Overview

The article highlights the essential role of loan commitment letters in the mortgage process. We understand how challenging this can be, and these letters provide a formal assurance from lenders to borrowers. They detail important terms such as loan amount and interest rate. This not only solidifies the borrower’s financial standing but also enhances their appeal in competitive real estate markets. We’re here to support you every step of the way as you navigate this important journey.

Introduction

Navigating the complexities of the mortgage process can be overwhelming, and we understand how challenging this can be. However, grasping the pivotal role of loan commitment letters can significantly ease your journey. These formal documents not only affirm a lender’s intent to finance you but also provide crucial assurance in the competitive real estate market.

What happens, though, when the conditions outlined in these letters are not met, or when your financial situation changes unexpectedly? Exploring the intricacies of loan commitment letters reveals their essential components and highlights their critical importance in securing a home.

We’re here to support you every step of the way.

Define Loan Commitment Letter

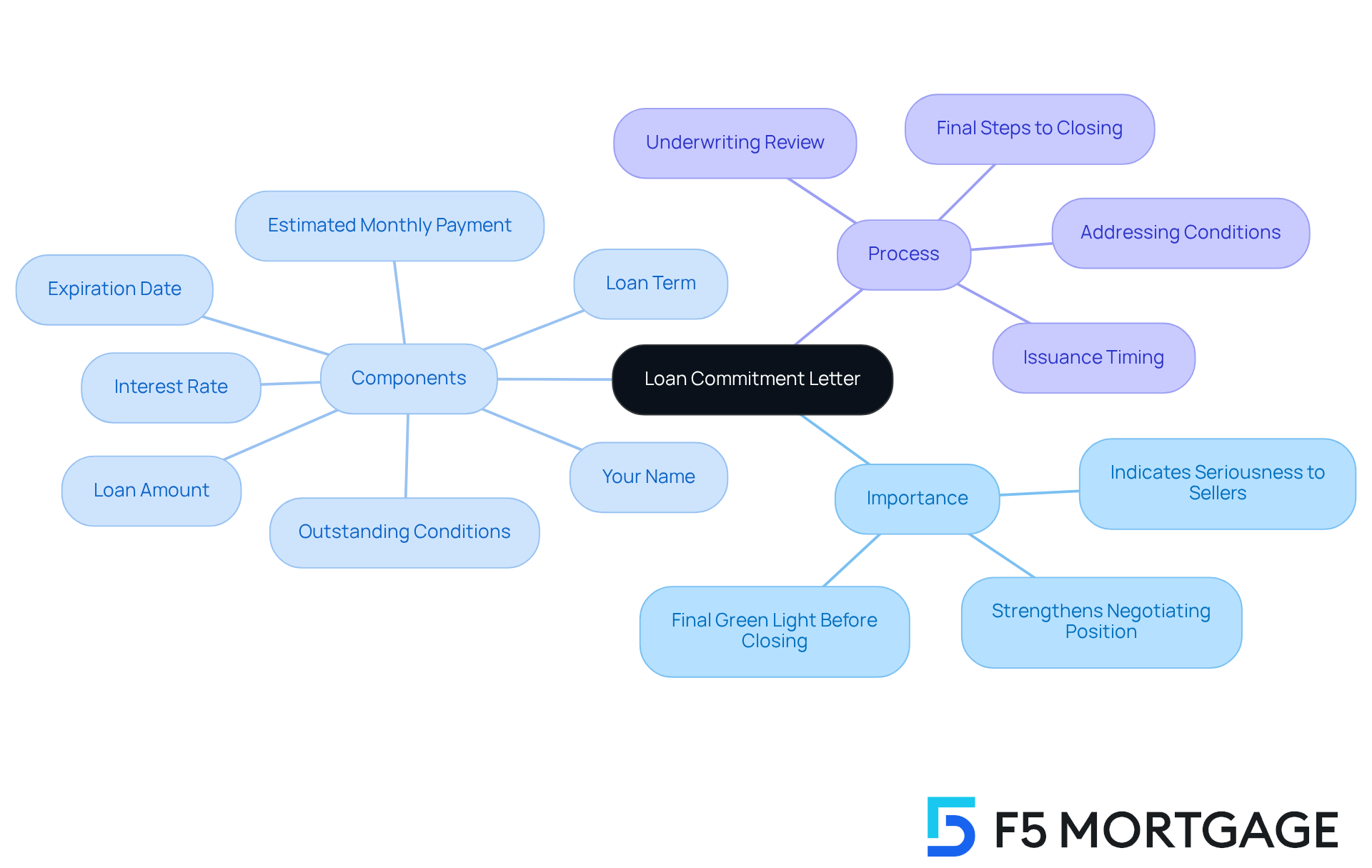

Navigating the mortgage process can feel overwhelming, but understanding a financing agreement can help ease some of that stress. A loan commitment letter is a formal document from a lender that affirms their intention to offer credit to a borrower, contingent upon certain conditions being met. This document is a significant milestone in your journey, as it shows that the lender has carefully reviewed your financial information and is prepared to move forward with the financing under specific terms.

Unlike a pre-approval document, which merely hints at potential qualification, a loan commitment letter signifies a more definitive step in securing your funding. Typically issued one to two weeks before closing, the loan commitment letter serves as a binding offer that is pending the completion of any final steps. The importance of the loan commitment letter cannot be overstated; it not only strengthens your negotiating position with sellers but also instills greater confidence that your financing will come through.

For instance, having a financing agreement can make you a more appealing buyer in competitive markets, showcasing your financial backing. Moreover, this loan commitment letter contains essential details such as:

- Your name

- Loan amount

- Interest rate

- Loan term

- Estimated monthly payment

- Expiration date

- Any outstanding conditions

This clarity ensures that both you and the lender are aligned on the loan terms, paving the way for a smoother process.

We know how challenging this can be, and we’re here to support you every step of the way. Understanding these documents and their implications is key to feeling empowered in your home-buying journey.

Explain Importance of Loan Commitment Letters

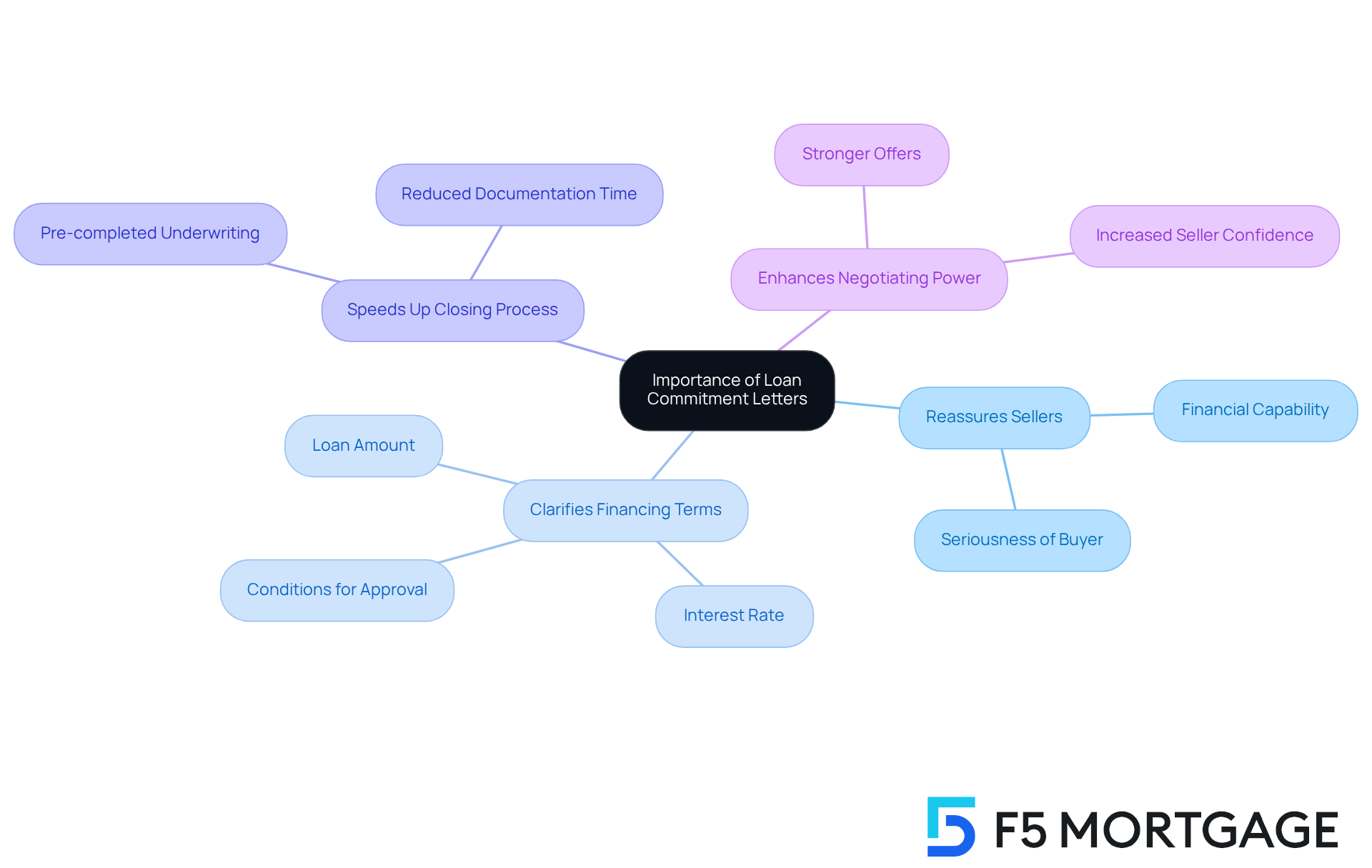

Loan commitment letters play a vital role in the home purchasing journey, and we understand how important they are for you. Firstly, the loan commitment letter and other documents reassure sellers that you are financially capable of completing the acquisition. This assurance, along with a loan commitment letter, can significantly strengthen your offer in competitive markets. With F5 Mortgage’s rapid and adaptable mortgage options, you can swiftly obtain your loan commitment letter, improving your stance in discussions.

Secondly, these documents include the loan commitment letter that outlines the specific terms of your financing, including the amount, interest rate, and any conditions that must be met before closing. This clarity is essential for both you and the sellers, helping everyone understand the financial obligations involved. Moreover, having a loan commitment letter can speed up the closing process, as it indicates that a significant portion of the underwriting tasks has already been completed, thanks to F5 Mortgage’s outstanding service.

It’s important to remember that while a mortgage agreement is legally binding, it does not guarantee final approval. Lenders can rescind their offers if your financial situation changes. Additionally, these documents typically have an expiration date that you should keep in mind. Even if you feel secure with a promise document, it’s crucial to acknowledge that you could still be denied a loan if requirements aren’t met or if your financial circumstances change dramatically.

Expert insights emphasize that a mortgage agreement not only strengthens your position but also enhances your negotiating power. Paul Esajian notes, “Acquiring the loan commitment letter is crucial as it assures the seller that you have received approval for financing.” Sellers are more inclined to consider proposals backed by a loan commitment letter, as it demonstrates your financial preparedness and commitment.

In summary, securing a loan commitment letter through F5 Mortgage is a strategic step that can greatly enhance your chances of successfully acquiring your dream home. We know how challenging this process can be, and we’re here to support you every step of the way.

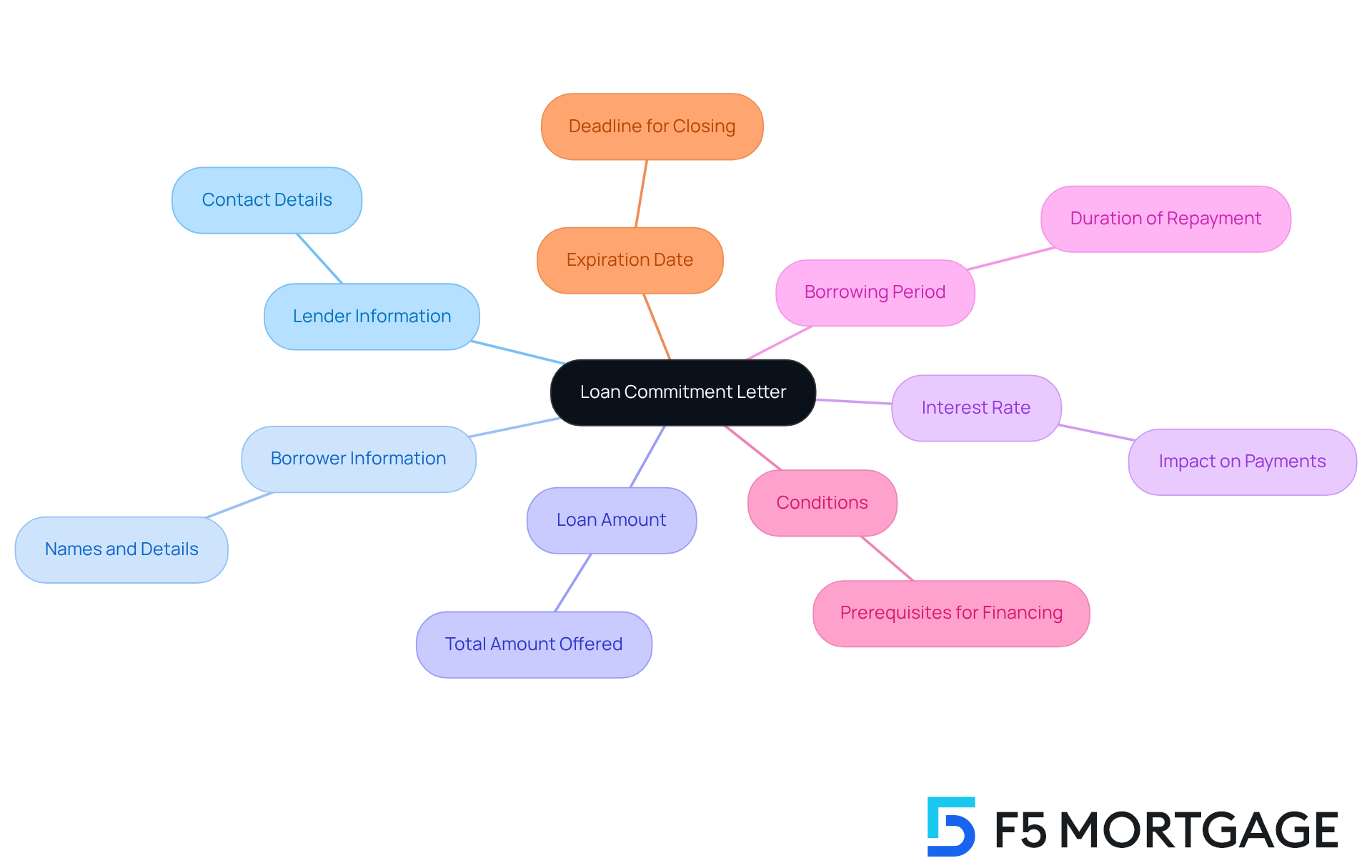

Detail Key Components of a Loan Commitment Letter

Understanding the key components of a loan commitment letter is essential for borrowers in the mortgage process, as it is an important document.

- Lender Information: This section provides the name and contact details of the lender, so you know exactly whom to reach out to with any questions.

- Borrower Information: Here, you’ll find the names and details of the borrower(s), confirming who is involved in the credit agreement.

- Loan Amount: This specifies the total amount being offered, which is crucial for your budgeting and financial planning.

- Interest Rate: The letter outlines the interest rate for the financing, directly impacting your monthly payments and the total cost of borrowing.

- Borrowing Period: This indicates the duration over which you will repay the credit, typically ranging from 15 to 30 years, affecting both your payment amounts and total interest paid.

- Conditions: Any prerequisites that must be met before finalizing the financing are detailed here, such as the need for additional documentation or a satisfactory property appraisal.

- Expiration Date: This is the deadline by which the agreement must close for the commitment to remain valid. Missing this date could lead to changes in your credit terms, including the interest rate.

Understanding these elements is vital for ensuring you are fully aware of your responsibilities and the terms outlined in your loan commitment letter. We know how challenging this can be, and we’re here to support you every step of the way, making the mortgage process as seamless as possible.

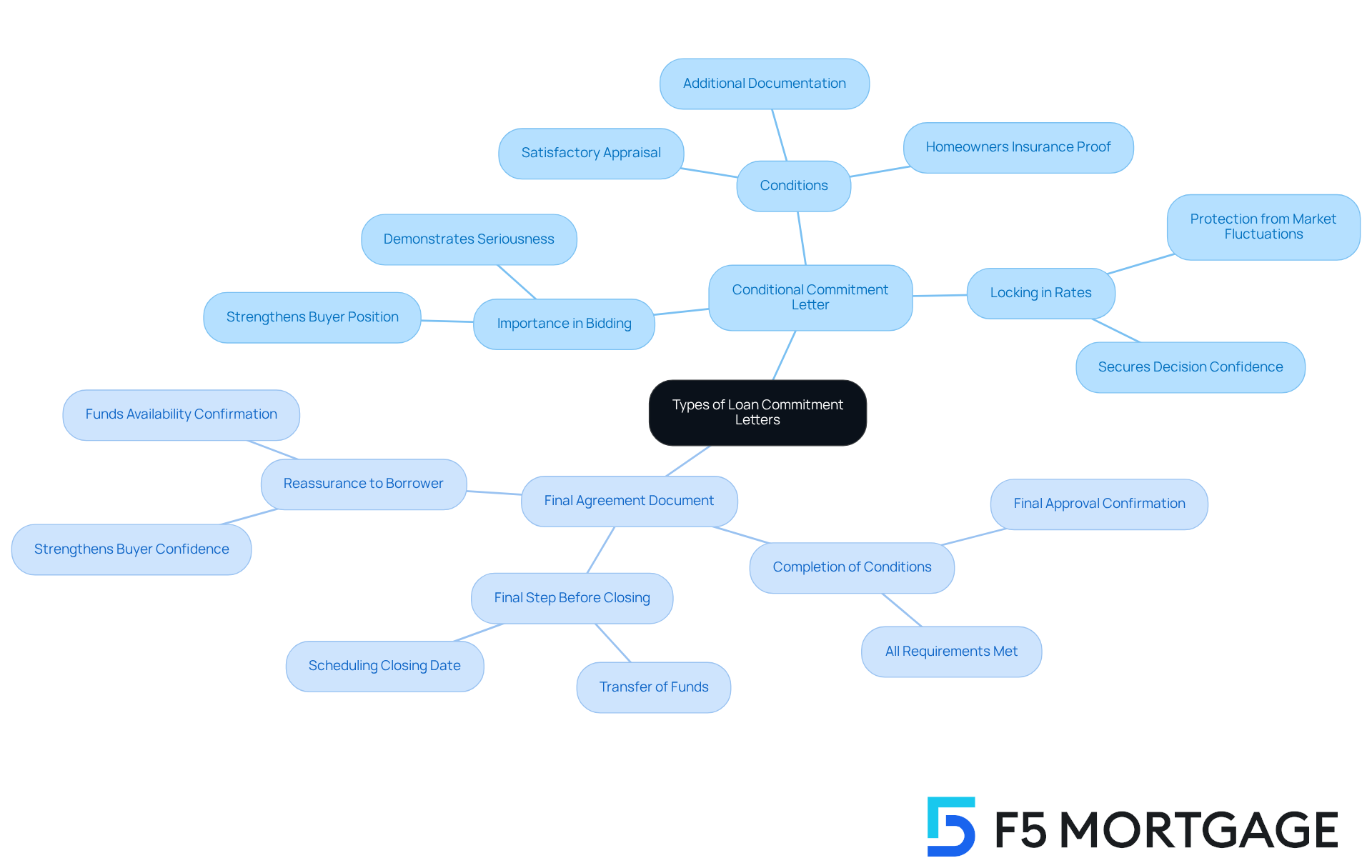

Identify Types of Loan Commitment Letters

Loan commitment letters are essential documents in the mortgage process, and they can sometimes feel a bit overwhelming. Understanding the two main types can help you navigate this journey with more confidence.

-

Conditional Commitment Letter: This letter shows that the lender is ready to provide the loan, but only if you meet specific conditions. These might include submitting additional documentation, obtaining a satisfactory appraisal, or proving you have homeowners insurance. Did you know that about 70% of assurance documents issued are conditional? This highlights their importance in the early phases of credit approval. In competitive bidding situations, the loan commitment letter can be particularly significant, as it demonstrates to sellers that you are serious and capable of securing funding. Once your application is approved, it’s crucial to lock in your mortgage rates. This step protects you from market fluctuations during the processing period, ensuring you feel secure in your decision.

-

Final Agreement Document: On the other hand, a final agreement document means that all the conditions have been met, and the lender is ready to move forward with the loan. This document represents the final step before closing, giving you reassurance that the funds will be available as promised. As a borrower, it is vital for you to know the difference between these two types of documents, particularly the loan commitment letter. It prepares you for the next steps in securing your mortgage and strengthens your position in competitive markets. For instance, a conditional agreement document might ask you to explain any significant withdrawals from your bank account, while a final agreement confirms that the lender has completed all necessary assessments and is committed to financing your mortgage. Remember, if a mortgage commitment letter expires before closing, you will need to reapply for the loan, which could impact the approved amount and interest rate. We know how challenging this can be, but understanding these details empowers you to take control of your mortgage journey.

Conclusion

A loan commitment letter is more than just a piece of paper; it’s a pivotal document in your mortgage journey. It confirms a lender’s intent to provide financing to you, the borrower, based on specific conditions. This formal agreement not only marks a significant milestone in securing your mortgage but also enhances your credibility in the eyes of sellers. This makes you a strong contender in competitive real estate markets.

We understand how daunting the mortgage process can be. Throughout this article, we’ve highlighted key points about the loan commitment letter, such as its role in reassuring sellers of your financial capability and the essential components that make up the letter. We’ve also discussed the difference between conditional and final agreement documents. By grasping these details, you can navigate the mortgage landscape with confidence, ensuring you’re well-prepared for the steps ahead.

In light of this information, it’s clear that obtaining a loan commitment letter is not merely a procedural formality; it’s a strategic move that can significantly enhance your home-buying experience. By being informed and proactive, you can leverage this document to strengthen your negotiating power and streamline the closing process. Taking the time to understand the nuances of loan commitment letters can ultimately lead to a more successful and fulfilling journey toward homeownership. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is a loan commitment letter?

A loan commitment letter is a formal document from a lender that confirms their intention to offer credit to a borrower, contingent upon certain conditions being met.

How does a loan commitment letter differ from a pre-approval document?

Unlike a pre-approval document, which suggests potential qualification, a loan commitment letter signifies a more definitive step in securing funding, showing that the lender has thoroughly reviewed the borrower’s financial information.

When is a loan commitment letter typically issued?

A loan commitment letter is typically issued one to two weeks before closing.

Why is a loan commitment letter important?

It strengthens the buyer’s negotiating position with sellers, instills confidence that financing will be secured, and makes the buyer more appealing in competitive markets.

What essential details are included in a loan commitment letter?

A loan commitment letter includes the borrower’s name, loan amount, interest rate, loan term, estimated monthly payment, expiration date, and any outstanding conditions.

How does a loan commitment letter improve the home-buying process?

The clarity provided by a loan commitment letter ensures that both the borrower and lender are aligned on the loan terms, paving the way for a smoother process.