Overview

We know how challenging navigating the mortgage approval process can be. Typically, the credit score needed for approval ranges from 620 to 740. Higher scores often qualify you for better rates and terms, which can significantly ease your financial burden. However, it’s important to note that FHA loans can accept scores as low as 500, offering a pathway for those who may feel discouraged.

This understanding is supported by the article’s detailed breakdown of how different mortgage types have varying minimum credit requirements. It highlights the significant impact your credit score can have on borrowing conditions and interest rates. By recognizing these factors, you can make informed decisions that align with your financial goals. We’re here to support you every step of the way as you explore your options.

Introduction

We understand how important it is to grasp the credit score necessary for mortgage approval, especially when you’re aiming to secure financing for your dream home. This crucial number not only reflects your reliability as a borrower but also plays a significant role in determining the terms and interest rates that lenders offer you.

With various mortgage types presenting different credit score requirements, how can you, as a prospective buyer, navigate these complexities to achieve the best possible outcome? By exploring the intricacies of credit scores and their impact on mortgage approval, you can empower yourself to make informed financial decisions and unlock the door to homeownership.

Define Credit Score and Its Importance in Mortgage Approval

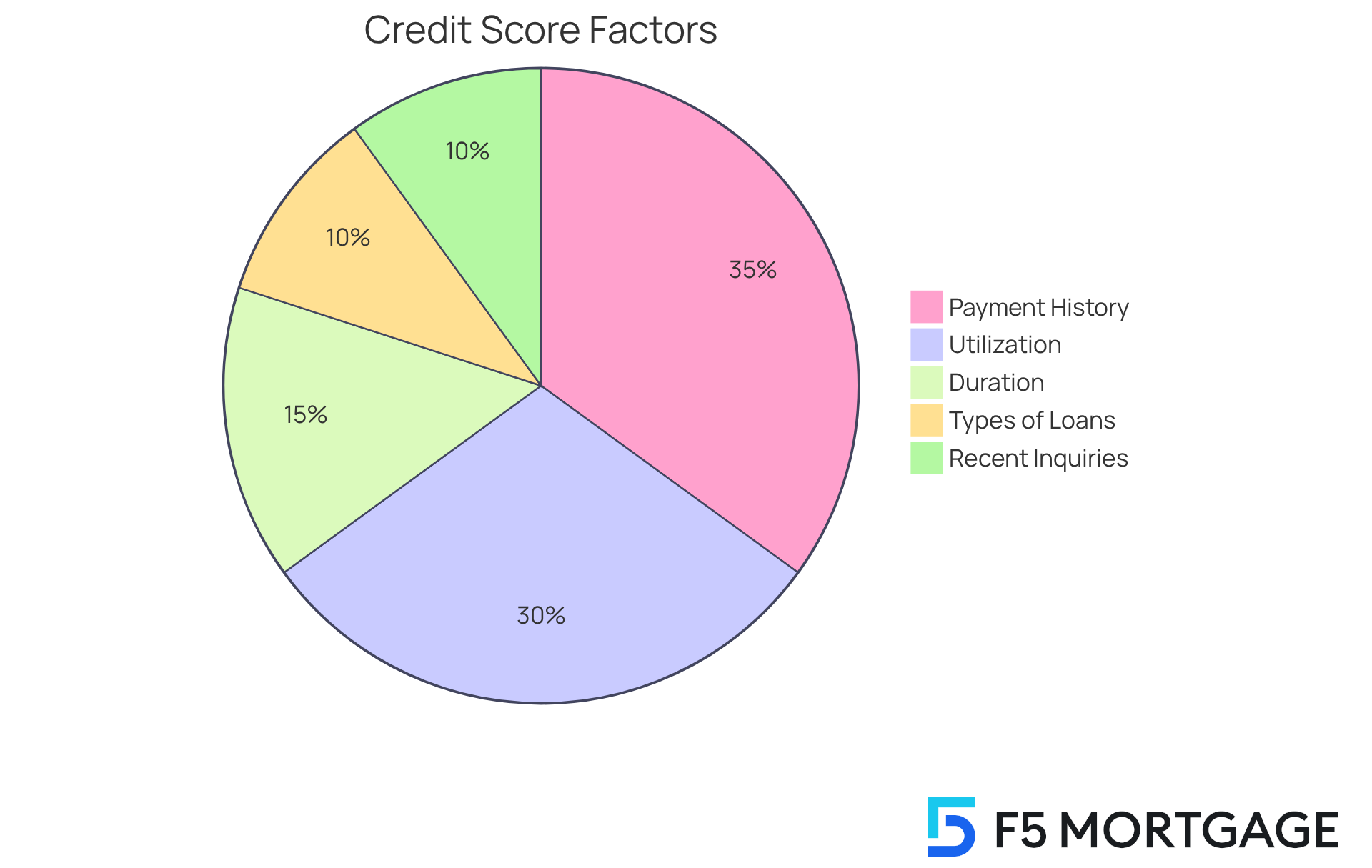

Understanding the credit score needed for mortgage is crucial, especially when navigating the world of mortgages. This rating, which typically ranges from 300 to 850, serves as a numerical representation of your reliability as a borrower. It’s important to know that this rating is influenced by several key factors:

- Payment history (35%)

- Utilization of borrowed funds (30%)

- Duration of borrowing history (15%)

- Types of loans used (10%)

- Recent inquiries for loans (10%)

When it comes to mortgage approval, the credit score needed for mortgage signals to lenders that you are more likely to repay your debt on time. This can lead to more favorable borrowing conditions and lower interest rates. For instance, if your rating is 740 or above, you often qualify for the best mortgage rates available. On the other hand, if your rating falls between 620 and 739, you may face higher rates and fewer options.

For first-time homebuyers, the credit score needed for mortgage FHA mortgages requires a minimum rating of 580 with a 3.5% down payment, or 500 with a 10% down payment. This illustrates how different financing options come with varying qualification requirements.

We know how challenging this can be, but understanding these dynamics is essential for prospective homebuyers. A solid financial rating not only enhances your chances of securing funding but can also significantly impact the terms of that funding, potentially saving you thousands over the life of your mortgage. We’re here to as you embark on this important journey.

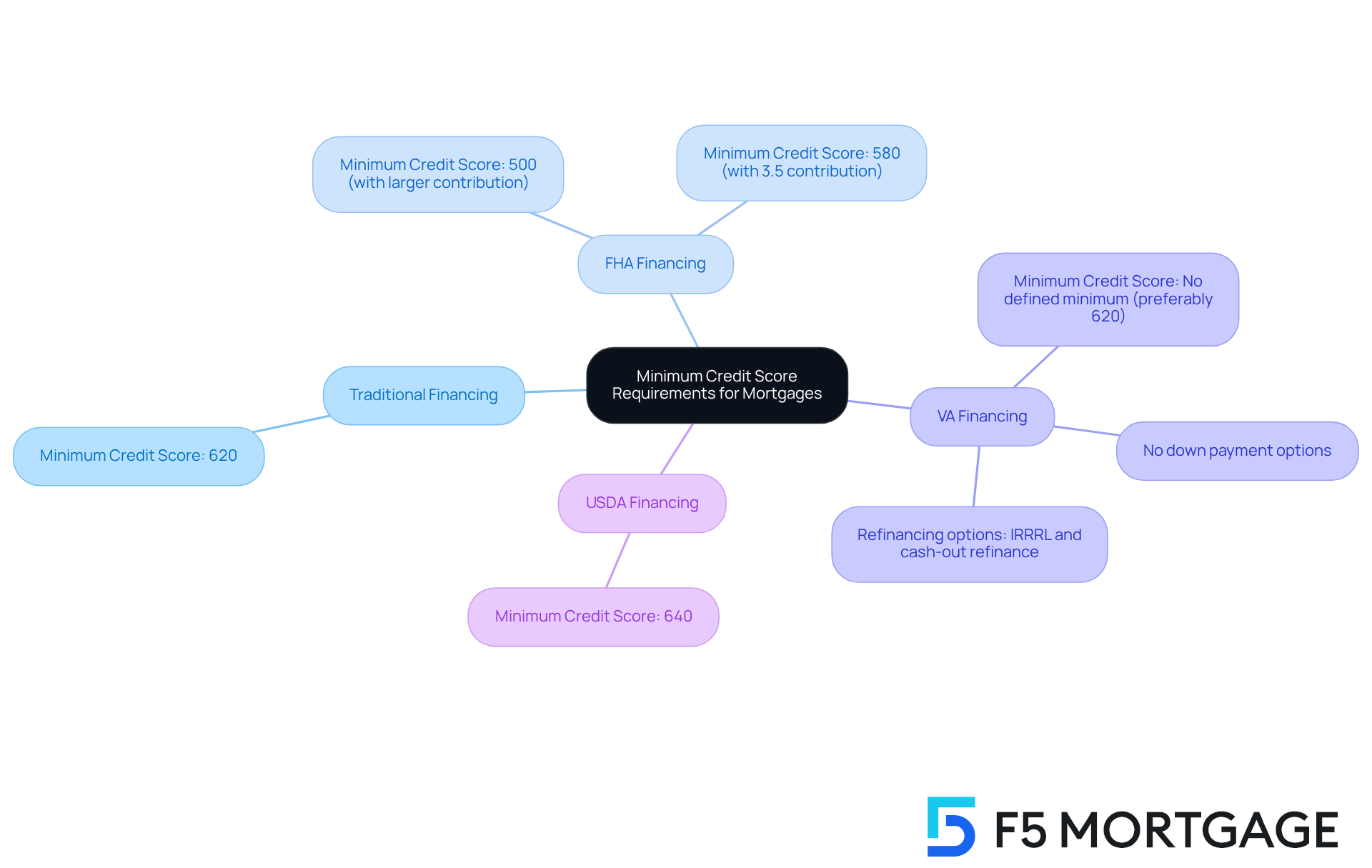

Explore Minimum Credit Score Requirements for Various Mortgage Types

Navigating the world of mortgages can feel overwhelming, but understanding the different types available can make a significant difference. Different mortgage types have varying minimum credit criteria requirements, and we understand the credit score needed for mortgage can be quite challenging. For traditional financing, lenders typically require a credit score needed for mortgage of 620 or higher. However, FHA financing offers more flexibility, allowing a credit score needed for mortgage as low as 500 with a larger initial contribution, or 580 for a smaller contribution of 3.5%.

For our veterans and active-duty personnel, VA financing stands out as a remarkable option. It does not have a defined minimum rating; most lenders simply prefer that the credit score needed for mortgage is no less than 620. This flexibility, combined with the possibility of no down payment and refinancing alternatives like the VA Interest Rate Reduction Refinance Program (IRRRL) and VA cash-out refinance, makes VA options an appealing choice for many borrowers.

On the other hand, USDA financing typically necessitates a minimum credit score needed for mortgage of 640. Understanding these criteria is essential for you to determine the accessible based on your financial profile. At F5 Mortgage, we’re here to support you every step of the way, offering a diverse range of financing programs. Even if one lender declines, rest assured that there are still options available for you.

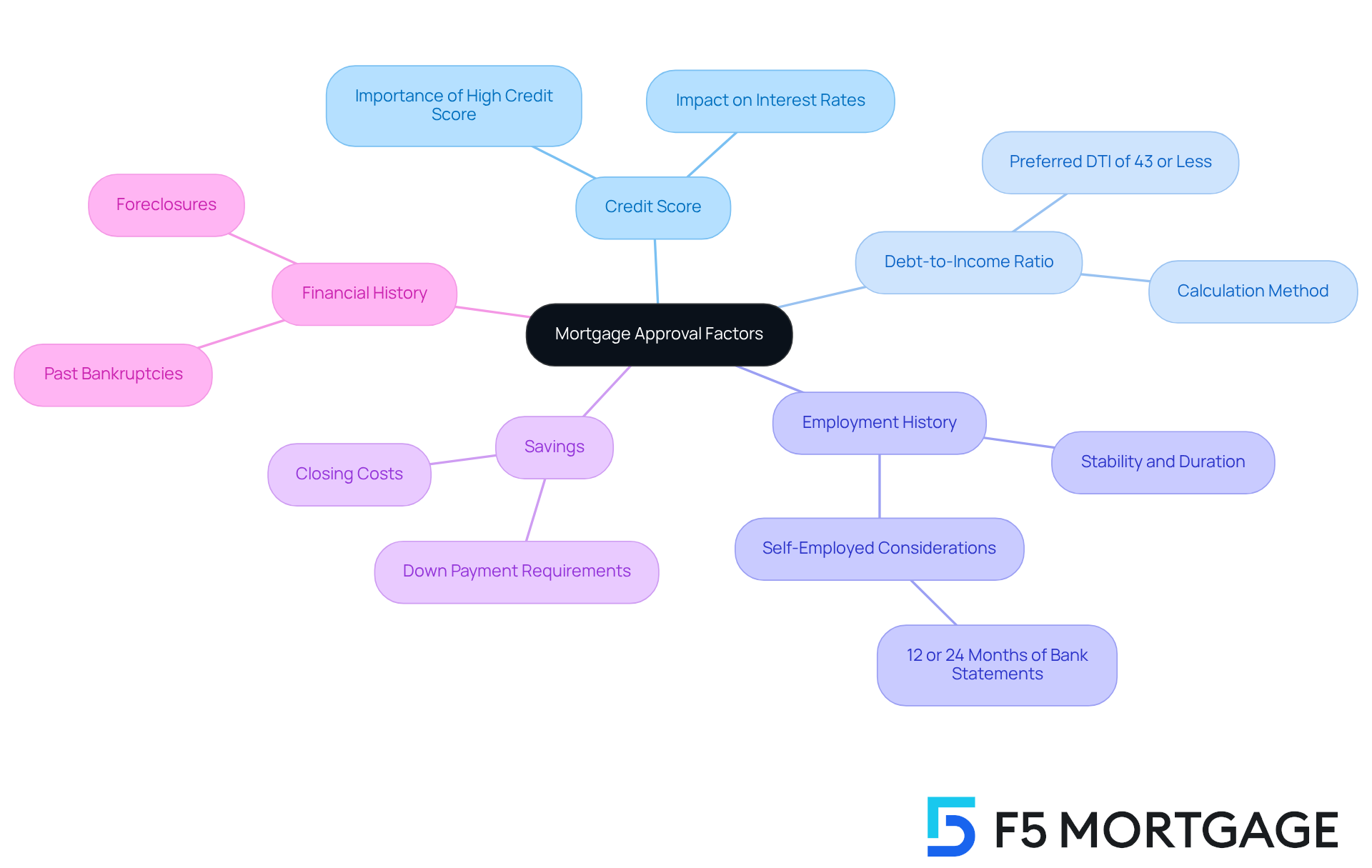

Examine Additional Factors Affecting Mortgage Approval Beyond Credit Scores

We know how challenging the can be, and while the credit score needed for mortgage plays a significant role, there are other important factors that lenders consider. Elements such as your debt-to-income (DTI) ratio, employment history, and savings all contribute to a lender’s decision. Essentially, an approval means that based on the financial information you provide, you’re seen as a good candidate for a mortgage.

During this process, you can expect to receive an estimate of your loan amount, interest rate, and potential monthly payment. Keep in mind that these can vary by lender. The DTI ratio, which compares your monthly debt obligations to your gross monthly income, is particularly vital; most lenders prefer a DTI of 43% or less.

Additionally, having a stable employment history and sufficient savings for a down payment and closing costs can enhance your profile as a borrower. For those who are self-employed, your income can be assessed using either 12 or 24 months of bank statements, allowing the underwriter to understand your business cash flow better.

Lenders may also take a close look at your overall financial history, including any past bankruptcies or foreclosures, to evaluate the risk involved. Remember, we’re here to support you every step of the way as you navigate this important journey.

Identify Strategies to Improve Your Credit Score Before Applying for a Mortgage

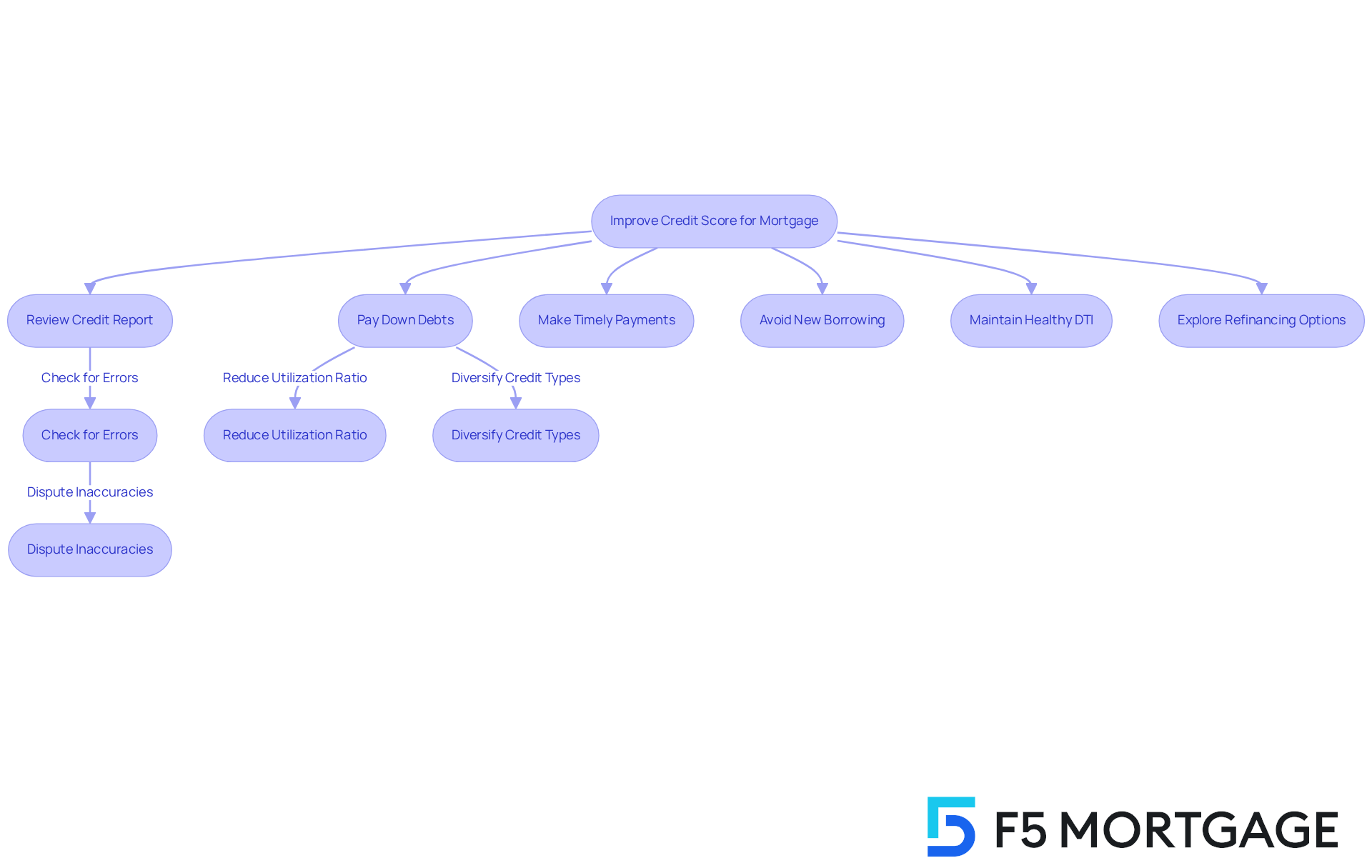

Enhancing your credit score needed for mortgage before applying can significantly influence your loan options and interest rates. We understand how challenging this process can be, and we’re here to support you every step of the way. Start by and disputing any inaccuracies you find. Paying down existing debts to reduce your utilization can make a big difference, and making all your payments punctually is crucial.

Additionally, steering clear of new borrowing inquiries before applying for a mortgage can help preserve your rating. A diverse mix of credit types, such as installment financing and revolving credit, can also positively impact your score. It’s essential to understand your debt-to-income (DTI) ratio, as maintaining a maximum of 43% DTI is typically necessary to achieve the credit score needed for mortgage applications. A better DTI can lead to more competitive mortgage rates, which is particularly important for families looking to upgrade their homes.

If your DTI exceeds 43%, it may limit your mortgage options and result in higher interest rates. By taking these steps, you can position yourself more favorably in the eyes of lenders. Consider exploring refinancing options available through F5 Mortgage, including:

- Conventional loans

- FHA loans

- VA loans

Remember, we’re here to guide you through this journey and help you achieve your homeownership dreams.

Conclusion

Understanding the credit score necessary for mortgage approval is crucial for anyone looking to secure financing for a home. We know how challenging this can be, but a strong credit score not only increases your chances of approval but also opens the door to better interest rates and loan terms. By familiarizing yourself with the various credit score requirements across different mortgage types, you can make informed decisions that align with your financial situation.

Throughout this article, we’ve shared key insights regarding the components that contribute to a credit score, the minimum requirements for various mortgage types—including FHA, VA, and USDA loans—and additional factors that lenders consider during the approval process. We also discussed strategies for improving credit scores before applying for a mortgage, emphasizing the importance of managing debt, maintaining a healthy DTI ratio, and ensuring timely payments.

Ultimately, enhancing your credit score and understanding the mortgage landscape can lead to significant savings and a smoother home-buying experience. Taking proactive steps to improve your financial health empowers you to achieve your homeownership dreams while maximizing your mortgage options. With the right knowledge and support, navigating the complexities of mortgage approval can become a manageable and rewarding journey.

Frequently Asked Questions

What is a credit score and why is it important for mortgage approval?

A credit score is a numerical representation of your reliability as a borrower, typically ranging from 300 to 850. It is important for mortgage approval because it signals to lenders your likelihood of repaying debt on time, which can lead to more favorable borrowing conditions and lower interest rates.

What factors influence a credit score?

The key factors that influence a credit score include: payment history (35%), utilization of borrowed funds (30%), duration of borrowing history (15%), types of loans used (10%), and recent inquiries for loans (10%).

What credit score is needed for the best mortgage rates?

To qualify for the best mortgage rates, a credit score of 740 or above is typically required.

What are the credit score requirements for FHA mortgages?

For FHA mortgages, a minimum credit score of 580 is required with a 3.5% down payment, or a score of 500 with a 10% down payment.

How can a solid credit score impact mortgage funding?

A solid credit score enhances your chances of securing funding and can significantly impact the terms of that funding, potentially saving you thousands over the life of your mortgage.