Overview

The article explores the benefits of FHA streamline refinancing for homeowners in 2025, focusing on features that can truly make a difference. With reduced interest rates, lower monthly payments, minimal documentation, and faster closing processes, these advantages are designed to empower you. We understand how challenging the refinancing journey can be, and this approach simplifies the process, making homeownership more accessible.

Imagine improving your financial situation with ease. The emphasis on customer satisfaction and the significant savings potential outlined in the content highlight just how transformative this option can be. We’re here to support you every step of the way, guiding you towards a brighter financial future. Take a moment to consider how these benefits can ease your concerns and pave the way for a more secure homeownership experience.

Introduction

Navigating the complexities of home financing can often feel overwhelming, especially for those looking to enhance their financial situation. We understand how challenging this can be. The FHA Streamline refinancing program emerges as a powerful tool, offering a range of benefits that can significantly ease the burden of mortgage payments. Homeowners in 2025 have the opportunity to explore how this streamlined process can lead to lower interest rates, reduced monthly payments, and minimal documentation requirements.

However, with such enticing advantages, we must ask:

- Are these benefits accessible to everyone?

- What does it truly take to qualify for this potentially life-changing financial solution?

We’re here to support you every step of the way.

F5 Mortgage: Personalized FHA Streamline Refinancing Solutions

At F5 Mortgage, we understand how challenging it can be to navigate the FHA streamline loan adjustments. That’s why we provide personalized consultations designed to empower homeowners like you to explore your options effectively. By taking the time to evaluate your unique financial situation, we can customize solutions that truly meet your needs, ensuring a smooth and worry-free experience.

This tailored approach is especially beneficial for families striving to enhance their savings while simplifying the loan adjustment process. Imagine being able to reduce your monthly payments and improve your financial situation—statistics show that personalized mortgage consultations significantly boost client satisfaction. In fact, F5 Mortgage proudly boasts a customer satisfaction rate of 94%, having assisted over 1,000 families on their journey.

Many households have successfully lowered their monthly payments through our customized loan options. Additionally, restructuring your loan through the FHA streamline can provide you with the opportunity to enhance your property’s appearance and value, further amplifying the benefits of the program. We’re here to support you every step of the way, ensuring you feel understood and guided throughout this process.

Lower Interest Rates: Unlock Savings with FHA Streamline Refinancing

One of the most notable benefits of the FHA streamline loan modification is the possibility of reduced interest rates. We understand how challenging it can be to manage mortgage payments, and homeowners can benefit from FHA streamline to take advantage of current market conditions and secure a more favorable rate. This can lead to substantial savings over the life of the loan, making homeownership more affordable.

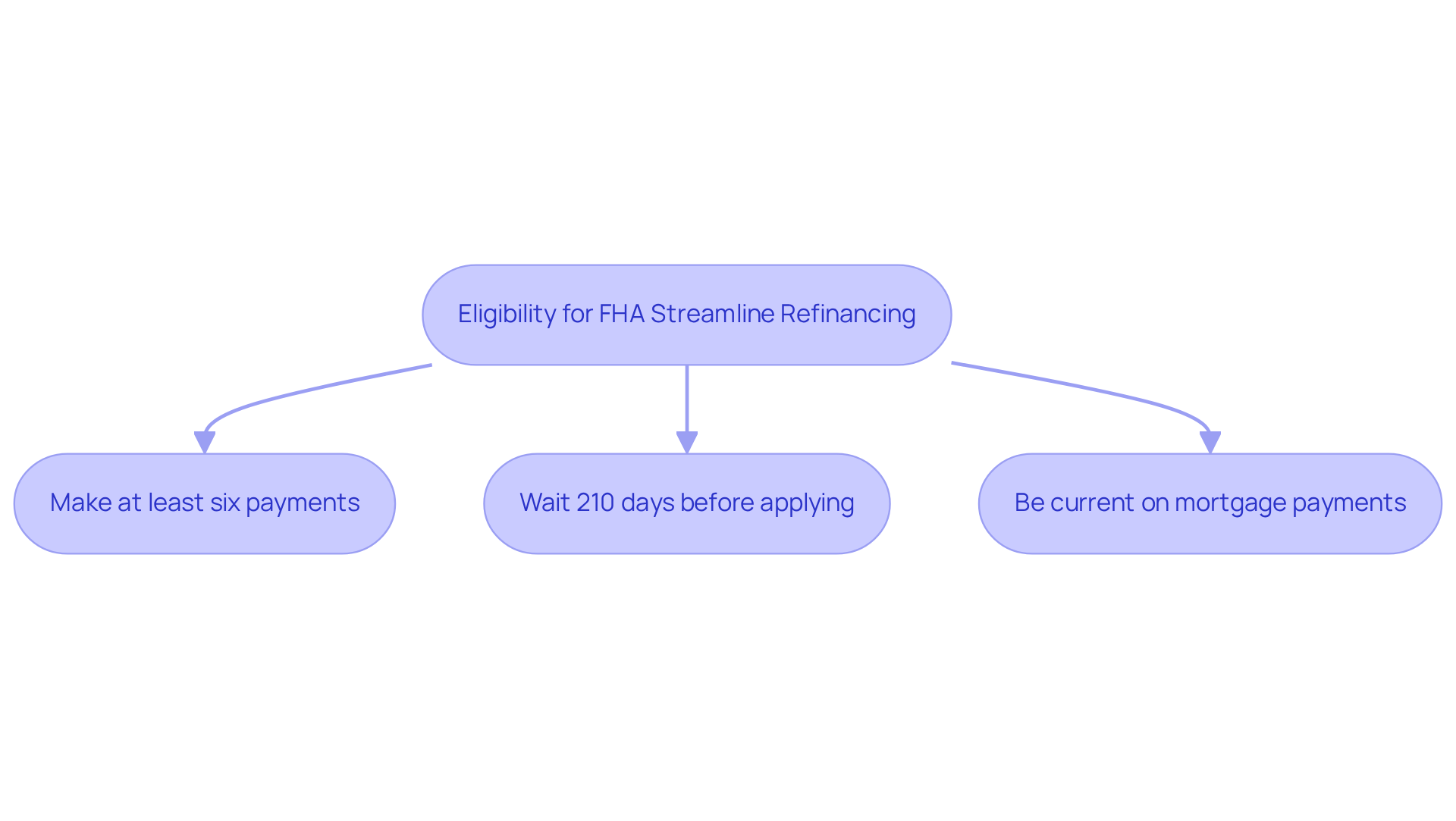

To be eligible for FHA Simplified loan modification, borrowers must:

- Have made at least six payments

- Wait 210 days before applying

- Be current on their mortgage payments with no delinquencies

Understanding these requirements is essential, and we’re here to support you every step of the way.

F5 Mortgage provides a rapid closing process, enabling property owners to refinance swiftly and effectively. For those considering this option, it’s advisable to gather necessary documentation and consult with a mortgage professional. Exploring the best rates available can make a significant difference, and we’re here to help you navigate this process with ease.

Reduced Monthly Payments: Enhance Your Budget with FHA Streamline Refinancing

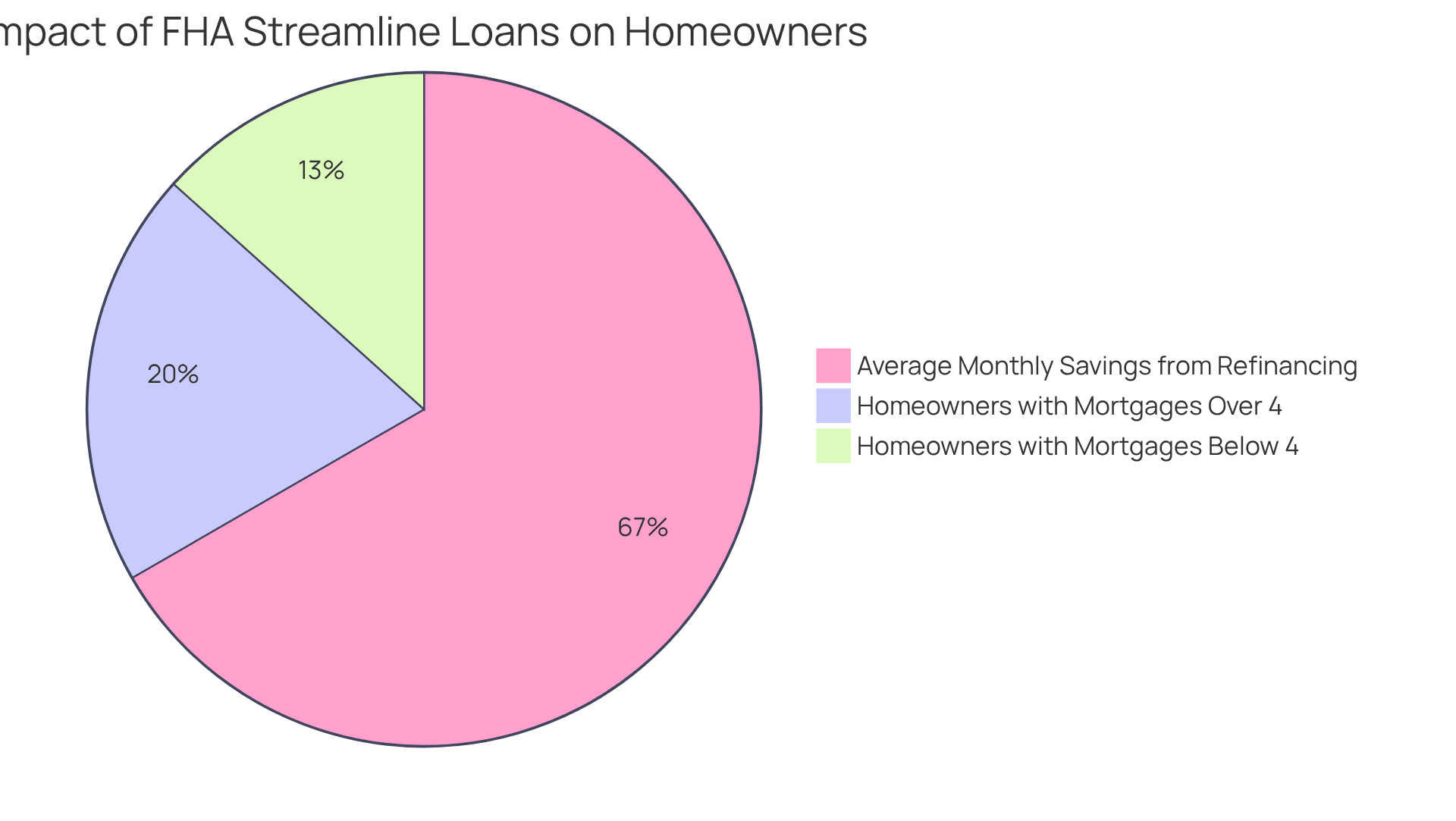

FHA streamline loan options provide property owners a wonderful opportunity to significantly lower their monthly payments, offering immediate financial comfort. By reducing the interest rate and possibly extending the loan term, families can improve their monthly budgets, creating more space for essential expenses or savings. For instance, a decrease in interest from 7.25% to 6.5% on a $400,000 loan could save a family around $200 each month. This newfound flexibility allows families to allocate funds toward crucial areas like education, healthcare, or retirement savings.

Moreover, with nearly 60% of active mortgages having interest rates below 4%, many homeowners feel trapped in higher payments, limiting their financial options. The FHA streamline loan restructuring can unlock these opportunities, enabling families to benefit from lower rates and enhance their overall financial well-being. As interest rates continue to fluctuate, families who refinance can see a significant improvement in their budgeting, allowing them to manage their finances more effectively and plan for future needs. As financial advisor Jane Doe states, ‘Lower mortgage payments can free up cash flow, allowing families to invest in their future.’

To explore these options, we know how challenging this can be, and we’re here to support you every step of the way. Families should consider seeking advice from a mortgage broker to evaluate their loan modification opportunities.

Minimal Documentation: Streamline Your Refinancing Process Effortlessly

One of the standout features of the FHA streamline loan modification is the minimal documentation required. We understand how overwhelming paperwork can be, and this streamlined method alleviates that stress. Homeowners can often complete the loan modification process with FHA streamline, requiring less documentation than conventional options. This simplification not only eases the burden but also empowers families to advance with their financial plans. We’re here to support you every step of the way, making this journey smoother and more manageable.

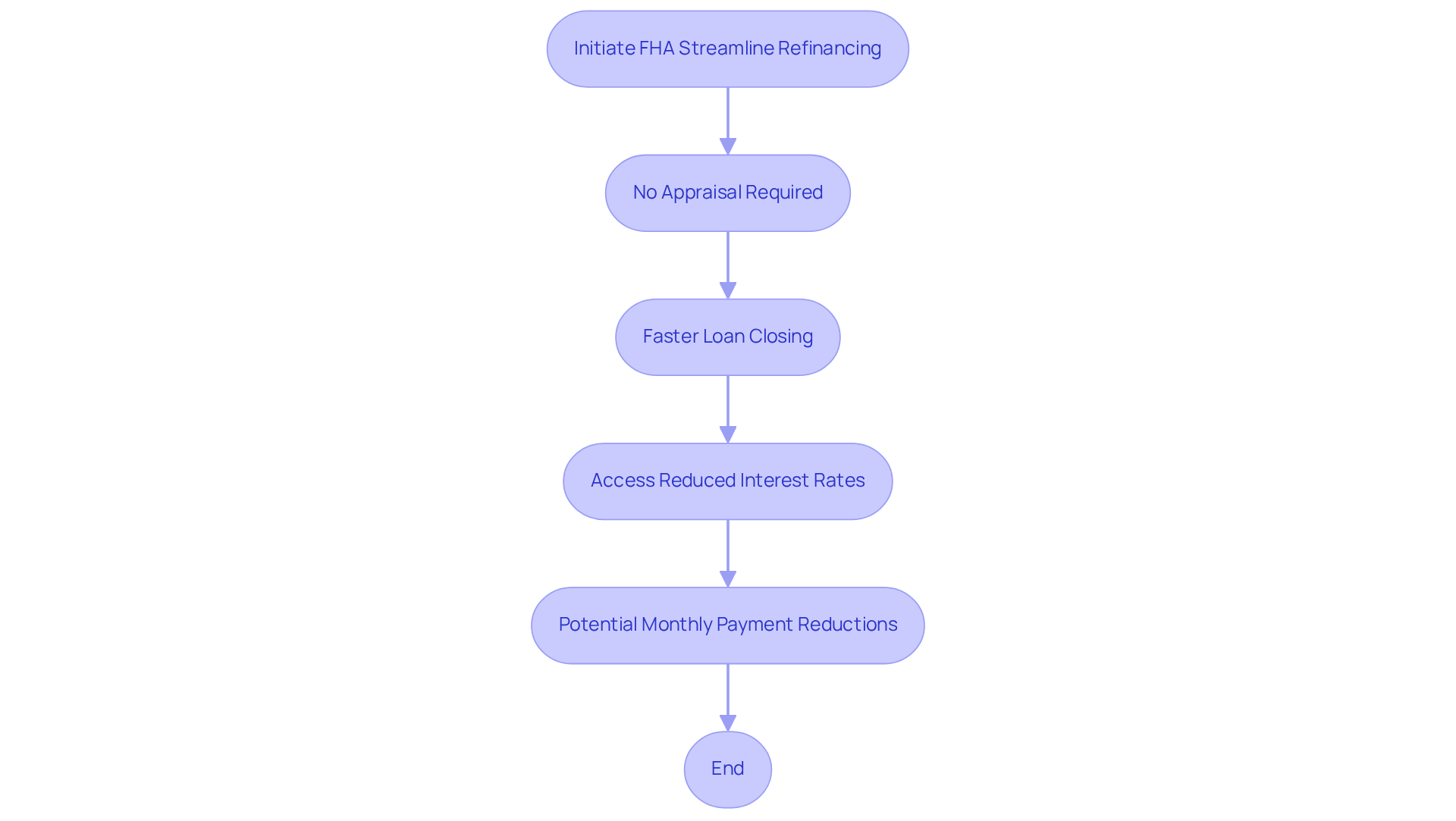

No Appraisal Needed: Speed Up Your FHA Streamline Refinancing

We understand how challenging navigating the mortgage process can be, and FHA Simplified loan modifications offer a substantial benefit by removing the requirement for a new appraisal. This often cumbersome step can delay conventional loan processes, but by omitting it, property owners can accelerate their loan journey. This means faster access to reduced interest rates and improved financial situations.

Imagine closing your loan through an FHA Streamline process within just a few weeks. This option is particularly appealing for those eager to take advantage of favorable market conditions. Not only does this FHA Streamline method save time, but it also alleviates stress, allowing you to focus on your financial objectives without the usual hurdles associated with refinancing.

Moreover, if you currently have an FHA loan, you may benefit from potential reductions in monthly payments, making this choice even more attractive. Typical closing costs for an FHA Simplified Refinance range from $1,500 to $4,000, providing you with a clear understanding of the financial implications involved. We’re here to support you every step of the way as you explore this opportunity.

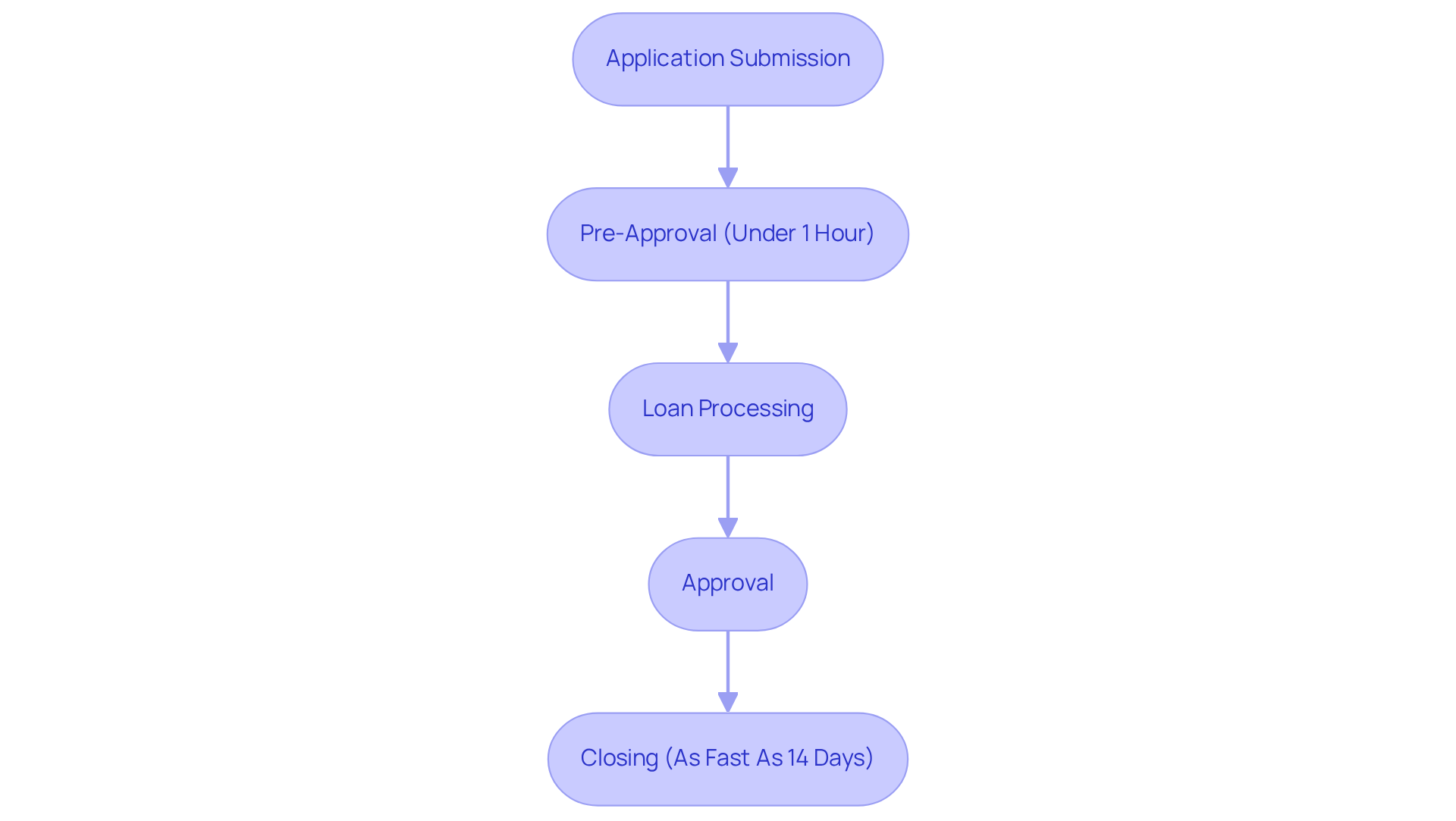

Faster Closing Process: Complete Your FHA Streamline Refinance Swiftly

FHA streamline loan restructuring provides property owners with a significantly faster closing process compared to traditional loan methods, which typically take around 45 to 60 days. At F5 Mortgage, we understand how important time is for families, and we excel in this area, often completing loans in under three weeks. Many of our clients have shared their experiences of completing FHA streamline refinances in as little as 14 days. This swift turnaround is especially beneficial for families eager to secure lower interest rates and ease their financial burdens without unnecessary delays.

By streamlining the application and approval processes, we promise pre-approval in under an hour. This means you can quickly take advantage of favorable market conditions, making homeownership more accessible and manageable. We know how challenging this can be, and we’re here to support you every step of the way.

Eligibility Criteria: Know If You Qualify for FHA Streamline Refinancing

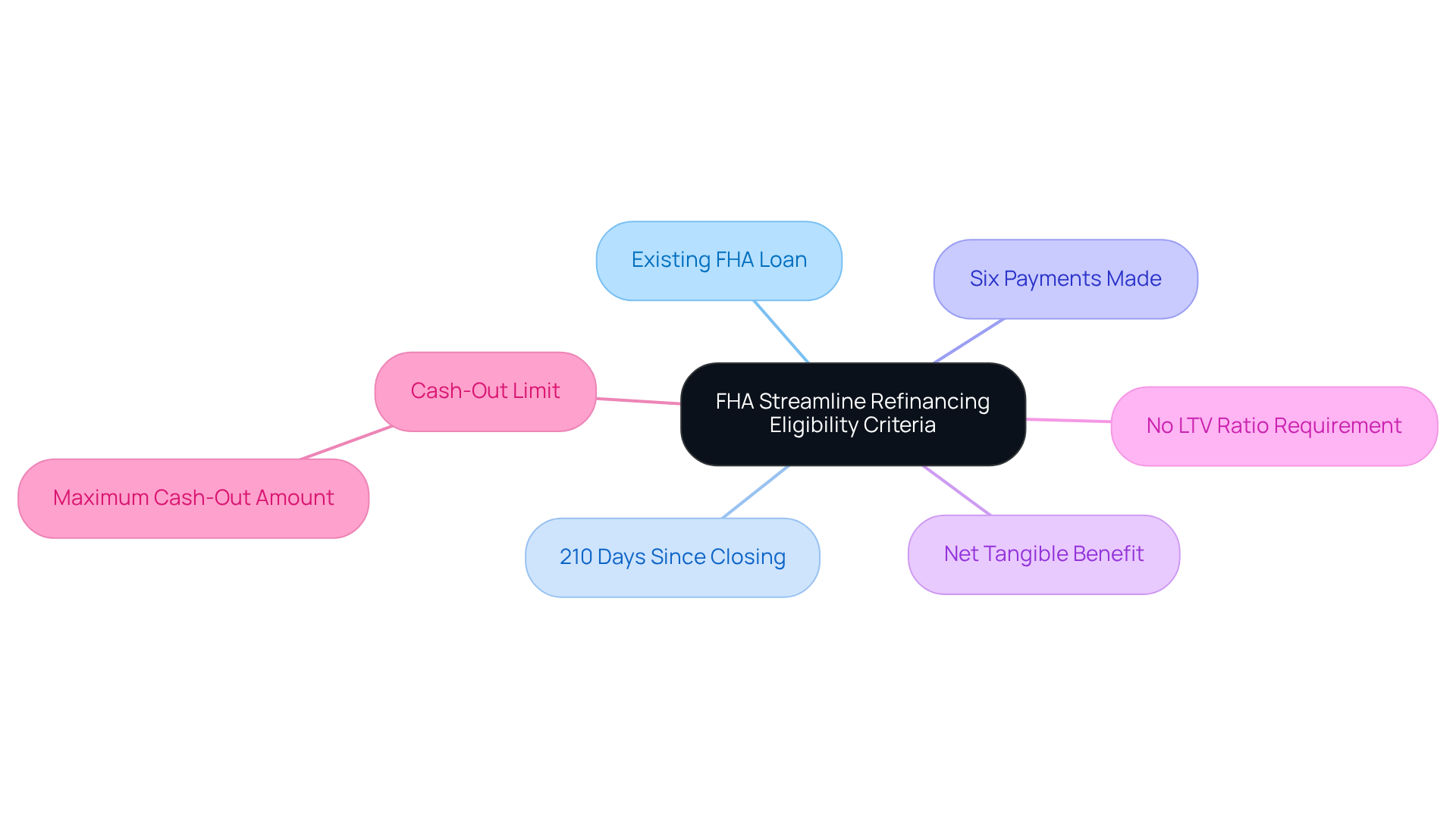

Navigating the world of FHA simplified loan modifications can feel overwhelming, but we’re here to help you understand the process. To qualify, property owners must meet specific eligibility requirements. This includes having an existing FHA loan and staying current on mortgage payments. Importantly, at least 210 days must have passed since the closing date of your existing FHA mortgage, and you must have made at least six payments on it. This ensures that you are genuinely on the path to improving your financial situation.

One of the most significant benefits of the FHA program is the absence of a loan-to-value (LTV) ratio requirement. This means that you can refinance even if you owe more than your home’s value. Recent data indicates that many property owners qualify for FHA streamline loan modifications, making this an appealing option for countless families.

Mortgage specialists, like Vishal Garg, emphasize the importance of understanding these criteria, as they can greatly influence your ability to take advantage of the FHA streamline loan modification option. By meeting the eligibility requirements, you can potentially save money and simplify your mortgage experience.

Key Points to Remember:

- You must have an existing FHA loan and be current on payments.

- At least 210 days must have passed since the closing date of your existing FHA mortgage.

- You must have made at least six payments on the existing FHA-backed mortgage.

- Refinancing must yield a ‘net tangible benefit.’

- There is no LTV ratio requirement, allowing for loan modification even if you owe more than your home’s value.

- Cash-out from an FHA Refinance is limited to $500.

We know how challenging this can be, but by understanding these guidelines, you can take the next steps toward a more manageable mortgage. We’re here to support you every step of the way.

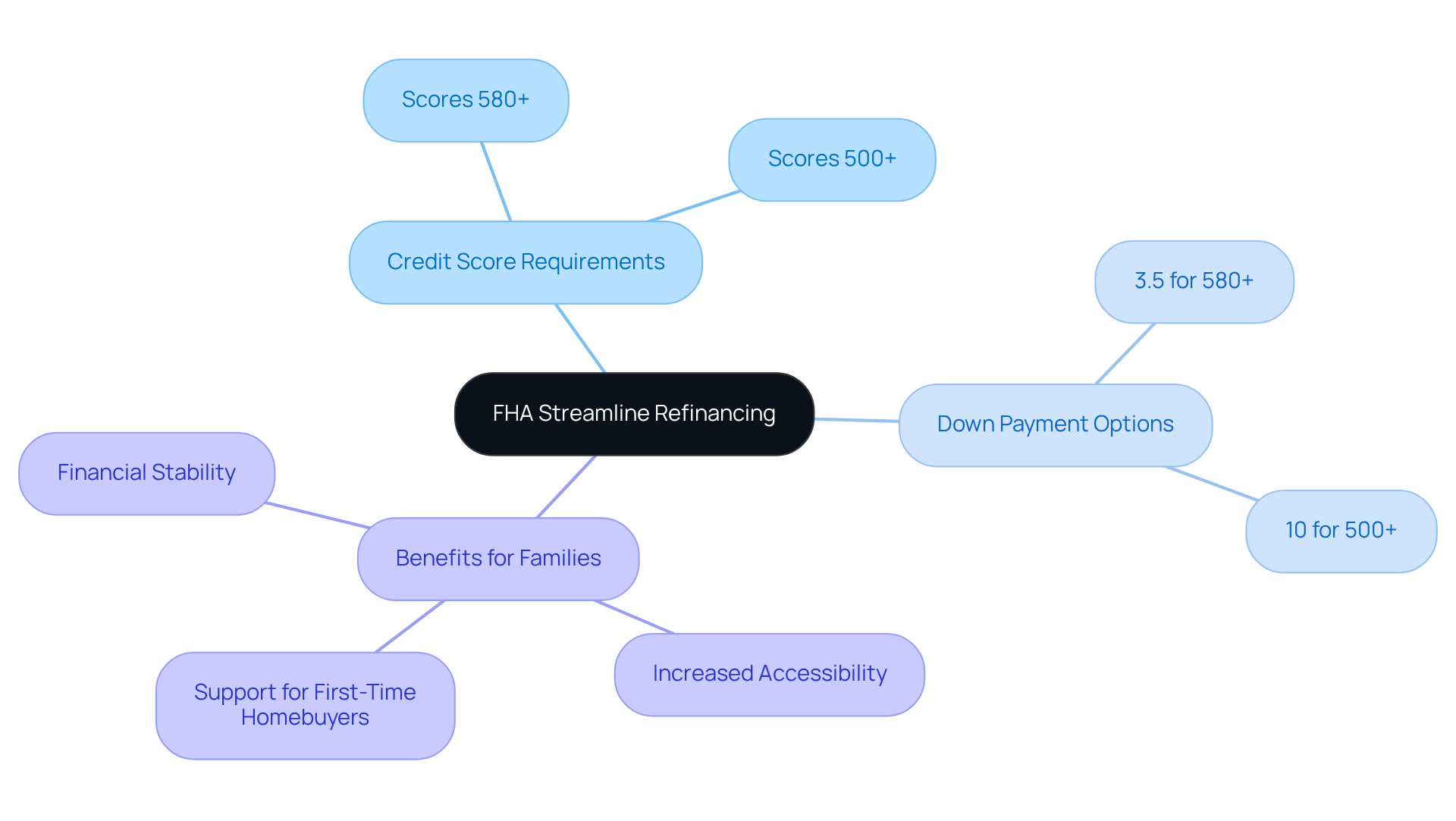

Flexible Credit Requirements: Access FHA Streamline Refinancing with Ease

Navigating the world of home loans can be daunting, especially for families facing credit challenges. The FHA Simplified loan modification offers a compassionate solution, designed with adaptable credit criteria that cater to a diverse range of homeowners. Unlike traditional loan modification methods that often impose strict credit standards, the FHA streamline approach is more lenient and inclusive. This means that families, including those with less-than-perfect credit histories, can access valuable restructuring opportunities.

For instance, borrowers with credit scores as low as 580 may qualify for an FHA loan with a down payment of just 3.5%. Even those with scores starting at 500 can still secure a loan with a 10% down payment. This flexibility is crucial, as it opens doors for many families who might otherwise feel sidelined in the financial restructuring process.

Statistics reveal that FHA loans are especially beneficial for first-time homebuyers and those looking to upgrade their living situations. By allowing for higher debt-to-income ratios, these loans enhance accessibility for families striving to improve their financial circumstances. We understand how challenging this can be, and that’s why FHA streamline loan options are here to empower property owners. In today’s mortgage environment, they serve as a valuable resource, helping families take meaningful steps toward financial stability.

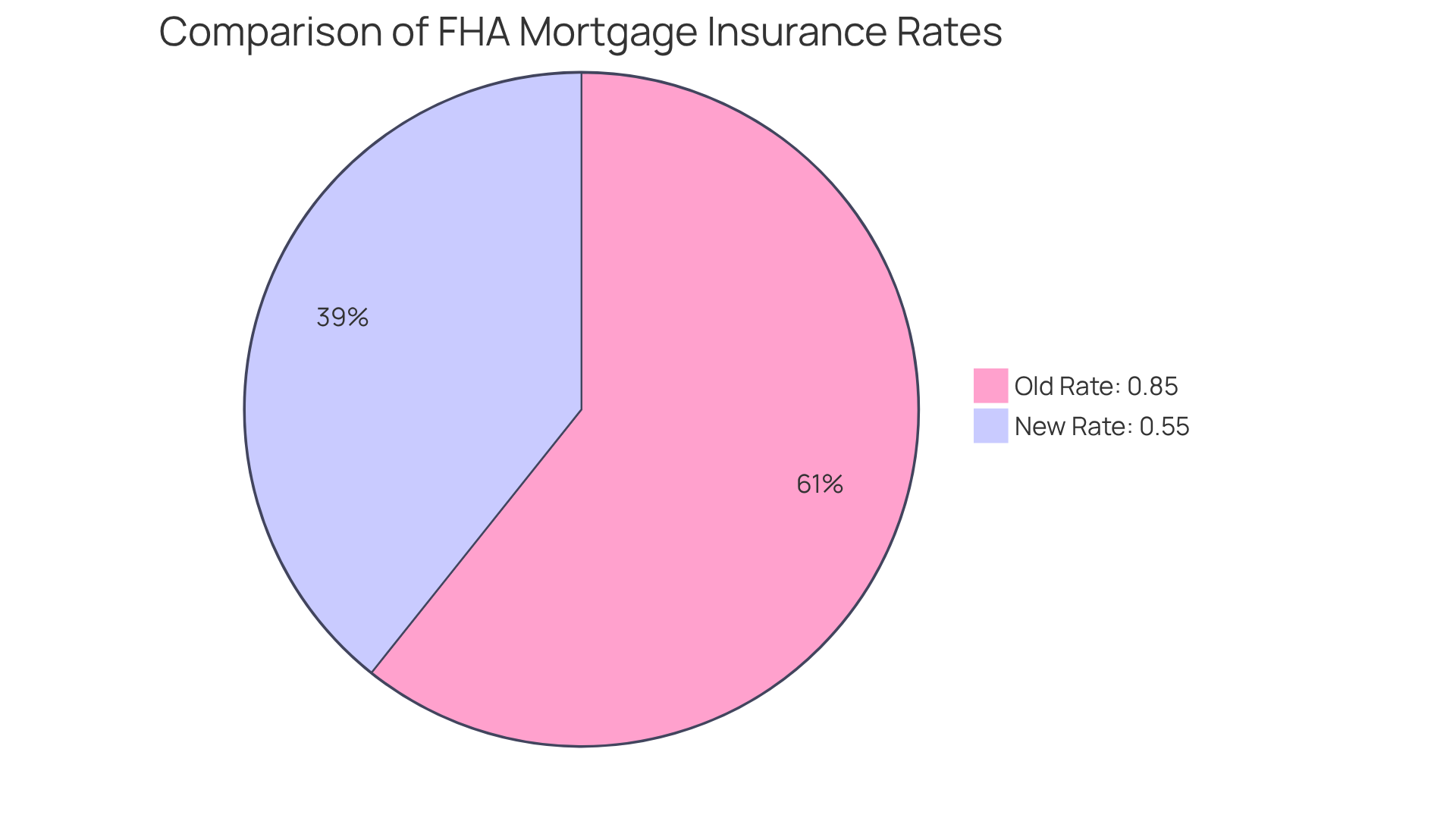

Lower Mortgage Insurance: Reduce Your Costs with FHA Streamline Refinancing

FHA streamline loan modifications provide property owners a valuable opportunity to reduce their mortgage insurance costs, resulting in significant savings. By choosing this loan restructuring option, families can enjoy reduced rates on their mortgage insurance, resulting in meaningful monthly savings. For example, in 2025, most FHA borrowers can expect to pay approximately 0.55% of the total loan amount in annual mortgage insurance premiums, down from the previous rate of 0.85%. This reduction can save borrowers hundreds of dollars each year, enhancing their financial flexibility.

Consider the story of a family who refinanced their FHA loan with a 10% down payment. They benefited from a lower annual MIP of 0.50% for 11 years, which significantly decreased their monthly payments. Such savings can be pivotal, allowing families to allocate funds toward other essential expenses or investments.

We understand how crucial it is to grasp mortgage insurance costs when budgeting for homeownership. With the right loan restructuring approach, property owners can effectively manage these expenses, making homeownership more attainable. The impact of FHA streamline loan adjustments on mortgage insurance costs not only alleviates financial pressures but also empowers families to pursue their homeownership dreams with greater ease.

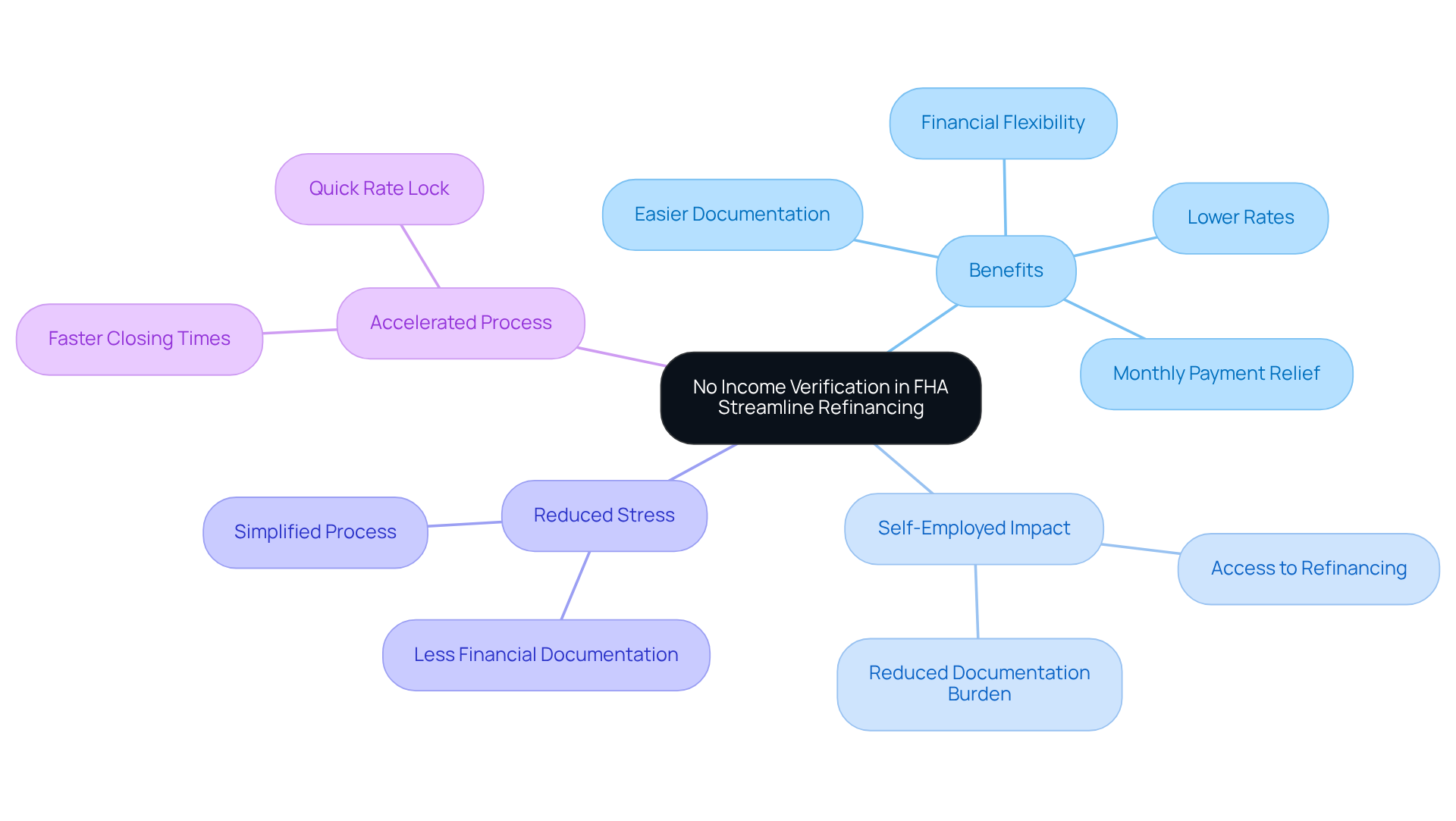

No Income Verification: Simplify Your FHA Streamline Refinancing

One of the standout features of the FHA Simplified loan modification is the removal of income verification. This change significantly eases the loan adjustment process for homeowners, especially for self-employed individuals or those with inconsistent income streams. We know how challenging it can be to gather extensive financial documentation, and this aspect allows them to refinance without that burden.

By eliminating this requirement, the FHA program creates opportunities for many who might otherwise struggle with conventional loan obstacles. In fact, a significant portion of self-employed borrowers find it difficult to supply the required income documentation for typical loan options. With the FHA streamline option, they can take advantage of loan modification opportunities more readily, enhancing their financial flexibility.

Mortgage professionals emphasize that this streamlined approach not only reduces stress but also accelerates the refinancing timeline. Homeowners can swiftly lock in lower rates and reduce monthly payments, providing them with much-needed relief. We’re here to support you every step of the way as you navigate this process.

Conclusion

The FHA Streamline refinancing program offers homeowners a unique opportunity to simplify their financial journey while enjoying substantial benefits. We know how challenging this can be, and by leveraging this program, families can unlock lower interest rates, reduce monthly payments, and enhance their overall financial health without the burden of excessive documentation or appraisals. This streamlined approach is designed to empower homeowners, making the refinancing process more accessible and efficient.

Throughout this article, we’ve highlighted key advantages of FHA Streamline refinancing, including:

- Minimal documentation requirements

- Faster closing times

- Flexible credit criteria

These features not only alleviate the stress often associated with traditional refinancing but also open doors for many families who may otherwise feel constrained by their financial situations. The potential for reduced mortgage insurance costs further enhances the appeal of this program, allowing homeowners to save significantly.

In conclusion, the FHA Streamline refinancing program serves as a vital resource for homeowners seeking financial relief and stability. By taking advantage of its numerous benefits, families can navigate their mortgage challenges with confidence and ease. Embracing this opportunity not only leads to immediate savings but also paves the way for a more secure financial future. We encourage homeowners to explore their options and consult with mortgage professionals to fully understand how FHA Streamline refinancing can transform their financial landscape.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage provides personalized consultations for FHA streamline refinancing solutions, helping homeowners navigate loan adjustments and customize solutions based on their unique financial situations.

How does F5 Mortgage ensure customer satisfaction?

F5 Mortgage boasts a customer satisfaction rate of 94%, having assisted over 1,000 families, emphasizing their commitment to understanding and guiding clients through the refinancing process.

What are the benefits of FHA streamline refinancing?

FHA streamline refinancing can lead to reduced interest rates, lower monthly payments, and improved financial situations for homeowners, making homeownership more affordable.

What are the eligibility requirements for FHA streamline refinancing?

Borrowers must have made at least six payments, wait 210 days before applying, and be current on their mortgage payments with no delinquencies.

How can FHA streamline refinancing help reduce monthly payments?

By lowering the interest rate and potentially extending the loan term, families can significantly reduce their monthly payments, creating more room in their budgets for essential expenses or savings.

What is the potential impact of lowering interest rates through FHA streamline refinancing?

Lowering interest rates can lead to substantial savings over the life of the loan, allowing homeowners to manage their finances more effectively and plan for future needs.

What should homeowners do to prepare for FHA streamline refinancing?

Homeowners should gather necessary documentation and consult with a mortgage professional to explore the best rates available and navigate the refinancing process efficiently.