Overview

We know how challenging navigating the mortgage process can be. VA loan assumption offers a unique opportunity for buyers to take over a seller’s existing VA mortgage. This can lead to potentially lower interest rates and reduced costs compared to traditional financing options. By considering this path, families can streamline their home purchasing experience and unlock significant financial advantages, especially in today’s rising interest rate environment.

However, it’s essential to understand the eligibility requirements and the associated risks involved. We’re here to support you every step of the way, ensuring you feel informed and confident in your decisions. By exploring VA loan assumptions, you’re taking a proactive step toward your homeownership goals, and we are committed to guiding you through this process with care and expertise.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially in a market where interest rates are rising. We understand how challenging this can be, which is why exploring VA loan assumption could be a strategic option for you. This approach allows veterans and active-duty service members to take over existing VA mortgages, often with favorable terms.

This process not only simplifies your journey to homeownership but also offers significant financial benefits. Imagine enjoying lower monthly payments and reduced closing costs—these advantages can make a real difference in your financial landscape. However, it’s vital to consider eligibility requirements and associated risks. How can you effectively leverage this opportunity to ensure a smooth transition?

We’re here to support you every step of the way, guiding you through the options available and helping you make informed decisions.

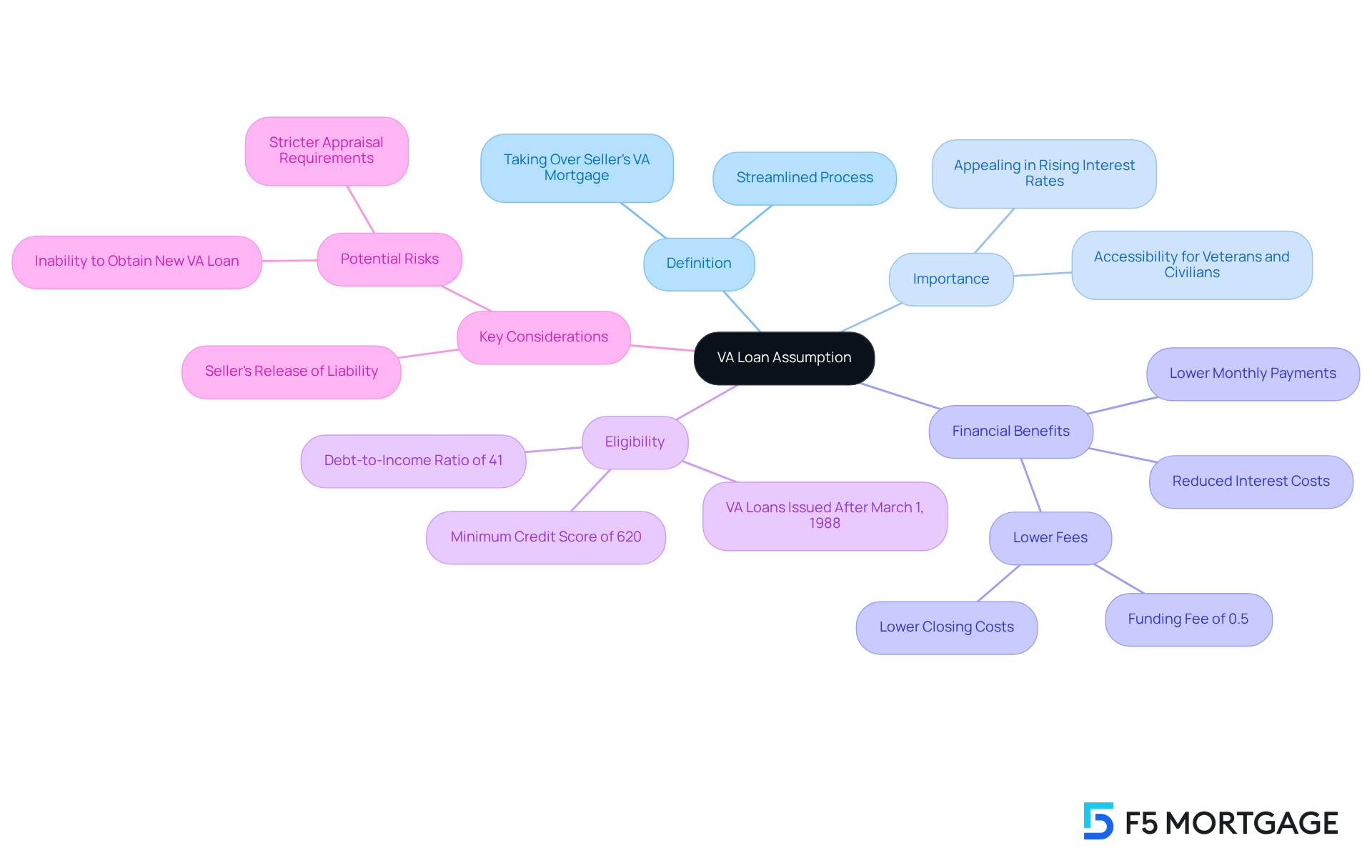

Define VA Loan Assumption and Its Importance

A VA loan assumption happens when someone takes over the financing of a seller’s VA mortgage. This allows the individual to benefit from existing terms, often featuring lower interest rates compared to current market rates. This option is particularly advantageous in 2025, with nearly 84% of VA homeowners holding mortgage rates below 5%. In a rising interest rate environment, this makes taking over a mortgage an appealing choice. By opting for a VA loan assumption, buyers can avoid the lengthy process of applying for new home financing, thus streamlining their home purchasing journey.

The financial benefits of VA mortgage transfers are significant. They can result in lower monthly payments and reduced overall interest costs—crucial factors for homebuyers aiming to maximize affordability. Additionally, the VA financing assumption process typically incurs lower fees and fewer closing costs than traditional home purchases, making it even more attractive. Experts emphasize that a VA loan assumption can provide a tremendous advantage, particularly if the current financing was secured at a lower rate, as it reduces monthly housing payments and the total interest paid over the life of the loan.

Moreover, VA financing allows for a maximum debt-to-income (DTI) ratio of 41%, which is beneficial for homebuyers assessing their financial planning. It’s also essential to note that any VA mortgage issued after March 1, 1988, is eligible for transfer, providing more options for potential buyers. The VA funding fee for assuming a mortgage is 0.5% of the balance, a detail that can influence purchasers’ decisions.

Generally, it is advisable for homeowners to plan to stay in their homes for at least five years to fully reap the financial benefits of homeownership. This timeframe enables buyers to and offset the costs associated with purchasing a home. In summary, understanding VA loan assumption is vital for homebuyers, especially veterans and active-duty service members. It offers a streamlined path to homeownership while capitalizing on favorable financing terms. This option not only simplifies the buying process but also provides substantial financial advantages, making it a valuable consideration in today’s housing market.

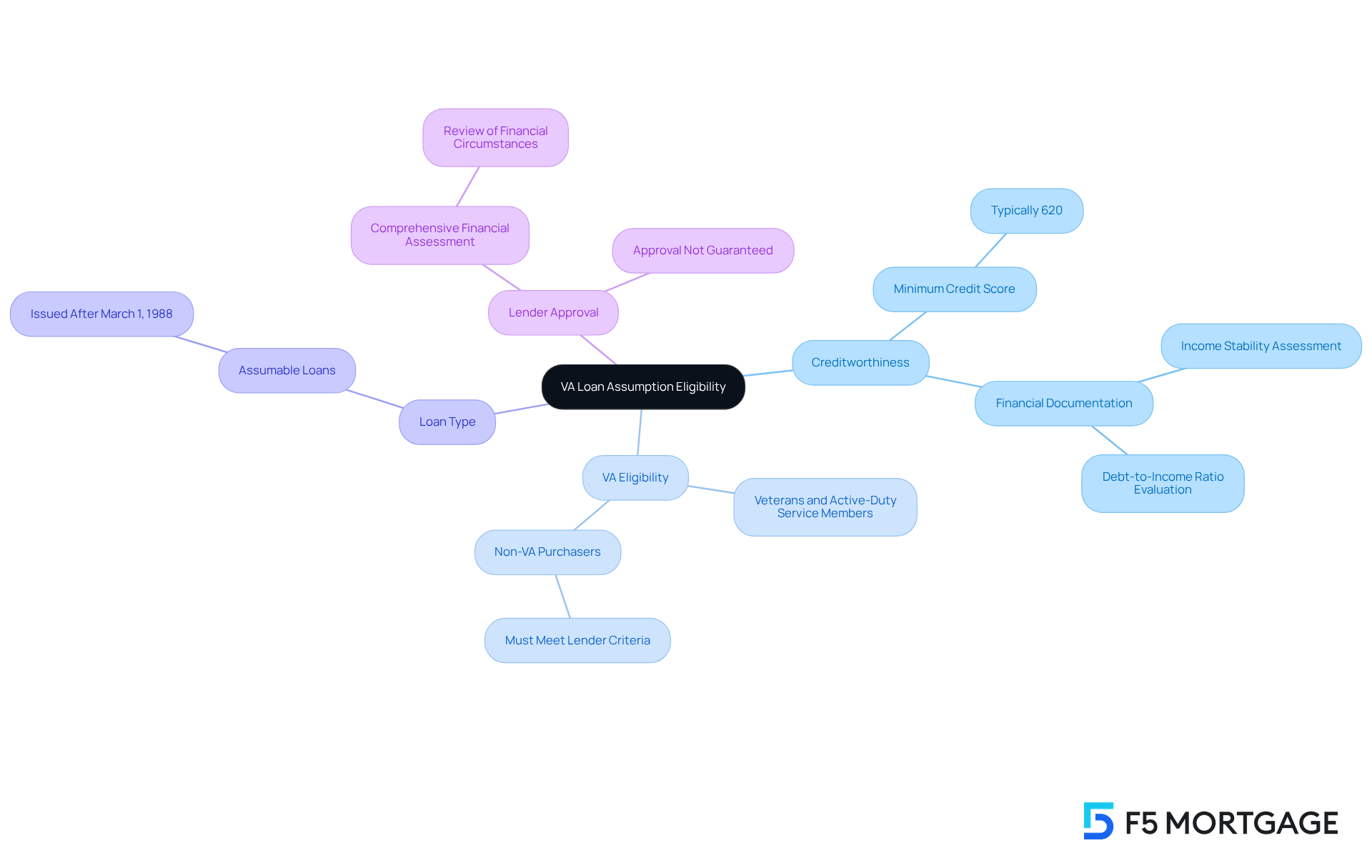

Identify Eligibility Requirements for VA Loan Assumption

Navigating the process of VA loan assumption can feel overwhelming, but understanding the eligibility criteria can make it much easier. Here’s what you need to know:

- Creditworthiness: It’s essential for buyers to demonstrate adequate creditworthiness, typically needing a minimum credit score of 620. Lenders will conduct a credit check to assess this, ensuring you’re on the right track.

- VA Eligibility: While this process is often linked to veterans and active-duty service members, it’s important to note that non-VA purchasers can also engage in VA loan assumption if they meet lender criteria. This flexibility opens the door for a wider variety of buyers to take advantage of favorable financing conditions.

- Loan Type: Remember, the original VA loan must be assumable. This generally applies to loans issued after March 1, 1988, so it’s worth checking the specifics of your situation.

- Lender Approval: Gaining lender approval is a crucial step. This involves a comprehensive assessment of your financial circumstances, including income stability and debt-to-income ratio.

Understanding these criteria is vital for prospective buyers, as it ensures you are well-equipped to navigate the assumption process effectively. With the right qualifications, you can enjoy and reduced closing costs. This makes the VA loan assumption an appealing choice in today’s housing market, and we’re here to support you every step of the way.

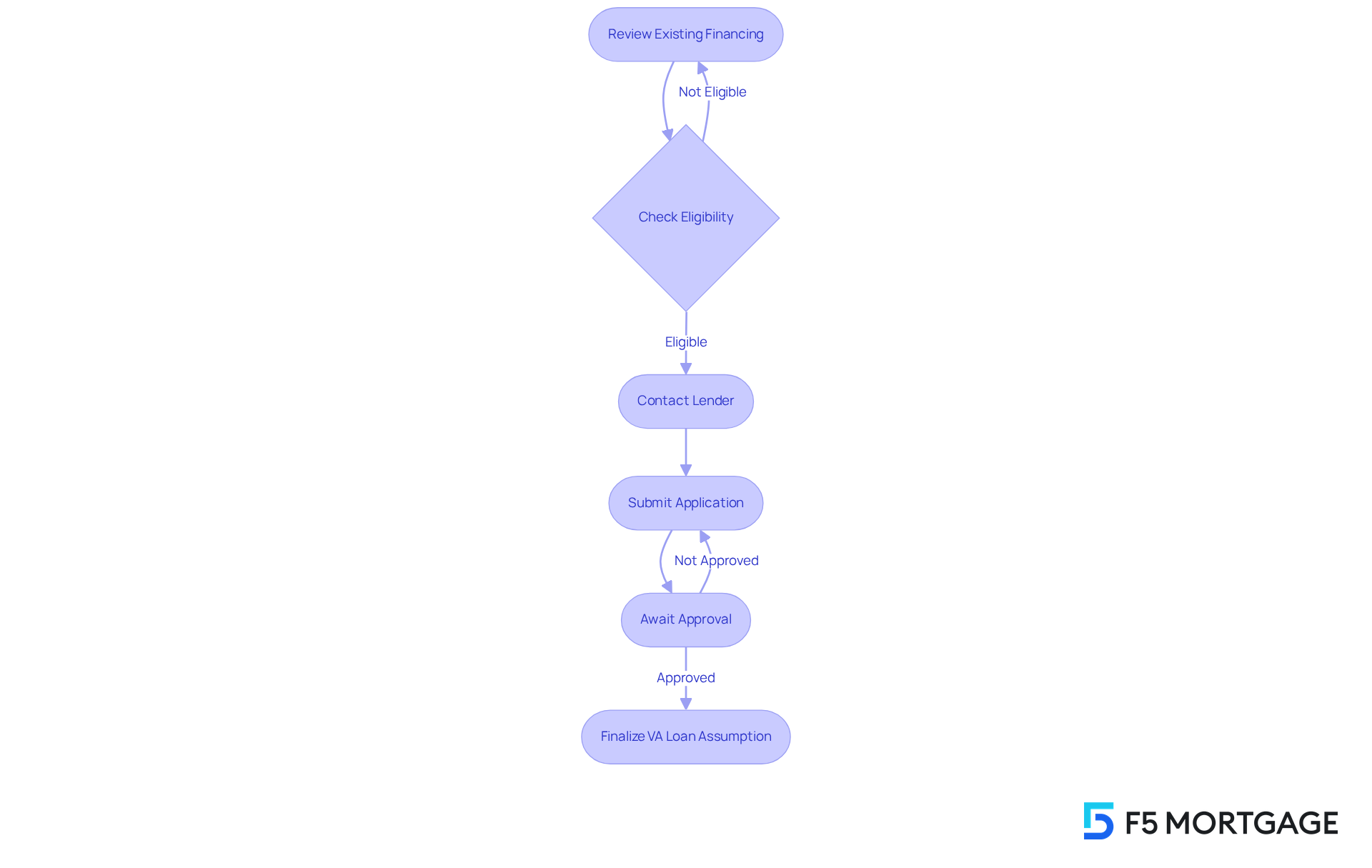

Outline the Process of Assuming a VA Loan

Assuming a VA loan involves several key steps to ensure a smooth transition for you and your family:

- Review the Existing Financing: Start by gathering details about your current VA financing, including the remaining balance, interest rate, and terms. We know how challenging this can be, and having this information at hand will help you feel more prepared.

- Check Eligibility: It’s important to confirm that both you and the financing meet the eligibility requirements for a VA loan assumption. This step is crucial to avoid any surprises down the road.

- Contact the lender to express your intention to proceed with a VA loan assumption in order to take over the financing. Inquire about their specific requirements, including any processing fees for the transfer, which can be up to $300. We’re here to support you every step of the way.

- Submit Application: Complete the necessary paperwork, which usually includes financial documentation such as proof of income, credit reports, and information regarding the VA loan assumption. Submitting your application for the transfer of obligation is a significant step toward achieving your goal.

- Await Approval: The lender will evaluate your application, assessing your creditworthiness and financial stability before deciding if the transfer can proceed. Be aware that the VA must also authorize the financing transfer after the lender’s consent, which can feel daunting.

- Finalize the VA loan assumption: Upon approval, you will need to sign the required documents to officially take over the debt. After this, the lender will update the records accordingly, marking a new chapter for you.

The typical has greatly decreased, with recent updates enabling approvals in as few as 45 days, compared to the earlier 90-120 days. Engaging with seasoned real estate experts can ease this undertaking, helping you navigate any legal intricacies or documentation needs. Proper organization of application records and clear communication between buyers and sellers are essential to avoid delays and ensure a successful transition.

Furthermore, once the transfer process is completed, the initial borrower is freed from responsibility, offering reassurance for both parties. Remember, you’re not alone in this process; support is available to help you through every step.

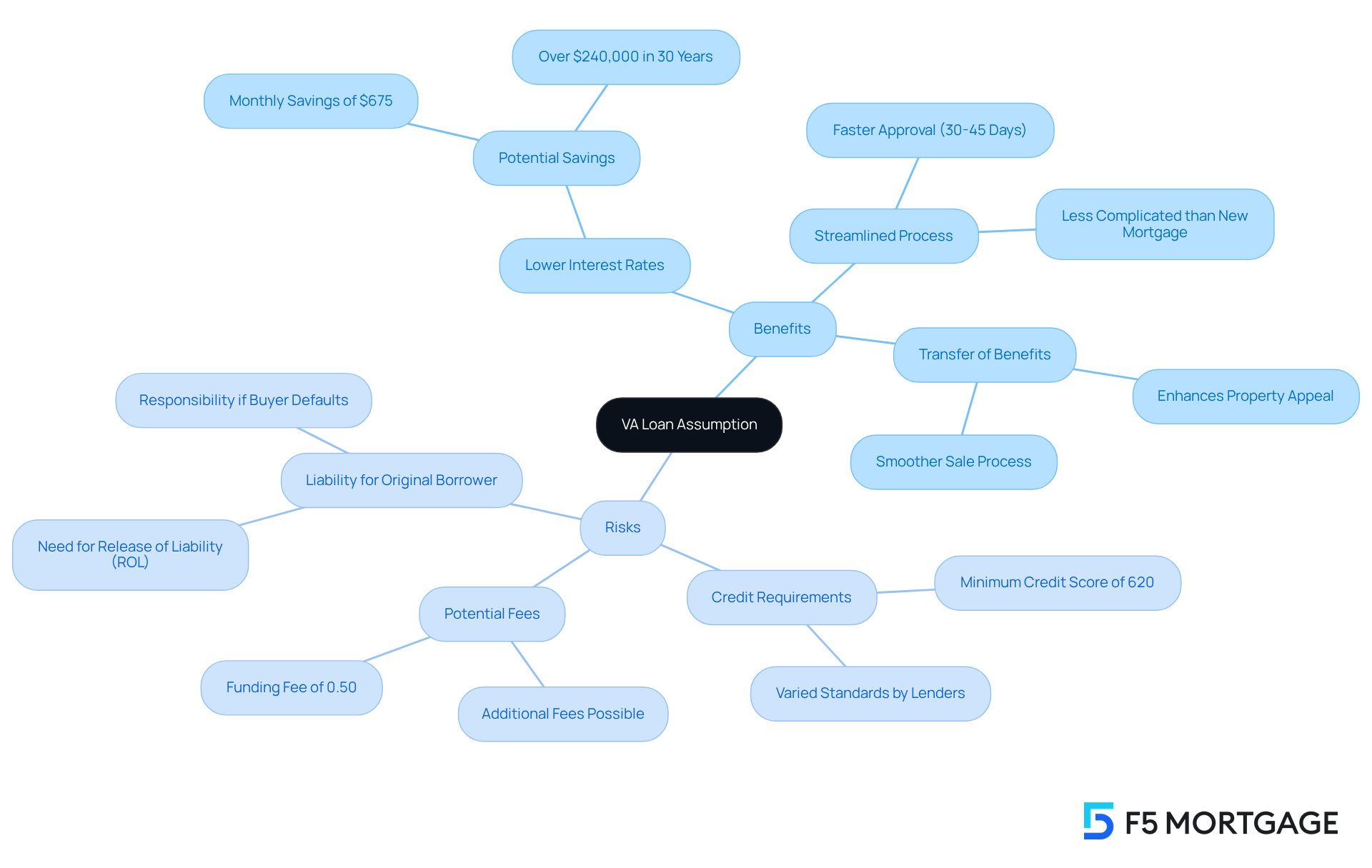

Evaluate Benefits and Risks of VA Loan Assumption

When considering a VA loan assumption, it’s essential to evaluate both the benefits and risks with care:

- Lower Interest Rates: Buyers often have the opportunity to secure lower interest rates compared to current market rates, leading to significant monthly savings. For example, assuming credit at 2.8% instead of borrowing anew at 6.5% could save around $675 monthly, resulting in over $240,000 in savings over a 30-year term. This potential reflects the financial relief for military families during times of high interest rates.

- Streamlined Process: The assumption process typically takes just 30-45 days, making it faster and less complicated than applying for a new mortgage. This is particularly helpful for military families who may be facing tight timelines due to Permanent Change of Station (PCS) orders.

- Transfer of Benefits: Veterans can transfer their VA financing advantages to qualified purchasers, which not only enhances the property’s appeal but may also lead to a smoother sale.

However, it’s important to consider the associated risks:

- Credit Requirements: Buyers need to meet the lender’s credit standards, which generally require a minimum credit score of 620. While this is a common requirement, different lenders may have , which could pose a challenge for some prospective purchasers.

- Potential Fees: Although the funding fee for a VA financing assumption is lower at 0.50% of the balance, there may still be additional fees involved in the process that could raise overall costs.

- Liability for Original Borrower: If the buyer does not fulfill the agreement, the original borrower may remain responsible unless a Release of Liability (ROL) is secured from the lender. If a seller transfers their debt without an ROL, they could be accountable for the entire term, even if the assumer defaults. This situation can create significant risk for sellers who may still be liable for the debt.

It’s crucial to highlight that the transfer process requires a clause in the sales agreement stating that the buyer will assume all responsibilities of the VA financing. Understanding these factors is vital for making an informed decision about pursuing a VA loan assumption. We know how challenging this can be, and ensuring that both buyers and sellers are aware of their rights and responsibilities can empower them throughout the process.

Conclusion

A VA loan assumption presents a wonderful opportunity for homebuyers, especially veterans and active-duty service members, to benefit from existing favorable mortgage terms. By assuming a seller’s VA mortgage, buyers can enjoy often lower interest rates and streamlined processes, making homeownership more attainable and affordable in today’s fluctuating market.

We understand how overwhelming the mortgage process can be, and this article outlines the essential steps involved in assuming a VA loan. It covers:

- Understanding eligibility requirements

- Contacting the lender

- Navigating the application process

Key insights highlight the financial benefits, such as reduced monthly payments and lower overall interest costs, while also addressing potential risks like credit requirements and seller liability. This comprehensive approach ensures that both buyers and sellers are well-informed before moving forward.

Ultimately, the significance of VA loan assumption lies in its ability to provide a straightforward pathway to homeownership, particularly during times of rising interest rates. By considering this option, prospective buyers can secure substantial savings and contribute to a smoother real estate transaction. Exploring the advantages and staying aware of the associated risks will empower individuals to make informed decisions, enhancing their financial well-being in the housing market. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is a VA loan assumption?

A VA loan assumption occurs when someone takes over the financing of a seller’s VA mortgage, allowing the individual to benefit from the existing loan terms, often including lower interest rates compared to current market rates.

Why is a VA loan assumption particularly advantageous in 2025?

In 2025, nearly 84% of VA homeowners hold mortgage rates below 5%, making it appealing for buyers to assume these loans in a rising interest rate environment.

What are the financial benefits of assuming a VA loan?

Assuming a VA loan can lead to lower monthly payments and reduced overall interest costs, which are crucial for homebuyers looking to maximize affordability. Additionally, the process typically incurs lower fees and fewer closing costs than traditional home purchases.

What is the maximum debt-to-income (DTI) ratio for VA financing?

VA financing allows for a maximum debt-to-income (DTI) ratio of 41%, which is beneficial for homebuyers in their financial planning.

Which VA mortgages are eligible for transfer?

Any VA mortgage issued after March 1, 1988, is eligible for transfer, providing more options for potential buyers.

What is the VA funding fee for assuming a mortgage?

The VA funding fee for assuming a mortgage is 0.5% of the balance, which can influence purchasers’ decisions.

How long should homeowners plan to stay in their homes to maximize financial benefits?

Homeowners are generally advised to plan to stay in their homes for at least five years to fully reap the financial benefits of homeownership, allowing them to build equity and offset purchasing costs.

Why is understanding VA loan assumption important for homebuyers?

Understanding VA loan assumption is vital for homebuyers, especially veterans and active-duty service members, as it offers a streamlined path to homeownership while capitalizing on favorable financing terms and substantial financial advantages.