Overview

This article is dedicated to helping families navigate the complexities of budgeting for home upgrades using the FHA mortgage payment calculator. We understand how challenging this can be, and we want to empower you with the right tools. By grasping key factors such as loan amount, interest rate, and additional costs like property taxes and insurance, you can achieve accurate estimates. This understanding is crucial for making informed financial decisions that truly benefit your family.

We’re here to support you every step of the way. As you explore these factors, think about how they affect your overall budget and future plans. By taking the time to analyze these elements, you can feel more confident in your choices and the financial path you’re paving for your loved ones.

Remember, budgeting for home upgrades is not just about numbers; it’s about creating a comfortable and secure environment for your family. Let’s take this journey together, ensuring that you have the knowledge and resources to make the best decisions for your future.

Introduction

Navigating the complexities of home financing can often feel overwhelming, especially for families eager to enhance their living situation. We understand how challenging this can be. That’s where FHA mortgage payment calculators come into play. These invaluable tools allow potential homebuyers to estimate their monthly payments by considering essential factors like loan amounts, interest rates, and insurance premiums.

As these calculators grow in importance, many families find themselves asking: how can one effectively utilize this resource to avoid common pitfalls and make informed financial decisions? This article aims to support you every step of the way, delving into the nuances of using FHA mortgage payment calculators. We’ll provide a step-by-step guide to mastering this essential tool, ensuring a smoother home-buying experience for you and your loved ones.

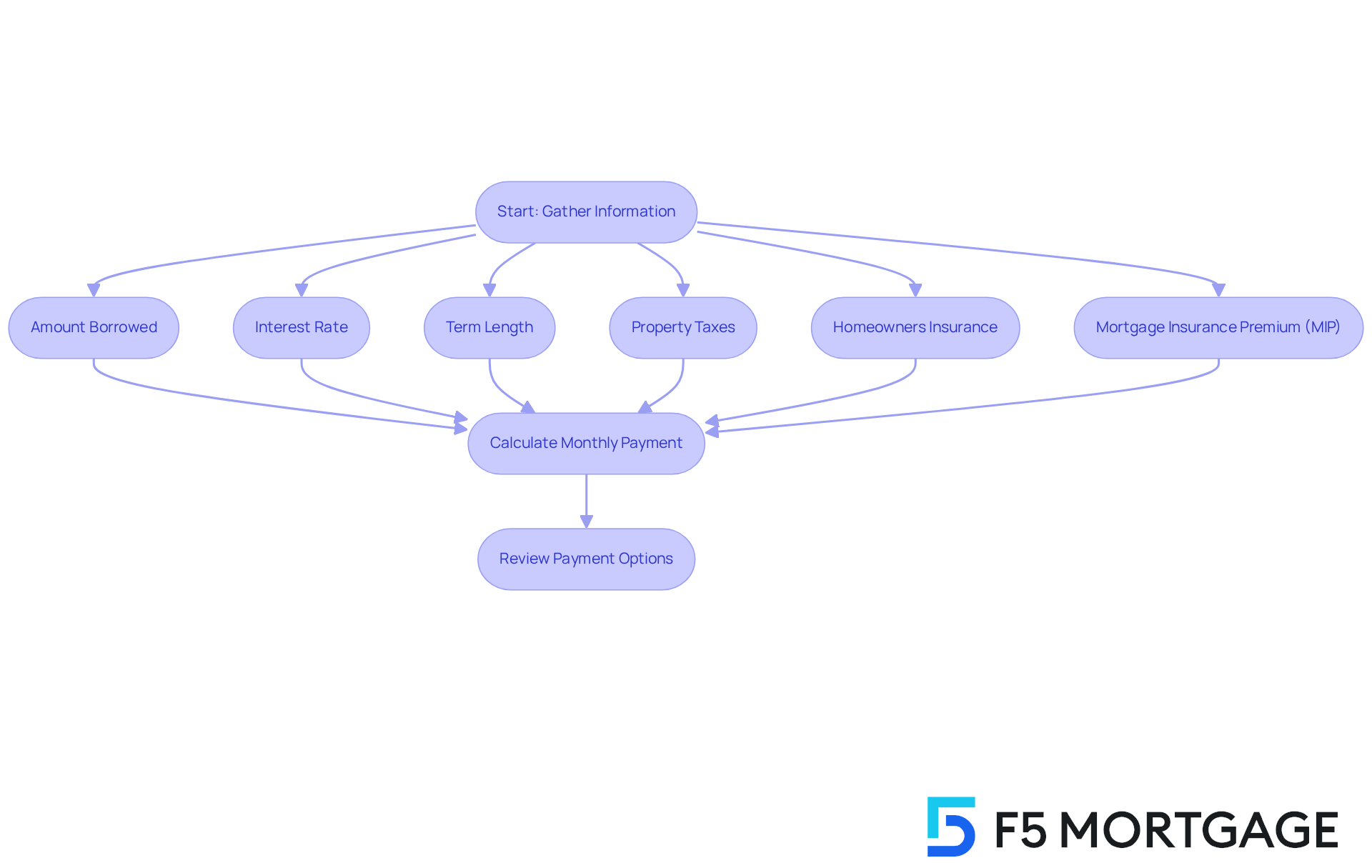

Explore the Basics of FHA Mortgage Payment Calculators

FHA mortgage cost calculators are essential tools for potential homebuyers, allowing them to estimate monthly mortgage costs by considering crucial factors such as the amount borrowed, interest rate, term length, property taxes, homeowners insurance, and Mortgage Insurance Premium (MIP). We know how challenging this can be, and in 2025, approximately 29% of homebuyers are expected to utilize these calculators, reflecting their growing importance in the home financing process.

To effectively use an FHA mortgage cost calculator, borrowers should gather essential information, including the amount borrowed, interest rate, and financing duration. For example, if a family is contemplating a home acquisition of $300,000 with a 3.5% down deposit, they would enter an amount of $290,000. By adjusting factors such as interest rates—currently averaging around 6.74%—users can see how these changes affect their payment amounts, encouraging improved financial planning.

Understanding the is crucial for families looking to secure favorable mortgage rates. A maximum DTI ratio of 43% is typically required for home loans, and a better DTI can lead to more competitive rates. Real-world examples demonstrate the calculator’s usefulness: a family estimating their expenses might discover that with an annual property tax of $3,600, their tax estimate would be $300 each month. Similarly, if their homeowners insurance costs $1,200 annually, they would input $100 as the monthly premium. This comprehensive approach allows families to visualize their potential financial commitments, making the home buying process less daunting.

Experts emphasize the importance of these calculators, noting that they help avoid common budgeting pitfalls for new homebuyers. FHA mortgage payment calculators empower families to make informed decisions about their home financing options by providing a clear overview of costs before completing an application. Furthermore, it is crucial to explore refinancing alternatives available in Colorado, such as conventional mortgages, FHA financing, and VA financing, which can offer various advantages based on individual situations.

Additionally, FHA mortgages include two insurance premiums: an upfront premium of 1.75% of the mortgage amount and an annual premium varying from 0.45% to 0.85%. This information is vital for families to understand the total cost of their mortgage. At F5 Mortgage, we are committed to leveraging technology to ensure a transparent and stress-free mortgage experience, helping families navigate their refinancing options with personalized support.

Identify Key Factors Affecting FHA Mortgage Payments

Several key factors significantly influence the calculations provided by the FHA mortgage payment calculator, and understanding them is crucial for families navigating this process.

- Loan Amount: The total amount borrowed directly impacts monthly payments. For instance, a larger borrowing sum leads to increased installments, which can be significant throughout the duration of the financing. Just a variation of $40,000 in the borrowing amount can result in over $200 in extra monthly charges. This illustrates the importance of selecting the .

- Interest Rate: The interest rate is a critical element of mortgage costs. Currently, average rates for FHA mortgages hover around 6.7%. Even a minor adjustment in this rate can significantly influence total costs over the mortgage term. For example, a 0.5% increase in the interest rate could mean over $40,000 in additional interest paid over 30 years.

- Borrowing Duration: The duration of the borrowing, typically 15 or 30 years, also influences regular installments. Shorter terms usually result in higher installments but reduced overall interest paid. A 30-year loan may offer lower regular installments compared to a 15-year loan, but the total interest paid will be considerably greater.

- Property Taxes: These taxes often comprise part of regular installments and can vary significantly depending on the area. Families should be mindful of local tax rates when budgeting for their mortgage.

- Homeowners Insurance: This coverage protects your home and is typically required by lenders, adding to the regular cost. The cost of insurance can vary based on the home’s value and location.

- Mortgage Insurance Premium (MIP): FHA financing necessitates MIP, which is an additional expense that must be factored into monthly costs. If the down payment is under 10%, this premium can last for the life of the loan. Therefore, it’s essential for borrowers to understand its impact on their overall expenses.

By understanding these factors, families can effectively budget for their home upgrade and make informed decisions about their mortgage options using an FHA mortgage payment calculator. We know how challenging this can be, and we’re here to support you every step of the way.

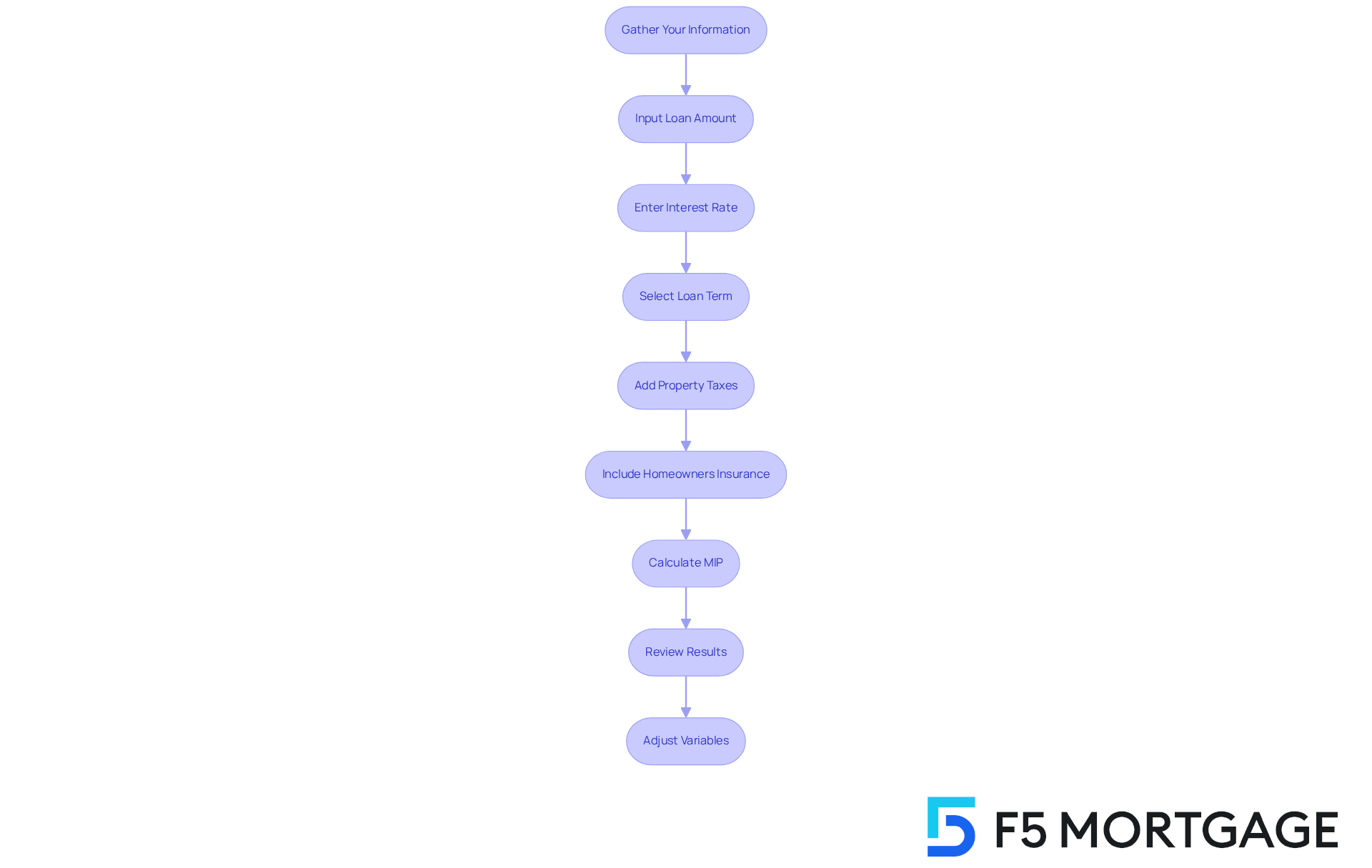

Utilize the FHA Mortgage Payment Calculator: A Step-by-Step Guide

We understand that it can be a bit daunting to effectively use the FHA mortgage payment calculator. But don’t worry; we’re here to support you every step of the way. Follow these essential steps to make the process smoother:

- Gather Your Information: Start by collecting necessary details such as the amount you wish to borrow, the current interest rate, the loan term, your property tax rate, and homeowners insurance costs. Knowing this information is crucial for an accurate estimate.

- Input Loan Amount: Enter the total amount you wish to borrow, which is typically calculated as the home price minus any down payment. This step is vital as it sets the foundation for your calculations.

- Enter Interest Rate: Input the current interest rate for FHA financing. You can obtain this information from lenders or . Remember, even a small change in the rate can impact your monthly payments.

- Select Loan Term: Choose the length of the loan—usually either 15 or 30 years. This decision can greatly influence your monthly budget and long-term financial planning.

- Add Property Taxes: Estimate your annual property tax rate and divide it by 12 to find the monthly amount. This is an important factor that often surprises many homeowners.

- Include Homeowners Insurance: Don’t forget to estimate your homeowners insurance premium. Adding this figure to the calculator ensures a comprehensive view of your potential costs.

- Calculate MIP: If applicable, include the recurring mortgage insurance premium (MIP) based on FHA guidelines. This component is crucial for understanding your total monthly obligation.

- Review Results: Click the calculate button to see your estimated recurring charge, which encompasses principal, interest, taxes, and insurance. Take a moment to review these figures—they can provide valuable insights into your budget.

- Adjust Variables: Finally, experiment with different loan amounts, interest rates, and terms to see how these changes influence your regular costs. This flexibility allows you to find the best fit for your financial situation.

By following these steps, families can gain a clearer understanding of their potential mortgage costs with the FHA mortgage payment calculator. We know how challenging this can be, but with this knowledge, you’ll be empowered to make informed decisions about your home financing choices.

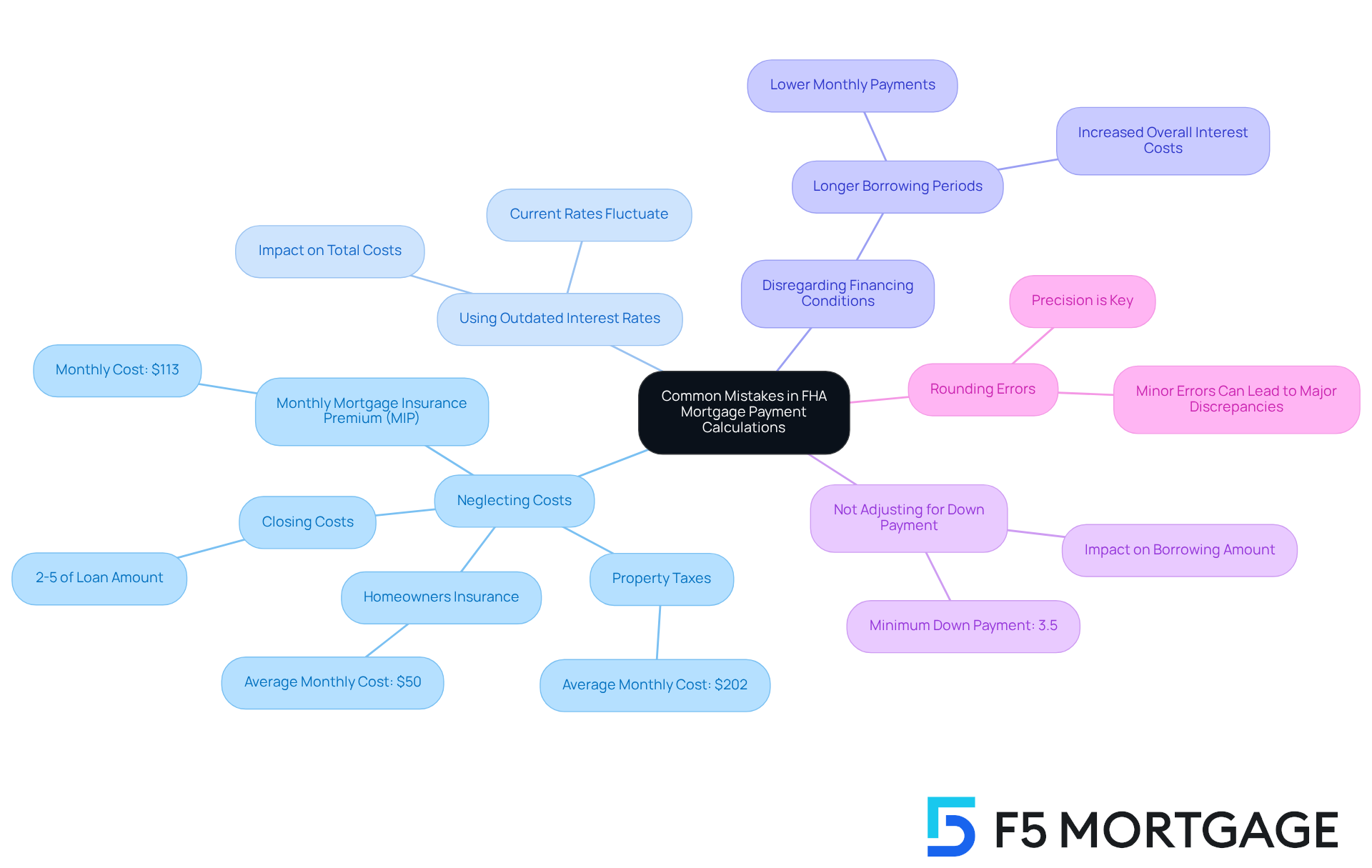

Avoid Common Mistakes When Calculating FHA Mortgage Payments

Families must be aware of common pitfalls that can lead to inaccurate estimates when utilizing the FHA mortgage payment calculator. We know how challenging this can be, and we’re here to support you every step of the way.

- Neglecting to Include All Costs: It’s crucial to factor in all associated costs, such as property taxes, homeowners insurance, and the monthly mortgage insurance premium (MIP). Neglecting to do this can lead to a significant underestimation of payment amounts each month. For instance, the average monthly property tax is estimated at $202, and homeowners insurance typically adds another $50 to monthly expenses. Furthermore, closing expenses for FHA mortgages are roughly 2-5% of the amount borrowed, which should also be taken into account.

- Using Outdated Interest Rates: Always verify the most current interest rates, as they can fluctuate and significantly affect total costs. FHA mortgage rates are often lower than conventional rates, making timely updates essential for accurate calculations.

- Disregarding Financing Conditions: Failing to take into account the financing period can lead to misunderstandings about the recurring charges and the overall interest incurred throughout the duration of the financing. Families should be aware that a longer borrowing period may lead to reduced monthly expenses but increased overall interest costs.

- Not Adjusting for Down Payment: Ensure that the borrowing amount accurately reflects the home price minus the initial deposit. FHA mortgages necessitate a minimum down contribution of 3.5%, and overlooking this adjustment can result in overvaluing costs. It’s also important to note that FHA mortgages have , which can affect budgeting.

- Rounding Errors: Precision is key; rounding figures can create significant discrepancies in calculations. For instance, a minor rounding mistake in the borrowed sum can result in a significant variation in monthly dues. Given that the average purchase price for a home in the U.S. was $503,800 as of Q1 2025, even minor errors can have substantial financial implications.

As Joe Wallace, Associate Editor for FHANewsblog.com, advises, “Don’t make the mistake of doing ‘the wrong math’ for your FHA loan.” By being mindful of these common mistakes, families can use an FHA mortgage payment calculator to accurately calculate their FHA mortgage payments, ensuring they make informed decisions about their home financing. This diligence is particularly important as many homebuyers overlook additional costs, which can lead to financial strain down the line.

Conclusion

Mastering the FHA mortgage payment calculator is an essential step for families looking to enhance their living situation. We understand how challenging this can be, and by utilizing this tool, potential homebuyers can gain clarity on their financial commitments. This ensures that they make informed decisions that align with their budgets and goals. The ability to visualize monthly payments based on various factors empowers families to navigate the complexities of home financing with confidence.

In this article, we discussed key aspects of the FHA mortgage payment calculator, including:

- The importance of understanding loan amounts

- Interest rates

- Additional costs such as property taxes and mortgage insurance premiums

Our step-by-step guide provided practical insights into effectively using the calculator while highlighting common mistakes that can lead to inaccurate estimates. By being aware of these pitfalls, families can avoid financial strain and better prepare for their home purchase.

In conclusion, leveraging the FHA mortgage payment calculator is not just a matter of convenience; it is a vital component of responsible financial planning. We encourage families to take the time to gather accurate information and utilize the calculator effectively. This proactive approach will not only enhance their understanding of mortgage payments but also pave the way for a smoother home-buying experience. Embracing these tools and insights can lead to a successful transition into homeownership, ensuring that families make choices that contribute to their long-term financial well-being.

Frequently Asked Questions

What is an FHA mortgage payment calculator?

An FHA mortgage payment calculator is a tool that helps potential homebuyers estimate their monthly mortgage costs by considering factors like the amount borrowed, interest rate, term length, property taxes, homeowners insurance, and Mortgage Insurance Premium (MIP).

Why are FHA mortgage payment calculators important?

These calculators are important because they assist homebuyers in understanding their potential financial commitments and help them make informed decisions about home financing options. In 2025, approximately 29% of homebuyers are expected to use these calculators.

What information do I need to use an FHA mortgage payment calculator?

To effectively use an FHA mortgage payment calculator, borrowers should gather information such as the amount borrowed, interest rate, and financing duration.

How do I calculate the amount to enter in the calculator?

For example, if a family is considering a home purchase of $300,000 with a 3.5% down payment, they would enter $290,000 as the amount borrowed.

What is the current average interest rate for FHA loans?

The current average interest rate for FHA loans is around 6.74%.

What is the Debt-to-Income (DTI) ratio, and why is it important?

The Debt-to-Income (DTI) ratio is a measure of a borrower’s monthly debt payments compared to their gross monthly income. A maximum DTI ratio of 43% is typically required for home loans, and a better DTI can lead to more competitive mortgage rates.

Can you provide an example of how to estimate property taxes and homeowners insurance?

For instance, if a family has an annual property tax of $3,600, their monthly tax estimate would be $300. If their homeowners insurance costs $1,200 annually, they would input $100 as the monthly premium.

What are the two insurance premiums associated with FHA mortgages?

FHA mortgages include an upfront premium of 1.75% of the mortgage amount and an annual premium that varies from 0.45% to 0.85%.

What refinancing options are available in Colorado?

In Colorado, refinancing options include conventional mortgages, FHA financing, and VA financing, each offering various advantages based on individual situations.

How does F5 Mortgage assist families with mortgages?

F5 Mortgage is committed to leveraging technology to provide a transparent and stress-free mortgage experience, helping families navigate their refinancing options with personalized support.