Overview

The article titled “7 Essential Tips for Managing a High LTV HELOC” offers valuable strategies for managing a Home Equity Line of Credit (HELOC) with a high loan-to-value ratio. We understand how challenging this can be, and it’s crucial to grasp the importance of understanding your property value.

Maintaining a strong credit score is another key aspect to consider. We’re here to support you every step of the way in preparing the necessary documentation. Having a clear repayment plan is essential as well; it enhances your chances of approval and ensures responsible borrowing practices.

By following these tips, you can navigate the complexities of a high LTV HELOC with confidence, making informed decisions that align with your financial goals.

Introduction

Navigating the complexities of a high LTV Home Equity Line of Credit (HELOC) can feel overwhelming for many homeowners. We understand how challenging this can be, especially with rising interest rates and changing lending criteria. It’s essential to grasp how to manage and leverage this financial tool effectively.

In this article, we offer essential tips designed to empower you to maximize your borrowing potential while minimizing risks. This way, you can confidently tap into your home equity for renovations, debt consolidation, or unexpected expenses.

But with so many variables at play, what strategies can you employ to make informed and beneficial decisions regarding your HELOC? We’re here to support you every step of the way.

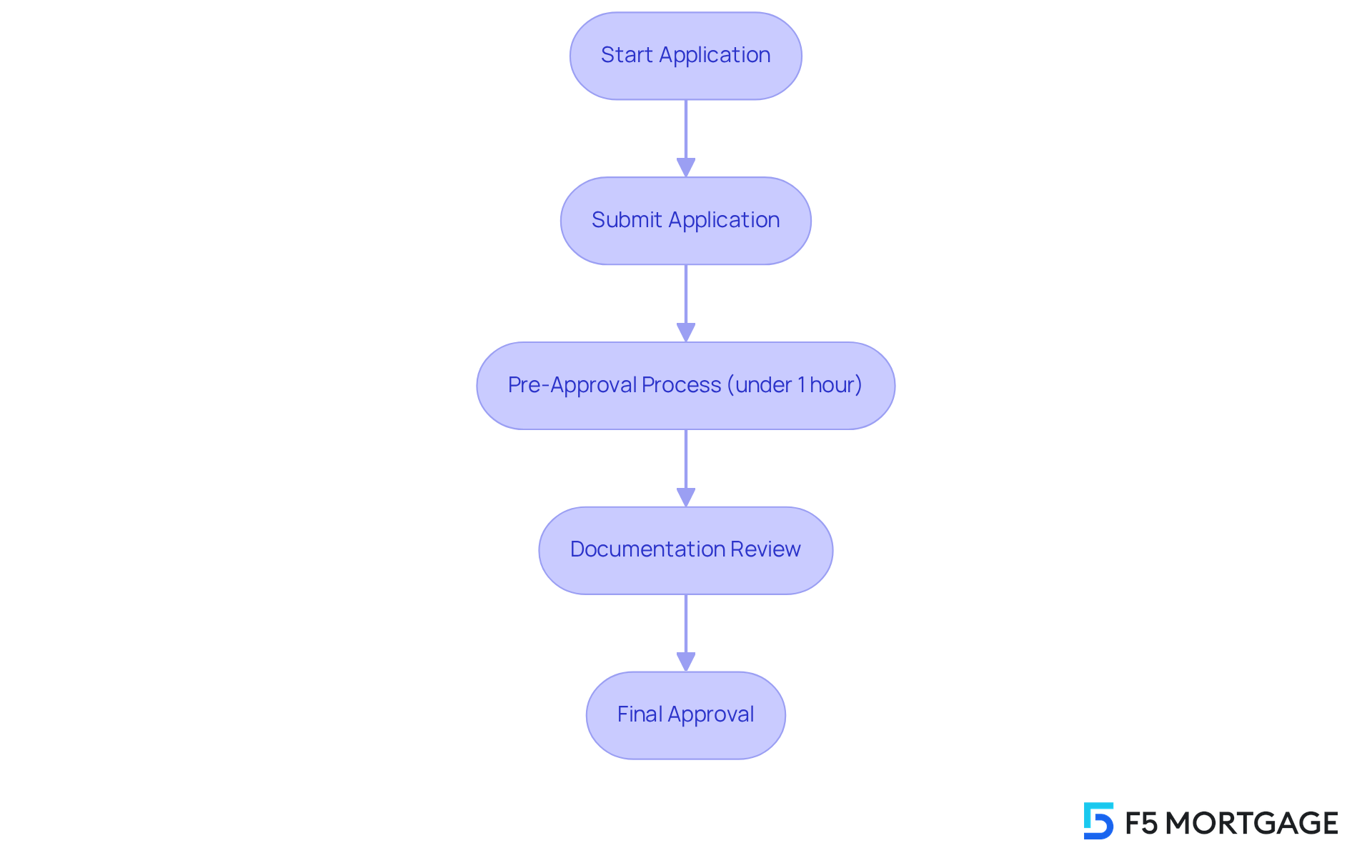

F5 Mortgage: Streamlined Application Process for High LTV HELOCs

At F5 Mortgage, we understand how important it is for families to access their home equity quickly and easily. That’s why we excel in providing a streamlined application process specifically for high ltv heloc. Our goal is to ensure that you can complete your application swiftly and effectively, addressing your needs with care.

Imagine being able to anticipate pre-approval in under an hour. This significant advantage allows you to tap into your home equity without unnecessary delays. We know how challenging this can be, and our commitment to personalized service means we’re here to support you every step of the way.

Our user-friendly technology simplifies paperwork, enhancing your overall borrowing experience. As more homeowners aim to utilize their equity—evidenced by a 22% year-over-year increase in home equity line of credit withdrawals—we want to help you manage the complexities of the process with ease and confidence. Let us guide you through this journey, empowering you to make informed decisions about your financial future.

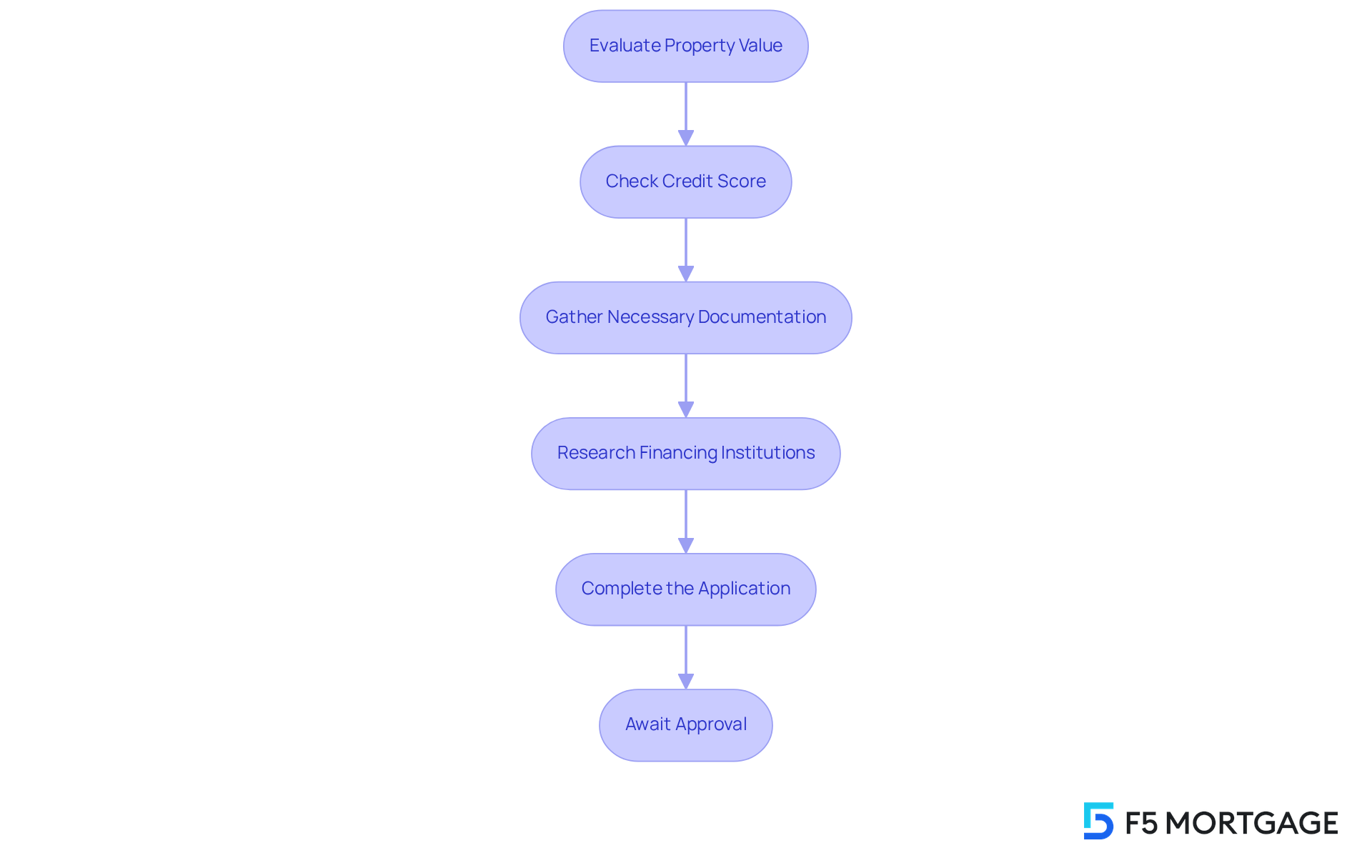

Bankrate: Step-by-Step Guide to Applying for a HELOC

Applying for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. By following these essential steps, you can maximize your chances of approval and streamline the process.

-

Evaluate Your Property Value: Start by determining how much equity you have in your home. This is done by subtracting your outstanding mortgage balance from your property’s current market value. With U.S. home prices reaching a record median of $435,300, many homeowners may discover they have significant equity to leverage.

-

Check Your Credit Score: It’s crucial to ensure your credit score meets borrowing standards. A higher score not only improves your chances of approval but can also secure better interest rates. We know how challenging this can be, so consider reviewing your credit report for errors and addressing any issues before applying.

-

Gather Necessary Documentation: Prepare important documents, including income verification, tax returns, and details of your existing mortgage. Having these ready can greatly expedite the application process.

-

Research Financing Institutions: Take the time to explore various providers to find the best rates and terms. Currently, the rates for high LTV HELOC have decreased to approximately 8.04%, making this a favorable time to borrow against your home equity. Rates can vary significantly by location, so comparing offers is essential.

-

Complete the Application: Fill out the application accurately and submit it along with your documentation. Many online financial institutions offer a quicker application process, with some providing same-day approvals and funding within five to seven days.

-

Await Approval: After submitting your application, be prepared for a waiting period. The typical duration to finalize a home equity line of credit application can vary, but many financial institutions strive to deliver a decision within several days.

By following these steps, you can enhance your chances of obtaining a home equity line of credit, allowing you to access funds for home improvements, debt consolidation, or unexpected expenses. Real-world examples show that clients who improve their credit scores and reduce debt before applying often experience better approval outcomes. Remember, thorough preparation can lead to a successful application, and we’re here to guide you through this process.

NerdWallet: Best HELOC Lenders for Competitive Rates

When searching for the best HELOC providers, we know how crucial it is to consider factors like interest rates, fees, and customer service. Understanding the fee structures among leading institutions can significantly impact your overall borrowing costs. For example, some lenders might charge origination fees or require minimum draw amounts, while others, like Alliant Credit Union, offer no closing costs for HELOCs up to $250,000. By comparing these fees, you can identify the most cost-effective options that suit your needs.

F5 Mortgage stands out in this competitive landscape by offering personalized service and attractive rates, making it a strong choice for families looking to enhance their homes. Financial analysts emphasize the importance of comparing competitive rates for high ltv heloc, as even a small difference in interest can lead to substantial savings over time. Families who utilize a high ltv heloc for home improvements or debt consolidation have reported significant financial benefits, allowing them to leverage their home equity effectively.

Staying informed about the latest competitive home equity line of credit rates is essential, as market conditions can change. Regularly reviewing offers and understanding the terms associated with each lender can empower you to make informed decisions that align with your financial goals. To effectively compare home equity line of credit offers, consider creating a checklist of key factors, such as:

- Interest rates

- Fees

- Repayment options

to streamline your decision-making process. We’re here to support you every step of the way.

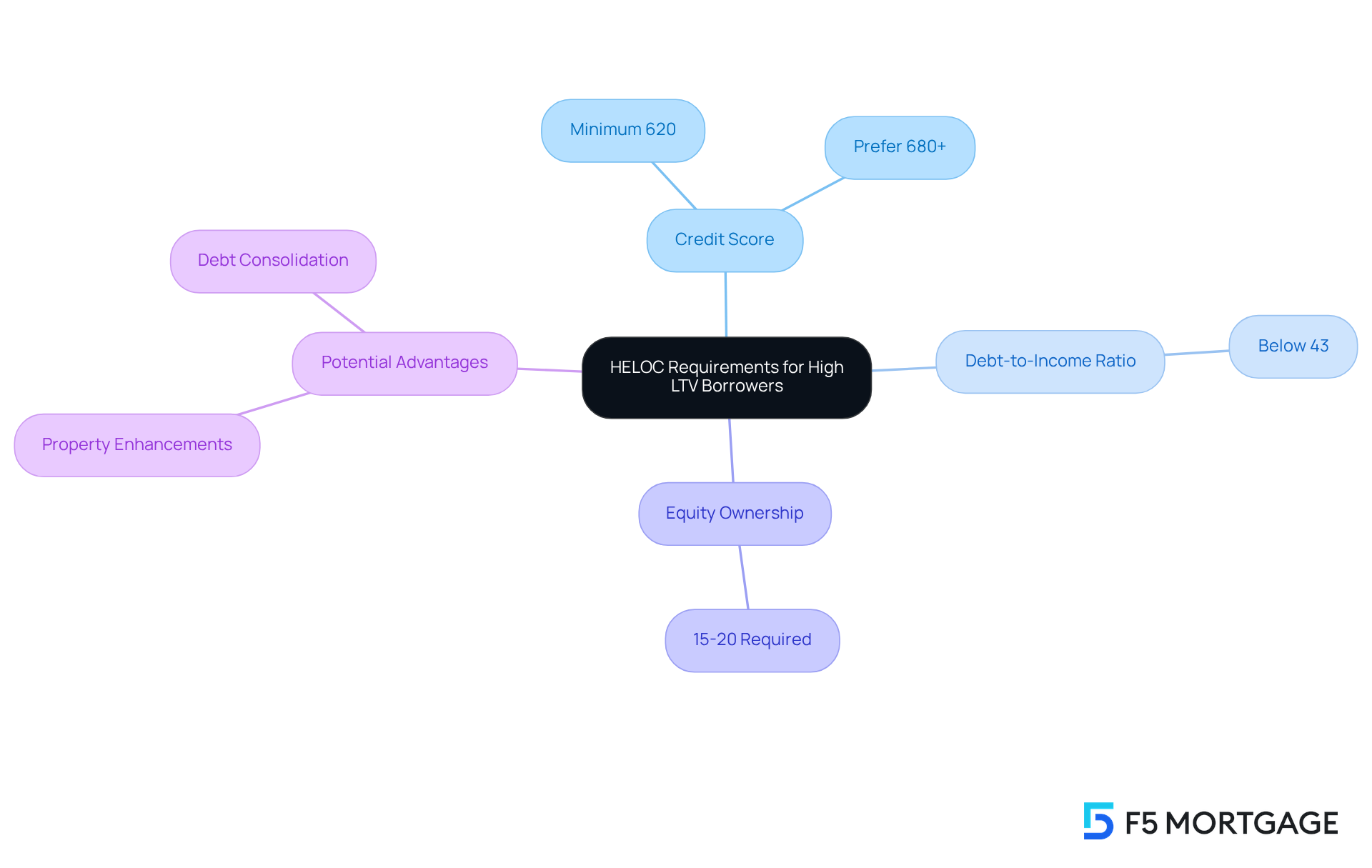

LendingTree: Understanding HELOC Requirements for High LTV Borrowers

Navigating the world of high LTV HELOCs can feel overwhelming for borrowers. We understand how challenging this can be, especially when it comes to meeting specific requirements. Most financial institutions set a minimum credit score of 620, but many prefer scores of 680 or higher to offer more favorable terms. It’s important to know that maintaining a debt-to-income (DTI) ratio below 43% is also crucial; this reflects your ability to manage monthly payments effectively. A better DTI can lead to more competitive mortgage rates, making it essential to understand your financial standing.

Ownership in your residence plays a vital role as well. Lenders typically require a minimum of 15-20% ownership before approving a HELOC. For example, if your property is valued at $400,000 and you have a remaining mortgage of $280,000, you possess $120,000 in equity, which equates to a 30% equity position. Understanding these criteria not only prepares you for the application process but also enhances your chances of securing favorable loan terms.

Beyond meeting these requirements, it’s worth considering the potential advantages of high LTV HELOCs. Many homeowners use them for significant property enhancements or to consolidate higher-interest debt. To maximize your chances of approval, take a moment to review your credit reports for errors and pay down existing debts before applying. Remember, we’re here to support you every step of the way. Collaborating with F5 Mortgage can provide you with competitive rates and customized service tailored to meet the unique needs of families looking to enhance their residences.

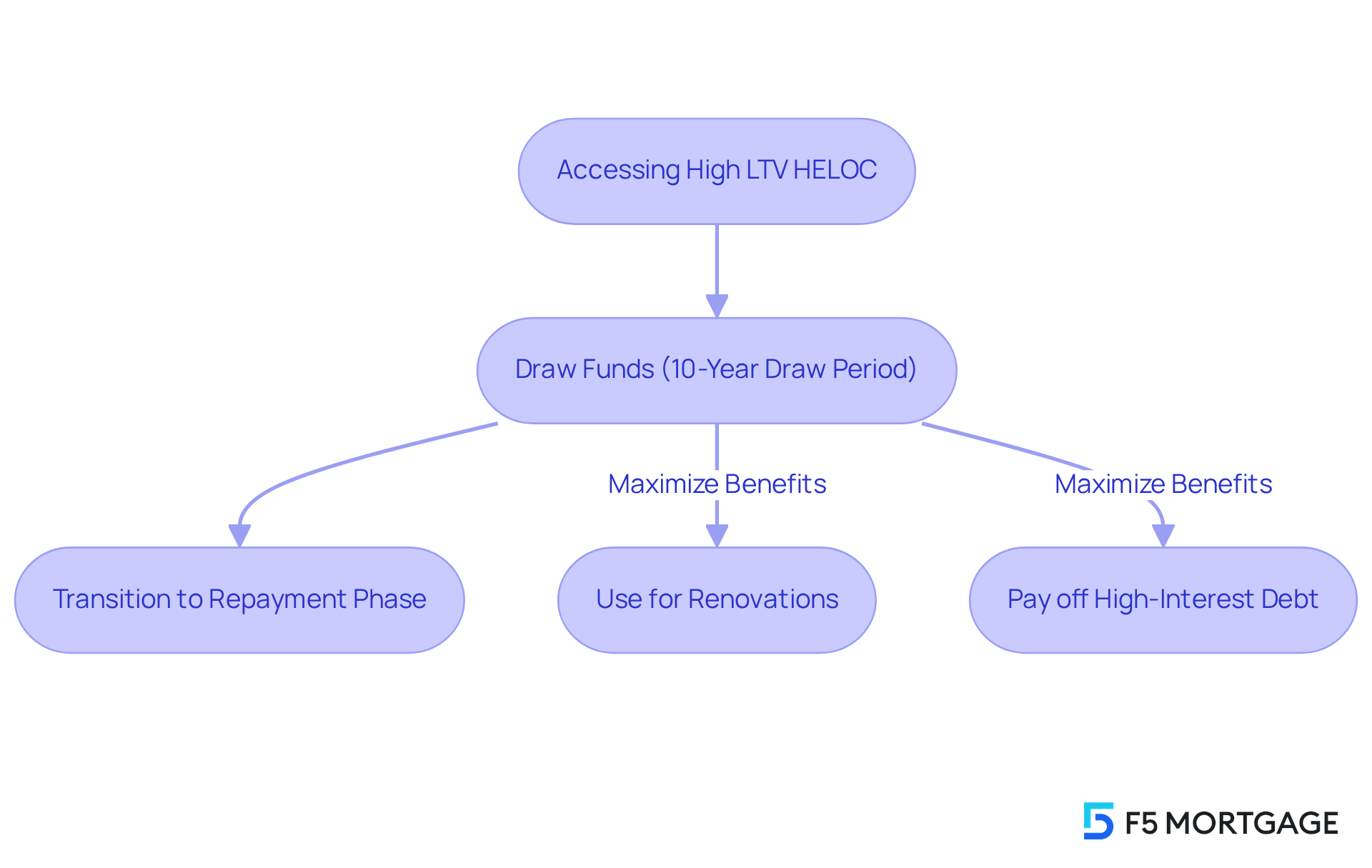

Citizens Bank: HELOC Basics and How They Work

A high ltv heloc is a flexible borrowing option that allows property owners to access their equity when they need it most. This revolving line of credit allows you to draw funds as necessary during a draw period that typically lasts around 10 years. After this period, you transition into the repayment phase, beginning to pay back both the principal and interest. Understanding these essential elements helps you make informed choices about effectively using your high ltv heloc.

To truly maximize the benefits of a high ltv heloc, consider using it for:

- Renovations

- Paying off high-interest debt

This can lead to significant savings on interest payments, easing your financial burden. If you’re a homeowner in Colorado looking to refinance, it’s important to know that the refinancing process is similar to taking out a new mortgage, requiring careful consideration of eligibility and loan terms.

Keep in mind that costs associated with refinancing, such as application and origination fees, can vary widely, impacting your overall financial strategy. By understanding these factors, you can navigate your options more effectively and make the most of your home equity. We know how challenging this can be, and we’re here to support you every step of the way.

Freedom Mortgage: How HELOCs Affect Your Credit Score

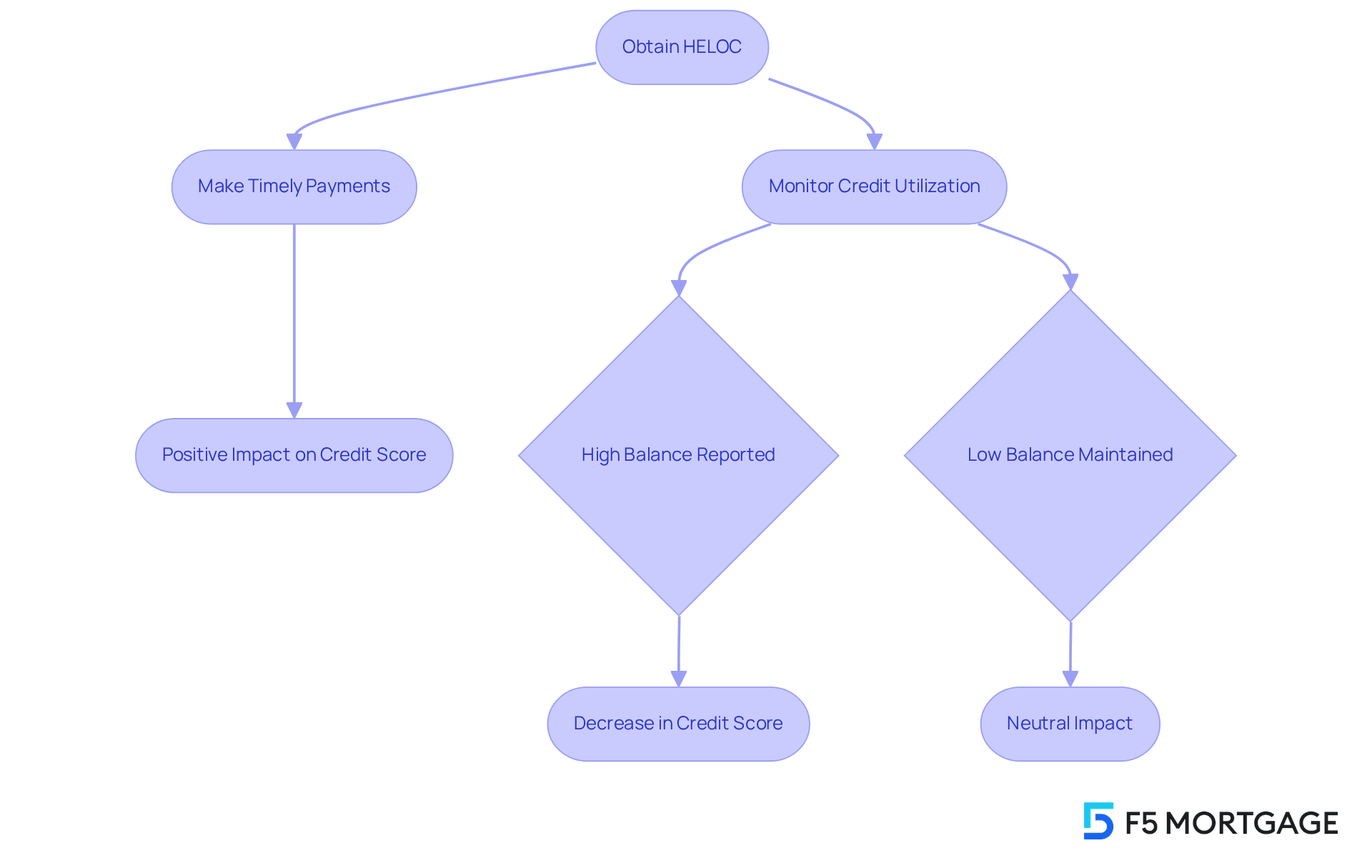

Understanding how obtaining a Home Equity Line of Credit can impact your credit score is essential for making informed decisions. We know how challenging this can be, especially when the application process triggers a hard inquiry on your credit report, which may lead to a temporary dip in your score. However, there is hope. Responsible management of your home equity line of credit can yield positive results over time.

Timely payments are crucial. When you make consistent on-time payments, you can gradually improve your credit score. It’s also important to keep an eye on your credit utilization ratio. While home equity line of credit balances generally do not factor into this ratio, significant outstanding balances can still adversely influence your score if reported by the lender. For example, if you terminate a home equity line of credit with a $40,000 limit while keeping a $2,000 balance on a credit card, your overall credit utilization could rise from 4% to 20%. This change may affect your creditworthiness.

Experts highlight that planning and tracking your usage are essential for effectively utilizing a high LTV HELOC. By using a high LTV HELOC wisely—such as for renovations or consolidating high-interest debt—you can enhance your financial profile and potentially boost your credit score. Remember, handling a high LTV HELOC wisely is crucial to avoid any adverse effects on your credit score. We’re here to support you every step of the way as you navigate these important financial decisions.

Canada.ca: Calculating Your Borrowing Potential with a HELOC

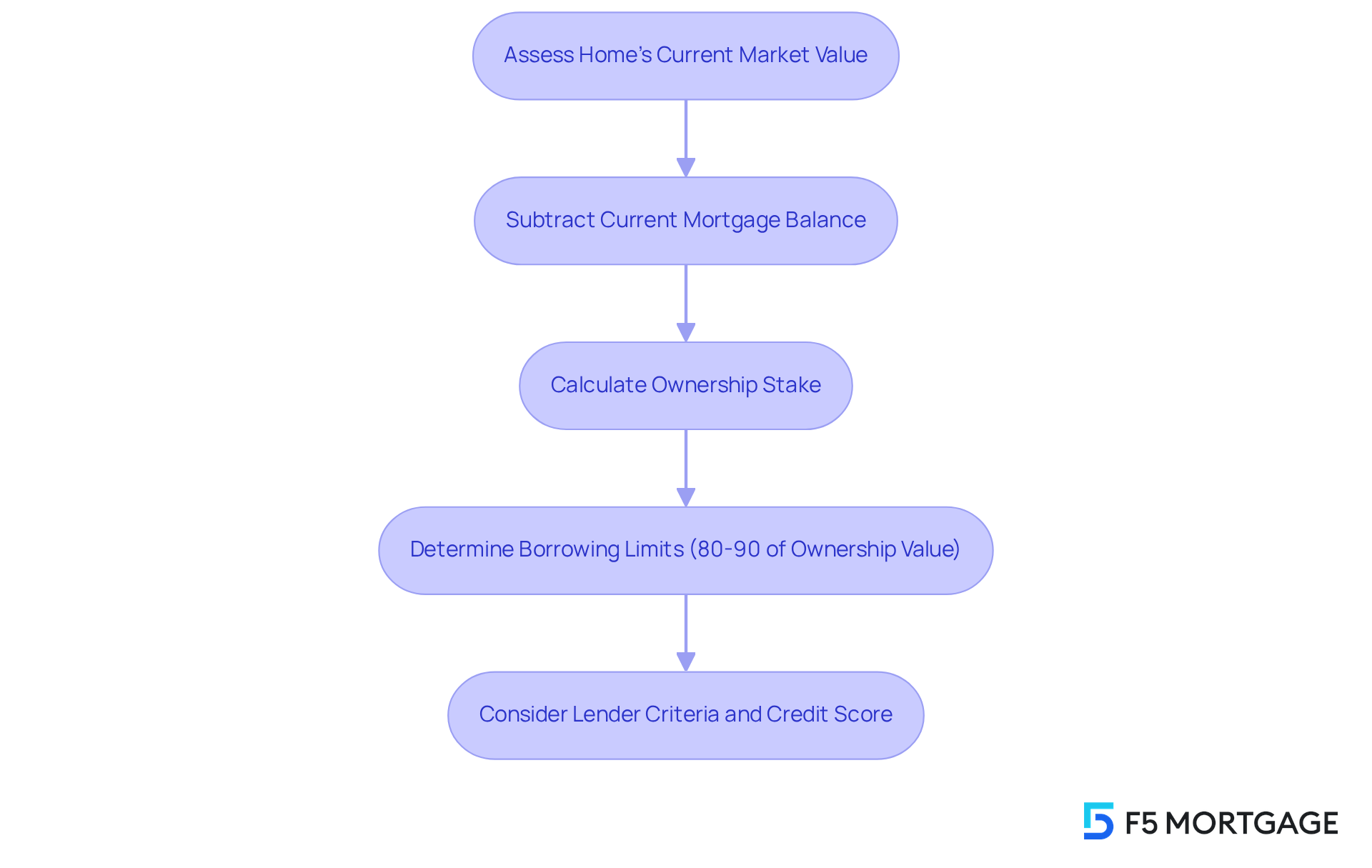

To determine your borrowing potential with a HELOC, it’s essential to start by assessing your home’s current market value. By subtracting your current mortgage balance from this value, you can uncover your ownership stake. Most financial institutions typically allow borrowing up to 80-90% of this ownership value with a high LTV HELOC. For example, if your property is valued at $300,000 and you owe $200,000, your equity stands at $100,000. This means you could potentially borrow between $80,000 and $90,000, depending on the lender’s specific policies.

As we approach 2025, understanding market value trends becomes vital. Property values can fluctuate due to economic conditions, and we know how challenging this can be. Recent surveys indicate that nearly 30% of U.S. property owners are considering accessing their residential value within the upcoming year, driven by motivations such as property enhancements and debt consolidation. Financial planners emphasize that maintaining a strong credit score can significantly influence your borrowing limits. Higher scores often lead to lower interest rates and increased borrowing capacity.

For families navigating these calculations, real-world examples can be particularly illuminating. Consider a household with a property worth $400,000 that may qualify for a high LTV HELOC, while having a mortgage balance of $250,000. They would possess $150,000 in ownership stake, enabling them to borrow between $120,000 and $135,000. As you assess your choices, remember that tracking your credit and understanding lender criteria will empower you to make informed decisions about utilizing your property value. We’re here to support you every step of the way.

Bravera Bank: Understanding the Risks of HELOCs

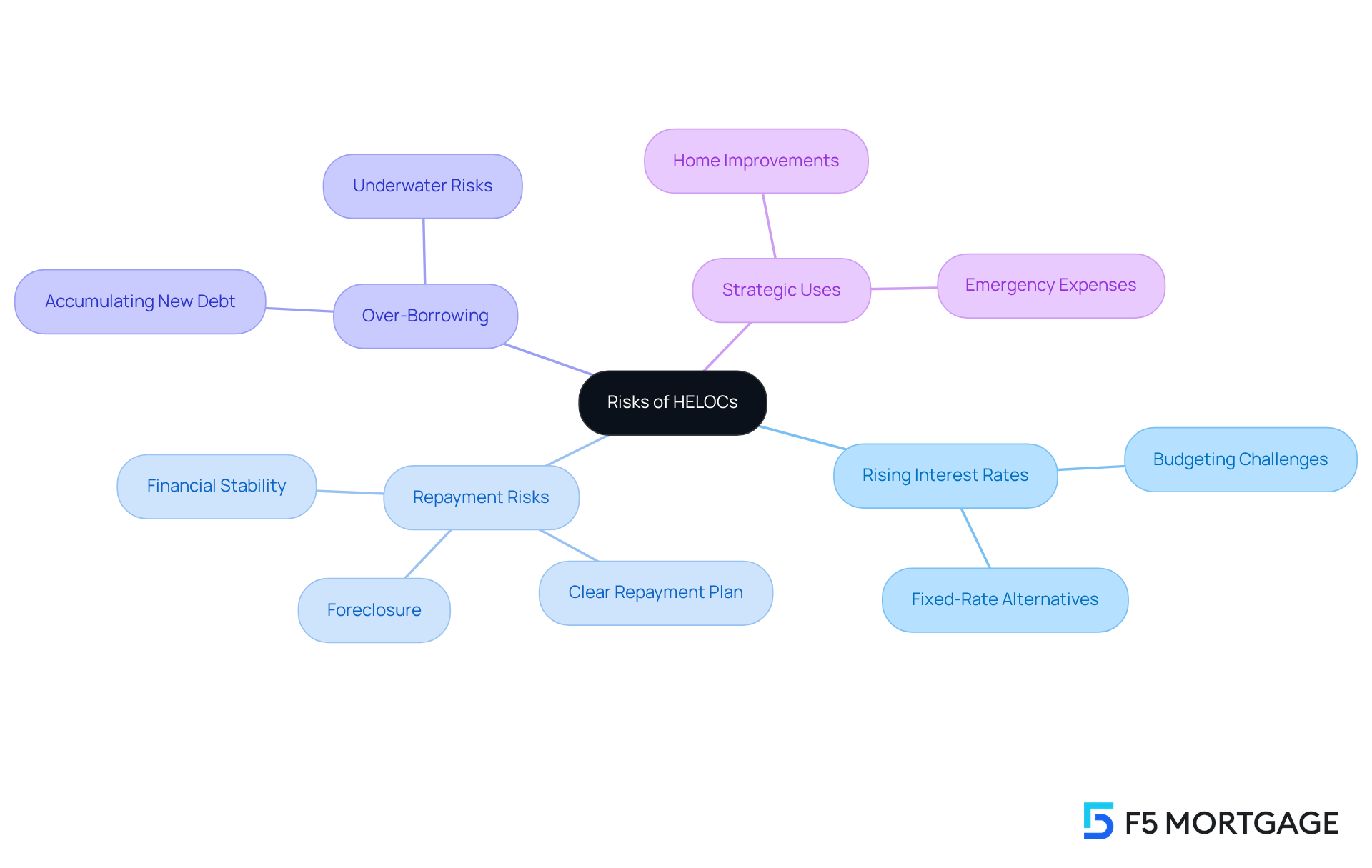

High LTV HELOCs provide homeowners with the flexibility and quick access to funds that they may need, but they also come with significant risks that deserve careful consideration. Over the past year, average interest rates for HELOCs have risen, now sitting between 8% and 9%, and they are not expected to drop significantly in the near future. This increase can lead to higher monthly payments, which may pose budgeting challenges, especially for those on a fixed income. As financial advisor Marguerita Cheng highlights, in a rising-interest-rate environment, securing a fixed-rate equity loan could be a more sensible choice.

Moreover, since a home equity line of credit is secured by your residence, failing to repay the borrowed amount could result in foreclosure. This risk underscores the importance of having a clear repayment plan. It’s wise for borrowers to avoid using home equity line of credit funds for non-essential expenses, as this can jeopardize their financial stability. Senior loan officer Becky Conner-McDuffy points out that over-borrowing can leave homeowners underwater if property values decline, making it crucial to maintain a financial cushion. Additionally, there’s the risk of accumulating new credit card debt after using a home equity line of credit to pay off old debts, which can complicate financial management even further.

Families who effectively manage line of credit risks often focus on using these funds for strategic purposes, such as renovations that enhance property value. For instance, investing in home improvements can yield a return on investment, unlike spending on luxury items. By understanding the rate framework and payment requirements, borrowers can navigate the complexities of HELOCs with greater confidence. This knowledge empowers them to make informed financial decisions that protect their equity, ensuring they are supported every step of the way.

The Mortgage Reports: Maximum HELOC Amounts Explained

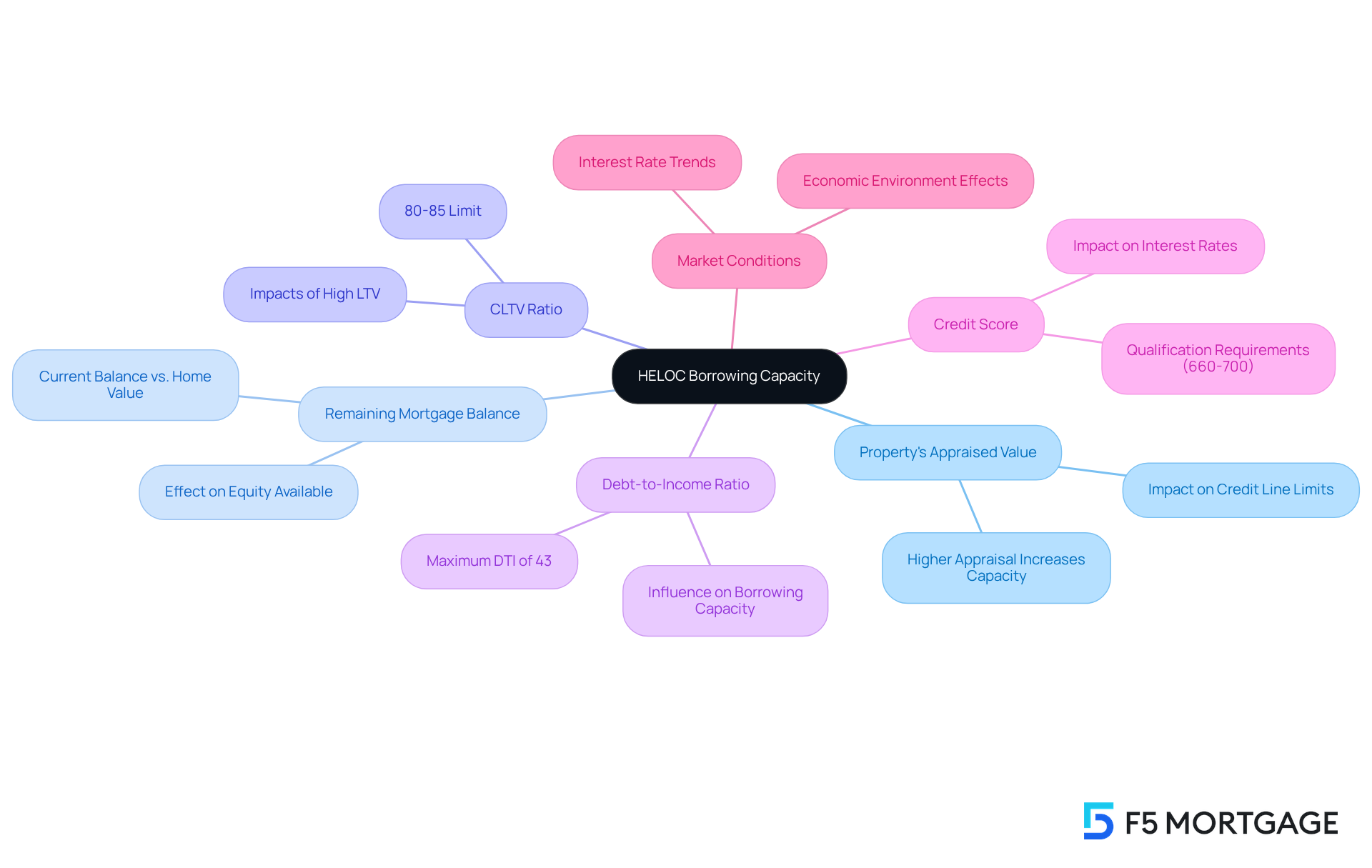

Understanding your borrowing capacity for a Home Equity Line of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. The key factors influencing this capacity are your property’s appraised value and your remaining mortgage balance. Most financial institutions set a limit for a high LTV HELOC with a combined loan-to-value (CLTV) ratio between 80% and 85%. For example, if your home is valued at $400,000 and you have a remaining mortgage balance of $250,000, your potential HELOC could range from $50,000 to $90,000, depending on the specific criteria of the lender.

In 2025, we see that many financial institutions are adopting a cautious strategy regarding high LTV HELOC and CLTV ratios. This approach is aimed at reducing risk, with numerous lenders requiring property owners to maintain a high LTV HELOC and a minimum 80% loan-to-value ratio. This means you need to have reduced at least 20% of your initial loan sum or your property needs to have appreciated in value. Additionally, a maximum debt-to-income (DTI) ratio of 43% is typically necessary for property loans, whether you’re obtaining a traditional mortgage or refinancing an existing one. It’s important to understand how appraised values directly affect your credit line limits, as a higher appraisal can significantly enhance your borrowing capacity.

Families like yours often find themselves carefully weighing their options. For instance, a household with a residence appraised at $500,000 and a loan of $300,000 could potentially secure a high LTV HELOC of up to $125,000, depending on the borrowing policies in place. This flexibility allows homeowners to tap into their equity for various purposes, from renovations to debt consolidation. Staying informed about current market conditions and lender criteria is vital, as it empowers you to make the best decisions for your family’s financial future.

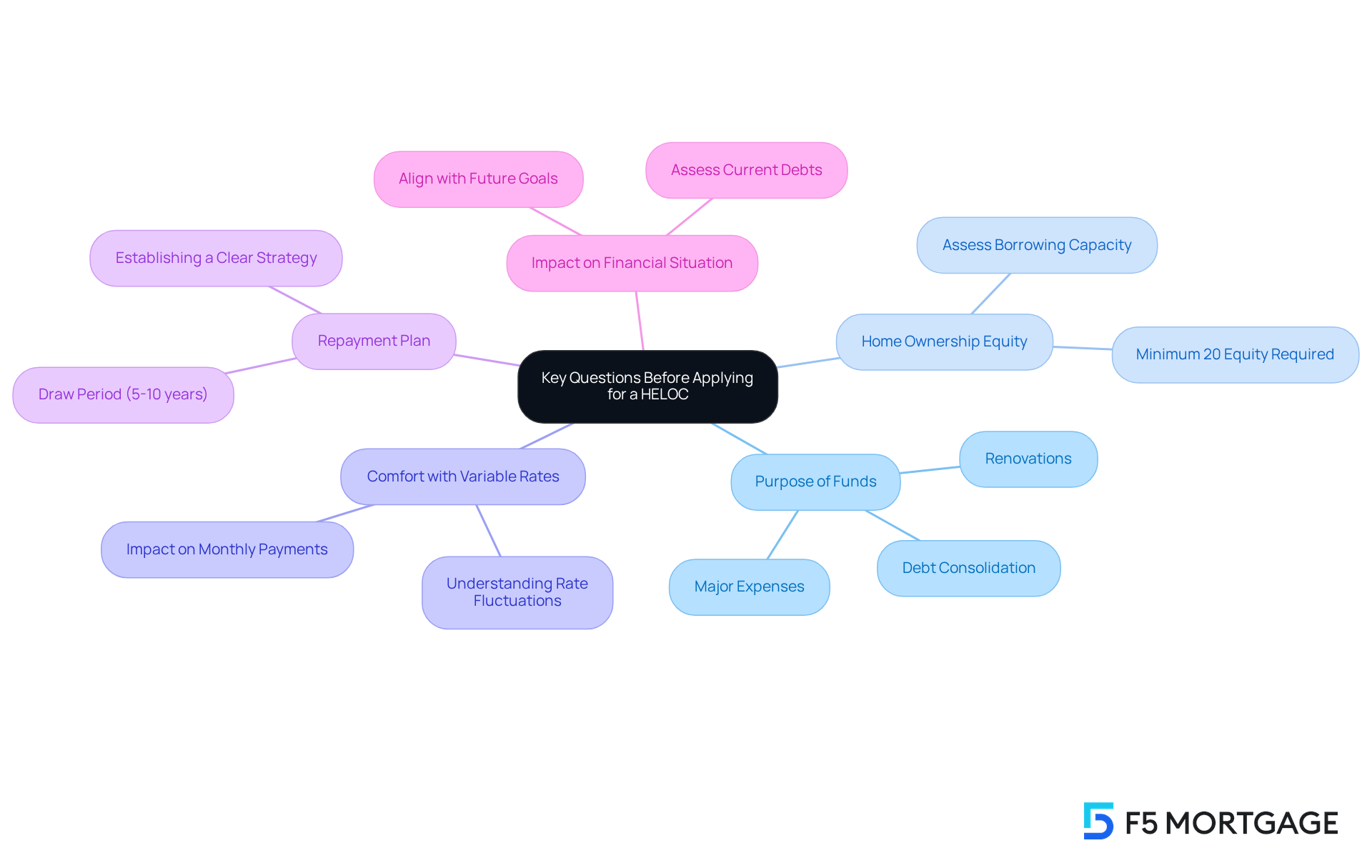

Oregon State Credit Union: Key Questions to Consider Before Applying for a HELOC

Before applying for a Home Equity Line of Credit (HELOC), families should take a moment to reflect on several key questions that can help align with their financial goals:

-

What will I use the funds for? Understanding the purpose of the funds is essential. Whether it’s for renovations, debt consolidation, or other major expenses, clarity on this can guide your decision.

-

How much ownership do I have in my home? To qualify for a high LTV HELOC, homeowners generally need a minimum of 20% equity. Knowing your equity can help you assess your borrowing capacity.

-

Am I comfortable with variable interest rates? Since HELOCs often come with variable rates, it’s important to consider your comfort level with potential fluctuations in monthly payments.

-

What is my repayment plan? Establishing a clear repayment strategy is crucial, especially since the draw period typically lasts 5 to 10 years before repayment begins.

-

How will this affect my overall financial situation? It’s vital to assess how a home equity line of credit will impact your financial well-being, particularly in relation to current debts and future financial objectives.

Contemplating these inquiries can empower families to make informed choices about utilizing a home equity line of credit, ensuring it effectively supports their long-term financial goals. Financial advisors emphasize the importance of aligning high LTV HELOC usage with broader financial strategies to maximize benefits and minimize risks. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Conclusion

Effectively managing a high LTV Home Equity Line of Credit (HELOC) is essential for homeowners who wish to leverage their property equity. We understand how challenging this can be, and this article offers a comprehensive overview of key strategies to help you navigate this process, from understanding the application to recognizing potential risks. By taking informed steps, you can maximize the benefits of your HELOC while minimizing pitfalls.

Key insights include:

- Evaluating your property value and credit scores

- Preparing necessary documentation

- Researching competitive lenders to secure the best rates

Additionally, grasping the implications of borrowing limits and maintaining a clear repayment strategy are vital components for successfully managing a high LTV HELOC. With the right approach, you can effectively utilize your equity for renovations, debt consolidation, or other financial needs.

Ultimately, navigating the complexities of a high LTV HELOC requires careful planning and awareness of market conditions. By staying informed and making strategic decisions, you can enhance your financial stability and ensure that your home equity serves as a valuable resource. Embracing these practices empowers you to take control of your financial future and make the most of your home investment. We’re here to support you every step of the way.

Frequently Asked Questions

What is F5 Mortgage’s approach to high LTV HELOC applications?

F5 Mortgage provides a streamlined application process for high LTV HELOCs, allowing families to access their home equity quickly and easily. They aim for pre-approval in under an hour and emphasize personalized service throughout the process.

How does F5 Mortgage ensure a smooth borrowing experience?

F5 Mortgage utilizes user-friendly technology to simplify paperwork, making the overall borrowing experience more efficient. They are committed to guiding clients through the complexities of the process to empower informed financial decisions.

What recent trend has been observed in home equity line of credit withdrawals?

There has been a 22% year-over-year increase in home equity line of credit withdrawals, indicating that more homeowners are looking to utilize their equity.

What are the essential steps to apply for a HELOC?

The essential steps include evaluating your property value, checking your credit score, gathering necessary documentation, researching financing institutions, completing the application, and awaiting approval.

How can I determine my property value for a HELOC application?

You can determine your property value by subtracting your outstanding mortgage balance from your property’s current market value.

Why is it important to check my credit score before applying for a HELOC?

A higher credit score improves your chances of approval and can secure better interest rates, making it crucial to review your credit report for errors and address any issues beforehand.

What documentation is typically required for a HELOC application?

Important documents include income verification, tax returns, and details of your existing mortgage.

What should I consider when researching financing institutions for a HELOC?

It’s important to compare rates, terms, and fee structures among various providers to find the best options. Currently, high LTV HELOC rates have decreased to approximately 8.04%.

How long does it usually take to receive approval for a HELOC?

The typical duration for finalizing a HELOC application can vary, but many financial institutions aim to deliver a decision within several days.

What factors should I consider when comparing HELOC lenders?

Key factors include interest rates, fees, and repayment options. Creating a checklist can help streamline your decision-making process.

How does F5 Mortgage stand out among HELOC lenders?

F5 Mortgage offers personalized service and attractive rates, making it a strong choice for families looking to enhance their homes. They emphasize the importance of comparing competitive rates for potential savings.