Overview

Understanding the essential steps for homebuyers regarding a master loan commitment can feel overwhelming. We know how challenging this can be, but rest assured, you are not alone in this journey. A loan commitment is not just a piece of paper; it represents lender approval and significantly enhances your negotiating power in real estate transactions.

To navigate this process successfully, it’s important to grasp the concept, types, and steps involved in securing a loan commitment. Start with pre-approval, which lays the groundwork for your home purchase. Next, complete the loan application and ensure you meet all final conditions. Each step is crucial in strengthening your position as a buyer.

Remember, we’re here to support you every step of the way. By understanding these steps, you empower yourself to make informed decisions, paving the way for a successful home purchase. Your dream home is within reach, and taking these steps will help you get there.

Introduction

Navigating the competitive real estate market can be daunting for aspiring homebuyers, and understanding the intricacies of securing a loan commitment is essential. This pivotal document not only signifies a lender’s willingness to provide financing but also enhances your negotiating power and credibility when making an offer.

However, we know how challenging this process can be. From fluctuating market conditions to the complexities of required documentation, the path to obtaining a loan commitment can be fraught with obstacles. But don’t worry; we’re here to support you every step of the way.

So, how can you effectively navigate this journey to ensure a successful and stress-free path toward homeownership? Let’s explore some empowering strategies together.

Define Loan Commitment: Key Concepts and Importance

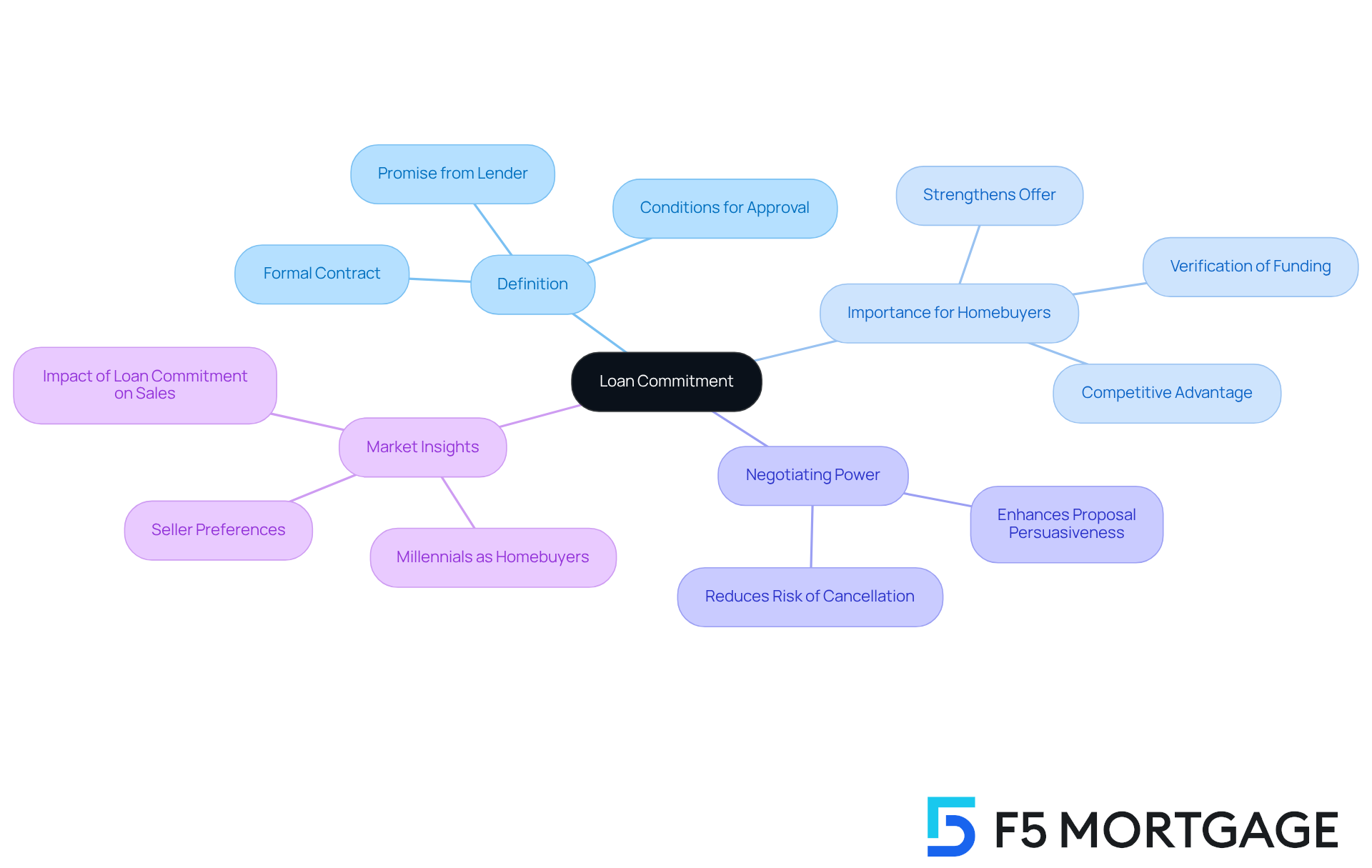

A loan commitment is more than just a formal contract; it represents a promise from a provider to offer a recipient a specified amount of capital under defined conditions. This document is essential because it indicates that the lender has taken the time to thoroughly assess the borrower’s financial condition and is ready to proceed with the loan commitment, contingent upon fulfilling any final requirements. For homebuyers, understanding this concept is crucial. It not only strengthens their position when submitting an offer on a property but also clarifies the terms and conditions of the loan commitment they are entering into.

After the pre-approval phase, the loan commitment serves as a vital step before finalizing a mortgage. It shows that purchasers are earnest and financially prepared to complete the acquisition. We know how challenging this process can be, and statistics indicate that sellers frequently favor purchasers with a loan commitment over those with just pre-approval. This preference significantly lowers the risk of last-minute cancellations. In fact, having a loan commitment can enhance a buyer’s negotiating power, making their proposal more persuasive in a competitive market.

Consider the impact of financial agreements on home purchasing. Purchasers with a loan commitment are often viewed more favorably by sellers because it verifies secured funding and suggests a greater chance of a successful closure. This advantage is particularly pronounced in a market where approximately 37% of homebuyers are millennials, who are increasingly prioritizing homeownership despite common misconceptions about their financial readiness.

In summary, understanding the nuances of a loan commitment is essential for homebuyers. It not only signifies approval from the financial institution but also empowers them to make informed choices in their homebuying journey. Remember, we’re here to support you every step of the way.

Explore Types of Loan Commitments: Secured vs. Unsecured

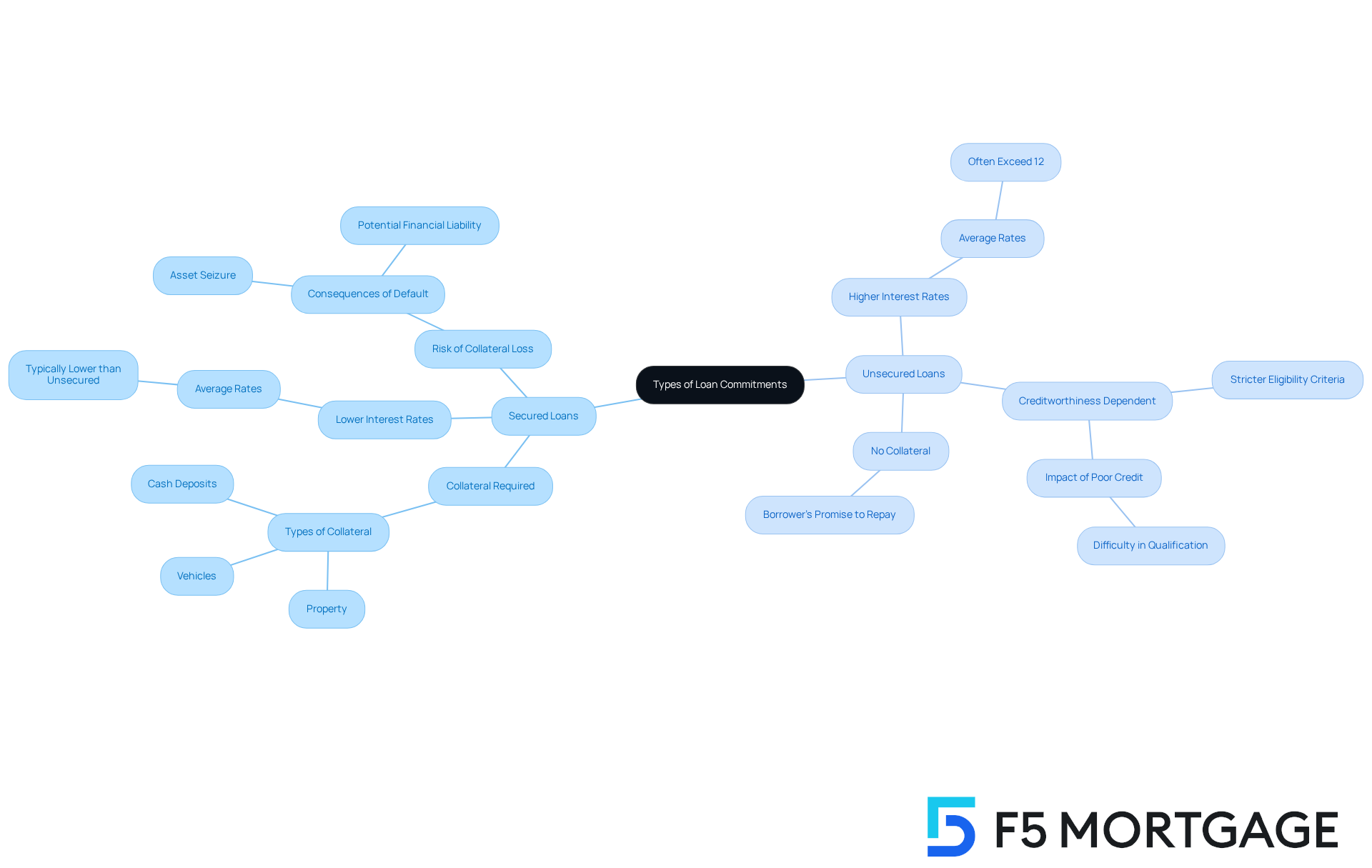

Loan commitments can be divided into two primary types: secured and unsecured. Understanding these options is crucial for making informed financial decisions.

-

Loan Commitment: These secured loan commitments require collateral, such as the property being purchased. If the borrower defaults, the creditor has the right to seize the collateral to recover their losses. Secured credits generally provide lower average interest rates compared to unsecured credits because of diminished lender risk. This makes them an attractive option for homebuyers, as they often feature significantly lower rates than unsecured loans, which can exceed 12 percent.

-

Loan Commitment: These unsecured loans do not require collateral, relying solely on the borrower’s creditworthiness. While they may offer more flexibility, they often come with higher interest rates due to the increased risk for lenders. We know how challenging it can be for borrowers with poor credit to qualify for unsecured financing, as these typically have stricter eligibility criteria and lower borrowing limits. Failing to make payments on unsecured debts can adversely affect credit ratings, resulting in additional financial challenges.

Comprehending these differences assists borrowers in selecting the appropriate kind of loan commitment according to their economic circumstances and risk appetite. For those with valuable collateral, secured financing can be a financially wise option. As Tom Parrish observes, “secured credit options typically come with considerably lower rates than unsecured options but may demand more documentation and take a longer time to obtain funds.”

Furthermore, individuals should be aware that failing to meet obligations on secured debts can lead to the loss of their collateral, highlighting the significance of responsible asset management. Different forms of secured financing, such as home equity lines and auto financing, offer choices for individuals seeking to utilize their assets. We’re here to support you every step of the way as you navigate these important decisions.

Navigate the Loan Commitment Process: Steps and Documentation

Navigating the loan commitment process can feel overwhelming, but by understanding the key steps and required documentation for a loan commitment, you can make it easier. We’re here to support you every step of the way.

-

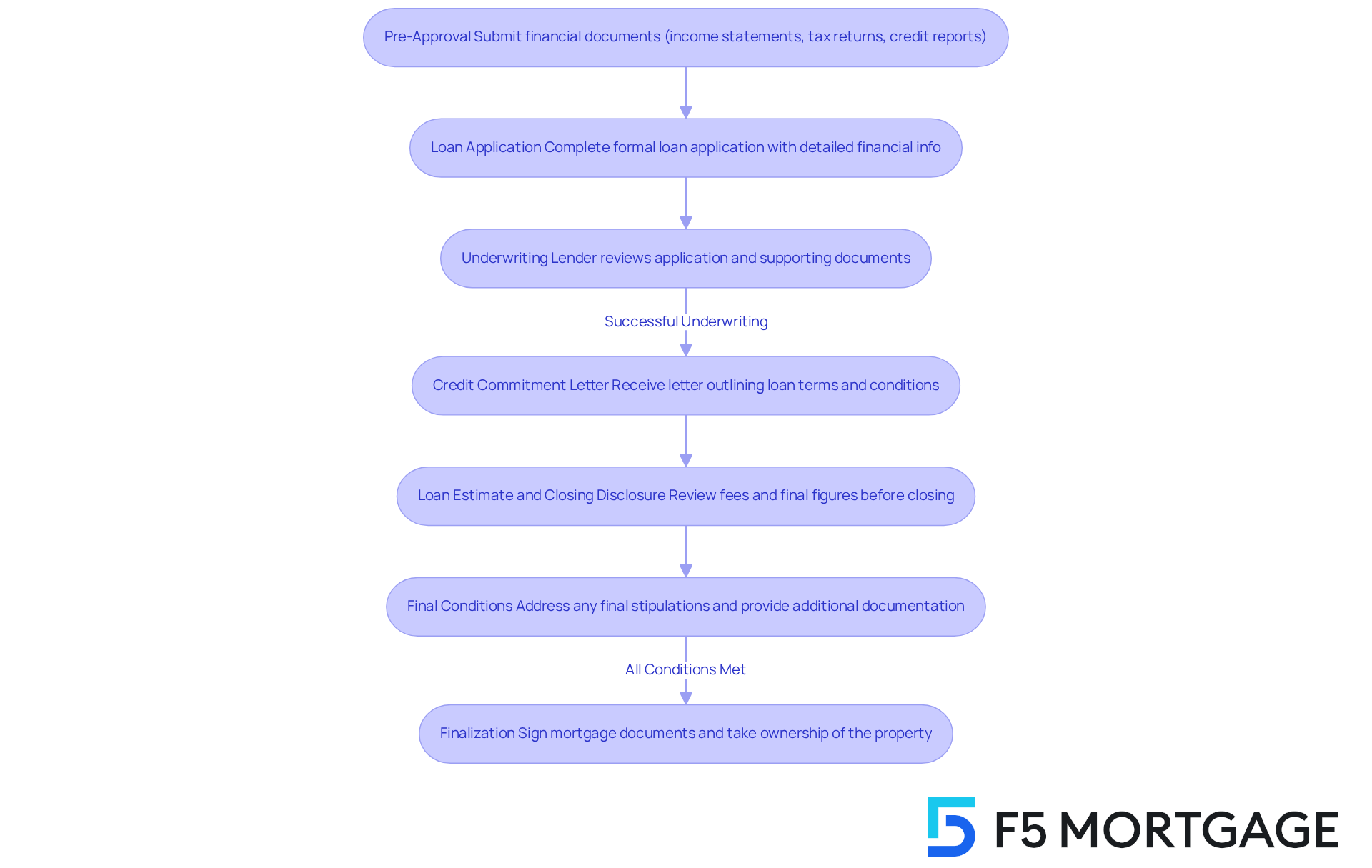

Pre-Approval: Before securing a financing commitment, it’s crucial to request pre-approval from a financial institution. This initial step involves submitting financial documents like income statements, tax returns, and credit reports. Pre-approval not only establishes a borrowing limit but also demonstrates serious intent to sellers, enhancing your position in competitive markets. Many buyers also ask sellers to complete repairs as a contingency, which can be a strategic move in negotiations.

-

Loan Application: Once you have pre-approval, the next step is to complete a formal loan application. This document requires detailed information about your financial situation and the property you wish to acquire, ensuring the financial institution has a comprehensive view of your qualifications.

-

Underwriting: During underwriting, the financial institution reviews your application and supporting documents to assess your creditworthiness and the property’s value. This thorough assessment is vital as it determines whether your financing will be authorized.

-

Credit Commitment Letter: If underwriting is successful, the lender issues a credit commitment letter outlining the loan’s terms, including the amount, interest rate, and any conditions that must be met before closing. This letter is a significant milestone, indicating that you are on track to secure financing. However, it’s important to note that while this letter is legally binding, it does not guarantee final mortgage approval, as lenders can withdraw offers if your financial situation changes.

-

Loan Estimate and Closing Disclosure: Before closing, you will receive a Loan Estimate that outlines the fees and costs associated with the loan. This estimate can change by up to 10% prior to closing. Additionally, a Closing Disclosure will be sent, detailing the final figures so you can see precisely what you are paying for.

-

Final Conditions: You must address any final stipulations specified in the agreement letter. Common requirements may include providing additional documentation, such as updated income statements or proof of homeowners insurance, and completing a home inspection. Promptly fulfilling these conditions is essential to keep the transaction on track. If the mortgage agreement expires, you may need to ask for an extension from your lender, which could involve fees or rate adjustments.

-

Finalization: Once all conditions are satisfied, the financing is completed, and you can proceed to closing. This final step involves signing the mortgage documents and taking ownership of the property. Maintaining stable finances throughout this process is crucial, as significant changes can jeopardize your loan commitment. Remember, you are not obligated to a specific lender until you sign closing documents, giving you flexibility in your financing options. Before closing, a final walkthrough allows you to verify the property’s condition, ensuring that any agreed-upon repairs have been completed.

Understanding these steps and the required documentation will empower you to navigate the complexities of obtaining a mortgage, ultimately leading to a successful home purchase. At F5 Mortgage, we leverage user-friendly technology to simplify this process, guiding you every step of the way to ensure a stress-free experience.

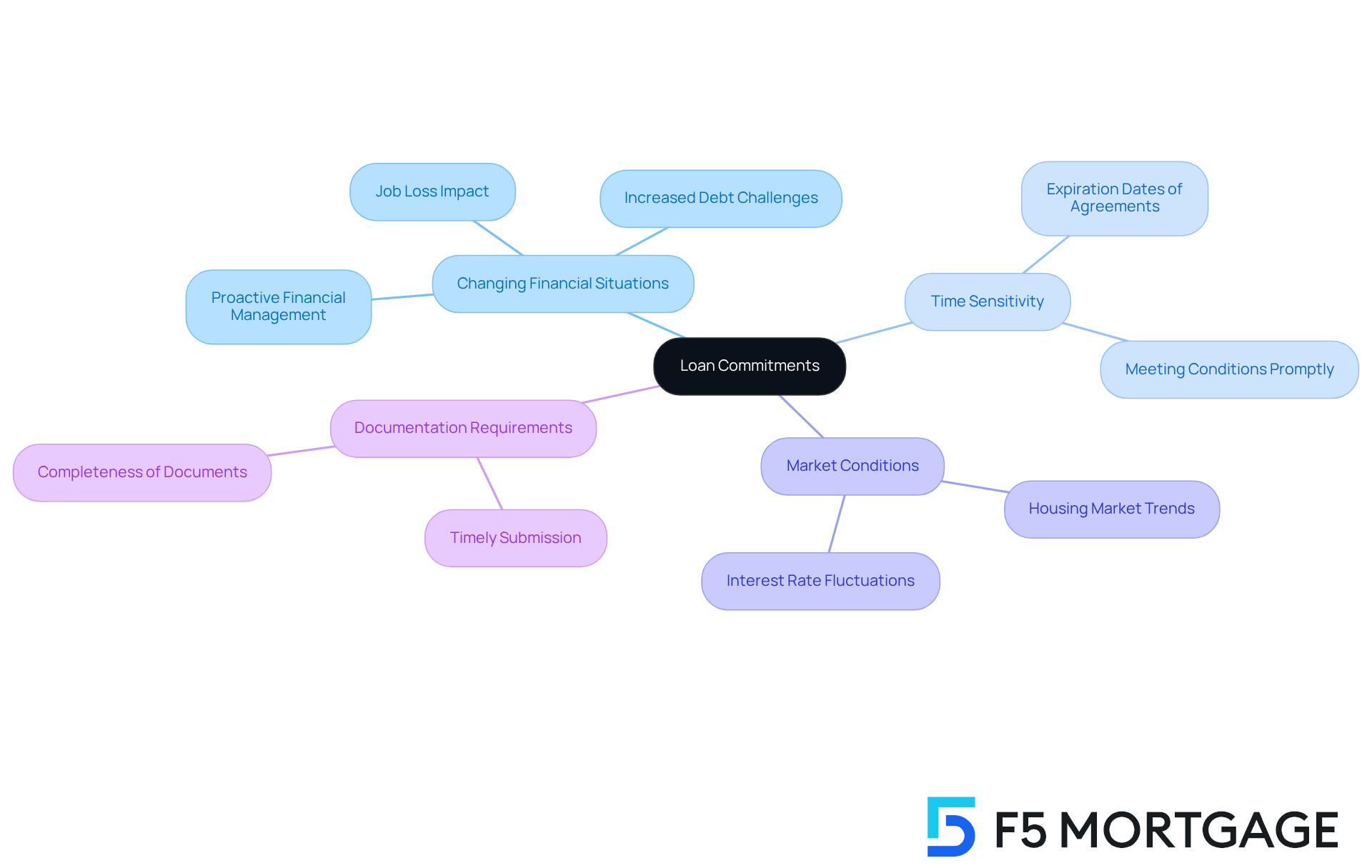

Understand Implications: Challenges and Considerations in Loan Commitments

Understanding the implications of a loan commitment is crucial for homebuyers, as it involves navigating several challenges and considerations.

-

Changing Financial Situations: We know how challenging it can be when significant changes in your financial circumstances—such as job loss or increased debt—arise. These changes can directly impact your loan commitment as well as the approval process. Staying proactive in managing your finances is essential to ensure you remain on track.

-

Time Sensitivity: Loan agreements typically come with expiration dates, making it imperative for you to act swiftly. To avoid losing valuable financing opportunities, it is essential to meet the conditions outlined in the agreement letter regarding the loan commitment.

-

Market Conditions: Interest rates and housing market changes can significantly affect the terms of your financial agreement. Staying informed about current market trends empowers you to make timely and advantageous decisions.

-

Documentation Requirements: Incomplete or incorrect documentation can lead to delays or even rejection of your application. We’re here to support you every step of the way, so ensure that all required documents are prepared and submitted promptly to facilitate a smooth approval process.

By understanding these implications, you can better prepare yourself for the loan commitment process, enabling informed decisions throughout your home buying journey. Additionally, understanding the mortgage approval process is essential, as it determines your eligibility for various loan options. F5 Mortgage offers fast and flexible mortgage solutions, allowing you to achieve homeownership with exceptional service and competitive rates.

Conclusion

Understanding the loan commitment process is essential for homebuyers who are navigating the complexities of purchasing a property. A loan commitment not only signifies a lender’s intent to provide financing under specific conditions, but it also enhances a buyer’s credibility in a competitive market. We know how challenging this can be, and by grasping the significance of this commitment, homebuyers can position themselves favorably when making offers and ultimately secure their dream homes.

Throughout this article, we’ve highlighted key aspects of loan commitments, including:

- The differences between secured and unsecured loans

- The step-by-step process for obtaining a loan commitment

- The potential challenges that may arise

From the initial pre-approval to the finalization of the mortgage, understanding each stage and the required documentation is crucial for a smooth transaction. Moreover, being aware of the implications of changing financial situations and market conditions can help buyers make informed decisions and avoid pitfalls.

In conclusion, the journey to homeownership is paved with important financial decisions, and a solid understanding of loan commitments is a critical component of this process. Homebuyers are encouraged to take proactive steps, stay informed, and utilize available resources to navigate the loan commitment landscape effectively. By doing so, they can not only enhance their chances of securing favorable financing but also achieve their goal of homeownership with confidence. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a loan commitment?

A loan commitment is a promise from a lender to provide a borrower with a specified amount of capital under defined conditions, indicating that the lender has assessed the borrower’s financial condition and is ready to proceed, pending any final requirements.

Why is a loan commitment important for homebuyers?

A loan commitment is important for homebuyers because it strengthens their position when submitting offers on properties, clarifies the terms of the loan, and shows sellers that they are earnest and financially prepared to finalize the purchase.

How does a loan commitment differ from pre-approval?

A loan commitment is a more definitive step than pre-approval, as it indicates that the lender has thoroughly evaluated the borrower’s financial situation and is willing to provide the loan, whereas pre-approval is an initial assessment.

How does having a loan commitment affect a buyer’s negotiating power?

Having a loan commitment enhances a buyer’s negotiating power by making their offer more persuasive in a competitive market, as it indicates secured funding and a higher likelihood of successful closure.

Why do sellers prefer buyers with a loan commitment?

Sellers often prefer buyers with a loan commitment because it reduces the risk of last-minute cancellations and suggests that the buyer is more likely to complete the transaction.

What demographic is increasingly prioritizing homeownership, and how does a loan commitment affect their buying process?

Millennials, who make up approximately 37% of homebuyers, are increasingly prioritizing homeownership. A loan commitment can help them secure a favorable position in the buying process by verifying their funding and readiness to close.

What role does understanding a loan commitment play in the homebuying journey?

Understanding a loan commitment is essential for homebuyers as it signifies approval from the financial institution and empowers them to make informed choices throughout their homebuying journey.