Overview

Currently, HELOC rates average around 8.26%. This figure is influenced by various factors, including credit scores, loan-to-value ratios, and overall economic conditions. We understand how challenging it can be to navigate these financial decisions, especially when considering options for your home.

While HELOCs typically offer lower rates compared to personal loans and credit cards, it’s important to recognize the associated risks. Potential foreclosure is a serious concern that requires careful thought and consideration. We’re here to support you every step of the way as you weigh your options and make informed choices for your family’s future.

Introduction

Understanding the landscape of home equity lines of credit (HELOCs) is essential for homeowners looking to leverage their property’s value. We know how challenging this can be, especially with current average interest rates hovering around 8.26%. Many families are eager to explore how these rates compare to other financing options and what factors influence them.

However, amidst the allure of flexible borrowing lies a critical question: how do homeowners navigate the potential risks? Fluctuating rates and the possibility of foreclosure can be daunting. This article delves into the current state of HELOC rates, their advantages, and the key considerations for making informed financial decisions. We’re here to support you every step of the way.

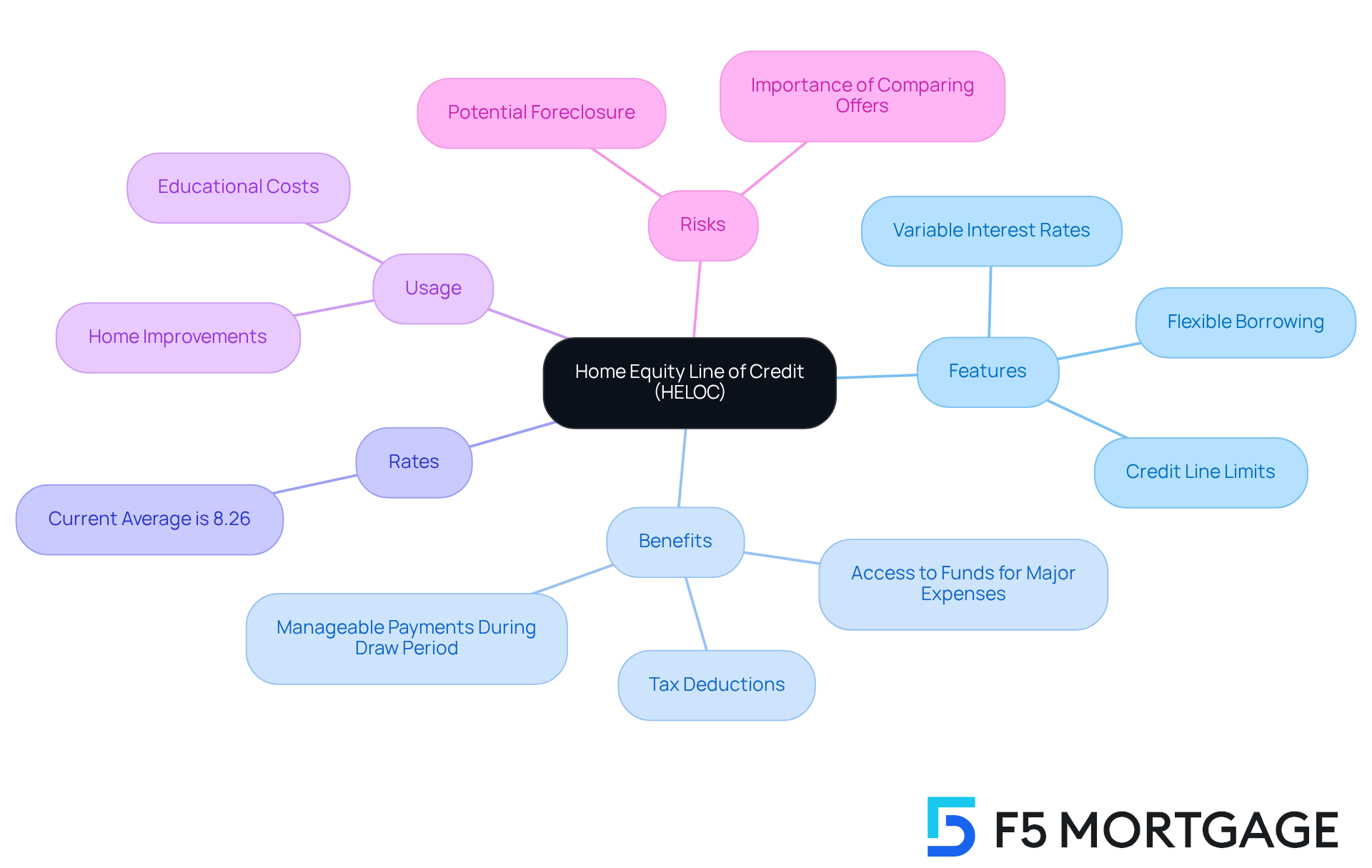

Define Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a flexible borrowing option that allows homeowners to tap into the equity of their property. Much like a credit card, it enables you to withdraw funds as needed, up to a set limit, and you only pay interest on the amount you use. Homeowners are often curious about what are HELOC rates right now, especially since the average interest rate is around 8.26%, making it an appealing choice.

Typically featuring variable interest rates, the cost of borrowing can fluctuate with market changes. This financial tool can be particularly advantageous for homeowners looking to cover significant expenses, such as home improvements or educational costs, all while making the most of their property’s value. Additionally, if you use the funds for IRS-eligible home repairs and renovations, you may benefit from tax deductions on the interest paid.

With credit lines often reaching $100,000 or more, homeowners can access substantial funds for various needs. However, it’s essential to compare different offers to find out what are HELOC rates right now and the best terms, since not all lenders provide the same options. For instance, F5 Mortgage offers appealing terms and personalized support, making it a strong contender for those considering a HELOC.

During the initial draw period, which usually lasts between 10 to 15 years, you’ll only need to make interest payments, allowing for more manageable cash flow. Yet, it’s crucial to understand the risks associated with home equity products, including the possibility of foreclosure if payments are missed. Many families have successfully used HELOCs to manage education expenses, showcasing their practicality and versatility in handling financial responsibilities. We know how challenging this can be, and we’re here to support you every step of the way.

Current HELOC Rates Overview

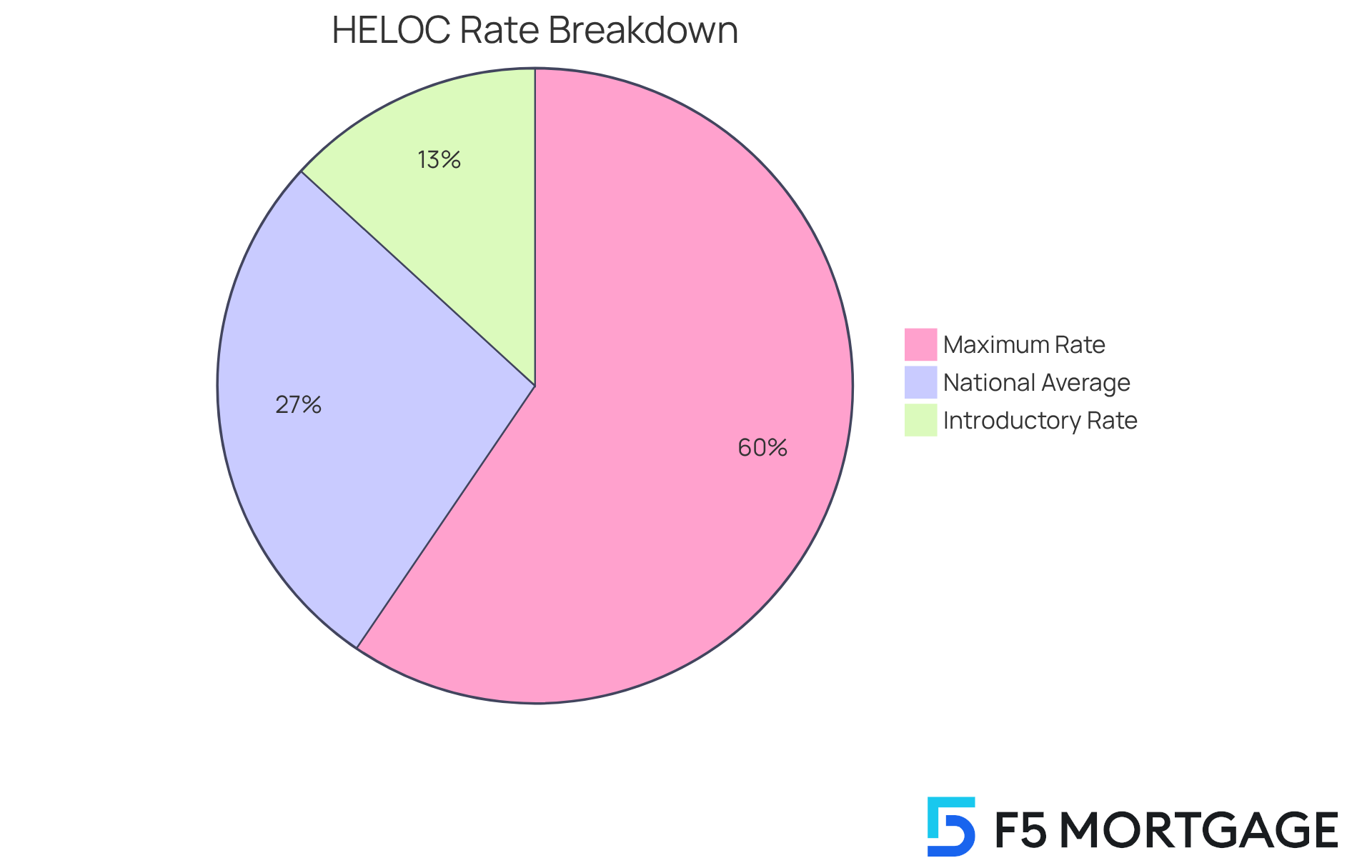

As of August 13, 2025, we know that navigating the world of home equity lines of credit (HELOCs) can feel overwhelming. According to Bankrate’s latest survey, what are HELOC rates right now, as the national average interest level stands at 8.26%? It’s important to understand that rates can vary significantly based on factors such as your credit score, the lender’s policies, and the overall economic environment. For instance, while some lenders may offer introductory rates as low as 3.99%, others might set maximum rates as high as 18%.

Most lenders typically require a minimum credit score of 620 for home equity loans, which is a crucial consideration for anyone looking to apply. If you have a strong credit score, you may be able to secure more favorable terms. However, if your credit score is lower, you might face higher borrowing costs, as lenders often reduce the maximum loan-to-value (LTV) ratio and increase interest rates for clients with poor credit.

As we look ahead, there is a glimmer of hope. Economists, including LendingTree’s chief consumer finance analyst Matt Schulz, suggest that home equity line of credit charges may decrease further in the upcoming months, prompting consumers to wonder what are HELOC rates right now as the Federal Reserve considers possible reductions. Yet, it’s essential to remain mindful of the risks associated with HELOCs. If payments are not made, there is a potential for foreclosure.

As you evaluate your options, we’re here to support you every step of the way. Consider how these factors align with your financial goals, and take the time to weigh the benefits and risks carefully.

Factors Influencing HELOC Rates

Understanding the factors that influence HELOC terms can be overwhelming, but we’re here to support you every step of the way. Several important elements come into play, including your credit score, the loan-to-value (LTV) ratio, and the current economic landscape. A higher credit score often means lower interest rates, as it indicates less risk to lenders. For instance, if your score exceeds 750, you might secure terms as low as 7.750% APR. In contrast, individuals with lower scores may face significantly higher rates.

The LTV ratio, which compares the loan amount to the appraised value of your home, also plays a crucial role. Generally, a lower LTV ratio can lead to more favorable terms. For example, an LTV of 80% or lower is frequently linked to better options.

Additionally, broader economic factors, such as the Federal Reserve’s interest rate decisions and inflation, can influence what are HELOC rates right now. It’s essential to stay informed about these market trends, as they can impact your borrowing experience.

Once your application is approved, securing your mortgage terms with F5 Mortgage is vital. This step helps protect you from potential market fluctuations during the processing period, ensuring you have the best possible outcome.

HELOC Rates Compared to Other Financing Options

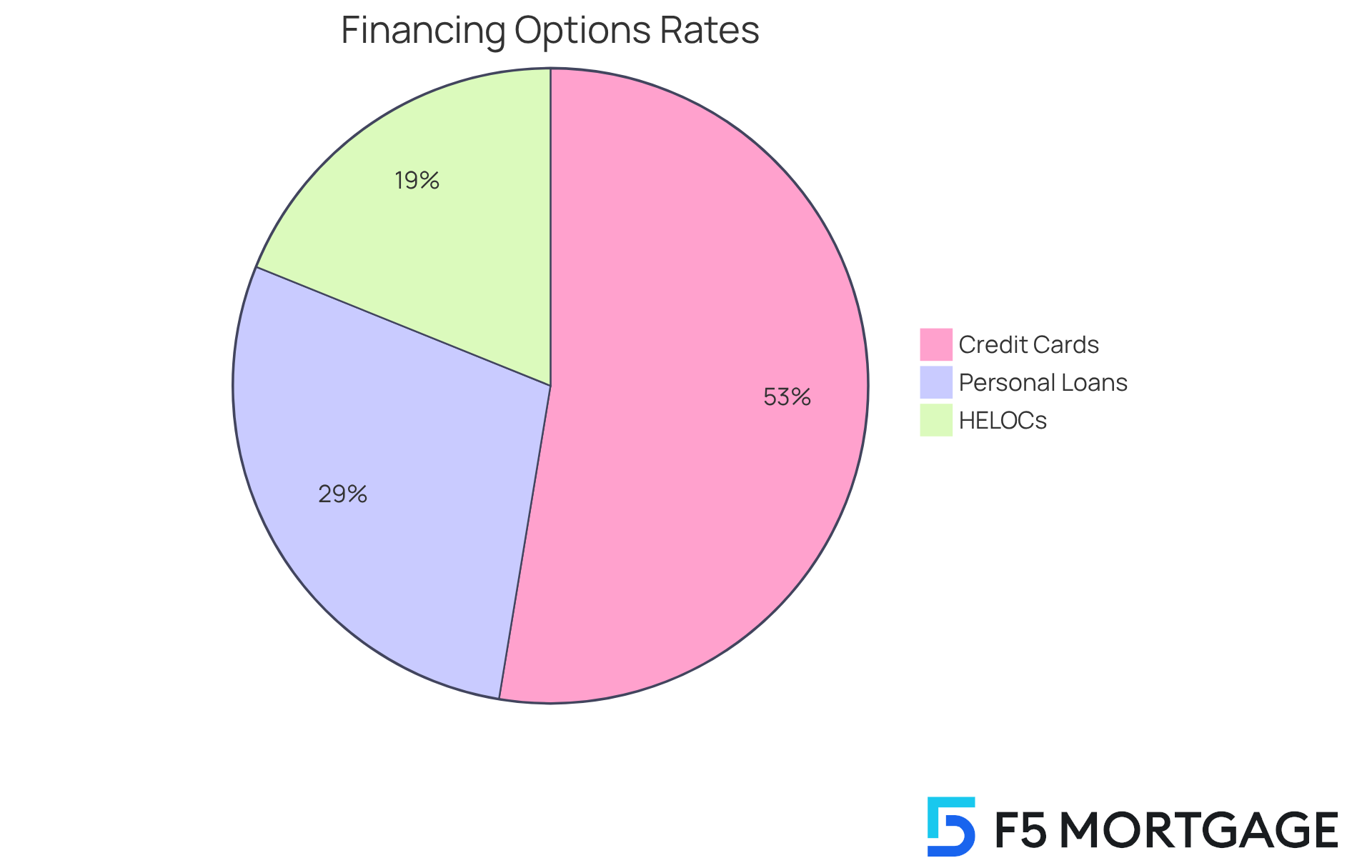

When considering HELOC terms alongside other funding options, such as personal loans and credit cards, many families find that HELOCs frequently present a more appealing choice. We understand how overwhelming financial decisions can be. As of August 2025, personal loan interest rates average around 12.47%, while credit card charges can soar to approximately 23%. In contrast, HELOCs currently offer significantly lower rates, so what are HELOC rates right now, averaging 8.26%? This makes them a cost-effective option for those needing access to funds.

Moreover, if you utilize a HELOC to purchase, construct, or significantly enhance your home, the interest paid may be tax-deductible. This can provide additional financial motivation for families seeking loans. HELOCs also offer flexibility, allowing homeowners to borrow as needed during the draw period, which can be particularly beneficial in times of uncertainty.

However, it’s crucial to remember that HELOCs are secured by your home. This means that failing to repay could lead to foreclosure. Therefore, while HELOCs can be advantageous, we encourage you to carefully assess your financial situation and repayment capabilities. We’re here to support you every step of the way in making informed decisions.

Conclusion

A Home Equity Line of Credit (HELOC) can be a valuable financial resource for homeowners. It allows you to tap into the equity of your home for various needs, whether it’s for home improvements or educational expenses. With current HELOC rates averaging around 8.26%, this option becomes increasingly appealing, especially when you consider the potential tax deductions on interest.

Key factors that influence HELOC rates include:

- Your credit score

- Loan-to-value ratio

- The overall economic climate

Understanding these elements is essential as you seek the best terms for your situation. Compared to personal loans or credit cards, which often come with higher interest rates, HELOCs can be a more favorable choice. The flexibility during the draw period adds to their attractiveness, but it’s important to be aware of the risks involved, including the possibility of foreclosure.

As you explore your financial options, consider the nuances of HELOCs. This understanding can empower you to make informed decisions that align with your financial goals. Staying updated on current trends and rates is crucial, as market fluctuations may present new opportunities. We encourage you to engage with trusted lenders who can guide you through this process, ensuring that you make choices that best suit your needs and financial circumstances. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a flexible borrowing option that allows homeowners to access the equity in their property, similar to a credit card, where they can withdraw funds as needed up to a set limit and only pay interest on the amount used.

What are the current average interest rates for HELOCs?

The average interest rate for HELOCs is around 8.26%.

How do HELOC interest rates work?

HELOCs typically have variable interest rates, meaning that the cost of borrowing can fluctuate with market changes.

What are common uses for a HELOC?

Homeowners often use HELOCs for significant expenses such as home improvements or educational costs.

Are there any tax benefits associated with HELOCs?

Yes, if the funds are used for IRS-eligible home repairs and renovations, homeowners may benefit from tax deductions on the interest paid.

How much can homeowners typically borrow with a HELOC?

Credit lines for HELOCs can often reach $100,000 or more, providing substantial funds for various needs.

Why is it important to compare HELOC offers?

It’s essential to compare different offers to find the best HELOC rates and terms, as not all lenders provide the same options.

What is the initial draw period for a HELOC?

The initial draw period usually lasts between 10 to 15 years, during which homeowners only need to make interest payments.

What are the risks associated with a HELOC?

The primary risk is the possibility of foreclosure if payments are missed, as HELOCs are secured against the home.

How have families successfully used HELOCs?

Many families have successfully utilized HELOCs to manage education expenses, showcasing their practicality and versatility in handling financial responsibilities.