Overview

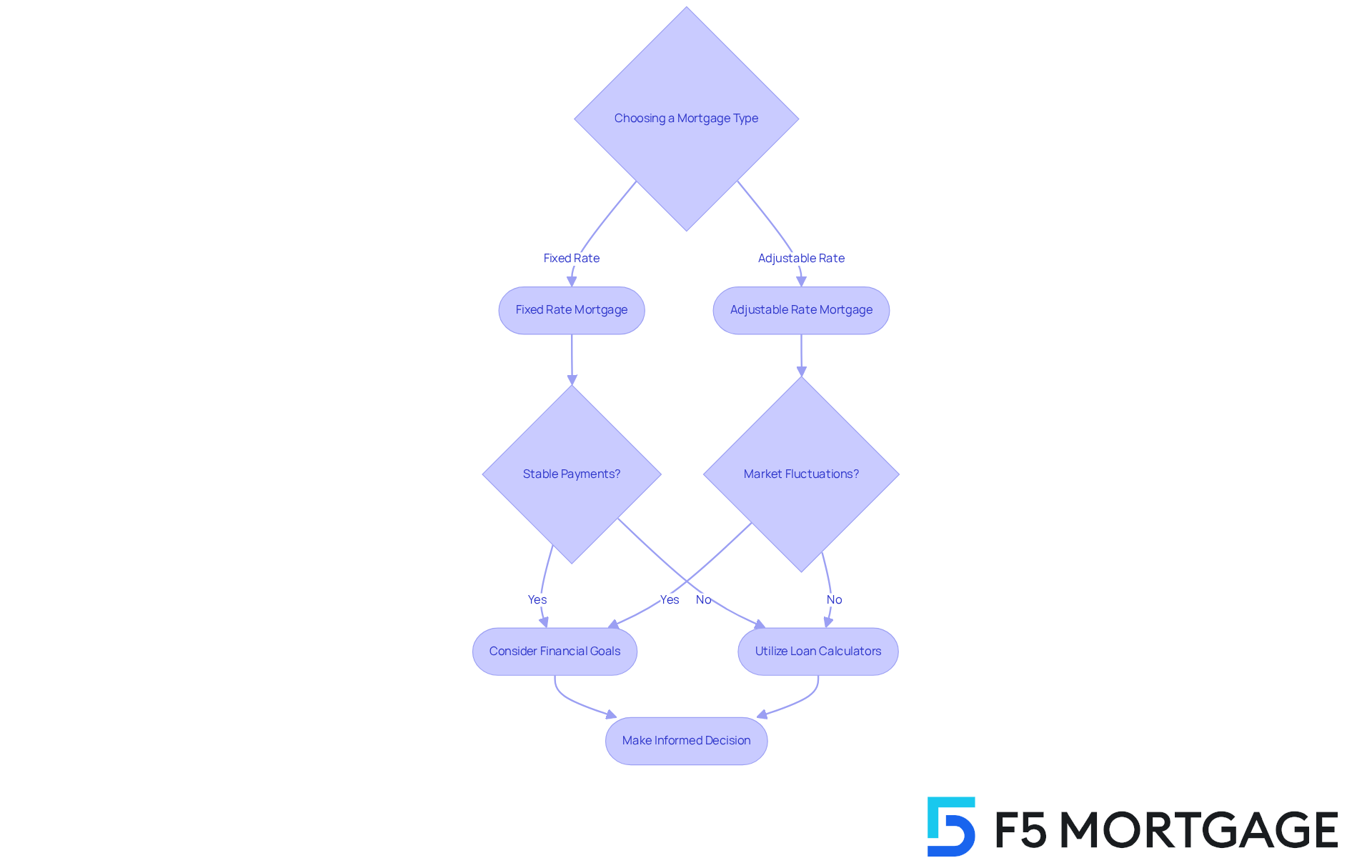

Navigating the world of mortgages can feel overwhelming, and we know how challenging this can be. This article explores the advantages and disadvantages of fixed-rate versus adjustable-rate mortgages, helping you make informed decisions aligned with your financial goals and risk tolerance.

Fixed-rate mortgages offer stability and predictability in payments, which can be a comforting choice for many families. You can plan your budget with confidence, knowing what to expect each month. On the other hand, adjustable-rate mortgages may provide initial savings, but they come with potential risks due to fluctuating rates. It’s important to weigh these factors carefully.

Ultimately, consider your long-term objectives when choosing between these two options. We’re here to support you every step of the way, ensuring you find a mortgage solution that fits your unique needs.

Introduction

Navigating the world of mortgages can feel overwhelming, especially when choosing between fixed-rate and adjustable-rate options. We understand how challenging this can be. Each choice comes with its own set of advantages and potential pitfalls, making it essential for borrowers to grasp their financial landscape and long-term goals. In this article, we delve into seven key insights that illuminate the benefits and drawbacks of both mortgage types. Our aim is to offer you a comprehensive guide to making informed decisions.

As families weigh their options, the question remains: which mortgage structure will best safeguard their financial future while accommodating their evolving needs? We’re here to support you every step of the way.

F5 Mortgage: Personalized Consultations for Fixed vs Adjustable Rate Mortgages

At F5 Mortgage, we understand how challenging the financing process can be. That’s why personalized consultations are essential. We encourage clients to engage in open discussions about their financial goals, preferences, and concerns with our experienced brokers, who are dedicated to providing the red carpet treatment.

This tailored approach empowers families to carefully evaluate the advantages and disadvantages of fixed rate vs adjustable rate mortgage options. We want to ensure you select the option that aligns with your . Our brokers utilize an extensive network of lenders to offer customized loan solutions that address individual needs, including unique challenges such as varying immigration statuses and self-employment situations.

Our commitment to individualized service not only improves customer satisfaction but also encourages informed decision-making. Ultimately, this results in better financial outcomes for you and your family. Furthermore, clients benefit from complimentary services offered by our loan brokers, which assist in safeguarding your credit scores while you evaluate various lending options.

To begin this journey, we invite families to arrange a complimentary consultation with F5 Mortgage today. Let us help you examine your financing choices and support you every step of the way.

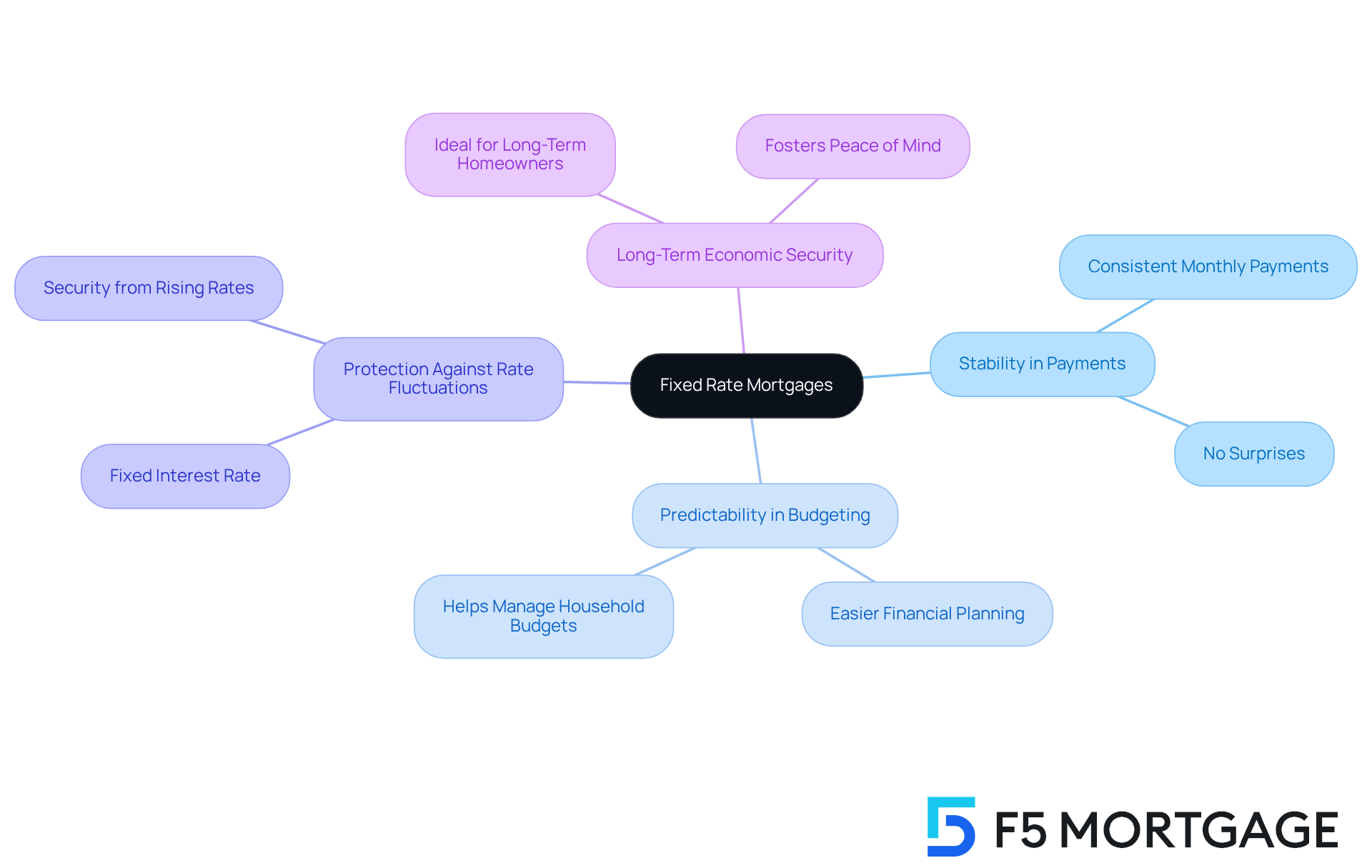

Fixed Rate Mortgages: Stability and Predictability in Payments

When considering fixed rate vs adjustable rate mortgage options, offer the comforting benefit of stable monthly payments that remain unchanged throughout the entire term. This predictability is especially valuable for families striving to manage their budgets effectively. By choosing a fixed rate vs adjustable rate mortgage, borrowers can feel secure against fluctuations in interest rates, allowing them to navigate their finances with confidence, free from the anxiety of rising payments. This stability is particularly beneficial for individuals planning to stay in their homes for an extended period, fostering a sense of economic security and peace of mind.

We understand how important financial stability is, and that’s why wealth advisors often recommend considering fixed rate vs adjustable rate mortgage options as a reliable budgeting strategy. They highlight the essential role these loans play in nurturing economic stability. In fact, surveys reveal that many homeowners prefer fixed-rate options when considering fixed rate vs adjustable rate mortgage, reflecting a widespread desire for predictable financial commitments. Real-life stories abound, showcasing families who have successfully managed their financial journeys with fixed-rate loans, reaping the rewards of consistent payments while investing in their homes. This trend underscores the significance of understanding fixed rate vs adjustable rate mortgage options in achieving long-term financial goals.

We know how challenging this can be, but choosing a fixed-rate loan can be a powerful step toward financial peace. We’re here to support you every step of the way as you consider your options.

Adjustable Rate Mortgages: Flexibility with Potential Risks

Adjustable interest loans (ARMs) can be a great option for borrowers looking to save on monthly expenses. They often offer reduced initial interest rates compared to a fixed rate vs adjustable rate mortgage, which is appealing for many families. However, it’s important to understand the implications of a fixed rate vs adjustable rate mortgage, as these rates can change after an initial fixed period, potentially leading to higher monthly payments.

To help you navigate these changes, securing your loan interest as soon as your application is approved is crucial. This step can protect you from market fluctuations while your loan is being processed. While considering a fixed rate vs adjustable rate mortgage, ARMs can be particularly before the rates adjust, but it’s essential to be aware of the risks, such as rising payments that could strain your budget.

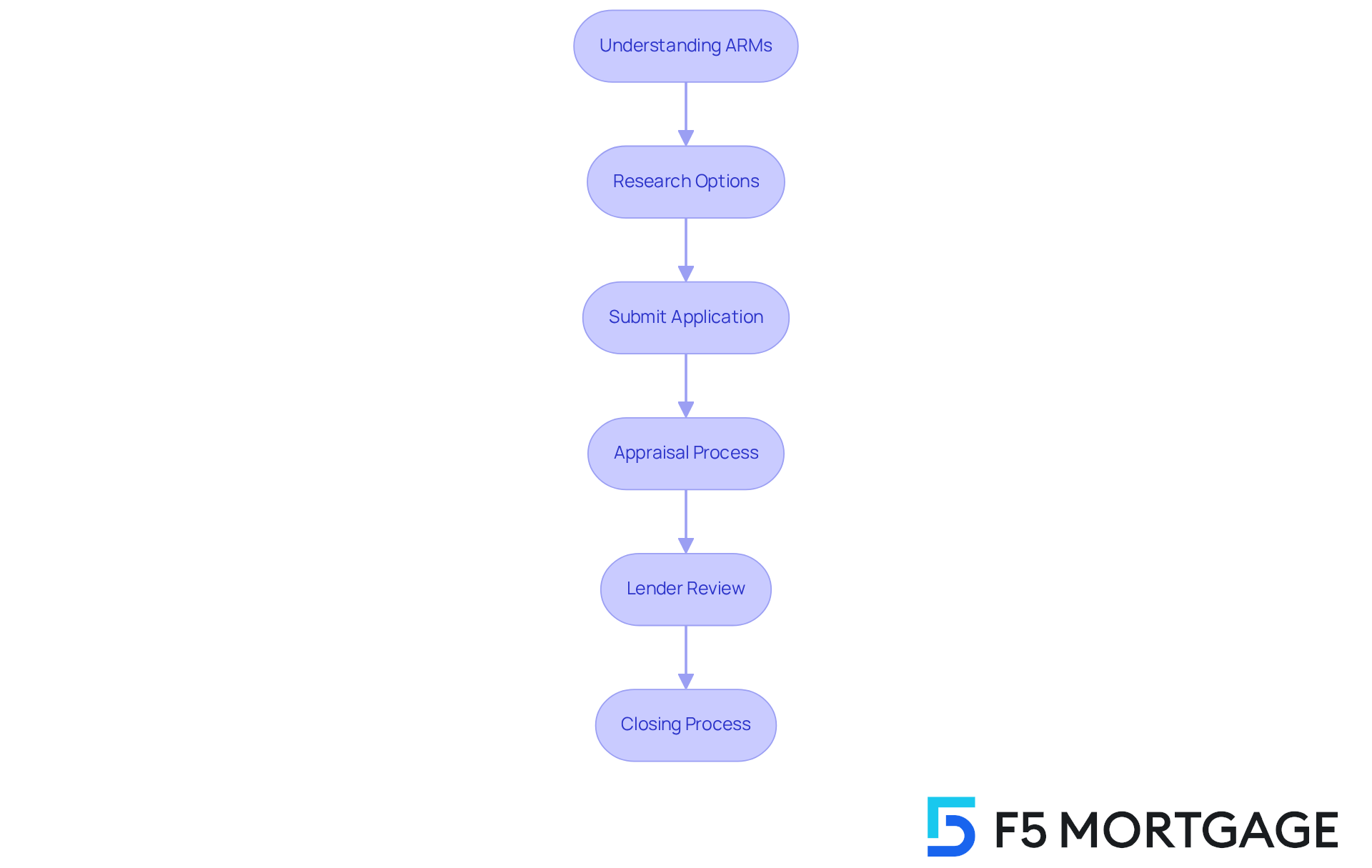

Understanding your break-even point for loan refinancing is vital. This involves:

- Researching your options

- Submitting an application

- Going through an appraisal process to determine your property’s current value

After that, the lender will review your application and financial history during the underwriting phase, followed by the closing process where you finalize the agreement and pay the closing costs.

By being informed about refinancing eligibility and the importance of appraisal, you can make better decisions regarding your loan options. We know how challenging this can be, so consider seeking advice from a loan consultant who can help you explore the best refinancing strategies suited to your financial situation. We’re here to support you every step of the way.

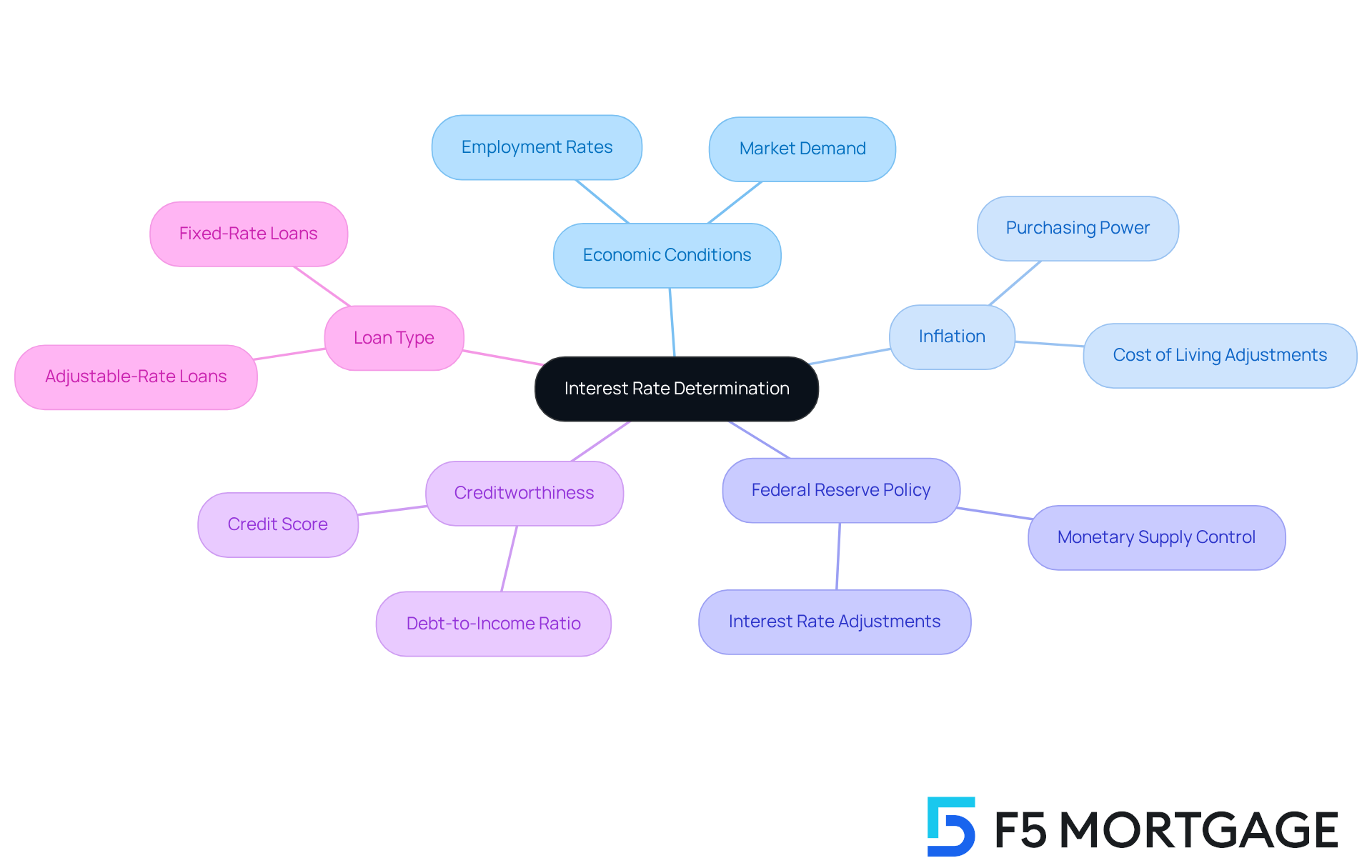

Interest Rate Determination: How Lenders Set Rates for Mortgages

Understanding home loans can feel overwhelming, but we’re here to help you navigate through it. Interest levels for home loans are influenced by various factors, such as economic conditions, inflation, and the Federal Reserve’s monetary policy. Lenders carefully consider these elements alongside your creditworthiness and the type of loan you’re seeking to determine the terms they offer.

By grasping these factors, you can better anticipate market fluctuations and make informed decisions about when to lock in your rates. This knowledge empowers you to secure the most for your loan, ultimately easing some of the stress associated with this process.

For homeowners in California, refinancing might be a strategic choice, especially if your property has appreciated in value. Removing private mortgage insurance (PMI) can significantly improve your loan-to-value (LTV) ratio, opening up potential cash-out options for significant expenses. When you’re considering refinancing, it’s essential to connect with lenders to compare rates, fees, and terms.

At F5 Mortgage, we understand how critical these decisions are. That’s why we pride ourselves on offering competitive pricing and personalized support, making us a trusted partner in your refinancing journey. Remember, we’re here to support you every step of the way.

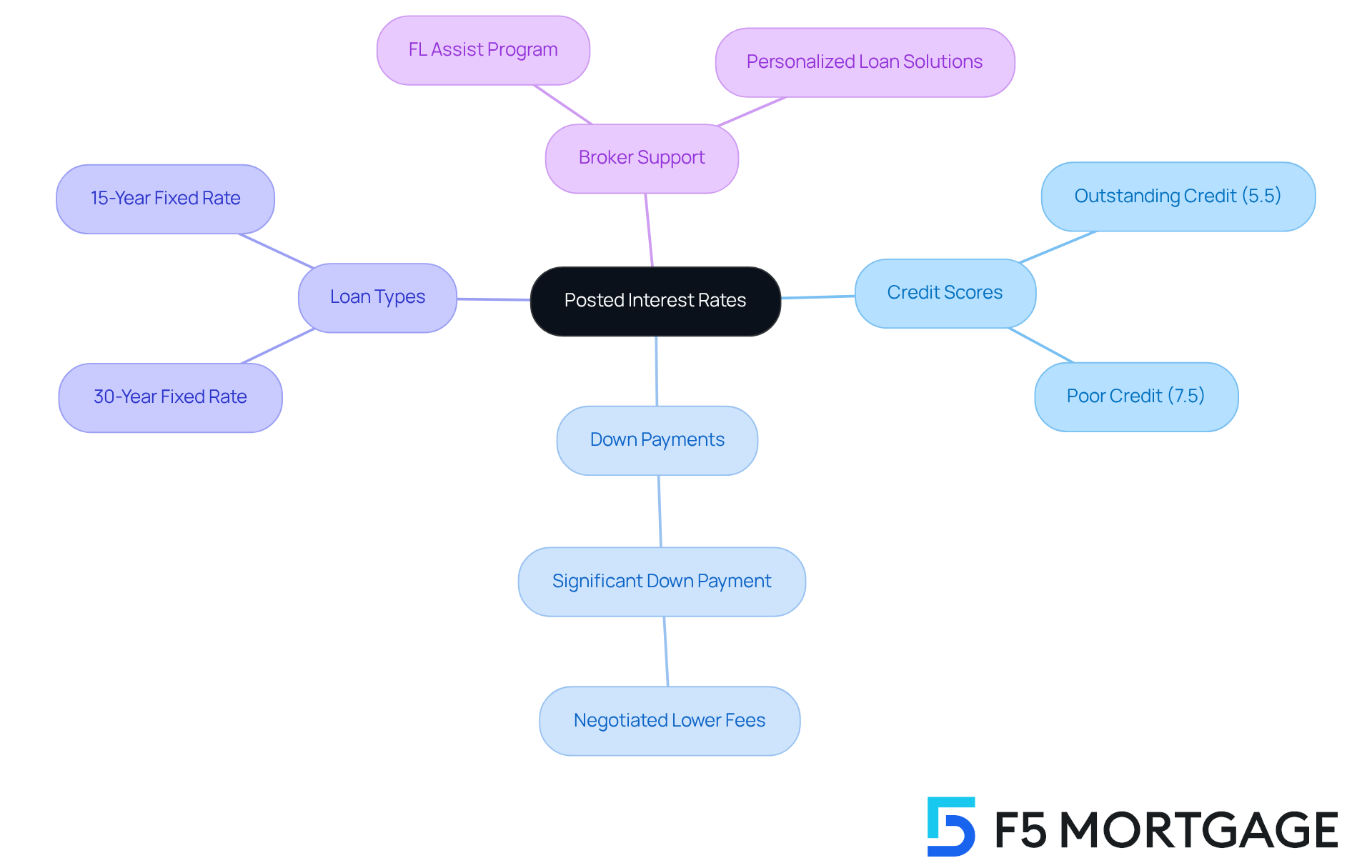

Posted Interest Rates: What Borrowers Need to Know

Posted interest figures represent the numbers advertised by lenders, but they often do not reflect the actual terms borrowers will obtain. We understand how confusing this can be. Various factors, including credit scores, down payments, and loan types, significantly affect the final offer presented. For example, in 2025, borrowers with outstanding credit scores (usually above 740) can anticipate terms that are significantly more advantageous, averaging around 5.5%. In contrast, those with poor credit histories may encounter figures surpassing 7.5%.

At F5 Mortgage, we collaborate with more than twenty leading lenders to ensure our customers receive the best possible offer tailored to their unique financial circumstances. Our personalized approach means we not only help you understand how your credit score and down payment can influence your costs, but we also actively advocate on your behalf to secure better conditions. For instance, a borrower with a strong income and a significant down payment was able to negotiate a lower fee by effectively conveying their financial strengths to the lender. This demonstrates how our support can empower individuals.

Our customers have expressed their satisfaction with our services, with one stating, ‘The F5 Mortgage team made the process so easy and stress-free! I couldn’t have asked for better support.’ We know how important it is to feel supported during this process.

Borrowers should consider posted rates as a standard and consult with their loan brokers to understand how their individual circumstances may affect the rates they are eligible for. This proactive approach not only empowers individuals to negotiate better terms but also equips them with the knowledge needed to make informed decisions. Furthermore, loan brokers highlight that understanding personal situations can lead to improved loan conditions, as they can customize solutions according to each client’s financial profile.

Moreover, it’s crucial to take into account the recent adjustments in Freddie Mac’s approach for monitoring mortgage costs, which now provides a more comprehensive perspective of the market. This context can help borrowers understand the dynamics of current rates and make more informed choices. At F5 Mortgage, we are committed to enhancing home buying opportunities. We also explore such as FL Assist and the MI Home Loan program, which can provide valuable support to our clients in achieving their homeownership goals.

Understanding Interest Costs: What You Can Expect

Understanding interest expenses is crucial for borrowers, as they can significantly impact the total amount paid over the life of a loan. We understand how challenging this can be, and it’s important to grasp how interest is calculated and how it differs in a fixed rate vs adjustable rate mortgage.

When comparing fixed rate vs adjustable rate mortgage, the interest for remains constant, providing stability. In contrast, the discussion of fixed rate vs adjustable rate mortgage shows that adjustable-rate mortgages (ARMs) may experience fluctuations due to market conditions, typically adjusting every six months after an introductory period with a lower rate. This unpredictability can influence your overall expenses.

As you navigate these options, consider your financial goals and strategies for your property. Comprehending home equity requirements, such as maintaining a minimum 80% home-to-value ratio and a maximum 43% debt-to-income (DTI) ratio, can lead to more competitive financing options. We’re here to support you every step of the way.

To help you make informed choices about which type of loan aligns with your financial aspirations, utilizing loan calculators can be invaluable. These tools allow you to estimate your total interest expenses based on various scenarios, empowering you to take control of your financial future.

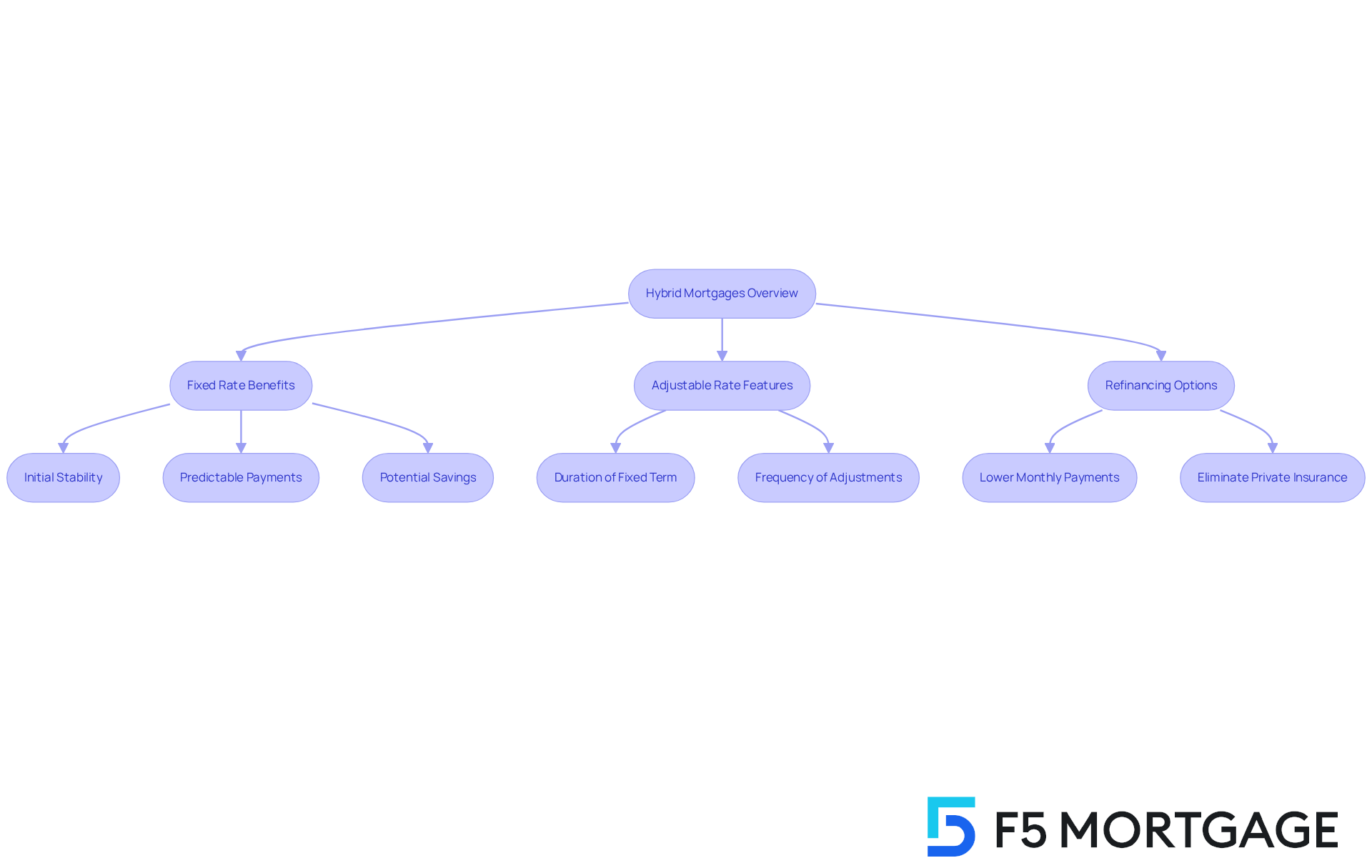

Hybrid Mortgages: Combining Fixed and Adjustable Features

Hybrid loans combine the best features of fixed rate vs adjustable rate mortgage options. They typically offer a fixed rate vs adjustable rate mortgage, starting with a fixed interest rate for a set period to provide you with initial payment stability before transitioning to an adjustable rate. This option is particularly appealing for those of you seeking the comfort of predictable payments while keeping the door open for potential savings down the line.

It’s important to carefully assess the conditions of hybrid loans. Take a close look at the duration of the fixed term and the frequency of adjustments to ensure they align with your financial strategy. At F5 Mortgage, we understand that navigating these choices can be overwhelming, and we’re here to support you every step of the way.

Additionally, F5 Mortgage provides various refinancing options that allow you to modify your loan terms. This could mean extending the period to lower your monthly payments or shortening it to pay off your debt sooner. If you purchased your home with a traditional loan and made a down payment of less than 20%, refinancing might also help you eliminate private insurance, especially given the rising property values in California.

We know how challenging this process can be, but F5 Mortgage is committed to leveraging technology to offer and a straightforward, hassle-free lending experience. Our goal is to empower you to make informed financial choices that best suit your family’s needs.

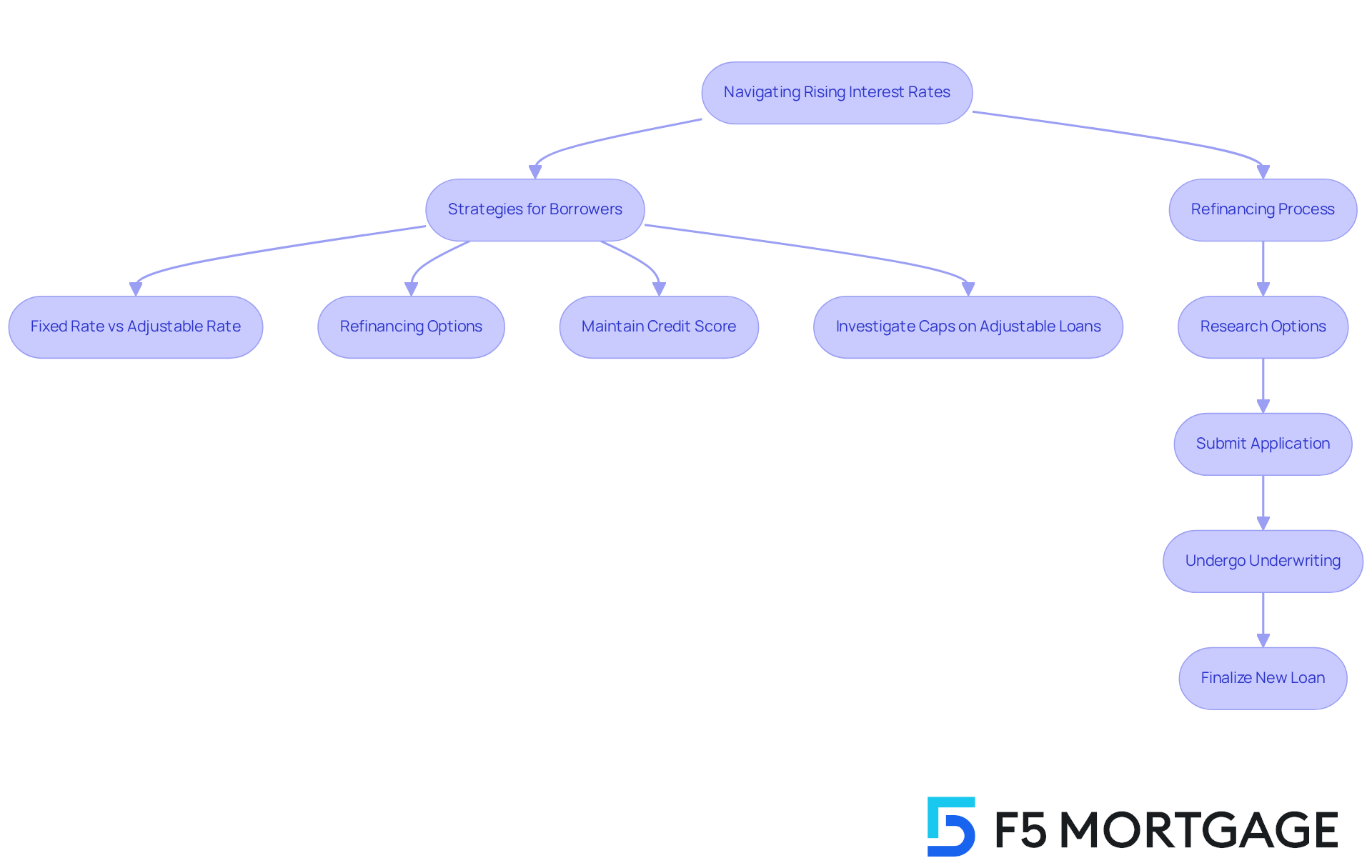

Protecting Against Rising Rates: Strategies for Borrowers

We understand how challenging it can be to navigate rising interest levels. To , consider exploring various strategies. Securing a fixed rate vs adjustable rate mortgage can provide you with long-term stability, while refinancing options may be available if rates decrease. It’s also crucial to maintain a robust credit score, as this can help you secure better terms. Additionally, investigating alternatives such as caps on adjustable loans can provide you with extra protection when considering fixed rate vs adjustable rate mortgage options.

Staying informed about market trends is essential. By working closely with F5 Mortgage, you can effectively navigate potential rate increases. Our personalized service and extensive lender partnerships ensure that you have access to the best financing solutions tailored to your needs.

To further enhance your understanding, here are some steps in the refinancing process:

- Research your options,

- Submit an application,

- Undergo underwriting,

- Finalize your new loan.

These steps will guide you through the refinancing journey, empowering you to make informed decisions.

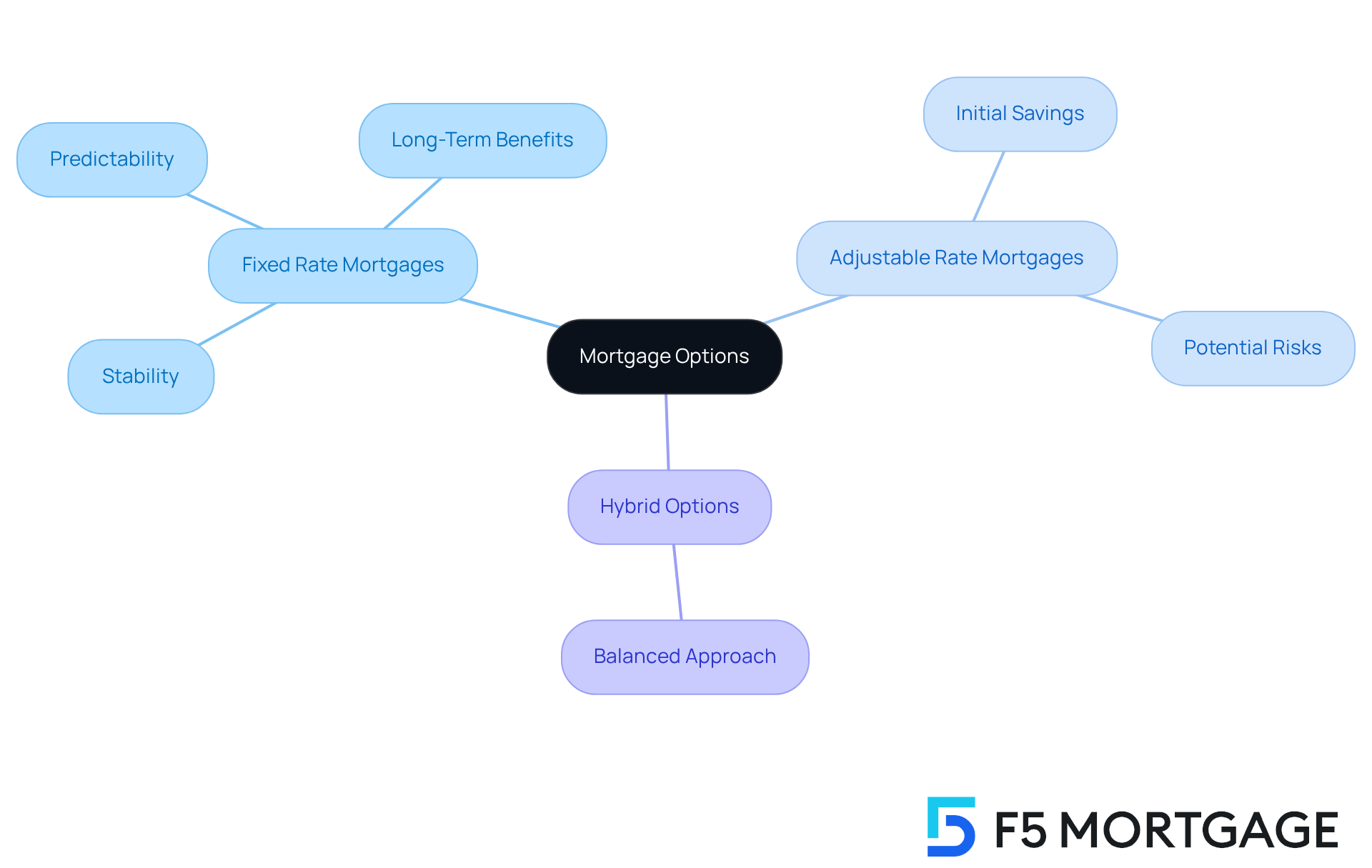

Key Takeaways: Choosing Between Fixed and Adjustable Rate Mortgages

When choosing between a fixed rate vs adjustable rate mortgage, we understand how important it is to evaluate your financial circumstances, long-term goals, and risk appetite. When considering fixed rate vs adjustable rate mortgage options, provide stability and predictability, making them an excellent choice for long-term homeowners. On the other hand, when considering fixed rate vs adjustable rate mortgage options, adjustable interest loans may provide initial savings, but they also come with potential risks. If you’re looking for a balance, hybrid options might be the perfect fit for you.

At F5 Mortgage, we prioritize your satisfaction. We’re here to support you every step of the way, ensuring you receive personalized assistance throughout the financing process. Our commitment to transparency, combined with our use of technology, allows us to offer competitive rates without the stress of hard sales tactics.

Engaging in personalized consultations with our knowledgeable mortgage brokers can help you navigate these choices. Together, we can explore the best mortgage solution for your needs, including down payment assistance programs like FL Assist and the MI Home Loan program. These options can enhance your home buying opportunities, making the journey smoother and more accessible.

Conclusion

Choosing the right mortgage option is a critical decision that can significantly impact your long-term financial stability. We understand how challenging this can be. Exploring fixed rate versus adjustable rate mortgages reveals unique advantages and potential drawbacks for each option.

- Fixed rate mortgages offer the peace of mind that comes from predictable payments, making them ideal for families seeking stability.

- In contrast, adjustable rate mortgages provide initial savings but carry the risk of fluctuating payments in the future.

Throughout this article, we’ve highlighted the importance of understanding your personal financial goals, the dynamics of interest rates, and the benefits of personalized consultations.

- Fixed rate mortgages are often favored for their reliability, while adjustable rate options can be advantageous for those willing to navigate their inherent risks.

- For those seeking a balance, hybrid mortgages present a viable solution, combining the benefits of both fixed and adjustable features to cater to diverse financial needs.

Ultimately, the choice between fixed and adjustable rate mortgages hinges on your individual circumstances and preferences. Engaging with knowledgeable mortgage brokers can provide invaluable guidance, helping you make informed decisions that align with your financial aspirations. By taking proactive steps—such as understanding market trends and exploring various loan options—you can secure a mortgage solution that not only meets your immediate needs but also supports your long-term financial health. We’re here to support you every step of the way.

Frequently Asked Questions

What services does F5 Mortgage offer?

F5 Mortgage offers personalized consultations to help clients evaluate fixed rate vs adjustable rate mortgage options, providing tailored loan solutions based on individual financial goals and needs.

Why are personalized consultations important at F5 Mortgage?

Personalized consultations allow clients to engage in open discussions about their financial goals, preferences, and concerns, which helps them make informed decisions that align with their long-term objectives.

What are the advantages of fixed-rate mortgages?

Fixed-rate mortgages offer stable monthly payments that remain unchanged throughout the loan term, providing predictability and economic security, especially for families planning to stay in their homes long-term.

How do fixed-rate mortgages contribute to financial stability?

They help borrowers manage their budgets effectively by protecting them from fluctuations in interest rates, allowing for consistent payments and reducing financial anxiety.

What are adjustable rate mortgages (ARMs)?

ARMs are loans that offer lower initial interest rates compared to fixed-rate mortgages but can change after an initial fixed period, potentially leading to higher monthly payments.

Who might benefit from adjustable rate mortgages?

Borrowers who plan to refinance before the rates adjust may find ARMs beneficial, as they can save on monthly expenses initially.

What should borrowers consider before choosing an adjustable rate mortgage?

Borrowers should understand the risks of rising payments after the initial fixed period and be informed about their refinancing options and eligibility.

What steps are involved in refinancing a mortgage?

The steps include researching options, submitting an application, going through an appraisal process to determine the property’s value, and then completing the underwriting and closing processes.

How does F5 Mortgage support clients during the financing process?

F5 Mortgage provides complimentary services that assist in safeguarding clients’ credit scores while they evaluate various lending options, along with expert advice throughout the process.