Overview

The title “7 Essential Features of a Home Buying Power Calculator” raises an important question: what key features truly make a home buying power calculator essential for prospective homebuyers? We understand how overwhelming the home buying process can be, and this article aims to shed light on critical features that can help you navigate it with confidence.

Among these features are:

- Real-time calculations

- Affordability assessments

- Loan type integrations

Each of these elements plays a crucial role in empowering you to make informed financial decisions. By understanding these aspects, you can enhance your confidence and grasp of the home buying process, ensuring that you feel supported every step of the way.

We know how challenging this can be, and our goal is to provide you with the tools and knowledge necessary to make the best choices for your future.

Introduction

Navigating the complex world of home buying can often feel overwhelming. We know how challenging this can be, especially for first-time buyers grappling with financial calculations and loan options. That’s where the home buying power calculator comes in—a powerful tool designed to simplify this process and empower you with essential insights into your purchasing capabilities.

But how can one tool transform the daunting task of securing a mortgage into an informed, confident decision-making journey? By exploring the essential features of a home buying power calculator, we can reveal not only its practical benefits but also its role in enhancing financial literacy. This understanding guides prospective homeowners like you toward your dream properties, making the journey feel a little less daunting and a lot more achievable.

F5 Mortgage: User-Friendly Mortgage Calculator for Home Buyers

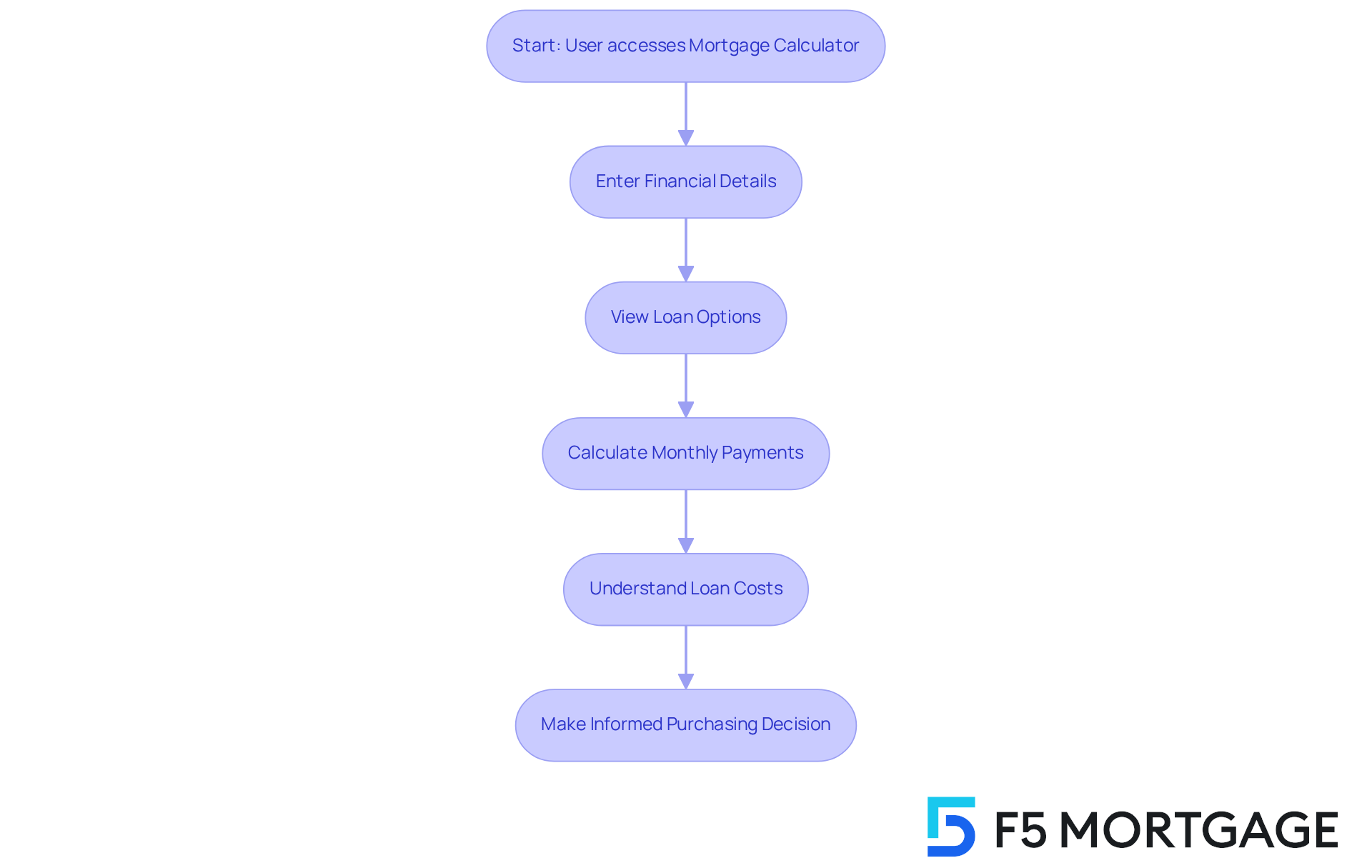

At F5 Mortgage, we understand how daunting the home purchasing process can be. That’s why we offer an easy-to-use home buying power calculator designed specifically for home purchasers, simplifying the often intricate calculations related to loan payments. This tool is particularly beneficial for newcomers, as it clarifies the financial aspects of buying a home and emphasizes personalized loan options tailored to fit individual budgets and needs. With a user-friendly interface, you can easily enter your financial details and quickly grasp your loan choices without feeling overwhelmed by technical jargon.

The impact of the home buying power calculator on home purchasing decisions is significant. They empower buyers to make informed choices by illustrating potential monthly payments and overall loan costs. For instance, a case study revealed that first-time buyers who utilized a loan calculator reported increased confidence in their purchasing decisions, leading to more successful transactions.

Experts in the lending industry emphasize the importance of accessible financing tools, noting that they play a crucial role in enhancing financial literacy among prospective buyers. As trends evolve, the home buying power calculator is becoming more sophisticated, featuring options that allow users to explore various loan scenarios, interest rates, and down payment possibilities, including FHA loans with as little as 3.5% down and VA loans with 0% down. This evolution not only aids in budgeting but also fosters a deeper understanding of the lending process, ultimately helping you achieve your homeownership dreams with F5 Mortgage.

To take the first step, visit our website to explore and discover the mortgage solution that best aligns with your needs. Remember, we’re here to support you every step of the way.

Affordability Assessment: Determine Your Budget for Home Purchases

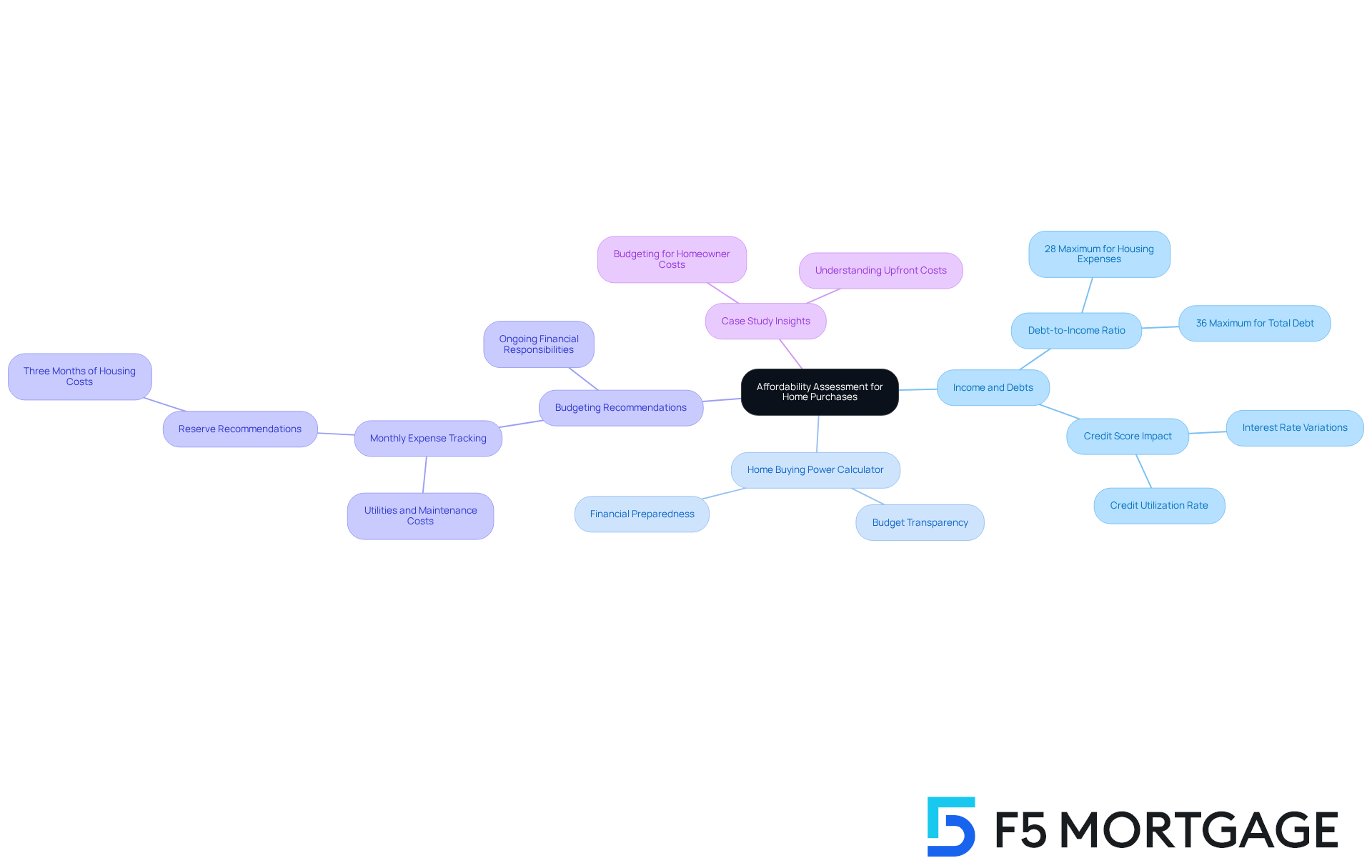

The affordability assessment feature of the F5 Mortgage calculator empowers you to thoroughly evaluate your financial landscape by inputting your income, debts, and other financial commitments. We understand how challenging this can be, and the is a critical tool that enables potential buyers to ascertain their home purchasing power, ensuring you remain within your financial means. By offering a transparent view of your budget, you can make well-informed decisions when exploring housing options, reflecting F5 Mortgage’s commitment to transparency and client empowerment.

In 2025, understanding your budget is more crucial than ever, especially as average debt-to-income ratios for homebuyers hover around 36%. This aligns with the ’28/36 rule’ that lenders often use to qualify applicants. This rule suggests that housing expenses should not exceed 28% of gross monthly income, while total debt payments should remain below 36%. Additionally, many lenders require homeowners to have at least an 80% home-to-value loan ratio, meaning you should have paid down at least 20% on your original loan amount or your home has increased in value. F5 Mortgage’s technology-driven approach ensures that families can access competitive rates without the stress of hard sales tactics, making the mortgage process more accessible.

Utilizing a home buying power calculator not only simplifies this process but also gives families a clearer understanding of their financial capabilities. For instance, a case study titled “Budgeting for Homeowner Costs” revealed that families who engaged with such tools were better prepared for the financial responsibilities of homeownership, leading to more successful purchasing experiences. This case study highlights how F5 Mortgage’s tools can enhance your financial preparedness.

Financial advisors recommend that prospective buyers maintain a budget that accounts for all monthly expenses, including utilities, groceries, and maintenance costs, which can average around $2,289 annually for homeowners. Furthermore, it is wise to keep a reserve of three months of housing costs along with regular monthly expenses to protect against unforeseen circumstances. This comprehensive approach to budgeting ensures that families are not only prepared for the initial costs of purchasing a home but also for the ongoing expenses that come with it. By leveraging the home buying power calculator, you can confidently navigate the complexities of home buying and make informed choices that align with your financial goals.

Real-Time Calculations: Instant Feedback on Mortgage Scenarios

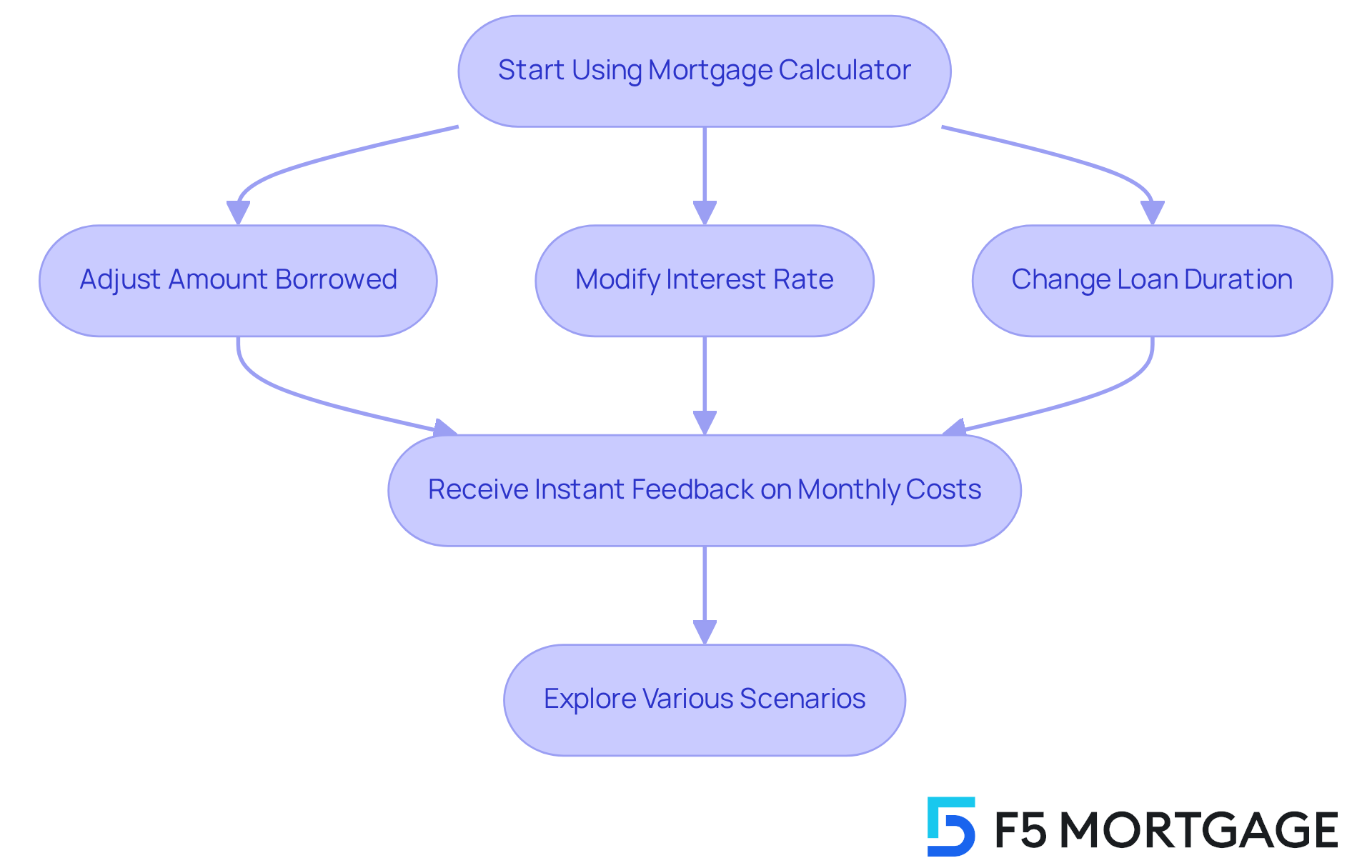

A key feature of the F5 Mortgage calculator is its capability for real-time calculations. We understand how challenging the mortgage process can be, and as you modify factors like the amount borrowed, interest rate, and loan duration, you receive prompt feedback on how these changes impact your monthly costs. This immediate understanding empowers you to explore various scenarios. For instance, you might consider extending your financing period to lower monthly payments, which can help maintain cash flow for other essential expenses. Alternatively, reducing the term can enable you to settle your debt sooner, allowing you to build equity more quickly and incur less interest over time.

Research shows that 78% of consumers prefer brands that offer personalized experiences, highlighting the importance of interactive tools like this in enhancing user engagement. The ability to adjust financing variables and observe the direct effects on payments fosters a deeper comprehension of home funding dynamics, especially when using a home buying power calculator. This includes strategies for eliminating private mortgage insurance (PMI) through refinancing, especially in light of high property appreciation rates in California. Ultimately, this knowledge leads to more informed decision-making.

Consider this: a case study revealed that users who utilized instant feedback tools reported a 31% increase in their confidence when selecting mortgage products. This demonstrates the significant role of real-time data in using a home buying power calculator during the home buying process. We’re here to support you every step of the way as you .

Loan Type Integration: Explore Fixed, FHA, VA, and Jumbo Loans

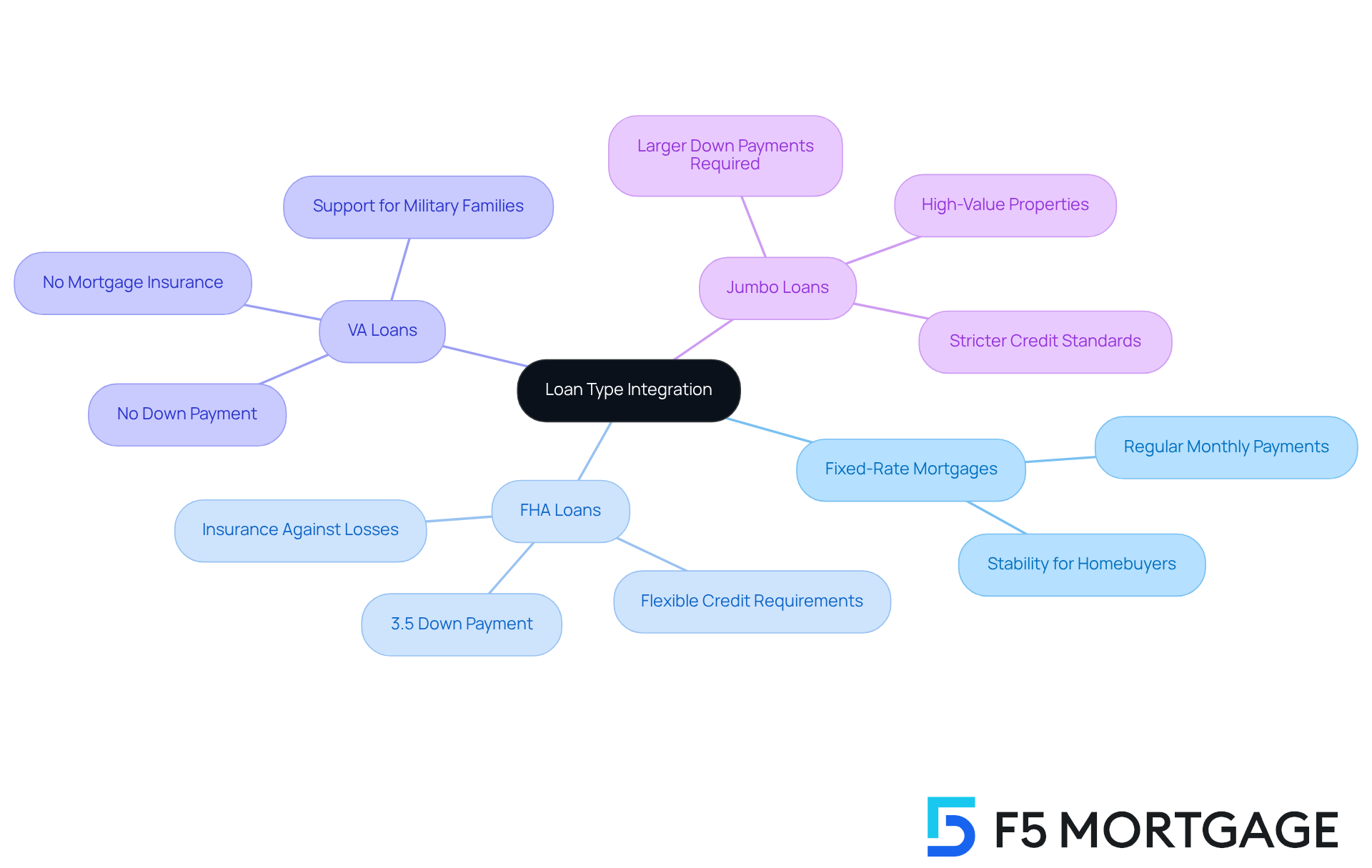

At F5, we understand how daunting the mortgage process can be, and our Mortgage calculator is designed to help you navigate through various financing types, including fixed-rate, FHA, VA, and jumbo options. This tool empowers you to explore financial solutions tailored to your unique circumstances, making it easier for you to achieve your homeownership dreams.

Fixed-rate mortgages are often favored by homebuyers for their stability, providing regular monthly payments that you can count on. If you’re a first-time buyer or have a lower credit rating, FHA financing could be a viable option, allowing down payments as low as 3.5%. We know how important it is to find attainable solutions, and this option opens doors for many.

For veterans and active-duty service members, VA financing offers incredible benefits, including no down payment and no mortgage insurance. This is our way of supporting military families as they pursue their dream homes.

If you’re looking at high-value properties, jumbo mortgages might be the right choice for you. While they do require a larger down payment and stricter credit standards, they can be the perfect solution for those seeking to invest in luxury real estate.

By utilizing the home buying power calculator, you can evaluate how different financing options affect your borrowing capacity and overall purchasing power. This insight is crucial as you take steps toward homeownership. We also recognize that can be a significant barrier for first-time homebuyers, and we’re here to support you every step of the way.

F5 Mortgage offers a diverse range of financing programs, ensuring that there are options available for every borrower, whether you are seeking standard or nontraditional solutions. Let us guide you in finding the mortgage solution that best fits your needs.

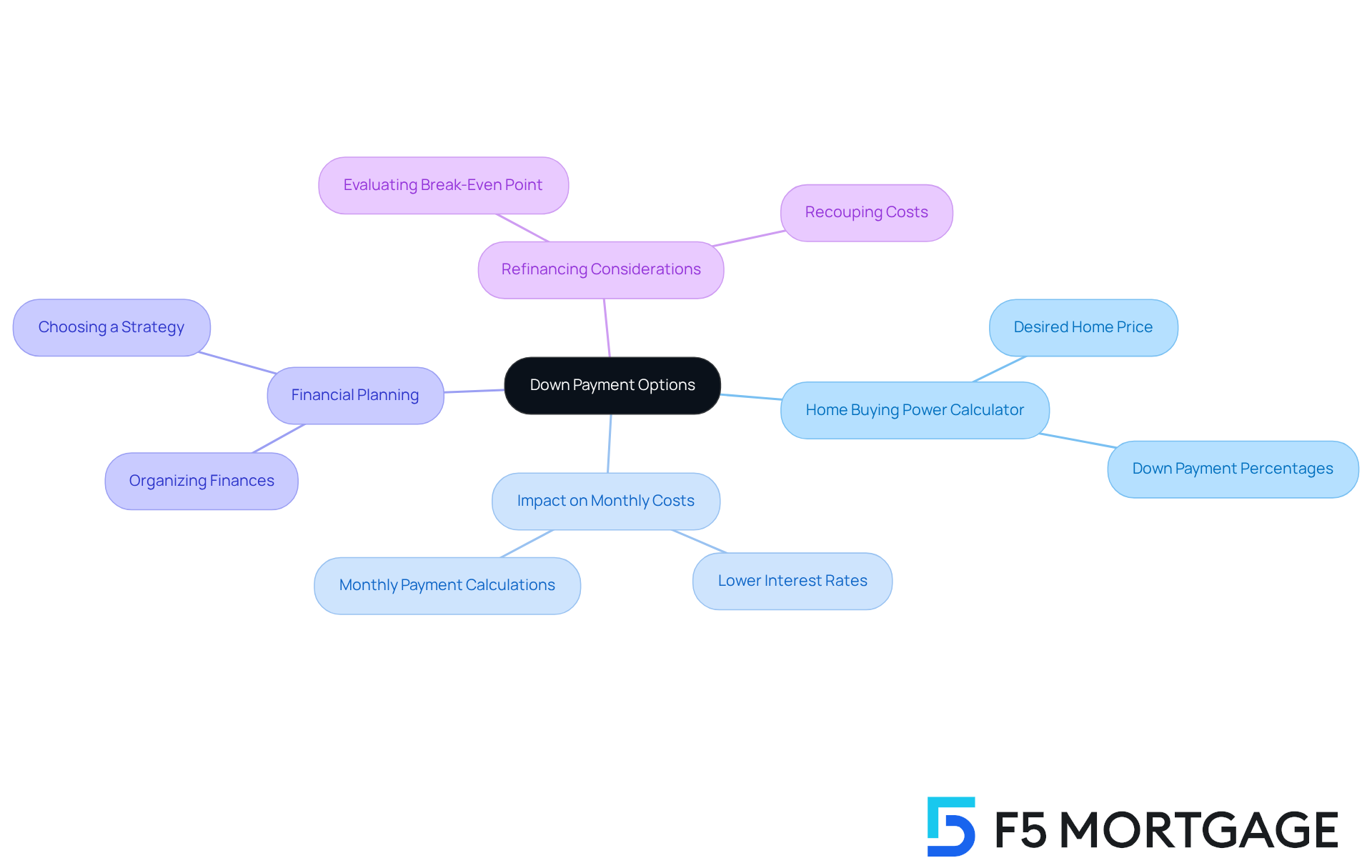

Down Payment Options: Understand Your Initial Investment

Understanding your down deposit options is crucial as you embark on the journey of home buying. The home buying power calculator offers valuable insights that can help you understand your initial investment needs. By utilizing the home buying power calculator to enter your desired home price and selecting different down deposit percentages, you can see how your choices impact your monthly loan costs and the total amount you borrow. A larger initial deposit often leads to lower interest rates and monthly payments, making it a strategic choice for many families.

We know how challenging can be, especially when considering the effects of loan insurance related to your deposit amount. This feature empowers you to organize your finances effectively and choose a down deposit strategy that aligns with your budget. For those contemplating refinancing, evaluating the break-even point is essential. It helps you determine how long it will take to recoup refinancing costs through savings on monthly payments, ensuring you make informed decisions throughout the mortgage process.

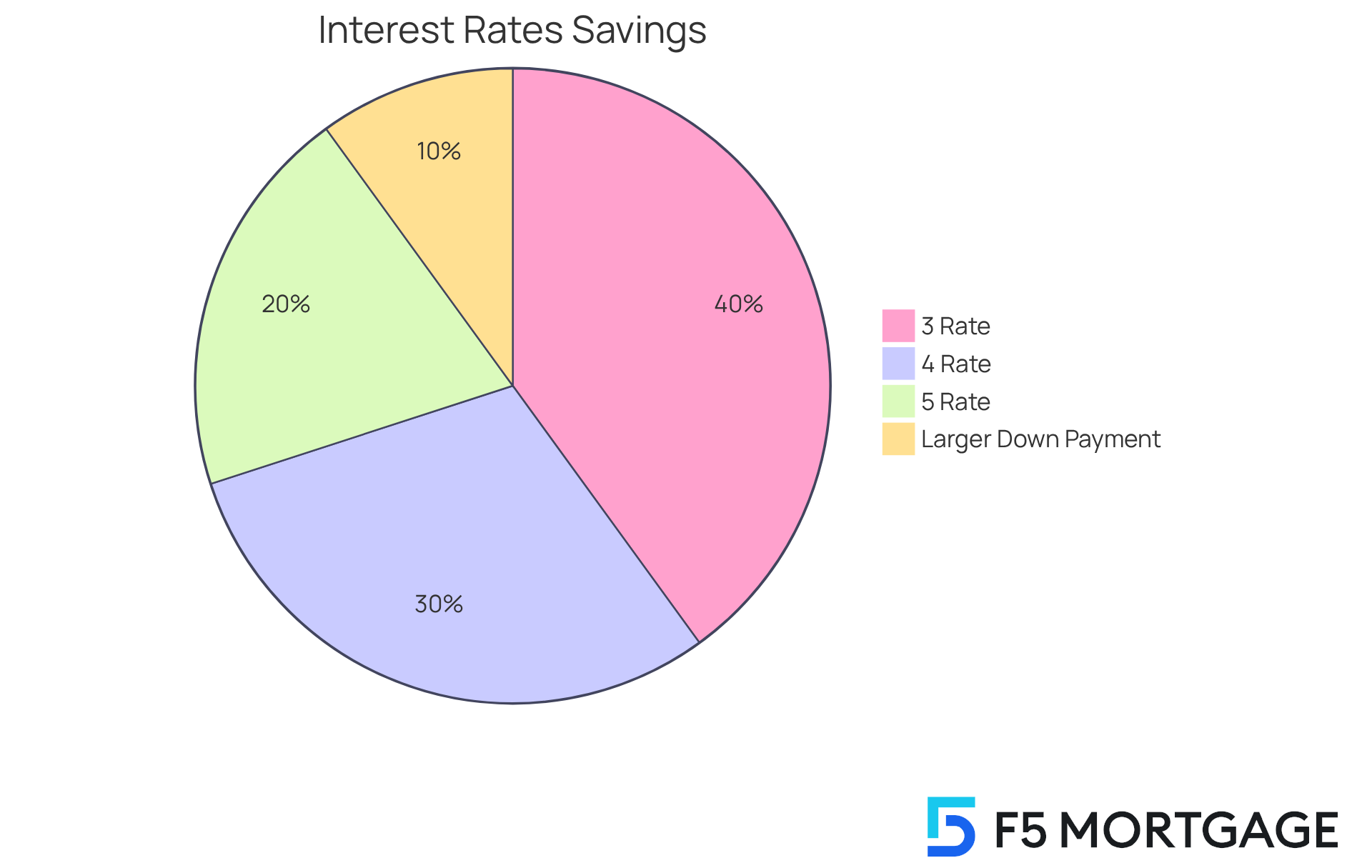

Interest Rate Comparisons: Evaluate Competitive Mortgage Offers

Navigating the mortgage landscape can be challenging, and the F5 Mortgage calculator is here to help you compare interest rates from various lenders. This crucial step allows you to evaluate competitive mortgage offers, ensuring that you make informed decisions. By simply inputting different interest rates, you can visualize how these rates affect your monthly expenses and total loan costs.

We know how important it is to shop around for the best deal. In fact, borrowers who obtain multiple rate quotes can save significantly—up to $1,200 annually in some cases. Understanding the and associated fees is vital, and we’re here to support you every step of the way. For instance, a larger down payment can lead to lower interest rates, reflecting a borrower’s reduced risk in the eyes of lenders.

As the housing market stabilizes and loan rates trend downward, we encourage you to utilize the home buying power calculator. This proactive approach to evaluating offers can lead to substantial savings and a more favorable home buying experience. Remember, you are not alone in this journey; we’re here to help you secure the most favorable terms for your loan.

User-Friendly Interface: Simplify Your Mortgage Calculations

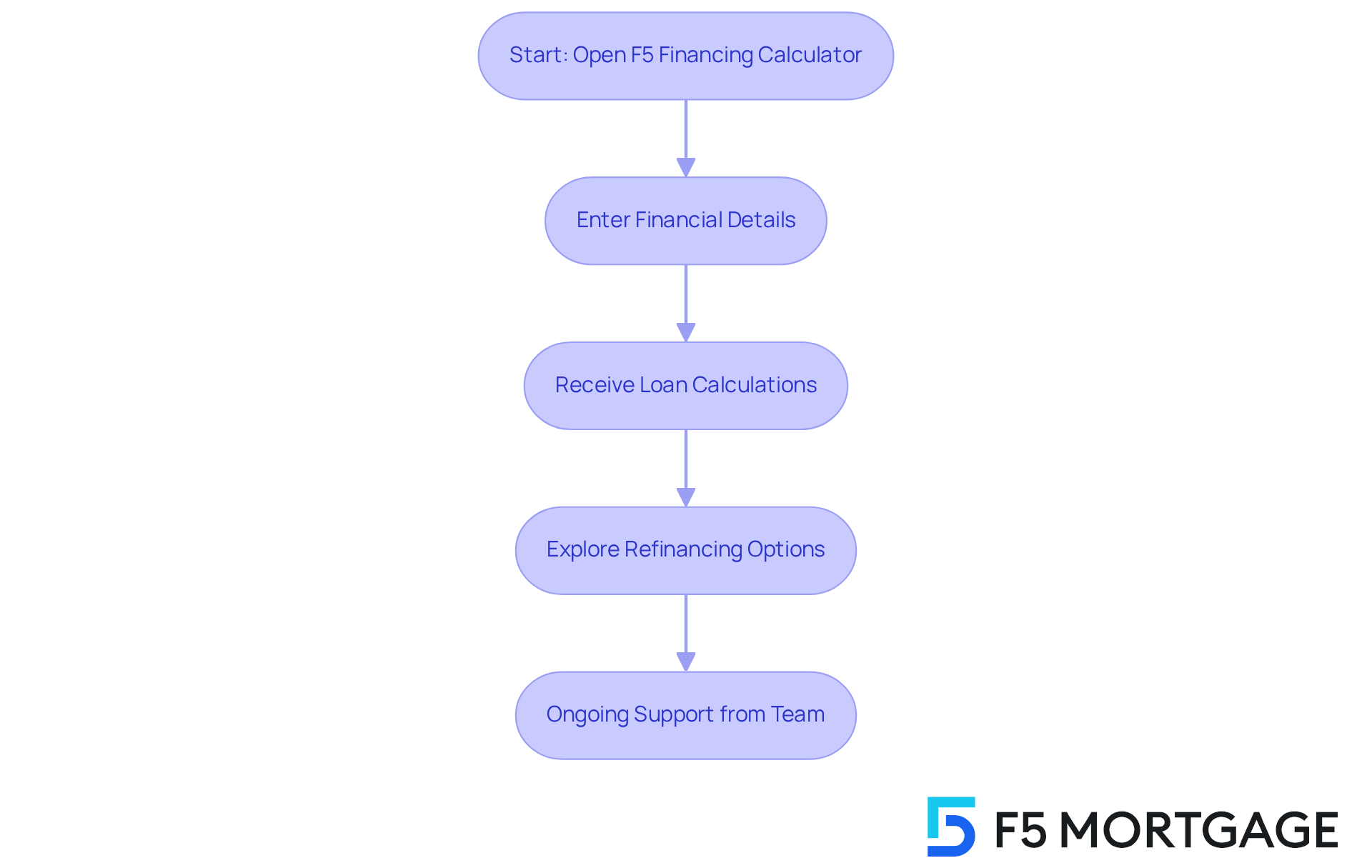

The F5 Financing calculator offers a user-friendly interface that simplifies the loan calculation process, making it an essential tool for California homeowners considering refinancing. We understand how daunting this process can be, and with intuitive input fields and easy navigation, you can effortlessly enter your financial details, ensuring clarity and reducing confusion.

This design prioritizes accessibility, allowing individuals with varying levels of financial literacy to engage with the tool confidently. As Nicholas Hiersche, President of F5 Mortgage, shares, “We understand every borrower’s situation is unique, and these tools are designed to cater to those specific needs.” By streamlining the loan calculation experience, F5 Mortgage empowers you to take charge of your financial choices, utilizing the home buying power calculator to make the home purchasing process less overwhelming and more accessible.

Additionally, our dedicated team is ready to assist you throughout the refinancing procedure. Together, you can explore strategic refinancing options that reveal lower rates and adaptable terms. We know how important it is to find the right solution for your unique situation.

Studies indicate that accessible loan calculators significantly improve user engagement, highlighting the importance of creating tools that consider all users. We’re here to , ensuring that you feel confident and informed in your decisions.

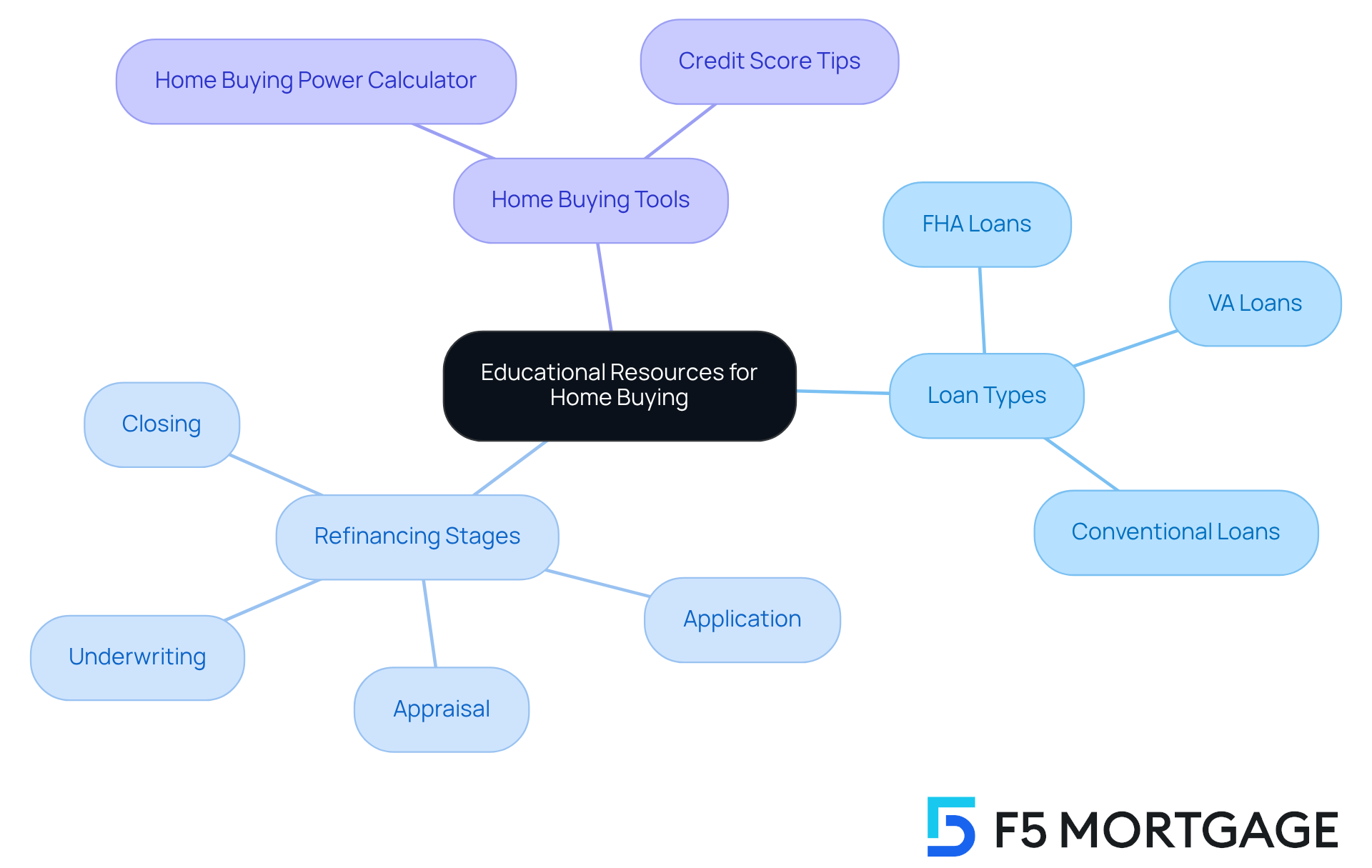

Educational Resources: Empower Yourself with Home Buying Knowledge

At F5 Mortgage, we understand how challenging the mortgage landscape can be. That’s why we provide an extensive array of educational resources, including a home buying power calculator, to empower homebuyers like you with the knowledge you need. Our comprehensive guides cover various loan types, including FHA, VA, and conventional loans, along with practical tips for improving credit scores. These invaluable tools are here to support you every step of the way.

We know that navigating the can feel overwhelming. That’s why we provide essential information about each stage—application, appraisal, underwriting, and closing. By doing so, we foster a sense of confidence and prepare you for the challenges of home buying. Our dedicated team approach ensures that you receive unparalleled support throughout the refinancing process, helping you secure competitive rates and favorable terms.

As industry specialists often mention, understanding the loan process is essential. It allows you to make informed choices that align with your financial objectives. The impact of our educational resources is profound; they significantly influence your financial decision-making, ensuring you feel empowered on your journey to homeownership by utilizing a home buying power calculator.

In 2025, the importance of home buying knowledge cannot be overstated. It remains a key factor in achieving successful and satisfying real estate transactions. Remember, we’re here to support you every step of the way.

Pre-Approval Features: Streamline Your Home Buying Process

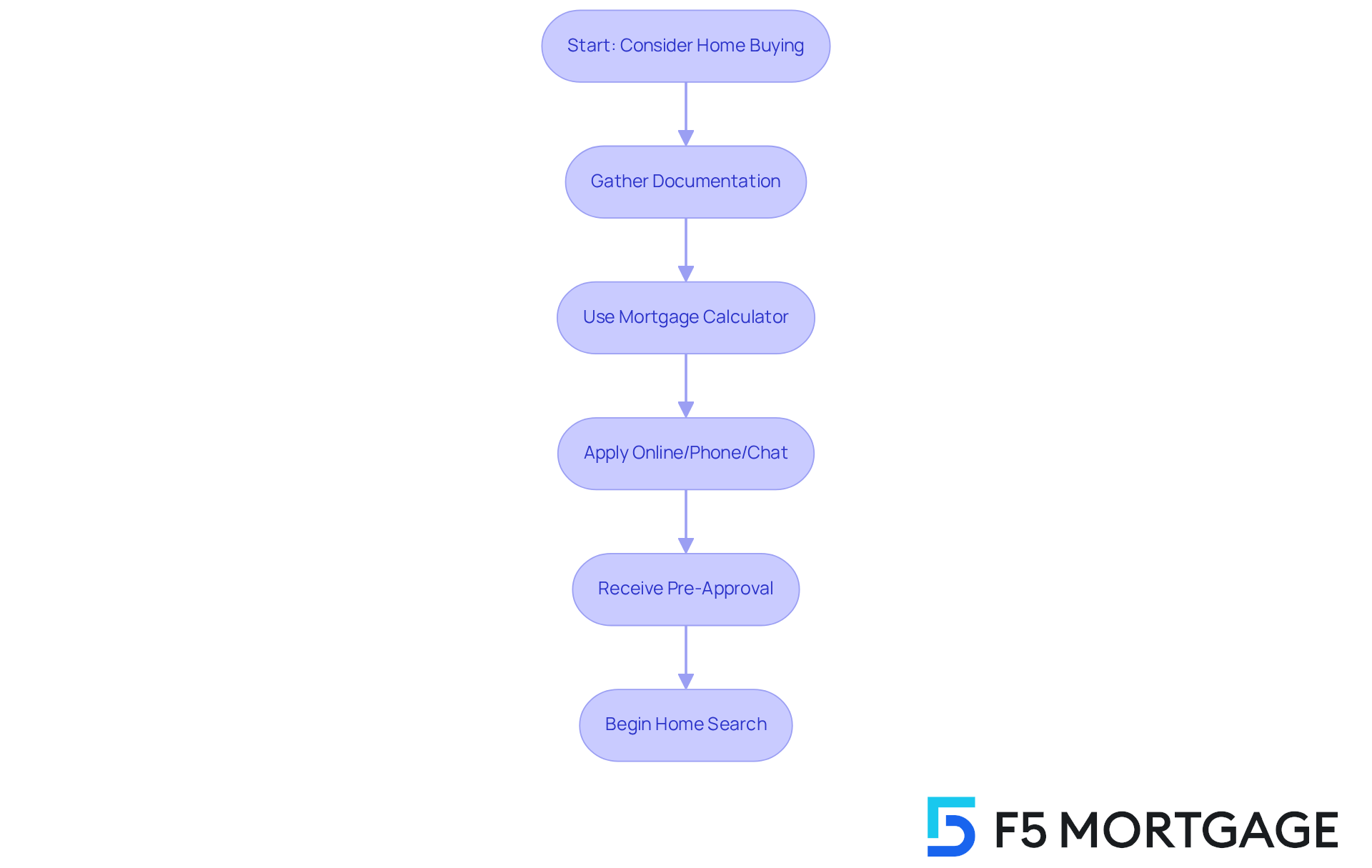

At F5 Mortgage, we understand how overwhelming the mortgage process can feel. Our mortgage calculator is designed to simplify the pre-approval journey, providing you with essential insights into the necessary documentation and application steps. You can apply online, by phone, or via chat, ensuring a convenient experience tailored to your needs.

In today’s market, obtaining mortgage pre-approval is crucial. The home buying power calculator not only enhances your credibility with sellers but also clarifies your budget, making it an essential part of your home buying journey. We know how challenging this can be, and understanding your financial position with a home buying power calculator is key before entering the market. Statistics show that 80% of recent purchasers financed their home acquisitions, highlighting the importance of being prepared.

When you secure pre-approval, you typically enjoy a more streamlined experience. This allows you to act quickly in a competitive environment, where 41% of consumers begin their search online. Mortgage experts stress that a home buying power calculator can greatly boost your confidence by enabling you to focus on properties within your financial capacity. Imagine the peace of mind knowing you’re using a home buying power calculator to look at homes you can afford.

A case study illustrates this point: buyers who secured pre-approval reported a 30% increase in their confidence levels during negotiations. This demonstrates the profound impact that this step can have on your overall home buying experience. With access to , including FHA, VA, and conventional loans, F5 Mortgage is here to support you every step of the way, ensuring that you can find the right financing solution tailored to your family’s needs.

Customer Support: Access Help When You Need It

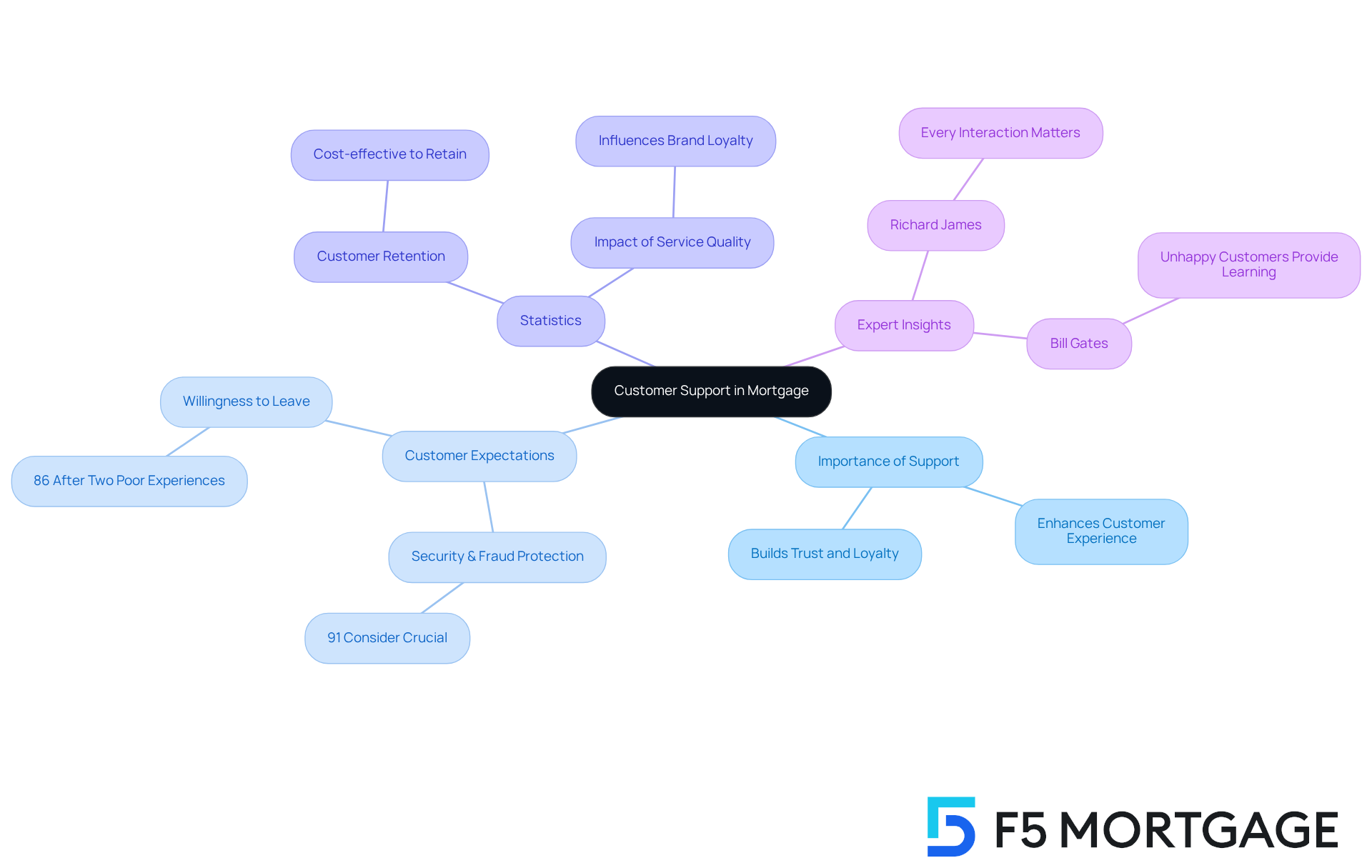

At F5 Mortgage, we understand that navigating the mortgage process can be daunting. That’s why we place a strong emphasis on customer support, ensuring you have access to assistance whenever you need it. Whether you have questions about our or need help with your application, our dedicated support team is here to guide you every step of the way. This unwavering commitment to customer service greatly enhances your experience, making you feel valued and supported throughout your financing journey.

Did you know that 91% of customers consider security and fraud protection crucial when selecting a digital banking platform? This statistic highlights the importance of reliable support in financial services. Additionally, research shows that 86% of customers are willing to leave a brand after just two poor experiences. This underscores the necessity for consistent, high-quality service that meets your needs.

Experts in customer service emphasize that effective support not only resolves issues but also fosters trust and loyalty among clients. Richard James, a director of customer experience, reminds us, “Every customer interaction influences their likelihood of returning.” This reinforces the idea that exceptional service is vital for your retention and satisfaction. By prioritizing customer support, F5 Mortgage not only streamlines the mortgage application process but also builds lasting relationships with clients like you, ultimately contributing to your success in achieving homeownership.

Conclusion

Understanding the essential features of a home buying power calculator can truly enhance your home purchasing journey. By utilizing tools like the F5 Mortgage calculator, you are empowered to make informed decisions. This not only streamlines the mortgage process but also helps you navigate the complexities of home financing with confidence. These calculators simplify calculations and provide valuable insights into budgeting, loan types, and down payment options.

Throughout this article, we’ve highlighted key arguments such as the importance of affordability assessments and real-time calculations. The user-friendly interface and educational resources offered by F5 Mortgage ensure that individuals from all financial backgrounds can effectively engage with the home buying process. Moreover, the emphasis on customer support enhances your overall experience, allowing you to feel secure and informed every step of the way.

As the housing market continues to evolve, leveraging a home buying power calculator becomes increasingly vital. It aids in understanding your financial capabilities and fosters a sense of preparedness for the responsibilities of homeownership. By taking advantage of these tools and resources, you can confidently embark on your journey toward homeownership, ensuring that your choices align with your financial goals and aspirations.

Frequently Asked Questions

What is the F5 Mortgage home buying power calculator?

The F5 Mortgage home buying power calculator is an easy-to-use tool designed to help home buyers understand their loan options and simplify the calculations related to loan payments. It is particularly beneficial for newcomers, as it clarifies the financial aspects of buying a home.

How does the home buying power calculator benefit first-time buyers?

The calculator empowers first-time buyers by illustrating potential monthly payments and overall loan costs, which can increase their confidence in purchasing decisions and lead to more successful transactions.

What features does the F5 Mortgage calculator offer?

The F5 Mortgage calculator offers an affordability assessment, real-time calculations, and options to explore various loan scenarios, interest rates, and down payment possibilities, including FHA and VA loans.

What is the importance of the affordability assessment feature?

The affordability assessment feature allows users to evaluate their financial landscape by inputting income, debts, and other commitments, helping them determine their home purchasing power and stay within their financial means.

What is the ’28/36 rule’ mentioned in the article?

The ’28/36 rule’ suggests that housing expenses should not exceed 28% of gross monthly income, while total debt payments should remain below 36%, which many lenders use to qualify applicants.

How does the calculator provide real-time feedback?

The calculator allows users to modify factors like the amount borrowed, interest rate, and loan duration, providing immediate feedback on how these changes impact monthly costs, which helps users explore various financing scenarios.

What impact does using the home buying power calculator have on user confidence?

Research shows that users who utilize instant feedback tools like the home buying power calculator report increased confidence in selecting mortgage products, leading to more informed decision-making.

What additional budgeting considerations should prospective buyers keep in mind?

Prospective buyers should maintain a budget that accounts for all monthly expenses, including utilities, groceries, and maintenance costs, and keep a reserve of three months of housing costs to protect against unforeseen circumstances.