Overview

This article is dedicated to helping you effectively master manufactured home loan rates through a structured approach to financing. We understand how challenging this process can be, and it’s crucial to grasp the different loan types available to you.

By enhancing your financial profile and comparing various lenders, you can secure favorable terms that meet your needs. We’re here to support you every step of the way, providing comprehensive guidance on each part of the process to empower you in making informed decisions.

Introduction

Navigating the world of manufactured home financing can often feel overwhelming. We understand how challenging this can be, especially with the many loan options available. It’s essential to grasp the nuances of these loans to secure the best rates and terms. As you explore your options, you might be asking: what steps can you take to master the complexities of manufactured home loan rates and ensure a successful financing journey? This guide offers a comprehensive look at the essential strategies and insights you need to demystify manufactured home financing. We’re here to support you every step of the way, empowering you to make informed decisions that align with your homeownership goals.

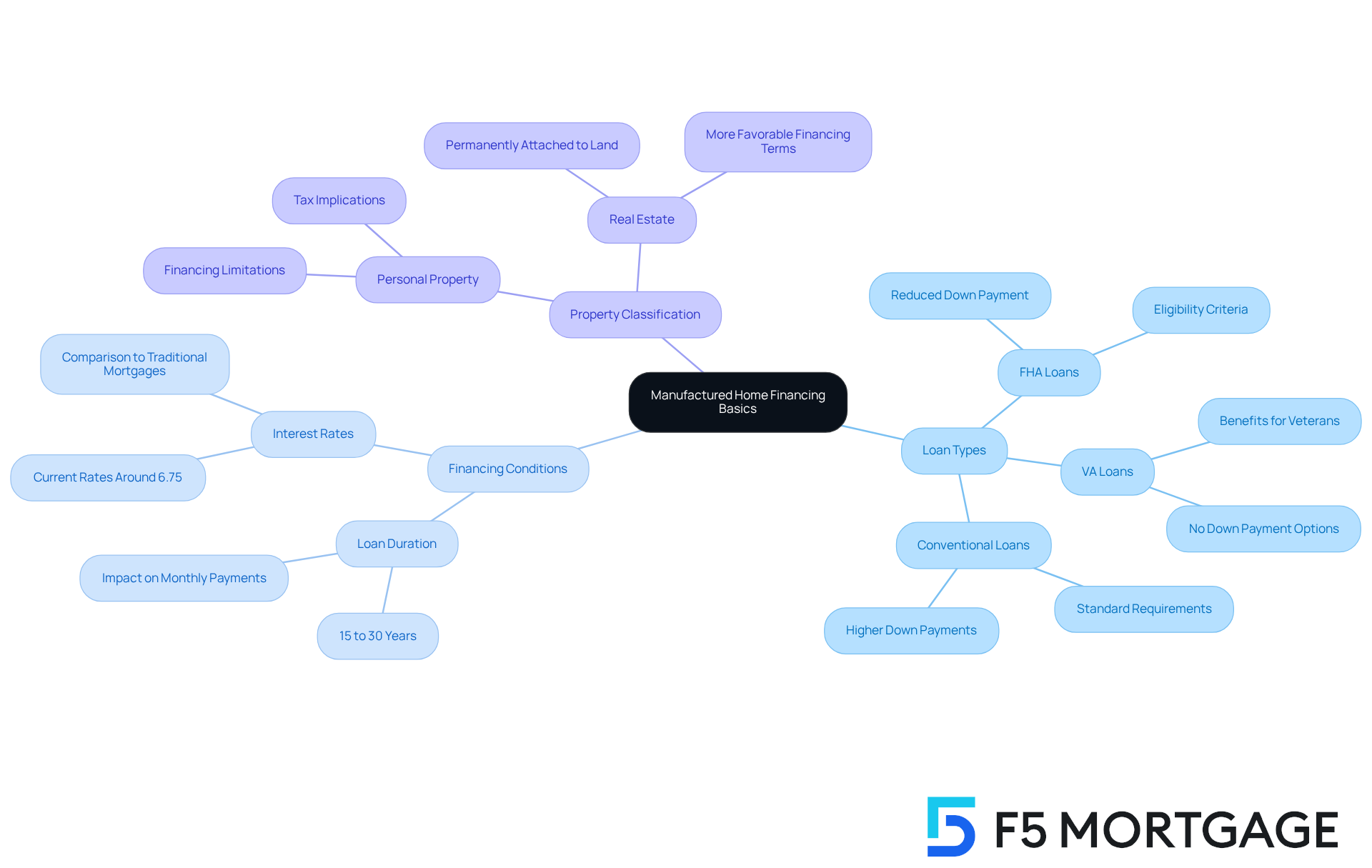

Understand Manufactured Home Financing Basics

Navigating manufactured property financing can feel overwhelming, especially when compared to conventional housing financing. Understanding the unique factors involved is essential for making that suit your needs. Here are some key aspects to consider:

- Loan Types: When it comes to financing manufactured homes, you have several options at your disposal, including FHA, VA, and conventional loans. Each type comes with its own eligibility criteria and benefits tailored to different borrower needs. For instance, FHA mortgages are often favored for their reduced down payment requirements, while VA financing offers advantageous conditions for qualified veterans and service members.

Manufactured home loan rates can vary significantly based on factors like credit score, financing type, and lender policies. As of September 2025, average manufactured home loan rates are competitive, starting around 6.75%, which closely aligns with the rates of traditional mortgages. We know how important it is for you to find favorable terms.

- Financing Conditions: Generally, financing for manufactured housing tends to have shorter durations compared to traditional mortgages, often spanning from 15 to 30 years. This difference can impact your monthly payments and overall financing costs, making it crucial to plan accordingly.

- Property Classification: It’s vital to determine whether your residence is classified as personal property or real estate. This classification directly affects your financing options and conditions. Homes categorized as real estate, which are permanently attached to land, typically enjoy more favorable financing terms.

By grasping these fundamentals, you can better navigate the complexities of securing financing for a manufactured dwelling. Remember, we’re here to support you every step of the way.

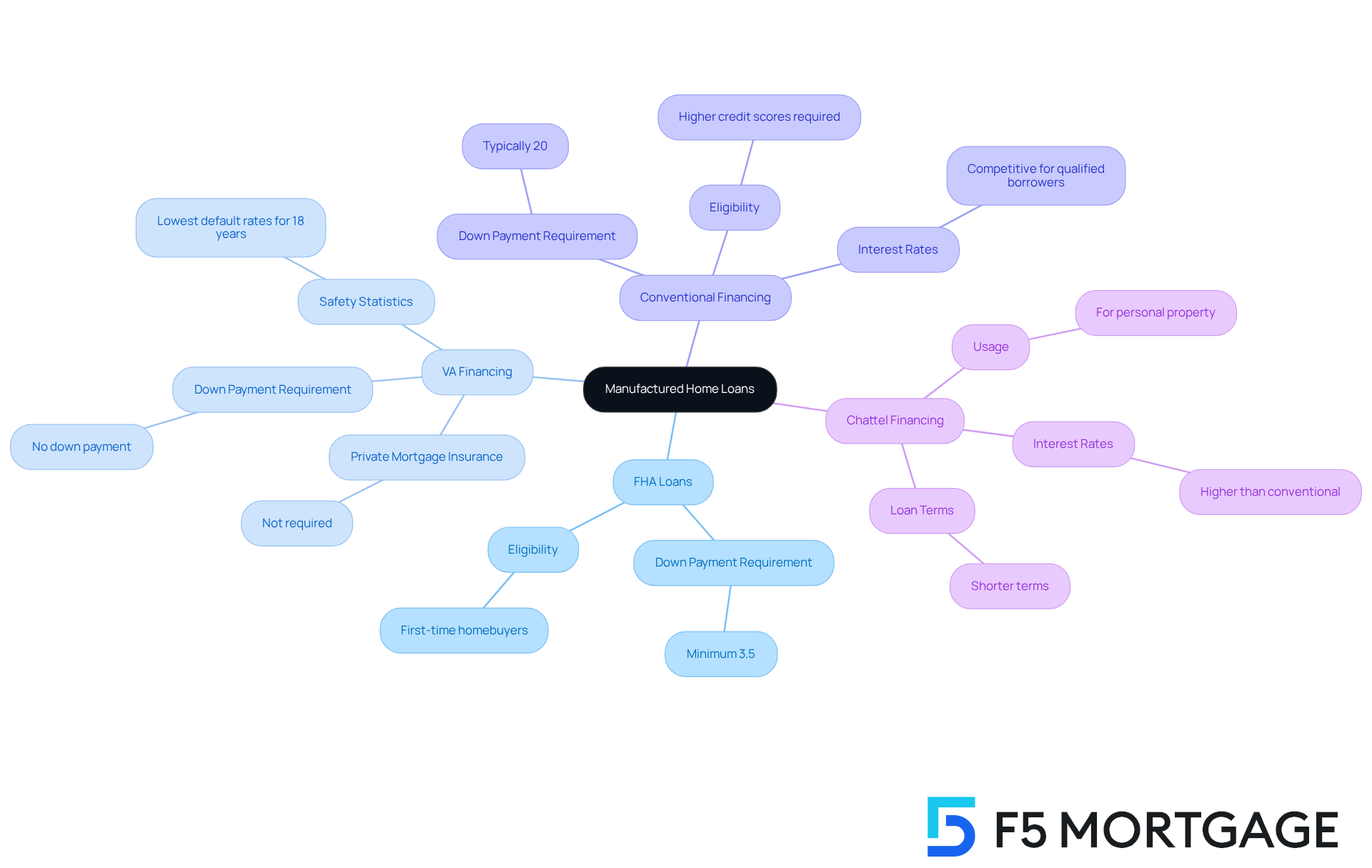

Explore Types of Manufactured Home Loans

When considering financing options for manufactured homes, it’s important to recognize the various choices available that can meet your needs:

- FHA Loans: These loans are particularly appealing for first-time homebuyers. With down payment requirements as low as 3.5% and flexible credit score criteria, FHA financing remains a viable option for those looking to enter the housing market in September 2025.

- VA Financing: Specifically designed for eligible veterans and active-duty service members, VA financing offers significant advantages. With and no private mortgage insurance (PMI), this option is excellent for veterans seeking to purchase manufactured homes. Recent statistics show that VA financing has consistently been the safest type for the past 18 years, contributing to lower default rates and helping many veterans achieve homeownership.

- Conventional Financing: Unlike government-backed options, conventional financing generally requires higher credit scores and down payments. However, they can offer competitive interest rates for qualified borrowers, making them a potential option for those with strong financial profiles.

- Chattel Financing: These funds are utilized for residences categorized as personal property. While they can be easier to acquire, chattel financing often carries higher interest rates and shorter terms compared to conventional mortgages, which may not be suitable for long-term funding.

By thoroughly assessing these choices, you can determine the financing type that best suits your financial circumstances and homeownership goals. If you are a veteran, consider utilizing the advantages of VA financing for purchasing a residence with manufactured home loan rates. Remember, we’re here to support you every step of the way.

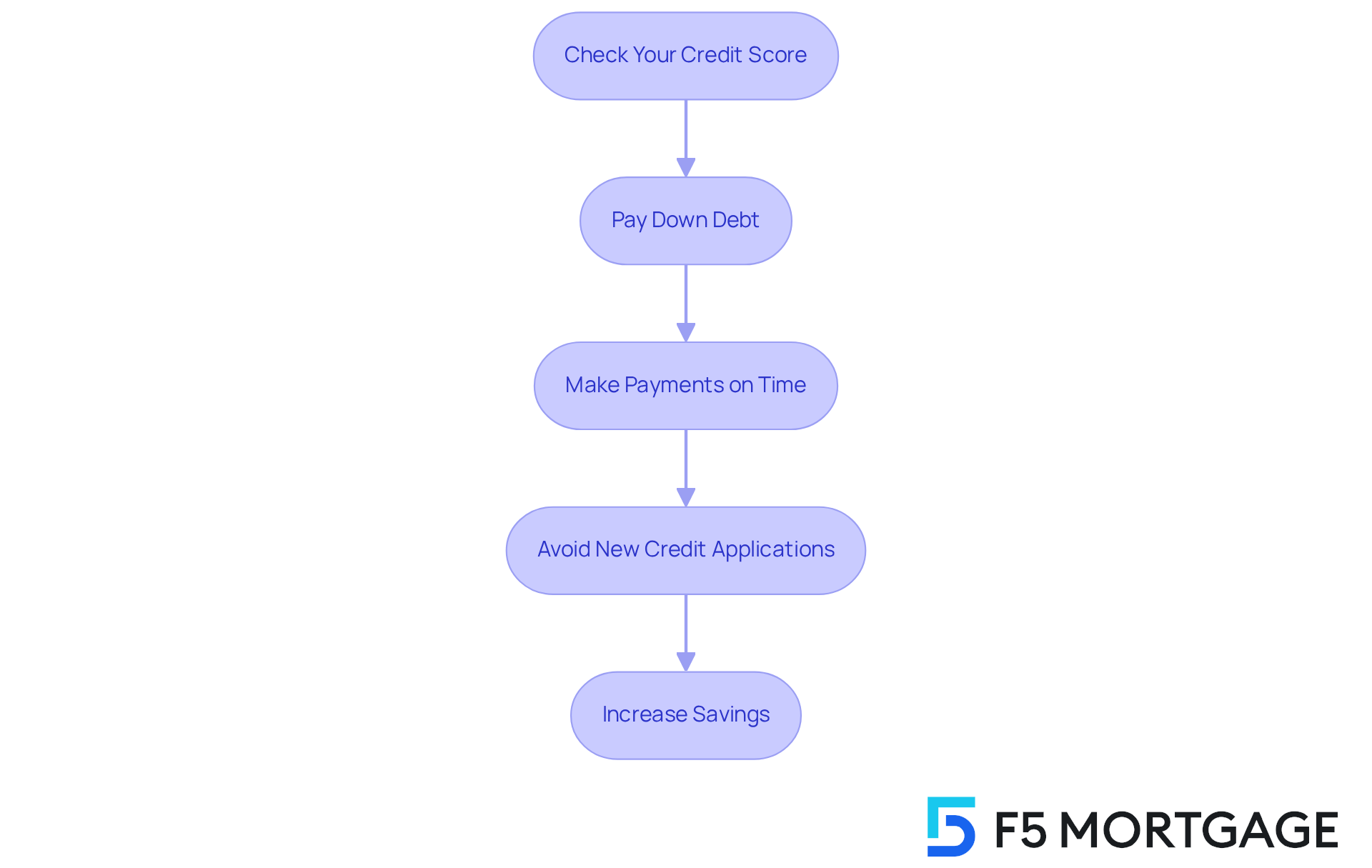

Enhance Your Financial Profile for Better Rates

Securing better manufactured home loan rates is within reach, and we’re here to support you every step of the way. By enhancing your financial profile, you can improve your chances of obtaining favorable terms. Here are some thoughtful steps to consider:

- Check Your Credit Score: Start by obtaining a copy of your credit report and checking your score. Aiming for a score of 620 or higher is advisable to qualify for most loan types. Remember, a higher credit score can significantly boost your chances of securing better mortgage terms.

- Pay Down Debt: Reducing existing debt can positively impact your credit utilization ratio, which should ideally be kept below 30%. This not only enhances your credit score but also demonstrates to financial institutions that you are managing your finances responsibly.

- Make Payments on Time: Consistently paying your bills on time is crucial for maintaining a good credit history. Since payment history accounts for 35% of your FICO score, it’s one of the most significant factors in determining your creditworthiness.

- Avoid New Credit Applications: It’s wise to limit new credit inquiries before applying for a mortgage. Multiple inquiries can lower your score, and each hard inquiry can temporarily reduce your credit score. Managing your credit applications carefully can help you maintain your score.

- Increase Savings: A larger down payment can decrease your borrowing amount and show financial stability to lenders. Plus, a substantial down payment may help you avoid Private Mortgage Insurance (PMI), which can add to your monthly payments.

By following these steps, you can enhance your chances of obtaining financing with favorable manufactured home loan rates. We understand how challenging this process can be, but taking these actions can ultimately make your smoother and more affordable.

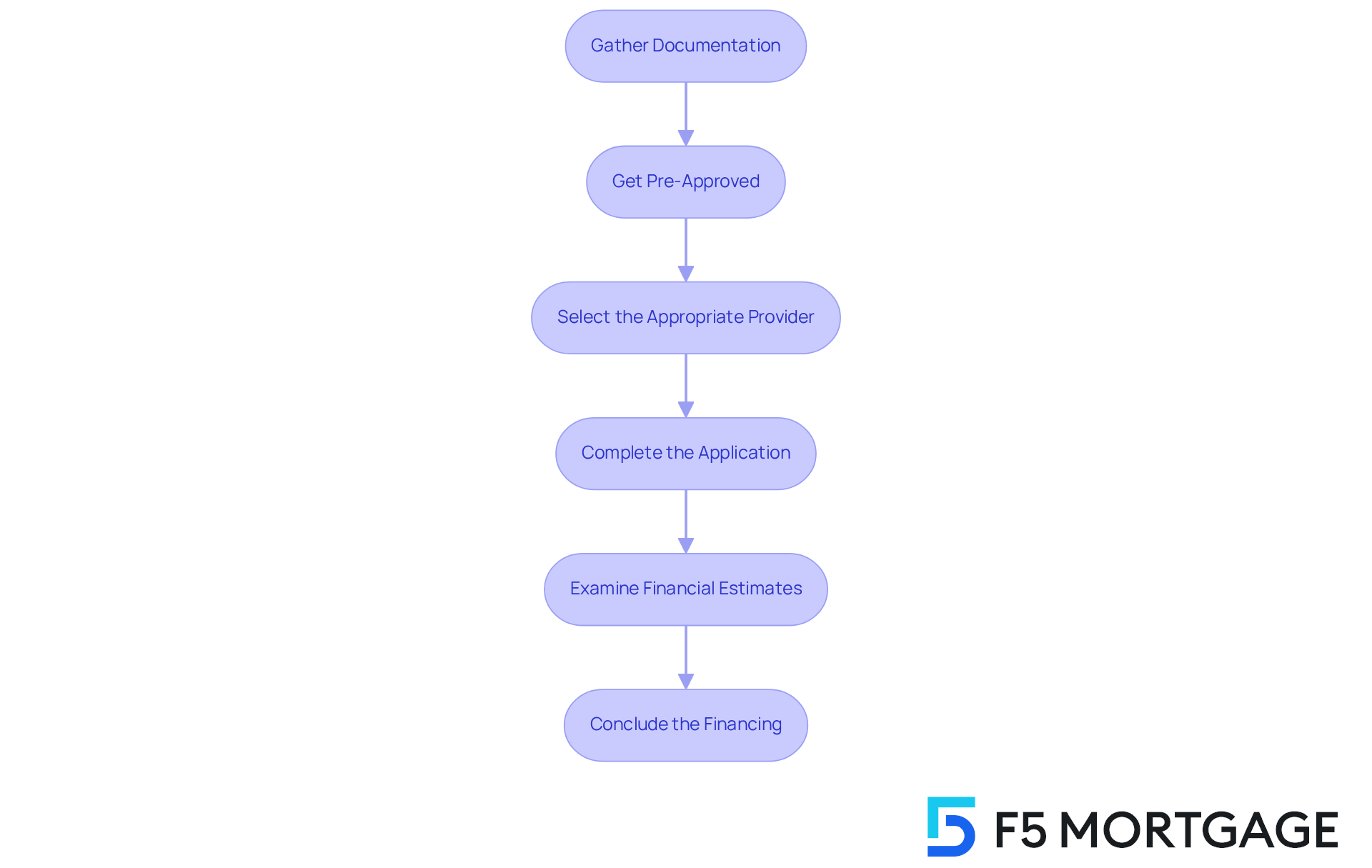

Apply for a Manufactured Home Loan Effectively

Applying for a manufactured home loan can feel overwhelming, but we’re here to support you with the manufactured home loan process every step of the way. By following these essential steps, you can navigate this process with confidence:

- Gather Documentation: Start by compiling the necessary documents, such as proof of income, tax returns, bank statements, and identification. We understand that lenders typically require comprehensive documentation to assess your financial situation accurately.

- Get Pre-Approved: It’s important to seek pre-approval from various financial institutions. This crucial step not only clarifies your borrowing capacity but also signals to sellers that you are a serious buyer. In competitive markets, obtaining a pre-approval can significantly improve your chances of acquiring a property.

- Select the Appropriate Provider: Take the time to investigate institutions that focus on manufactured home financing. To find the best fit for your needs, compare , fees, and customer reviews. A financial institution experienced in this niche can provide tailored advice and options that align with your situation.

- Complete the Application: When filling out the funding request, ensure that all necessary information and documentation are included. Incomplete applications can delay the process or lead to denials, and we know how frustrating that can be.

- Examine Financial Estimates: After submitting your application, carefully assess the financial estimates provided by the institutions. Concentrate on interest rates, closing expenses, and financing conditions to make a well-informed choice that suits your family’s needs.

- Conclude the Financing: Once you choose a lender, collaborate with them to finalize the financing. Make sure you fully understand all provisions and conditions before signing any contracts.

By following these steps, you can approach the application process with assurance, positioning yourself for success in obtaining financing for your manufactured home.

Compare Lenders and Negotiate Loan Terms

To secure the best deal on your manufactured home loan, we understand how crucial it is to adhere to these essential guidelines for comparing lenders and negotiating terms:

- Research Multiple Lenders: We know how overwhelming this process can be, so aim to obtain quotes from at least three different lenders. This allows you to effectively compare manufactured home loan rates, along with fees and financing terms. Research shows that borrowers who collect five estimates can potentially save over $6,000 throughout the duration of their financing.

- Understand Loan Estimates: As you review the loan estimates from each financial institution, pay special attention to the Annual Percentage Rate (APR), closing costs, and any additional fees. These factors significantly impact the overall cost of your mortgage, and we’re here to help you navigate this information.

- Negotiate Terms: Don’t hesitate to negotiate with financial institutions. Ask if they can lower the interest rate or reduce fees based on competing offers. Many borrowers have successfully negotiated better terms regarding manufactured home loan rates, leading to substantial savings, and you can too.

- Consider Customer Service: Evaluate the responsiveness and assistance provided by financial institutions. A provider with outstanding customer support can make the financing process smoother, which is essential during this important financial obligation.

- Lock in Your Rate: Once you identify a favorable rate, consider locking it in to protect against potential increases before closing. This strategy can shield you from market fluctuations that may occur during the processing period.

By diligently comparing lenders and negotiating terms, you can secure a loan that aligns with your financial goals and needs, particularly by focusing on manufactured home loan rates. Remember, we’re here to support you every step of the way.

Conclusion

Navigating the world of manufactured home financing can feel overwhelming, but we understand how crucial it is for buyers to feel empowered in making informed decisions. This guide highlights the importance of recognizing various loan types available—such as FHA, VA, and conventional loans—and the impact of credit scores and property classification on loan rates. By mastering these fundamentals, prospective homeowners can position themselves for more favorable financing options.

Throughout this article, we’ve shared essential strategies to enhance your financial profile. Improving credit scores, managing debt effectively, and preparing thorough documentation for loan applications are all vital steps. Additionally, the significance of comparing lenders and negotiating terms to secure the best possible rates is emphasized, offering you actionable steps to optimize your financing experience.

Ultimately, approaching the journey to obtaining a manufactured home loan with knowledge and confidence is key. By leveraging the insights provided, you can navigate this process more effectively, leading to better loan terms and a smoother path to homeownership. Embracing these strategies not only enhances your financial stability but also empowers you to make choices that align with your long-term goals. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are the main types of loans available for financing manufactured homes?

The main types of loans for financing manufactured homes include FHA loans, VA financing, conventional financing, and chattel financing. Each type has different eligibility criteria and benefits tailored to various borrower needs.

What are the benefits of FHA loans for manufactured homes?

FHA loans are appealing for first-time homebuyers due to their low down payment requirements, which can be as low as 3.5%, and flexible credit score criteria.

Who is eligible for VA financing and what are its advantages?

VA financing is designed for eligible veterans and active-duty service members. Its advantages include no down payment requirement and no private mortgage insurance (PMI), making it an excellent option for veterans seeking to purchase manufactured homes.

How does conventional financing differ from government-backed options?

Conventional financing generally requires higher credit scores and down payments compared to government-backed options like FHA and VA loans. However, it can offer competitive interest rates for qualified borrowers.

What is chattel financing and when is it used?

Chattel financing is used for residences categorized as personal property. It is often easier to acquire but typically comes with higher interest rates and shorter terms compared to conventional mortgages, making it less suitable for long-term funding.

How do manufactured home loan rates compare to traditional mortgage rates?

As of September 2025, average manufactured home loan rates are competitive, starting around 6.75%, which closely aligns with the rates of traditional mortgages.

What are the typical financing durations for manufactured homes?

Financing for manufactured homes generally has shorter durations compared to traditional mortgages, often spanning from 15 to 30 years, which can impact monthly payments and overall financing costs.

Why is property classification important in manufactured home financing?

Property classification is crucial because it determines whether the home is classified as personal property or real estate, which directly affects financing options and conditions. Homes categorized as real estate, permanently attached to land, typically enjoy more favorable financing terms.