Overview

This article is designed to guide you through the essential FHA loan requirements that every homebuyer in Florida should be aware of. We understand how overwhelming this process can feel, and it’s important to know that you’re not alone. By grasping these key requirements—like credit score thresholds, down payment options, and debt-to-income ratios—you can navigate the FHA financing process with confidence. Our goal is to help you achieve your dream of homeownership.

Understanding these requirements is crucial for prospective buyers. We know how challenging this can be, but with the right information, you can take empowered steps towards your future. Let’s explore how each of these elements plays a role in your journey, ensuring you feel supported every step of the way.

Remember, you have the ability to make informed decisions that align with your financial situation. Together, we can work through these requirements, transforming what seems daunting into a manageable path to homeownership.

Introduction

Navigating the journey to homeownership can often feel like traversing a complex maze, especially for first-time buyers in Florida. We understand how overwhelming this process can be, particularly when faced with a myriad of FHA loan requirements. Grasping the nuances of these financing options is essential for making informed decisions that can alleviate financial stress and enhance access to homeownership.

This article explores the crucial FHA loan criteria every homebuyer should be aware of, offering insights designed to empower you. But what are the key factors that can determine the success of an FHA loan application in Florida? How can you, as a prospective buyer, effectively prepare to meet these requirements? Let’s delve into this together, ensuring you feel supported every step of the way.

F5 Mortgage: Personalized FHA Loan Consultations for Florida Homebuyers

At F5 Mortgage, we understand how daunting the FHA loan requirements FL can be, especially for Florida property purchasers. That’s why we provide customized FHA financing consultations designed specifically for your needs. Our personalized approach allows us to thoroughly assess your unique financial situation, enabling us to recommend the most suitable financing options. With our support, you can with greater confidence and ease.

The importance of tailored consultations cannot be overstated, particularly for first-time homebuyers who often face challenges such as limited savings for upfront costs. We’re here to help you understand the benefits of FHA financing, particularly the FHA loan requirements FL, which include an incredibly low down payment requirement of just 3.5%. This accessibility can significantly ease the financial strain for many buyers, making homeownership a more achievable goal.

Our success stories speak volumes about the effectiveness of our personalized service. Clients have shared their satisfaction with the comprehensive support they receive, which not only simplifies the application process but also empowers them with knowledge about their options. One client expressed, “The team at F5 Mortgage made the process easy and worry-free, ensuring I understood every step.” These positive experiences contribute to a smoother home buying journey and reinforce our commitment to your satisfaction.

In conclusion, the benefits of tailored mortgage consultations for FHA financing, especially in understanding FHA loan requirements FL, are clear: they enhance homebuyer confidence, simplify the mortgage process, and lead to higher satisfaction rates among clients. At F5 Mortgage, we are dedicated to being a reliable partner for Florida homebuyers as you navigate the FHA loan requirements FL for financing. We’re here to support you every step of the way.

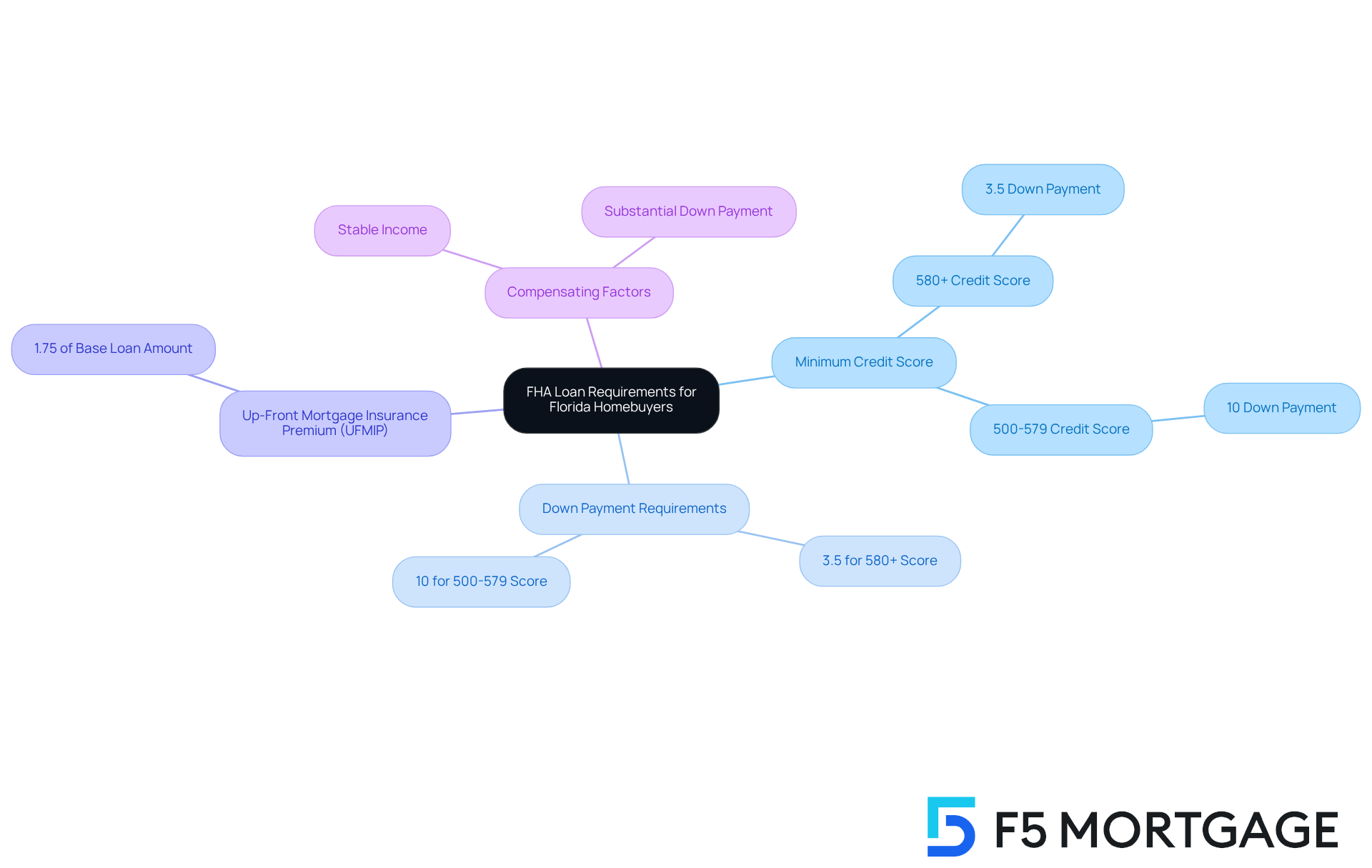

Minimum Credit Score: FHA Loan Requirements for Florida Homebuyers

In Florida, we understand how daunting the process of securing a mortgage can be. To meet the [FHA loan requirements FL](https://f5mortgage.com/fha-loan-max-florida-key-requirements-and-benefits-explained), borrowers typically need a minimum credit score of 580, which allows them to benefit from a low upfront cost of just 3.5%. If your credit score falls between 500 and 579, you can still qualify, but a larger down payment of 10% will be necessary. This flexibility makes FHA financing an appealing option for many home purchasers, especially first-time buyers or those with limited savings.

Recent data reveals that nearly 20% of home purchases are made using an FHA mortgage, showcasing the program’s accessibility. It’s crucial for prospective borrowers to understand that FHA loan requirements FL significantly impact their eligibility and borrowing conditions. As one mortgage specialist wisely notes, “Higher credit scores typically boost your likelihood of obtaining financing,” underscoring the importance of maintaining a strong credit profile. If your score does not meet this standard, you may find it challenging to qualify for a traditional mortgage, which underscores the benefits of FHA loan requirements FL for those with lower credit scores.

Moreover, there are instances where borrowers with credit scores below 580 have successfully secured financing by meeting FHA loan requirements FL, often by demonstrating strong compensating factors like stable income or a substantial down payment. This commitment to providing opportunities for homeownership is particularly significant for individuals facing financial challenges.

It’s also important to recognize that FHA loan requirements FL mandate an Up-Front Mortgage Insurance Premium (UFMIP) of 1.75% of the base loan amount, which is a vital cost consideration for potential borrowers. Understanding the FHA loan requirements FL and the associated expenses is essential as you navigate the application process. We’re here to support you every step of the way, ensuring you are well-prepared to meet the requirements and .

Down Payment Requirement: Essential FHA Loan Criteria in Florida

The FHA loan requirements in Florida indicate that FHA financing requires a minimum deposit of 3.5% for applicants with a credit score of 580 or above. If your credit score falls between 500 and 579, the deposit requirement increases to 10%. We understand how challenging this can be, but this flexibility in initial financing options makes FHA products an appealing choice for first-time homebuyers and those with limited savings.

Moreover, F5 Mortgage offers several down payment assistance programs that can help ease the financial burden for buyers. By understanding these requirements, families can effectively plan their finances and discover valuable assistance options available in Florida. We’re here to support you every step of the way as you .

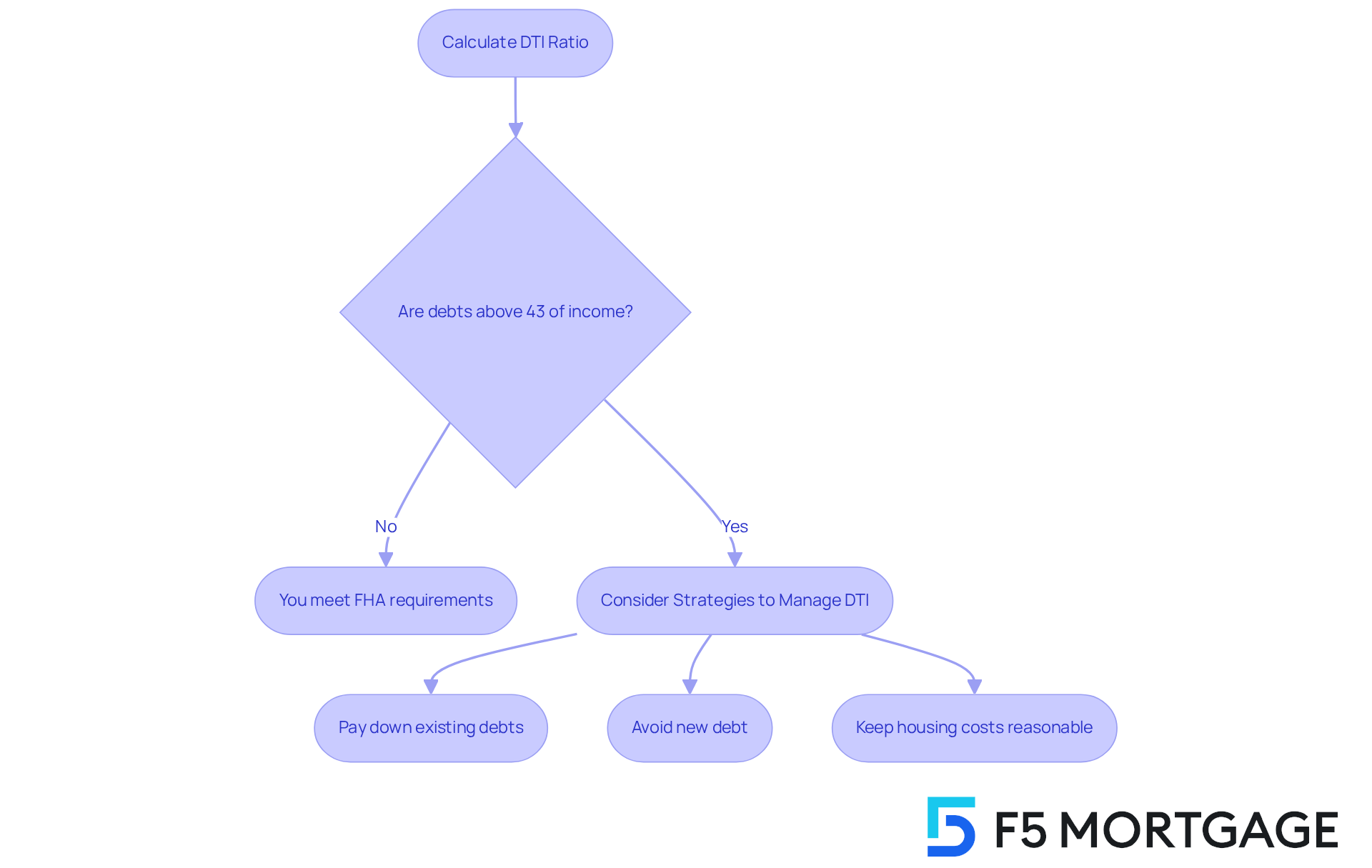

Debt-to-Income Ratio: Key FHA Loan Requirement for Florida Buyers

Navigating the FHA loan approval process can feel overwhelming, especially when it comes to understanding the debt-to-income (DTI) ratio. This ratio is crucial, as guidelines typically set the maximum DTI at 43%. This means that no more than 43% of your gross monthly income should go toward debt obligations, including your mortgage. However, if you have a strong credit profile or other significant compensating factors, you might qualify for exceptions that allow for a DTI ratio of up to 50%.

To calculate your DTI ratio, simply divide your total monthly debt obligations by your gross monthly income. For example, if your monthly debt payments are $2,100 and your gross income is $5,000, your DTI would be 42%. Understanding this calculation is essential for determining your eligibility for an FHA mortgage, particularly in relation to the , as it directly influences the amount you can borrow.

Effectively managing your DTI ratio can greatly enhance your chances of meeting the [FHA loan requirements in Florida](https://f5mortgage.com/understanding-fha-loan-limits-in-florida-for-homebuyers) for securing financing. Consider strategies such as:

- Paying down existing debts

- Avoiding new debt

- Keeping your monthly housing costs within reasonable limits

With thoughtful financial planning, you can make homeownership a reality.

Additionally, if you reside in Colorado, you have various refinancing options available, including conventional mortgages and FHA refinancing. These can help you manage your DTI ratio and secure competitive mortgage rates. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

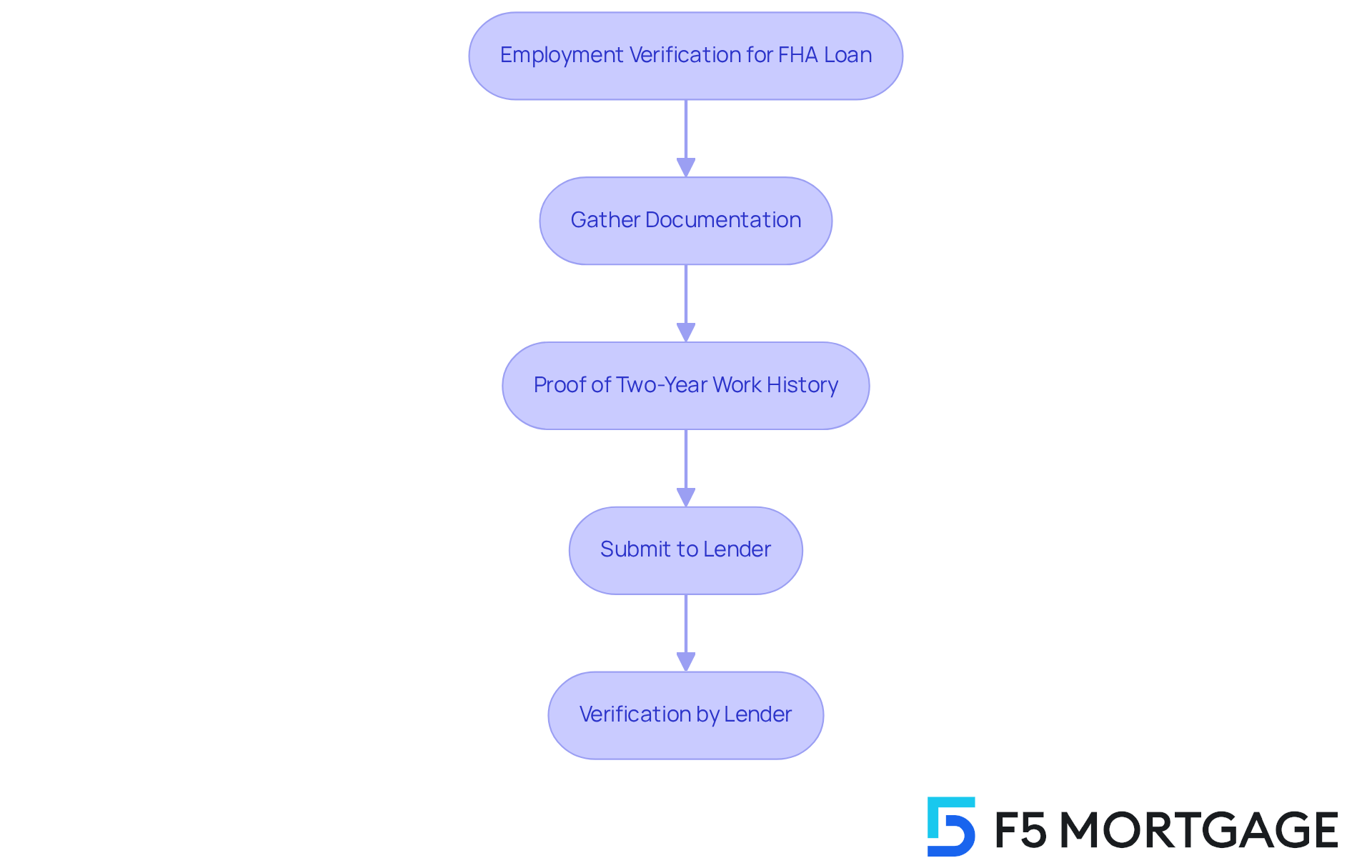

Steady Employment Verification: A Must for FHA Loan Approval in Florida

We understand how challenging the mortgage process can be, especially when it comes to proving your financial stability. According to [FHA loan requirements in Florida](https://f5mortgage.com/loan-programs/fha-loans/texas), lenders typically require borrowers to provide proof of steady employment, often needing a two-year work history. This verification process is crucial, as it ensures you fulfill the FHA loan requirements in Florida by having a to support your mortgage payments.

By comprehending the employment verification criteria, you can feel more prepared and confident. Gathering the essential documentation not only enhances your likelihood of a successful financing application but also empowers you on your journey to homeownership. Remember, we’re here to support you every step of the way.

Property Requirements: FHA Loan Standards for Florida Homes

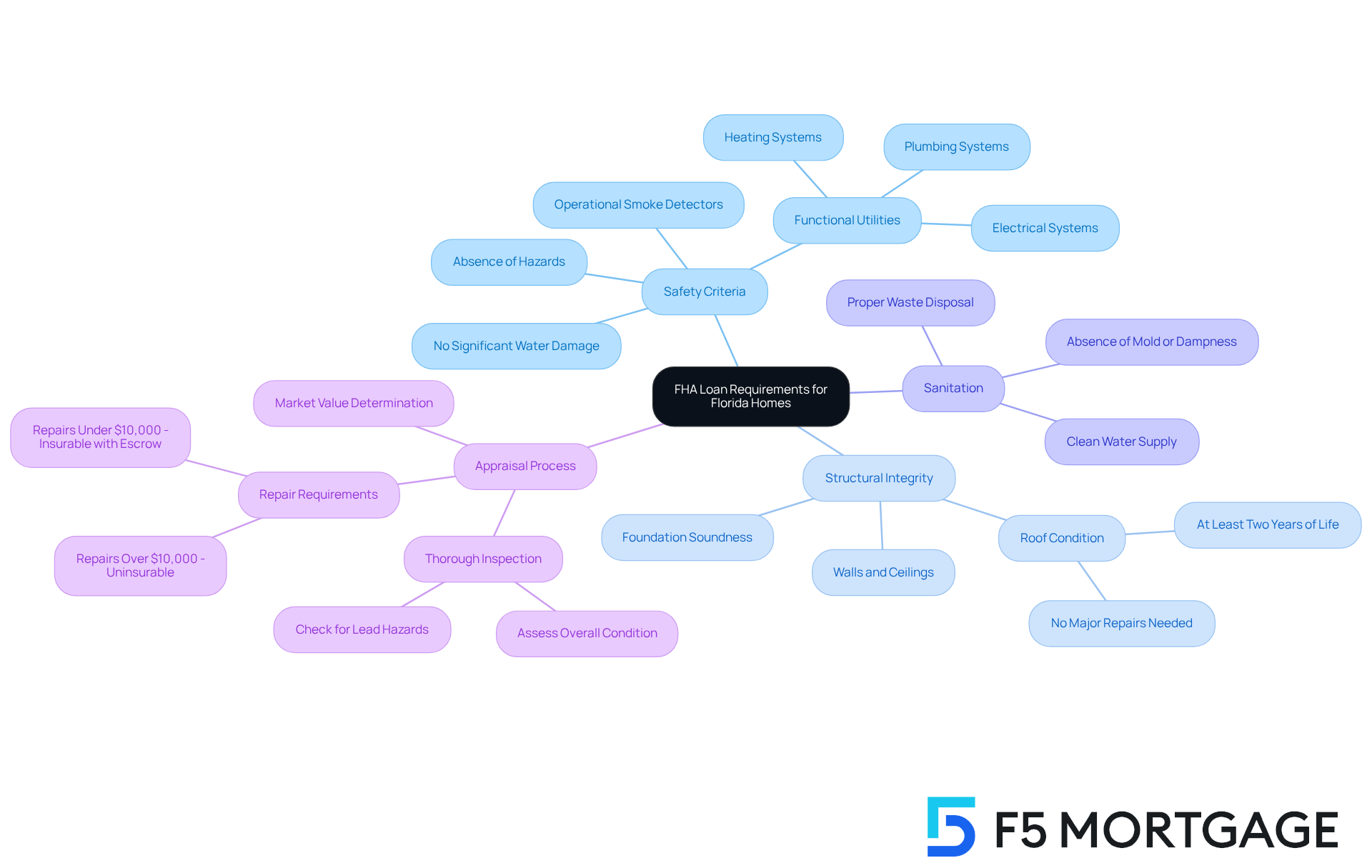

[FHA financing options](https://f5mortgage.com/loan-programs/fha-loans/georgia) are designed with specific property criteria to ensure that homes are secure, livable, and suitable for families. We understand how important it is for you to find a safe place to call home. To qualify for [FHA loan requirements FL](https://f5mortgage.com/loan-programs/fha-loans/california), properties must meet minimum standards that encompass structural integrity, safety, and sanitation. Key FHA loan requirements FL include that the home must be the borrower’s primary residence and that it meets essential safety criteria, such as the absence of significant hazards like exposed electrical wires or roof leaks.In Florida, the [FHA appraisal process](https://f5mortgage.com/master-the-fha-payment-calculator-step-by-step-guide) is particularly thorough. Appraisers check for issues like peeling paint, which can indicate lead hazards in homes built before 1978. The lender will order a home appraisal to determine your property’s current market value, which will identify how much equity you have, ultimately affecting your mortgage rates. Appraisers also assess the overall condition of the roof, plumbing systems, and electrical systems to ensure they meet FHA standards. It’s crucial that homes are free from health and safety hazards, with utilities like heating, plumbing, and electricity functioning properly.

Understanding the FHA loan requirements FL is essential for homebuyers, as it helps to avoid potential complications during the appraisal process. Properties that do not meet these standards may require repairs before the financing can close. We know how challenging this can be, but with the right knowledge, you can confidently navigate the and secure a home that meets your needs while adhering to the necessary guidelines.

Mortgage Insurance Premium: Understanding FHA Loan Costs in Florida

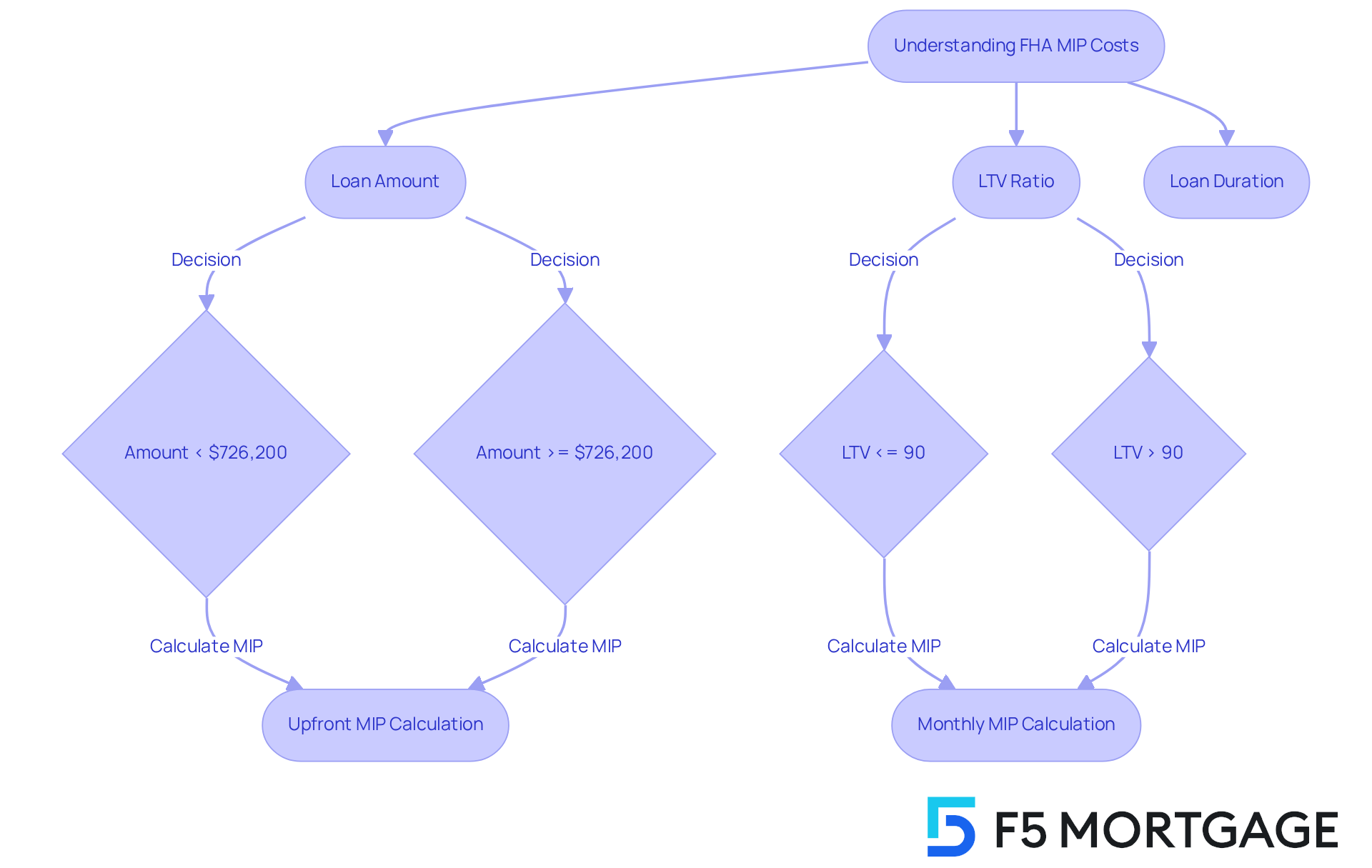

Navigating the world of FHA financing can feel overwhelming, especially when it comes to understanding the mortgage insurance premium (MIP). This premium serves as a safety net for lenders, protecting them against borrower defaults. The upfront MIP is typically set at 1.75% of the borrowing amount, and the good news is that this cost can be rolled into the mortgage itself, easing the initial financial burden on homebuyers.

But that’s not all—borrowers also need to consider the annual MIP, which fluctuates based on the loan term and the loan-to-value (LTV) ratio. For example:

- FHA mortgages of $726,200 or less with an LTV of 90% or less incur an annual MIP of 0.50% for 11 years.

- Those with an LTV greater than 90% may face rates around 0.55%.

Understanding these expenses is crucial for effective budgeting, as they significantly .

To illustrate, let’s take a look at a $328,100 FHA mortgage with a 3.5% down payment. This would result in an upfront MIP of approximately $5,742, along with a monthly MIP charge of about $141.67, calculated from the annual MIP of $1,700 divided by 12. Financial experts stress that being aware of MIP costs empowers prospective buyers to make informed choices and plan their finances wisely.

As Maya Dollarhide insightfully notes, “The yearly mortgage premium relies on your borrowing amount, your borrowing duration, and your down payment, and it ranges from 0.15 percent to 0.75 percent of the borrowing amount.” Additionally, it’s heartening to know that recent changes effective March 20, 2023, have lowered FHA MIP rates, which enhance the FHA loan requirements in Florida and make this option even more appealing for homebuyers in Florida‘s competitive market. We know how challenging this can be, but with the right information, you can navigate these waters with confidence.

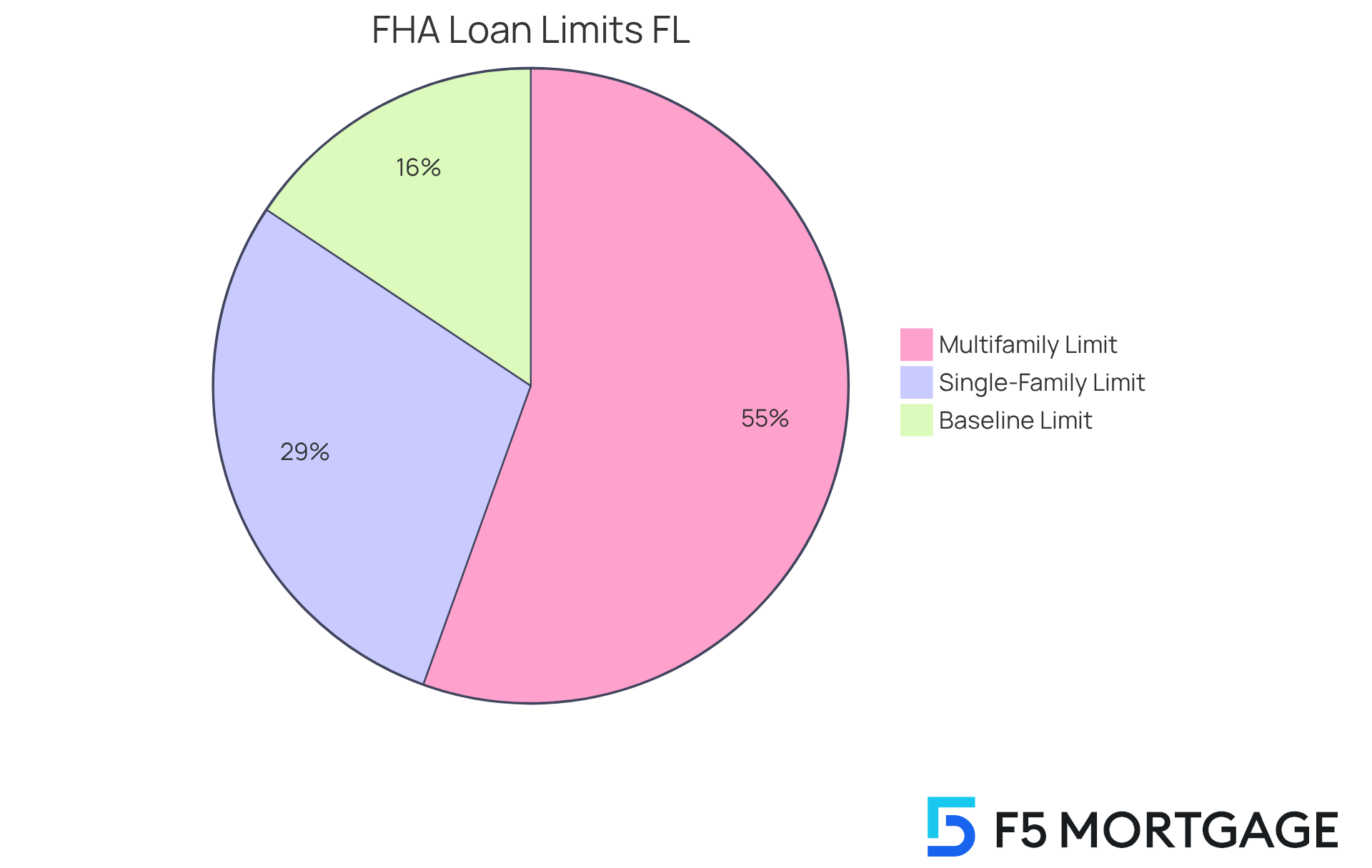

FHA Loan Limits: Maximum Financing for Florida Homebuyers

Understanding the FHA loan requirements FL, including borrowing limits, can feel overwhelming, especially when considering local housing expenses that vary significantly by county. For 2025, the baseline limit for a single-family home is set at $524,225. In contrast, in more expensive areas like Monroe County, limits can rise to as much as $967,150. This variation is important to recognize, as it directly impacts your home-buying journey.

If you’re looking at multifamily properties, you’ll find even greater opportunities. In Monroe County, for instance, the FHA borrowing limits can reach up to $1,859,950, which opens doors for those interested in multi-unit homes. With a of just 3.5%, these options become accessible for many individuals ready to purchase their homes.

This structured framework is designed to empower you as a prospective buyer, allowing you to evaluate your financing choices with confidence. For example, in Alachua County, the limit remains at $524,225, while high-cost counties offer soaring limits, providing more opportunities in desirable locations.

Understanding the FHA loan requirements FL is essential, as it directly affects your ability to secure financing. We know how challenging this can be, but understanding these parameters can help you navigate the intricacies of the housing market more efficiently. Remember, we’re here to support you every step of the way.

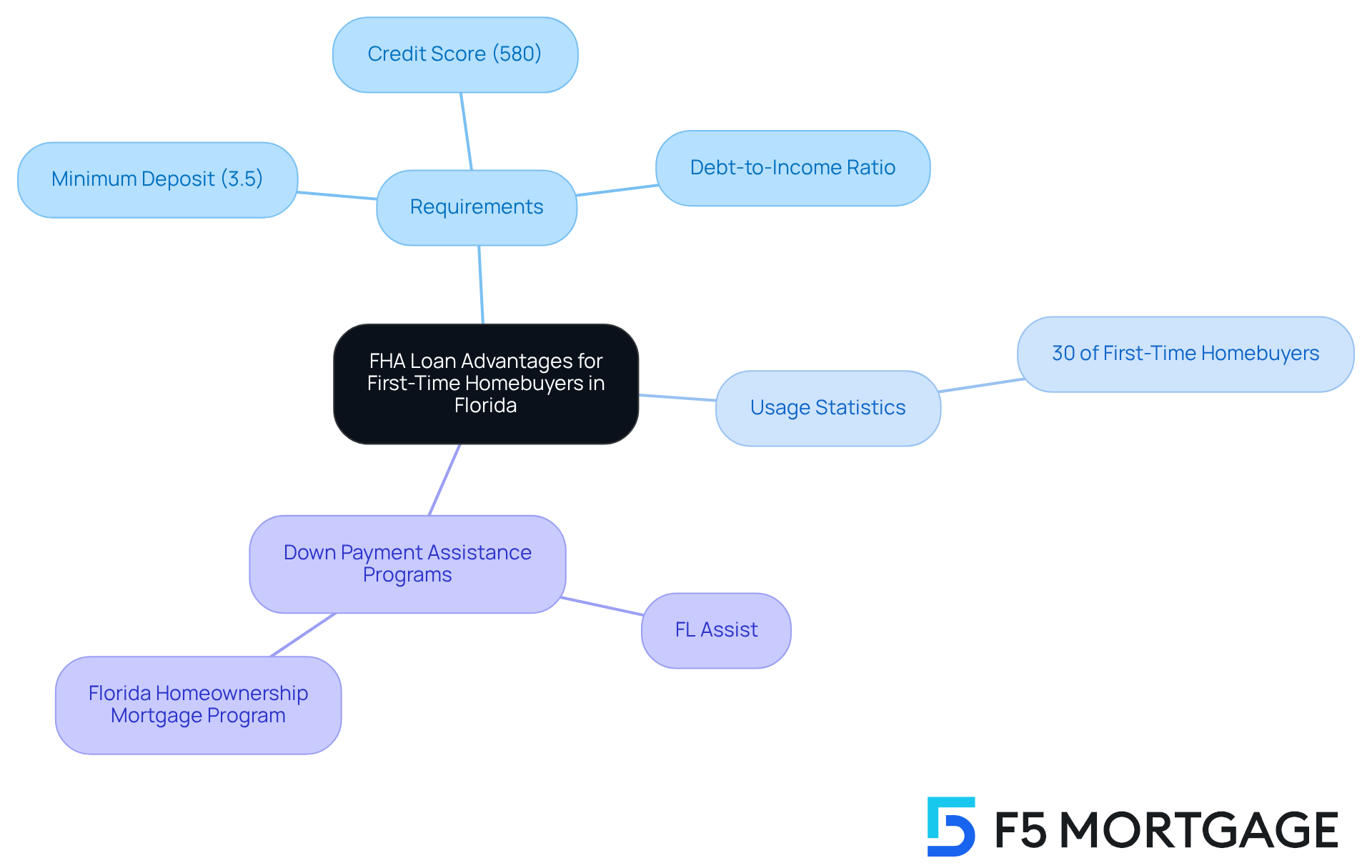

First-Time Homebuyer Benefits: FHA Loan Advantages in Florida

FHA loan requirements FL provide a wealth of benefits for first-time homebuyers in Florida, making them a welcoming option for those stepping into the housing market. These financial products significantly lower the barriers to homeownership with FHA loan requirements FL that include a minimum deposit requirement as low as 3.5%. Additionally, FHA loan requirements FL include flexible credit score requirements, allowing borrowers with scores as low as 580 to qualify for this advantageous down payment option. This flexibility extends to , which can be higher than those permitted by traditional financing, further broadening access for potential buyers.

We know how challenging the home buying process can be. According to recent information, approximately 30% of first-time homebuyers in Florida utilize FHA financing, underscoring its popularity in the state. Many families have successfully navigated the home purchasing journey with FHA financing, benefiting from manageable interest rates and the ability to secure funding even with less-than-ideal credit histories. As one satisfied client shared, “Everything went very smoothly!” This reflects the exceptional customer satisfaction that F5 Mortgage is committed to providing.

Moreover, Florida offers several down payment assistance programs that can enhance home buying opportunities even further. Programs like FL Assist and the Florida Homeownership Mortgage Program provide up to $10,000 as a deferred second mortgage for various financing types, making homeownership even more attainable. Collectively, these benefits position FHA financing as an ideal choice for first-time buyers in Florida, especially considering the FHA loan requirements FL, empowering them to confidently pursue their homeownership dreams.

Application Process: Step-by-Step Guide for FHA Loans in Florida

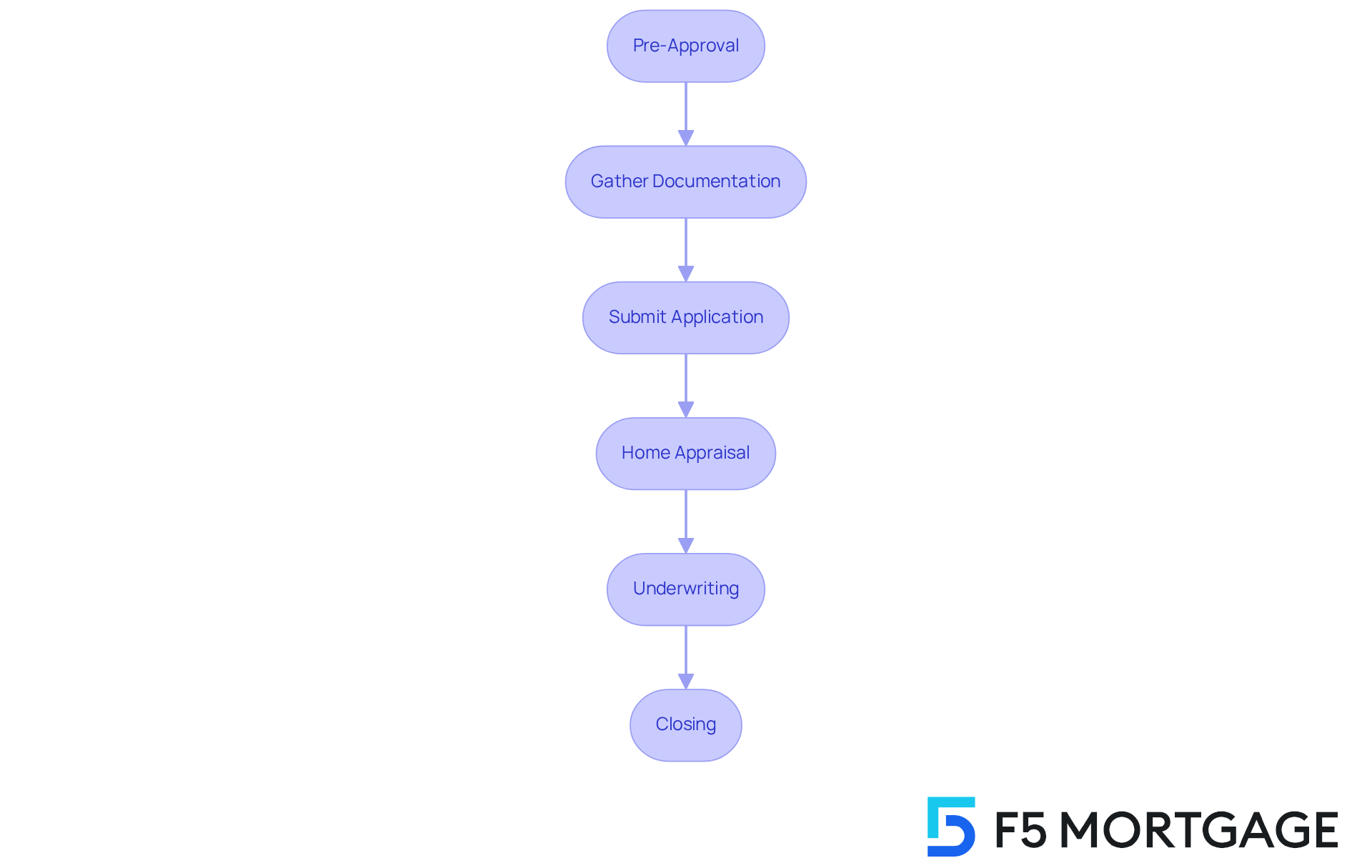

Navigating the FHA loan requirements FL application process can feel overwhelming, but we’re here to support you every step of the way. Understanding the can make your journey smoother and more manageable.

- Pre-Approval: Begin by securing pre-approval from a lender. This important step helps you assess your borrowing capacity and sets a solid foundation for your home search.

- Gather Documentation: Compile essential documents like proof of income, employment verification, and credit history. Having these ready can significantly expedite the process, relieving some of the stress.

- Submit Application: Complete the funding application with your chosen lender. This is where you formally express your intent to secure financing, taking a significant step toward your new home.

- Home Appraisal: The lender will arrange an appraisal to ensure that the property meets FHA standards. This verification helps confirm that the property’s value aligns with the mortgage amount, providing peace of mind.

- Underwriting: In this phase, the lender reviews your application and documentation to assess your eligibility. This essential step ensures you receive the financial assistance you need.

- Closing: Once approved, you’ll finalize the financing and complete the purchase, marking the culmination of your FHA financing journey.

We know how challenging this can be, but understanding the FHA loan requirements FL can empower you and streamline the application process. In Florida, many applicants report pre-approval times of under an hour, allowing you to move quickly in a competitive market. Together, we can make your FHA loan experience a success.

Conclusion

Navigating the complexities of FHA loan requirements in Florida can indeed be challenging. However, understanding these essential criteria is key to unlocking homeownership opportunities. This article highlights the significant benefits that FHA loans offer, particularly for first-time homebuyers. With low down payment options, flexible credit score requirements, and supportive down payment assistance programs, these factors create a more accessible pathway for individuals looking to purchase their first home.

We know how crucial it is for potential borrowers to grasp vital aspects such as:

- Minimum credit scores

- Down payment requirements

- Debt-to-income ratios

- Employment verification

- Property standards

By emphasizing the importance of tailored consultations and expert guidance, we reinforce that informed decision-making is paramount in the home buying process.

Ultimately, the FHA loan program stands out as an empowering option for Florida homebuyers, especially for those facing financial hurdles. With the right knowledge and support, prospective buyers can confidently navigate the FHA landscape, making their dream of homeownership a reality. Engaging with experienced professionals, like those at F5 Mortgage, can further enhance this journey, ensuring that every step is taken with clarity and purpose.

Frequently Asked Questions

What services does F5 Mortgage provide for Florida homebuyers?

F5 Mortgage offers personalized FHA financing consultations tailored to the unique financial situations of Florida homebuyers, helping them navigate FHA loan requirements and recommend suitable financing options.

What are the FHA loan requirements in Florida?

To qualify for FHA loans in Florida, borrowers typically need a minimum credit score of 580 for a down payment of 3.5%. If the credit score is between 500 and 579, a larger down payment of 10% is required.

How does F5 Mortgage assist first-time homebuyers?

F5 Mortgage provides tailored consultations that help first-time homebuyers understand FHA financing benefits and navigate the complexities of the mortgage process, particularly regarding upfront costs and credit score requirements.

What is the significance of the 3.5% down payment for FHA loans?

The 3.5% down payment requirement for FHA loans makes homeownership more accessible, especially for buyers with limited savings, easing the financial burden of purchasing a home.

What is the Up-Front Mortgage Insurance Premium (UFMIP) for FHA loans?

The FHA loan requirements mandate an Up-Front Mortgage Insurance Premium (UFMIP) of 1.75% of the base loan amount, which is an important cost consideration for potential borrowers.

Can individuals with lower credit scores still qualify for FHA loans?

Yes, individuals with credit scores between 500 and 579 can qualify for FHA loans, but they will need to make a larger down payment of 10%. Additionally, strong compensating factors like stable income may help them secure financing.

What are the benefits of personalized consultations at F5 Mortgage?

Personalized consultations at F5 Mortgage enhance homebuyer confidence, simplify the mortgage process, and lead to higher satisfaction rates among clients, as they receive comprehensive support and knowledge about their options.

Are there down payment assistance programs available through F5 Mortgage?

Yes, F5 Mortgage offers several down payment assistance programs that can help ease the financial burden for buyers, making it easier for families to plan their finances and explore available options in Florida.