Overview

Understanding the various types of mortgages is crucial for families navigating their homeownership journey. We know how challenging this can be, and choosing the best financing option that aligns with your financial needs and goals is essential. This article outlines different mortgage categories, including government-backed loans such as FHA, VA, and USDA, along with conventional options. Each category has its distinct features and benefits, empowering you to make informed decisions based on your unique financial situation. We’re here to support you every step of the way as you explore these options.

Introduction

Navigating the complex landscape of mortgages can feel overwhelming for families seeking to secure a home. We understand how challenging this can be. With various options available, it’s essential to grasp the nuances of different mortgage types to make informed financial decisions. Families can explore a range of mortgage products—from government-backed loans that offer lower entry barriers to conventional options that may provide long-term savings.

But with so many choices, how can families determine which mortgage aligns best with their unique financial situations and homeownership goals? We’re here to support you every step of the way.

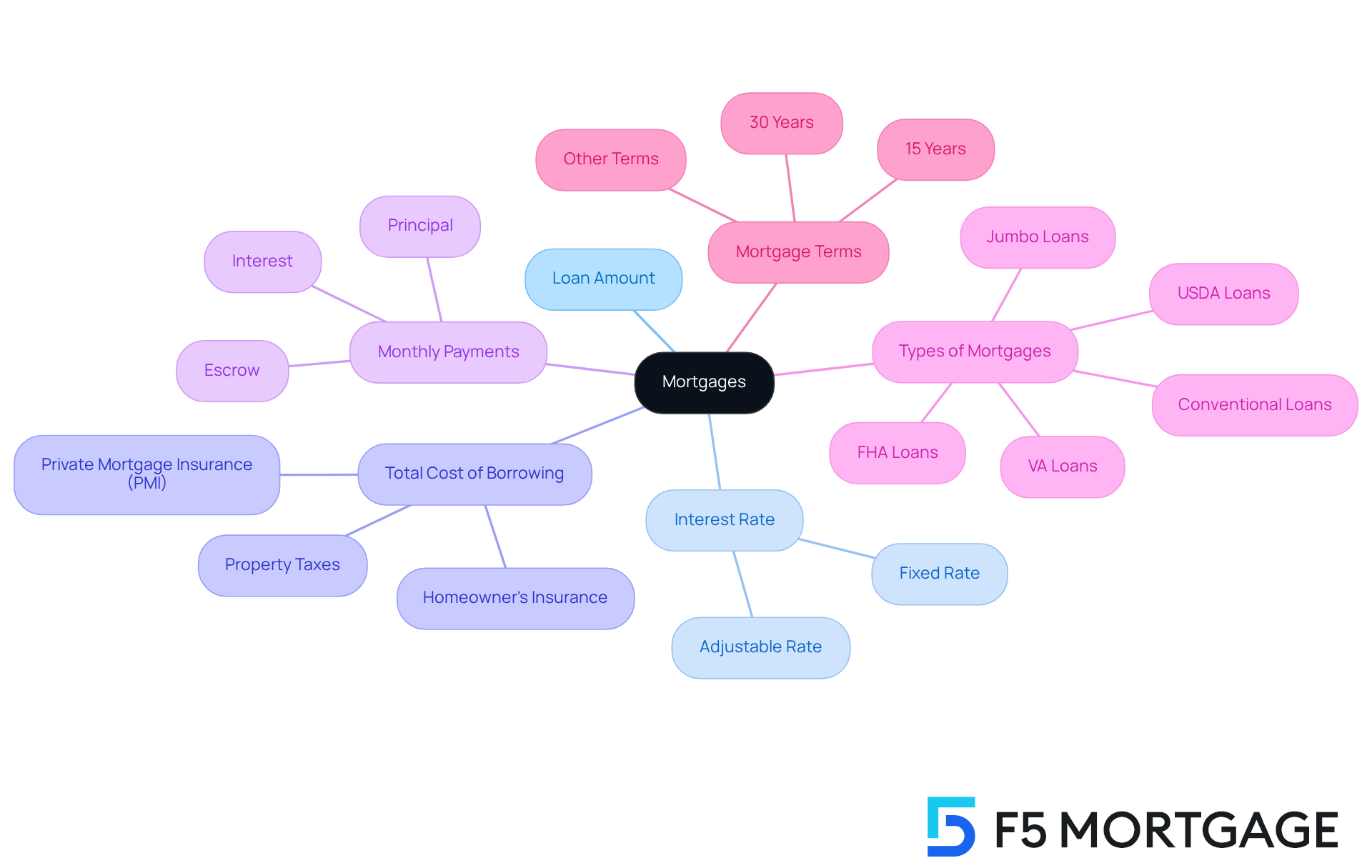

Define Mortgages: Understanding the Basics

Navigating the world of mortgages can feel overwhelming, and we know how challenging this can be. A mortgage is a financial agreement specifically designed for acquiring real estate, with the property itself acting as collateral. This means that if the borrower fails to repay the debt, the lender has the right to seize the property. Mortgages typically involve long-term repayment plans, often spanning from 15 to 30 years, and consist of both principal and interest contributions. Many families opt for 30-year fixed-rate mortgages to ensure consistent monthly payments, providing a sense of stability in their budgeting.

Understanding the fundamental framework of a home loan is essential for families embarking on the property purchasing journey. Key components include:

- The loan amount

- Interest rate

- The total cost of borrowing, which also encompasses additional expenses like property taxes and homeowner’s insurance

For instance, imagine a family considering a $400,000 home with a 3.5% interest rate over 30 years. They would need to factor in monthly payments that include not just the loan but also those additional costs.

This comprehensive understanding empowers families to make informed decisions. By understanding the different types of mortgages available, they can choose the best fit for their financial situations. We’re here to as you explore this important milestone.

Explore Mortgage Categories: Government-Backed vs. Conventional

Mortgages can be categorized into different types of mortgages, such as government-backed financing and conventional financing. We know how challenging navigating homeownership can be, and understanding these options is the first step toward making informed decisions.

Government-supported options, including FHA, VA, and USDA financing, aim to enhance accessibility to homeownership. These financial products generally offer reduced initial payments—beginning at just 3.5% for FHA options—and more adaptable credit criteria. This makes them especially attractive for first-time purchasers and households with limited savings. For example, FHA mortgages permit credit scores as low as 580, which can greatly assist families that may not meet the criteria for traditional financing.

On the other hand, traditional financing options are not insured or guaranteed by the government. They generally require , typically starting at 620, along with larger down payments to secure favorable rates. These financial products are frequently chosen by households with strong credit histories and considerable savings, as they can help reduce long-term expenses by removing private mortgage insurance (PMI) once 20% equity is attained.

Currently, there’s a growing interest in government-supported financing, especially among families seeking budget-friendly entry options into the housing market. Mortgage experts highlight the benefits of these financial products, observing that they often provide a faster route to homeownership for individuals with unique financial circumstances. For instance, VA mortgages offer no down payment alternatives for qualified veterans, while USDA financing serves households looking to buy homes in rural areas without requiring a down payment.

Grasping the different types of mortgages is crucial for families to make informed choices that align with their financial situations and homeownership goals. By consulting with a financing specialist, families can explore tailored options and determine which type of credit best meets their needs. Remember, we’re here to support you every step of the way.

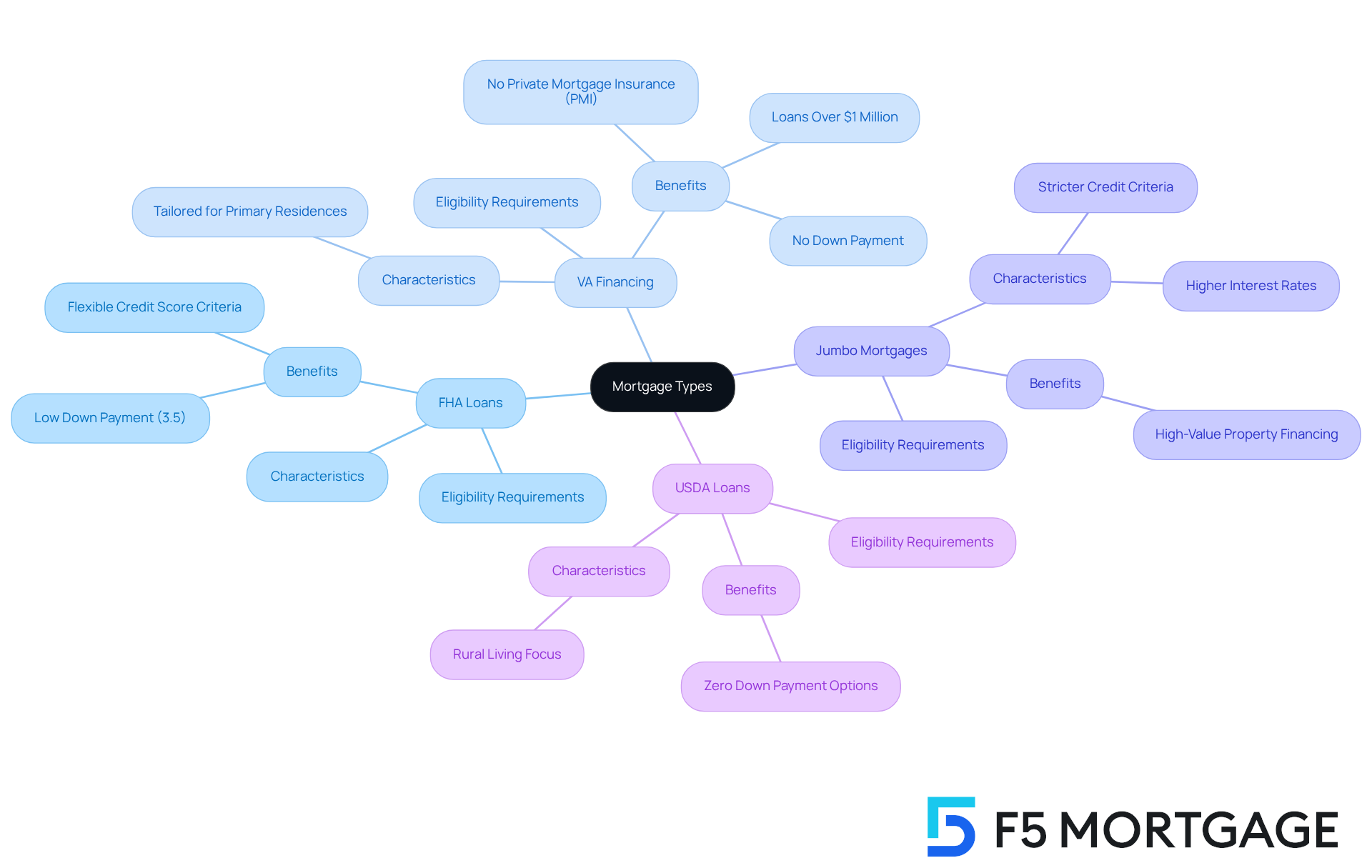

Examine Specific Mortgage Types: FHA, VA, Jumbo, and More

Navigating the world of mortgages can be overwhelming, but several specific types cater to your unique needs:

- FHA Loans: Insured by the Federal Housing Administration, these loans are often favored by first-time homebuyers. With a that can be as little as 3.5% and flexible credit score criteria, they help families enter the housing market without significant financial strain. We understand how important it is to find a pathway to homeownership.

- VA Financing: For veterans and active-duty service members, VA financing offers remarkable advantages. Imagine securing a home with no initial cost and no private mortgage insurance (PMI). In 2025, qualifying veterans can obtain financing exceeding $1 million without a down payment, making homeownership more achievable than ever. Since its inception, the VA financing program has been crucial in assisting over 60,000 veterans, with a homeownership rate approaching 80%. These financial products are tailored specifically for primary residences, ensuring veterans can find homes that truly meet their needs.

- Jumbo Mortgages: If you’re looking at high-value properties, jumbo mortgages might be the right fit. These financial products exceed the conforming limits established by Fannie Mae and Freddie Mac. However, they often come with more stringent credit criteria and elevated interest rates, making them suitable for households seeking luxury residences or homes in high-demand areas.

- USDA Loans: For those considering rural living, USDA loans offer fantastic opportunities with zero down payment options. Backed by the U.S. Department of Agriculture, this program is especially advantageous for families looking for affordable housing in less populated regions.

Each of the different types of mortgages serves distinct borrower needs, and it’s essential for families to evaluate their options carefully. We know how challenging this can be, and understanding the advantages of VA loans, in particular, can empower veterans and service members to make informed decisions about their home financing. Remember, we’re here to support you every step of the way.

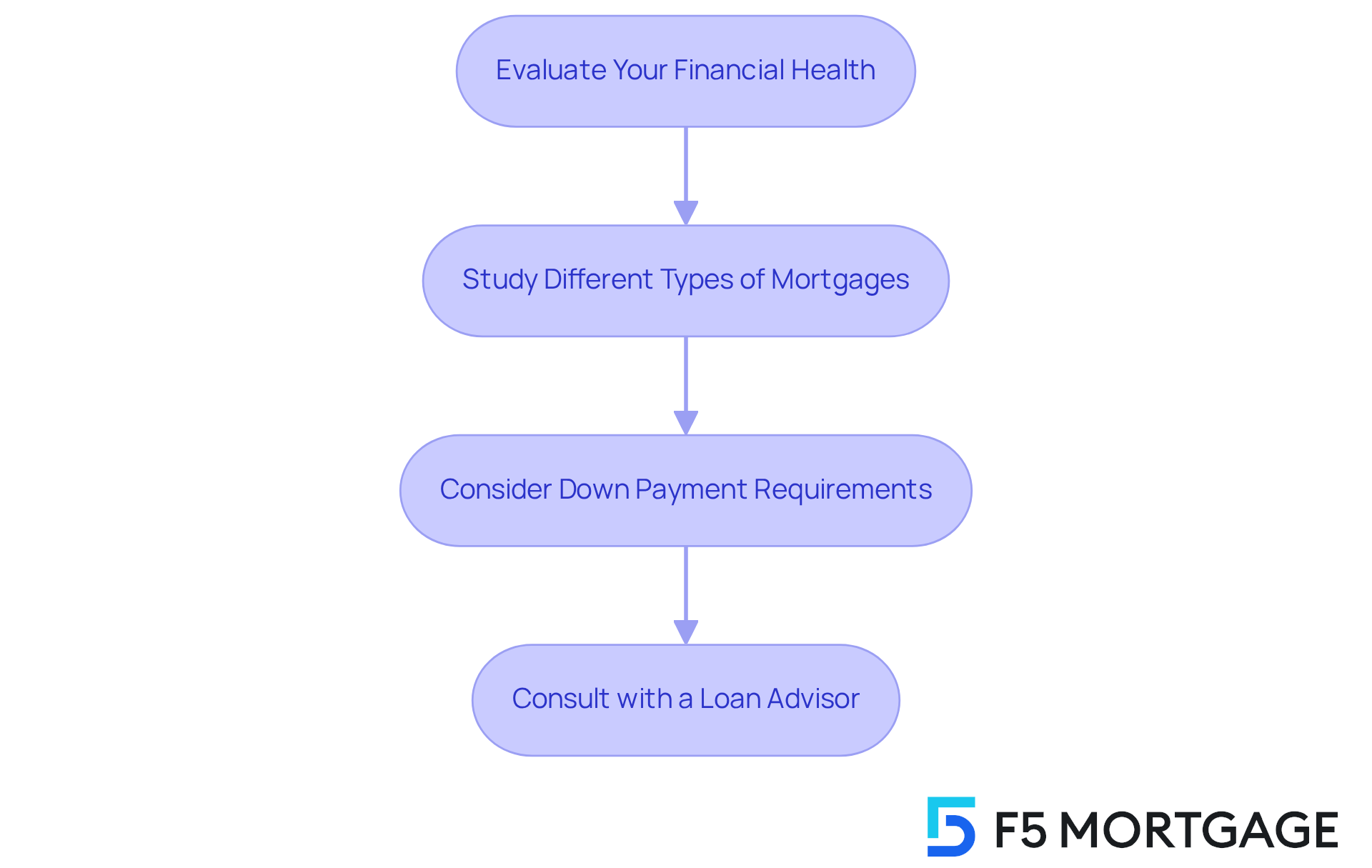

Assess Your Options: Choosing the Right Mortgage for Your Needs

Choosing the right loan can feel overwhelming, but it’s an important step towards achieving your homeownership dreams. Let’s take a closer look at how you can navigate this process with confidence.

- Evaluate Your Financial Health: We know how challenging it can be to assess your finances. Start by taking a good look at your income, expenses, and credit score. This will help you establish a realistic budget for your loan. Generally, a credit score of 620 is the minimum for traditional financing, but remember, higher scores can unlock better rates.

- Study the : Understanding your financing choices is crucial. Explore options like government-supported programs, including FHA and VA loans, which often come with reduced initial costs and flexible credit standards. These alternatives can align perfectly with your financial goals.

- Consider Down Payment Requirements: Think about how much you can afford to put down. A down payment of at least 20% can help you avoid private mortgage insurance (PMI), but there are also programs that allow for smaller down payments. Knowing your options can ease some of the stress.

- Consult with a Loan Advisor: Engaging with a knowledgeable loan advisor can make a world of difference. They can provide tailored insights and simplify the lending process for you. Brokers are there to help you navigate the complexities of different types of mortgages and find the best available rates.

By following these steps, you can make informed decisions that align with your homeownership aspirations. Remember, we’re here to support you every step of the way, ensuring a smoother path to securing the right mortgage.

Conclusion

Understanding the various types of mortgages is essential for families looking to achieve their homeownership dreams. We know how challenging this can be. By familiarizing themselves with the intricacies of mortgage options, families can make informed decisions that best suit their financial situations and long-term goals. This knowledge empowers them to navigate the complex landscape of home loans with confidence and clarity.

The article delves into the fundamental concepts of mortgages, highlighting the importance of:

- Evaluating financial health

- Understanding different mortgage types

- Considering down payment requirements

It emphasizes the distinctions between government-backed loans, such as FHA and VA financing, and conventional mortgages, showcasing how each category serves unique borrower needs. Additionally, the guidance offered on consulting with loan advisors underscores the value of tailored support in the decision-making process.

Ultimately, the journey to homeownership is a significant milestone for families, and selecting the right mortgage is a critical step in that journey. By taking the time to assess options and seek expert advice, families can pave the way for a secure financial future. Embracing this process not only enhances their understanding of mortgages but also ensures they find a solution that aligns with their aspirations and budgetary constraints. We’re here to support you every step of the way.

Frequently Asked Questions

What is a mortgage?

A mortgage is a financial agreement designed for acquiring real estate, where the property itself serves as collateral. If the borrower fails to repay the debt, the lender has the right to seize the property.

What is the typical duration of a mortgage?

Mortgages typically involve long-term repayment plans that span from 15 to 30 years.

What are the main components of a mortgage?

The main components of a mortgage include the loan amount, interest rate, and the total cost of borrowing, which includes additional expenses like property taxes and homeowner’s insurance.

Why do many families choose 30-year fixed-rate mortgages?

Many families opt for 30-year fixed-rate mortgages to ensure consistent monthly payments, providing a sense of stability in their budgeting.

Can you provide an example of mortgage costs?

For example, a family considering a $400,000 home with a 3.5% interest rate over 30 years would need to factor in monthly payments that include not just the loan but also additional costs like property taxes and insurance.

How can understanding mortgages help families?

Understanding the different types of mortgages and their components empowers families to make informed decisions and choose the best fit for their financial situations.