Overview

We understand that navigating the mortgage process can be overwhelming, especially when it comes to credit scores. For FHA loan approval, a credit score of 580 or above is typically required, which allows you to secure a mortgage with a down payment as low as 3.5%. This can be a significant relief for many families.

It’s essential to recognize that maintaining a strong credit profile is crucial. Higher credit scores not only improve your chances of approval but can also lead to better financing conditions. Imagine securing a loan with lower interest rates and reduced down payment requirements—this can make a real difference in your financial journey.

We know how challenging this can be, but we’re here to support you every step of the way. By focusing on your credit health, you can empower yourself to achieve your homeownership dreams. Take proactive steps today to enhance your credit score, and you may find that the path to owning your home becomes much clearer.

Introduction

Navigating the complexities of homeownership can be daunting, especially for first-time buyers. We know how challenging this can be. FHA loans, backed by the Federal Housing Administration, offer a lifeline with accessible financing options designed for low- to moderate-income families.

However, understanding the credit score needed for FHA loan approval is crucial, as it directly influences eligibility and borrowing conditions. What happens when a potential borrower’s credit score falls short of the FHA’s requirements?

This article delves into the nuances of FHA loans and the significance of credit scores. We’re here to support you every step of the way, exploring the alternatives available for those facing credit challenges and illuminating the path toward homeownership for many.

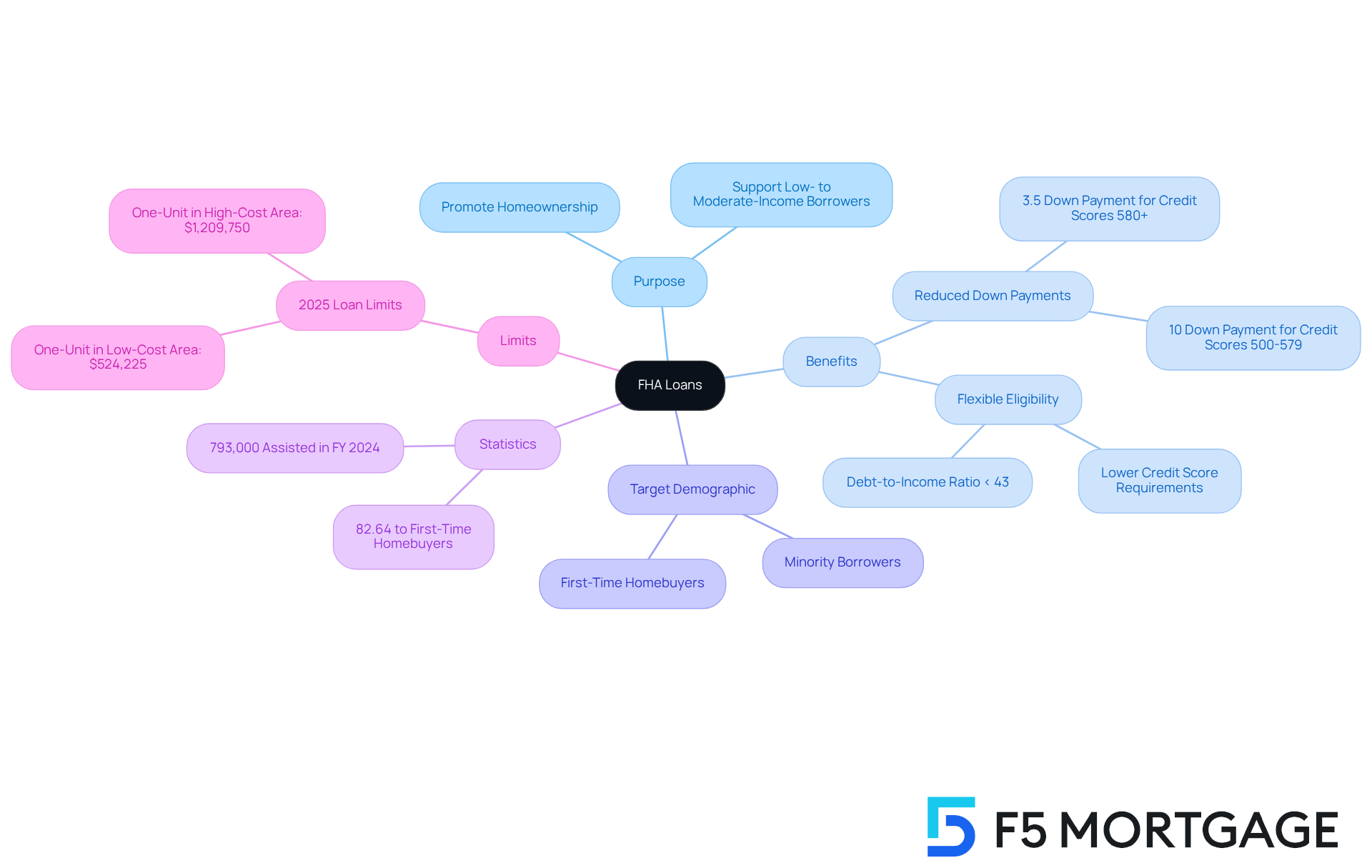

Define FHA Loans and Their Purpose

FHA mortgages, or Federal Housing Administration mortgages, are government-backed financing options created in 1934 to promote homeownership for low- to moderate-income borrowers. We understand how challenging it can be to navigate the home buying process, and these financial products aim to make purchasing a home more attainable.

By offering reduced down payment standards and more flexible eligibility criteria compared to traditional options, FHA mortgages are designed to help families like yours. For instance, the credit score needed for an FHA loan is 580 or above, which allows you to secure an FHA mortgage with a down payment as low as 3.5%. This accessibility is crucial, as it not only supports first-time homebuyers but also stimulates the housing market, contributing to increased homeownership rates across the United States.

In fact, FHA mortgages have become the most favored option for first-time homebuyers, with 82.64% of FHA purchase mortgages issued in fiscal year 2024 going to this demographic. The FHA’s commitment to facilitating homeownership is further demonstrated by its initiatives to assist over 793,000 homebuyers and homeowners in fiscal year 2024 alone. This highlights the substantial impact these financial products have on fostering stability and equity in the housing market.

As of 2025, the FHA Forward Mortgage Loan Limits for one-unit properties are set at $524,225 in low-cost areas and $1,209,750 in high-cost areas, enhancing affordability for buyers in various markets. Additionally, it’s important to consider the effect of annual mortgage insurance premiums on your total borrowing expenses.

With various available through F5 Mortgage, families can explore options tailored to their financial situations. We’re here to support you every step of the way as you move closer to achieving your homeownership dreams.

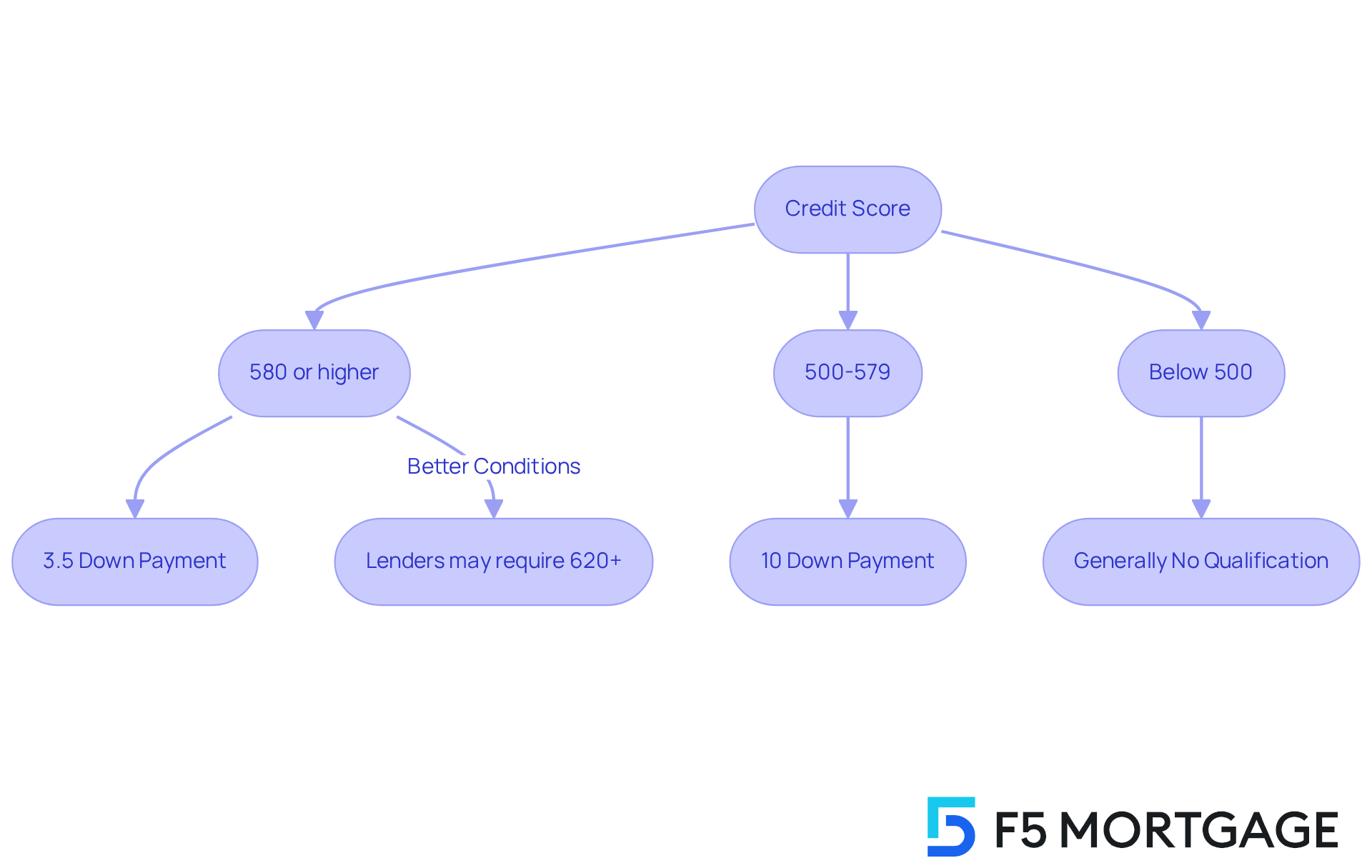

Outline Minimum Credit Score Requirements for FHA Loans

Navigating the world of FHA mortgages can feel overwhelming, but we’re here to support you every step of the way. To qualify for an FHA mortgage, borrowers typically need a [credit score needed for FHA loan](https://f5mortgage.com/7-essential-fha-loan-florida-insights-for-2025-borrowers) of 580 to take advantage of the low down payment option of just 3.5%. If your score falls between 500 and 579, there’s still hope; qualification is possible with a larger down payment of at least 10%. While the FHA establishes these foundational standards, individual lenders may have stricter criteria, often requiring the to be 620 or higher for better borrowing conditions. This variability underscores the importance of exploring multiple lending options.

In 2025, the average credit score of FHA applicants shows a trend toward greater accessibility. Many lenders are now offering flexible policies to accommodate a wider variety of credit profiles. Additionally, eligible borrowers can benefit from the $25,000 available through the Down Payment Assistance Program, which provides crucial financial support for first-time homebuyers.

Understanding these dynamics, including the FHA’s requirement for a debt-to-income ratio, is essential for homebuyers looking to navigate the FHA financing landscape effectively. FHA financing generally features more lenient qualification standards compared to traditional mortgages, making them an appealing choice for families looking to enhance their homes. We know how challenging this can be, but with the right information and support, you can find a path that works for you.

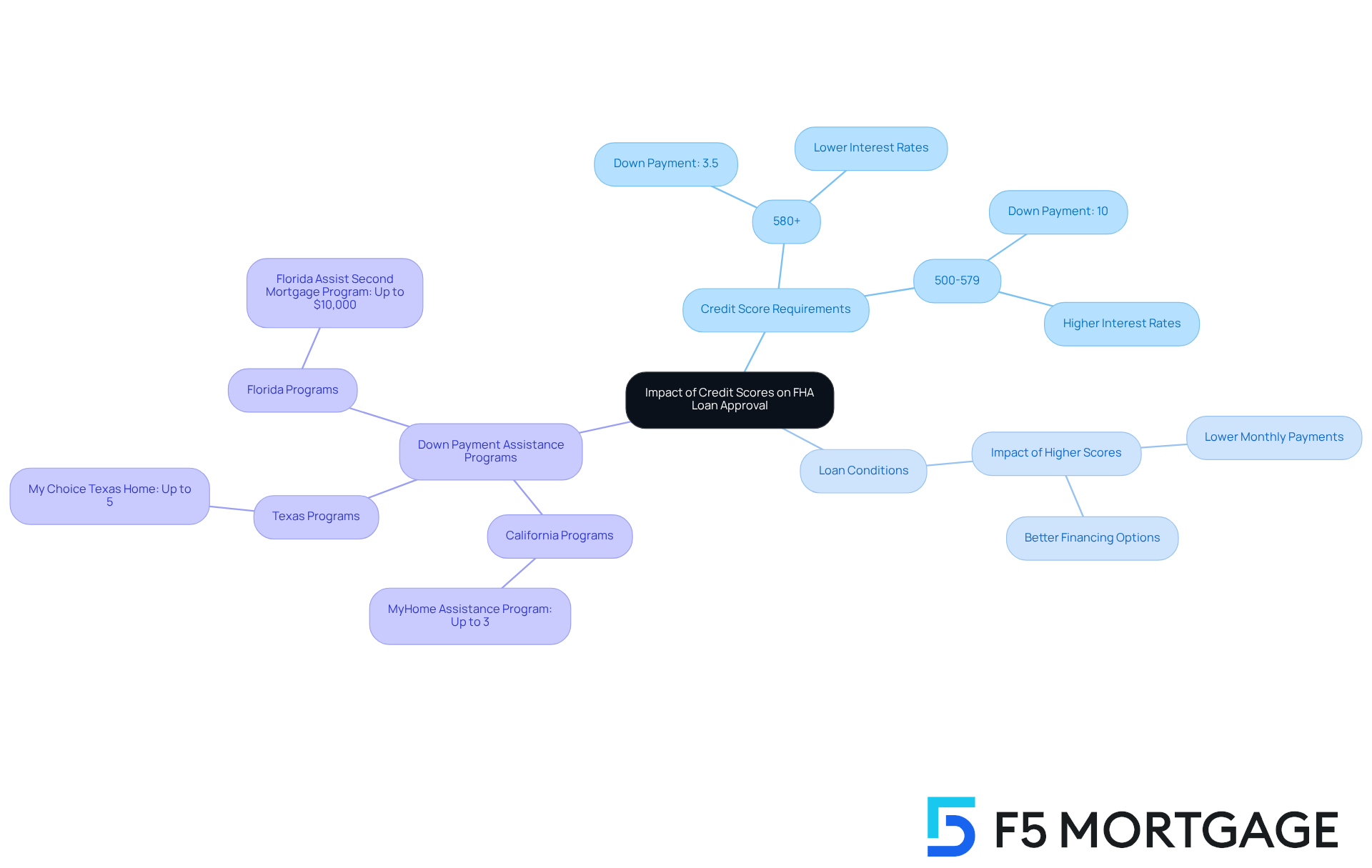

Discuss the Impact of Credit Scores on FHA Loan Approval

Credit ratings play a vital role in the FHA approval process, and knowing the credit score needed for FHA loan is crucial for families seeking a home. An improved rating not only increases the chances of approval but also opens the door to better financing conditions, such as lower interest rates and reduced down payment requirements. For example, borrowers with a rating of 580 can qualify for a down payment as low as 3.5%, significantly less than the 10% required for those with ratings below 580. This difference underscores the importance of maintaining a strong financial profile for prospective FHA mortgage applicants.

As of July 2025, borrowers with a FICO rating of 800 can secure an average mortgage rate of 6.644%. In contrast, those with ratings between 500 and 579 may still find financing options, but at higher rates. This clearly illustrates how financial ratings impact borrowing costs. Understanding and is essential if you’re considering an FHA mortgage, as it can lead to substantial savings over the life of your loan.

Moreover, families looking to upgrade their homes can take advantage of various down payment assistance programs available through F5 Mortgage. For instance, the MyHome Assistance Program in California provides up to 3% of the home’s purchase price, while Texas offers the My Choice Texas Home program, which includes up to 5% for down payment and closing assistance. In Florida, programs like the Florida Assist Second Mortgage Program can offer up to $10,000 for upfront costs. Grasping these options, along with understanding financial rating criteria, is essential for navigating the FHA financing landscape. We’re here to support you every step of the way.

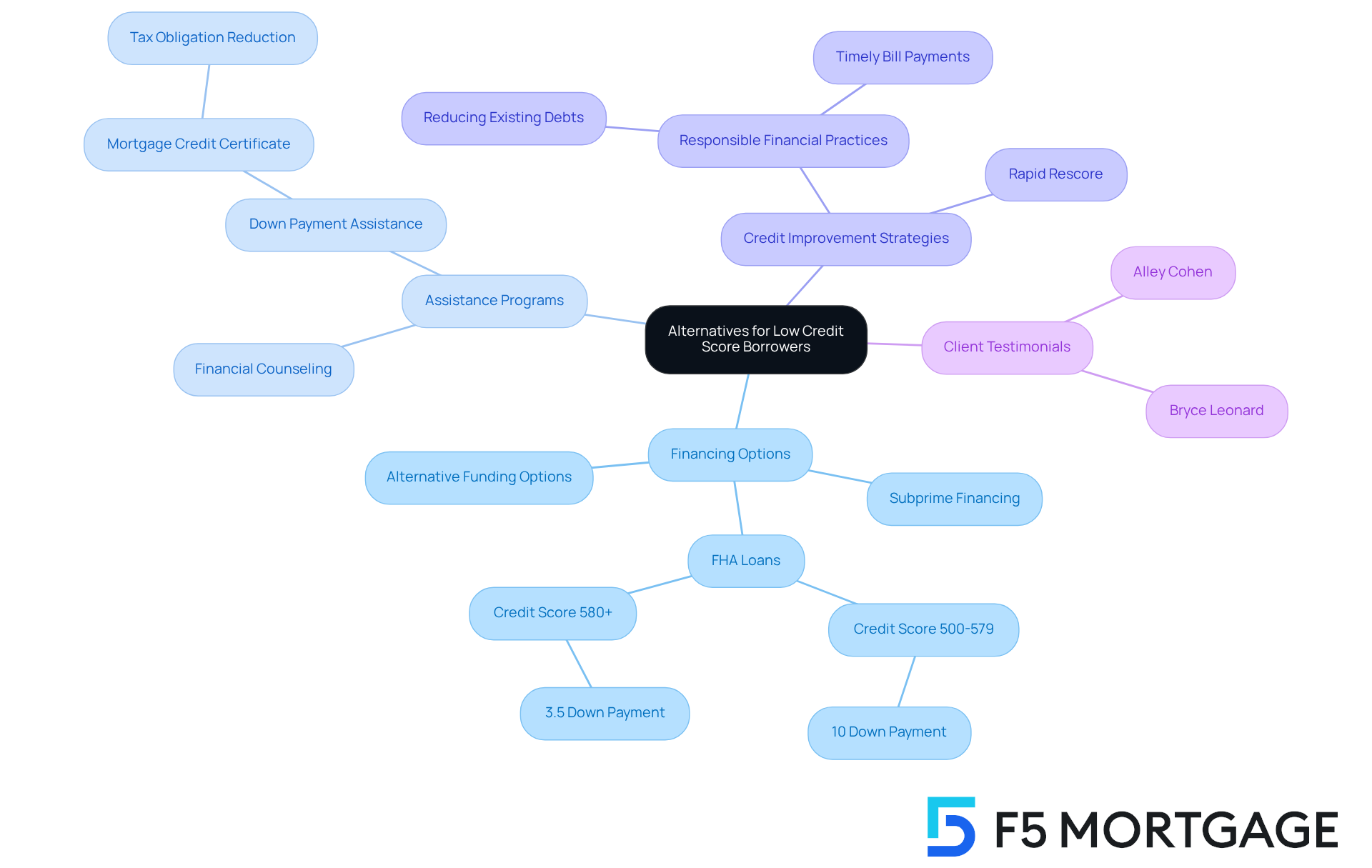

Explore Alternatives for Low Credit Score Borrowers

For borrowers facing challenges with ratings below the FHA’s minimum requirements, there are various options available to enhance their chances of securing financing. We understand how daunting this can feel, but numerous lenders now offer . These include subprime financing and alternative funding options designed to meet your needs.

Data indicates that borrowers with a credit score needed for FHA loan as low as 500 have historically accessed FHA financing, albeit with higher down payment requirements. Moreover, non-profit organizations frequently provide invaluable resources, such as down payment assistance and financial counseling, which can significantly support aspiring homeowners.

At F5 Mortgage, we offer a range of services aimed at assisting borrowers with challenging financial histories. We provide information on down payment assistance initiatives, like the Mortgage Credit Certificate program in Los Angeles County, which allows for a dollar-for-dollar reduction in the buyer’s federal income tax obligation, thereby enhancing affordability for homebuyers.

Improving your credit score through responsible financial practices—such as reducing existing debts and ensuring timely bill payments—can also unlock better loan options for you. Testimonials from satisfied clients, like Bryce Leonard and Alley Cohen, underscore the exceptional support provided by F5 Mortgage. Their experiences reinforce the importance of expert guidance in navigating these financial pathways.

By exploring these alternatives, we believe you can better position yourself to realize your homeownership dreams. Remember, we’re here to support you every step of the way.

Conclusion

FHA loans are a vital resource for individuals and families striving for homeownership, especially those with limited financial means. We understand how challenging this can be, and by grasping the credit score needed for FHA loan approval, potential borrowers can navigate their options more effectively. The accessibility and flexibility in credit requirements make FHA loans an appealing choice, particularly for first-time homebuyers.

A credit score of 580 or above allows borrowers to secure a lower down payment of just 3.5%. For those with scores between 500 and 579, there’s still hope, as they can qualify with a larger down payment. It’s important to maintain a good credit score to unlock better financing conditions, including lower interest rates and reduced overall borrowing costs. Additionally, various down payment assistance programs and specialized options for those with lower credit scores further enhance the accessibility of FHA financing.

The journey toward homeownership can feel daunting, but with the right information and support, it becomes achievable. We’re here to support you every step of the way. Prospective borrowers are encouraged to explore their options, improve their credit profiles, and seek assistance through programs designed to facilitate the home buying process. By taking proactive steps, individuals can position themselves for success in securing an FHA loan and fulfilling their dream of owning a home.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are government-backed financing options created in 1934 to promote homeownership for low- to moderate-income borrowers.

What is the purpose of FHA loans?

The purpose of FHA loans is to make purchasing a home more attainable for families by offering reduced down payment standards and more flexible eligibility criteria compared to traditional financing options.

What are the credit score requirements for an FHA loan?

The credit score needed for an FHA loan is 580 or above, which allows borrowers to secure an FHA mortgage with a down payment as low as 3.5%.

Who primarily benefits from FHA loans?

FHA loans primarily benefit first-time homebuyers, with 82.64% of FHA purchase mortgages issued in fiscal year 2024 going to this demographic.

How many homebuyers did the FHA assist in fiscal year 2024?

In fiscal year 2024, the FHA assisted over 793,000 homebuyers and homeowners.

What are the FHA Forward Mortgage Loan Limits for 2025?

As of 2025, the FHA Forward Mortgage Loan Limits for one-unit properties are set at $524,225 in low-cost areas and $1,209,750 in high-cost areas.

What should borrowers consider regarding annual mortgage insurance premiums?

Borrowers should consider the effect of annual mortgage insurance premiums on their total borrowing expenses when applying for an FHA loan.

How can families explore FHA loan options?

Families can explore various low down payment solutions available through F5 Mortgage, which are tailored to their financial situations.