Overview

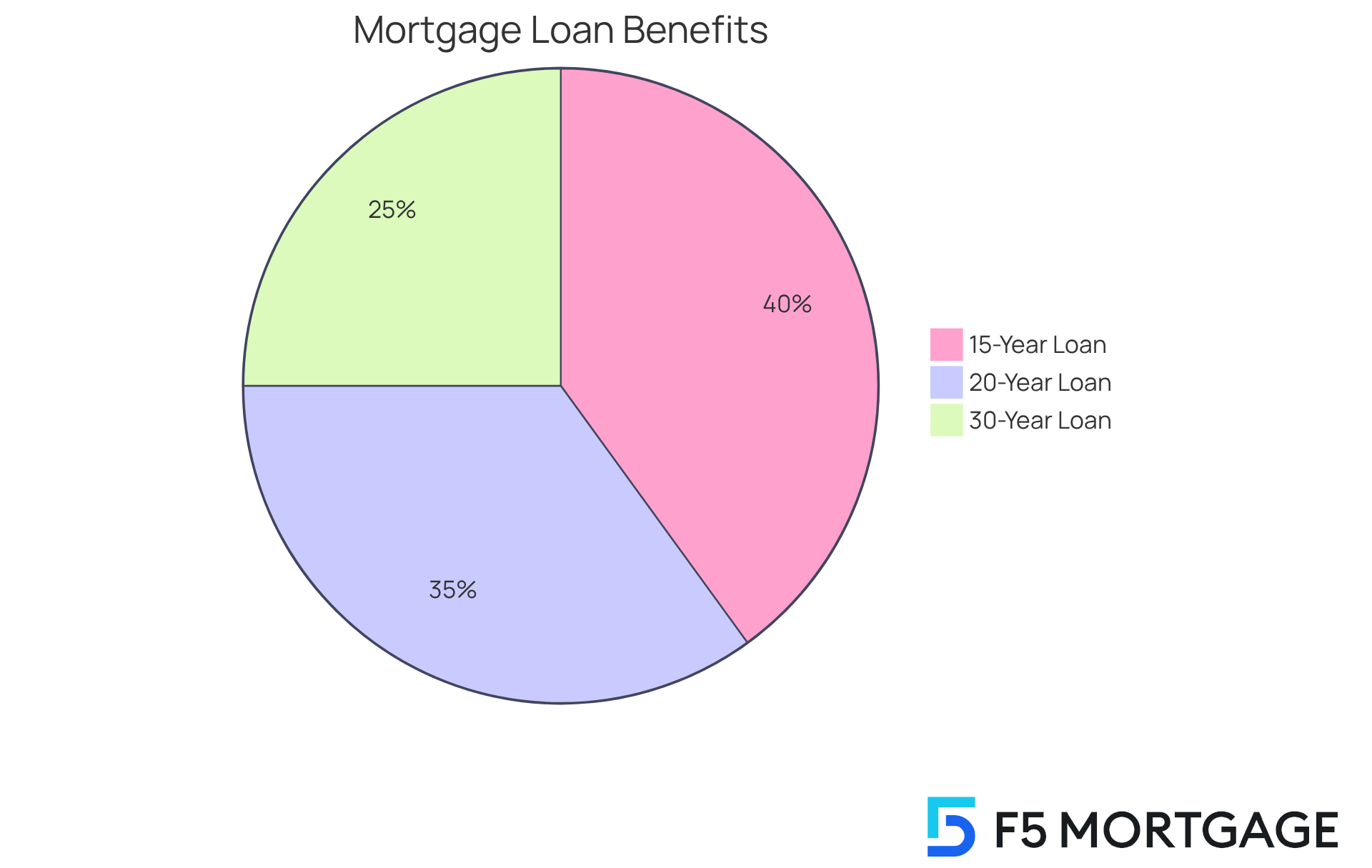

Choosing a 15-year mortgage can be a significant decision for your family, and we understand how challenging this can be. The key benefits include:

- Lower interest rates

- Faster equity accumulation

- Reduced overall interest costs when compared to longer-term loans

These advantages not only lead to substantial savings over time but also offer your family the financial security and flexibility you deserve.

Imagine being able to allocate more resources towards future needs like education and retirement. With a 15-year mortgage, you can achieve this goal while feeling confident in your financial decisions. We’re here to support you every step of the way as you navigate this important process.

In summary, a 15-year mortgage not only helps you save money but also empowers you to invest in your family’s future. Consider taking this step towards a more secure financial future today.

Introduction

Choosing the right mortgage is a pivotal decision for families, shaping their financial future for years to come. We understand how challenging this can be. Among the various options available, the 15-year mortgage stands out, offering significant benefits like lower interest rates and faster equity accumulation. However, many families grapple with the challenge of understanding whether this option truly aligns with their financial goals.

What are the key advantages of a 15-year mortgage? How can it empower families to achieve homeownership more swiftly and affordably?

We’re here to support you every step of the way.

F5 Mortgage: Personalized Mortgage Consultations for 15-Year Loans

At F5 Mortgage, we understand how challenging navigating the complexities of a can be for families. That’s why we excel in offering tailored to your unique monetary situation. Our goal is to provide guidance that aligns with your . As Dave Ramsey wisely states, “You want an agent you can trust—one who has lots of experience and can guide you through every step of the .” This personalized approach not only but also empowers you to make informed decisions.

Families like yours significantly benefit from our services, ensuring you are aware of all available options for a smoother and more efficient experience. Our dedication to has earned us praise from clients like Ruth Vest, who commend our monetary expertise and attention to detail. Ruth highlighted how our team worked diligently to secure that met her needs.

Moreover, we recommend that housing payments should not exceed 25% of your net income. At F5 Mortgage, we assist households in aligning their loan options with their . By focusing on understanding the distinct needs of families, we enhance and reinforce our reputation as a . Remember, we’re here to support you every step of the way.

Lower Interest Costs: The Financial Advantage of 15-Year Mortgages

Choosing a can significantly impact your . One of the most compelling reasons to consider this option is the . Typically, these loans come with interest rates that are 0.25% to 1% lower than those associated with 30-year home loans. For example, as of late August 2025, the national average interest rate for a 15 yr mortgage is 5.69%, compared to 6.54% for a 30-year option. This difference can lead to , potentially allowing homeowners to save tens of thousands of dollars in interest payments.

We understand how challenging it can be to manage financial burdens. For households striving to alleviate their economic pressures, this benefit can be transformative. It opens up opportunities to allocate resources toward other , such as education, retirement savings, or home improvements. Imagine how much more secure you would feel knowing you can invest in your while also managing your mortgage effectively.

Moreover, experts suggest that a shorter loan duration fosters , which can further enhance your . By choosing a 15 yr mortgage, you not only benefit from but also pave the way for a more stable financial future. We’re here to support you every step of the way as you navigate this important decision.

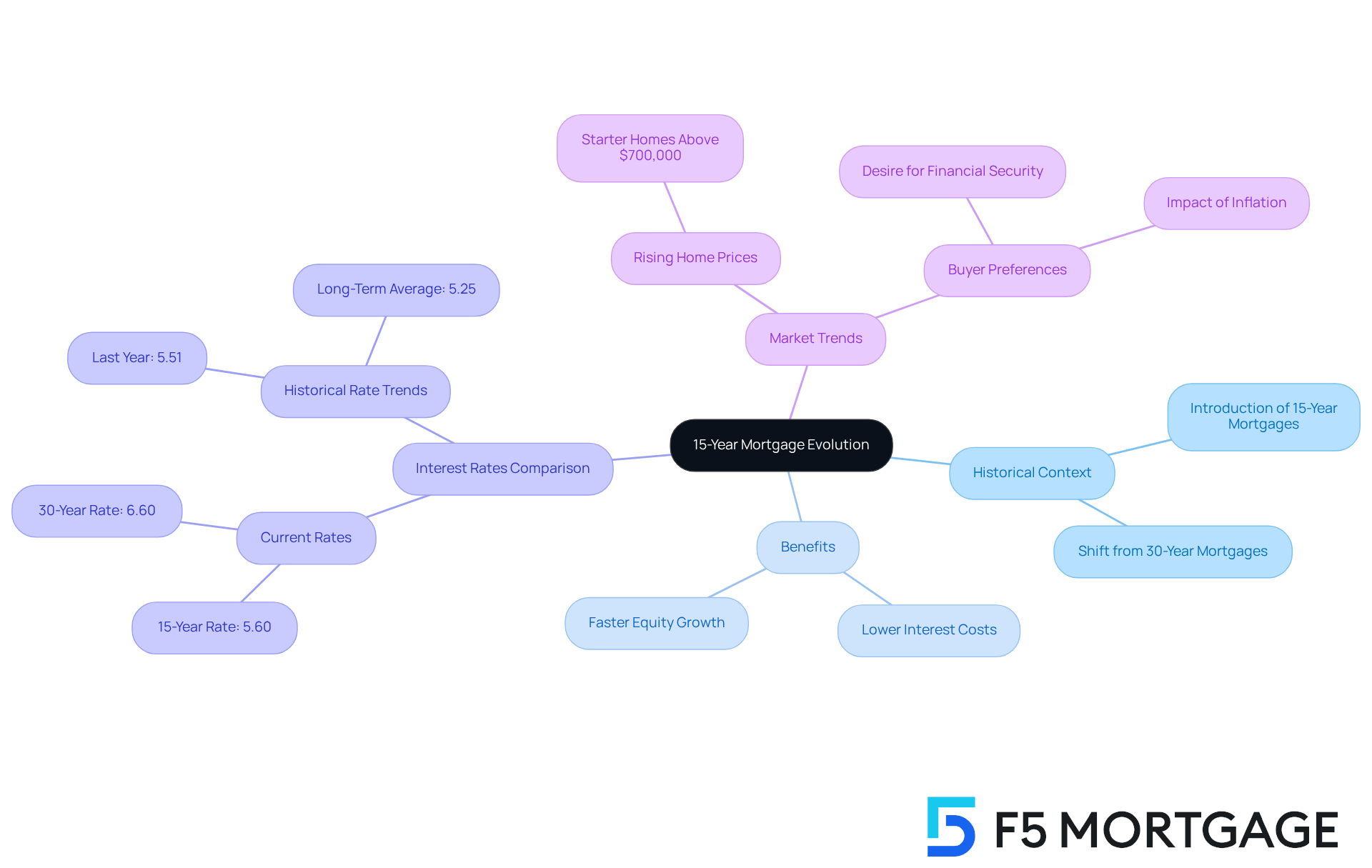

Historical Context: The Evolution of the 15-Year Mortgage

Have you ever felt overwhelmed by the prospect of ? The long-term loan has seen a remarkable transformation since its introduction, with the becoming a favored option for homeowners eager to pay off their debts more quickly. Initially, this loan type was often overshadowed by the more traditional 30-year loan. However, as families increasingly recognize the benefits of the 15 yr mortgage—like and faster equity growth—this has gained significant popularity.

Currently, the national average interest rate for a short-term loan stands at 5.60%, notably lower than that of the 30-year option. This makes a 15 yr mortgage an attractive choice for those wishing to lighten their long-term financial burdens. Rising home prices in major metropolitan areas, where starter homes frequently exceed $700,000, have prompted many buyers to explore more manageable debt solutions.

Moreover, experts highlight that a 15 yr mortgage allows households to , a factor that resonates deeply in today’s competitive real estate market. This shift in preference reflects a growing desire for . As a result, the 15 yr mortgage has become a reliable , empowering families to secure their financial futures without the prolonged pressure of a 30-year commitment. We know how challenging this can be, and we’re here to .

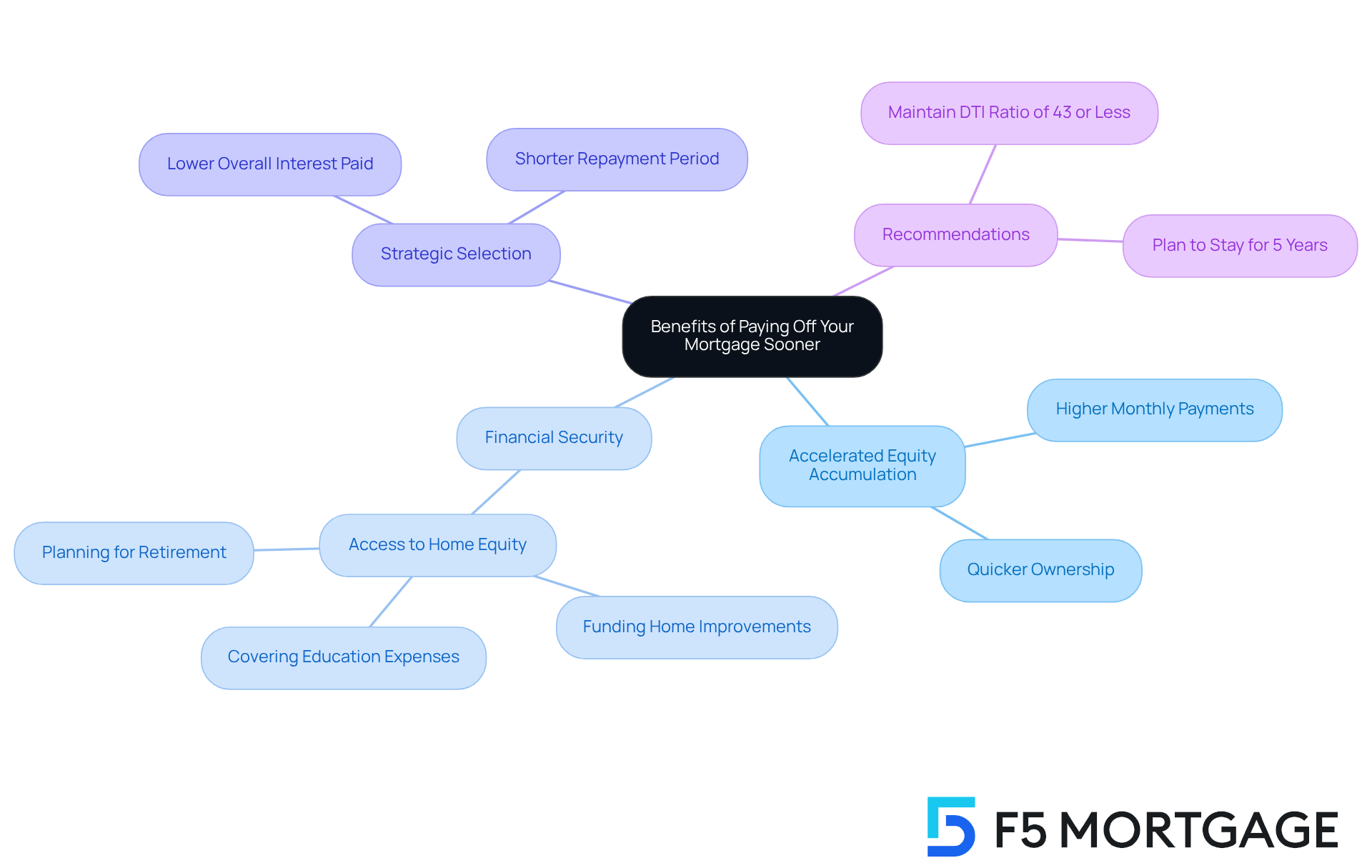

Faster Home Equity: Benefits of Paying Off Your Mortgage Sooner

One of the most compelling benefits of a is the . We know how important it is for families to feel secure in their homes. With higher monthly payments, a larger share of each payment is directed towards decreasing the principal balance. This allows households to . This rapid equity accumulation is particularly advantageous for families looking to leverage their home’s value for future , such as funding home improvements, covering education expenses, or planning for retirement.

Statistics indicate that property owners with than those with longer-duration financing. While a 30-year mortgage may offer , it results in a longer repayment period during which borrowers pay more interest overall. In contrast, the 15 yr mortgage option not only but also enables households to accumulate equity more efficiently. This makes it a .

Families who choose shorter-term loans often find themselves in a more , as they can access their sooner. This can be particularly beneficial for funding significant life events or investments. For instance, imagine a household that acquired a residence priced at $500,000 with a long-term loan. They could witness their equity increase significantly over ten years, offering them a safety net for upcoming projects. Additionally, borrowers typically must uphold a debt-to-income (DTI) ratio of 43% or less to be eligible for a home loan, which highlights the importance of managing current debts alongside home equity.

In conclusion, selecting a 15 yr mortgage can enable households to reach their monetary objectives more swiftly. We’re here to support you every step of the way, making it a prudent investment for those dedicated to homeownership. Generally, it is recommended that homeowners plan to stay in their homes for at least five years to fully realize the financial benefits of their investment.

20-Year Mortgages: A Compromise Between 15 and 30 Years

For households seeking a balance between manageable and the desire to pay off their home quicker than a , a presents an appealing compromise. This option typically results in reduced monthly payments compared to a 15-year loan, while still allowing homeowners to save on interest compared to a 30-year financing option.

By choosing a 20-year loan, families can enjoy the benefits of without the stress of increased payments. Imagine being able to invest in your future while maintaining . This makes the 20-year loan a practical choice for many homeowners.

We know how challenging this decision can be, but we’re here to . Consider the advantages of a 20-year loan as you navigate your . It’s about finding a solution that aligns with your financial goals while providing peace of mind.

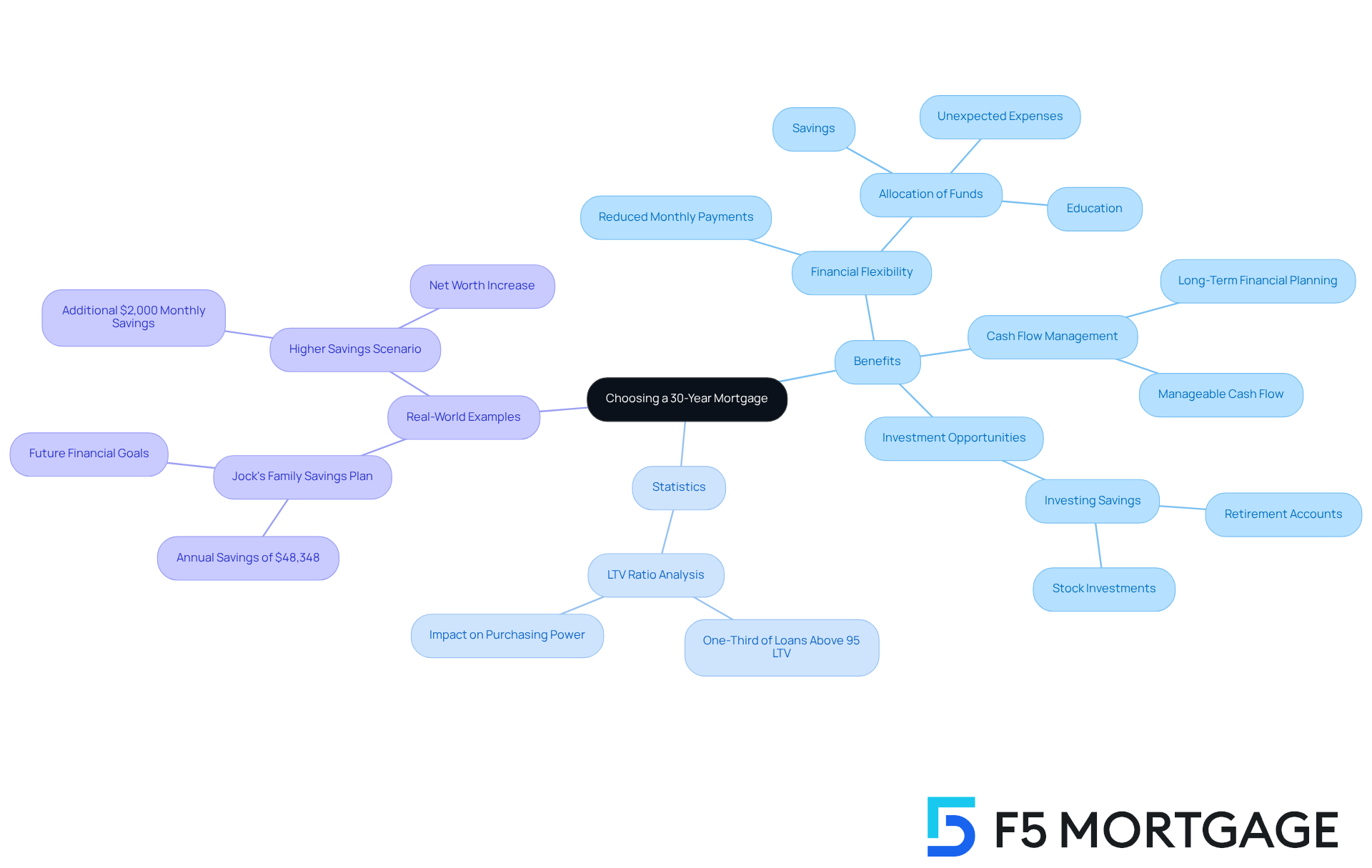

When to Choose a 30-Year Mortgage: Understanding Your Options

A can be a beneficial option for households, especially those managing tighter budgets. The reduced monthly payments associated with this loan type offer essential . This flexibility enables families to allocate funds toward other priorities, such as education, savings, or unexpected expenses. For instance, families anticipating a significant income increase may find a 30-year loan appealing, as it allows them to maintain manageable cash flow now while preparing for larger payments in the future.

Statistics reveal that about one-third of in 2023 had a of 95% or above. This suggests many households are leveraging 30-year loans to boost their . This approach can be particularly advantageous for those looking to buy in competitive markets where affordability is a major concern.

Financial advisors often stress the importance of when selecting a loan. They note that a 30-year loan can provide families with the flexibility needed to navigate life’s while still pursuing . For example, families who choose this option can invest the difference in their monthly payments into savings or retirement accounts, potentially enhancing their economic security over time.

Real-world examples highlight the benefits of 30-year loan flexibility. Families like Jock’s, who are thoughtfully planning their finances, can use the lower payments to save for their children’s education or invest in other opportunities. By understanding the nuances of loan options, families can make informed decisions that align with their financial strategies and future aspirations. We know how challenging this can be, and we’re here to support you every step of the way.

Debunking Myths: What Financial Experts Say About 15-Year Mortgages

Several can discourage families from considering this option. One common concern is the belief that the increased monthly payments are unaffordable for many households. However, many discover that the and the benefits of owning their home outright sooner far outweigh the initial financial strain. At F5 Mortgage, we understand how challenging this can be, which is why we offer adaptable loan rates with no hidden fees, allowing families to explore options that fit their budget and .

Additionally, some people think that long-term loans are only suitable for wealthy individuals. In reality, they can be a smart choice for anyone committed to financial discipline and long-term savings. F5 Mortgage provides and , empowering families to enjoy the that a can offer. Economic experts consistently highlight these benefits, showing how they can lead to achieving homeownership more quickly and a more stable financial future. We’re here to support you every step of the way.

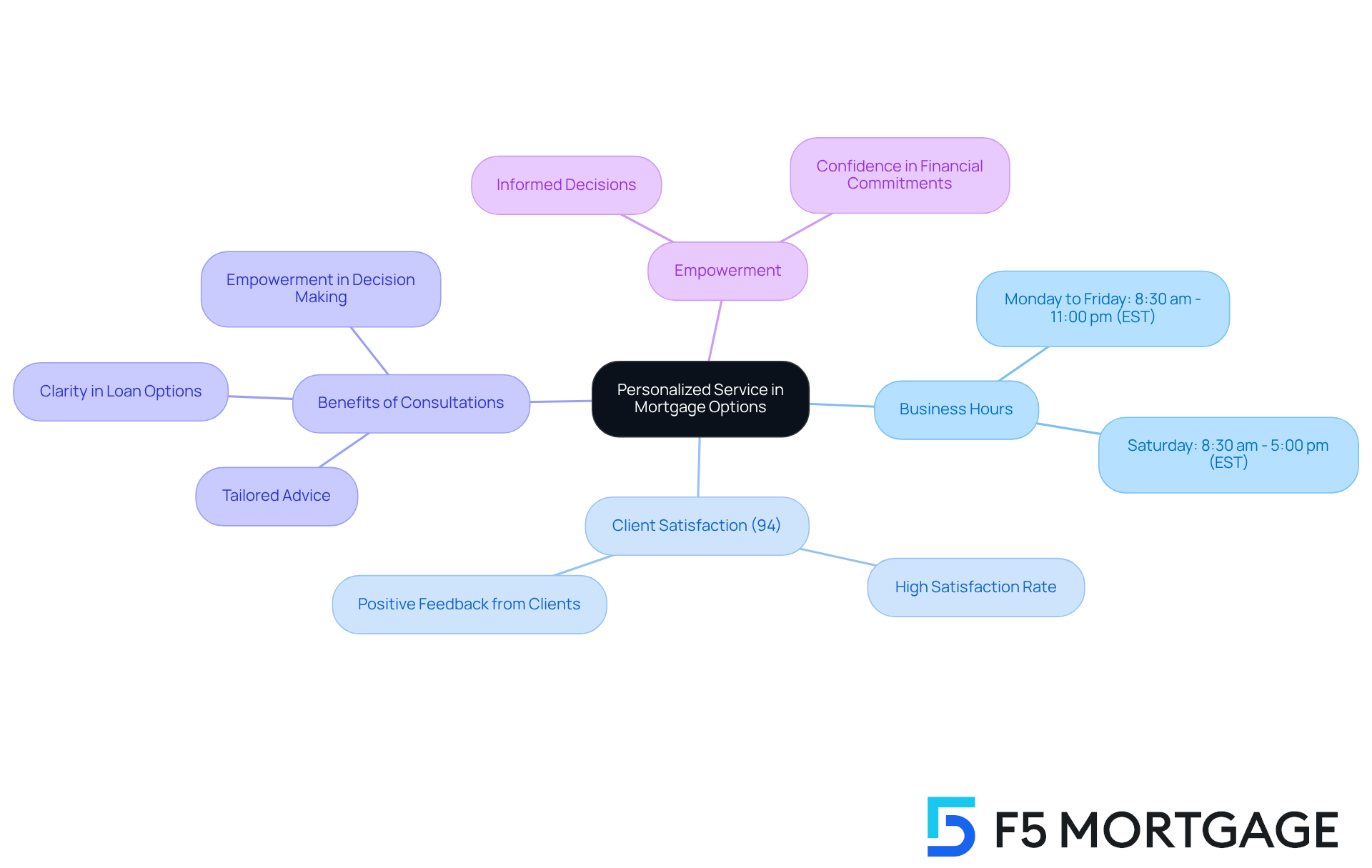

Personalized Service: The Key to Navigating Mortgage Options

Navigating the loan landscape can feel overwhelming, especially for . We understand how challenging this can be, and that’s why the in this journey cannot be overstated. It allows you to receive . At F5 Mortgage, we pride ourselves on offering , enabling families to thoroughly explore their options—whether you’re leaning towards a or considering other financing types.

Our business hours are designed with you in mind:

- Monday to Friday from 8:30 am to 11:00 pm (EST)

- Saturday from 8:30 am to 5:00 pm (EST)

This accessibility means you can easily reach out for assistance whenever you need it. This dedication to personalized service fosters confidence and empowers you to make informed decisions about one of the most significant of your life.

Statistics show that clients who engage in personalized loan consultations report a remarkable , highlighting the effectiveness of this approach. Many families have benefited from our , gaining clarity and guidance in their loan selections. Ultimately, this has led to more favorable outcomes in their . We’re here to , ensuring you feel confident and informed throughout your journey.

Challenges for First-Time Homebuyers: Navigating Mortgage Choices

Navigating the world of home financing can feel daunting for . We understand how overwhelming the array of choices can be, especially when considering options like a . The weight of committing to such a significant financial obligation often brings anxiety and uncertainty. At , we’re here to support you every step of the way. We offer tailored and designed to empower you to make informed decisions.

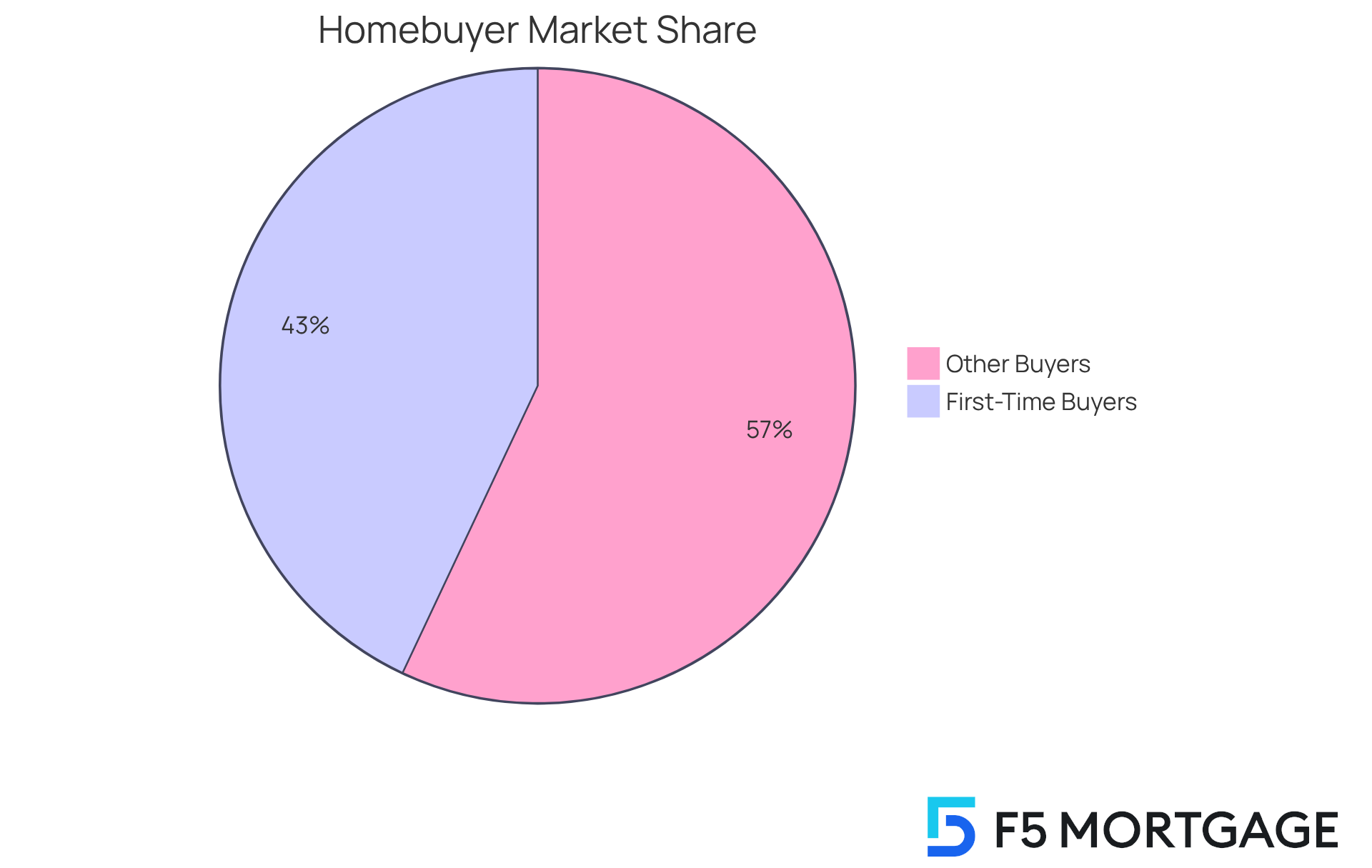

Our goal is to clarify the home financing process, equipping families with the knowledge and confidence needed to embark on their . Did you know that first-time buyers accounted for 43% of all homebuyers in 2023? With a median household income of $95,900, many rely heavily on savings for their down payments. This underscores the importance of understanding your to ensure .

By providing detailed guides and professional advice, F5 Mortgage helps first-time buyers navigate the intricacies of financing. We believe that with the right support, you can experience a smoother transition into homeownership.

Overall Advantages: Why the 15-Year Mortgage Stands Out

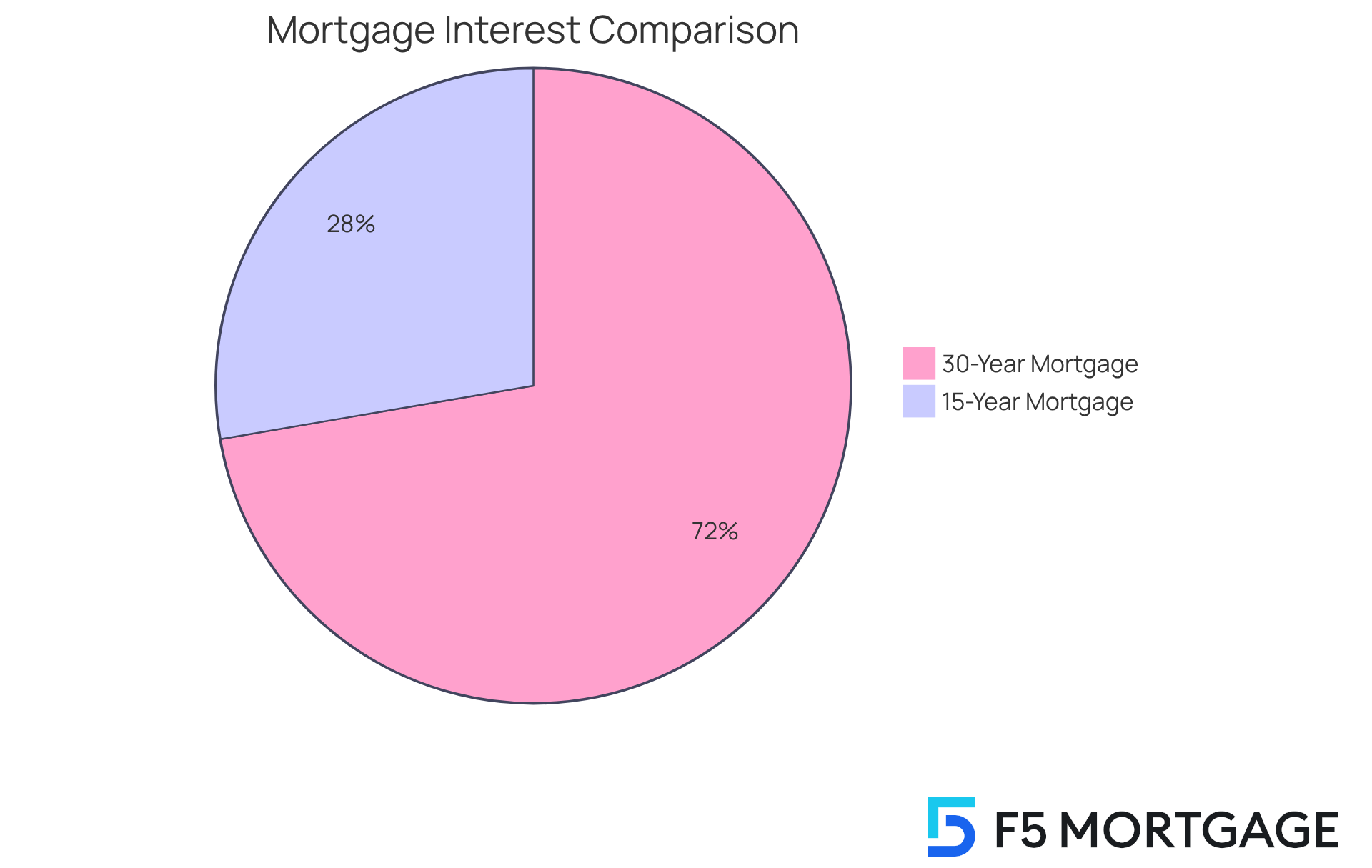

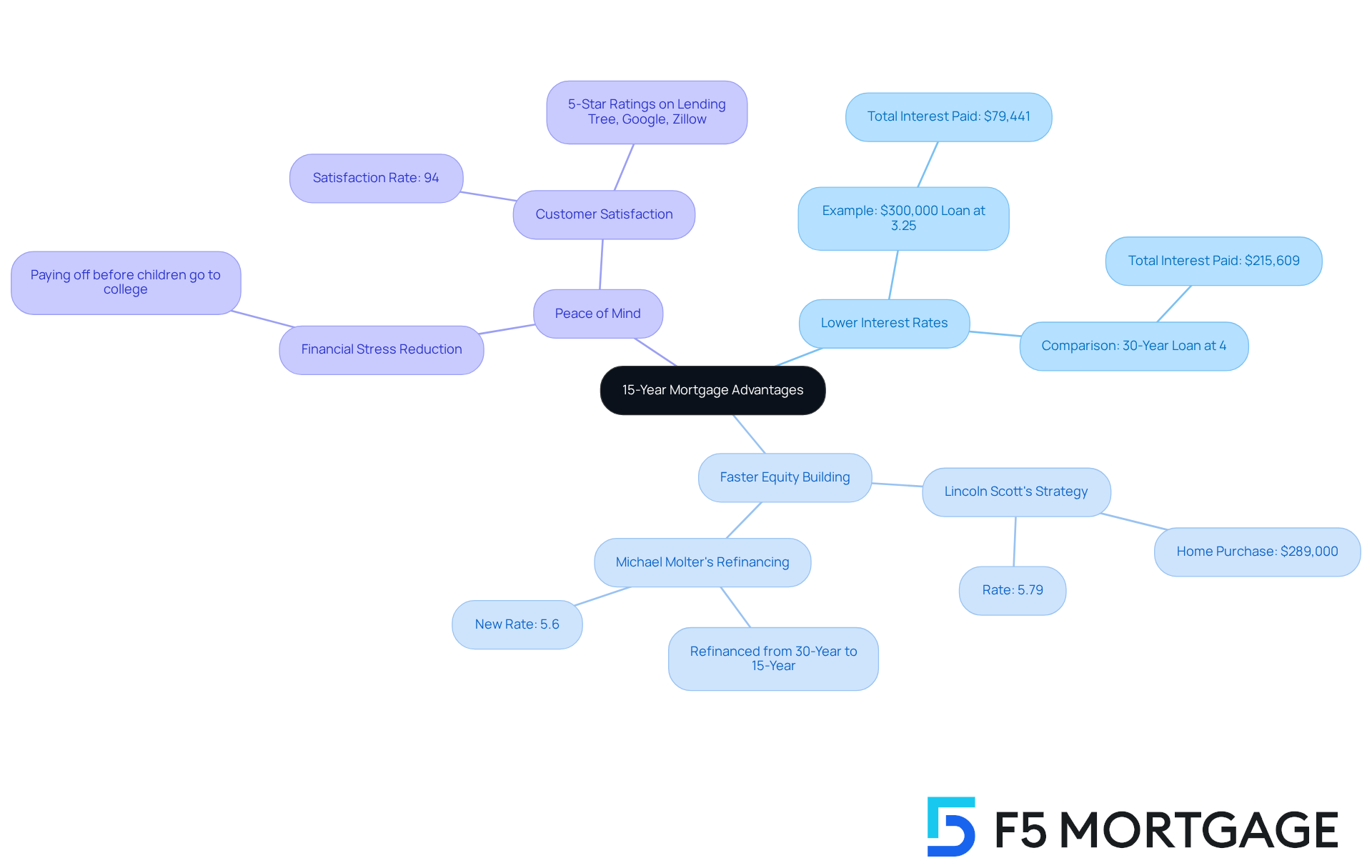

The offers several compelling advantages for families, and we understand how challenging it can be to choose the right option. Primarily, it features , which can lead to substantial savings over the loan’s duration. For instance, a $300,000 loan at a 3.25% interest rate results in total interest payments of approximately $79,441, compared to $215,609 for a 30-year loan at 4%. This difference truly highlights the . Homeowners also , allowing them to access their home’s value for future monetary needs, such as education or retirement planning.

Moreover, the peace of mind associated with owning a home outright in a shorter timeframe is invaluable. Families can , particularly during like sending children to college. Financial specialists highlight that a long-term loan can act as a method of enforced savings, assisting families in maintaining discipline in their budgeting.

Practical examples demonstrate these advantages. Lincoln Scott, a consultant, chose a long-term loan with a rate of 5.79% to settle his home, acquired for $289,000, within three to four years, greatly lowering his interest expenses compared to a more extended loan. Likewise, Michael Molter refinanced from a 30-year loan at 7.4% to a shorter-term option at 5.6%, enabling him to increase equity more rapidly and align with his objective of being debt-free sooner.

With a and 5-star ratings on Lending Tree, Google, and Zillow, F5 Mortgage empowers households to navigate the intricacies of loan financing, ensuring informed choices that align with their long-term economic objectives. Clients have praised the , highlighting their expertise and personalized approach. For instance, one client noted how the team guided them through the process, making it smooth and worry-free. This is crucial in helping families achieve their financial aspirations while enjoying the numerous benefits associated with a 15 yr mortgage.

Conclusion

Choosing a 15-year mortgage can be a transformative decision for families seeking financial stability and a quicker path to homeownership. This loan option not only offers lower interest rates compared to traditional 30-year mortgages but also enables homeowners to build equity at an accelerated pace. By understanding the unique advantages of a 15-year mortgage, families can make informed choices that align with their long-term financial goals.

We know how challenging this can be, and throughout the article, several key benefits have been highlighted. These include:

- Reduced interest costs

- Faster equity accumulation

- The peace of mind that comes with paying off a mortgage sooner

Additionally, personalized consultations provided by experts like F5 Mortgage ensure that families receive tailored advice that meets their specific financial situations. The historical evolution of the 15-year mortgage showcases its growing popularity as a reliable option for those looking to secure their financial future without the burdens of long-term debt.

Ultimately, the decision to opt for a 15-year mortgage can lead to significant savings and a more secure financial position for families. As the landscape of home financing continues to evolve, it is essential to weigh the benefits carefully. Consider how this choice can facilitate achieving personal and financial aspirations. Engaging with mortgage professionals and exploring all available options can empower families to navigate this journey with confidence, making the dream of homeownership a reality.

Frequently Asked Questions

What services does F5 Mortgage offer for 15-year loans?

F5 Mortgage provides personalized loan consultations tailored to individual financial situations, helping families navigate the complexities of 15-year mortgages and aligning loan options with their homeownership aspirations.

What are the benefits of choosing a 15-year mortgage?

A 15-year mortgage typically has lower interest rates (0.25% to 1% lower than 30-year loans), leading to significant savings on interest payments over the life of the loan. It also fosters faster equity growth, which enhances financial stability.

How does F5 Mortgage ensure customer satisfaction?

F5 Mortgage focuses on understanding the unique needs of families, offering outstanding customer service and expertise in securing favorable loan packages, as highlighted by client testimonials.

What is the recommended guideline for housing payments in relation to income?

It is recommended that housing payments should not exceed 25% of your net income, and F5 Mortgage assists households in adhering to this guideline.

How has the perception of 15-year mortgages evolved over time?

The 15-year mortgage has gained popularity as more families recognize its benefits, such as lower interest costs and quicker equity growth, particularly in response to rising home prices in major metropolitan areas.

What is the current national average interest rate for a 15-year mortgage?

As of late August 2025, the national average interest rate for a 15-year mortgage is 5.69%, compared to 6.54% for a 30-year mortgage.

How can a 15-year mortgage impact a household’s financial future?

By reducing interest expenses and allowing for faster equity growth, a 15-year mortgage can help families allocate resources towards other essential goals like education, retirement savings, or home improvements.