Overview

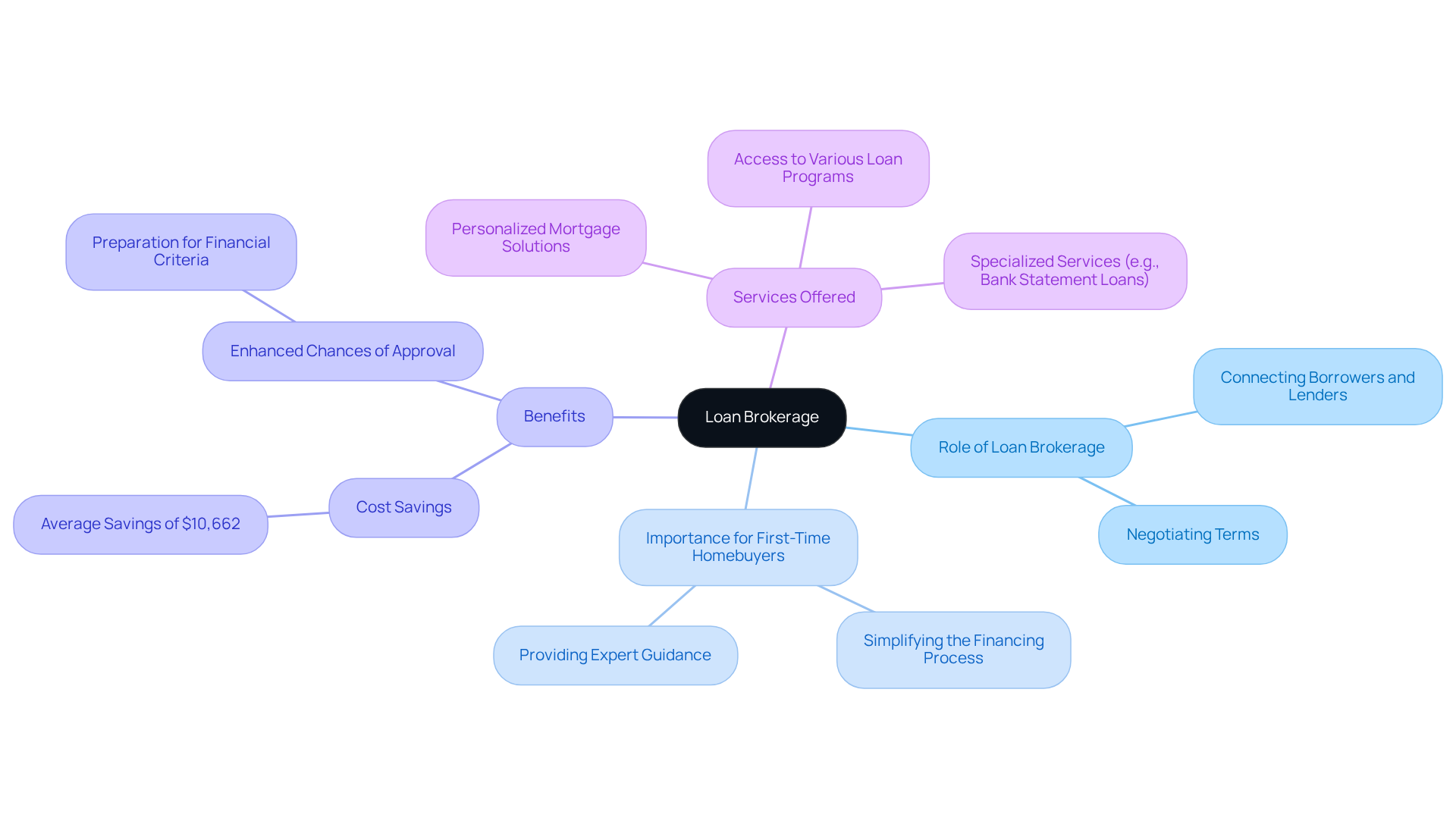

Navigating the world of home financing can be overwhelming, but loan brokerage is here to help. By connecting homebuyers with lenders and negotiating favorable terms tailored to their unique financial situations, brokers play a crucial role in simplifying the process. We know how challenging this can be, and that’s why having expert guidance is so important.

Brokers provide access to a variety of loan products and personalized support, significantly enhancing your chances of loan approval. Imagine having someone in your corner, dedicated to saving you both time and money during your home purchasing journey. With their help, you can focus on what truly matters—finding the perfect home for you and your family.

As you embark on this journey, remember that you don’t have to do it alone. Loan brokers are here to support you every step of the way, ensuring that your experience is as smooth and stress-free as possible. Take that first step towards your dream home with confidence, knowing that expert assistance is just a call away.

Introduction

Navigating the labyrinth of home financing can feel overwhelming, especially for first-time buyers. We understand how daunting this experience can be. The complexities of securing a loan often leave many feeling lost. This is where loan brokerage becomes a vital ally, acting as a bridge between borrowers and lenders. It simplifies the process and offers tailored solutions that cater to individual financial needs.

However, with so many options available, how can homebuyers ensure they are making informed choices? This article delves into the essential insights of loan brokerage. We will explore its importance, the variety of loan products available, and the unique challenges it helps to overcome. Our goal is to empower you to make confident decisions in your pursuit of homeownership. We’re here to support you every step of the way.

Define Loan Brokerage and Its Importance

Navigating the world of loans can feel overwhelming, but a loan brokerage offers a guiding hand. Loan brokerage serves as a trusted intermediary, connecting individuals seeking funds with lenders who can help. They simplify the financing process, helping clients find the right funding options tailored to their unique financial situations. This service is especially vital for first-time homebuyers, who may find the complexities of financing daunting. Brokers leverage their industry expertise and established relationships with lenders to negotiate favorable terms and rates, ultimately saving clients both time and money.

Did you know that consumers can save an average of over $10,000 during their financing journey by partnering with an independent financial advisor instead of going through nonbank retail lenders? Furthermore, a recent study found that 34% of homebuyers sought an agent for their latest loan, reflecting a growing trend towards professional assistance in managing loan financing. These successful stories in loan brokerage highlight how intermediaries not only streamline the process but also enhance the chances of loan approval for first-time buyers by preparing them for essential financial criteria.

We understand how crucial it is to have support during such a significant decision. Expert insights consistently affirm the vital role of loan brokerage in assisting home purchases. They provide personalized guidance, ensuring clients are informed about their options and the financing process. This tailored approach not only alleviates the stress associated with securing financing but also empowers clients to make informed choices. Additionally, F5 Mortgage offers specialized services like Bank Statement Loans and Adjustable Rate Mortgages, catering to various client needs. With a remarkable , F5 Mortgage exemplifies the positive outcomes of working with a dedicated mortgage professional, as reflected in numerous client testimonials praising their exceptional service and personalized mortgage solutions.

We know how challenging this can be, but remember, you’re not alone. Collaborating with an experienced advisor can make all the difference in your home buying journey. Let’s take this step together.

Explain How Loan Brokerage Works

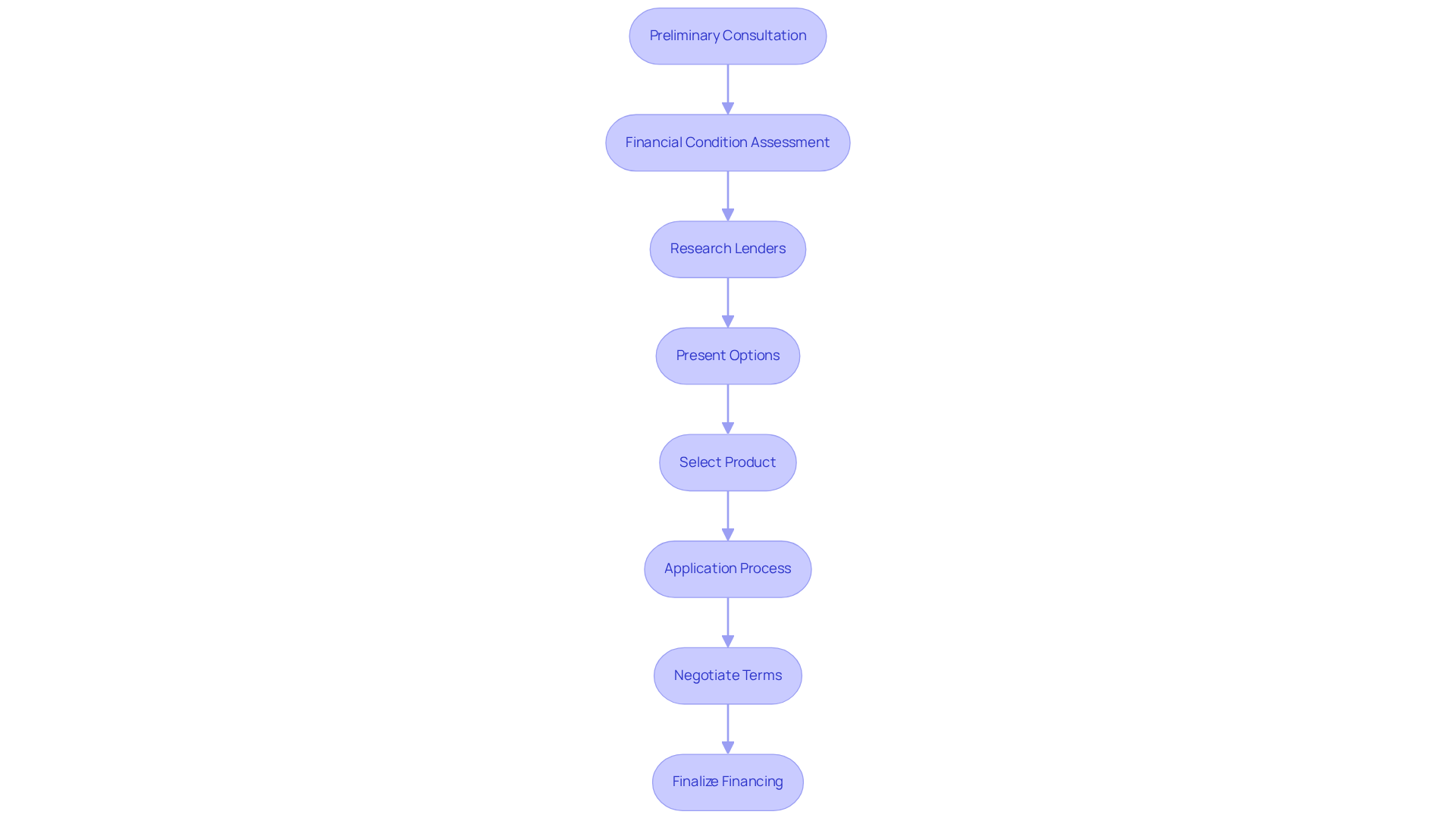

Starting the financing brokerage procedure can feel overwhelming, but we know how challenging this can be. It begins with a preliminary consultation, where the agent takes the time to assess your financial condition, including your income, credit rating, and specific financing preferences. After this evaluation, the agent conducts thorough research on various lenders and financial products that best meet your needs.

Once suitable options are identified, the agent presents these choices to you, clearly explaining the advantages and disadvantages of each. This way, you can make an informed decision. After you select a financial product, the intermediary assists with the application process, ensuring that all necessary paperwork is submitted correctly.

Throughout this journey, your representative acts as your advocate, negotiating favorable terms and conditions with lenders to secure the best possible deal. This support continues until the financing closes, providing ongoing assistance to ensure a smooth transition into homeownership.

Remarkably, lenders can often finalize financing in under three weeks, greatly accelerating the process for you. In a rapidly evolving loan market, loan brokerage services are increasingly recognized for their ability to simplify the lending experience, making them essential partners for homebuyers.

Moreover, F5 Mortgage offers convenient application options, allowing you to apply online, by phone, or through chat. We’re here to support you every step of the way, guaranteeing a that meets your requirements. F5 Mortgage’s commitment to client assistance includes connecting you with premier real estate agents and securing the most favorable financing options, further enhancing your overall experience.

Explore Different Loan Products Offered by Brokers

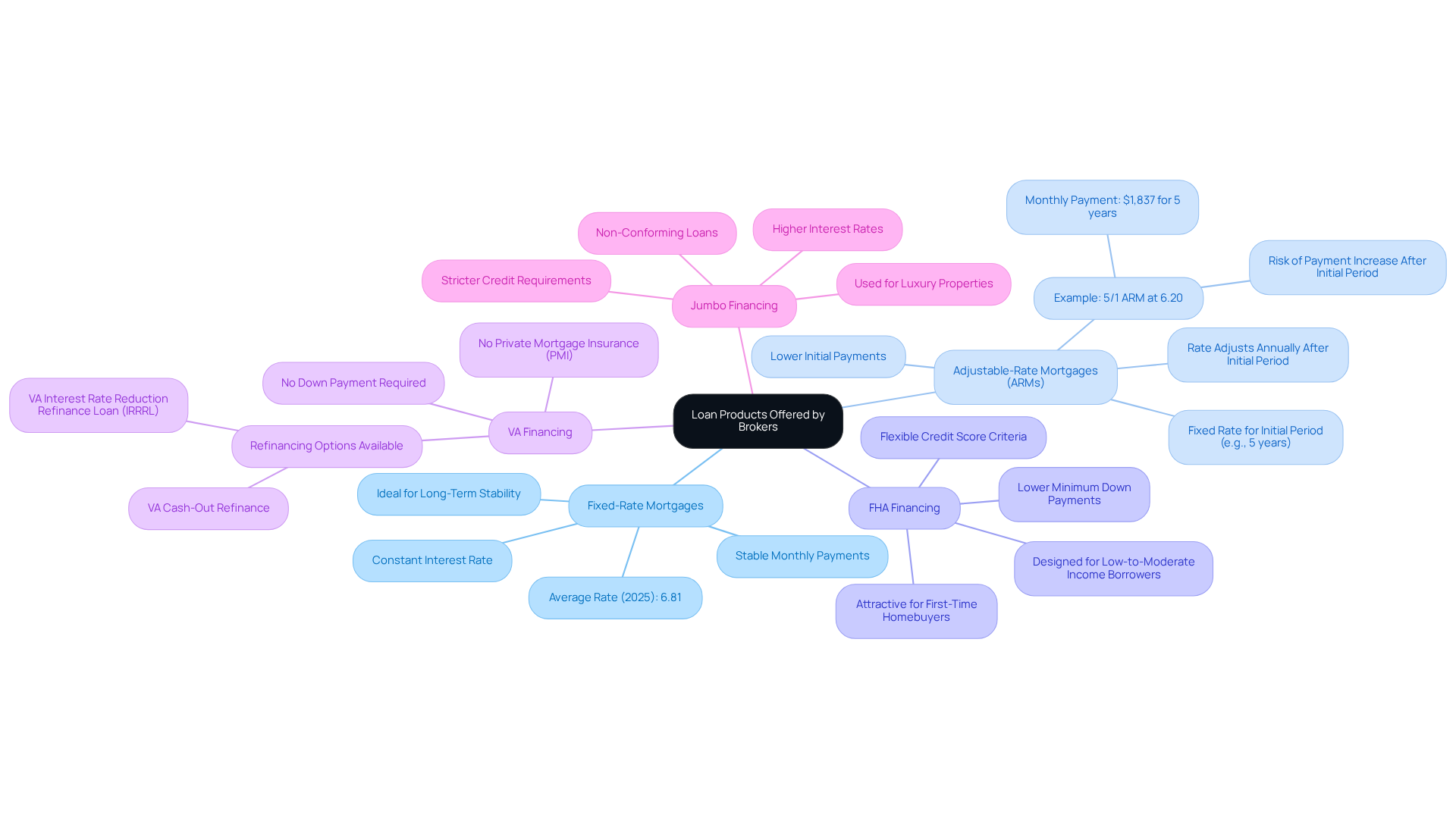

Navigating the world of mortgages with the help of a loan brokerage can feel overwhelming, but understanding your options can empower you to make informed decisions. Here’s a look at some common loan products that might suit your needs:

- Fixed-Rate Mortgages: These loans provide a constant interest rate and stable monthly payments, ideal for those seeking long-term financial stability. In 2025, the average fixed-rate loan rate is approximately 6.81%, offering predictability in budgeting for homeowners.

- Adjustable-Rate Mortgages (ARMs): ARMs can be appealing due to lower initial payments, featuring fixed rates for a set period, typically five years. After that, rates adjust annually based on market conditions. For example, a 5/1 ARM with an initial rate of 6.20% results in monthly payments of $1,837 for the first five years, compared to $1,955 for a 30-year fixed-rate mortgage at 6.80%. However, it’s important to be aware that payments may rise significantly after the initial period, making these options more suitable for those not planning to stay long-term.

- FHA Financing: Supported by the Federal Housing Administration, FHA financing is designed for individuals with low-to-moderate income. It requires and offers flexible credit score criteria, making it an attractive option for first-time homebuyers or those with limited financial resources.

- VA Financing: Tailored for veterans and active-duty military personnel, VA financing comes with favorable terms, including no down payment and no private mortgage insurance (PMI). This can greatly reduce the overall cost of homeownership for eligible borrowers. Additionally, refinancing options like the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinance can enhance these benefits, allowing homeowners to lower their monthly payments or access cash for other financial needs.

- Jumbo Financing: These non-conforming loans exceed the limits set by the Federal Housing Finance Agency (FHFA) and are often used for luxury properties. Jumbo mortgages typically have and higher interest rates, reflecting the increased risk for lenders.

We know how challenging it can be to find the right mortgage option in today’s market. By understanding these choices, you can navigate the mortgage landscape more effectively and select a financial product that aligns with your goals, particularly when considering options through loan brokerage, especially in a time when affordability is increasingly important.

Highlight Benefits of Using a Mortgage Broker

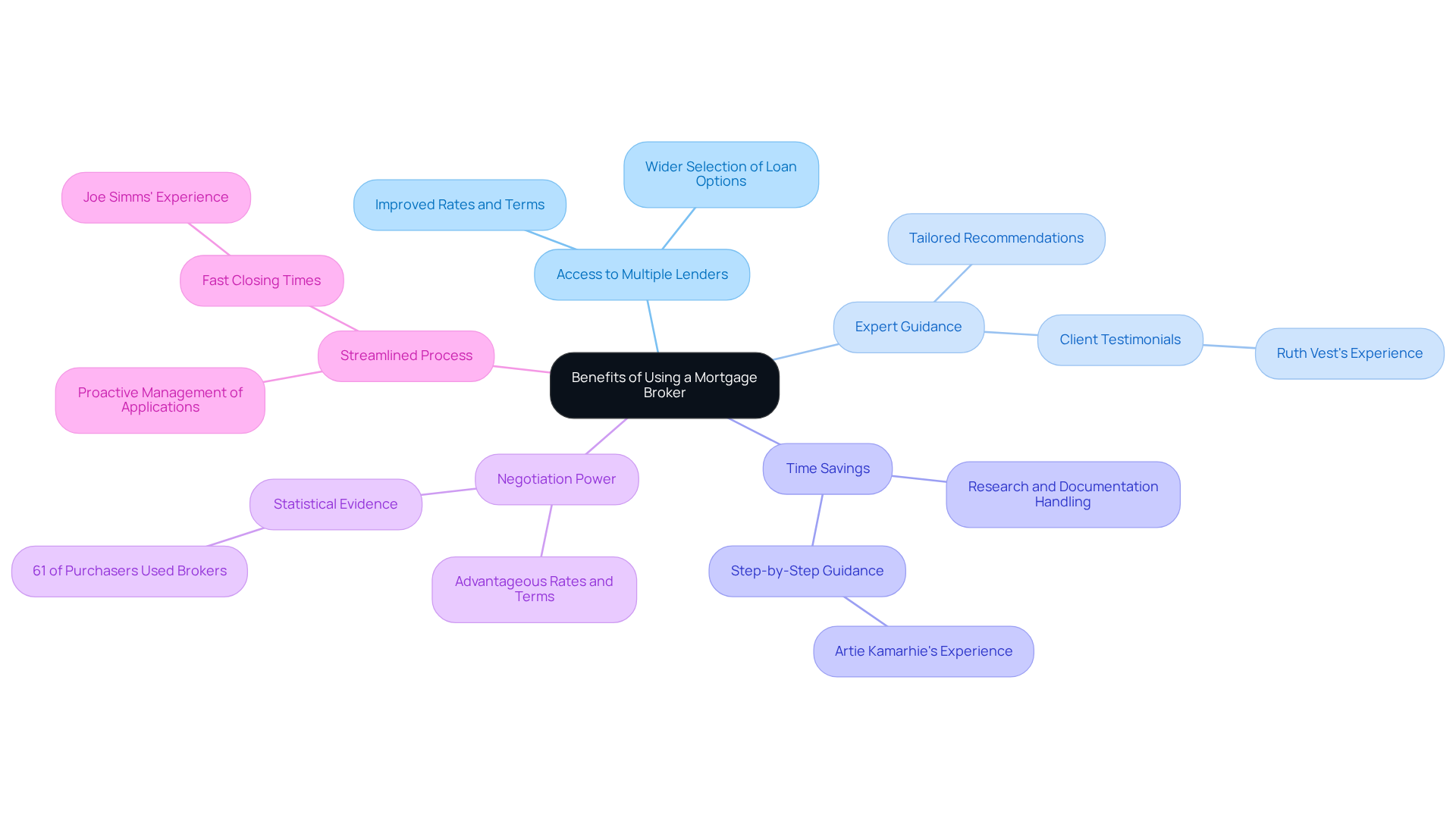

Utilizing a loan brokerage can truly make a difference for homebuyers navigating the often overwhelming world of financing.

- Access to Multiple Lenders: We understand how daunting it can be to choose the right lender. Brokers engaged in loan brokerage maintain relationships with a diverse array of lenders, which allows them to offer a wider selection of loan options compared to a single bank. This access can lead to improved rates and terms that are customized to your unique needs.

- Expert Guidance: Brokers provide tailored recommendations that consider your distinctive financial situation, helping you maneuver through the frequently intricate loan environment with confidence. Clients like Ruth Vest have praised F5 Mortgage for their exceptional financial knowledge and customer support, noting how the team worked diligently to secure a suitable financing arrangement.

- Time Savings: We know how valuable your time is, especially for busy families looking to upgrade their homes. By handling the research and documentation, brokers save borrowers significant time and effort during the loan process. As Artie Kamarhie shared, the F5 Mortgage team provided step-by-step guidance, making the experience smooth and stress-free.

- Negotiation Power: With their industry knowledge and established connections, brokers can and terms on your behalf. This can lead to substantial savings throughout the financing period. Research shows that 61% of purchasers utilized a loan brokerage for improved interest rates, highlighting the tangible benefits of their services. Ryan Witucki’s experience with F5 Mortgage illustrates this perfectly; he secured a fantastic rate and closed in about 10 days, much faster than traditional lenders.

- Streamlined Process: Brokers oversee the entire application process, ensuring that all necessary documentation is complete and submitted promptly. This proactive management can significantly expedite loan approval and closing times, with many loans closing in less than three weeks. Joe Simms noted how Jeff and his team made the process easy and worry-free, ensuring that every step was clearly understood.

F5 Mortgage sets itself apart by leveraging technology to enhance the loan experience, ensuring clarity and support throughout the process. As David Stroud points out, loan brokerage can help you secure loan conditions that are not accessible through conventional banks and credit unions. These advantages underscore the importance of loan consultants, especially for home purchasers who may be experiencing the financing process for the first time or those with unique financial circumstances.

Moreover, it is crucial to inform consumers about the benefits of collaborating with independent loan brokerage. This knowledge empowers clients to make informed choices and enhances their overall financing experience, reminding them that we are here to support them every step of the way.

Identify Common Challenges in Mortgage Financing and Broker Solutions

Homebuyers often face a variety of challenges during , and we understand how overwhelming this can be. Here are some common hurdles and how we can help you navigate them:

- High-Interest Rates: Securing favorable rates can be particularly difficult in a fluctuating market. We know how challenging this can be, which is why loan brokerage is instrumental in comparing offers from multiple lenders to identify the best available rates. With loan rates expected to stay above 6% throughout 2025, the expertise of loan brokerage becomes even more essential. At F5 Mortgage, we partner with over two dozen top lenders to ensure you receive the most competitive rates tailored to your specific needs.

- Complex Paperwork: The mortgage application process often feels overwhelming due to extensive documentation requirements. We’re here to support you every step of the way. Our loan brokerage simplifies this process by guiding you through the necessary paperwork, ensuring that all documents are correctly completed and submitted on time. At F5 Mortgage, we handle the entire process for you, acting as your personal concierge to make the experience as stress-free as possible.

- Lack of Personalized Service: Many borrowers feel adrift when dealing directly with lenders, which can lead to confusion and frustration. Our loan brokerage offers the tailored attention and assistance you need, empowering you with the information required to make knowledgeable choices during your financing journey. F5 Mortgage is committed to providing no-pressure guidance, ensuring that families looking to upgrade or refinance receive the personalized support they deserve.

- Unique Financial Situations: If you have non-traditional income sources or credit histories, securing loans can be particularly challenging. We understand this struggle, and our loan brokerage has the expertise to identify lenders who are more flexible and willing to accommodate unique financial profiles. F5 Mortgage’s technology-driven strategy revitalizes the financing process, ensuring that even individuals with unique circumstances can discover appropriate funding options.

By addressing these challenges, loan brokerage professionals play a crucial role in facilitating a smoother and more successful mortgage experience for their clients. With over 1,000 families helped and a customer satisfaction rate of 94%, F5 Mortgage exemplifies how dedicated loan brokerage services can transform your home financing journey.

Conclusion

Navigating the complexities of home financing can indeed feel overwhelming. However, understanding the role of loan brokerage can significantly ease this journey. Loan brokers act as vital intermediaries, connecting you with suitable lenders and offering personalized guidance tailored to your unique financial situation. Their expertise not only simplifies the loan process but also increases your chances of securing favorable terms. This makes them an invaluable resource for homebuyers, especially those taking their first steps into the market.

We know how challenging this can be, and key insights reveal that loan brokers provide access to a diverse range of loan products. From fixed-rate mortgages to specialized options like FHA and VA financing, they save you time by managing the application process and negotiating better rates on your behalf. Additionally, brokers are skilled at navigating common challenges, such as high-interest rates and complex paperwork, ensuring that you feel supported throughout your mortgage journey.

Ultimately, leveraging the services of a loan broker can transform your home buying experience, making it more manageable and less stressful. As the housing market continues to evolve, we encourage you to consider the significant advantages of working with a knowledgeable broker. By doing so, you not only enhance your chances of finding the right financing solution but also empower yourself to make informed decisions that align with your financial goals.

Frequently Asked Questions

What is loan brokerage and why is it important?

Loan brokerage serves as a trusted intermediary that connects individuals seeking funds with lenders. It simplifies the financing process, helping clients find tailored funding options, which is especially vital for first-time homebuyers. Brokers use their expertise and relationships with lenders to negotiate favorable terms, potentially saving clients time and money.

How much can consumers save by using a loan broker?

Consumers can save an average of over $10,000 during their financing journey by partnering with an independent financial advisor instead of going through nonbank retail lenders.

What role do loan brokers play for first-time homebuyers?

Loan brokers enhance the chances of loan approval for first-time buyers by preparing them for essential financial criteria and providing personalized guidance throughout the financing process.

How does the loan brokerage process work?

The process begins with a preliminary consultation where the agent assesses the client’s financial condition. The agent then researches suitable lenders and financial products, presents the options, and assists with the application process, negotiating terms with lenders until financing closes.

How quickly can lenders finalize financing through a loan broker?

Lenders can often finalize financing in under three weeks, greatly accelerating the process for clients.

What services does F5 Mortgage offer in loan brokerage?

F5 Mortgage provides specialized services such as Bank Statement Loans and Adjustable Rate Mortgages, along with convenient application options online, by phone, or through chat. They also connect clients with premier real estate agents and help secure favorable financing options.

What is the customer satisfaction rate for F5 Mortgage?

F5 Mortgage has a customer satisfaction rate of 94%, reflecting positive outcomes from working with their dedicated mortgage professionals.