging industry-leading technology, such as advanced data analytics and efficient application procedures, firms like F5 empower individuals to navigate the complexities of obtaining a loan. We’re here to , making your financing experience smoother and more successful.

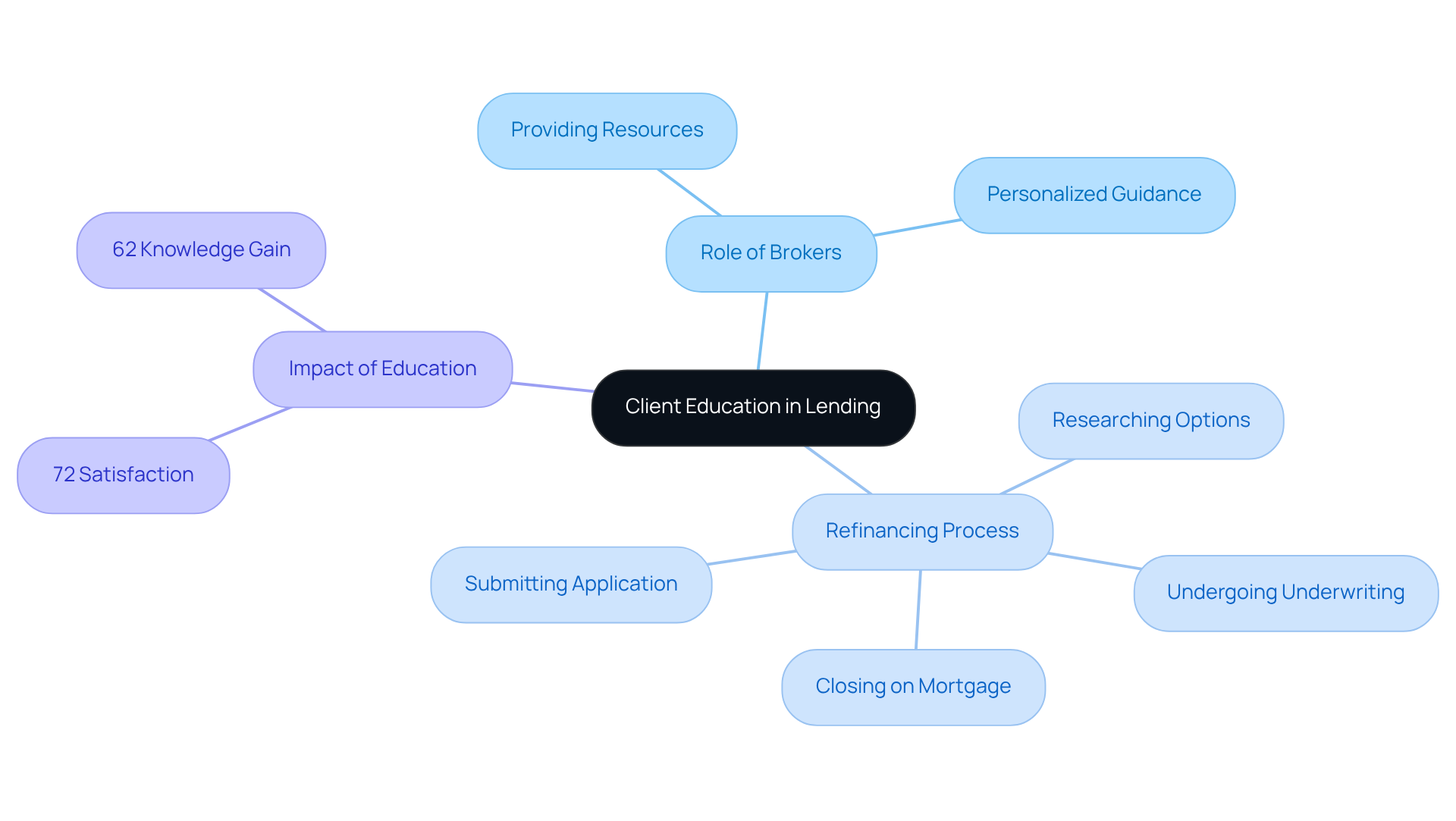

Client Education: Brokers Empower You with Knowledge

An informed loan advisor plays an essential role in easing the application process and empowering individuals through education. At F5 Mortgage, we truly understand how challenging this can be, and we excel in providing valuable resources. Our comprehensive home buyer’s guides and refinancing guides are designed to improve your understanding of your options. This commitment to education helps clarify the lending process, enabling you to navigate your financing journey with confidence.

can feel overwhelming, but it involves several key steps:

- Researching options

- Submitting an application

- Undergoing underwriting

- Closing on the new mortgage

Statistics reveal that 72% of broker users express satisfaction with their experience, underscoring the effectiveness of personalized guidance. Additionally, a notable 62% of home purchasers stated they felt more knowledgeable about the financing process after interacting with our educational materials. This change in comprehension is essential, as it prepares you to make informed choices that align with your financial objectives.

Successful case studies emphasize the transformative effect of education in the lending sector. For instance, 30% of homebuyers received financial gifts from family members, which were crucial for meeting their down payment needs. This demonstrates the significance of understanding diverse funding sources and how intermediaries can assist you in utilizing these options efficiently. By cultivating a culture of learning, loan specialists like us at F5 ensure that you are well-prepared to begin your homeownership journey. We’re here to support you every step of the way.

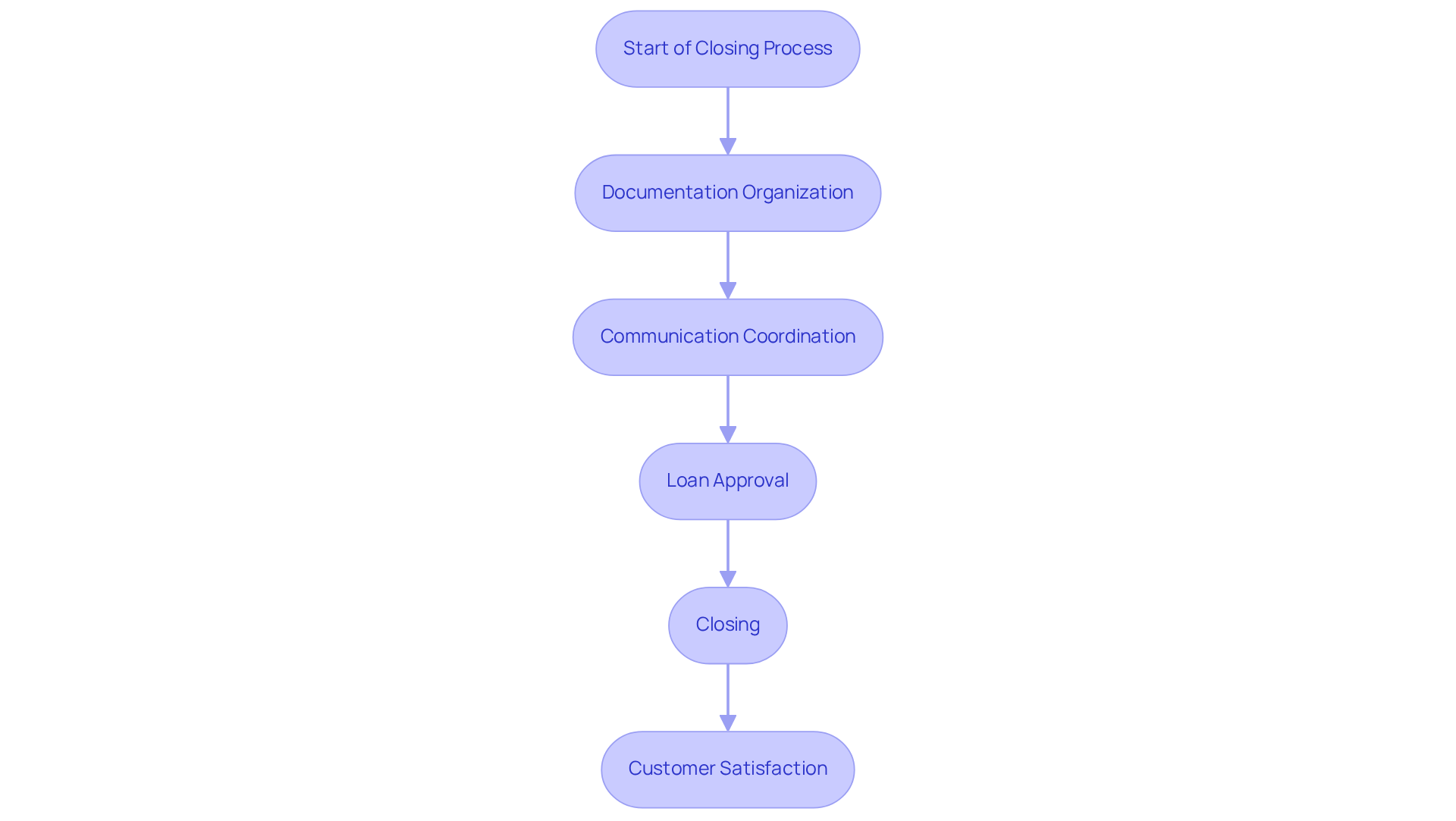

Efficient Closings: Brokers Speed Up Your Mortgage Process

Navigating the closing process can be daunting, but a mortgage broker near me is available to help. They excel at streamlining this journey, ensuring that all necessary documentation is meticulously organized and that communication among all parties flows smoothly. At F5 Mortgage, we understand how important efficiency is. That’s why we proudly share that most loans close in under three weeks. This swift turnaround not only saves you valuable time but also significantly eases the stress typically linked to the closing phase of home financing.

Research shows that timely closings can reduce customer anxiety levels by up to 30%. This underscores the importance of an efficient process. Our clients often express their gratitude, with one individual stating, “The process was easy and worry-free,” while another commended our team for their “amazing attention to detail.” We know how challenging this can be, and we’re here to support you every step of the way.

By leveraging industry expertise and technology, a mortgage broker near me like F5 facilitates quicker approvals and closings. This allows you to concentrate on what truly matters—your new home—rather than the complexities of financing. With a , F5 Mortgage demonstrates its commitment to providing you with a smooth and supportive experience.

Conclusion

Choosing a mortgage broker, especially one with local expertise like F5 Mortgage, can significantly enhance your home financing experience. We understand how daunting this process can be, and that’s where brokers come in. They provide personalized solutions tailored to your unique financial situation, streamlining the entire journey toward homeownership.

The advantages of working with a mortgage broker are numerous:

- They give you access to diverse loan options.

- They simplify paperwork.

- They offer ongoing support and expert guidance.

With their help, the mortgage process becomes smoother and more efficient. Personalized service and trust are at the heart of this relationship, ensuring you have a dedicated professional by your side who can navigate your unique financial landscape and empower you with knowledge.

Ultimately, partnering with a mortgage broker can lead to a more satisfying and successful home financing experience. As the landscape of mortgage lending continues to evolve, leveraging the expertise and resources of a broker like F5 Mortgage is not just a smart choice—it’s a strategic move towards achieving your homeownership dreams with confidence and ease. Embrace the support and guidance available, and take the first step towards securing the best financing options tailored specifically for you.

Frequently Asked Questions

What services does F5 Mortgage provide?

F5 Mortgage offers personalized mortgage consultations tailored to individual financial situations, along with a variety of loan options including fixed-rate loans, FHA loans, VA loans, and jumbo loans.

What is the satisfaction rate of F5 Mortgage clients?

F5 Mortgage boasts a remarkable 94% satisfaction rate, reflecting their commitment to providing a smooth and stress-free experience for clients.

How quickly can clients expect their loans to close with F5 Mortgage?

Clients have reported fast loan closings in under three weeks.

What local expertise does F5 Mortgage offer?

F5 Mortgage provides local knowledge about property values, regulations, and economic conditions, allowing them to offer personalized guidance that reflects specific community needs.

What down payment assistance programs does F5 Mortgage help clients access?

F5 Mortgage can assist clients with down payment assistance programs such as the MyHome Assistance Program in California, the My Choice Texas Home program, and several options available in Florida.

How do mortgage brokers help secure better rates and terms?

Mortgage brokers, like those at F5 Mortgage, use strong negotiation skills and established connections with various lenders to advocate for better interest rates and more favorable loan conditions for clients.

What potential savings can clients expect when using a mortgage broker?

Statistics indicate that borrowers using a mortgage broker can save significantly; for example, a 0.5% difference in interest on a $375,000 loan could result in approximately $9,400 in savings over five years.

What advantages do mortgage brokers provide in the loan process?

Mortgage brokers simplify lender negotiations, provide access to beneficial financing options, and negotiate terms that can include reduced charges and flexible repayment options, enhancing the overall loan experience.

How does F5 Mortgage’s network benefit clients?

F5 Mortgage has an extensive network of over two dozen lenders, offering a broader range of options and improved terms for clients compared to working independently.