Overview

If you’re a veteran looking to ease your financial burden, VA IRRRL rates—also known as Interest Rate Reduction Refinance Loans—could be just what you need. These loans allow you to refinance your existing VA loans at lower interest rates, which can significantly reduce your monthly mortgage payments and enhance your overall financial stability.

We understand how overwhelming the refinancing process can be, especially when considering the various factors that influence these rates. Key elements such as:

- Credit scores

- Loan size

- Market conditions

play a significant role in determining your options. Fortunately, the VA IRRRL program offers streamlined requirements, making it a beneficial choice compared to other refinancing alternatives.

By choosing this path, you can take control of your financial future. We’re here to support you every step of the way, ensuring you have the information and guidance needed to make the best decision for you and your family.

Introduction

Navigating the complexities of refinancing can feel overwhelming, especially for veterans looking to lower their mortgage costs. We understand how challenging this can be. VA Interest Rate Reduction Refinance Loans (IRRRL) present a valuable opportunity for veterans to reduce their monthly payments and improve their financial stability. Yet, grasping the specific factors that influence VA IRRRL rates and the eligibility requirements is crucial for unlocking significant savings.

What hurdles might veterans encounter in maximizing these benefits?

How can they navigate the refinancing landscape effectively to secure the best possible terms?

We’re here to support you every step of the way.

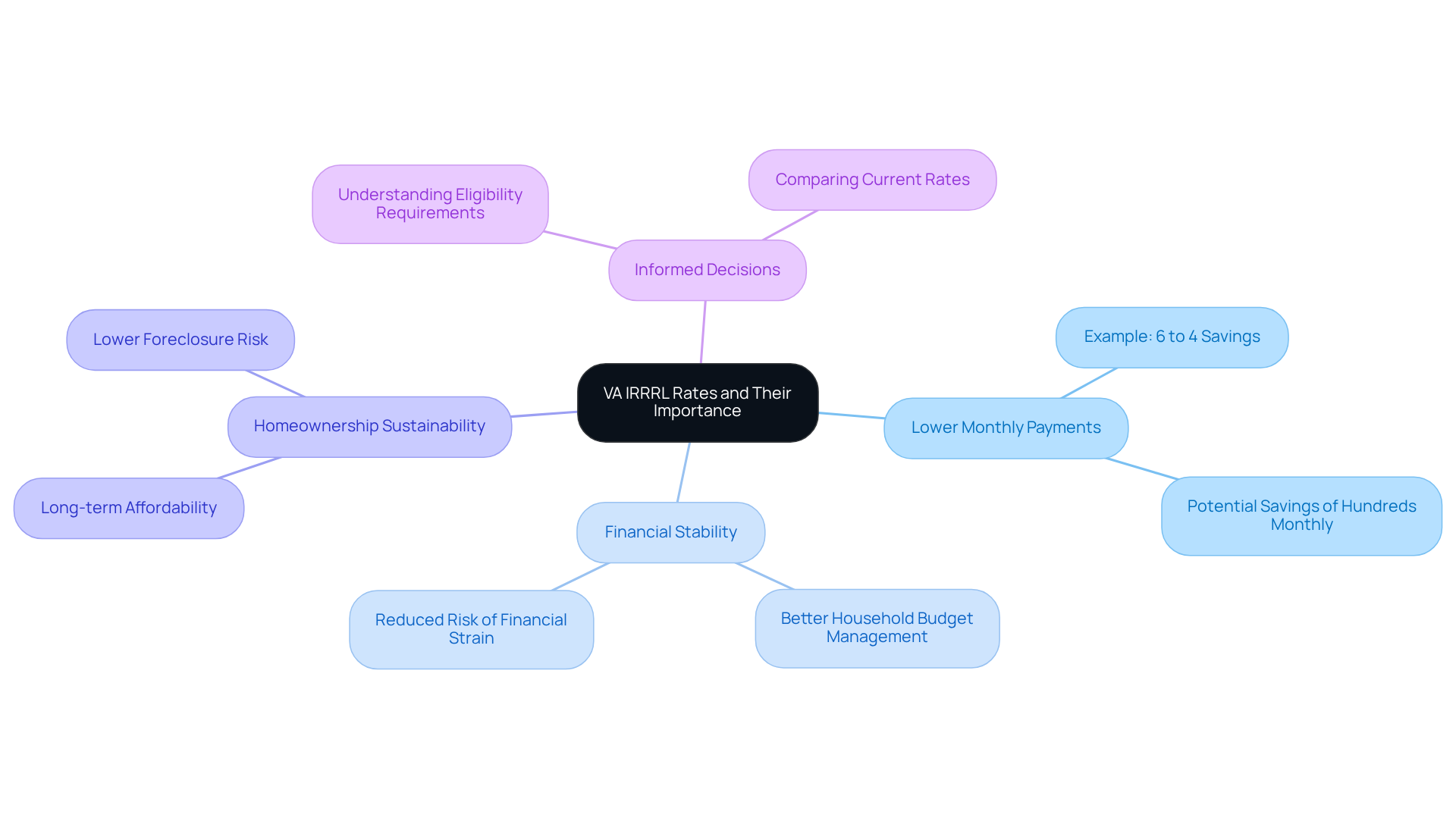

Define VA IRRRL Rates and Their Importance

VA Interest Rate Reduction Refinance Loans are crucial for veterans aiming to refinance their current VA loans at lower VA IRRRL rates. We understand how important it is to manage monthly expenses, and these reduced VA IRRRL rates can lead to significant decreases in mortgage costs, making homeownership more affordable for veterans.

Imagine a veteran currently paying 6% interest on their VA loan. By refinancing through this program at a 4% interest rate, they could save several hundred dollars each month. This reduction not only enhances financial stability but also allows for better management of household budgets, enabling veterans to direct funds toward other essential expenses or savings.

Moreover, the impact of VA IRRRL figures extends beyond immediate savings; they play a crucial role in promoting long-term homeownership sustainability. By lowering monthly payments through VA IRRRL rates, veterans can enjoy their homes more comfortably, reducing the risk of financial strain and potential foreclosure. We understand how challenging this can be, and knowing the VA IRRRL rates empowers veterans to make informed refinancing decisions, ultimately leading to improved financial outcomes and a better quality of life.

We’re here to support you every step of the way as you navigate this process.

Outline VA Streamline Refinancing Requirements

Navigating the world of refinancing can feel overwhelming, but understanding the requirements for VA IRRRL rates can make the process smoother for you. Here’s what you need to know:

- Existing VA Financing: To qualify, you must currently have a VA-backed home mortgage.

- Occupancy: It’s important to certify that you live in or have previously lived in the home you wish to refinance.

- Payment Record: You should have made at least six continuous monthly payments on your current VA financing, with at least 210 days since your first payment.

- No Late Payments: Ideally, you should not have any late payments in the last 12 months.

- Reduced Interest Charge: Your new agreement must offer a reduced interest rate compared to your current one, unless you’re transitioning from an adjustable-rate mortgage (ARM) to a fixed-rate mortgage.

These criteria are designed to ensure that the refinancing program remains beneficial for veterans like you, allowing for reduced costs while also positively impacting VA IRRRL rates without the burden of extensive paperwork or credit evaluations.

If you’re in Colorado, you might also want to explore various refinancing options like conventional loans and FHA loans. Each of these could provide favorable terms for those looking to improve their living situation.

Understanding these requirements and available options is crucial for homeowners like you who are aiming to maximize financial benefits while navigating the refinancing process. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

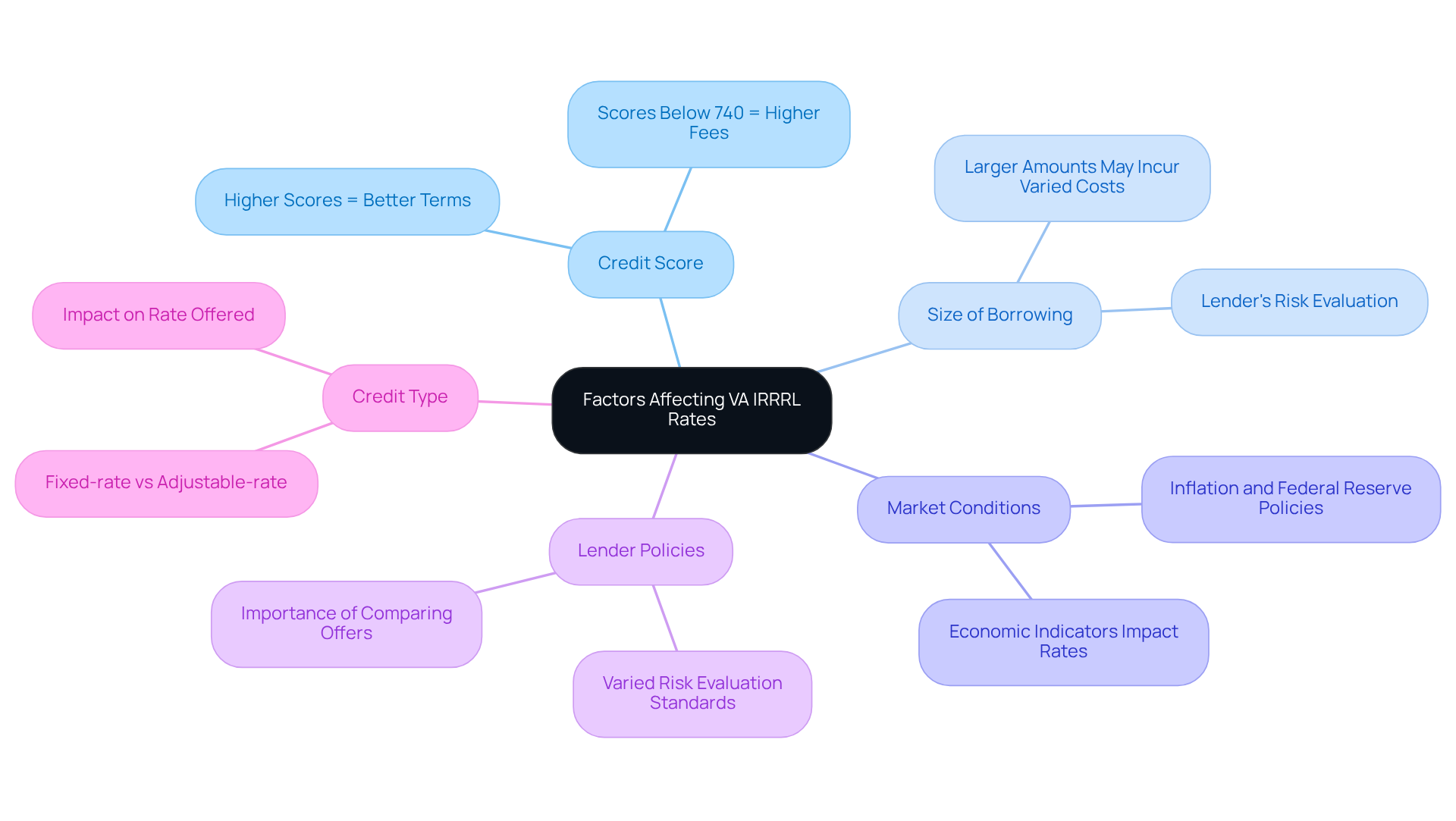

Analyze Factors Affecting VA IRRRL Rates

Several factors significantly influence VA IRRRL rates, and we understand how important it is for you to navigate VA IRRRL rates effectively. Here are some key elements to consider:

- Credit Score: While the IRRRL program doesn’t require a credit assessment, it’s important to note that borrowers with higher credit scores often enjoy more favorable interest terms in the market. For instance, those with typical credit scores may face elevated fees, whereas individuals with scores exceeding 740 can secure more advantageous conditions.

- The size of your borrowing plays a crucial role in determining the interest charge. Typically, larger amounts may incur somewhat varied costs compared to smaller ones, reflecting the lender’s risk evaluation. Understanding this can help you make informed decisions about VA IRRRL rates.

- Market Conditions: Economic indicators such as inflation, Federal Reserve policies, and the overall demand for mortgage financing can lead to fluctuations in interest levels. Staying informed about these trends can empower you to time your refinancing effectively.

- Lender Policies: Each lender has its own risk evaluation standards and business approaches, which can result in differing charges. This variability underscores the importance of comparing offers from multiple lenders to secure the best deal possible.

- Credit Type: The nature of the financing being refinanced, whether it’s fixed-rate or adjustable-rate, can also impact the rate offered. Understanding the differences between these credit types can assist you in making informed choices that align with your financial goals.

By recognizing and understanding these factors, you can strategically tackle your refinancing efforts to achieve better VA IRRRL rates. This knowledge could lead to more advantageous loan terms and reduced monthly costs, ultimately supporting you on your financial journey.

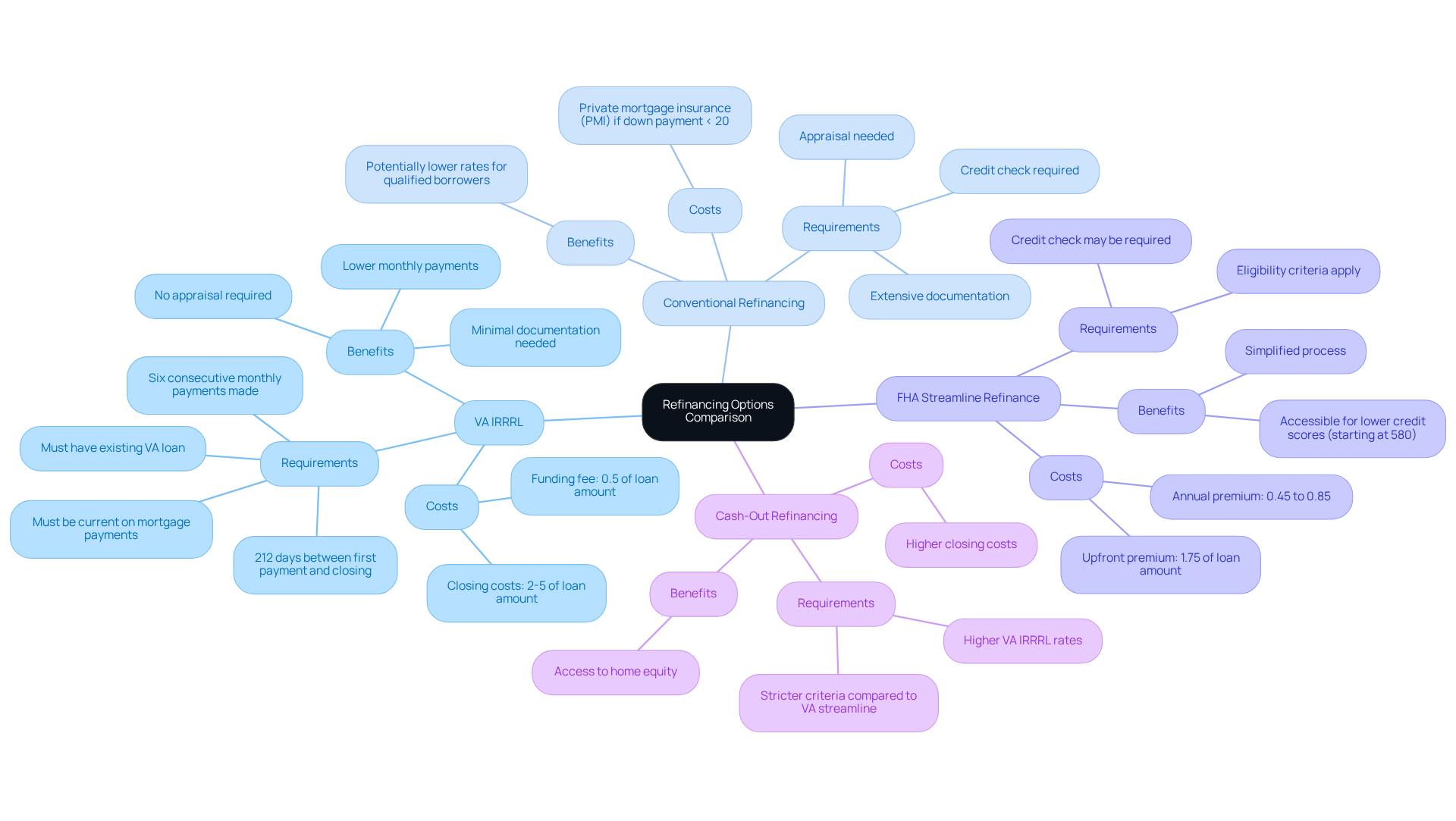

Compare VA IRRRL with Other Refinancing Options

When evaluating refinancing options, we understand how overwhelming it can feel. Let’s take a closer look at the VA IRRRL and how it compares to other alternatives:

- Conventional Refinancing: This option often requires a credit check, appraisal, and extensive documentation. If your down payment is less than 20%, you may need private mortgage insurance (PMI), which can increase your overall costs.

- FHA Streamline Refinance: Similar to the VA IRRRL rates, the FHA streamline refinancing process is simplified. However, it may still require a credit check and has specific eligibility criteria. FHA mortgages, backed by the government, can be more accessible for homeowners with lower credit scores, typically starting at 580. Keep in mind that every FHA home loan in Colorado includes two insurance premiums: one premium of 1.75% of the loan amount, paid upfront at closing, and an annual premium ranging from 0.45% to 0.85%. This structure can make it less attainable for some borrowers.

- Cash-Out Refinancing: This option allows homeowners to access the equity in their properties. However, it usually comes with higher VA IRRRL rates and stricter criteria compared to the VA streamline loan, which makes it a less appealing choice for those primarily seeking reduced costs.

- Adjustable-Rate Mortgages (ARMs): While ARMs may offer lower initial rates, they can lead to unpredictable future costs, contrasting with the stability provided by fixed-rate options available through the VA Streamlined Refinancing.

Overall, the VA refinancing program, which offers competitive VA IRRRL rates, stands out due to its minimal documentation requirements, no appraisal needs, and the potential to lower monthly costs without the complexities associated with other refinancing options. Remember, you must have made six consecutive monthly payments on your current mortgage before refinancing with a VA Streamline, and there should be 212 days between your first payment on the original mortgage and closing on the VA Streamline. Additionally, the VA IRRRL rates include a funding fee of 0.5% of the loan amount, and the closing costs for refinancing can range from 2 to 5 percent of the loan amount, often able to be rolled into the new loan. This makes it a fantastic choice for eligible veterans and military families looking to simplify their mortgage costs. We’re here to support you every step of the way.

Conclusion

Understanding VA IRRRL rates is essential for veterans seeking to refinance their home loans effectively. These rates offer not just the potential for significant savings on monthly mortgage payments but also foster long-term financial stability. By taking advantage of lower interest rates, veterans can improve their quality of life, ensuring that homeownership remains both accessible and sustainable.

In this article, we explored key factors that influence VA IRRRL rates, such as:

- Credit scores

- Loan amounts

- Market conditions

- Lender policies

We also compared these rates with other refinancing options, highlighting the unique benefits of the VA IRRRL program, including:

- Minimal documentation requirements

- Absence of a credit assessment

Understanding these elements equips veterans with the knowledge they need to make informed refinancing decisions.

Ultimately, the significance of VA IRRRL rates goes beyond immediate savings; they symbolize a pathway to financial empowerment for veterans and military families. By staying informed about current rates and requirements, veterans can take proactive steps toward securing better loan terms and enhancing their financial well-being. Embracing this opportunity can lead to a more stable and fulfilling homeownership experience. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What are VA IRRRL rates?

VA IRRRL rates refer to the interest rates associated with VA Interest Rate Reduction Refinance Loans, which allow veterans to refinance their current VA loans at lower rates.

Why are VA IRRRL rates important for veterans?

VA IRRRL rates are important because they can significantly reduce monthly mortgage costs, making homeownership more affordable for veterans. Lower rates can lead to substantial savings each month, enhancing financial stability.

How much can a veteran save by refinancing through the VA IRRRL program?

For example, a veteran currently paying 6% interest on their VA loan could save several hundred dollars each month by refinancing at a 4% interest rate through the VA IRRRL program.

What are the long-term benefits of lower VA IRRRL rates?

Lower VA IRRRL rates promote long-term homeownership sustainability by reducing monthly payments, which helps veterans manage their finances better and decreases the risk of financial strain and potential foreclosure.

How do VA IRRRL rates empower veterans?

Knowing the VA IRRRL rates empowers veterans to make informed refinancing decisions, leading to improved financial outcomes and a better quality of life.

How can veterans get support during the refinancing process?

Veterans can receive support throughout the refinancing process to help them navigate the options available and make the best decisions for their financial situation.