Overview

This article highlights essential mortgage calculator tools tailored for VA homebuyers, emphasizing their vital role in helping you make informed financial decisions. We understand how challenging this process can be, and these calculators are designed to provide personalized estimates of monthly payments, integrating various financial factors. By utilizing these tools, you can navigate the home financing process with confidence. Statistics and expert insights underscore the effectiveness of these calculators, reinforcing that you are not alone on this journey. We’re here to support you every step of the way.

Introduction

Navigating the complex world of home financing can be a daunting task, especially for veterans seeking to leverage their unique benefits. We know how challenging this can be, and with an increasing number of veterans expected to utilize online mortgage calculators, these essential tools are transforming the homebuying experience. They provide clarity and confidence in financial decision-making.

However, as the landscape of mortgage options evolves, how can homebuyers ensure they are making the most informed choices? This article delves into ten vital VA mortgage calculator tools that empower veterans and homebuyers alike. Together, we can confidently assess financing options and take the next steps toward homeownership.

F5 Mortgage: User-Friendly VA Mortgage Calculator

F5 Mortgage’s mortgage calculator va is thoughtfully crafted for veterans, enabling them to input their financial details for accurate monthly payment projections, which encompass property taxes and insurance. This tool simplifies the home loan journey by using a mortgage calculator va, empowering veterans to make well-informed choices about their financing options. With an intuitive interface, it is designed to cater to all users, including first-time homebuyers, reflecting F5 Mortgage’s commitment to exceptional service and client satisfaction.

In 2025, approximately 70% of veterans are expected to utilize online resources like the mortgage calculator va, highlighting the growing trend of digital tools that simplify home financing. By using the mortgage calculator va, veterans can receive personalized rate quotes and current loan rates, which enhances their understanding of affordability and potential financing options.

Real-life examples demonstrate how the mortgage calculator va has positively impacted financing choices for veterans. For instance, a veteran who used the Armed Forces Bank VA loan estimator was able to accurately assess their monthly payments, leading to a more informed decision regarding their home purchase. As a representative from Armed Forces Bank noted, “Our VA loan estimator is designed to meet the unique needs of veterans, providing personalized rate quotes based on individual circumstances.” This underscores the practical benefits of the tool, making the home purchasing experience more accessible and informed. We’re here to support you every step of the way.

Bankrate: Comprehensive Mortgage Payment Calculator

Bankrate’s extensive loan cost estimator serves as a vital resource for homebuyers, allowing them to input important factors such as loan amount, interest rate, and loan duration. This tool provides a comprehensive breakdown of monthly payments, including principal, interest, taxes, and insurance. By shedding light on how various factors influence total loan costs, it empowers families to make informed choices about their financing options.

As we look ahead to 2025, it’s projected that the average number of users for detailed loan estimation tools will see a significant rise, with estimates indicating a 20% increase from the previous year. This growth reflects a heightened awareness of the importance of financial planning when purchasing a home. Experts agree that utilizing a mortgage calculator va can greatly assist homebuyers in understanding their financial obligations, leading to more confident and strategic decisions throughout the financing process.

As Greg McBride, Chief Financial Analyst at Bankrate, wisely points out, “Your loan interest rate will significantly influence how much you pay each month.” With the typical loan installment in the U.S. currently around $2,700 each month, grasping these expenses is crucial for families. Additionally, it’s important to remember that escrow accounts may include property taxes and home insurance, which can further impact monthly costs. We know how challenging this can be, and we’re here to support you every step of the way.

Better.com: Mortgage Calculator with Tax and Insurance Integration

At Better.com, we understand how challenging navigating finances can be, especially when utilizing a mortgage calculator va for home buying. That’s why we offer a financing estimator designed to ease your concerns. This mortgage calculator va not only calculates your monthly costs based on the borrowed sum and interest rate, but it also takes into account property taxes and homeowners insurance.

By integrating these elements, our estimator provides you with a clearer picture of your monthly financial commitments. This comprehensive overview helps you plan your budget more effectively, ensuring there are no surprises down the line. We’re here to support you every step of the way, empowering you to make informed decisions for your family’s future.

Chase: Detailed Mortgage Payment Breakdown Calculator

We know how challenging navigating loans can be. Chase’s thorough loan cost breakdown tool allows you to enter your loan information and receive a complete analysis of your monthly expenses. This includes a detailed breakdown of principal and interest, along with estimates for taxes and insurance. By utilizing this tool, homebuyers can gain valuable insights into how their payments will be organized over time, empowering them to make informed choices about their loan options.

Moreover, F5 Mortgage offers an easy-to-use mortgage calculator designed to streamline the financing process. This helpful resource assists clients in comprehending their financial obligations more effectively. We’re here to support you every step of the way, providing educational materials like manuals on loan terms and the lender’s role, so you can manage the intricacies of financing with confidence.

As financing experts emphasize, understanding the nuances of payment structures can significantly impact your long-term financial well-being. This knowledge enables you to navigate your loan journey with confidence. Additionally, recognizing the importance of comparing lenders can lead to lower interest rates, making the entire loan experience more manageable. Remember, you’re not alone in this process; we’re here to help you every step of the way.

Veterans Lending Group: Specialized VA Mortgage Calculator

Veterans Lending Group offers a specialized VA loan estimator designed specifically to meet the unique needs of veterans and active-duty service members. This valuable tool seamlessly integrates the distinct advantages of VA loans, such as no down payment and the elimination of private mortgage insurance (PMI). By utilizing this estimator, veterans can accurately evaluate their monthly payments and discover how their military service enhances their home financing opportunities.

We understand that navigating financing options can be overwhelming. Statistics show that approximately 70% of veterans turn to specialized loan estimators to help them make informed choices. These tools, such as the mortgage calculator va, are instrumental in helping veterans grasp the financial implications of their decisions, empowering them to confidently approach their home purchases.

For instance, the mortgage calculator va provides clarity on potential monthly payments based on varying loan amounts and interest rates, while also illustrating the long-term savings associated with no PMI. Furthermore, these tools can incorporate additional expenses, such as closing costs and property taxes, ensuring a comprehensive understanding of the financial commitment involved. Importantly, VA financing comes with specific limits on closing costs, further supporting veterans in their journey.

Experts in the housing finance sector emphasize the importance of these specialized tools for veterans and active-duty service members. Evelyn Waugh, a personal finance author, notes, “VA financing options are a benefit created to assist those who’ve served in the U.S. military forces in purchasing a home.” This highlights that these tools not only simplify the financing process but also empower users to take control of their financial futures, making homeownership more achievable and manageable. We’re here to support you every step of the way as you explore your options.

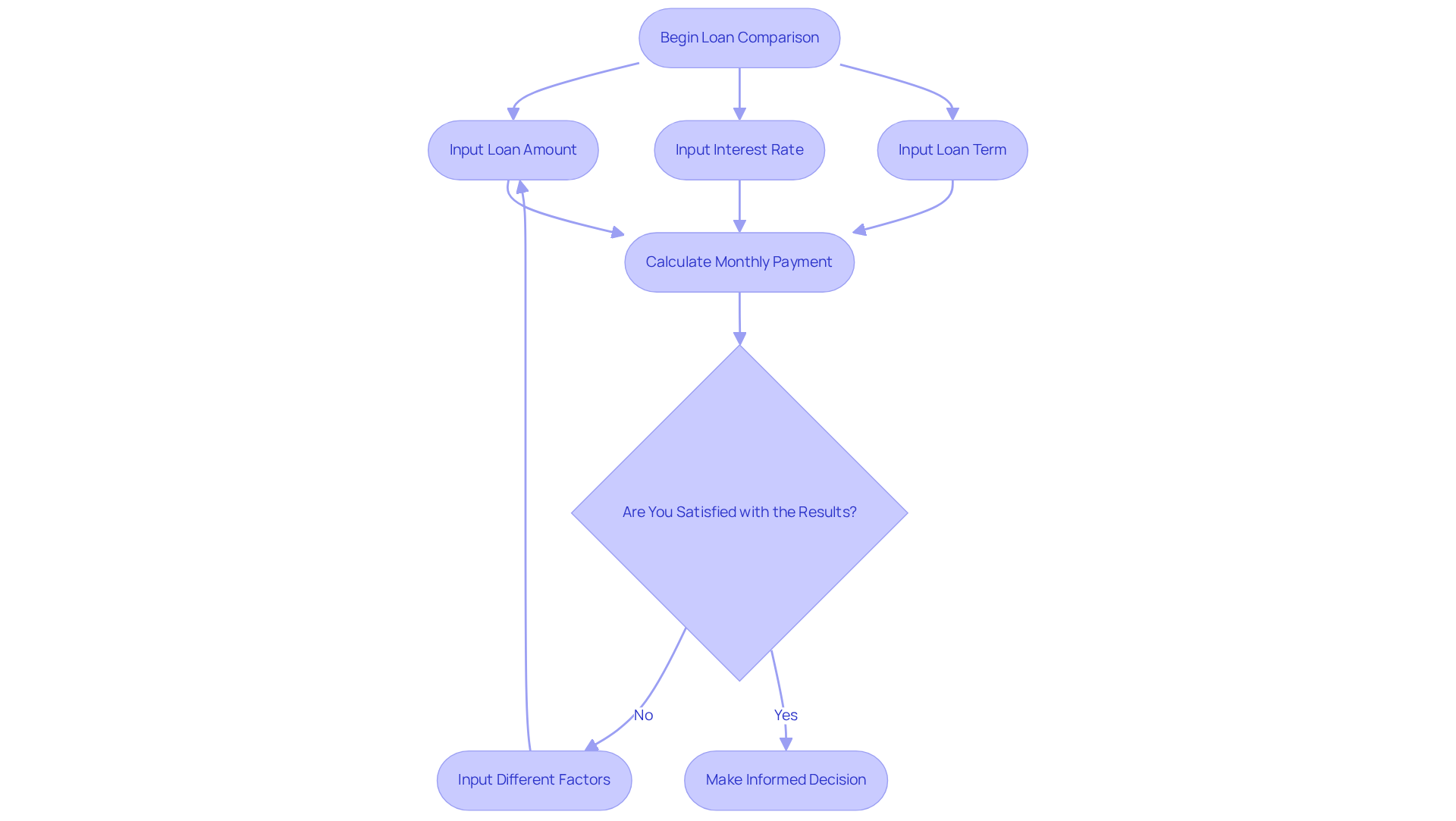

SmartAsset: Versatile Mortgage Calculator for Loan Comparison

Navigating the world of home financing can feel overwhelming, but SmartAsset’s versatile mortgage calculator va is here to help. This empowering tool allows homebuyers to compare various financing scenarios by inputting different loan amounts, interest rates, and terms. We understand how important it is for you to explore your options, as even small changes in these factors can significantly impact your monthly costs. For example, if you’re considering a $300,000 loan at a 6.5% interest rate, you might find that your monthly payment would be around $1,896.

Financial advisors emphasize the importance of examining different funding alternatives. They often mention that ‘home loan borrowers comparing options tend to save more just as depositors exploring choices tend to benefit more.’ By utilizing the mortgage calculator va, you can make informed decisions tailored to your financial situation, leading to better loan selections.

Current trends show that home financing estimators are becoming increasingly sophisticated. In fact, 30% of lenders are embracing or experimenting with AI software in 2024. This advancement allows users to perform thorough financing scenario comparisons, which is crucial in today’s variable interest rate landscape.

Moreover, understanding the home loan pre-approval process is vital for potential buyers, as it can greatly influence your financing options. This growing trend reflects a heightened awareness among homebuyers of the need to leverage technology for smarter financial planning. Remember, we’re here to support you every step of the way as you navigate this journey.

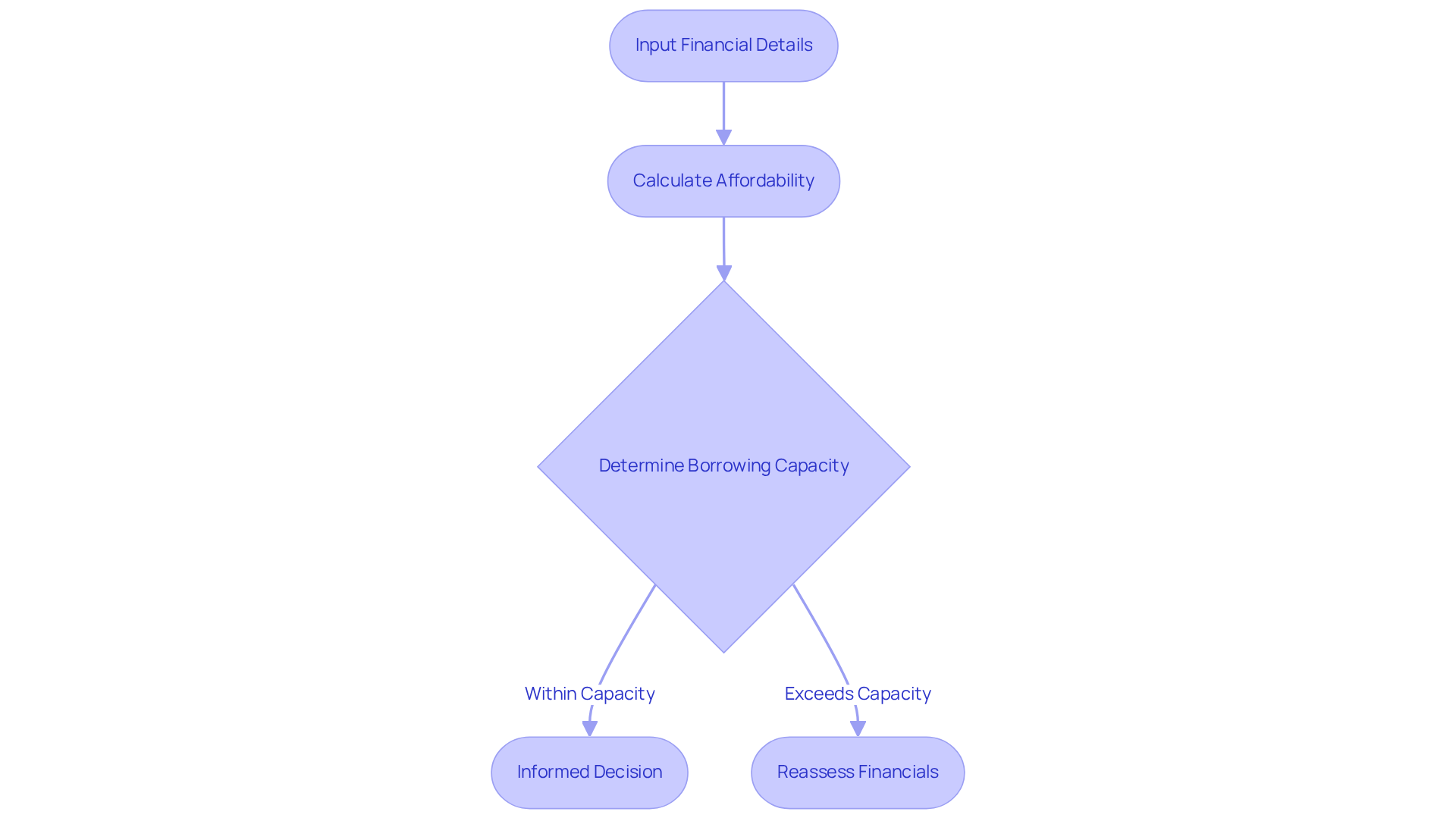

CIBC: Mortgage Affordability Calculator for VA Loans

CIBC offers a mortgage calculator va that is specifically designed for VA financing. This tool allows users to input their income, expenses, and other financial details, helping them understand how much they can afford to borrow. We know how challenging it can be to navigate the home buying process, and this calculator is essential for homebuyers to make financially sound decisions without overextending themselves. By grasping their affordability, users can confidently take steps toward homeownership.

Did you know that approximately 80% of VA buyers purchase their homes without a down payment? This makes it even more crucial for them to understand their financial limits. Recently, 81,876 VA Purchase Financing agreements closed nationwide, marking a significant 28.2% increase from the previous quarter. This trend highlights the growing interest in VA financing. Experts emphasize the importance of affordability tools, including a mortgage calculator va, in the home purchasing process, providing insights that help prospective homeowners establish their budgets based on their unique financial situations. For example, a family with a gross monthly income of $5,000 can use the tool to evaluate their debt-to-income (DTI) ratio, ideally kept below 41% for VA loans. With a total monthly debt of $1,200 and a gross monthly income of $4,500, a DTI of 26% can be calculated, showcasing how the affordability tool aids users in understanding their financial position.

Furthermore, these tools empower homebuyers to make informed choices by illustrating how various factors, such as monthly debt payments and estimated loan expenses, impact their overall budget. A household of four in the Midwest typically requires $1,003 in residual income, a vital component in maintaining a low foreclosure rate for VA financing. This comprehensive approach not only helps determine what they can afford but also fosters a sense of financial security as they embark on their journey to homeownership. As Chris Birk, Vice President of Mortgage Insight, wisely notes, “The VA’s residual income guideline provides a strong and practical approach to assessing VA financing affordability and whether new homeowners have sufficient income to manage living costs and remain up-to-date on their payments.”

Additionally, F5 Mortgage streamlines the application process, promising pre-approval in under an hour. This further simplifies the homebuying experience, ensuring that clients feel supported every step of the way.

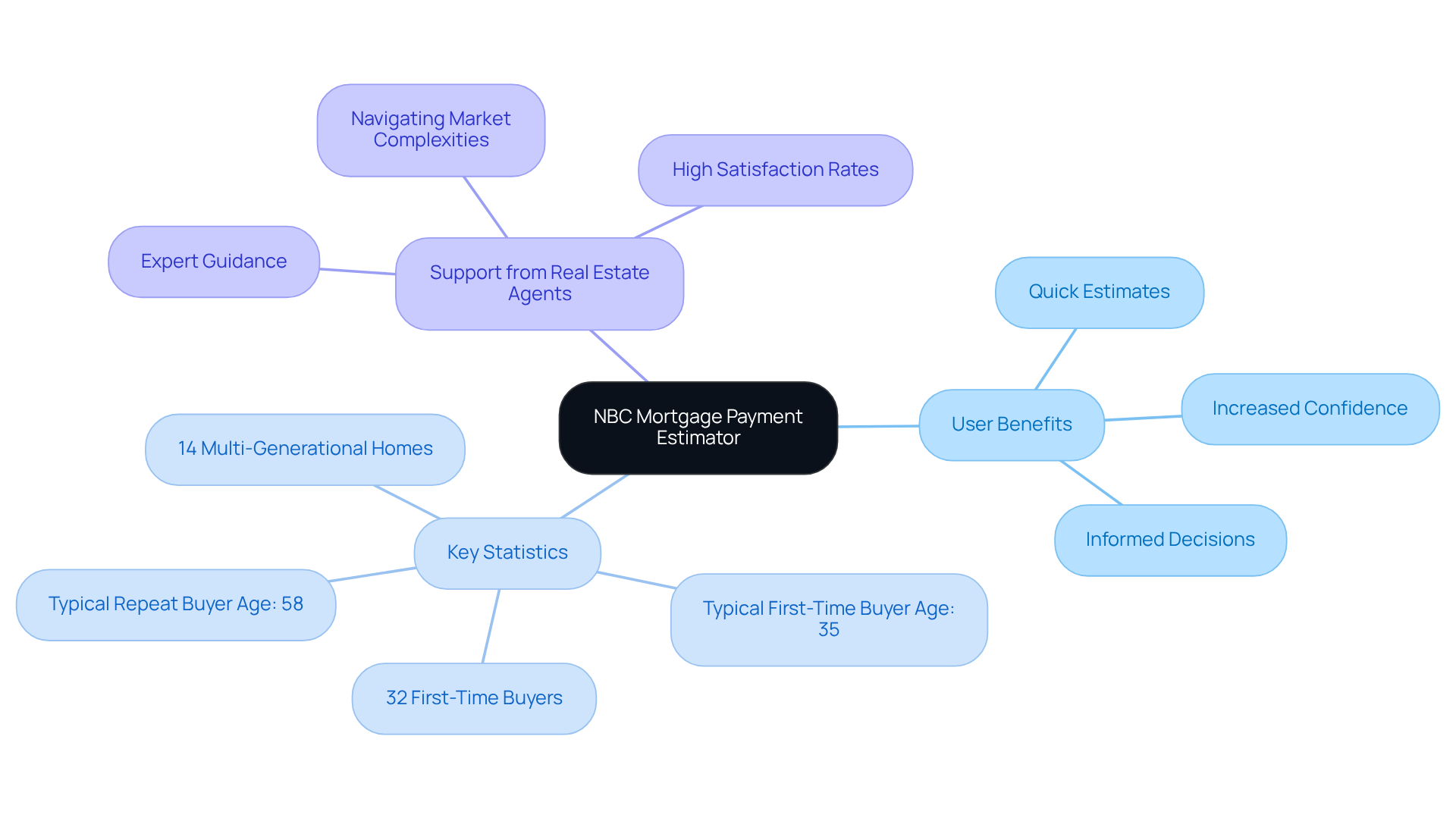

NBC: Simplified Mortgage Payment Estimator

We know how challenging the homebuying process can be, and NBC’s efficient loan cost estimator is here to help. This tool allows users to quickly input crucial information like loan amount and interest rate, providing an instant estimation of monthly costs. For homebuyers just beginning their financing journey, this estimator offers a valuable first glimpse into potential payment scenarios.

By delivering quick estimates, NBC empowers users to embark on their path to homeownership with greater assurance. With 32% of recent homebuyers being first-time buyers, tools like this are essential in simplifying the initial stages of the homebuying process. They enable individuals to make informed decisions early on, which can alleviate some of the stress associated with buying a home.

Mortgage professionals emphasize that access to a mortgage calculator can significantly enhance a buyer’s confidence, making the transition into homeownership smoother and more manageable. As F5 Mortgage prides itself on a fast and efficient closing process, utilizing tools like NBC’s estimator can lead to a more seamless transaction.

Additionally, the guidance of real estate agents remains crucial in navigating the complexities of the housing market. Their expertise complements the benefits of digital tools, ensuring that you feel supported every step of the way.

CMHC: Informative Mortgage Options Calculator

Navigating the world of mortgages can feel overwhelming, but the Canada Mortgage and Housing Corporation (CMHC) offers a valuable loan options tool designed to help you explore different loan products and their associated costs. We understand how challenging this process can be, especially for home purchasers eager to find the best financing alternatives. This tool is essential in guiding you through options like fixed-rate and variable-rate loans, allowing you to discover which product aligns with your financial needs and aspirations. By utilizing this resource, you can gain clarity and confidence in your decision-making, empowering you to take the next steps towards homeownership.

US Bank: Tailored VA Mortgage Calculator for Veterans

At US Bank, we understand how important it is for veterans to navigate the complexities of home financing. That’s why we provide a tailored mortgage calculator va tool designed specifically for you. This tool allows you to input your unique financial details, providing customized estimates of your monthly costs. With the benefits of VA financing—like no down payment and competitive interest rates—you can feel empowered in your home-buying journey.

Research indicates that 70% to 75% of homeowners believe they secured the best financing arrangement when using customized mortgage tools. We know how challenging this can be, and that’s why experts highlight the significance of these personalized financial tools for veterans. They offer clarity and confidence, essential for making informed decisions.

Hal Bundrick, a CFP® Senior Writer, notes, “VA programs are a valuable military service benefit supported by the U.S. Department of Veterans Affairs.” Our mortgage calculator va not only simplifies the estimation of your monthly obligations but also takes into account VA funding fees and other unique aspects of VA loans. This way, you can visualize your total homeownership costs and fully understand your monthly outlay. We’re here to support you every step of the way as you explore your financing options.

Conclusion

The significance of utilizing mortgage calculators, especially those tailored for VA loans, is truly profound. These essential tools empower homebuyers, particularly veterans, to navigate the complexities of financing with confidence. By offering personalized estimates and comprehensive breakdowns of costs, mortgage calculators facilitate informed decision-making. This ensures that users understand their financial commitments and can plan accordingly.

Throughout this article, we’ve highlighted various mortgage calculators, each offering unique features that cater to the specific needs of homebuyers. For instance, F5 Mortgage provides a user-friendly interface, while Bankrate offers a detailed breakdown of loan costs. These tools enhance the homebuying experience by simplifying the process and equipping users with vital information. Moreover, real-life success stories illustrate how these calculators have positively influenced the financing choices of veterans, showcasing their practical benefits.

Ultimately, embracing these digital resources can lead to smarter financial planning and more successful homeownership journeys. As the landscape of home financing evolves, leveraging technology like mortgage calculators will be crucial for prospective buyers. By taking advantage of these tools, homebuyers can alleviate the stress of the purchasing process and secure the best possible financing arrangements tailored to their unique circumstances. We know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What is the purpose of the F5 Mortgage VA mortgage calculator?

The F5 Mortgage VA mortgage calculator is designed for veterans to input their financial details and receive accurate monthly payment projections, including property taxes and insurance, simplifying the home loan journey.

Who can benefit from using the F5 Mortgage VA mortgage calculator?

The calculator caters to all users, including first-time homebuyers, and is specifically crafted to meet the unique needs of veterans.

What features does the F5 Mortgage VA mortgage calculator offer?

It allows veterans to receive personalized rate quotes and current loan rates, helping them understand affordability and potential financing options.

How does the use of online resources for mortgage calculations trend among veterans?

By 2025, approximately 70% of veterans are expected to utilize online resources like the mortgage calculator, indicating a growing trend in digital tools for simplifying home financing.

Can you provide an example of how the mortgage calculator has helped veterans?

A veteran using the Armed Forces Bank VA loan estimator was able to accurately assess their monthly payments, leading to a more informed decision regarding their home purchase.

What is Bankrate’s loan cost estimator used for?

Bankrate’s loan cost estimator helps homebuyers input factors such as loan amount, interest rate, and loan duration to provide a comprehensive breakdown of monthly payments, including principal, interest, taxes, and insurance.

What is the expected growth in the use of detailed loan estimation tools by 2025?

It is projected that there will be a 20% increase in the average number of users for detailed loan estimation tools compared to the previous year.

Why is it important to understand loan interest rates?

Understanding loan interest rates is crucial because they significantly influence monthly payments, with the typical loan installment in the U.S. currently around $2,700 each month.

How does Better.com’s mortgage calculator assist users?

Better.com’s mortgage calculator not only calculates monthly costs based on the borrowed sum and interest rate but also considers property taxes and homeowners insurance, providing a clearer picture of monthly financial commitments.

What is the benefit of integrating property taxes and insurance into the mortgage calculator?

Integrating property taxes and homeowners insurance into the mortgage calculator helps users plan their budgets more effectively, ensuring there are no surprises in their financial commitments.