Overview

Navigating the world of mortgages can feel overwhelming, and we understand how challenging this can be. This article sheds light on the differences between interest rates and APR (Annual Percentage Rate), aiming to empower you with the knowledge needed to make informed decisions.

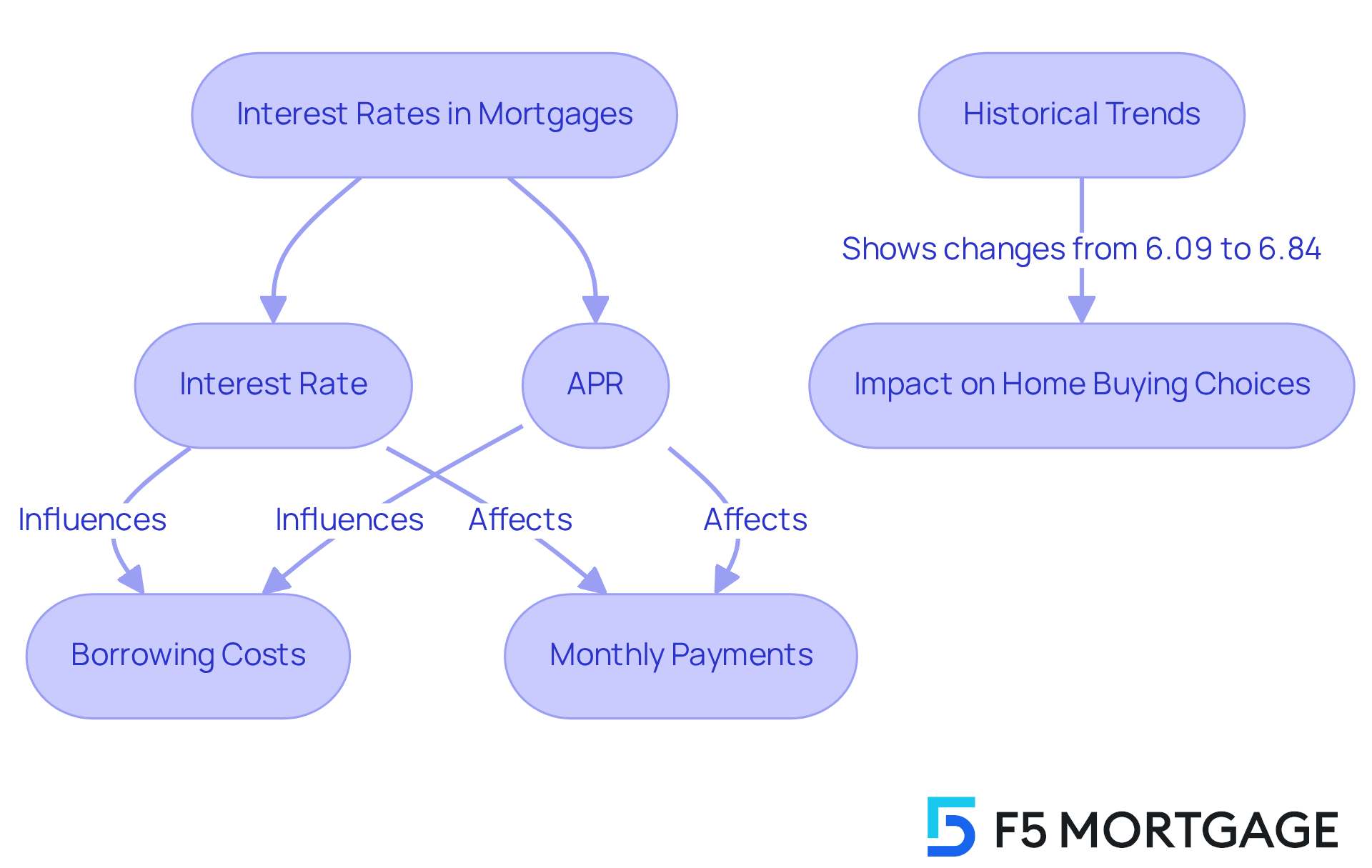

While the interest rate reflects the cost of borrowing, the APR encompasses additional fees and costs. It’s essential for you to grasp both metrics to accurately evaluate the total expense of your mortgage. By understanding these concepts, you can take confident steps toward securing the best financial outcome for your family.

Introduction

Navigating the complexities of mortgage financing can feel overwhelming, especially when it comes to understanding interest rates and APR. These critical elements not only determine the cost of borrowing but also significantly impact your financial future. By exploring the differences between interest rates and APR, you can discover opportunities for substantial savings, empowering you to make informed decisions that align with your homeownership dreams.

We know how challenging this can be, particularly in a fluctuating market with varying lender terms. So, how can you effectively navigate these complexities to secure the best possible deal? This article delves into ten essential insights designed to equip you with the knowledge needed to master the mortgage landscape and optimize your borrowing strategy. Together, we can support you every step of the way.

F5 Mortgage: Personalized Consultations on Interest Rates and APR

At F5 Mortgage, we understand how challenging the mortgage process can be. That’s why we excel in offering tailored consultations that clarify the differences between interest rate vs APR mortgage—vital components in your loan decision-making journey. Our dedicated loan officers, each bringing unique qualifications and a personal touch, take the time to evaluate your specific financial circumstances. This allows us to provide advice that is truly tailored to your needs, empowering you to make informed choices that align with your homeownership aspirations.

Our personalized approach not only streamlines the loan process but also enhances your satisfaction. We want you to feel confident as you of financial landscapes. In 2025, personalized mortgage advice is more critical than ever, fostering deeper relationships and ensuring that you feel supported throughout your financial endeavors.

At F5 Mortgage, we’re here to support you every step of the way. We utilize user-friendly technology, like our intuitive online application process and real-time financing tracking, to provide no-pressure guidance. Our goal is to ensure fast closings, often in under three weeks, so you can focus on what truly matters—your future home.

Interest Rate: Definition and Importance in Mortgages

A borrowing charge represents the expense of obtaining funds, expressed as a percentage of the amount borrowed. In the context of mortgages, understanding the interest rate vs APR mortgage is crucial in determining the total charges a borrower will incur throughout the loan’s duration. We know how challenging this can be, and a reduced lending cost can lead to significant savings on monthly payments. This makes it an essential factor for home purchasers and individuals seeking to refinance. For instance, current trends show that when borrowing costs decline, homebuyers can save hundreds of dollars monthly, improving their purchasing capability and overall financial security.

Comprehending present market values is vital for borrowers looking to secure advantageous agreements. Historical information indicates that over the last ten years, loan costs have varied considerably, with significant decreases during economic declines. For example, the typical interest on a 30-year loan increased from 6.09 percent in September 2023 to 6.84 percent by November 2023. These fluctuations can significantly influence , and we’re here to support you every step of the way.

Economists highlight that borrowing costs directly impact homebuyers’ affordability and refinancing choices. As interest levels remain a key factor in the loan landscape, understanding the interest rate vs APR mortgage can empower borrowers to make strategic financial choices. In 2025, the effect of borrowing costs on home purchasing remains significant, as prospective buyers navigate a market where even minor adjustments can affect their mortgage conditions and total expenses. Remember, understanding these dynamics can help you make informed decisions that align with your financial goals.

APR: Comprehensive Overview and Its Role in Mortgage Costs

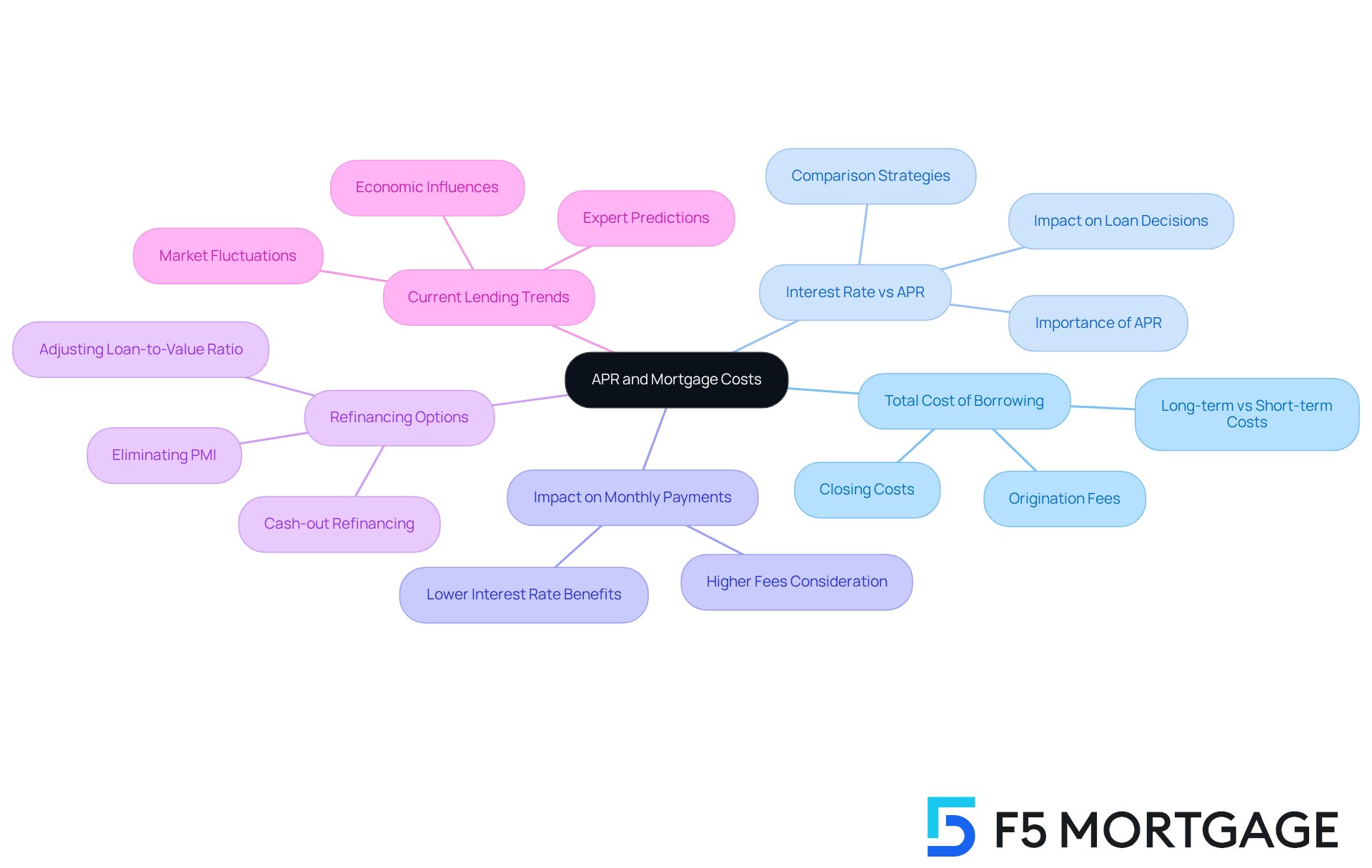

APR, or Annual Percentage Rate, is a vital measure that reveals the total expense of borrowing, expressed as an annual figure. It encompasses not just the percentage but also additional charges like origination fees and closing costs. This comprehensive perspective is crucial for borrowers as it enables them to make effective comparisons between different loan options, particularly when considering the interest rate vs APR mortgage. A lower APR often signals a more favorable loan, even if the initial cost appears higher.

We know how overwhelming mortgage decisions can be, and financial analysts stress the importance of understanding APR. For instance, Cicchelli points out that when two lenders offer the same percentages but have significantly different APRs, borrowers can use this information to make more informed decisions. This highlights the necessity of considering both the percentage and APR when evaluating borrowing expenses.

The significance of the interest rate vs APR mortgage goes beyond mere comparison; it directly influences the total cost of a mortgage. Borrowers should recognize that while a lower cost can lead to reduced monthly payments, it may be offset by higher fees, resulting in a greater total loan expense. For example, a borrower planning to stay in their home for a shorter period might prioritize a lower APR to minimize overall costs, while those intending to remain long-term may benefit more from a reduced borrowing cost.

In California, homeowners who purchased their homes with less than a 20% down payment might have the opportunity to eliminate Private Mortgage Insurance (PMI) through refinancing. Given the rising home appreciation values in the state, determining a new loan-to-value (LTV) ratio based on their home’s increased worth can lead to new financing options with a lower LTV ratio. This strategy not only aids in removing PMI but can also provide cash-out alternatives for significant expenses, as long as the new loan features a more favorable interest percentage.

Recent lending trends further underscore the importance of understanding interest rate vs APR mortgage. As loan interest rates fluctuate due to economic factors like inflation and market stability, examining the interest rate vs APR mortgage can provide a clearer picture of the actual expense of borrowing. With the typical 30-year fixed loan percentage currently around 6.60%, we encourage prospective homebuyers to to secure the best deal.

In summary, understanding the nuances of interest rate vs APR mortgage in relation to loan costs is essential for borrowers aiming to make informed financial choices in the mortgage landscape. This is especially true when considering refinancing options to eliminate PMI and capitalize on rising home values. Remember, we’re here to support you every step of the way.

How Interest Rates and APR Are Calculated: Key Differences

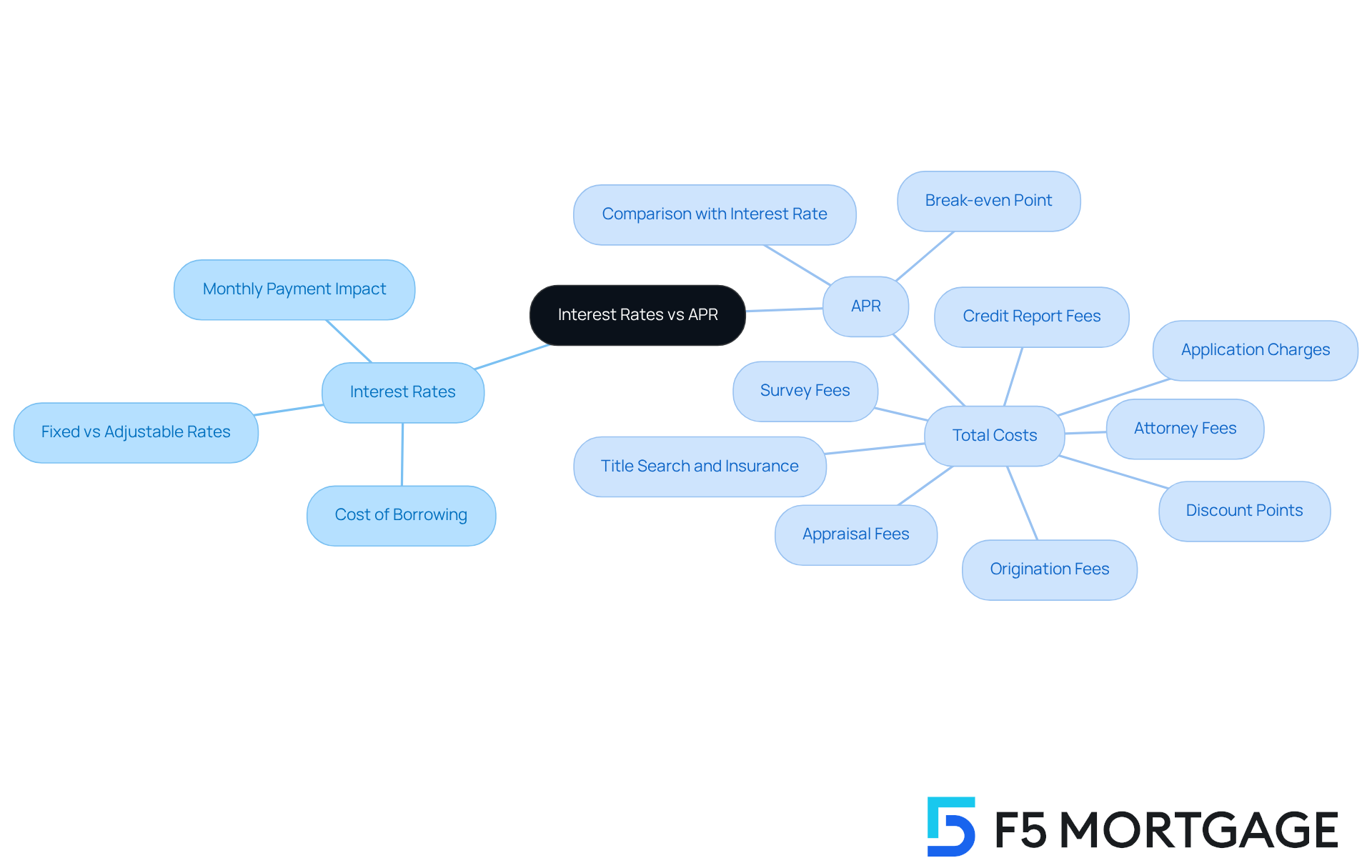

Interest levels are primarily influenced by the amount borrowed, the duration of borrowing, and the borrower’s creditworthiness. In contrast, the Annual Percentage Ratio (APR) encompasses the total cost of borrowing. This includes not only the interest but also various fees, such as:

- Application charges ranging from $75 to $500

- Origination fees between 0.5% and 1.5% of the borrowed amount

- Credit report fees around $35

- Appraisal fees usually between $300 and $500

- Title search and title insurance costing between 0.5% and 1% of the borrowed amount

- Attorney fees starting at $500

- Discount points at 1% of the borrowed amount for a 0.25% cost reduction

- Survey fees ranging from $150 to $400

To calculate APR, these total costs are divided by the amount borrowed and then annualized, providing a yearly cost representation.

The essential distinction between the two in the discussion of [interest rate vs APR mortgage](https://f5mortgage.com/10-essential-facts-about-conventional-loans-you-must-know) lies in their scope: the borrowing charge indicates the expense of acquiring funds, while APR offers a comprehensive view of total expenses involved. For instance, a borrower might face a loan with a nominal percentage of 6%, but when considering $5,000 in fees, the APR could rise to 6.15%. This scenario illustrates how additional costs can significantly impact the overall expense of borrowing.

Understanding the is crucial for borrowers. If you plan to stay in your home for an extended period, focusing on the interest rate vs APR mortgage may provide you with a clearer picture of long-term costs. Conversely, if you intend to sell or refinance in a few years, a lower upfront cost might be more beneficial, even if it comes with a higher interest rate vs APR mortgage. Determining your break-even point can help you understand how long it will take to recover refinancing expenses through savings in monthly payments. For example, if your refinancing costs are $4,000 and your monthly savings are $100, your break-even point would be 40 months ($4,000 / $100 = 40 months). This decision-making process highlights the importance of evaluating both the interest rate vs APR mortgage to make informed financial choices. As Andrew Weinberg observes, “APR attempts to consider the fact that there are typically specific expenses linked to obtaining credit.

Comparing Interest Rates vs. APR: Practical Tips for Borrowers

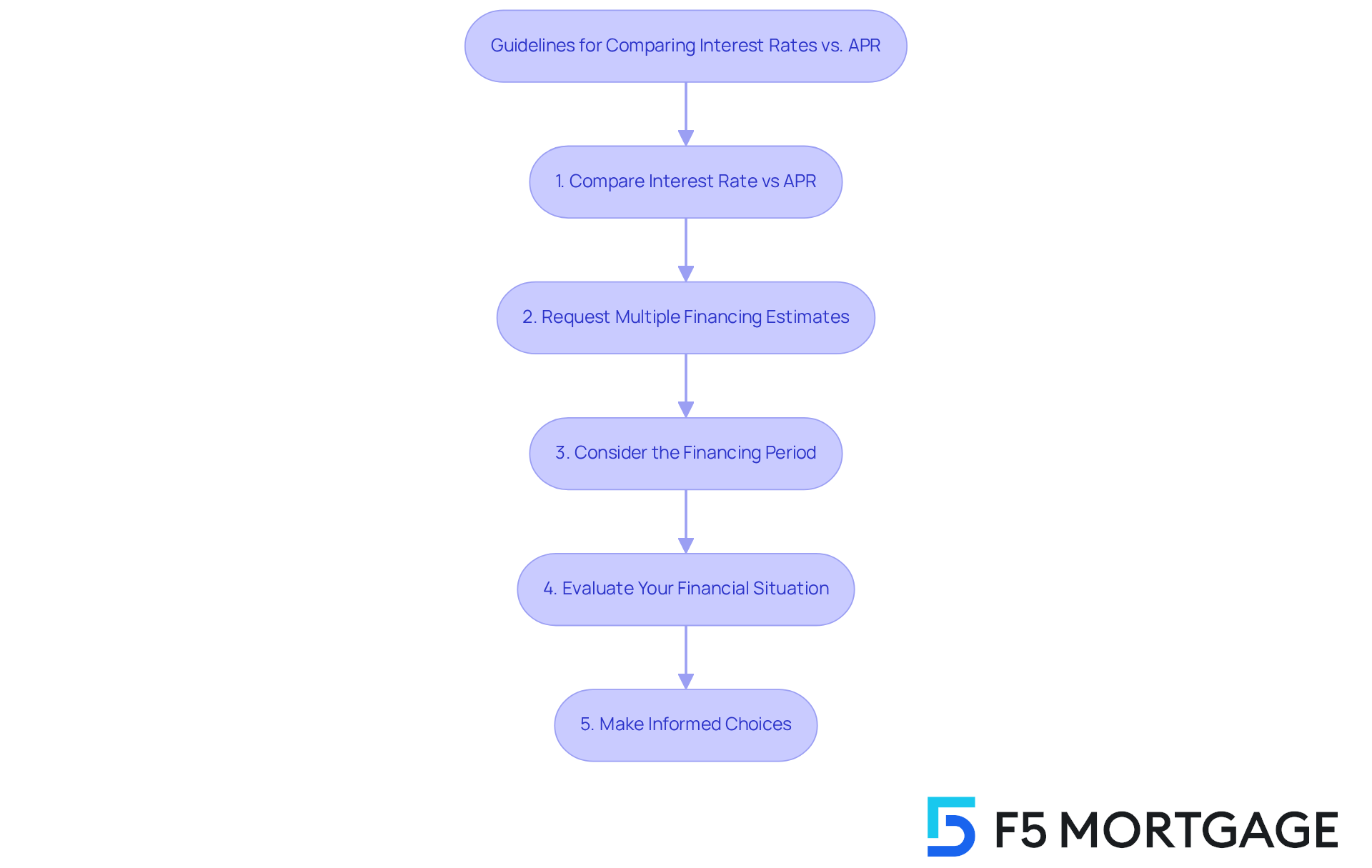

When considering mortgage proposals, it’s important to look beyond just the interest rate vs APR mortgage to understand the . We understand how overwhelming this process can be, and we’re here to support you every step of the way. Here are some essential tips to guide your comparison:

- Compare interest rate vs APR mortgage: The Annual Percentage Rate (APR) includes not only the interest percentage but also additional charges. This gives you a clearer view of the overall cost of borrowing, particularly in terms of the interest rate vs APR mortgage, helping you make a more informed decision.

- Request multiple financing estimates: By obtaining financing estimates from various providers, you can see a comprehensive breakdown of expenses. This simplifies the process of identifying the most advantageous terms for your situation.

- Consider the financing period: While a lower borrowing cost on a longer-term agreement might seem appealing, it could lead to greater total expenses. Take the time to evaluate the total interest paid over the life of the loan.

- Evaluate your financial situation: Reflect on your financial circumstances and how long you plan to stay in your home. This can greatly influence which loan option is best for you.

By following these guidelines, you can navigate the complexities of loan offers more effectively. Remember, making informed choices that align with your financial objectives is key to a successful mortgage experience.

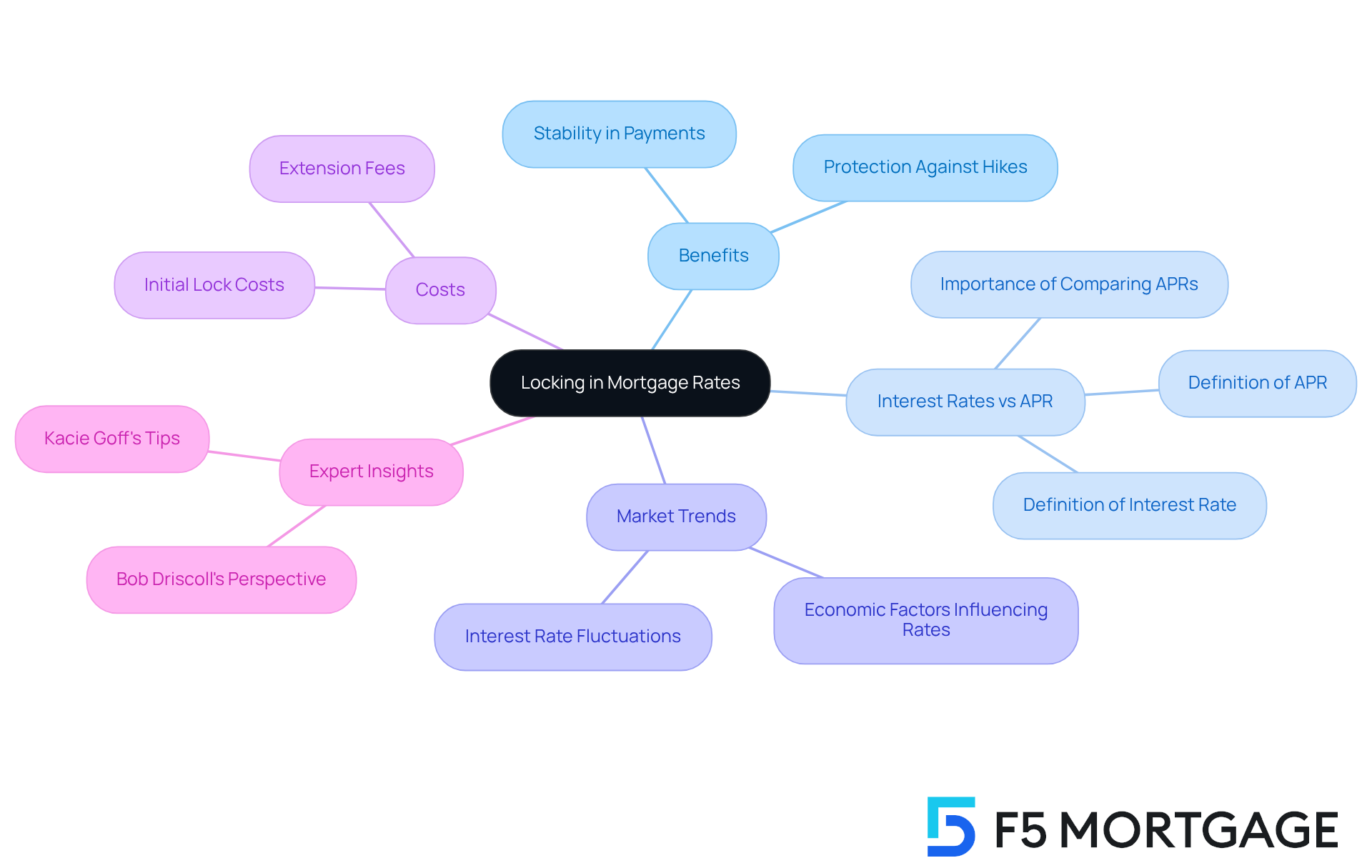

Locking in Rates: Impact on Interest Rate vs. APR

Locking in a mortgage price is a crucial step in securing your financial future. It means you can protect yourself from potential price hikes during the financing process, which can feel overwhelming. Interest rates can fluctuate daily—sometimes even hourly—so having a fixed rate can provide peace of mind. For instance, if you lock in a rate of 6.68% for 45 days, you shield yourself from a possible increase to 7%, allowing you to benefit from that lower percentage.

While securing a price can stabilize your monthly payments, it’s essential to understand the , as it does not affect the APR unless the associated financing charges change. We know how challenging it can be to navigate these decisions, so it’s vital to consider market trends and your personal financial situation. These factors can significantly influence your overall loan expenses.

Additionally, be aware that some lenders might charge a fee for extending a lock on your interest rate. Understanding these details is crucial as you evaluate your options. At F5 Mortgage, we’re here to support you every step of the way. We offer attractive pricing and personalized service, making it easier for families to enhance their homes while managing these important choices.

As Bob Driscoll, Senior Vice President and Director of Residential Lending, wisely notes, ‘The mortgage market can be unpredictable, which is why a mortgage price lock can be a wise decision.’ Ultimately, weighing the benefits and risks of securing a price is essential for optimizing your overall loan expenses, especially when evaluating the interest rate vs APR mortgage. Comparing APRs can also provide clearer insight into the total financing cost, empowering you to make informed decisions.

Strategies to Lower Your Interest Rate and APR

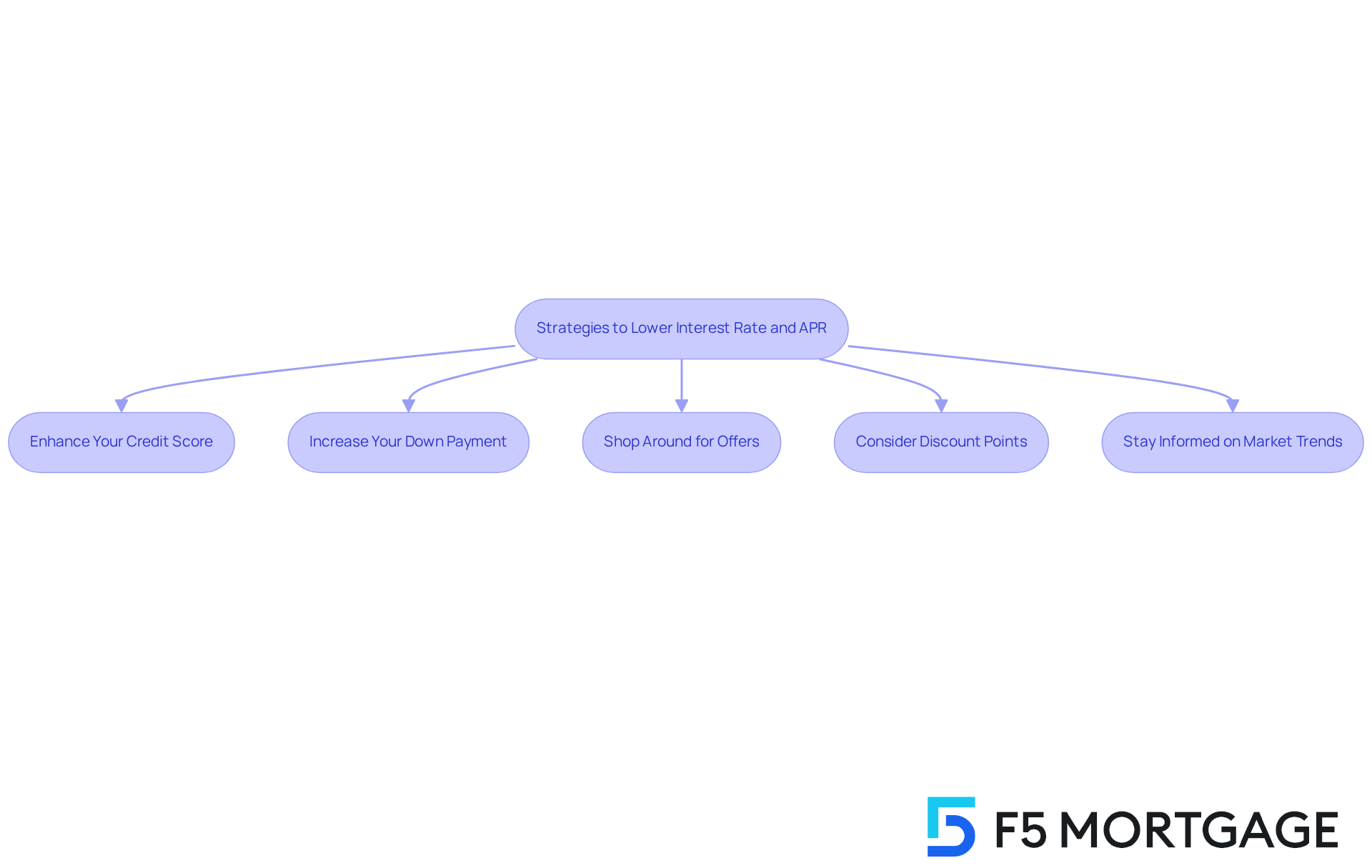

To effectively lower your interest rate vs apr mortgage, we understand that it can feel overwhelming. However, by considering the following strategies, you can take meaningful steps toward achieving your goals:

- Enhance Your Credit Score: We know how challenging it can be to navigate credit scores. Before seeking a loan, focus on boosting your credit score. Higher credit scores are often linked to better loan conditions, as lenders see these borrowers as less risky. For instance, consistently making on-time payments and reducing credit card debt can significantly improve your score.

- Increase Your Down Payment: A larger down payment not only decreases the borrowed amount but also lowers the lender’s risk, potentially leading to more favorable rates. For example, putting down 20% or more can often eliminate private loan insurance (PMI), which can save you over $100 per month. Taking advantage of Down Payment Assistance Programs through F5 Mortgage can help you boost your down payment, allowing you to present a more competitive offer and possibly secure a lower financing amount and decreased housing payments. As one satisfied customer shared, “Awesome work. I enjoyed getting help with my loan through F5 Mortgage. Highly recommend to anyone who is looking for true experts.”

- Shop Around for Offers: Don’t settle for the first mortgage quote you receive. We encourage you to evaluate proposals from various lenders, as this can uncover more advantageous conditions and terms. Financial advisors often emphasize the importance of exploring different options to secure the best deal. As Steven Parangi observes, even a small variation in costs can save you thousands of dollars over the course of your financing.

- Consider Discount Points: Paying for discount points at closing can be a smart move to reduce your interest cost. Each point generally costs 1% of the loan amount and can lower your interest by roughly 0.25%. This strategy can be particularly beneficial if you plan to stay in your home long enough to through monthly savings.

- Stay Informed on Market Trends: We know that timing can be crucial. Monitoring housing market trends can assist you in timing your application effectively. For example, with forecasts indicating that home loan costs may drop slightly in 2025, waiting for the optimal time could lead to substantial savings.

By utilizing these tactics, including taking advantage of Down Payment Assistance Programs from F5 Mortgage, you can improve your chances of obtaining a lower cost, specifically when considering interest rate vs apr mortgage, ultimately making your mortgage more budget-friendly. As another customer shared, “Excellent! I highly recommend F5 Mortgage team. Everything went very smoothly!

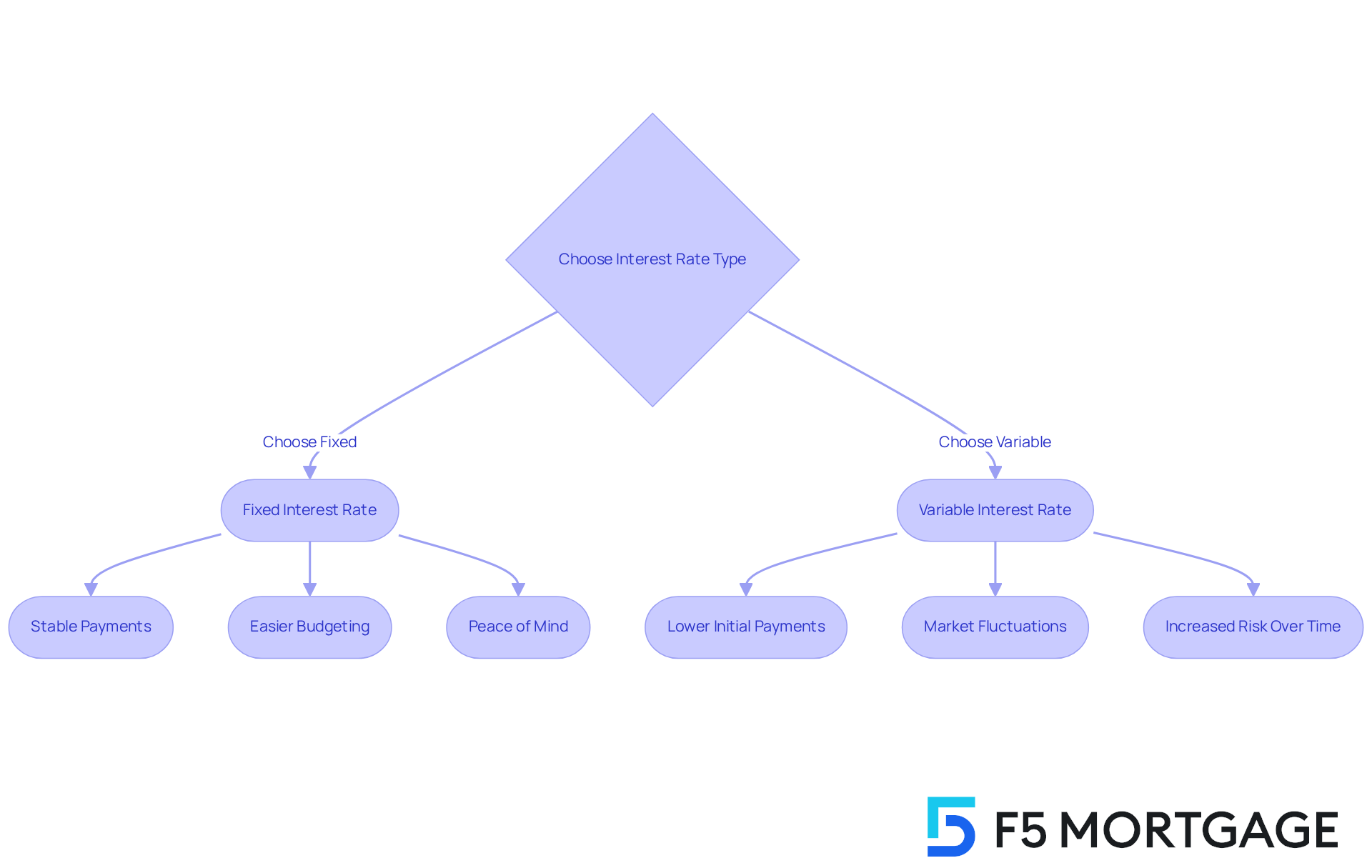

Fixed vs. Variable Interest Rates: APR Considerations

Fixed charges provide borrowers with a sense of consistency and foreseeability, as they remain constant throughout the loan’s term. This stability allows for easier budgeting, making it an appealing choice for those who seek a clear financial outlook. However, variable pricing can fluctuate based on market conditions, often resulting in lower initial payments. Yet, this variability brings a level of risk, as payments may increase over time, potentially leading to higher overall costs.

When considering the , it’s essential for borrowers to reflect on how each option aligns with their financial goals and their comfort with risk. Fixed prices offer peace of mind, especially in unpredictable economic climates, while variable options might yield savings if market conditions are favorable. For instance, a borrower with a $300,000 mortgage at a 4% fixed interest rate would enjoy stable monthly payments, whereas a variable option could start lower but may rise significantly if interest rates increase.

Real-life experiences highlight these dynamics: borrowers who opted for fixed terms during periods of rising costs often express relief at avoiding payment spikes. In contrast, those with adjustable terms may have initially benefited from lower payments but faced challenges as costs increased. Financial analysts stress the importance of understanding the risks and benefits associated with interest rate vs apr mortgage, advising borrowers to thoughtfully evaluate their long-term financial strategies before making a choice.

In this context, comparing lenders early in the process is crucial. Partnering with F5 Mortgage not only provides access to competitive pricing but also ensures personalized service tailored to your unique financial situation. By seeking lenders like F5 Mortgage, you can uncover the most suitable option for your needs, empowering you to make a well-informed decision between fixed and variable options based on your personal circumstances, market trends, and comfort with risk.

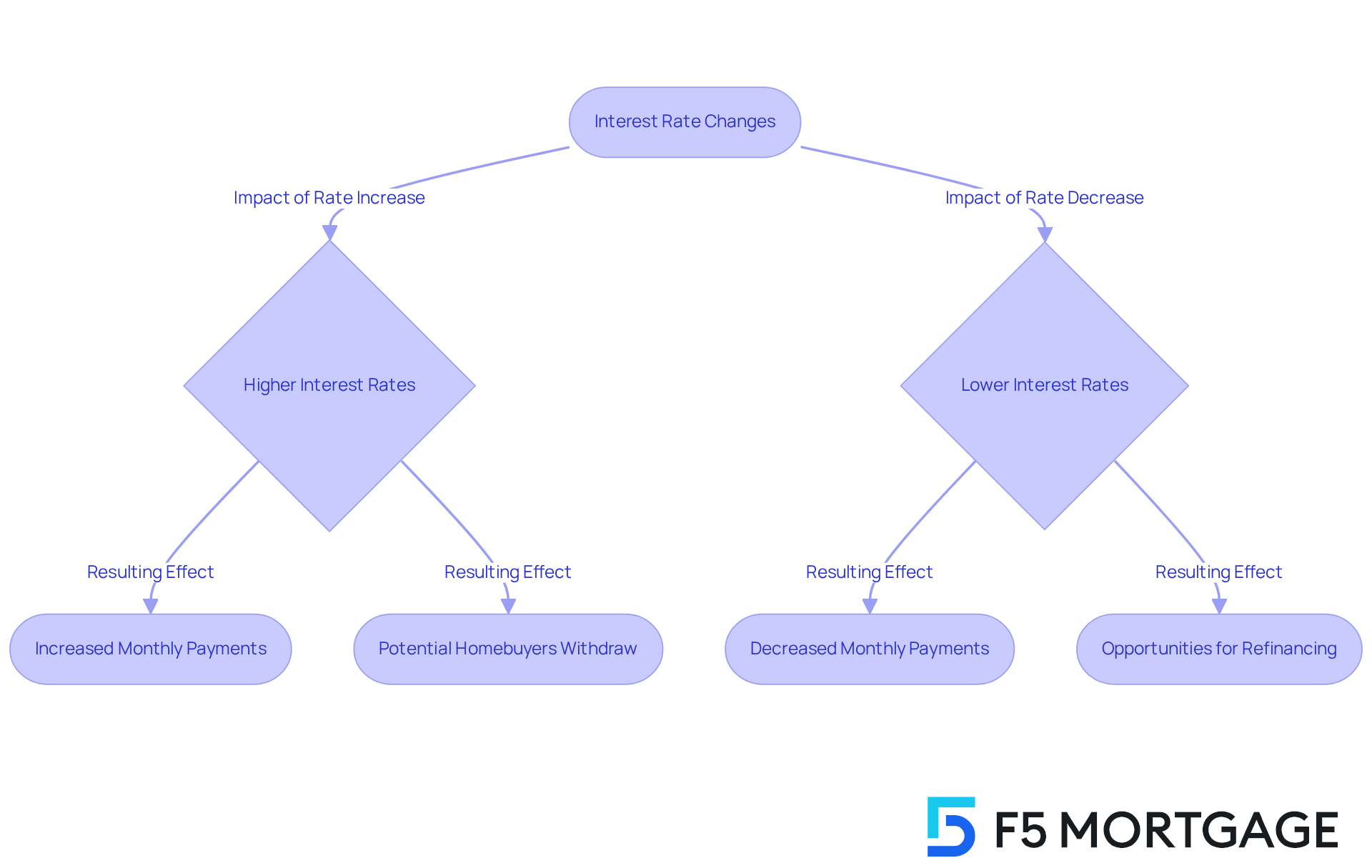

Impact of Interest Rate Changes on Mortgage Payments

The concept of interest rate vs apr mortgage fluctuations plays a crucial role in determining loan payments, significantly influencing home affordability. We understand how challenging this can be. For instance, when borrowing costs rise, monthly payments can escalate significantly, making homeownership less attainable for numerous purchasers. In August 2025, the existing loan interest for a 30-year fixed term is at 6.64%, indicating a trend where percentages have nearly doubled since 2021. This increase has led many potential homebuyers to withdraw from the market, as higher payments strain budgets.

On the other hand, a reduction in interest levels can decrease monthly payments, creating advantageous circumstances for refinancing. Recent trends show that mortgage costs are presently at their lowest points of the year, offering chances for borrowers to reevaluate their financial strategies. As Greg McBride from Bankrate mentions, “Mortgage costs are at their lowest points of the year,” emphasizing the necessity of tracking these trends for anyone intending to purchase or refinance soon. Even minor fluctuations can have considerable financial consequences.

At F5 Mortgage, we utilize advanced technology to offer competitive pricing and a no-pressure service model that distinguishes us from conventional lenders. We recognize the challenges presented by changing interest levels and are dedicated to equipping our clients with . Historical data indicates that as prices change, borrowers frequently modify their strategies accordingly. For example, during times of increasing interest, many homeowners decide to remain in place to maintain their current low terms, while others might look to refinance when costs decrease. This dynamic demonstrates the significance of comprehending how lending costs, particularly the interest rate vs apr mortgage, influence overall home affordability and the choices that borrowers need to consider in reaction to these changes.

Key Takeaways:

- Monitor interest rate trends regularly to stay informed about potential changes.

- Consider consulting with F5 Mortgage for personalized advice tailored to your financial situation.

- Be aware that even minor variations in costs can significantly affect your monthly payments and overall affordability.

In summary, the interaction between financial charges and home loan payments is essential for potential home purchasers and existing property owners alike. Keeping updated on trend changes can enable borrowers to make strategic choices that align with their financial objectives. At F5 Mortgage, we are here to revitalize the mortgage process and assist you in owning your dream home more quickly.

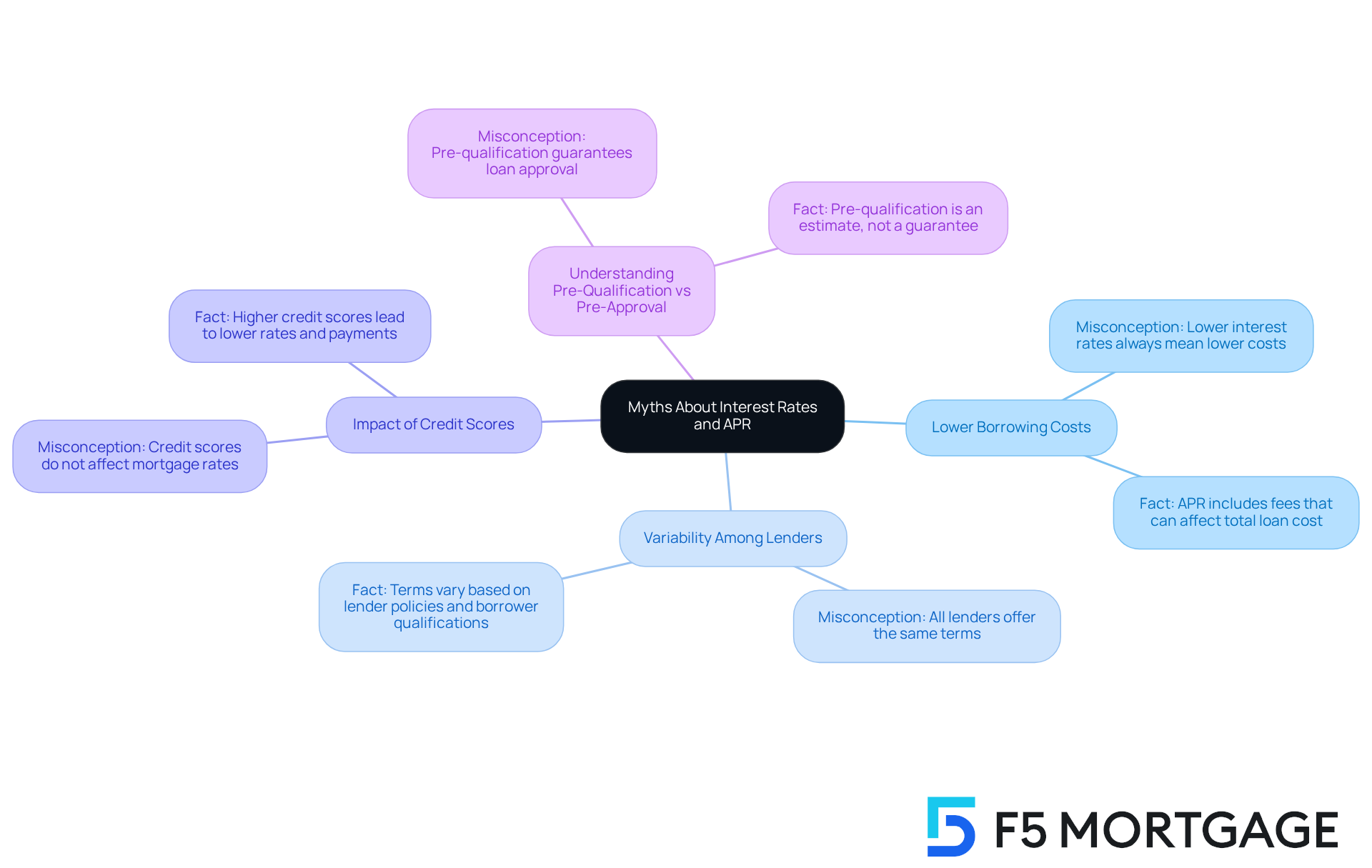

Debunking Myths: Common Misconceptions About Interest Rates and APR

Many myths surrounding borrowing costs and the can mislead borrowers, influencing their financial decisions. We know how challenging this can be. A common misunderstanding is that a lower cost of borrowing ensures a better arrangement. In reality, when comparing the interest rate vs APR mortgage, if the APR is considerably higher because of related fees, the total expense of the loan may surpass that of a loan with a somewhat elevated cost but reduced fees.

Furthermore, numerous borrowers erroneously think that all lenders offer identical terms; however, terms can vary significantly depending on lender policies and individual borrower qualifications. For example, borrowers with lower credit scores frequently encounter elevated charges when considering the interest rate vs APR mortgage, which can result in higher monthly payments. Conversely, those with higher credit scores typically enjoy lower rates in the context of interest rate vs APR mortgage and reduced monthly payments.

By educating themselves about these misconceptions, borrowers can make more informed financial choices. We’re here to support you every step of the way, ultimately resulting in improved loan outcomes. Engaging with resources such as comprehensive home buyer’s guides and mortgage calculators can further empower individuals to navigate the complexities of mortgage financing effectively.

Conclusion

Understanding the nuances between interest rates and APR in mortgage lending is essential for making informed financial decisions. We know how challenging this can be, and a comprehensive grasp of these terms not only aids in evaluating loan options but also empowers borrowers to navigate the complexities of the mortgage landscape with confidence. The differences between interest rates and APR can significantly affect the overall cost of borrowing, influencing both monthly payments and long-term financial commitments.

Throughout this article, we have shared key insights regarding the definitions, calculations, and implications of interest rates and APR. As you consider your financial situation, the duration of homeownership, and the potential for refinancing, remember that practical tips—like comparing multiple loan estimates and understanding the impact of locking in rates—can enhance your decision-making. Additionally, debunking common myths surrounding these concepts helps clarify the importance of thorough research and personalized advice.

Ultimately, the journey toward homeownership is complex, but with the right knowledge and support—such as that offered by F5 Mortgage—you can make strategic choices that align with your financial goals. Staying informed about current trends and leveraging personalized consultations can lead to more favorable mortgage terms and a smoother borrowing experience. Embracing this knowledge is a vital step toward achieving financial security and realizing your homeownership aspirations.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized consultations to clarify the differences between interest rates and APR, helping borrowers make informed decisions tailored to their financial circumstances.

Why is understanding interest rates and APR important in mortgages?

Understanding interest rates and APR is crucial because they determine the total costs a borrower will incur over the loan’s duration, affecting monthly payments and overall affordability.

How can fluctuations in interest rates impact homebuyers?

Fluctuations in interest rates can significantly influence homebuyers’ purchasing choices and affordability. For example, a decrease in borrowing costs can lead to substantial savings on monthly payments.

What is APR and how does it differ from interest rate?

APR, or Annual Percentage Rate, represents the total cost of borrowing expressed annually, including additional charges like origination fees and closing costs, while the interest rate is simply the cost of borrowing expressed as a percentage.

How can borrowers use APR to make informed decisions?

Borrowers can compare APRs from different lenders to identify more favorable loan options, even if the initial interest rates appear similar, as a lower APR indicates lower overall borrowing costs.

What factors should borrowers consider when choosing between a lower interest rate and a lower APR?

Borrowers should consider their length of stay in the home; those staying shorter may prioritize a lower APR, while long-term homeowners might benefit from a lower interest rate to reduce monthly payments.

How does refinancing impact Private Mortgage Insurance (PMI) in California?

Homeowners in California who purchased with less than a 20% down payment may eliminate PMI through refinancing, especially if their home’s value has increased, leading to a more favorable loan-to-value (LTV) ratio.

What technology does F5 Mortgage use to assist borrowers?

F5 Mortgage utilizes user-friendly technology, including an intuitive online application process and real-time financing tracking, to provide guidance without pressure.

What is the typical closing time for loans at F5 Mortgage?

F5 Mortgage aims for fast closings, often completing the process in under three weeks.

How can understanding the interest rate vs APR help borrowers in 2025?

In 2025, understanding the differences between interest rates and APR will help borrowers navigate the mortgage market, make strategic financial choices, and secure advantageous agreements amidst fluctuating borrowing costs.