Overview

We understand how crucial FHA interest rates are for your financial journey, especially when it comes to credit scores. Higher credit scores typically lead to lower rates, which can mean significant savings for you and your family. Even small improvements in your credit rating can unlock substantial financial benefits.

Imagine being able to secure a more favorable FHA loan simply by enhancing your credit score. We’re here to support you every step of the way with effective strategies to boost your credit. By taking these steps, you can not only improve your chances of obtaining better loan terms but also ease some of the stress that comes with the mortgage process.

Let’s explore how you can make these improvements and pave the way for a brighter financial future. Remember, every little bit counts, and we know how challenging this can be. Together, we can navigate this journey toward homeownership with confidence.

Introduction

Navigating the world of home financing can feel overwhelming, particularly for first-time buyers and those with limited income. We understand how challenging this can be. FHA loans, backed by the Federal Housing Administration, have emerged as a lifeline for many families. They offer lower down payment options and more accessible credit criteria, making the dream of homeownership more attainable.

However, it’s important to note that the interest rates associated with these loans are significantly influenced by borrowers’ credit scores. This presents both an opportunity for potential savings and a challenge for many. So, how can prospective homeowners leverage their credit scores to secure the best FHA interest rates? We’re here to support you every step of the way as you work towards achieving your dream of homeownership.

Explore FHA Loans and Their Importance in Home Financing

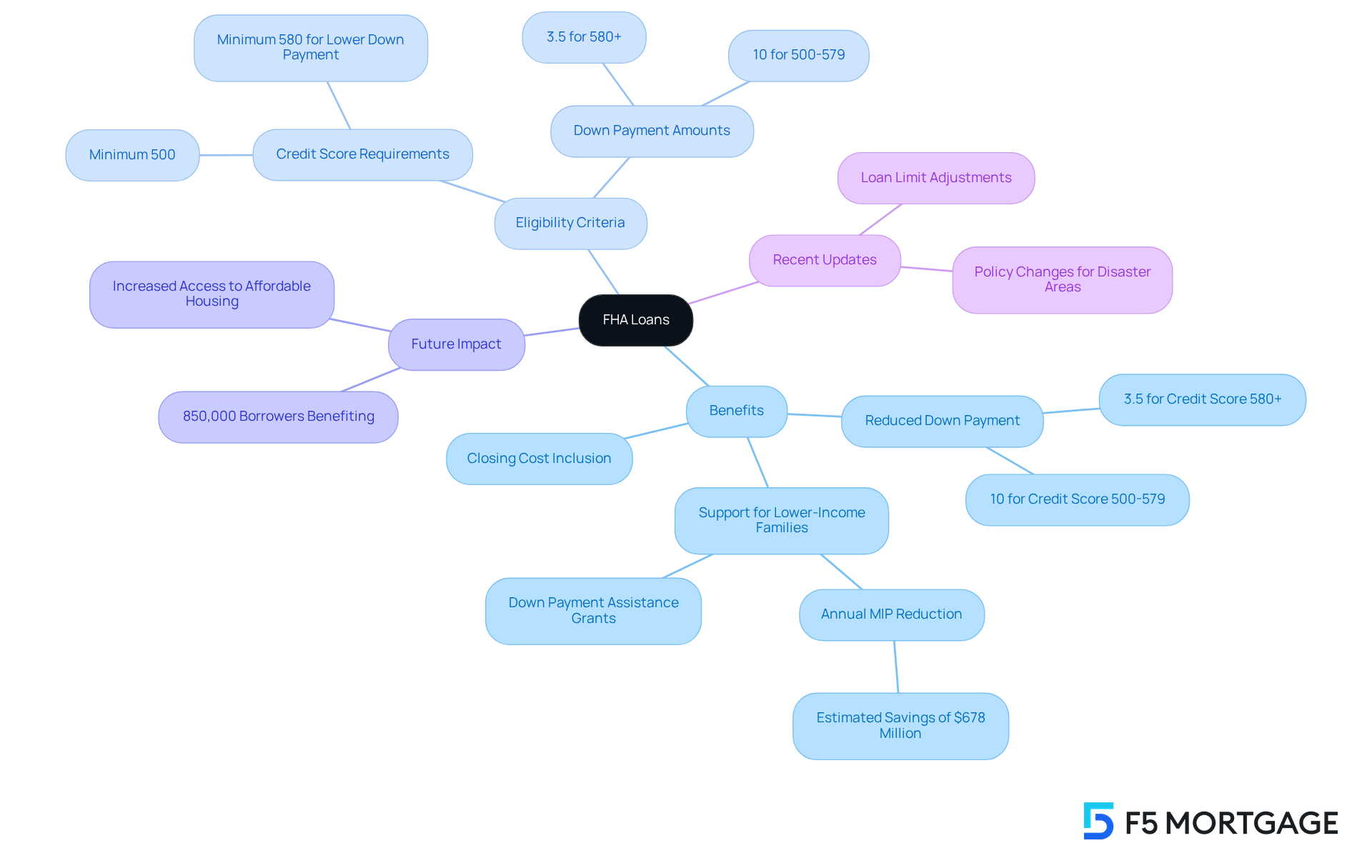

FHA mortgages, insured by the Federal Housing Administration, play a crucial role in assisting lower-income and first-time homebuyers in securing financing. We know how challenging this can be, and these financial products are especially beneficial due to their reduced down payment criteria, which can be as low as 3.5% for individuals, influenced by FHA interest rates by credit score of 580 or above. This accessibility is vital for families who may find it difficult to qualify for conventional financing. In 2025, FHA financing is anticipated to greatly impact lower-income families, with around 850,000 borrowers set to benefit from a decrease in yearly mortgage insurance premiums, saving them roughly $678 million in total during the first year.

The adaptability of FHA mortgages goes beyond down payments; they allow for the incorporation of certain closing expenses in the total amount, further easing the financial strain on homebuyers with limited savings. Case studies demonstrate how these financial products have empowered families to attain homeownership despite economic difficulties. For instance, down payment assistance grants have been instrumental in helping first-time buyers cover upfront costs, making homeownership more attainable.

Furthermore, FHA financing is designed to cater to various financial circumstances, including those of individuals whose options are influenced by FHA interest rates by credit score. This inclusivity is reflected in the fact that borrowers can qualify for FHA interest rates by credit score with scores as low as 500, albeit with a higher down payment requirement of at least 10% for those with scores between 500 and 579. The ability to fund up to 96.5% of a home’s worth makes FHA options a favored choice for numerous purchasers.

Recent news highlights the ongoing commitment of the FHA to assist lower-income families, with updates to borrowing limits and policies aimed at improving access to affordable housing. As these financial aids continue to evolve, we’re here to support you every step of the way, ensuring they remain a vital resource for families striving to achieve their homeownership dreams.

Analyze the Impact of Credit Scores on FHA Interest Rates

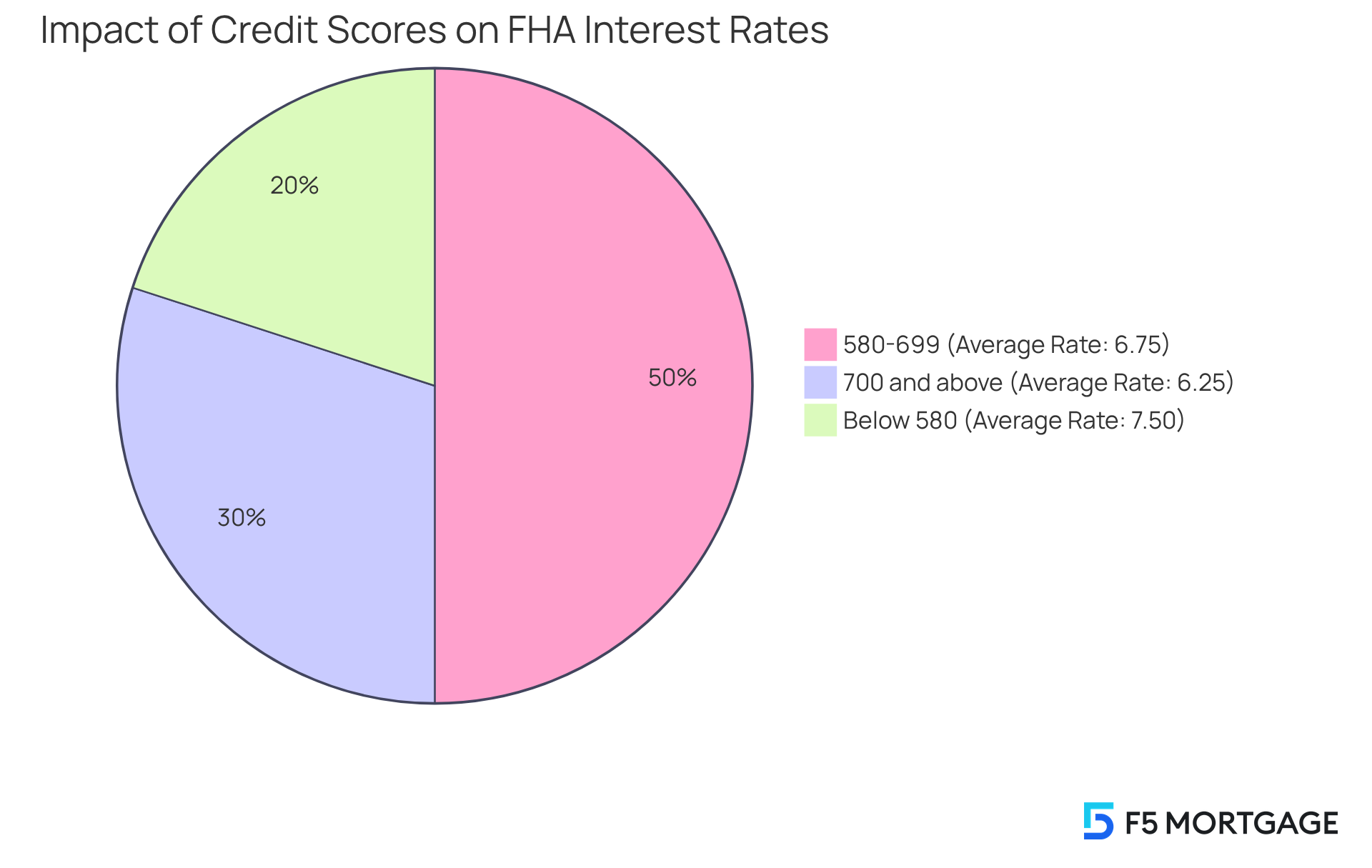

Credit ratings play a crucial role in determining the FHA interest rates by credit score that are available to borrowers seeking financing. Generally, a higher rating translates to lower interest rates, which can save borrowers thousands over the life of their loan. While FHA guidelines allow ratings as low as 500, securing maximum financing with a 3.5% down payment requires a minimum rating of 580. Borrowers with ratings below this level may face higher rates or need to make a larger down payment.

Understanding this relationship is essential for prospective borrowers. Even a small improvement in creditworthiness can lead to significant savings. For instance, a borrower with a rating of 700 might secure a rate that is approximately 0.5% lower than someone with a rating of 620. This clearly illustrates the financial benefits of maintaining a robust financial profile. Striving for a rating of 700 or above opens up the best financing options, making it vital for borrowers to aim for this standard.

Moreover, improving one’s financial rating can yield immediate monetary benefits. A modest increase of just 20 points can lower the mortgage rate by up to 1.25 percentage points. As of July 10, 2025, the average 30-year mortgage rate stands at 6.72%. This underscores the importance of enhancing financial ratings to secure the most favorable rates.

In conclusion, the link between credit ratings and FHA interest rates by credit score is clear: higher ratings lead to lower FHA interest rates by credit score and greater savings. Therefore, it is crucial for borrowers to focus on improving their financial standing. As Tim Lucas aptly notes, “A first-time home purchaser will need a financial rating of at least 500 to acquire a home with an FHA mortgage,” highlighting the importance of understanding financing requirements. We know how challenging this can be, and we’re here to support you every step of the way.

Implement Strategies to Enhance Your Credit Score for Better FHA Rates

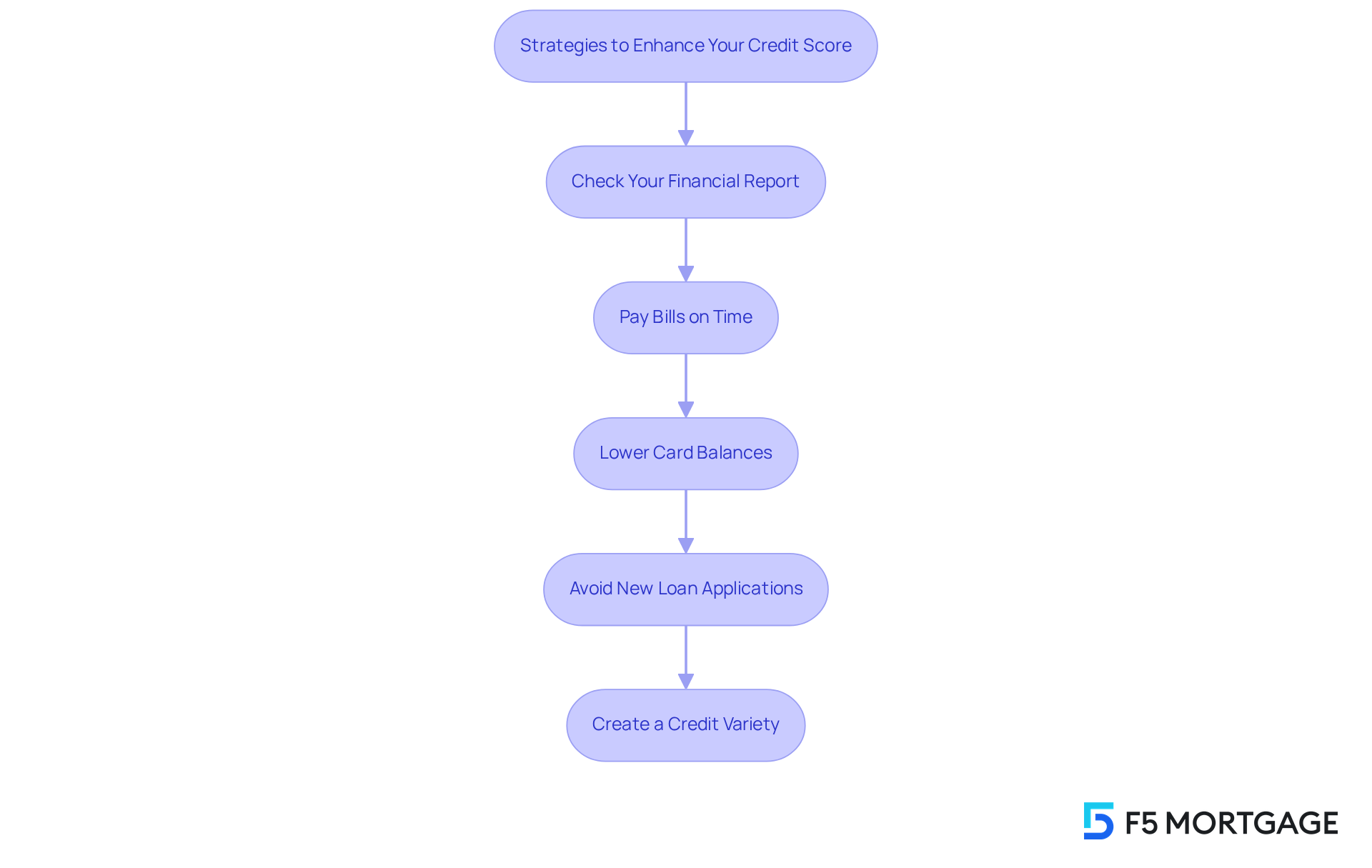

Improving your financial rating is crucial for securing advantageous FHA interest rates by credit score. We know how challenging this can be, but there are effective strategies you can consider:

- Check Your Financial Report: Start by obtaining a free copy of your financial report. Thoroughly examine it for any mistakes and challenge inaccuracies, as these can negatively influence your results.

- Pay Bills on Time: Prompt bill payments are essential because payment history is the most important element affecting your financial rating. Consider setting up reminders or automatic payments to help you stay on track.

- Lower Card Balances: Strive to keep your utilization ratio under 30%, which represents 30% of your overall rating. Reducing current card debt can greatly enhance your rating, making you more appealing to lenders.

- Avoid New Loan Applications: Each new inquiry can temporarily decrease your rating. Restrict new applications, especially in the months prior to your FHA financing request, to safeguard your financial status.

- Create a Credit Variety: A varied financial portfolio, encompassing charge cards and installment financing, can favorably influence your rating. However, only take on new financing if you can manage it responsibly.

By applying these strategies, you can effectively improve your rating, which may help you secure better FHA interest rates by credit score on financing. Many individuals who consistently adhere to these steps frequently experience an average increase of 50 to 100 points, which can create a considerable impact on borrowing conditions. As Amanda Barroso, a financial specialist, observes, ‘Enhancing your financial rating can assist in qualifying for different mortgage options and obtaining more favorable FHA interest rates by credit score.’ Moreover, a case study on ‘Obtaining a Mortgage with Poor Credit’ demonstrates how enhancing credit scores can result in improved financing terms, highlighting the significance of these strategies. We’re here to support you every step of the way.

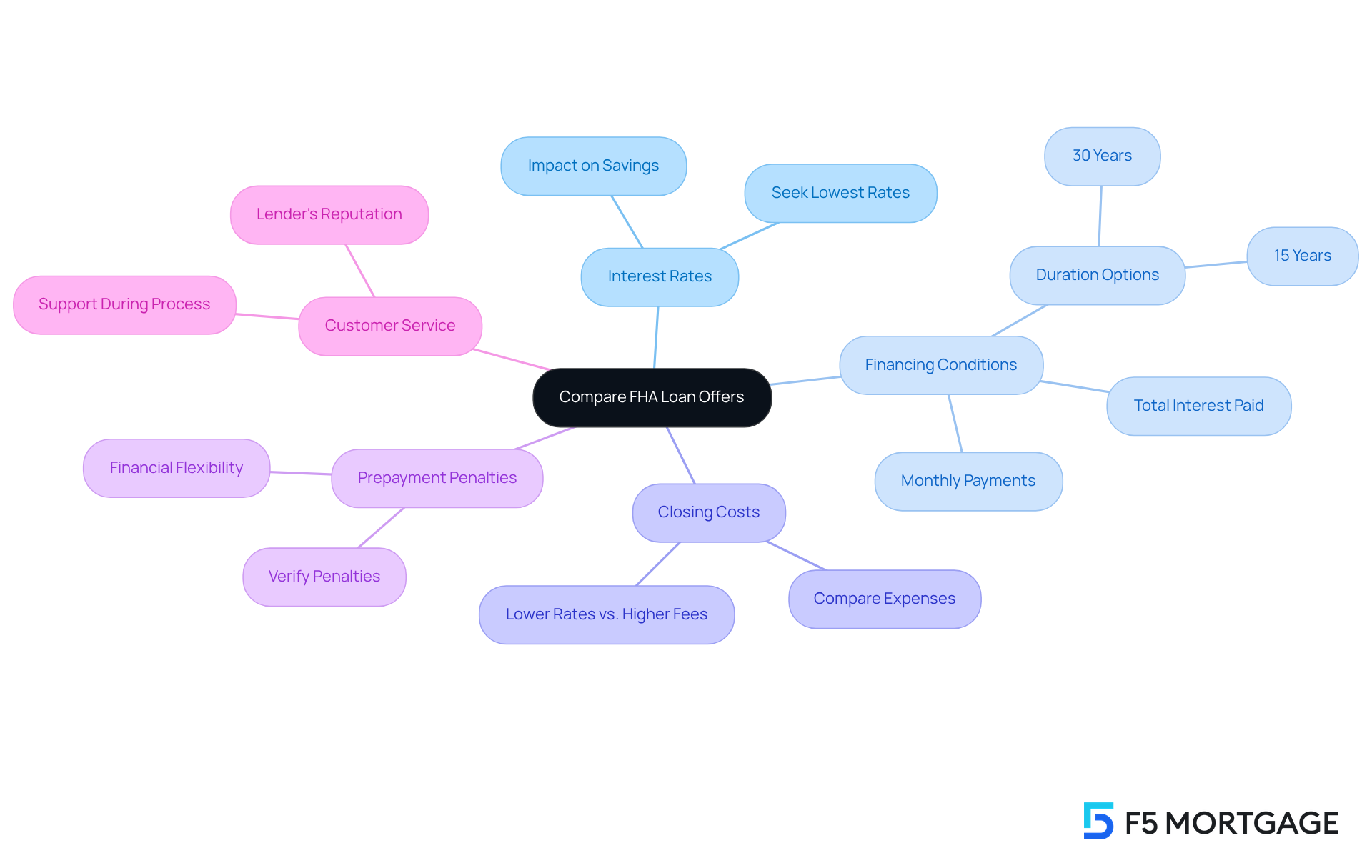

Compare FHA Loan Offers: Understanding Rates and Terms

When evaluating FHA financing options, we know how challenging it can be to navigate through various proposals from lenders. It’s crucial to compare these options to discover the best rates and conditions that suit your needs. Here are some key factors to evaluate:

- Interest Rates: Seek the lowest available interest rates. Even a minor difference can lead to substantial savings throughout the duration of your financing.

- Financing Conditions: Understand the duration of the financing, whether it’s 15 or 30 years, and how it influences your monthly payments and total interest paid.

- Closing Costs: Compare the closing expenses linked to each financing proposal. Some lenders may offer lower rates but charge higher fees.

- Prepayment Penalties: Verify if there are any penalties for settling your debt early. This can significantly influence your financial flexibility.

- Customer Service: Consider the lender’s reputation for customer service. A supportive lender can make your mortgage process much smoother.

By carefully comparing these factors, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way in securing the best possible FHA loan.

Conclusion

FHA loans serve as a crucial lifeline for aspiring homeowners, especially those with lower incomes or first-time buyers. We understand how daunting the journey to homeownership can be, but by grasping how FHA interest rates are influenced by credit scores, you can take proactive steps to enhance your financial standing and secure more favorable loan terms. The accessibility of these loans, characterized by lower down payment requirements and flexible credit criteria, highlights their significance in fostering homeownership among diverse communities.

Key insights reveal the profound effect credit scores have on FHA interest rates. A higher credit rating can lead to lower interest rates, which translates into significant savings over the life of your mortgage. Strategies for improving credit scores—such as making timely bill payments and reducing credit card balances—are essential for those aiming to qualify for the best possible rates. Additionally, comparing loan offers is vital, as even small differences in interest rates and terms can greatly influence your long-term financial outcomes.

Ultimately, the journey to homeownership through FHA loans is filled with opportunities for those ready to invest in their financial health. By prioritizing credit score improvement and diligently comparing loan options, you can position yourself for success in a competitive housing market. We know the path may be challenging, but with the right strategies and resources, the dream of homeownership is within reach for many families.

Frequently Asked Questions

What are FHA loans and who do they assist?

FHA loans are mortgages insured by the Federal Housing Administration, designed to help lower-income and first-time homebuyers secure financing.

What are the down payment requirements for FHA loans?

The down payment for FHA loans can be as low as 3.5% for individuals with a credit score of 580 or above. For those with credit scores between 500 and 579, a higher down payment of at least 10% is required.

How do FHA loans benefit lower-income families?

FHA loans provide accessibility due to reduced down payment criteria and the ability to incorporate certain closing expenses into the total loan amount, making homeownership more attainable for families with limited savings.

What is the anticipated impact of FHA financing in 2025?

In 2025, FHA financing is expected to benefit around 850,000 borrowers from lower-income families, with a decrease in yearly mortgage insurance premiums saving them approximately $678 million in the first year.

Can FHA loans accommodate various financial circumstances?

Yes, FHA loans cater to different financial situations, allowing borrowers with credit scores as low as 500 to qualify, although they may face stricter terms.

What recent updates have been made to FHA policies?

Recent updates include changes to borrowing limits and policies aimed at improving access to affordable housing for lower-income families.

How do FHA loans support first-time homebuyers?

FHA loans offer down payment assistance grants and flexible financing options, which help first-time buyers cover upfront costs and achieve homeownership despite economic challenges.