Overview

This article outlines seven essential steps to successfully use a VA home loan for purchasing land. We understand how overwhelming this process can be, which is why it’s crucial to grasp your eligibility, secure pre-approval, and collaborate with knowledgeable lenders. Each step, from finding VA-approved land to finalizing your purchase, is accompanied by practical advice and insights. These resources are designed to guide veterans and service members through the complexities of the VA loan process, empowering you to achieve your dream of land ownership.

We know how challenging this can be, but with the right support, you can navigate these steps with confidence. By following this guide, you’ll not only gain clarity but also the assurance that you are making informed decisions every step of the way. Let’s embark on this journey together, ensuring that you feel supported and equipped to realize your goal of land ownership.

Introduction

Navigating the path to homeownership can feel particularly daunting for veterans and active-duty service members, especially when it comes to purchasing land. We understand how challenging this can be. VA home loans present a unique opportunity, offering favorable terms that can make your dream of owning a home a reality.

However, the intricacies of the VA loan process—ranging from eligibility requirements to the appraisal and closing stages—can leave many feeling overwhelmed. We’re here to support you every step of the way.

How can you effectively leverage these benefits to secure your ideal property while avoiding common pitfalls? Let’s explore this together.

Understand VA Home Loans

VA home mortgages are more than just financing options; they are a lifeline supported by the U.S. Department of Veterans Affairs, designed specifically to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in achieving their dream of homeownership. We know how challenging this journey can be, and that’s why it’s important to understand the key advantages these mortgages offer. With and no private mortgage insurance (PMI), you can save significantly. These favorable financing terms make homeownership not just a dream, but a reachable goal for eligible individuals.

Acquainting yourself with the specific terms and conditions linked to VA financing is crucial. By doing so, you empower yourself to utilize these advantages effectively. Remember, we’re here to support you every step of the way as you navigate this process toward finding a place you can truly call home.

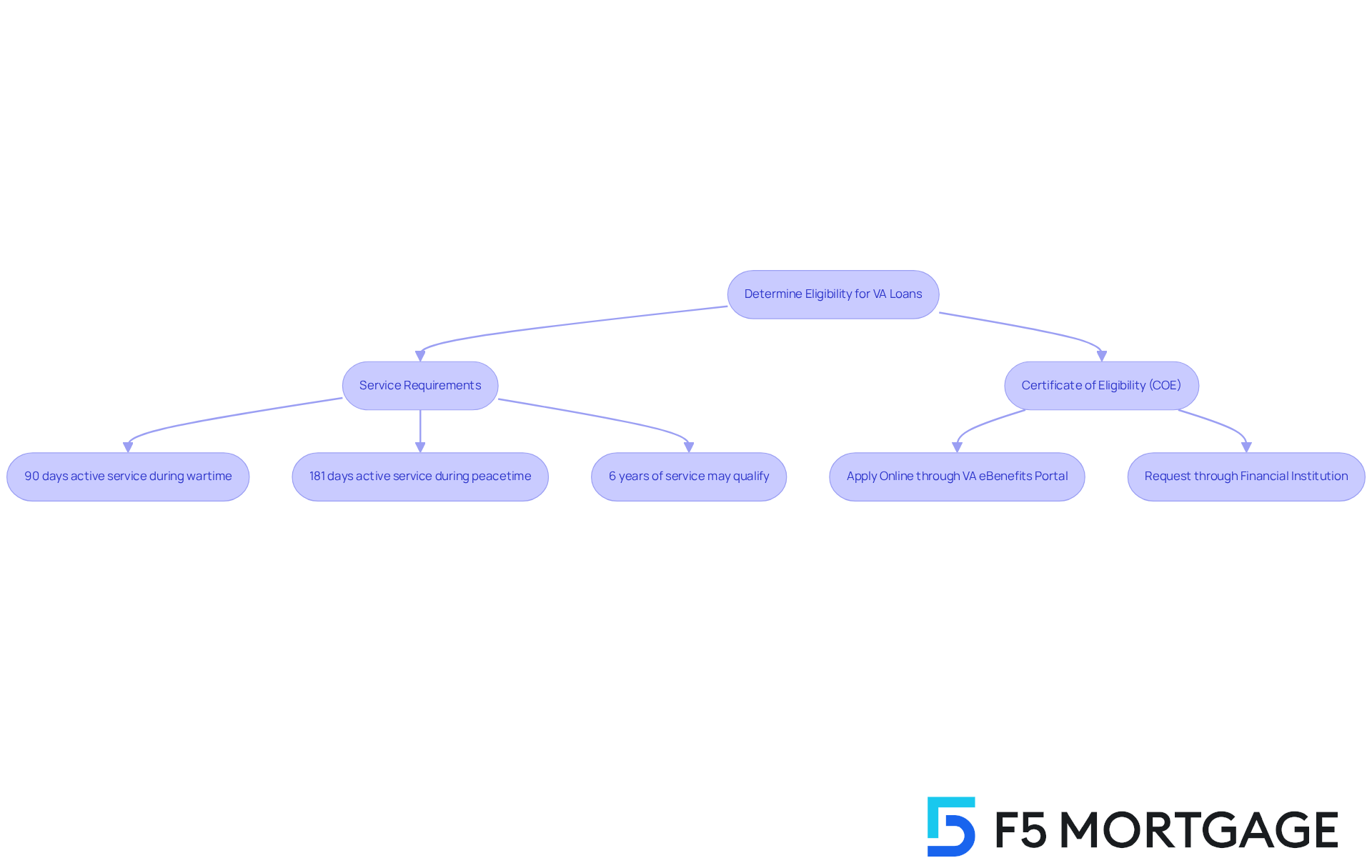

Determine Eligibility for VA Loans

We understand that navigating the VA mortgage process can feel overwhelming, but we’re here to support you every step of the way. To qualify for a VA mortgage, you need to meet specific service requirements. Generally, this means serving:

- 90 consecutive days of active service during wartime

- 181 days during peacetime

If you are a National Guard or Reserve member, you may qualify after six years of service.

Obtaining your Certificate of Eligibility (COE) from the VA is a crucial step. This document confirms your eligibility status and is essential for financial institutions to process your financing request. You can easily through the VA’s eBenefits portal or request it through your financial institution. Remember, we’re here to help you navigate this process and ensure you have the support you need.

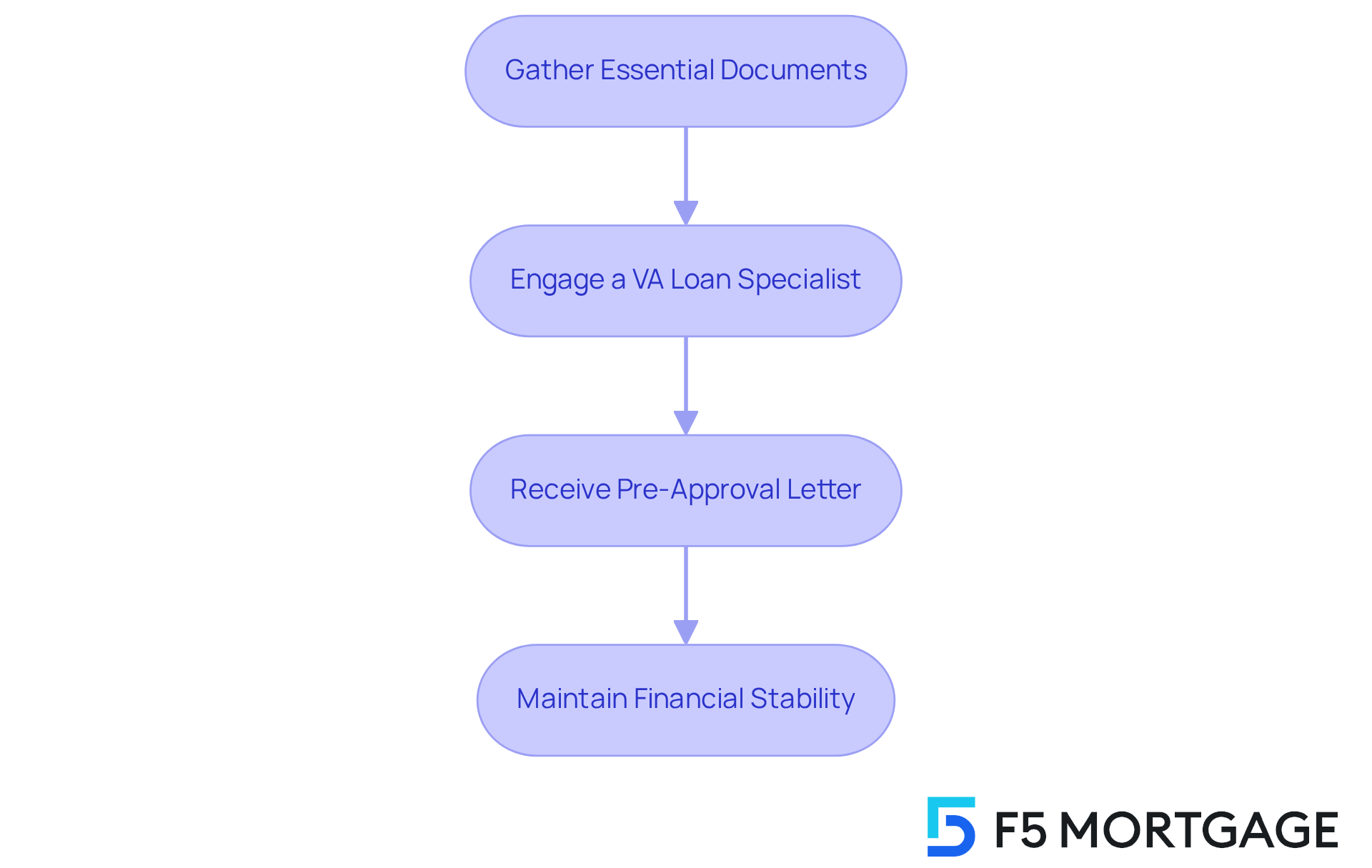

Get Pre-Approved for a VA Loan

We know how challenging the mortgage pre-approval process can be, but with the right steps, you can navigate it with confidence. To begin, gather essential documents such as your Certificate of Eligibility (COE), proof of income, recent tax returns, and a detailed credit history. Engaging a financier who specializes in VA loans, like F5 Mortgage, is a crucial step. They will assess your financial profile and issue a pre-approval letter that details the loan amount for which you qualify.

This is vital when making offers on land using a VA home loan to buy land. It shows sellers that you are a serious buyer who has a VA home loan to buy land already arranged. Typically, the pre-approval procedure can be completed in minutes online, and many borrowers receive their letters within a week, depending on the lender and the speed of documentation submission. Having your financial documents organized, such as recent bank statements and pay stubs, can significantly accelerate this process.

Remember, a strong credit score—ideally a median score of 620 or higher—can enhance your chances of pre-approval and secure better loan terms. Additionally, maintaining a debt-to-income (DTI) ratio below 43% is essential. Exceeding this threshold may require you to present additional compensating factors to qualify. It’s also beneficial to explore refinancing options available in Colorado, which can provide more flexibility in your financing choices.

By following these steps and ensuring your financial stability—steering clear of significant purchases or new credit lines during the pre-approval stage—you can traverse the pre-approval process with assurance. This places you advantageously in the competitive property buying market, and we’re here to support you every step of the way.

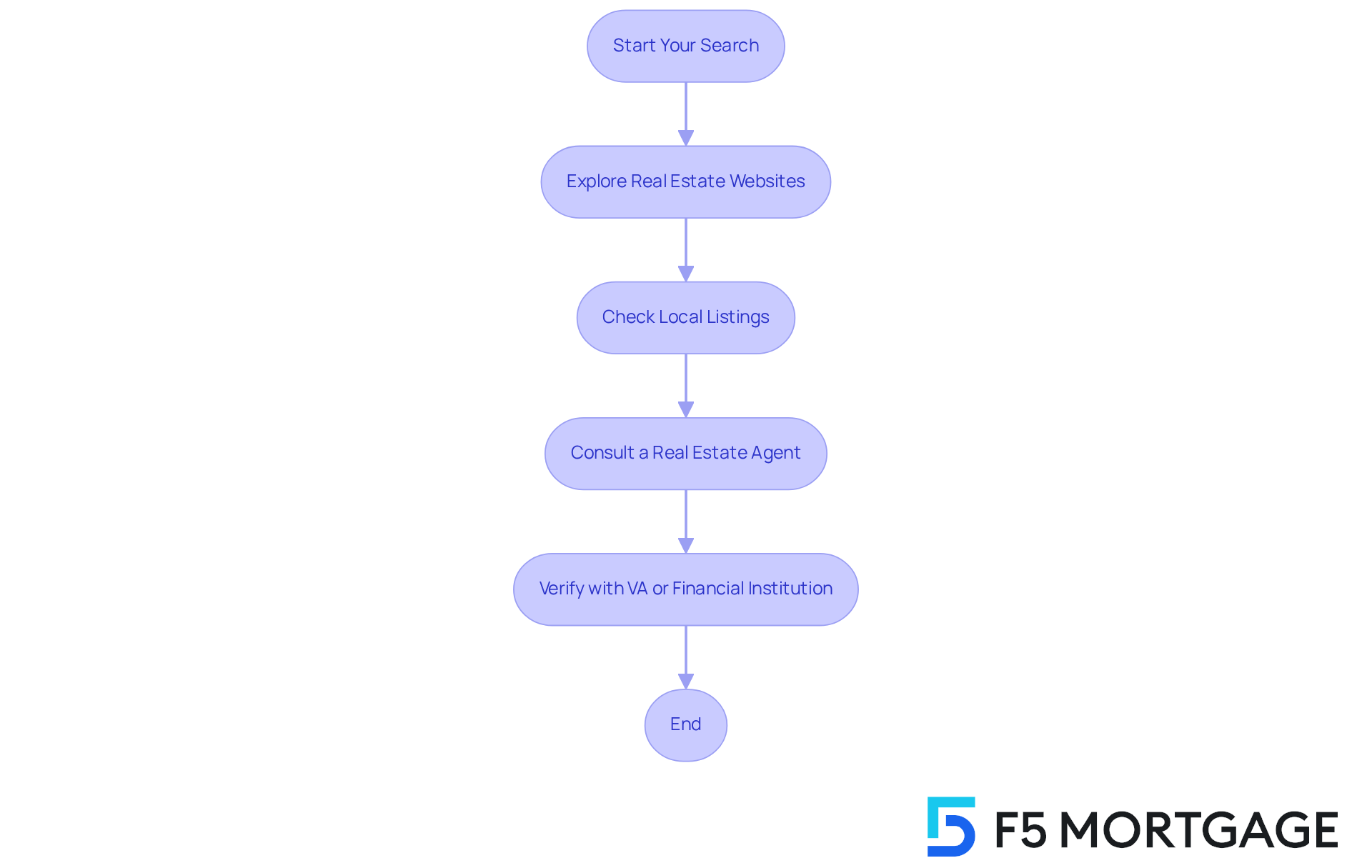

Find VA-Approved Land

Finding the right property can feel overwhelming, especially when you’re navigating the VA home loan to buy land requirements. It’s essential to ensure that the property is suitable for residential use and has access to utilities. You might consider starting your search on real estate websites, exploring local listings, or working with a knowledgeable real estate agent who understands .

We know how challenging this can be, so it’s crucial to verify with the VA or your financial institution. This step ensures that the property you’re considering qualifies for a VA home loan to buy land. Taking this precaution can help you avoid complications later in the process. Remember, we’re here to support you every step of the way.

Collaborate with a VA-Savvy Lender

When choosing a provider for your to buy land, we understand how important it is to select one with a proven track record in managing VA financing, particularly for property acquisitions. F5 Mortgage truly shines in this area, as highlighted by numerous client testimonials that praise their exceptional service and personalized mortgage solutions. For instance, Ruth Vest shared, “Thank you very much for your financial expertise and excellent customer service,” while Artie Kamarhie noted, “They have an amazing attention to detail & guided me as a first-time home buyer step by step.”

Clients like these illustrate how the dedicated team at F5 Mortgage, including skilled financing specialists like Jeff and Jorge, supported them throughout the application process with ease and expertise. We know how challenging this can be, and their commitment to ensuring clients understand their options and secure the best rates is evident in the 5-star reviews they consistently receive.

By engaging with a provider like F5 Mortgage, you can look forward to a smooth loan experience tailored to your needs. This support makes your journey to acquiring property as seamless as possible, and we’re here to support you every step of the way.

Navigate the VA Appraisal Process

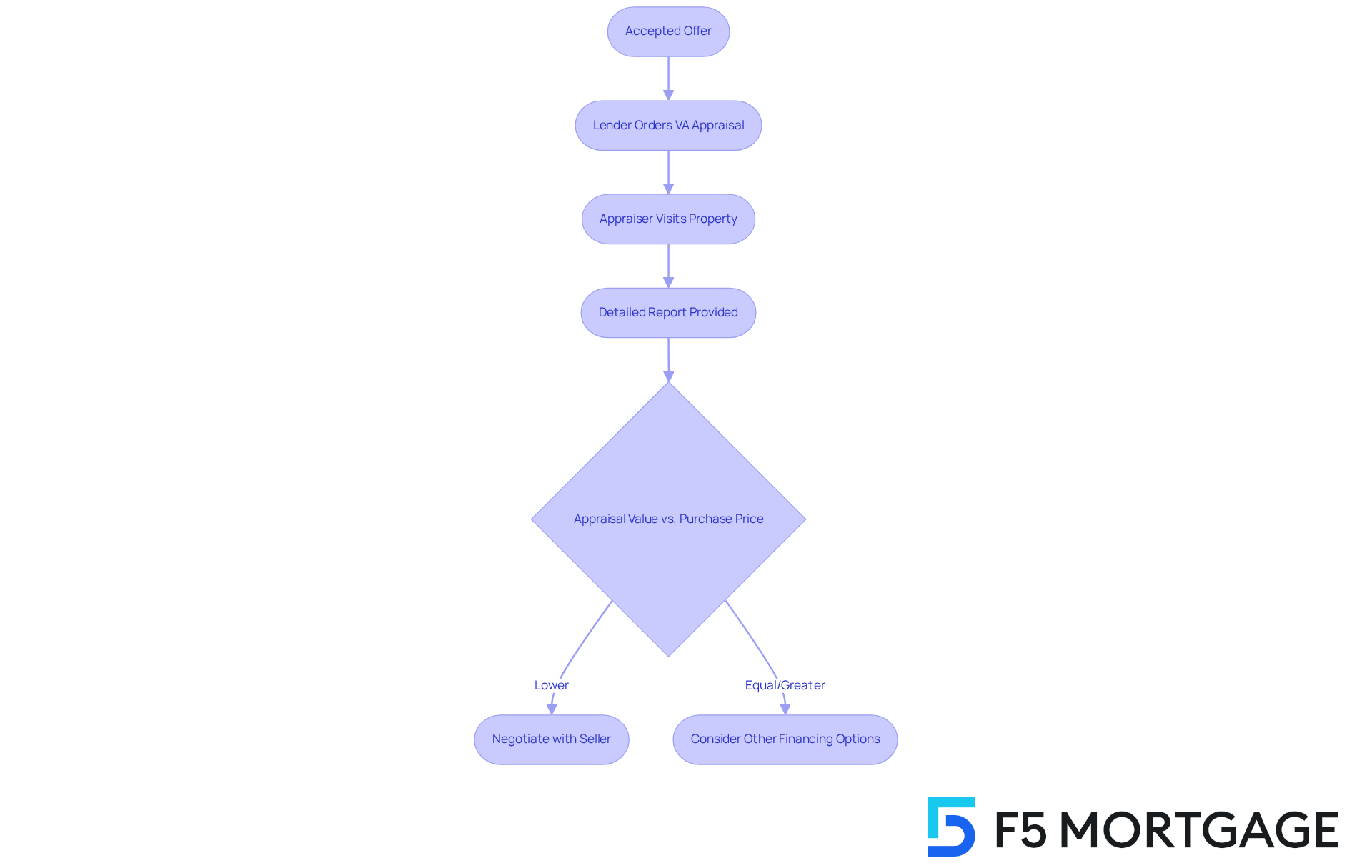

Once you have an accepted offer on the property, it’s important to understand the next steps. Your lender will order a to assess the property’s value and ensure it meets VA standards. This appraisal is crucial; it determines the current market value of the property and identifies how much equity you have.

The appraiser will visit the property to evaluate its condition, location, and market value. Be prepared for this visit, as the appraiser will provide a detailed report. If the appraisal comes in lower than the purchase price, you may need to negotiate with the seller or consider other financing options.

We know how challenging this can be, but understanding this process will help you navigate any challenges that may arise. Remember, we’re here to support you every step of the way.

Finalize Your Land Purchase

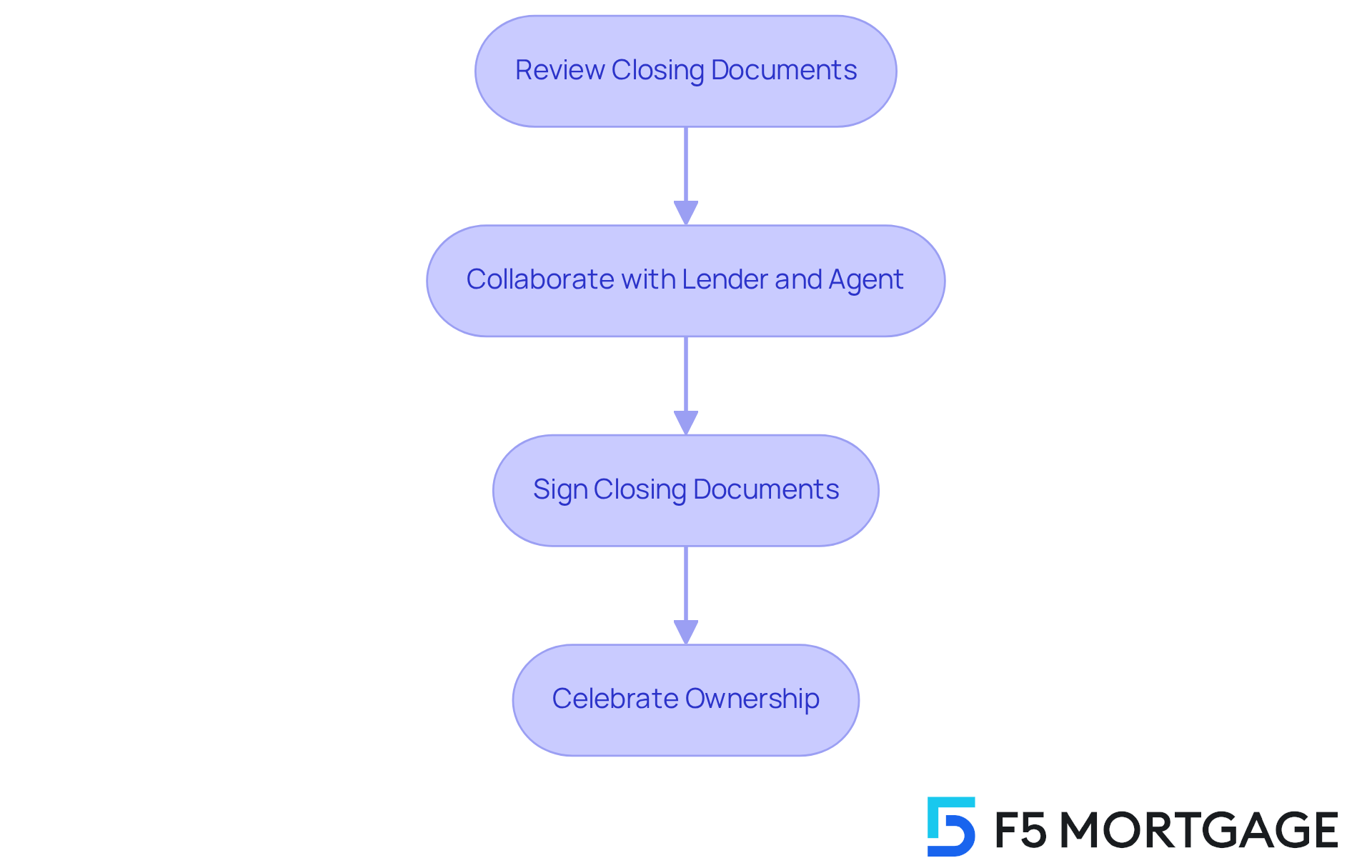

Once you’ve completed the evaluation and made any necessary adjustments, it’s time to finalize your property purchase. Take a moment to carefully review all closing documents. This is your opportunity to ensure that every term aligns with what you agreed upon. Collaborate closely with your lender and real estate agent; they are there to help you navigate this process, ensuring that all paperwork is accurate and submitted on time.

When everything is in order, you’ll and pay any required fees. This is a significant milestone—one that officially marks your ownership of the land. We know how challenging this journey can be, and it’s important to celebrate this achievement. Now, you can start planning your next steps for building or developing your new property. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the process of using a VA home loan to buy land can truly transform the lives of veterans and service members. We understand how challenging this journey can be, and it’s essential to recognize the unique advantages of VA loans, such as no down payment and no private mortgage insurance. By following the outlined steps, you can empower yourself to take full advantage of these benefits, ensuring a successful journey toward acquiring land.

Key points to consider include:

- Determining your eligibility for VA loans

- Obtaining a Certificate of Eligibility

- Securing pre-approval to strengthen your purchasing power

- Finding VA-approved land

- Collaborating with knowledgeable lenders

- Understanding the appraisal process

Each step is designed to guide you through the complexities of the VA loan process, making it more accessible and less daunting.

Ultimately, the significance of this article lies in its ability to equip you with the knowledge and resources needed to confidently pursue your dream of land ownership. By leveraging the advantages of VA home loans and adhering to the outlined steps, you can turn your aspirations into reality. Embracing this journey not only honors your service but also lays the foundation for future growth and development on your new property.

Frequently Asked Questions

What are VA home loans?

VA home loans are financing options supported by the U.S. Department of Veterans Affairs, specifically designed to assist veterans, active-duty service members, and certain members of the National Guard and Reserves in achieving homeownership.

What are the key advantages of VA home loans?

Key advantages include no down payment requirement and no private mortgage insurance (PMI), which can lead to significant savings for eligible individuals.

How can I determine my eligibility for a VA loan?

To qualify for a VA loan, you generally need to have served 90 consecutive days of active service during wartime or 181 days during peacetime. National Guard or Reserve members may qualify after six years of service.

What is a Certificate of Eligibility (COE)?

A Certificate of Eligibility (COE) is a document that confirms your eligibility status for a VA mortgage and is necessary for financial institutions to process your financing request.

How can I obtain my Certificate of Eligibility?

You can apply for your COE online through the VA’s eBenefits portal or request it through your financial institution.