Overview

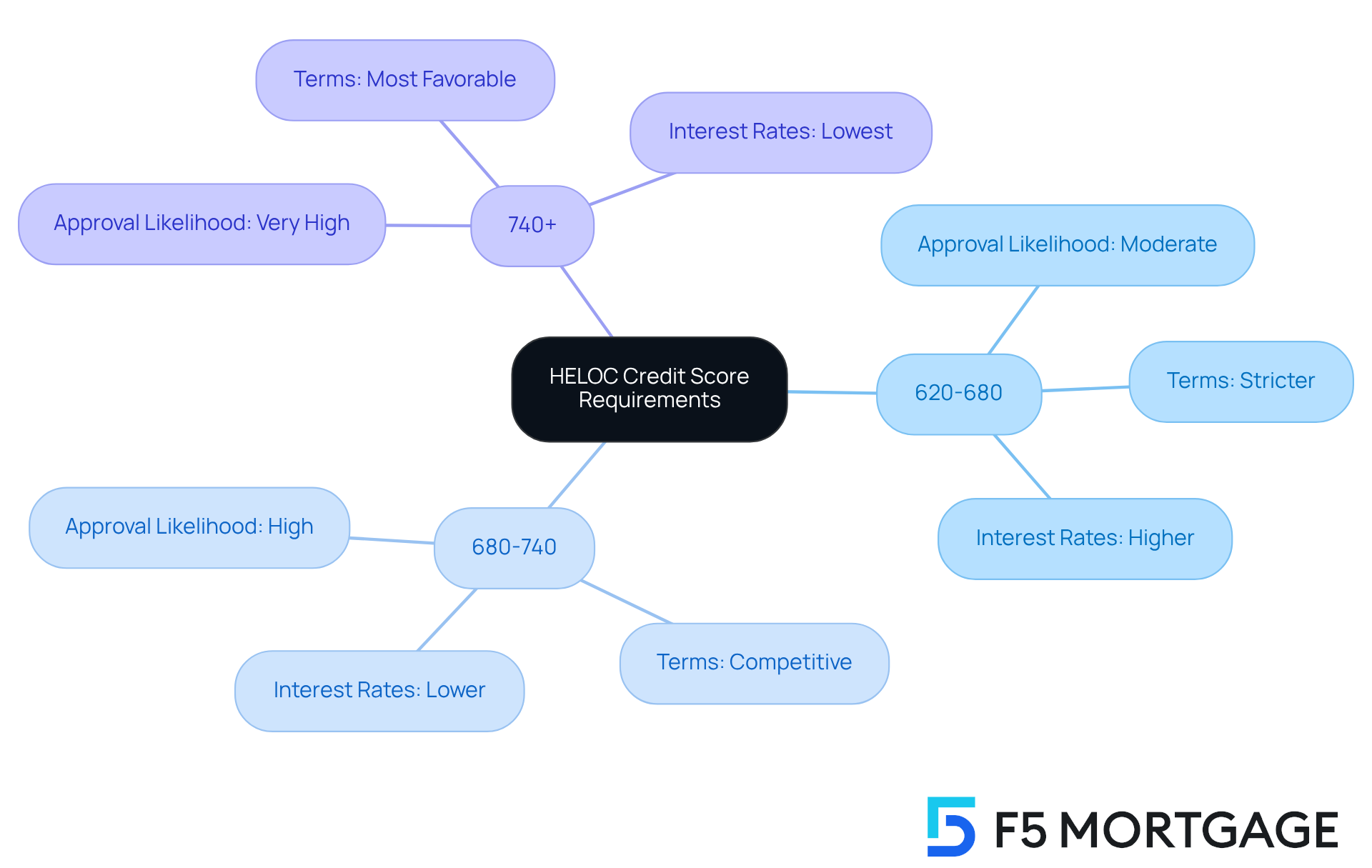

We know how challenging navigating the world of Home Equity Lines of Credit (HELOC) can be, especially when it comes to understanding credit scores. Typically, the minimum credit score for HELOC approval ranges from 620 to 740. If your score is above 680, you are likely to secure more favorable terms and lower interest rates.

While some lenders may accept lower scores, aiming for a score of 740 or higher can significantly enhance your borrowing conditions. This is important because lenders also consider other factors, such as your debt-to-income ratio and your stake in property ownership, during the approval process.

We’re here to support you every step of the way. By focusing on improving your credit score and understanding these factors, you can take proactive steps towards securing the best possible terms for your HELOC.

Introduction

Understanding the minimum credit score required for a Home Equity Line of Credit (HELOC) is crucial for homeowners like you who are looking to leverage your property’s value. We know how challenging this can be, especially as the demand for financial flexibility grows. HELOCs have emerged as a popular option, offering lower interest rates and adaptable borrowing solutions that can truly make a difference in your financial journey.

However, many potential borrowers may find themselves questioning:

- What exactly is the minimum credit score needed for HELOC approval?

- How can you navigate the various eligibility criteria?

This article delves into the intricacies of HELOCs, shedding light on credit score requirements and providing strategies to enhance your financial readiness for this valuable financial tool. We’re here to support you every step of the way.

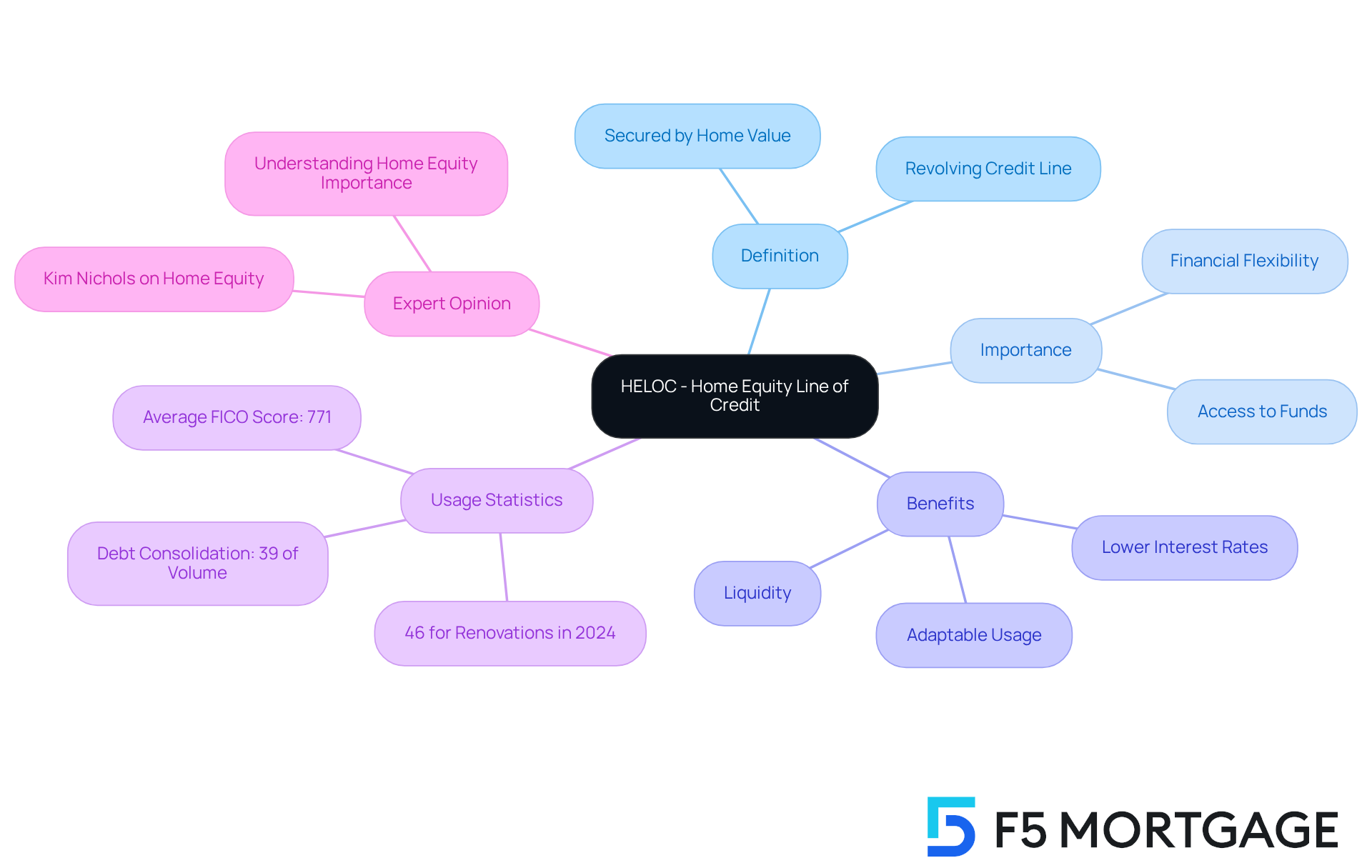

Define HELOC and Its Importance in Home Financing

A Home Value Line of Credit (HELOC) offers you a revolving credit line secured by the value of your home. This means you can borrow against your asset’s worth, providing you with adaptable access to funds for various needs, such as renovations, debt consolidation, or unexpected expenses. We understand how important it is to have financial flexibility, and one of the key benefits of HELOCs is their lower interest rates compared to unsecured loans. This makes them an appealing option for homeowners looking to make the most of their residential value.

In 2024, the average FICO score for HELOC borrowers climbed to 771, which surpasses the minimum credit score for HELOC applicants, indicating a positive trend toward higher credit quality. HELOCs can also serve as a financial safety net, offering liquidity when you need it without the pressure of a lump-sum loan. For example, many homeowners have turned to HELOCs for renovations. In fact, 46 percent of borrowers in 2024 chose this purpose, down from 65 percent in 2022, reflecting a shift in financial priorities.

This adaptability and affordability underscore the importance of HELOCs in today’s property financing landscape. They allow you to meet your financial needs while leveraging the value of your home. As Kim Nichols, Chief Third-Party Origination Production Officer, wisely states, ‘Understanding how residential property value functions, and how to utilize it, is important for any property owner.’

Additionally, with F5 Mortgage’s home refinance services, you can access competitive rates and user-friendly technology, ensuring a smooth process for tapping into your home equity. We’re here to support you every step of the way as you navigate these important financial decisions.

Outline Credit Score Requirements for HELOC Approval

Qualifying for a Home Equity Line of Lending (HELOC) can feel daunting, but we’re here to support you every step of the way. Lenders typically require a minimum credit score for HELOC that ranges from 620 to 740, influenced by their specific standards and your overall financial situation. While some lenders may approve applicants with ratings as low as 620, aiming for a score above 680 can help you secure more favorable terms and lower interest rates. Many lenders establish a minimum credit score for HELOC at 680 in order to offer competitive rates, making it a crucial benchmark. If you can reach a score of 740 or higher, you could significantly improve your borrowing conditions.

Home appraisals are also vital, as they assess your property’s value and ownership stake, directly impacting mortgage rates. Most lenders cap their HELOC offerings at 80% of your total equity, with a typical maximum loan-to-value ratio of 85%. It’s essential to consult with your chosen lender, like F5 Mortgage, to understand their specific rating requirements, particularly the minimum credit score for HELOC, as these can vary greatly between institutions.

If your credit rating is above 700, you’ll likely enjoy the lowest interest rates. However, if you find yourself in the mid-600s, be prepared for higher rates and stricter terms. Additionally, maintaining a debt-to-income (DTI) ratio below 43% is crucial for qualifying for a HELOC. Understanding these dynamics can empower you to make informed decisions about your financial future. We know how challenging this can be, but with the right information and support, you can navigate the process confidently.

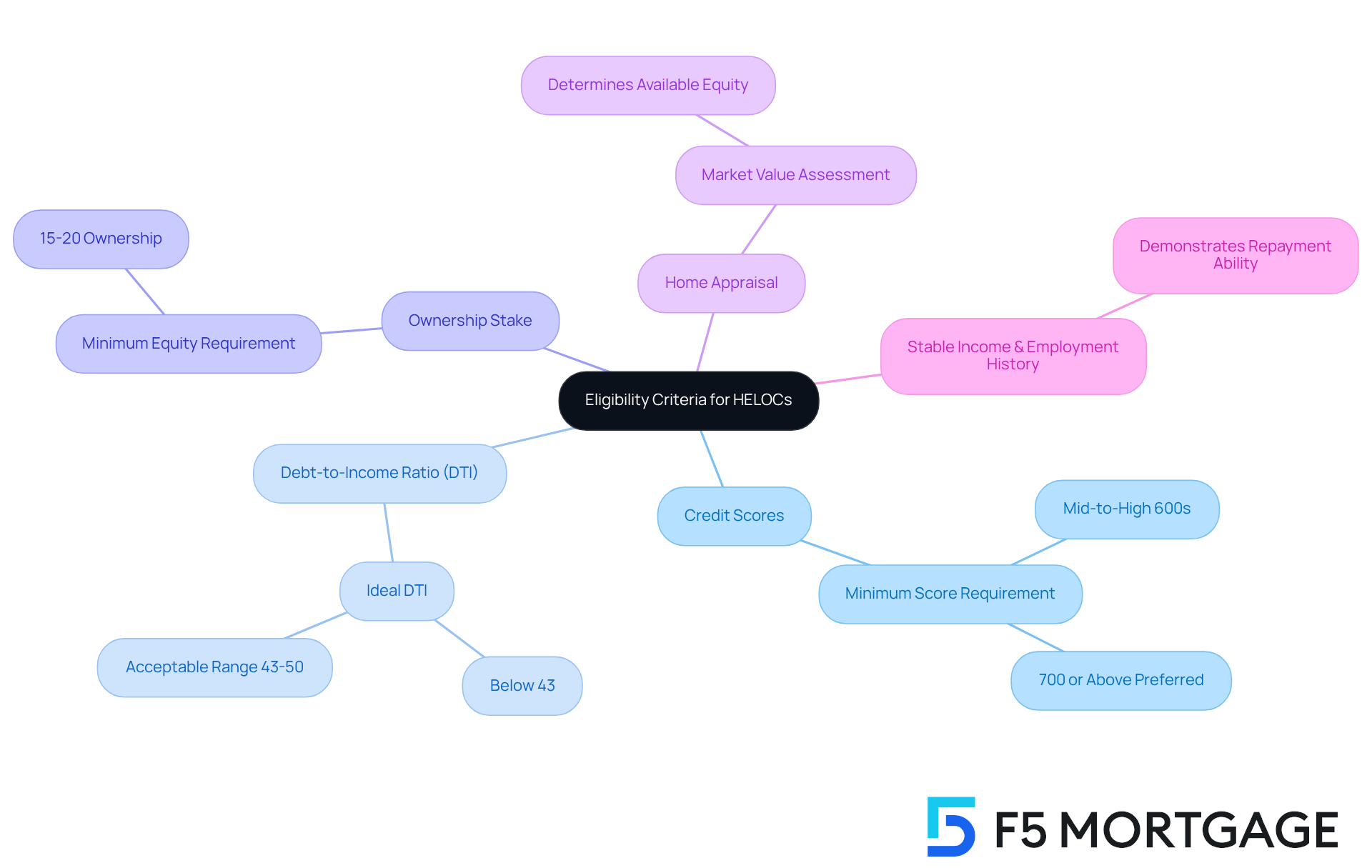

Examine Additional Eligibility Criteria for HELOCs

We understand that navigating the world of home equity lines of credit (HELOC) can feel overwhelming. In addition to credit scores, lenders assess the minimum credit score for HELOC along with several other important factors to determine your eligibility.

One key aspect is your debt-to-income (DTI) ratio, which ideally should be below 43%. This helps demonstrate your financial stability and readiness for a loan.

Another crucial factor is your ownership stake in the property. Typically, lenders require at least 15-20% ownership to qualify for a HELOC. A vital step in this process is the home appraisal, which the lender orders to assess the current market value of your home. This appraisal reveals how much equity you have, directly influencing the rates available to you.

Moreover, having a stable income and a solid employment history is essential. These elements indicate your ability to repay the loan, which is essential for determining the minimum credit score for HELOC and provides lenders with confidence in your financial situation.

We know how challenging this can be, but understanding these factors can empower you on your journey to securing a HELOC.

Implement Strategies to Improve Your Credit Score for HELOCs

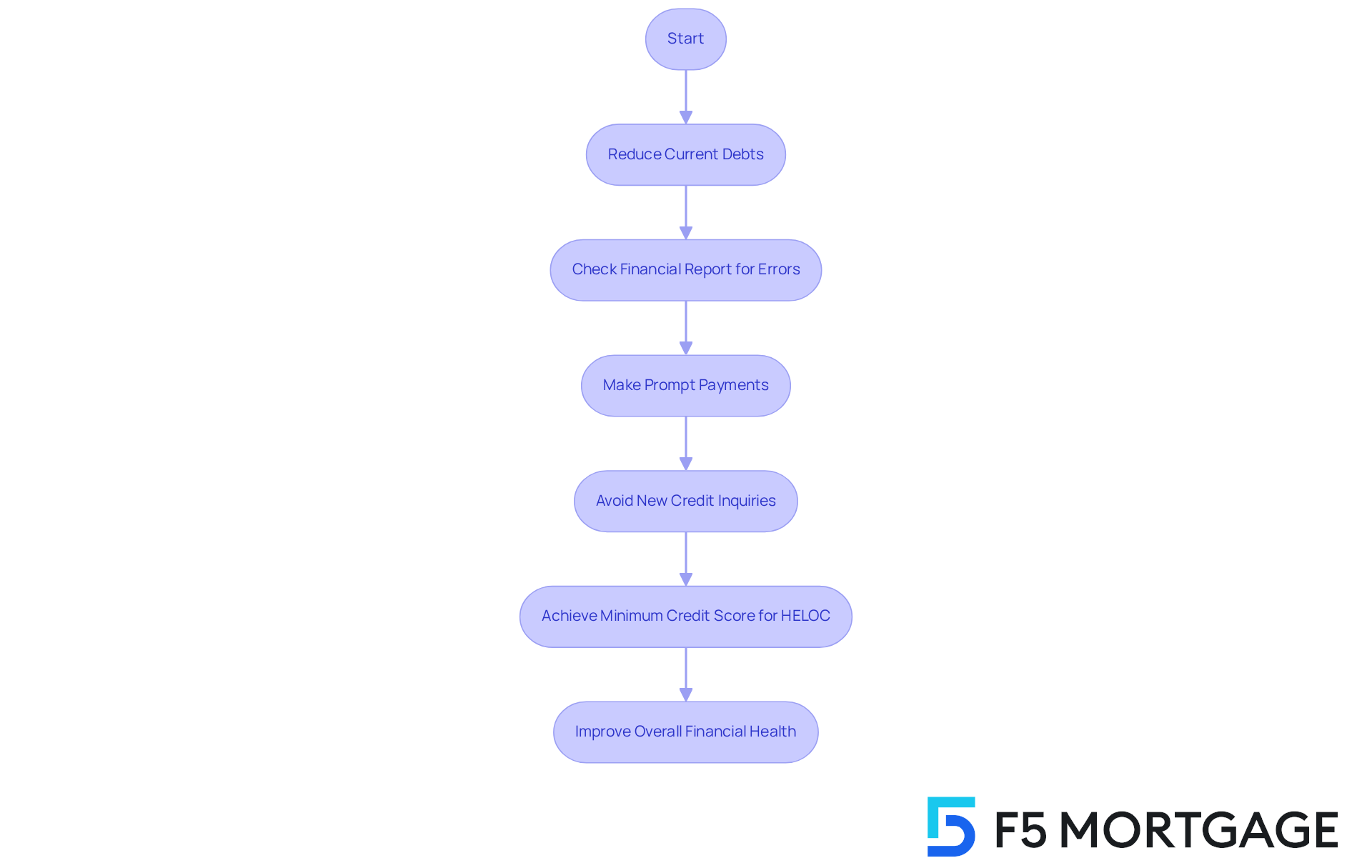

Improving your rating is a crucial step towards achieving the minimum credit score for HELOC approval. We understand how challenging this can be, and we’re here to support you every step of the way. Start by reducing your current debts to lower your utilization ratio, ideally keeping it below 30%. This ratio is vital because a high utilization can negatively impact your rating.

It’s also important to regularly check your financial report for errors and contest any discrepancies you find. Remember, prompt payments on all accounts are essential, as your payment history is the most significant factor influencing your financial ratings. Moreover, it’s wise to avoid new credit inquiries before applying for a HELOC, as these can cause temporary dips in your score.

By implementing these strategies, you can strengthen your application and potentially achieve the minimum credit score for HELOC, thus improving your overall financial health. Taking these steps not only helps with your HELOC approval but also ensures you meet the minimum credit score for HELOC, empowering you to take control of your financial future.

Conclusion

Understanding the minimum credit score for HELOC approval is essential for homeowners looking to tap into their property’s equity. We know how challenging navigating financial options can be, and a HELOC offers a flexible solution, allowing you to access funds based on your home’s value. By grasping the credit score requirements and other eligibility criteria, you can better position yourself to secure favorable loan terms and improve your financial health.

Throughout this article, we’ve highlighted key points to support you. The typical credit score range for HELOC approval generally falls between 620 and 740. Maintaining a low debt-to-income ratio and a stable income is also significant. We’ve discussed strategies for improving your credit score, such as:

- Reducing debt

- Ensuring timely payments

These proactive steps can enhance your borrowing potential.

Ultimately, understanding and meeting the minimum credit score for HELOC approval is not just about securing a loan; it’s about leveraging home equity responsibly and effectively. We encourage you to take these insights to heart, assess your financial situation, and consider reaching out to lenders like F5 Mortgage for personalized guidance. By doing so, you can unlock the financial flexibility that HELOCs offer and make informed decisions that align with your long-term financial goals.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A Home Equity Line of Credit (HELOC) is a revolving credit line secured by the value of your home, allowing you to borrow against your home’s worth for various needs.

What are the key benefits of a HELOC?

The key benefits of a HELOC include financial flexibility, lower interest rates compared to unsecured loans, and the ability to access funds for purposes like renovations, debt consolidation, or unexpected expenses.

How has the average FICO score for HELOC borrowers changed recently?

In 2024, the average FICO score for HELOC borrowers increased to 771, which is above the minimum credit score required for HELOC applicants, indicating a trend towards higher credit quality.

What are common uses for a HELOC?

Common uses for a HELOC include home renovations, with 46 percent of borrowers in 2024 utilizing it for this purpose, reflecting a shift from 65 percent in 2022.

Why are HELOCs considered an important financial tool for homeowners?

HELOCs are important because they provide liquidity and financial safety without the pressure of a lump-sum loan, allowing homeowners to meet their financial needs while leveraging their home’s value.

How does F5 Mortgage assist with HELOCs?

F5 Mortgage offers home refinance services that provide competitive rates and user-friendly technology, ensuring a smooth process for accessing home equity through a HELOC.