Overview

The article titled “7 Key Benefits of Fixed Rate HELOCs for Homeowners” thoughtfully explores the advantages that fixed-rate home equity lines of credit (HELOCs) provide to homeowners. We know how challenging financial decisions can be, and this article aims to shed light on some supportive options available to you.

One of the key benefits is the stability of monthly payments. This predictability can greatly aid in budgeting, allowing families to plan their finances with confidence. Additionally, leveraging your home equity can provide essential funds for various financial needs, whether it’s for home improvements, education, or unexpected expenses.

Moreover, with current interest rates being favorable compared to other borrowing options, now might be an ideal time to consider a fixed-rate HELOC. We’re here to support you every step of the way as you navigate these options, ensuring you feel empowered in your financial journey.

Introduction

Navigating the world of home financing can feel overwhelming, and we understand how challenging this can be, especially for homeowners looking to leverage their property’s equity. Fixed-rate home equity lines of credit (HELOCs) present a compelling solution, offering stability in monthly payments and a predictable budgeting experience. Yet, with various options available, you might wonder:

- What are the true advantages of choosing a fixed-rate HELOC over other financing methods?

- How can it align with your financial goals in an unpredictable economic landscape?

This article explores the key benefits of fixed-rate HELOCs, shedding light on how they can empower you to make informed financial decisions.

F5 Mortgage: Competitive Fixed-Rate HELOC Options for Homeowners

At F5 Mortgage, we understand how challenging it can be to navigate home financing. That’s why we offer a variety of competitive HELOC options tailored specifically for homeowners like you. Our commitment to personalized service means you’ll receive customized loan solutions that truly align with your financial goals.

Imagine having a stable payment arrangement that not only guarantees consistency in your monthly costs but also simplifies budgeting for your family. As of September 2025, the average interest levels for fixed rate HELOCs are approximately 8.10%. This rate is considerably lower than what you might find with credit cards or personal loans, making HELOCs an appealing borrowing option.

We’re proud of our strategic alliances with over twenty prominent lenders, which ensures you have access to the most favorable terms available. This enhances your borrowing experience, providing you with competitive choices that reflect the latest market trends. More homeowners are seeking predictable payment options, especially in today’s fluctuating interest rate environment.

The benefits of selecting fixed rate HELOCs from F5 Mortgage are clear:

- Enjoy steady monthly payments

- Leverage your home equity for various financial needs

- Experience a streamlined application process

We’re here to support you every step of the way, ensuring outstanding customer assistance and satisfaction.

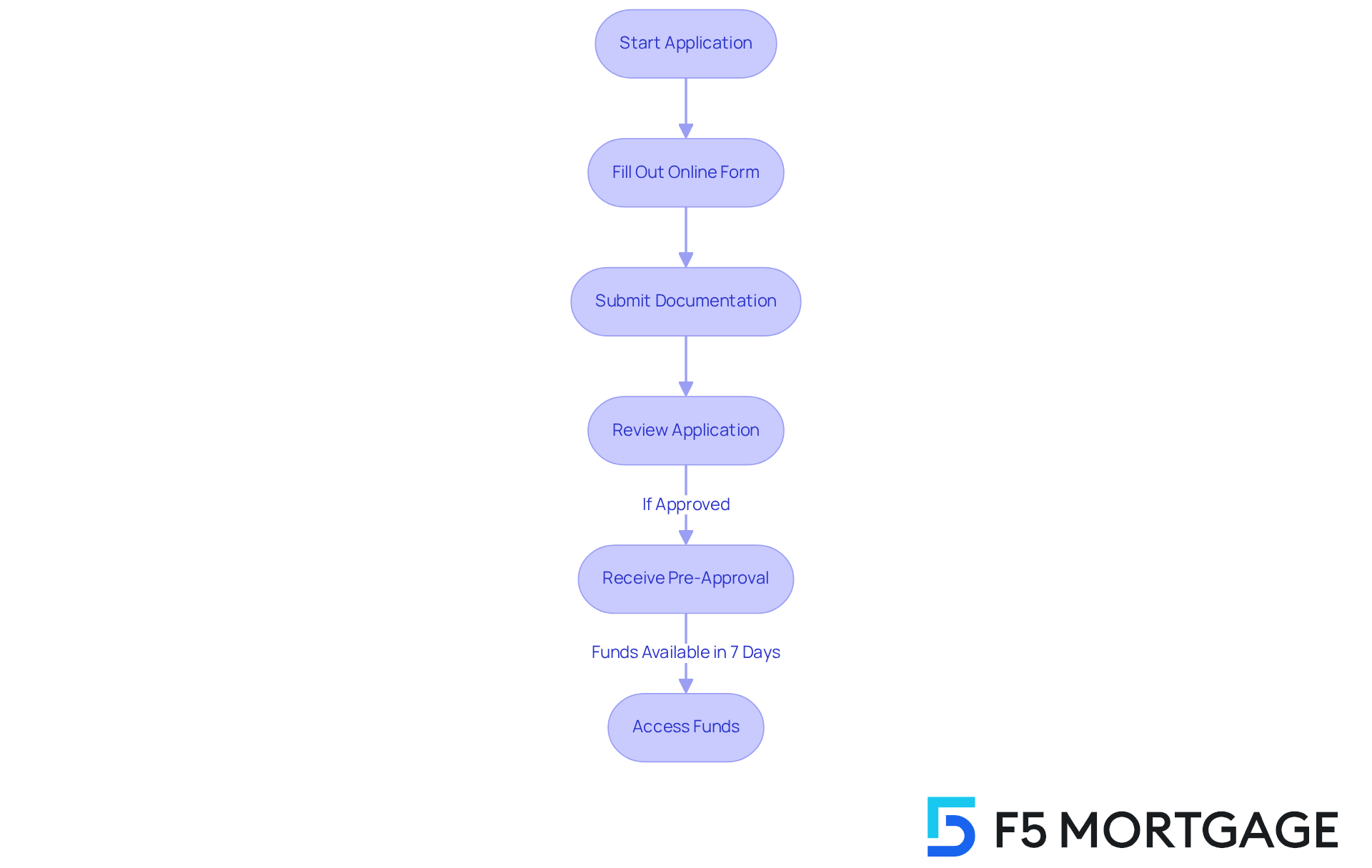

Better.com: Streamlined Application Process for Fixed-Rate HELOCs

At Better.com, we understand how challenging navigating the mortgage process can be, especially when it comes to securing a home equity line of credit. That’s why we’ve developed an efficient online application procedure that allows property owners to maneuver through the system effortlessly. Our user-friendly interface simplifies each step of the application, enabling you to complete your submissions swiftly.

Imagine this: you could receive pre-approval in as little as three minutes. This significant advantage over traditional methods, which often take weeks, means you can access funds quickly when you need them most. This rapid access to financing is especially beneficial for property owners seeking immediate solutions.

As we look toward 2025, the trend toward streamlined digital applications continues to grow. Platforms like Better.com are leading the way, making the mortgage process more accessible and efficient for families. We’re here to support you every step of the way, ensuring that you feel understood and empowered in your financial journey.

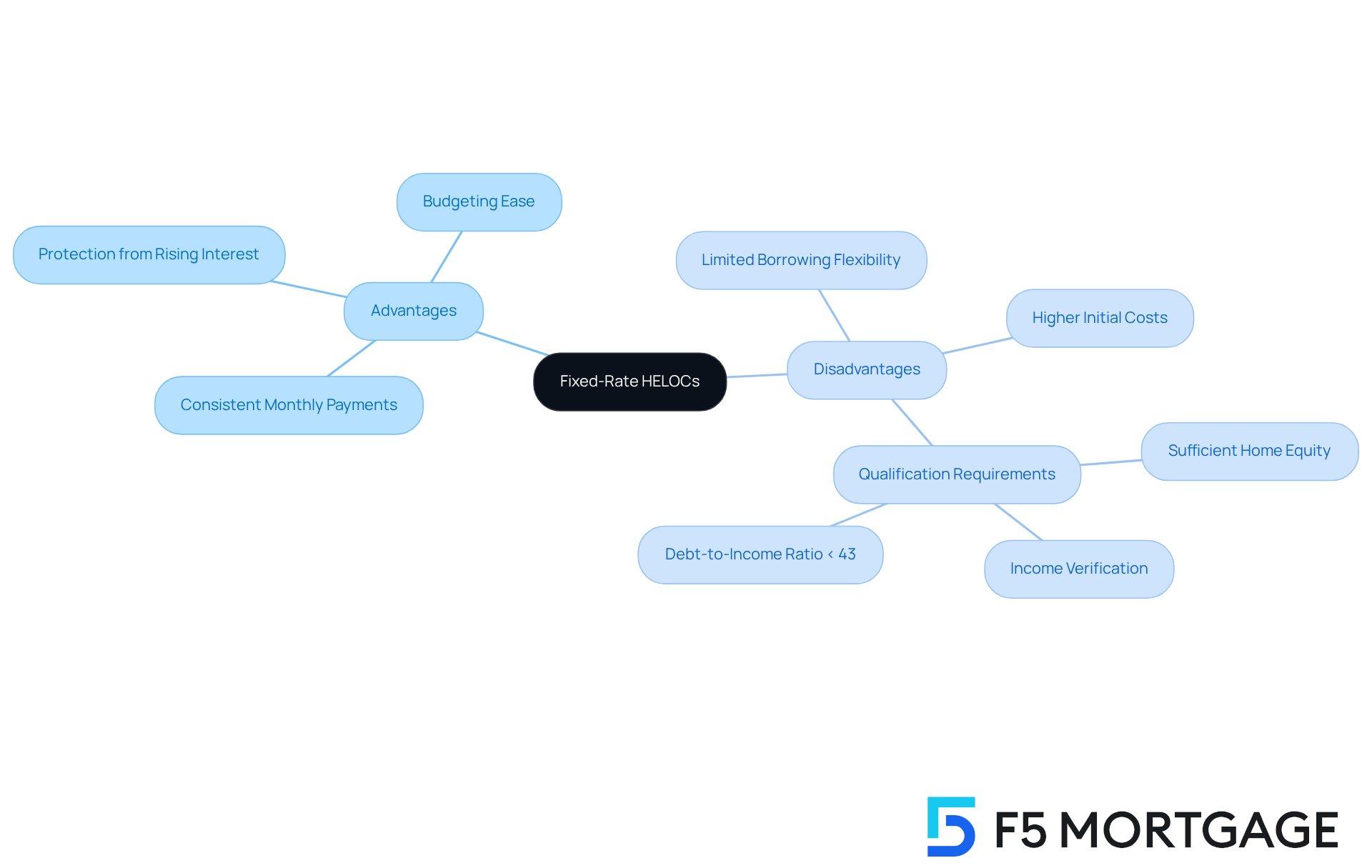

Bankrate.com: In-Depth Analysis of Fixed-Rate HELOC Advantages and Disadvantages

At Bankrate.com, we understand how challenging it can be to navigate the world of home equity lines of credit (HELOCs). Fixed rate helocs can offer you the peace of mind that comes with consistent monthly payments, making it easier for families like yours to budget. These loans protect you from rising interest costs, ensuring that your payments remain stable over time. Currently, HELOC interest rates range from 8% to 10%. It’s crucial for homeowners to keep these figures in mind when evaluating their options.

However, it’s important to consider some potential drawbacks. Fixed rate helocs may have higher initial costs compared to variable-interest options, and they could limit your borrowing flexibility. To qualify for a HELOC, you typically need sufficient equity in your home, income verification, and a debt-to-income ratio not exceeding 43%. We know how overwhelming this can feel, especially with the risks associated with home equity lines of credit, such as the possibility of foreclosure if payments are missed.

Financial advisors frequently emphasize that while stable options might have higher upfront costs, the predictability they provide can outweigh these expenses, especially in a fluctuating interest environment. Keep in mind that not all lenders offer stable interest options for HELOCs, which may limit your choices.

When selecting fixed rate helocs, it’s essential to understand the terms of the loan, the lender’s policies on rate locking, and any associated fees. By doing so, you can make informed decisions that align with your long-term financial strategies. Remember, we’re here to support you every step of the way.

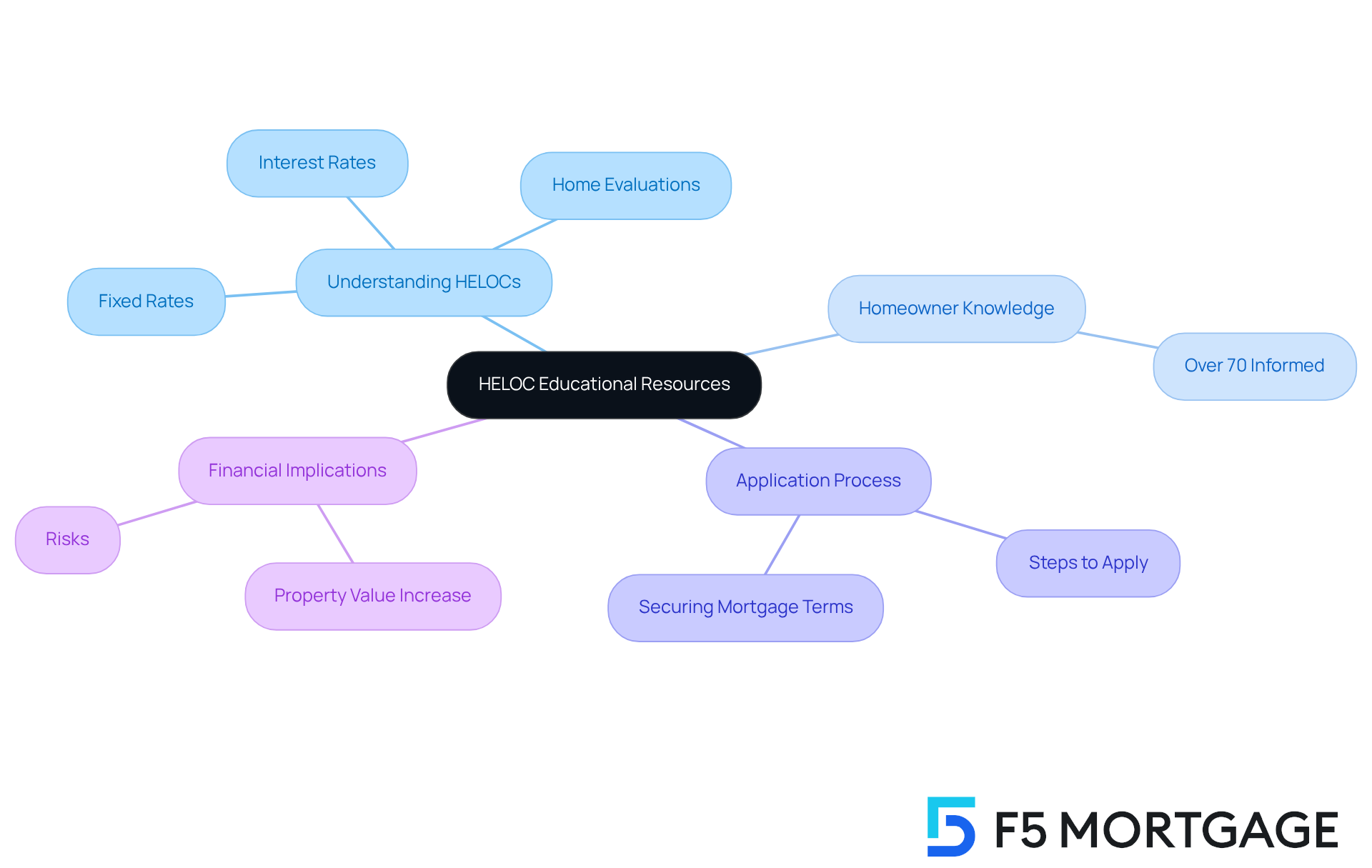

Investopedia: Educational Resources on Fixed-Rate HELOC Mechanics

Homeowners today have access to numerous educational materials that clarify home equity lines of credit, with platforms like Investopedia paving the path. We know how challenging navigating these options can be, and these resources explore the workings of fixed rate helocs and their set interest rates. They outline how they operate, the application procedure, and the essential elements that affect interest rates.

A significant percentage of homeowners—over 70%—report feeling informed about their HELOC options. This knowledge is crucial for making sound financial decisions. By comprehending the complexities of fixed rate helocs, property owners can attain improved financial results and develop assurance in handling their home equity. For instance, consider a homeowner who utilized fixed rate helocs to finance home renovations. Not only did they improve their living space, but they also increased their property value, showcasing the practical benefits of informed decision-making.

Moreover, grasping the significance of home evaluations is essential, as they directly impact property value and equity. This, in turn, affects mortgage costs. Once your application is approved, it is essential to secure your mortgage terms to protect yourself from market fluctuations during the processing period. Homeowners should remain informed and proactive in utilizing their home equity while being aware of the related risks, such as fluctuating interest levels and the urge to overspend. We’re here to support you every step of the way as you navigate this important financial journey.

Lendedu.com: Reviews of Top Lenders for Fixed-Rate HELOCs

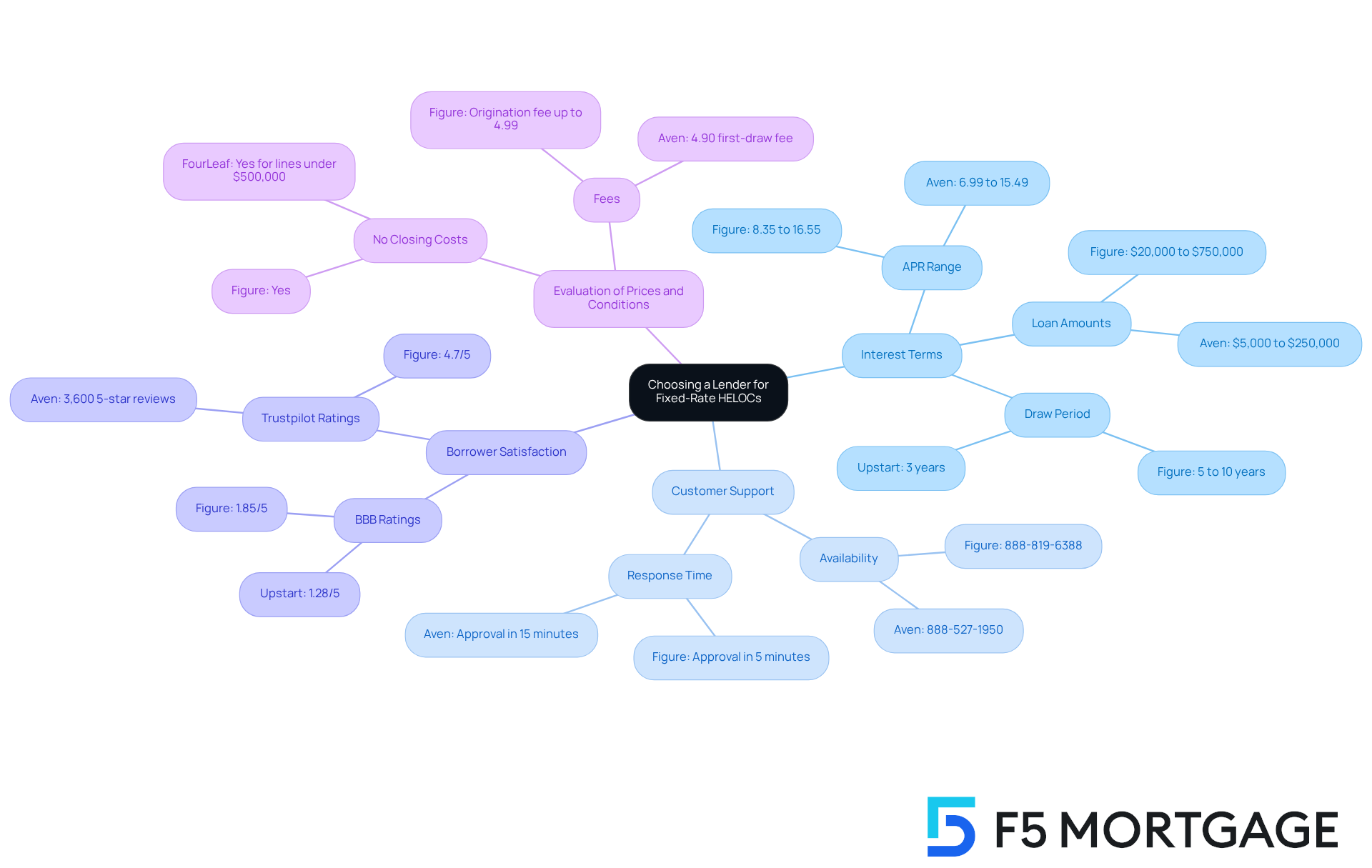

At Lendedu.com, we understand how overwhelming it can be to choose the right lender for your fixed rate helocs. That’s why we offer comprehensive evaluations of prominent lenders, focusing on essential factors like interest terms, customer support, and borrower satisfaction. By analyzing these aspects, property owners can identify lenders that align with their unique needs and preferences.

Making an informed decision is crucial, as the choice of lender significantly impacts both your borrowing experience and the financial implications of fixed rate helocs. We know how challenging this can be, which is why we encourage you to evaluate prices, expenses, and conditions carefully to ensure they fit your requirements.

Considering F5 Mortgage could be a beneficial step, as they provide competitive pricing and personalized assistance tailored to your specific needs. We’re here to support you every step of the way, helping you navigate this important financial decision with confidence.

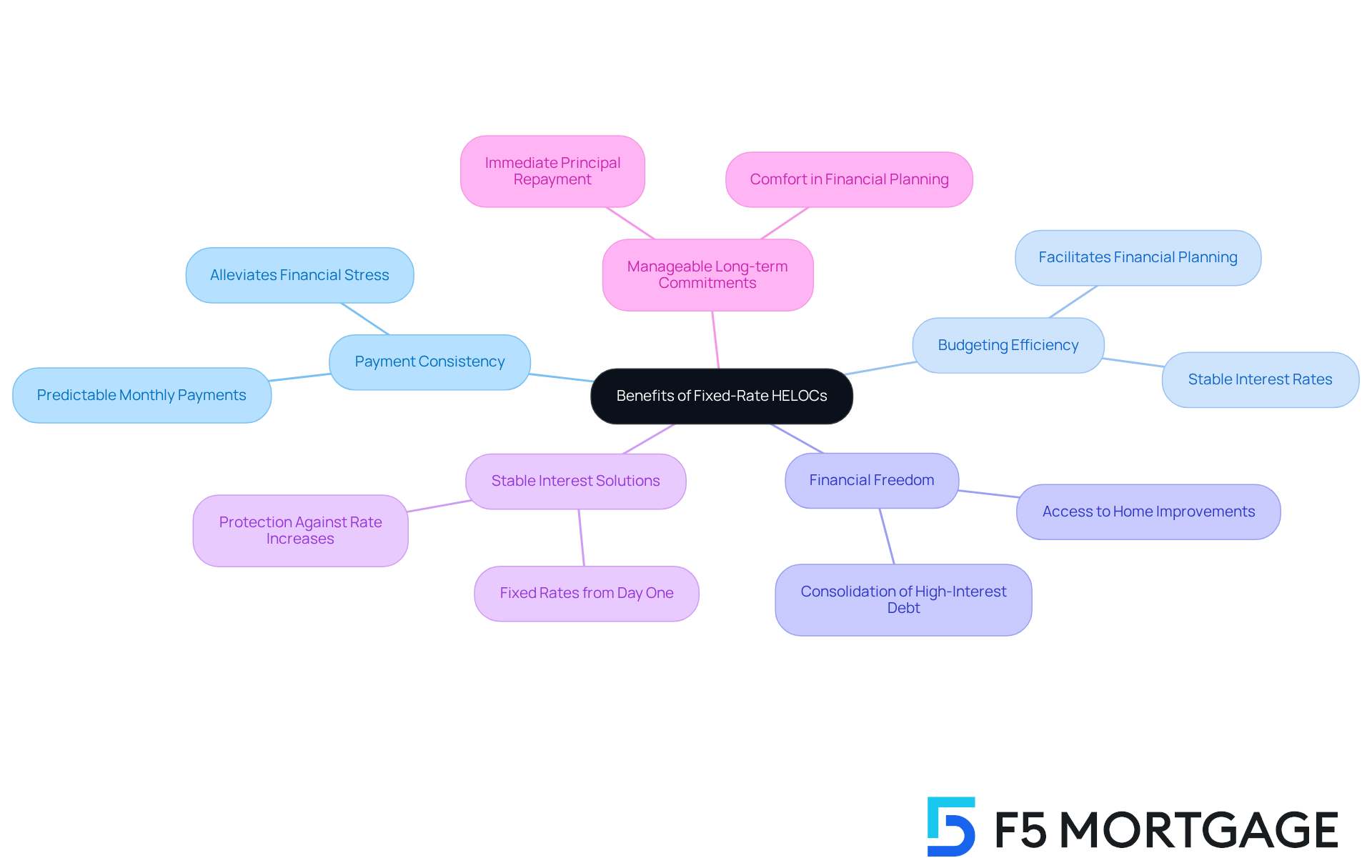

Achieve.com: Benefits of Choosing a Fixed-Rate HELOC

Selecting fixed rate helocs provides numerous important advantages for property owners, especially regarding payment consistency. This feature allows families to budget efficiently, alleviating concerns about fluctuating interest rates that can complicate financial planning. We know how challenging this can be, especially when almost half of U.S. homeowners with mortgages are categorized as ‘equity rich.’ This status provides them with greater financial freedom to utilize fixed rate helocs for home improvements and other significant expenses. It enhances their borrowing options, enabling families to secure funds for enhancements without the stress of changing costs.

For many households, fixed rate helocs provide a stable-interest solution for financing home enhancement projects. This ensures they can manage their monthly obligations without the anxiety of unexpected rate increases. Financial advisors frequently highlight the importance of budgeting with fixed rate helocs, emphasizing that the stability in payments can significantly reduce financial pressure during unpredictable economic times. As financial planner Dana George wisely states, “A stable option like fixed rate helocs is certainly the superior choice” for those looking to manage their expenses effectively.

Moreover, fixed rate helocs allow property owners to begin repaying both principal and interest from the outset. This approach can lead to more manageable long-term financial commitments. As property owners navigate their financial journeys, the assurance of steady payments can provide comfort. This makes fixed rate helocs an appealing option for individuals looking to enhance their living environments or consolidate higher-interest debts.

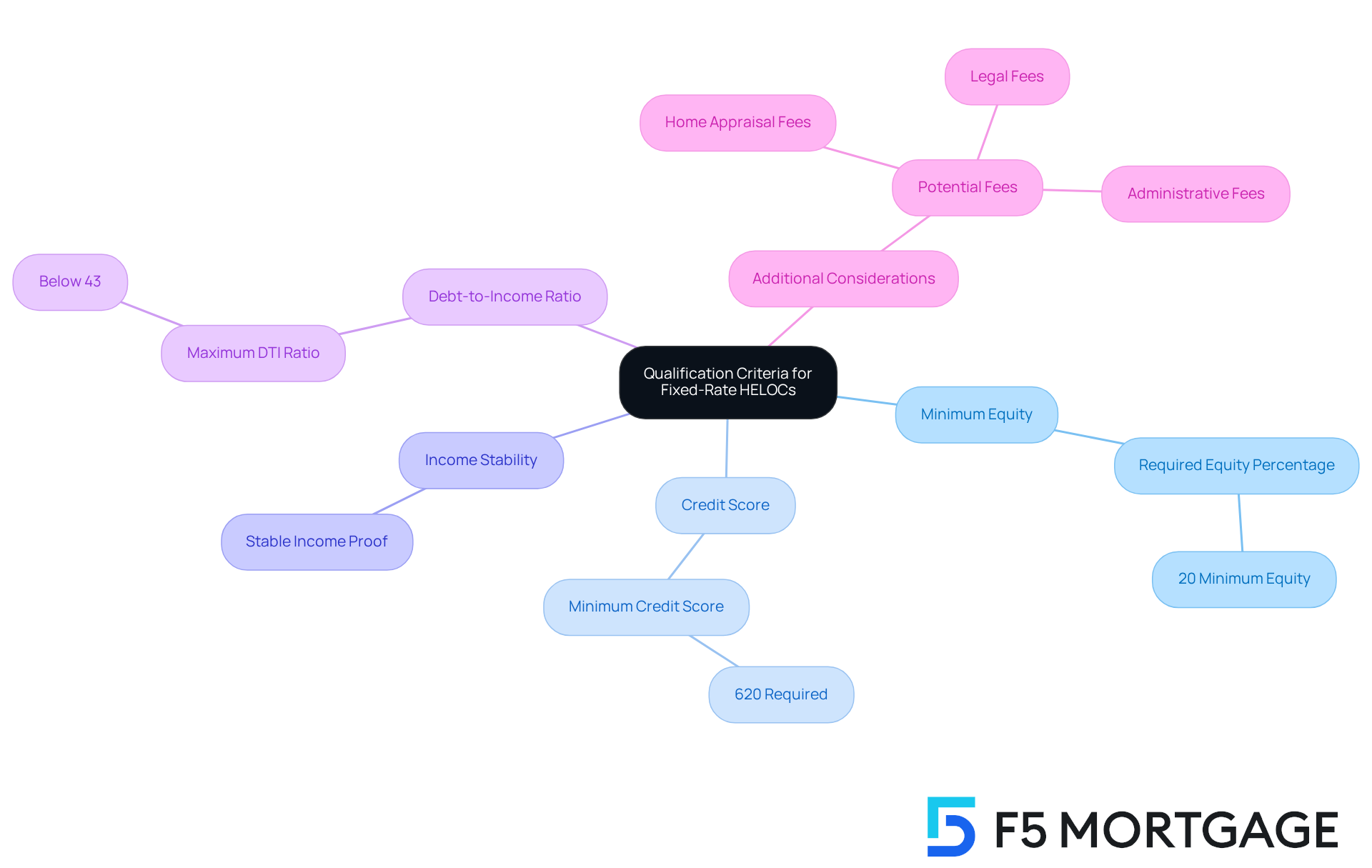

Canada.ca: Qualification Criteria for Fixed-Rate HELOCs in Canada

In Canada, property owners seeking fixed rate HELOCs must navigate specific qualification criteria that can feel overwhelming. We understand how challenging this can be, but knowing what to expect can make the process smoother. Typically, a minimum equity of 20% in the property is required, meaning that the homeowner’s mortgage balance must be less than 80% of the home’s appraised value. Lenders assess credit scores, usually needing a score of at least 620 for approval. Higher scores can enhance your chances of obtaining advantageous terms, which is something to strive for.

Income stability and a debt-to-income (DTI) ratio below 43% are crucial factors in the assessment process. A better DTI can lead to more competitive mortgage rates, which is another reason to focus on your financial health. Real-life examples can shed light on how Canadian property owners successfully qualify for fixed rate HELOCs. For instance, consider someone with a property valued at $500,000 and a remaining mortgage balance of $350,000. With 30% equity, they would be eligible for a HELOC, allowing them to access funds for renovations or debt consolidation.

Mortgage professionals emphasize the importance of understanding these equity requirements. As one expert noted, “Home equity is a powerful tool for homeowners, but knowing how much equity you have and how it affects your borrowing options is essential.” In 2025, the average equity required for qualification of fixed rate HELOCs remains around 20%, reflecting a consistent standard in the lending landscape.

Homeowners should also be aware of potential fees associated with HELOCs, including home appraisal fees, legal fees, and administrative fees. The lender will order a home appraisal to determine the current market value of the property, which is critical in identifying how much equity you have and how it affects your rates. By understanding these criteria, property owners can better prepare for the application process and utilize their home equity to achieve financial goals. We’re here to support you every step of the way.

Turnedaway.ca: Unique Features of Fixed-Rate HELOCs in Ontario

Turnedaway.ca showcases the unique features of fixed rate helocs in Ontario, specifically catering to the needs of property owners in the region. These features may encompass specific lending terms, interest rates, and repayment options. We understand how important it is for you to navigate these options effectively. Additionally, the site discusses provincial regulations that can impact your borrowing journey. By grasping these localized features, you can make more informed decisions about your financing options and select products that best suit your financial situation.

As property owners in Ontario collectively owe over $170 billion in home equity lines of credit, it’s crucial to recognize the significance of these financial products. However, we know how challenging it can be to access HELOCs amid new mortgage rules and rising interest rates, which complicates the borrowing landscape.

Moreover, Ontario mandates that property owners maintain at least 20% equity in their property after the first mortgage to qualify for a HELOC. As Scott M. mentions, “To qualify for a HELOC in Ontario, property owners generally need to have at least 20% equity in their asset.” This regulation serves as a safety net, helping to reduce the risk of over-leveraging your home.

While fixed rate helocs provide consistency in monthly payments, it’s essential to recognize the potential risks associated with these products. Over-borrowing can lead to financial strain, and failing to make repayments may result in severe consequences, including foreclosure. We’re here to support you every step of the way in understanding these risks.

In summary, fixed rate helocs in Ontario present a reliable financing choice, characterized by consistent interest rates and favorable provincial regulations. By leveraging these products wisely, you can effectively manage your financial obligations while enhancing your property value. Remember, we’re here to help you navigate these decisions with confidence.

Newrez.com: Refinancing Options for Fixed-Rate HELOCs

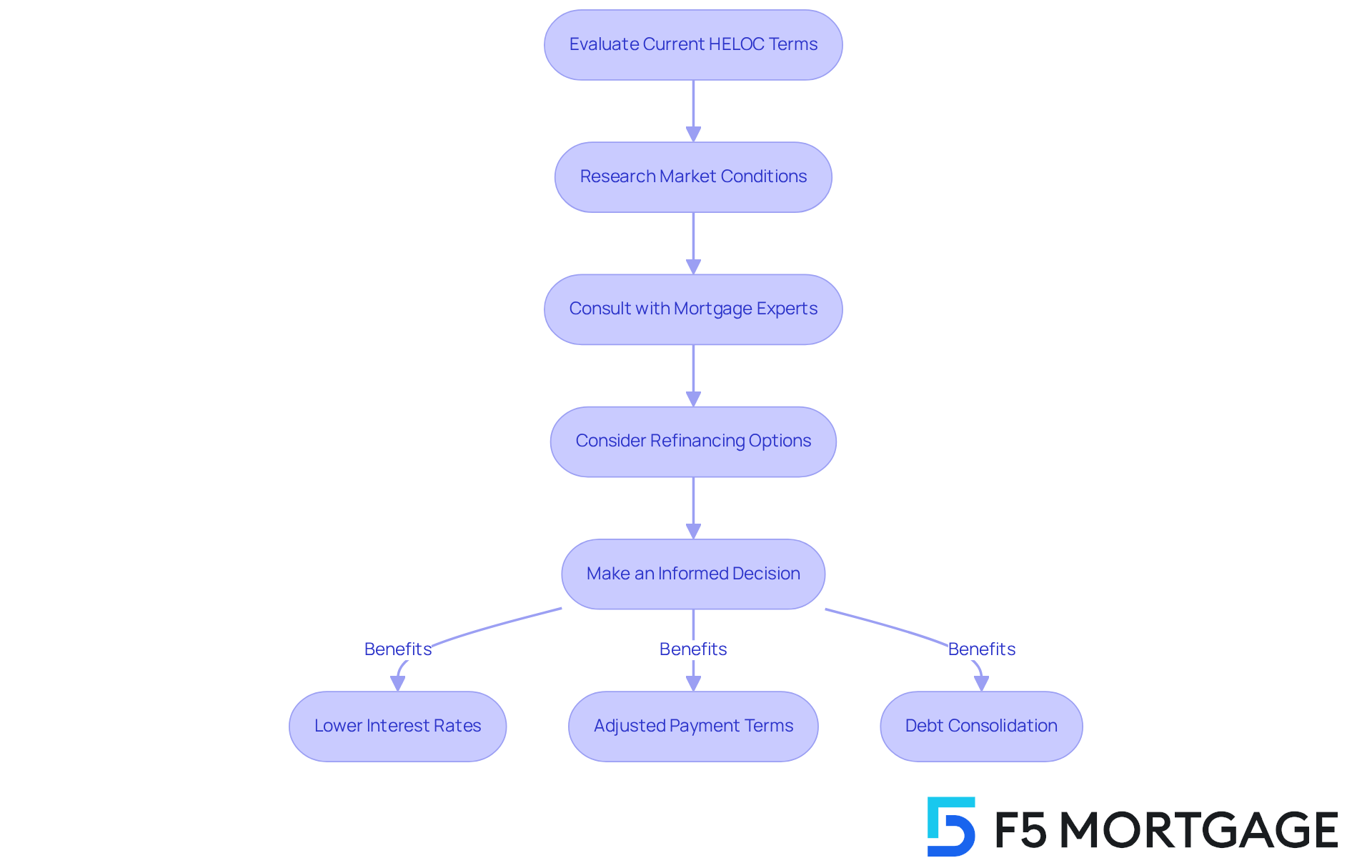

If you’re a homeowner looking to enhance your financial strategies, exploring refinancing options for fixed rate helocs could be a valuable step. Refinancing can help you secure lower interest rates, adjust payment terms, or consolidate existing debt, providing significant financial relief. Given the current market conditions, many homeowners are seizing the opportunity to refinance their fixed rate helocs, especially since interest rates are expected to drop further.

Consider the real-life benefits: individuals who have refinanced their fixed rate helocs often report savings of several hundred dollars on average each month. This extra money can be redirected toward other important financial goals. Current market trends indicate a growing interest in refinancing, with nearly 30% of U.S. homeowners thinking about tapping into their home equity in the upcoming year.

Financial advisors stress the importance of optimizing your HELOC terms. They highlight that refinancing can be a strategic move to better align your borrowing with your current financial needs. As the economic landscape changes, we encourage you to evaluate your options and consult with mortgage experts who can guide you through the refinancing process with care and expertise.

F5 Mortgage: Personalized Consultations for Fixed-Rate HELOC Guidance

At F5 Mortgage, we understand how challenging it can be for property owners to navigate home equity lines of credit. That’s why we offer customized consultations designed to provide personalized guidance, taking into account your unique financial circumstances and objectives. By collaborating with experienced mortgage brokers, you’ll gain valuable insights into the most suitable options available, ensuring that your chosen fixed rate helocs meet your specific needs perfectly.

This tailored approach not only streamlines your decision-making process but also significantly enhances your satisfaction. Many homeowners who have engaged in our consultations report feeling more confident in their financial choices. This newfound confidence often leads to successful home improvement projects and effective debt consolidation efforts.

Our mortgage brokers emphasize the importance of understanding your unique situation. This understanding is crucial for recommending the best products, ultimately fostering a more informed and empowered borrower experience. We’re here to support you every step of the way, ensuring you feel understood and guided throughout this journey.

Conclusion

Fixed-rate home equity lines of credit (HELOCs) offer a reassuring financial solution for homeowners seeking stability and predictability in their borrowing. By choosing a fixed-rate HELOC, you can enjoy consistent monthly payments that simplify budgeting and financial planning, protecting you from the uncertainties of fluctuating interest rates.

In this article, we’ve explored various aspects of fixed-rate HELOCs, highlighting their advantages such as:

- Steady payments

- The ability to leverage home equity for diverse financial needs

- Streamlined application processes with leading lenders like F5 Mortgage and Better.com

We also discussed potential drawbacks, qualification criteria, and the importance of informed decision-making, showcasing how these factors play a critical role in your borrowing experience.

Ultimately, understanding the benefits and mechanics of fixed-rate HELOCs is essential for homeowners looking to enhance their financial strategies. By leveraging these products wisely, you can not only manage your expenses more effectively but also seize opportunities for home improvements and debt consolidation. As you navigate this financial landscape, remember that seeking personalized guidance and staying informed about your options can empower you to make confident, strategic decisions that align with your long-term goals.

Frequently Asked Questions

What is a fixed-rate HELOC?

A fixed-rate HELOC (Home Equity Line of Credit) is a borrowing option that allows homeowners to leverage their home equity with a stable interest rate, ensuring consistent monthly payments.

What are the benefits of choosing a fixed-rate HELOC?

The benefits include steady monthly payments, the ability to leverage home equity for various financial needs, and a streamlined application process.

How does F5 Mortgage support homeowners with HELOC options?

F5 Mortgage offers competitive fixed-rate HELOC options, personalized service, and access to favorable terms through strategic alliances with over twenty prominent lenders.

What is the average interest rate for fixed-rate HELOCs as of September 2025?

The average interest rate for fixed-rate HELOCs is approximately 8.10%, which is lower than rates for credit cards or personal loans.

How does Better.com simplify the HELOC application process?

Better.com provides an efficient online application procedure that allows property owners to complete submissions quickly, with pre-approval possible in as little as three minutes.

What are the interest rate ranges for HELOCs according to Bankrate.com?

HELOC interest rates currently range from 8% to 10%.

What are some potential drawbacks of fixed-rate HELOCs?

Drawbacks may include higher initial costs compared to variable-interest options and limited borrowing flexibility.

What qualifications are typically needed to qualify for a HELOC?

To qualify for a HELOC, homeowners generally need sufficient equity in their home, income verification, and a debt-to-income ratio not exceeding 43%.

Why might financial advisors recommend fixed-rate HELOCs despite higher upfront costs?

Financial advisors often recommend fixed-rate HELOCs because the predictability of stable payments can outweigh the higher initial costs, especially in a fluctuating interest rate environment.

What should homeowners consider when selecting a fixed-rate HELOC?

Homeowners should understand the terms of the loan, the lender’s policies on rate locking, and any associated fees to make informed decisions that align with their long-term financial strategies.