Overview

This article explores key strategies for families looking to utilize their home equity to enhance their living space. We understand how challenging it can be to navigate property value and borrowing options, and we’re here to support you every step of the way. With favorable borrowing conditions and a significant increase in home equity, families can effectively leverage their property through loans or HELOCs for renovations. This not only improves your home but also contributes to your financial stability.

By understanding your property’s worth and the various borrowing options available, you can make informed decisions that benefit your family. Imagine transforming your home into a space that meets your family’s needs while also securing your financial future. This is a journey worth taking, and we want to help you explore the possibilities.

As you consider these options, remember that the right approach can lead to a more comfortable and fulfilling home environment. Take the first step today by assessing your home equity and researching the best borrowing solutions available. Your dream home is within reach, and with the right support, you can turn those dreams into reality.

Introduction

Understanding the nuances of home equity is essential for families looking to enhance their living spaces and financial stability. We know how challenging this can be, especially with residential loan rates at historic lows. There has never been a better time to explore the potential of leveraging home equity for upgrades and renovations.

However, navigating the various strategies and options can feel daunting. Many homeowners find themselves wondering: how can they effectively maximize their home equity to achieve their goals? This article delves into seven key strategies that not only clarify the borrowing process but also highlight how families can transform their homes while securing their financial future. We’re here to support you every step of the way.

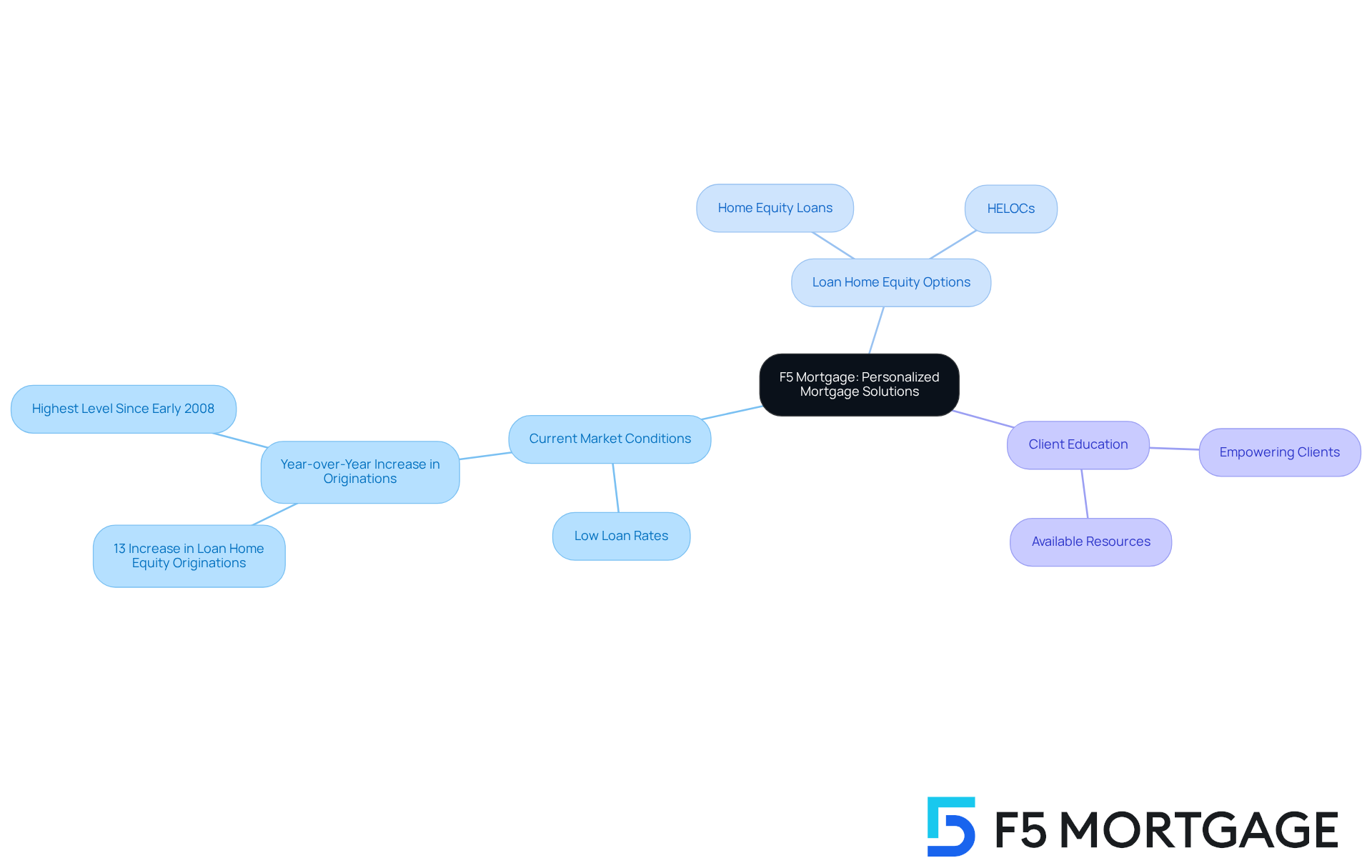

F5 Mortgage: Personalized Mortgage Solutions for Home Equity

At F5 Mortgage, we understand how important it is for families to access their property value using a loan home equity. With residential loan rates reaching a low not seen since 2025, now is a wonderful opportunity for families to benefit from . We offer a diverse range of options, including loan home equity and HELOCs, tailored to meet your unique financial goals. This flexibility is crucial, especially as loan home equity borrowing against residential assets has surged, with originations increasing by 13% year-over-year as of Q4 2024—the highest level since early 2008.

We know how challenging this process can be, which is why we strive to simplify it for you. F5 Mortgage places a strong emphasis on client education, providing resources that empower property owners to make informed decisions about utilizing their assets. With nearly half of U.S. property owners classified as asset-rich, there is a growing opportunity for families to leverage their property value through a loan home equity. By consulting with F5 Mortgage, you can navigate your options with confidence, ensuring you choose the best financial strategy for your situation. We’re here to support you every step of the way.

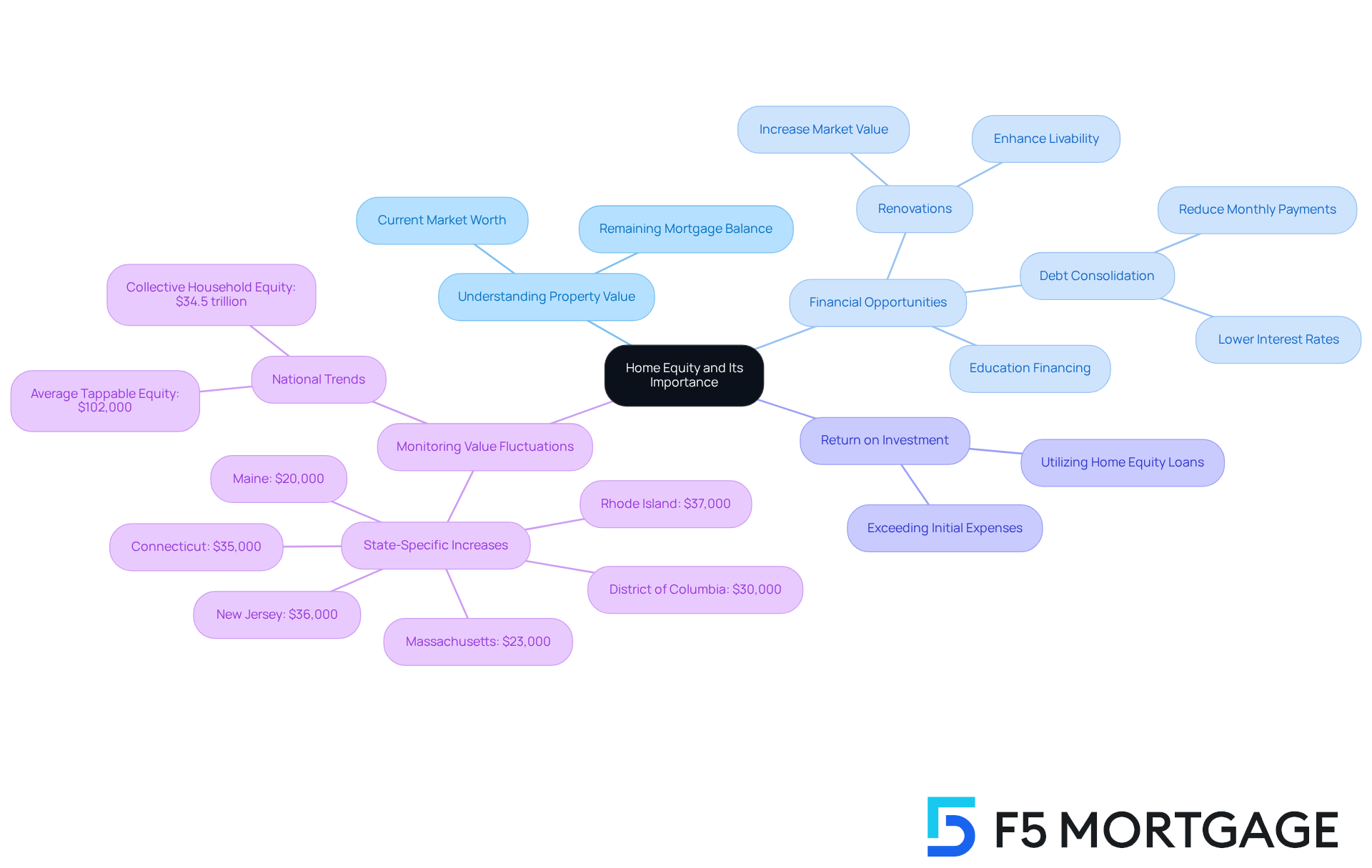

What Is Home Equity and Why It Matters

Understanding the value of your property is essential, especially when it comes to enhancing your living environment. Essentially, property value is the difference between its current market worth and the remaining balance on your mortgage. This monetary asset can be vital for homeowners like you, as it opens doors to various opportunities, such as renovations, debt consolidation, or even financing education. With the typical rising by almost $102,000, grasping the concept of property value is crucial for boosting your asset worth and enhancing your overall economic stability.

Investing in home enhancements not only elevates the livability of your space but can also significantly increase your home’s market value. Many homeowners who have dedicated resources to renovations often notice a return on investment that exceeds their initial expenses, making it a smart financial decision. In fact, numerous individuals have successfully utilized a loan home equity to finance valuable renovations, thereby improving their financial situation while remaining in their cherished homes.

Statistics reveal that American homeowners have built substantial wealth, averaging around $150,000 in property value. This trend underscores the importance of monitoring residential value fluctuations, as they can unveil opportunities for economic growth. For instance, homeowners in states like Rhode Island and New Jersey have experienced value increases of $37,000 and $36,000, respectively, showcasing the potential for significant economic leverage.

As you explore your options, it’s vital to approach property value with a clear financial objective in mind. Financial advisors often caution against using residential value for speculative investments, as this can introduce unnecessary risks. Instead, focusing on practical applications, such as consolidating high-interest debt or financing home improvements, can lead to more beneficial outcomes. By understanding and effectively leveraging your home value, you can navigate your financial journey with confidence and make informed decisions that align with your long-term aspirations.

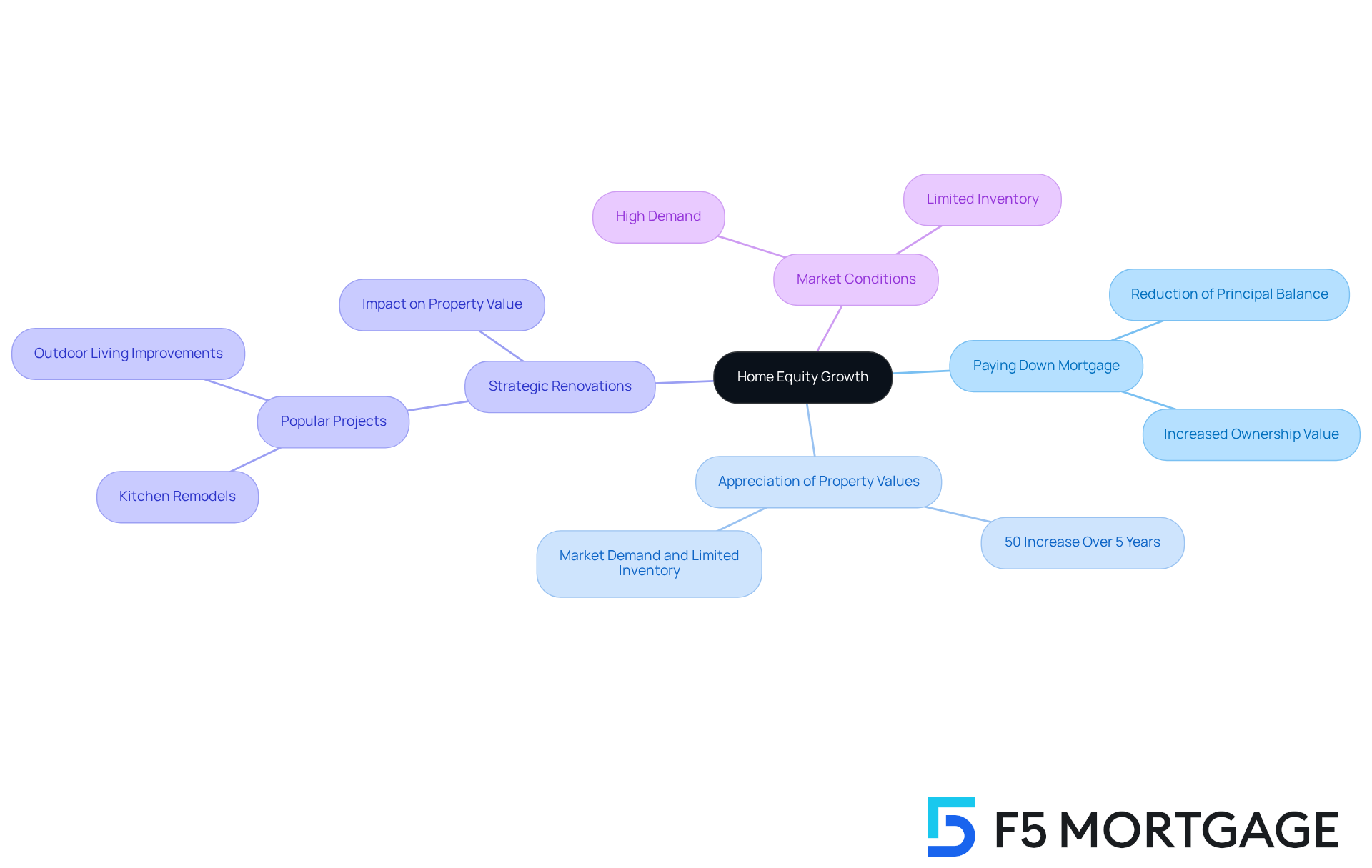

How Home Equity Grows: Factors and Considerations

Home ownership can be a rewarding journey, primarily increasing through two key mechanisms: paying down the mortgage and appreciating property values. Each mortgage payment you make lowers the principal balance, thereby increasing your ownership value. In 2025, property owners have seen an impressive average property value rise of about 50% over the previous five years, greatly enhancing ownership stakes. This growth is further fueled by market conditions, driven by high demand and limited inventory.

Strategic renovations can also play a crucial role in increasing property value. Popular projects like kitchen remodels and outdoor living improvements reflect a shift in property owner preferences towards functional and enjoyable living spaces. Experts emphasize that well-planned renovations not only improve your quality of life but also add substantial value to your property. As Liz Young notes, “We’re seeing people look to have a fluid indoor-outdoor living setup where you’re able to transition seamlessly from entertaining or hanging out inside as well as outside.” Investing in property enhancements is a wise approach for those aiming to increase their home value.

With the present average property owner possessing approximately $311,000 in value, and the total asset value of U.S. property owners hitting $17.8 trillion as of Q2 2025, utilizing this resource through renovations can lead to even greater financial freedom. Homeowners should carefully consider how their renovation choices align with market trends and consult with mortgage professionals to explore refinancing options. Many lenders require property owners to maintain at least an 80% loan-to-value ratio, which indicates that their loan home equity is sufficient as they have either paid down at least 20% on their original loan amount or that their residence has appreciated in value. A loan home equity cash-out may have even greater ownership requirements. Understanding these elements can assist you in making informed choices about efficiently. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

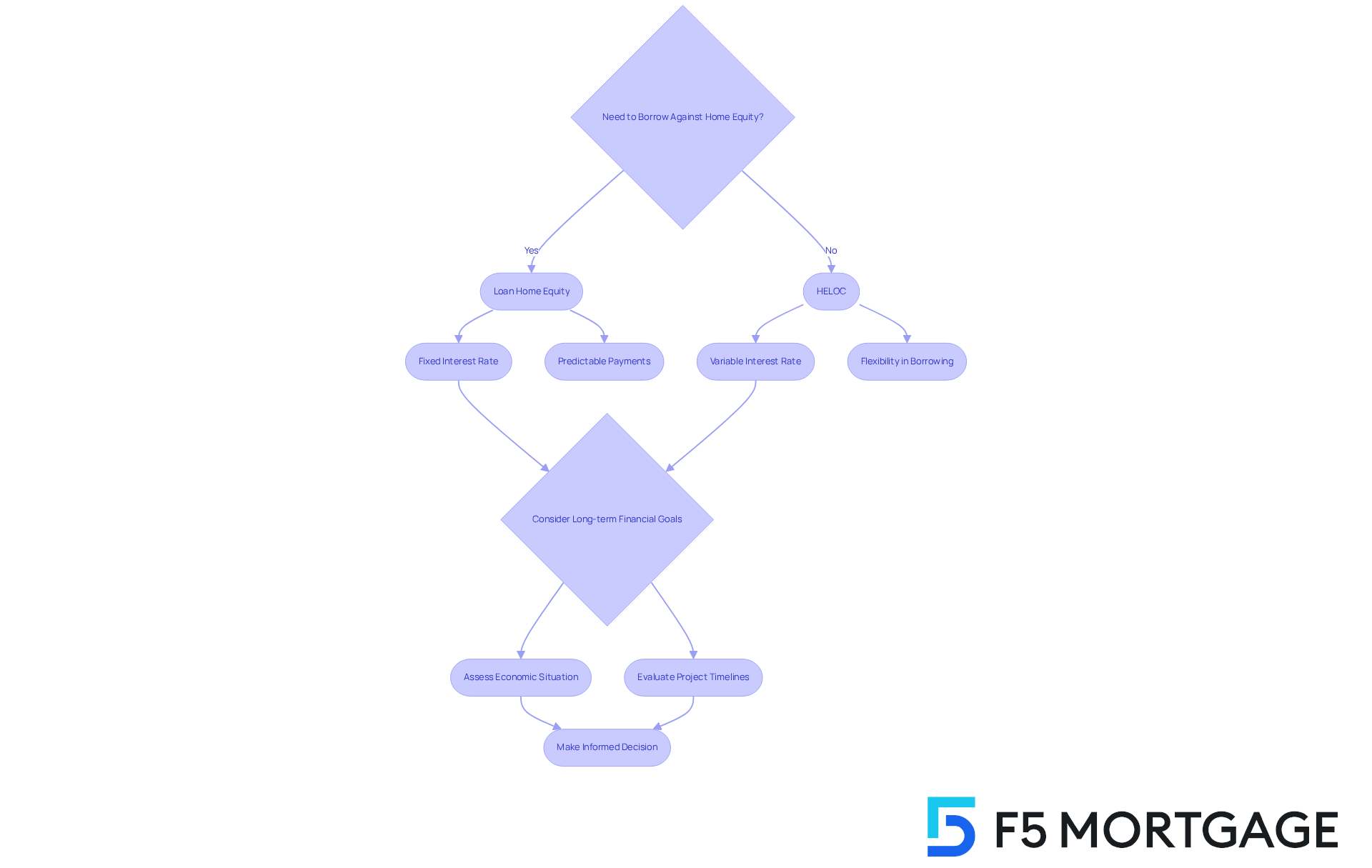

Borrowing Against Home Equity: Options and Strategies

As a property owner, you have the opportunity to unlock the value of your home through various options, primarily loan home equity and lines of credit (HELOCs) linked to your property’s worth. A loan home equity provides a lump sum with fixed interest rates, making it particularly beneficial for significant expenses like renovations or major repairs. This predictability in payments allows for easier budgeting, especially for larger projects. On the other hand, a HELOC serves as a revolving line of credit, enabling you to borrow as needed, which is ideal for ongoing or smaller-scale projects that require flexibility.

Before you proceed, it’s essential to understand that the lender will order a home appraisal to determine your property’s current market value. This evaluation not only assesses how much equity you possess but also influences your mortgage rates and the borrowing options available to you. Did you know that property owners currently hold an average of $313,000 in accessible funds? This statistic highlights the potential for considerable borrowing capacity. You can strategically utilize this asset for value-enhancing renovations. Specialists like Shmuel Shayowitz emphasize the importance of updates that raise your property’s worth or enhance essential livability. However, we know how challenging it can be to navigate these options, so it’s crucial to thoroughly assess your economic situation and project timelines before making a decision.

When choosing between a loan home equity option or a HELOC, it’s vital to . Mismanagement can lead to long-term financial pressure, and we’re here to support you every step of the way. Recent trends indicate that while residential property loans typically offer lower interest rates, they may come with various fees, including closing costs and application fees, which can affect the overall cost of borrowing. In contrast, HELOCs often feature variable interest rates that can increase, potentially leading to higher monthly payments if rates rise. Therefore, consider the advantages of fixed payments against the adaptability of a HELOC, keeping in mind your ability to manage potential rate changes and the risks of excessive borrowing against your home’s value.

Ultimately, the decision between a property loan and a HELOC should align with your specific financial objectives and project needs. By making an informed choice, you can enhance your property’s value without jeopardizing your economic future.

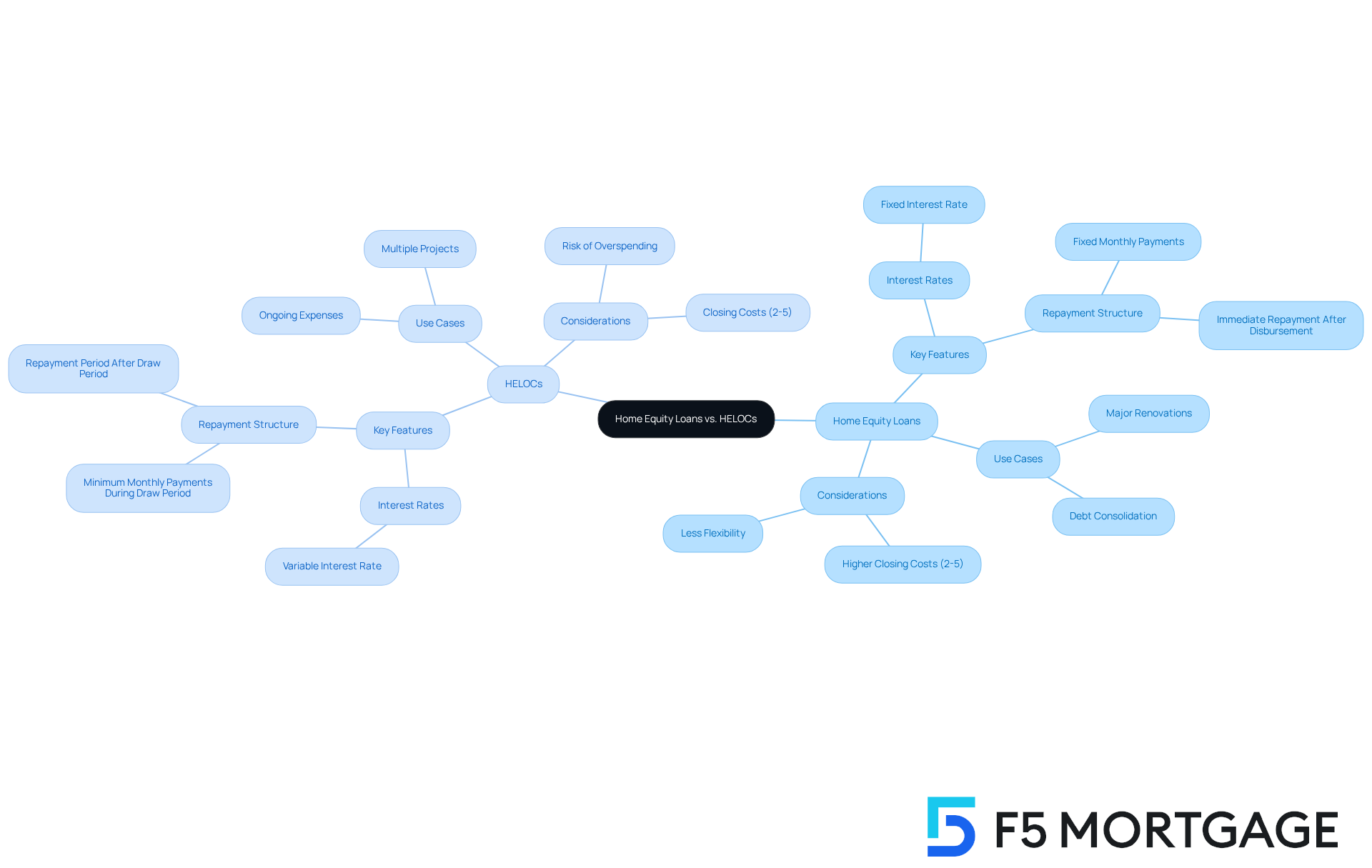

Home Equity Loans vs. HELOCs: Key Differences Explained

Loan home equity options and Home Value Lines of Credit (HELOCs) serve different financial needs, each with its unique features. If you’re considering a residential property loan, it provides a one-time lump sum with fixed interest rates. This ensures stability and predictability in your monthly payments, making it ideal for specific projects like major renovations or debt consolidation. On the other hand, a HELOC operates similarly to a credit card, allowing you to borrow against your assets as needed, typically with variable interest rates. This flexibility can be beneficial for ongoing expenses or projects where costs may fluctuate over time.

When deciding between these options, it’s important to reflect on your financial objectives. For instance, if you have a defined project and a clear budget, a loan home equity might be the best fit for its straightforward repayment structure. Conversely, if you’re anticipating variable costs or have multiple projects in mind, a HELOC could serve you better due to its revolving credit feature.

Statistics indicate that many borrowers often choose loan home equity for significant, one-time expenses, while HELOCs are favored for their adaptability in managing ongoing financial needs. Consulting with experts, like those at Security National Bank of South Dakota, can provide valuable insights to determine the best option for your individual situation. Additionally, utilizing funds from loan home equity or HELOCs for major renovations may allow you to receive a tax deduction on the interest paid, which can enhance the appeal of these choices.

It’s also crucial to consider the closing costs associated with loan home equity and HELOCs, which typically range from 2-5%. Financial advisors often recommend assessing your personal budgeting styles and project timelines when selecting between these two products. However, it’s essential to be mindful of the potential risks linked to HELOCs, such as overspending due to their revolving nature. Ultimately, understanding the is vital for homeowners to make informed decisions that align with their financial strategies. We know how challenging this can be, and we’re here to support you every step of the way.

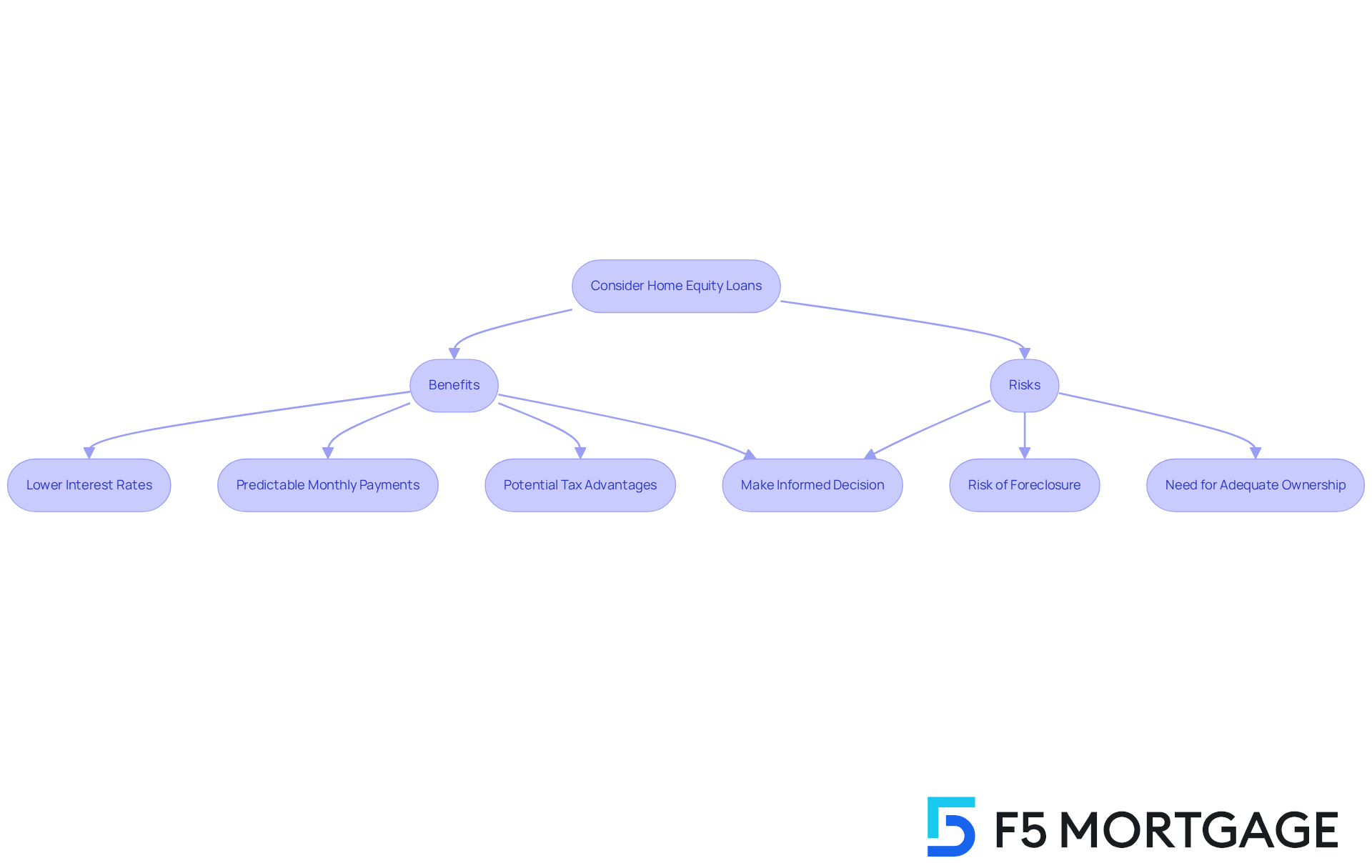

Pros and Cons of Home Equity Loans

Loan home equity can be a wonderful solution for families aiming to improve their financial situation. They offer several benefits, such as:

- Lower interest rates compared to unsecured loans

- Predictable monthly payments

- Potential tax advantages

We know how challenging financial decisions can be, and it’s often recommended to own your home for at least five years. This timeframe allows for better and market stability, which can significantly enhance your financial benefits.

However, it’s important to be aware of the risks involved. Missing payments can lead to foreclosure, and you need to have adequate ownership to qualify. As you consider a loan home equity against your property, we encourage you to thoughtfully weigh these advantages and disadvantages. This ensures that your decision aligns with your unique financial circumstances and goals.

Moreover, when exploring property value options, it’s crucial to seek out lenders and compare rates, fees, and terms. F5 Mortgage stands out with its competitive rates and personalized service, making it a valuable choice for families like yours who are looking to enhance their homes. Remember, we’re here to support you every step of the way as you navigate this important journey.

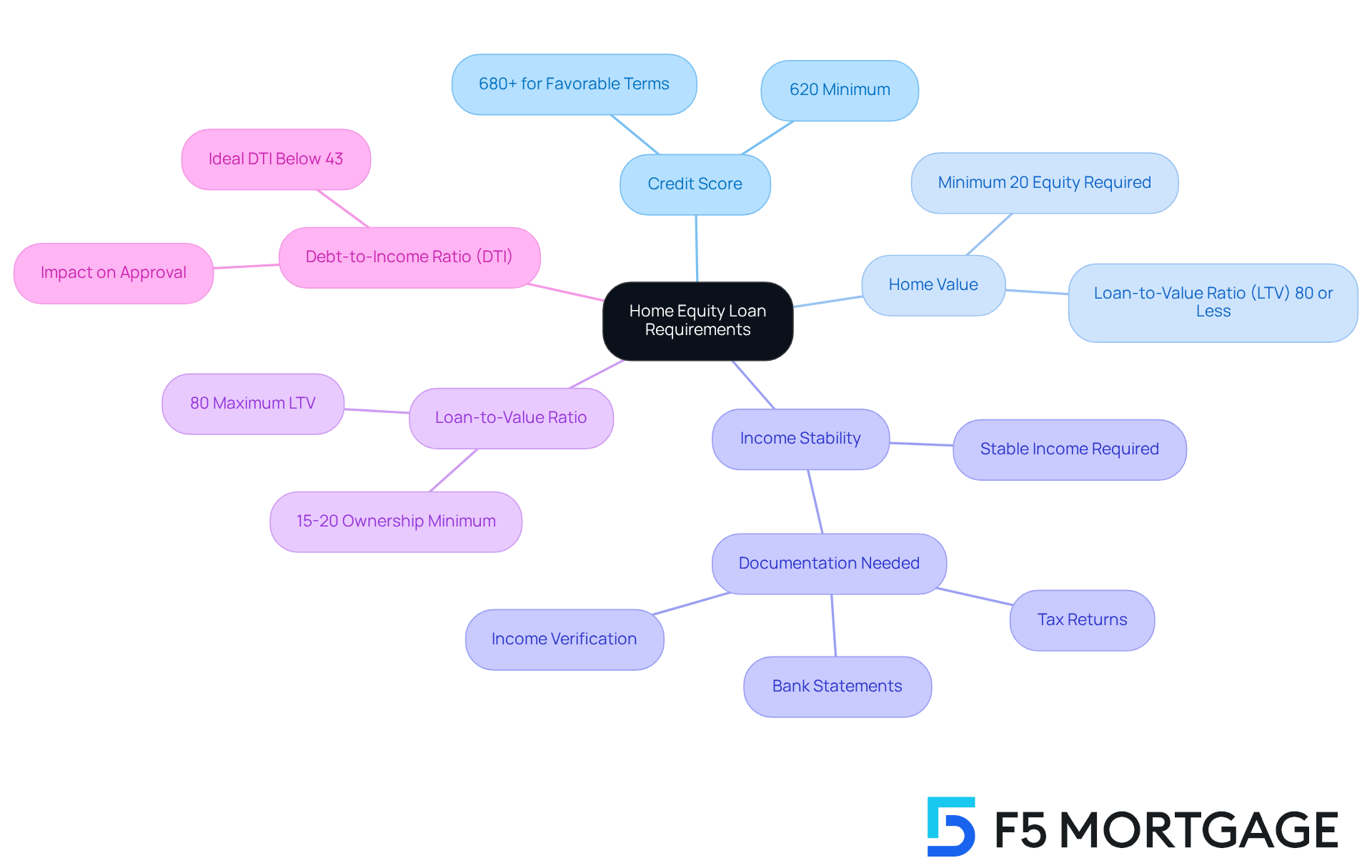

Home Equity Loan Requirements: What You Need to Know

We understand how challenging it can be to navigate the world of property value loans. To qualify, property owners typically need to meet that can feel overwhelming. These include:

- Maintaining a minimum credit score

- Ensuring adequate value in your home

- Having a stable income

Most lenders look for at least 15-20% ownership, meaning your loan-to-value ratio should ideally be 80% or less.

For example, if your home is valued at $400,000, you would need to keep your mortgage balance at or below $320,000. This allows for a maximum equity loan amount of $120,000. Many lenders require that homeowners have an 80% loan-to-value ratio, which shows that they have paid down at least 20% of their original loan or that their property has appreciated in value.

A strong credit history is crucial in this process. Many lenders prefer scores of 680 or higher to secure favorable loan terms, but some may accept scores as low as 620. Additionally, it’s important to maintain a low debt-to-income (DTI) ratio—ideally below 43%—as this reflects the balance between your existing debt and income.

To prepare for this journey, homeowners should gather necessary documentation, such as:

- Income verification

- Social Security numbers

- Bank statements

- Tax returns

- Pay stubs

This helps assess your financial standing before applying. By understanding these requirements, you can better position yourself for a successful loan application. Remember, we’re here to support you every step of the way.

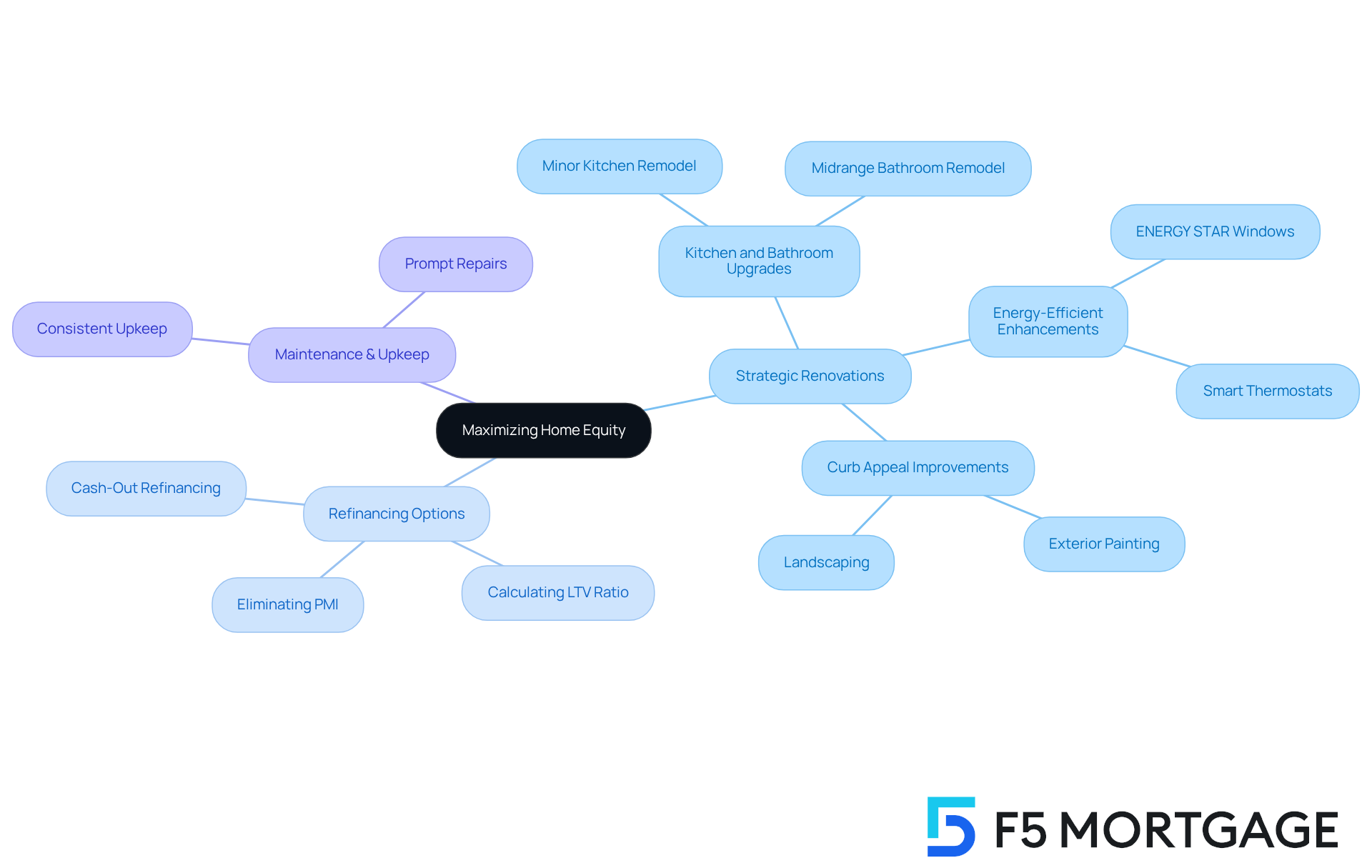

How to Maximize Your Home Equity Effectively

To enhance the value of your home, we understand that property owners face the challenge of knowing where to invest. Strategic renovations can truly make a difference. Consider focusing on:

- Kitchen and bathroom upgrades

- Energy-efficient enhancements

- Improvements to curb appeal

These changes not only elevate your property’s worth but also create a more enjoyable living space for you and your family.

In California, homeowners have a unique opportunity. With high home appreciation rates, you might be able to by refinancing, especially if your initial down payment was less than 20%. By calculating a new loan-to-value (LTV) ratio based on your home’s increased value, you can take a significant step toward financial relief.

Making additional mortgage payments can also accelerate your asset growth. By reducing the principal balance more quickly, you’re setting yourself up for greater financial freedom. If unexpected expenses arise, don’t hesitate to explore a cash-out refinance to access your loan home equity. This option allows you to access additional funds through a loan home equity, while potentially securing a more affordable interest rate on your new mortgage.

Lastly, remember that consistent upkeep and prompt repairs are vital. They not only help preserve your property’s value but also ensure that you can utilize your assets effectively when the time comes. We know how challenging this can be, but with the right approach, you can navigate these decisions with confidence and peace of mind.

Selling Your Home: Impact on Home Equity

Maximizing value during a property sale is essential for individuals seeking to enhance their financial gains. We know how challenging this can be, and ideally, property owners should strive for a minimum of a . This not only helps cover closing expenses but also improves the overall profitability of the sale. In 2025, the typical property owner in the U.S. possesses around $315,000 in value, showing a notable rise of $129,000 since the pandemic began. This increase in assets highlights the importance of understanding current market conditions, as rising property values can significantly affect sale prices.

Real-life examples illustrate how strategic decisions can lead to substantial gains. For instance, property owners who made cost-efficient renovations before selling often experience a greater return on investment. Furthermore, selling in a seller’s market—characterized by high demand and low inventory—can further enhance value. Consulting with a real estate expert can provide customized insights into timing and pricing strategies, ensuring property owners capitalize on favorable market conditions.

Statistics indicate that almost 49.2% of U.S. mortgaged residential properties are considered wealthy in assets due to their loan home equity, meaning their loan balance is less than half the home’s worth. This statistic emphasizes the opportunity for property owners to effectively utilize their assets through a loan home equity. Additionally, experts advise that property owners consider cash offers, which can accelerate the selling process and remove traditional sales fees, enabling a faster and more lucrative transaction.

When navigating the complexities of selling a property and maximizing value, it’s also essential to compare mortgage lenders. Collaborating with F5 Mortgage can offer property owners competitive rates and tailored assistance. We’re here to support you every step of the way, ensuring you make well-informed choices that align with your financial objectives.

In summary, understanding how to optimize value when selling a home involves strategic planning, awareness of market dynamics, and leveraging professional insights. By taking these measures and considering the benefits of collaborating with F5 Mortgage, property owners can greatly boost their sale earnings and achieve their financial goals.

Home Equity and Retirement Planning: A Strategic Overview

Home value is a vital asset in retirement planning, providing homeowners with essential funds to meet their financial needs during their later years. We understand how challenging this can be, and there are several approaches to utilizing this asset:

- Downsizing can free up cash.

- Using reverse mortgages can provide flexibility.

- Accessing a property value line of credit (HELOC) can enhance cash flow.

For instance, retirees who downsize often free up considerable capital, averaging around $174,000, which can greatly enhance their retirement income. Given that residential expenses total around $18,000 each year, this asset can significantly assist in managing those costs.

Reverse mortgages, especially the Home Equity Conversion Mortgage (HECM), allow individuals aged 62 and older to convert their loan home equity into cash without monthly payments, thereby enhancing financial flexibility. This option can be especially beneficial for retirees looking to maintain their lifestyle while managing expenses, providing a steady income stream. Significantly, 76% of property owners knowledgeable about reverse mortgages agree that it can offer necessary cash flow in retirement. However, it’s crucial to be aware of the associated costs and risks, such as the potential for foreclosure if property taxes and maintenance costs are not met.

Additionally, a loan home equity can provide homeowners with immediate access to funds, allowing them to cover unexpected expenses or supplement their income as needed. This flexibility can be a game-changer for retirees, particularly during periods of economic uncertainty.

Financial advisors emphasize the importance of understanding these options. As Matthew Argyle observes, recognizing property value as a strategic asset can assist retirees in managing economic shocks and prolonging the lifespan of their investment portfolios. By incorporating a loan home equity into their retirement plan, homeowners can improve their economic security and maintain their preferred lifestyle. We’re here to support you every step of the way, and is essential to navigate these options effectively and tailor a plan that aligns with your individual financial goals.

Conclusion

Leveraging home equity can be a transformative strategy for families seeking to enhance their living spaces and financial situations. We understand how challenging this can be, and the insights shared throughout this article highlight the importance of understanding home equity, the various options available for borrowing against it, and the strategic decisions that can maximize its potential. By recognizing the value of their property and making informed choices, homeowners can effectively utilize their assets to achieve their financial goals.

Key strategies discussed include:

- Understanding the difference between home equity loans and HELOCs

- Identifying the right financial objectives

- Considering the impact of renovations on property value

Additionally, it is crucial to be aware of the requirements for securing a home equity loan and the potential pros and cons associated with these financial products. By consulting with professionals and conducting thorough research, families can navigate these options with greater confidence.

Ultimately, the journey of utilizing home equity is not just about accessing funds; it’s about making strategic decisions that align with long-term aspirations. Homeowners are encouraged to take proactive steps, whether that means investing in renovations, planning for retirement, or preparing for a successful home sale. We’re here to support you every step of the way. By understanding the nuances of home equity and engaging with trusted mortgage experts like F5 Mortgage, families can unlock the full potential of their property value and create a brighter financial future.

Frequently Asked Questions

What is home equity and why is it important?

Home equity is the difference between your property’s current market value and the remaining balance on your mortgage. It is important because it can be used for various financial opportunities such as renovations, debt consolidation, or financing education.

How can homeowners leverage their home equity?

Homeowners can leverage their home equity by utilizing loans such as home equity loans or HELOCs. This allows them to access cash for purposes like home improvements, which can enhance their living environment and potentially increase their home’s market value.

What factors contribute to the growth of home equity?

Home equity grows primarily through paying down the mortgage and appreciating property values. Each mortgage payment reduces the principal balance, and market conditions, such as high demand and limited inventory, can also increase property values.

What are some effective ways to increase property value?

Effective ways to increase property value include strategic renovations, such as kitchen remodels and outdoor living improvements. These enhancements not only improve quality of life but can also add substantial value to the property.

What is the average property value for homeowners in the U.S.?

As of Q2 2025, the average property owner possesses approximately $311,000 in property value, contributing to a total asset value of $17.8 trillion among U.S. property owners.

What should homeowners consider when planning renovations?

Homeowners should consider how their renovation choices align with current market trends. Consulting with mortgage professionals can also help them explore refinancing options and understand loan-to-value ratios required by lenders.

What resources does F5 Mortgage provide to assist homeowners?

F5 Mortgage emphasizes client education and provides resources that empower property owners to make informed decisions about utilizing their assets, ensuring they choose the best financial strategy for their situation.