Overview

In 2025, families face many challenges when considering their financial options. We understand how overwhelming this can be, but there are various low-interest home equity loan options available that can truly make a difference. These competitive loan products not only offer streamlined application processes but also tailored services from multiple lenders.

By leveraging your home equity, you can effectively address your financial needs while being mindful of the potential risks associated with these loans. We’re here to support you every step of the way, ensuring you find the best solution that fits your family’s unique situation. Take the time to explore these options and empower yourselves to make informed decisions for your future.

Introduction

Navigating the world of home equity loans can feel overwhelming for families, especially in today’s ever-changing financial landscape. We understand how challenging this can be. As property values rise and interest rates fluctuate, it’s essential to grasp the best low-interest home equity loan options available in 2025. This knowledge is crucial for making informed financial decisions.

What effective strategies can families employ to leverage their home equity without falling into common pitfalls? In this article, we explore seven competitive loan options that promise affordability while catering to the unique needs of families looking to maximize their financial potential.

We’re here to support you every step of the way.

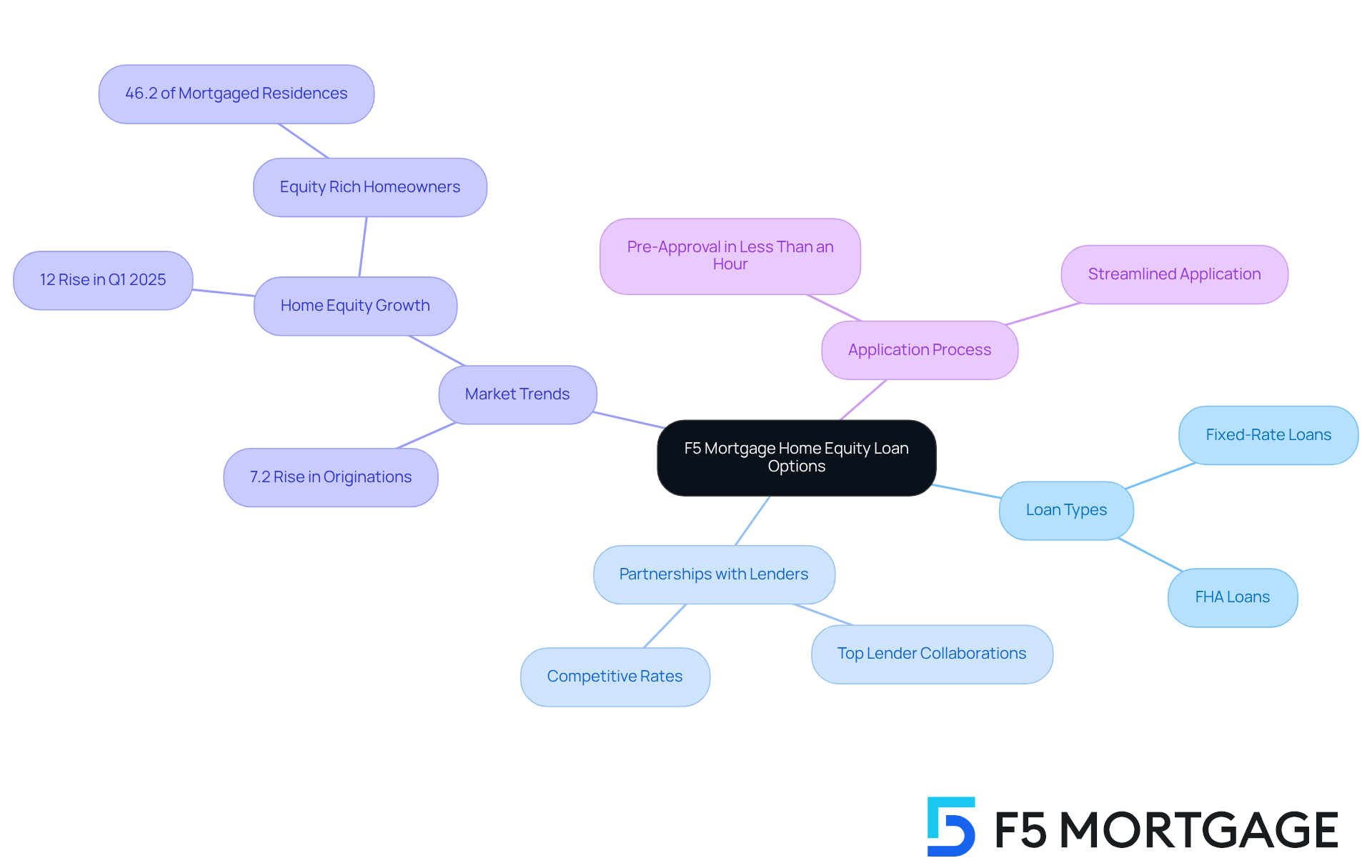

F5 Mortgage: Competitive Low-Interest Home Equity Loan Options

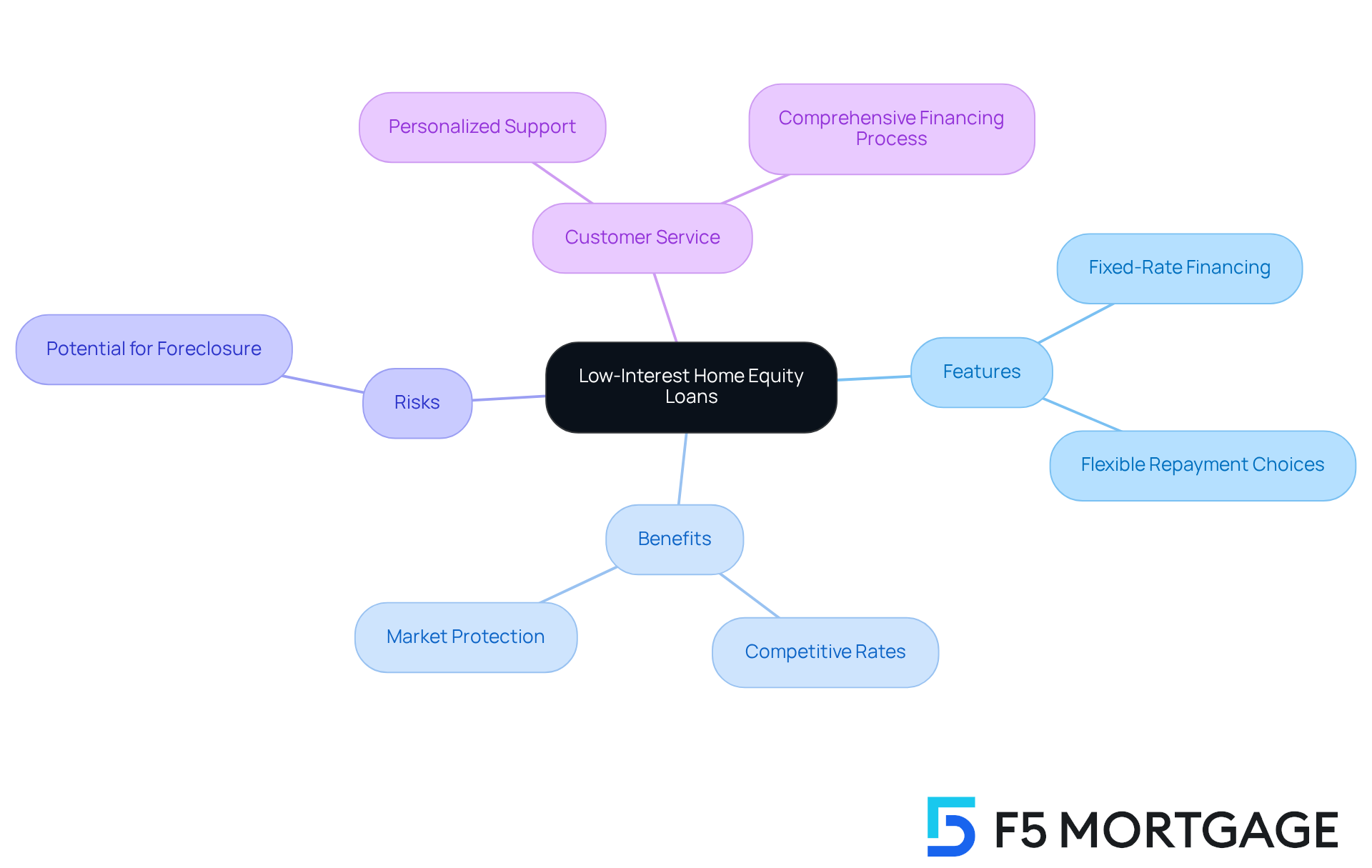

At F5 Mortgage, we understand how challenging it can be to navigate the world of property financing. That’s why we offer a variety of options, including a low interest home equity loan, specifically tailored for households like yours. Through personalized consultations, you can explore different loan types, including fixed-rate loans and FHA loans, ensuring you find the best fit for your financial needs.

Our partnerships with top lenders enable us to offer a low interest home equity loan, making us an ideal choice for families looking to leverage their property value efficiently. With the residential asset market experiencing a significant this year, now is a great time to take advantage of these favorable circumstances.

We know that time is of the essence, which is why our streamlined application process guarantees pre-approval in less than an hour. This means you can [access funds quickly and effectively](https://cbsnews.com/news/home-equity-loan-rates-drop-to-2025-low-is-loan-worth-opening-now), allowing you to make informed decisions about utilizing your property value.

At F5 Mortgage, we’re here to support you every step of the way, helping you navigate your options with confidence and care.

PNC Bank: Trusted Provider of Low-Interest Home Equity Loans

At F5 Mortgage, we understand that navigating the world of loans can be daunting. That’s why we offer a diverse selection of loan products, featuring attractive interest rates, including fixed-rate loans and flexible repayment options tailored for families like yours. Our streamlined online application process makes it easier for homeowners to access their property value efficiently.

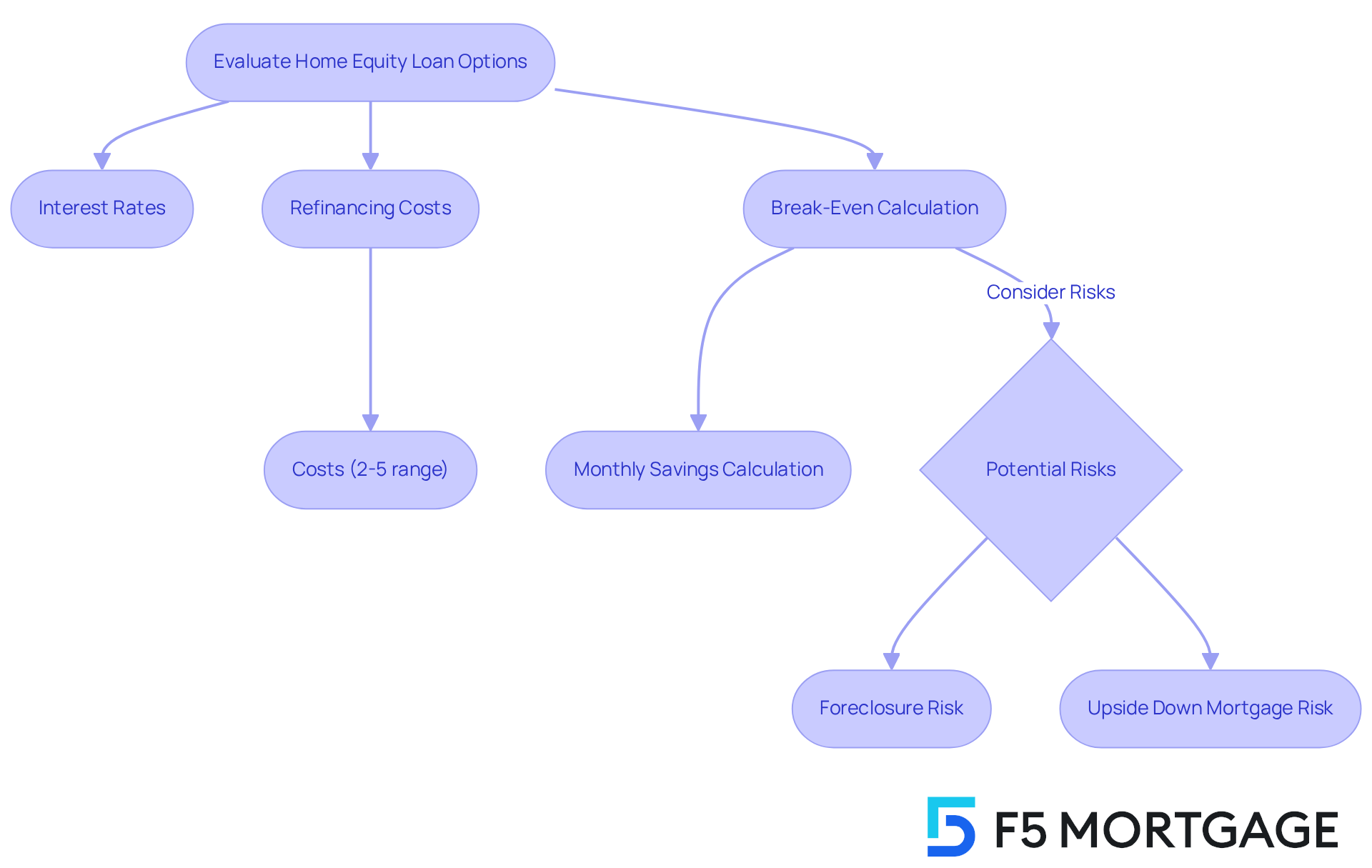

We’re proud to provide excellent customer service, as reflected in our high satisfaction ratings. This makes us a trustworthy choice for families looking to secure a low interest home equity loan. However, when considering refinancing, it’s essential to be aware of the associated costs, which typically range from 2% to 5% of the mortgage amount in California. For instance, refinancing a $300,000 mortgage could result in closing costs between $6,000 and $15,000, covering application fees, origination charges, and appraisal costs.

Calculating your break-even point is crucial. For example, if your refinancing costs amount to $4,000 and you save $100 monthly, it would take you 40 months to break even. Yet, we know how challenging this can be, as families must also weigh the , such as foreclosure if payments are missed or being upside down on a mortgage if property values decrease.

According to industry insights, property owners have, on average, accumulated over $200,000 in accessible wealth due to rising real estate values. This can be a significant advantage when managed wisely. As Aly J. Yale points out, ‘The biggest drawback of a home equity product is that it adds a second monthly payment to your household.’ Therefore, it’s important to ensure your budget can accommodate this added obligation.

For families exploring their options, it may also be beneficial to consider alternatives like cash-out refinancing, personal loans, or a low interest home equity loan, which can offer various advantages tailored to your unique situation. We’re here to support you every step of the way as you make these important decisions.

Rocket Mortgage: Fast and Affordable Home Equity Loan Solutions

At F5 Mortgage, we understand how challenging financial decisions can be, especially when it comes to securing quick and cost-effective financing solutions. As a leading option for households in 2025, we prioritize your needs. Our streamlined online application process allows for approvals in just minutes, enabling families to access funds swiftly for renovations, debt consolidation, or other pressing financial needs.

If you’re considering refinancing a mortgage in California, it’s important to first assess your current mortgage terms and clarify your financial goals. From there, you can shop for lenders, comparing rates, costs, and terms to find the best fit for your unique situation. At F5 Mortgage, we offer competitive rates that are influenced by various borrower-specific factors, such as credit score and existing debt. Our flexible terms cater to diverse financial situations, ensuring you feel supported throughout the process.

For property financing, the highest combined-loan-to-value ratio (CLTV) we offer is 80%, with an average closing period of roughly 20 days from application. We also require a complete appraisal as part of the application process, which is essential for accurately assessing property value. We know how important customer satisfaction is, and we’re proud of our impressive ratings, with 94% of clients expressing satisfaction with our services.

Our testimonials highlight the effectiveness and assistance we provide during the financing process, reinforcing our commitment to being a trustworthy ally in utilizing your residential value. We’re here to support you every step of the way, making the journey to as smooth as possible.

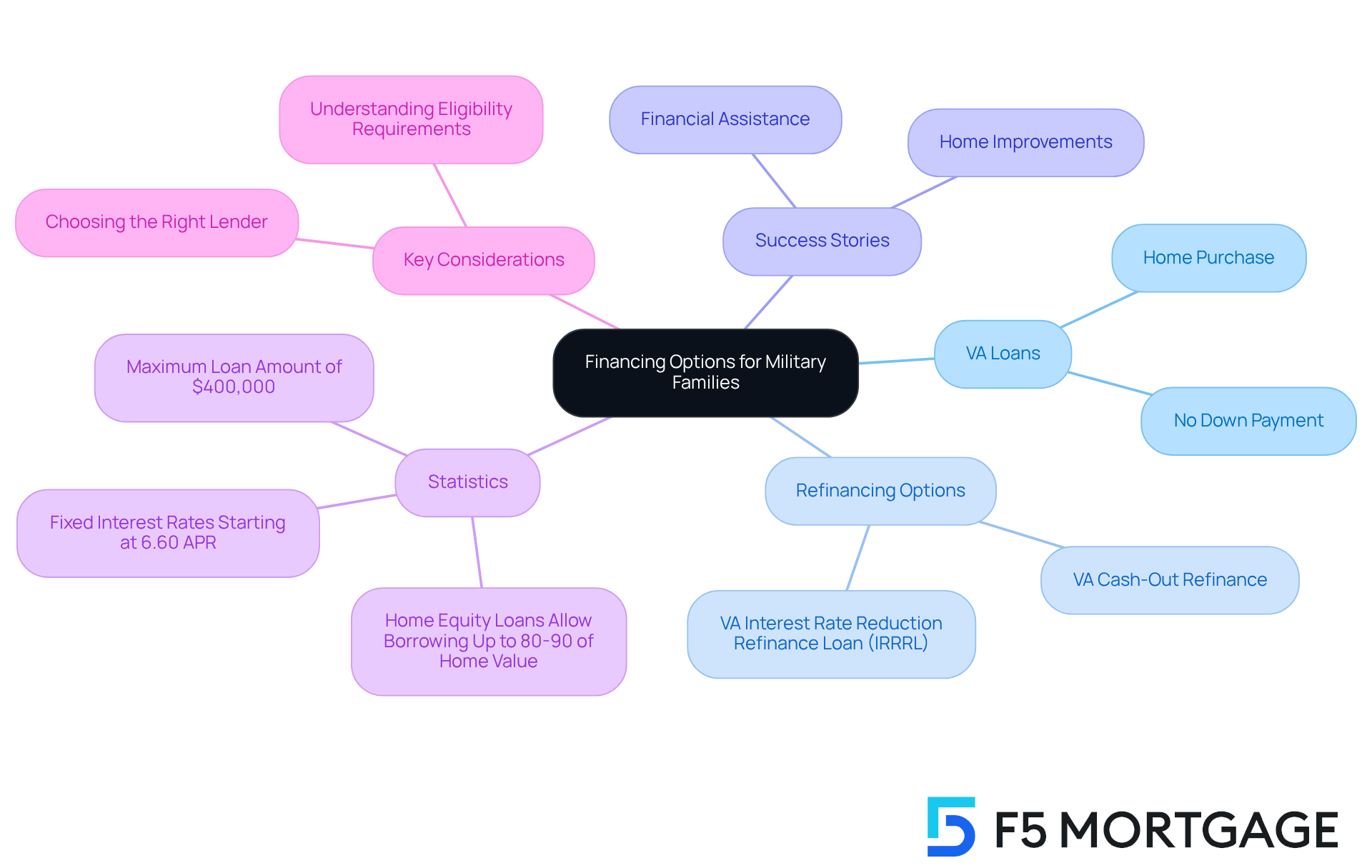

Navy Federal Credit Union: Low-Interest Loans for Military Families

At F5 Mortgage, we understand how challenging it can be for military families to navigate financing options. That’s why we offer competitive solutions specifically designed for you, including the benefits of California VA Loans. With a , you can purchase a single-family residence as your primary home without the burden of a down payment. This makes it an appealing choice for those looking to improve their living situation.

As you build equity in your home, we’re here to support you with two refinancing options:

- The VA Interest Rate Reduction Refinance Loan (IRRRL) can help lower your rate and monthly payments.

- The VA cash-out refinance provides funds to address various financial needs.

Recent statistics reveal that many military households are utilizing a low interest home equity loan to renovate their homes and consolidate debt, showcasing the effectiveness of these financial tools.

Our commitment to assisting military personnel and their families is reflected in our tailored financial products and exceptional customer support. Success stories from military families highlight how our services have facilitated home improvements and provided crucial financial assistance. We know how important it is to have the right support, and we’re here to guide you every step of the way.

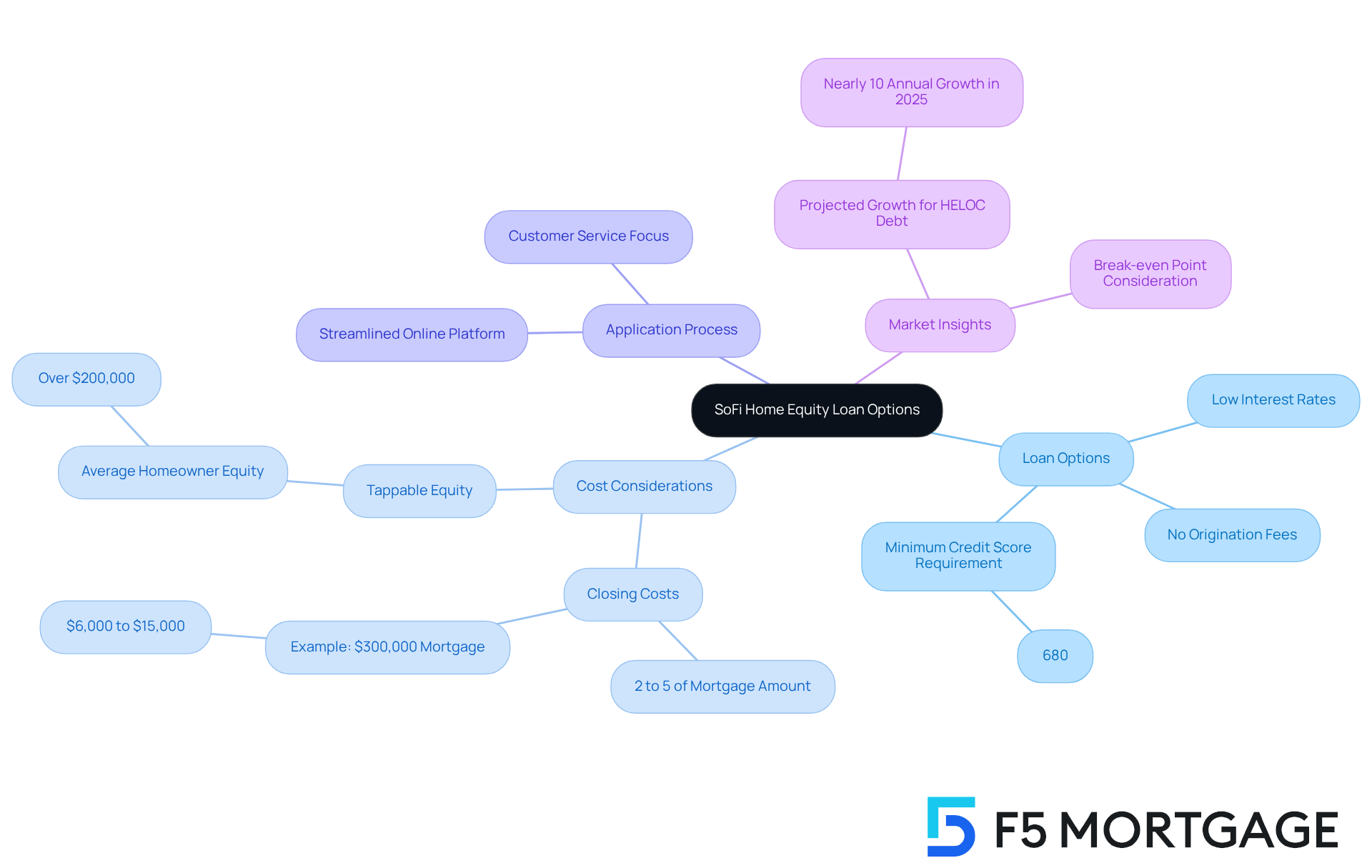

SoFi: Flexible Low-Interest Home Equity Loan Options

At SoFi, we understand that navigating property loans can be a challenging journey for families. That’s why we offer adaptable options for a low interest home equity loan, designed to accommodate a variety of financial circumstances. With no origination fees and competitive rates, families can tap into their home value without worrying about additional costs. Did you know that the average homeowner has over $200,000 in tappable equity? This makes accessing your financial resources an appealing option.

However, it’s essential to comprehend the expenses linked to refinancing in California. Closing costs generally range from 2% to 5% of the mortgage amount, which can significantly impact your financial planning. For instance, if you refinance a $300,000 mortgage, you might face closing costs between $6,000 and $15,000. We know how overwhelming these figures can be, but .

SoFi’s online platform streamlines the application process, enabling borrowers to manage their finances effortlessly. Our dedication to customer service and transparency has made us a favored choice among homeowners seeking a low interest home equity loan to access their assets. Yet, it’s important to note that we require a minimum credit score of 680, which may be higher than some other lenders.

As the market for residential value loans continues to expand, with projections of nearly 10 percent annual growth for HELOC debt in 2025, we encourage households to evaluate their options thoughtfully. Consider determining your break-even point to ensure that refinancing is a financially sensible choice for you. Remember, we’re here to support you every step of the way.

M&T Bank: Reliable Provider of Low-Interest Home Equity Loans

At F5 Mortgage, we understand how challenging it can be to navigate home equity financing. That’s why we pride ourselves on being a trustworthy source for a low interest home equity loan, ensuring customer satisfaction is a top priority in every aspect of our offerings. Our selection includes fixed-rate financing and flexible repayment choices, allowing families to find solutions that align with their unique financial situations.

Currently, we offer competitive rates for rate-and-term financing options, which are particularly appealing to California homeowners looking to refinance. This choice empowers families to lower their monthly mortgage payments by replacing their existing mortgage with a new one that provides a better rate or varying term length. Additionally, when you lock in your mortgage rate with F5 Mortgage, you protect yourself from market fluctuations during the processing period, ensuring that you secure the best possible terms.

With , families can take advantage of competitive terms and utilize a low interest home equity loan to tap into the value of their homes. However, it’s important to consider the risks associated with property value loans, including the potential for foreclosure if payments are missed. At F5 Mortgage, our commitment to personalized service means that you will receive comprehensive support throughout the financing process, enhancing your overall experience.

This dedication to our clients is reflected in our outstanding customer satisfaction ratings, establishing F5 Mortgage as a reliable choice for families looking to leverage their property value efficiently. We’re here to support you every step of the way, ensuring that you feel confident and informed in your decision-making.

Connexus Credit Union: No-Appraisal Low-Interest Home Equity Loans

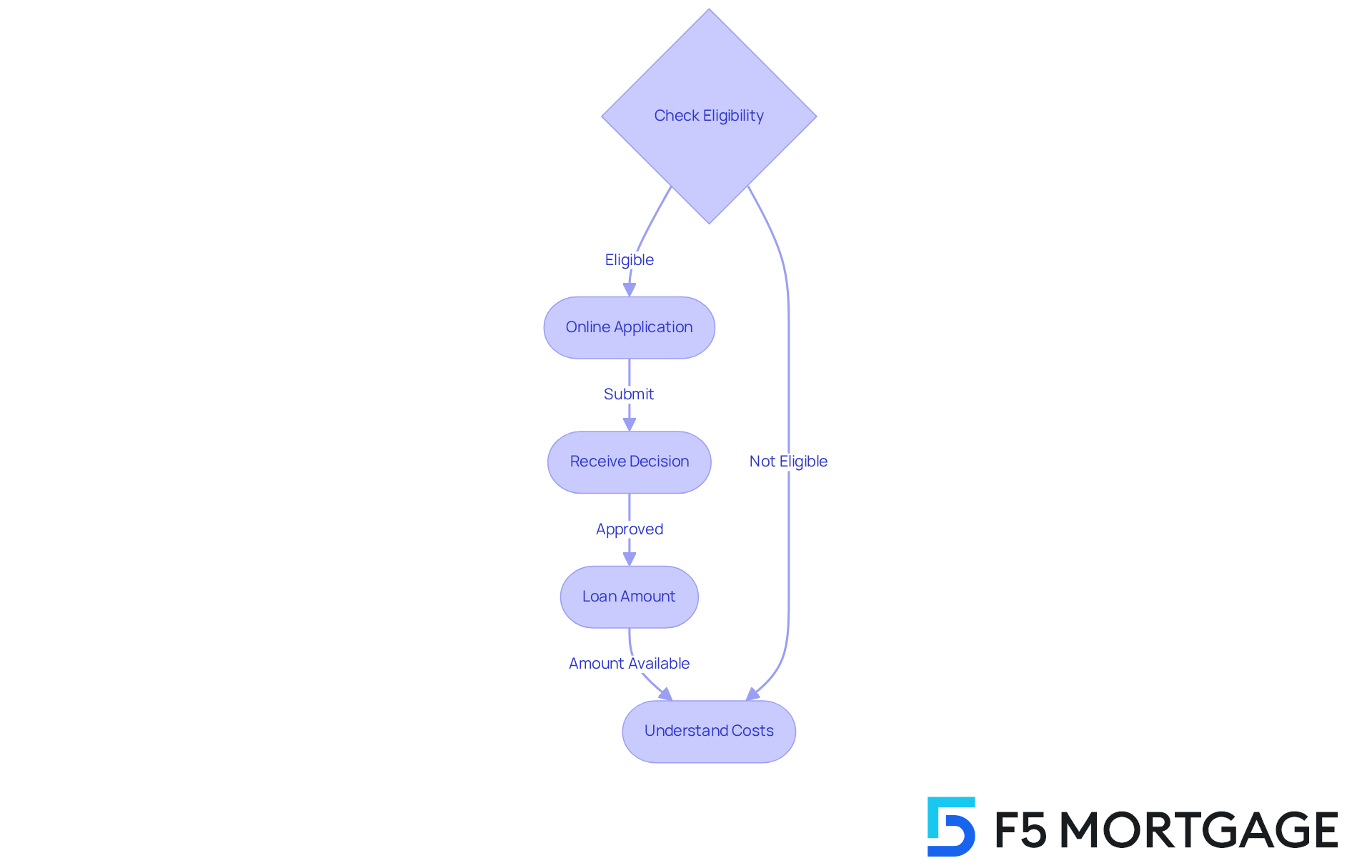

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of property financing. That’s why we offer creative, no-appraisal options, including a low interest home equity loan, that allow you to tap into your property’s value without the usual hurdles. To qualify for these credits, you’ll need a minimum of 10% equity in your home, aligning with the common requirement of maintaining at least an 80% home-to-value ratio. Additionally, we typically require a maximum debt-to-income (DTI) ratio of 43%, ensuring that you can manage your payment obligations comfortably.

This streamlined process is designed to make securing funds easier for you. With our , you can receive decisions in as little as 24 hours, providing you with the support you need during this important time. We provide a low interest home equity loan with competitive rates and flexible terms, allowing you to borrow up to 90% of your property’s value, so you can find financing that truly meets your unique needs.

Understanding the costs associated with refinancing is also crucial. Closing costs for these loans range from $175 to $2,000, giving you a clear picture of the upfront expenses. Our commitment to your satisfaction shines through in our personalized service and support, which is reflected in our high customer satisfaction ratings. At F5 Mortgage, we’re here to support you every step of the way, making your borrowing experience as straightforward as possible.

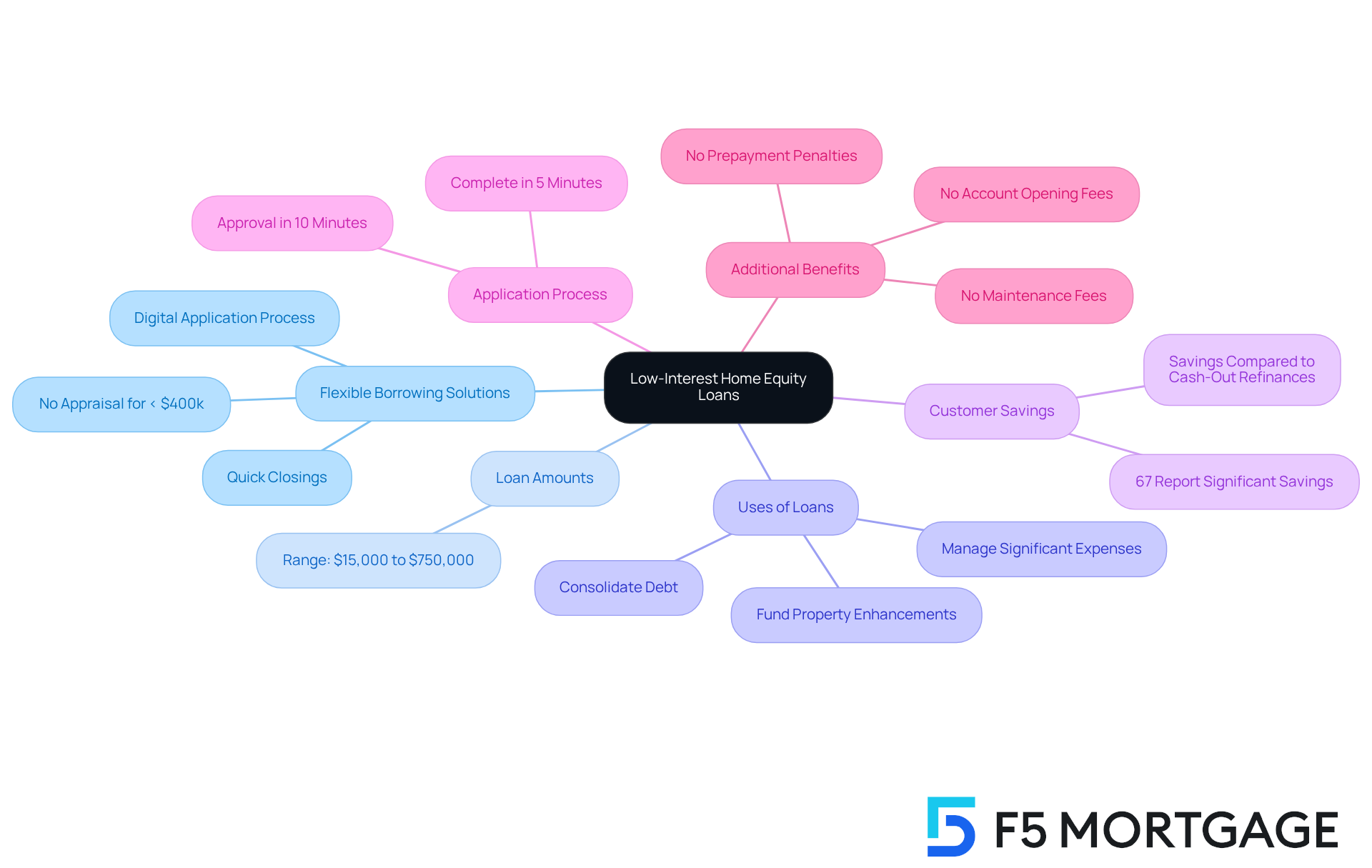

Figure: Innovative Low-Interest Home Equity Line of Credit Solutions

At F5 Mortgage, we understand how challenging it can be to navigate financial options. That’s why we offer creative low interest home equity loans designed to provide families with flexible borrowing solutions. Our fully digital application process means you can receive approval in as little as ten minutes, making it easier than ever to access the funds you need.

With , property owners can tap into their assets as necessary. Whether you’re looking to:

- Fund property enhancements

- Consolidate debt

- Manage significant expenses

Our low interest home equity loan is an ideal option. In fact, 67% of our customers have reported significant savings compared to traditional cash-out refinances, highlighting the financial benefits of choosing F5 Mortgage.

We also offer competitive fixed rates for predictable payments, and for amounts under $400,000, there’s no need for an in-person appraisal, which simplifies the process of obtaining a low interest home equity loan. Plus, with no account opening fees, maintenance fees, or prepayment penalties, our offerings are designed to be as accessible as possible.

At F5 Mortgage, we are dedicated to providing outstanding service and quick closings—most transactions finalize in under three weeks. We’re here to support you every step of the way, establishing ourselves as a top choice in the residential finance market for families in 2025.

TD Bank: Customer-Friendly Low-Interest Home Equity Loans

At F5 Mortgage, we understand how challenging the journey to securing a low interest home equity loan can be. That’s why we prioritize a customer-focused strategy that emphasizes clarity and support throughout your lending experience. Our offerings include fixed-rate financing and flexible repayment options, designed to help families like yours manage finances effectively.

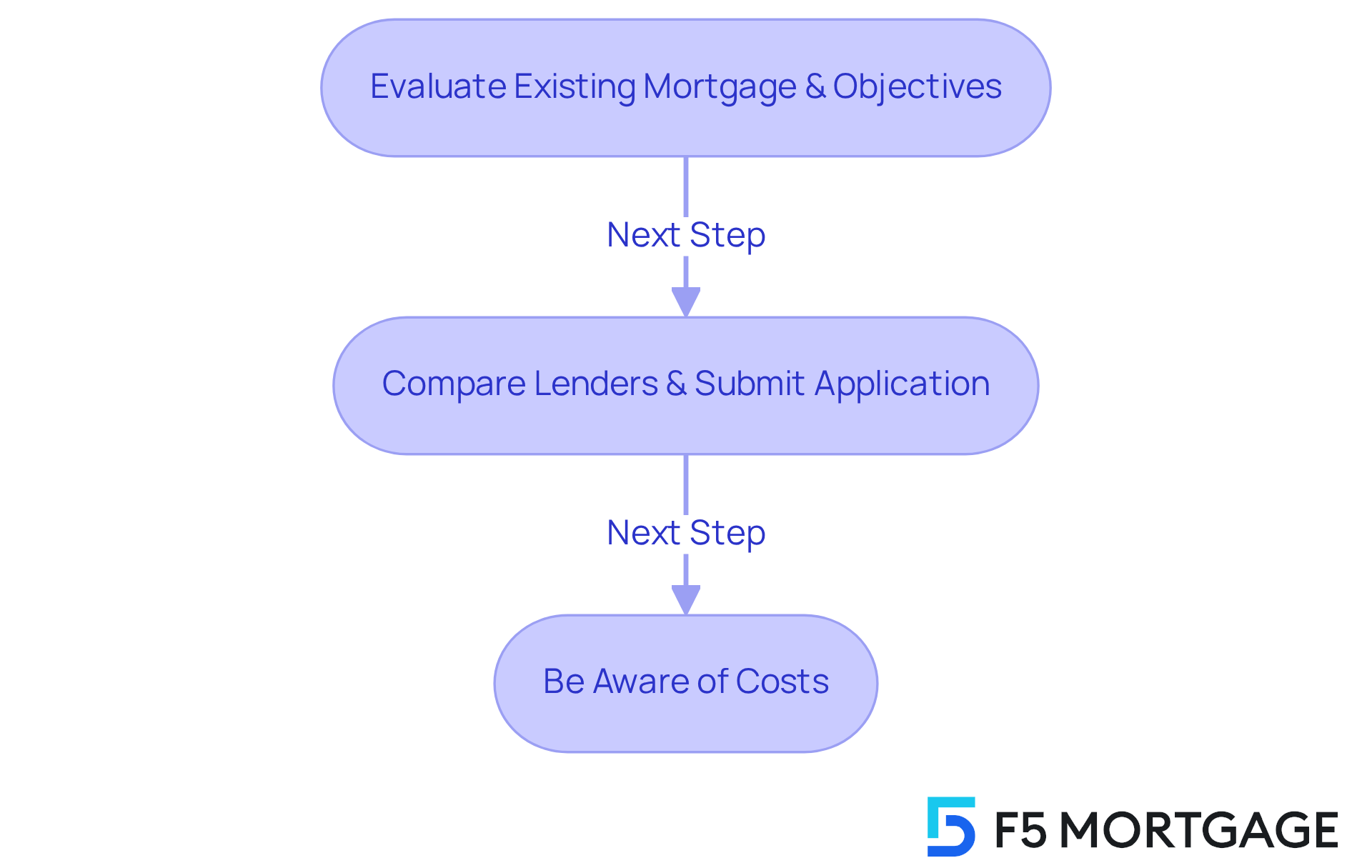

Navigating the refinancing process in California involves several essential steps:

- Evaluate your existing mortgage and establish your refinancing objectives.

- Compare lenders, submit your application, and finalize the agreement.

- Be aware of the costs associated with refinancing, which may include application fees, appraisal fees, and closing costs.

With a strong commitment to , we ensure that you receive comprehensive guidance at every step of your loan journey. We know how important it is to navigate these refinancing steps with confidence. F5 Mortgage stands out with competitive rates and personalized service, making us a reliable choice for homeowners seeking a low interest home equity loan to access their property value.

Our dedication to client satisfaction is evident in our consistently positive customer ratings. As we look ahead to 2025, F5 Mortgage’s strong reputation and commitment to your success make us a top choice for families looking to enhance their homes. We’re here to support you every step of the way, ensuring a smooth and rewarding refinancing experience.

Fifth Third Bank: Diverse Low-Interest Home Equity Loan Options

At F5 Mortgage, we understand how challenging it can be to navigate home financing options. That’s why we offer a variety of low interest home equity loan solutions, including rate-and-term products that many California homeowners appreciate. These financial products empower families to refinance their current mortgages, helping them secure better rates or alternative term lengths. This can make managing monthly payments easier or even accelerate mortgage repayment.

Key features of F5 Mortgage’s rate-and-term loans include:

- The flexibility to switch between variable and fixed-rate mortgages, allowing you to adapt to changing market conditions.

- Personalized service, as highlighted by numerous client testimonials that praise our team’s exceptional support and expertise.

- Access to residential value for various purposes, such as property enhancements or debt consolidation, ensuring you can navigate the loan process with confidence and ease.

With F5 Mortgage, families can enjoy a while accessing a low interest home equity loan. We’re here to support you every step of the way.

Conclusion

Navigating the landscape of low interest home equity loans can feel overwhelming, especially for families eager to make the most of their property value. In this article, we shine a light on various options available in 2025, showcasing competitive offerings from trusted lenders like F5 Mortgage, PNC Bank, Rocket Mortgage, and others. Each institution presents unique features, tailored services, and streamlined processes designed to meet the diverse financial needs of homeowners.

We understand how crucial it is to grasp the intricacies of refinancing costs. There’s potential for significant savings through various loan products, but it’s essential to evaluate your financial situation before making a commitment. With statistics indicating a rise in property values and accessible wealth, we encourage families to explore low interest home equity loans as a viable solution for renovations, debt consolidation, or other financial needs.

As you consider your financing options, it’s vital to approach this decision with careful thought about both the benefits and risks involved. Engaging with reputable lenders and understanding the terms of each loan can empower you to make informed choices. By taking action now, families can capitalize on the favorable market conditions and secure the financial support they need to enhance their living situations. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What types of home equity loans does F5 Mortgage offer?

F5 Mortgage offers a variety of home equity loan options, including low interest home equity loans, fixed-rate loans, and FHA loans, tailored to meet the financial needs of households.

How does F5 Mortgage ensure competitive interest rates?

F5 Mortgage partners with top lenders to provide low interest home equity loans, making it an ideal choice for families looking to leverage their property value efficiently.

What is the current trend in the residential asset market?

The residential asset market has experienced a significant 7.2% rise in originations this year, presenting favorable circumstances for homeowners.

How quickly can I get pre-approved for a loan with F5 Mortgage?

F5 Mortgage guarantees pre-approval in less than an hour, allowing you to access funds quickly and make informed decisions about utilizing your property value.

What should I consider when refinancing my mortgage?

When refinancing, it’s important to be aware of associated costs, which typically range from 2% to 5% of the mortgage amount. For example, refinancing a $300,000 mortgage could incur closing costs between $6,000 and $15,000.

How can I calculate my break-even point when refinancing?

To calculate your break-even point, divide your refinancing costs by your monthly savings. For instance, if your costs are $4,000 and you save $100 monthly, it would take 40 months to break even.

What are the risks associated with home equity loans?

Risks include the potential for foreclosure if payments are missed and being upside down on a mortgage if property values decrease.

How much accessible wealth have property owners accumulated on average?

Property owners have, on average, accumulated over $200,000 in accessible wealth due to rising real estate values.

What should families consider when adding a second monthly payment?

Families should ensure their budget can accommodate the additional monthly payment that comes with a home equity product.

What alternatives are available to home equity loans?

Alternatives include cash-out refinancing, personal loans, or other low interest home equity loan options that can offer various advantages tailored to individual situations.

What is the highest combined-loan-to-value ratio (CLTV) offered by F5 Mortgage?

F5 Mortgage offers a highest combined-loan-to-value ratio (CLTV) of 80%.

How long does the closing process take with F5 Mortgage?

The average closing period with F5 Mortgage is roughly 20 days from application.

What is required as part of the application process for a home equity loan?

A complete appraisal is required to accurately assess property value as part of the application process.

What do clients think about F5 Mortgage’s services?

F5 Mortgage has impressive ratings, with 94% of clients expressing satisfaction with their services.