Overview

This article addresses how families can effectively maximize VA seller concessions to make home upgrades more affordable. We understand how challenging financial decisions can be, and these concessions offer a valuable opportunity. Sellers can contribute up to 4% of the home’s purchase price toward closing costs, which can significantly lighten the financial load for buyers. This not only alleviates immediate costs but also enhances your ability to invest in meaningful home improvements.

Imagine the possibilities that open up when you can redirect those savings toward creating a space that truly reflects your family’s needs. By utilizing these concessions wisely, families can turn their dream upgrades into reality. We’re here to support you every step of the way as you navigate this process. Take action today to explore how these concessions can work for you and transform your home into a haven that meets your aspirations.

Introduction

Navigating the complexities of homeownership can often feel like an uphill battle. For families striving to turn their dreams into reality through VA loans, this journey can be particularly daunting. We understand how challenging this can be, but there is hope. By grasping the concept of seller concessions—financial contributions from the vendor that can ease closing costs—you open a world of possibilities. This knowledge can significantly reduce upfront expenses, enhancing affordability for your family.

Yet, many potential homebuyers remain unaware of how to fully leverage these benefits. How can families effectively negotiate these concessions to maximize their financial advantage? We’re here to support you every step of the way, guiding you towards a more manageable path to homeownership.

Define Seller Concessions in VA Loans

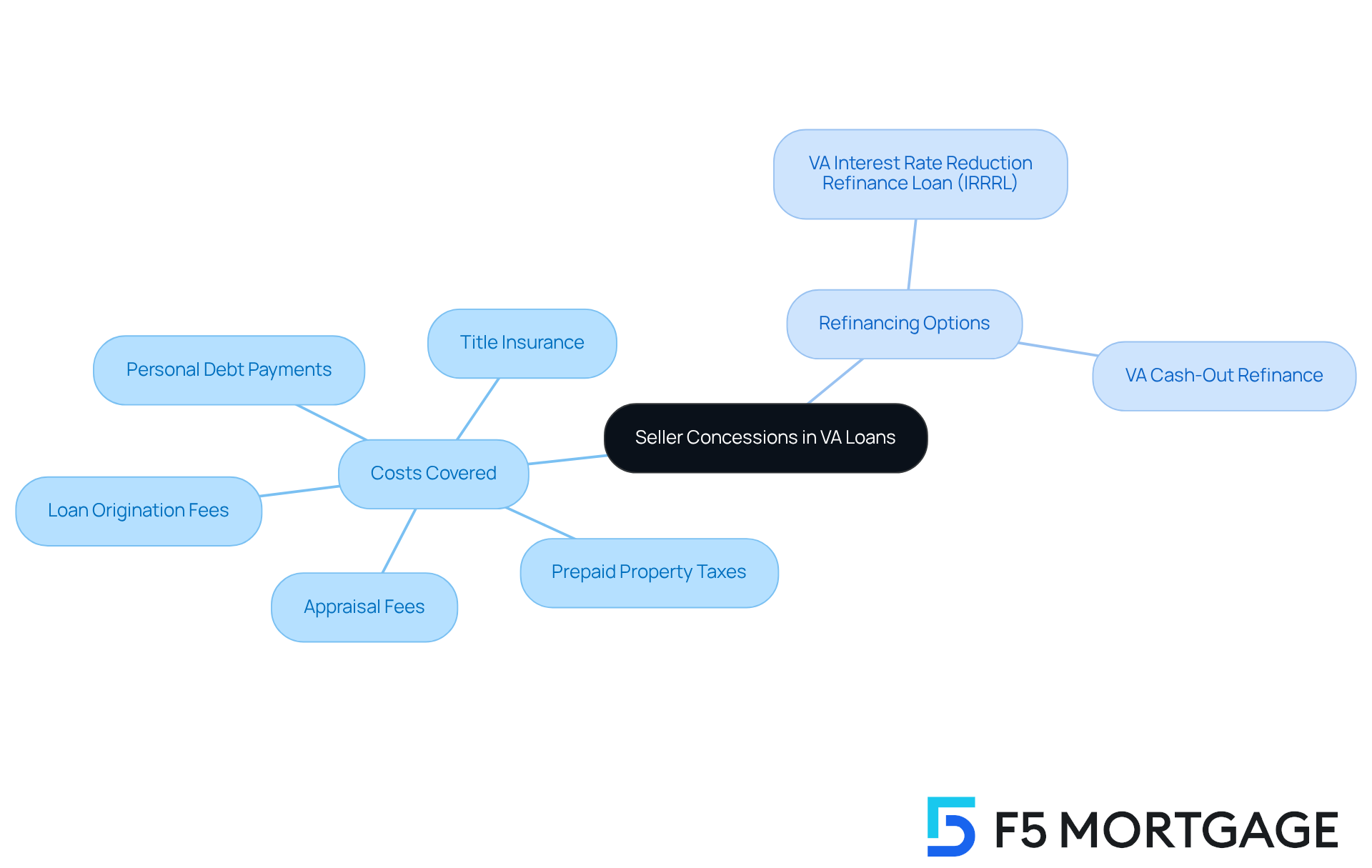

Navigating the world of VA loans can be challenging, especially when it comes to understanding financial contributions. These contributions refer to the monetary assistance provided by the vendor to help buyers cover closing costs or other expenses related to acquiring a property. This support can include various costs, such as:

- Loan origination fees

- Appraisal fees

- Title insurance

- Prepaid property taxes

- Personal debt payments

By grasping vendor allowances, families can take advantage of these benefits to reduce their out-of-pocket expenses when purchasing a home. This can make the dream of homeownership feel more achievable. It’s important to remember that the maximum VA seller concessions are capped at 4% of the property’s purchase price, excluding standard closing expenses, which can be fully covered.

While vendors are not required to provide these contributions, discussing them can significantly enhance the for families. We know how important it is to make informed decisions during this process. Additionally, families may want to explore refinancing options, such as:

to access equity and further improve their financial situation with F5 Mortgage. We’re here to support you every step of the way.

Explain How Seller Concessions Work in VA Loans

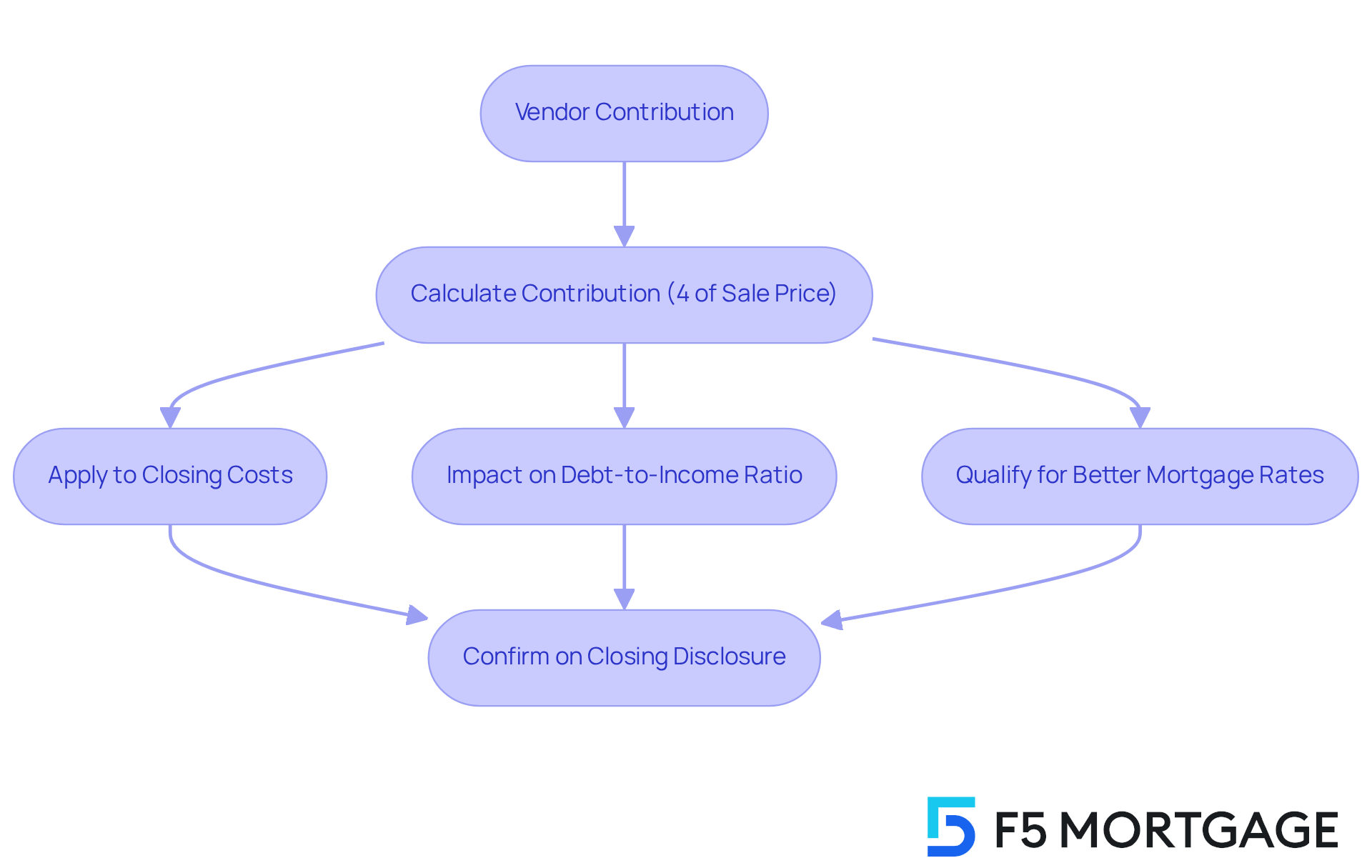

In VA loans, vendor contributions play a vital role in easing the financial burden for homebuyers. We understand how overwhelming purchasing a home can be, and these contributions allow vendors to assist with a portion of the property’s sale price, specifically towards the purchaser’s closing expenses. For example, if a property is listed at $300,000 and the vendor agrees to a 4% discount, that translates to a generous $12,000 contribution towards closing costs. This not only makes homeownership more affordable but also enhances the likelihood of securing financing by lowering the upfront costs.

Typically, the contribution amount for VA loans is limited by the maximum VA seller concessions, which hovers around this 4% limit. This enables veterans to utilize these funds effectively to manage their purchase expenses. By strategically applying these vendor contributions, homebuyers can also improve their chances of qualifying for better mortgage rates, as it positively impacts their debt-to-income ratio. We know how crucial it is to navigate these financial waters, and such compromises can truly make a difference in the home purchasing journey.

However, it’s essential to remember that vendor allowances cannot be applied towards down payments. Therefore, confirming classifications and totals on the Closing Disclosure is critical. This step ensures compliance with VA loan regulations and maximizes the maximum VA seller concessions provided by vendor assistance. We’re here to support you every step of the way, helping you understand and as you embark on your homeownership journey.

Outline the Maximum Seller Concessions Allowed on VA Loans

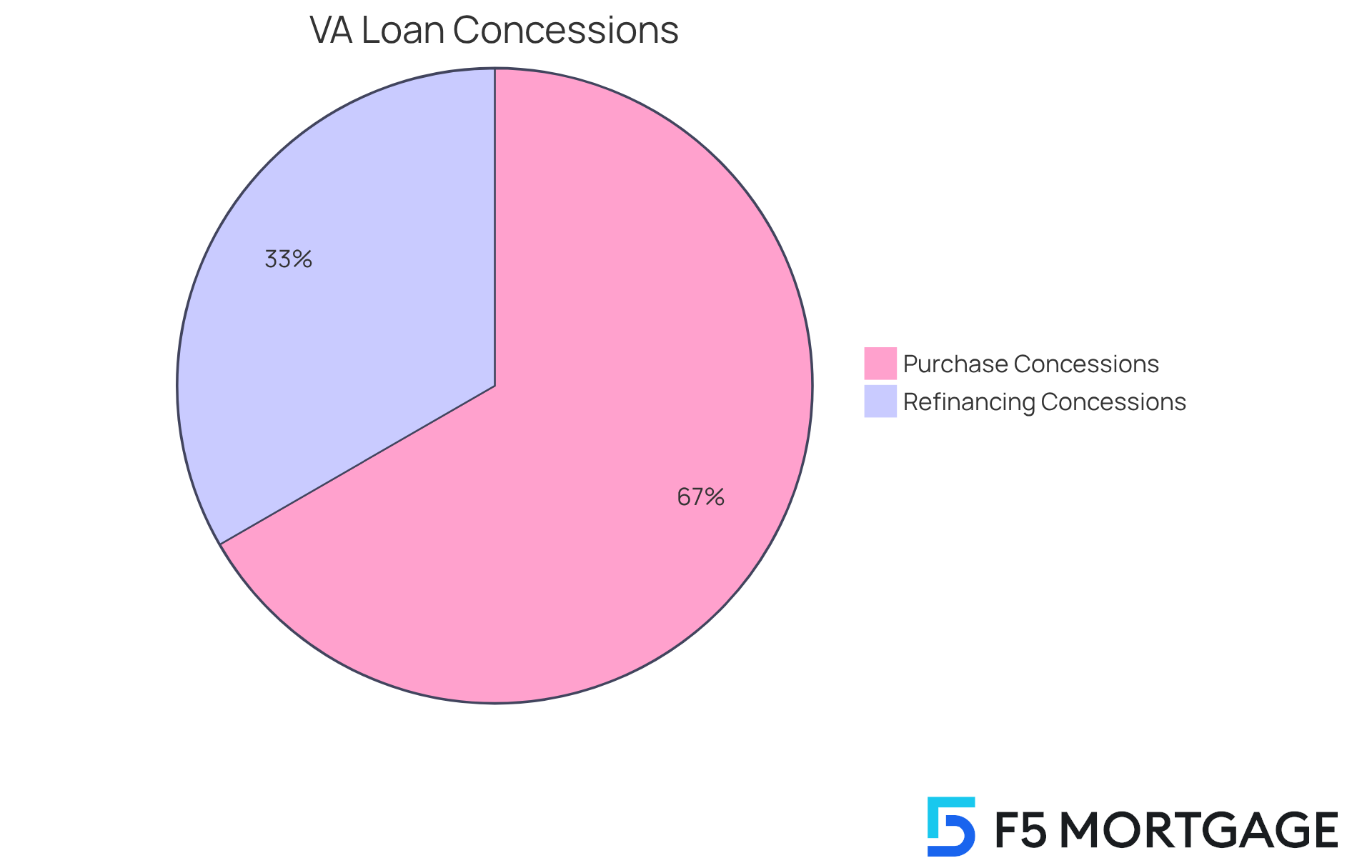

Navigating the homebuying process can be overwhelming for families, and understanding the maximum concessions allowed for vendors on VA loans is essential. For purchase transactions, vendors can contribute up to 4% of the sale price toward closing costs. This significantly eases the financial burden on purchasers, allowing them to focus on what truly matters.

In contrast, for refinancing transactions, the limit is typically set at 2%. Grasping these limits is crucial, as they directly affect the maximum VA seller concessions, overall affordability of a property acquisition, and the purchaser’s financial strategy. For example, on a $300,000 residence, a seller could offer up to $12,000 in allowances. This generous contribution can cover various expenses, such as property taxes, insurance, and even assist in settling current debts.

This flexibility enables families to direct more resources toward improvements or personal expenses, enhancing their overall purchasing power. We know how challenging this can be, but every step of the way, making the dream of homeownership more attainable.

Highlight the Benefits of Seller Concessions for Homebuyers

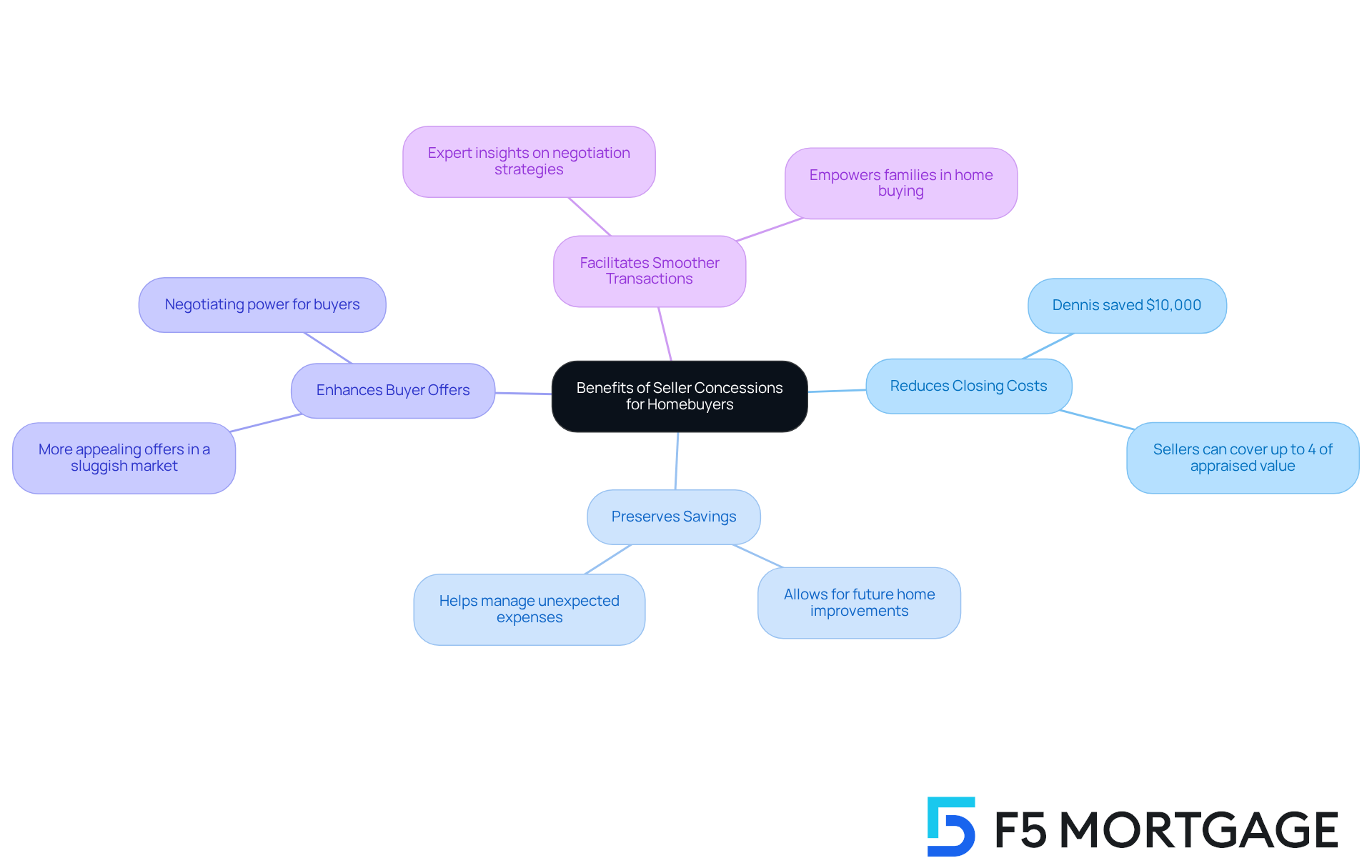

Seller incentives can provide significant advantages for home purchasers, especially when considering for those using VA loans. By covering closing costs and other expenses, these allowances can greatly reduce the initial costs associated with buying a property. This support makes it easier for families to achieve their homeownership goals.

For instance, buyers can negotiate for maximum VA seller concessions, which enable vendors to cover up to 4% of the property’s appraised value in allowances, leading to substantial savings. Recently, a buyer named Dennis successfully negotiated for the vendor to cover his entire $10,000 in closing costs, allowing him to complete the purchase without any out-of-pocket expenses.

Moreover, vendor allowances help buyers preserve their savings for future needs, such as home improvements or unexpected emergencies. This financial flexibility is crucial for families looking to invest in their new homes or manage unforeseen expenses. In a sluggish housing market, vendors may be more willing to make concessions, enhancing a buyer’s offer and making it more appealing to those who prefer deals that require less cash upfront.

Expert insights highlight that vendor allowances not only facilitate smoother transactions but also empower families to navigate the complexities of home buying with greater confidence. Chris Birk, Vice President of Mortgage Insight, notes, ‘When purchasing a home with a VA loan, one possible method to save money is by negotiating maximum VA seller concessions through vendor allowances.’ By taking advantage of these opportunities, homebuyers can significantly lighten their financial burden, paving the way for a more manageable and fulfilling homeownership journey.

Provide Strategies for Negotiating Seller Concessions

Negotiating vendor allowances can be a challenging process for families, but with the right strategies, it becomes more manageable. Here are some effective approaches to consider:

- Research the Market: We know how important it is to understand local real estate conditions. In the first quarter of 2025, 44.4% of residential transactions involved compromises from the vendor, indicating a trend towards a more flexible atmosphere. Familiarizing yourself with recent trends can help you gauge your leverage in negotiations.

- Highlight Your Strengths: If you have pre-approval, make sure to emphasize this to vendors. A robust financial standing can render you a more appealing purchaser, enhancing your chances of obtaining benefits.

- Be Adaptable: Showing flexibility on aspects like the closing date can encourage vendors to accept your requests for compromises. For instance, offering a 60-day closing with a rent-back option can attract homeowners needing time to locate their next residence.

- Work with a Knowledgeable Agent: Partnering with a real estate agent experienced in VA loans can provide valuable insights and tailored negotiation tactics. We’re here to support you every step of the way, and an agent can assist you in managing the intricacies of vendor allowances effectively.

- Present a Compelling Offer: Craft an attractive proposal that clearly outlines your request for adjustments, including any repairs or upgrades you may desire. This clarity can facilitate agreement, making it easier for vendors to understand and accept your terms. Common types of concessions, including maximum VA seller concessions, involve covering closing costs, adjusting the sale price, or providing a home warranty.

- Request Repairs and Upgrades: It’s common for buyers to ask vendors to complete repairs or make enhancements as a condition of the sale. While this can increase your purchase price, it’s a negotiation point worth considering. If the vendor counters your offer, be prepared to negotiate not only the price but also the conditions of repairs or enhancements. Remember, your lender will provide a Loan Estimate and a Closing Disclosure, detailing your final numbers and helping inform your negotiation strategy.

By utilizing these strategies, families can improve their likelihood of effectively negotiating vendor allowances, making home improvements more achievable. For example, Jason, a first-time homebuyer, successfully negotiated a maximum of $5,000 in seller concessions toward closing costs by offering the full asking price. This demonstrates how can lead to significant savings.

Conclusion

Understanding and maximizing VA seller concessions can significantly ease the financial burden of homeownership for families. By leveraging vendor contributions, homebuyers can access valuable support that covers closing costs and other associated expenses, making the path to homeownership more attainable. We know how challenging this can be, and the insights shared throughout this article highlight the importance of these concessions in enhancing affordability and improving the overall homebuying experience.

Key arguments presented include:

- The definition and functionality of seller concessions.

- The specific limits on contributions for both purchase and refinancing transactions.

- The advantages these concessions offer to homebuyers.

Strategies for negotiating these benefits were also discussed, emphasizing the importance of:

- Market research.

- Showcasing financial strengths.

- Working with knowledgeable real estate agents.

These elements collectively empower families to navigate the complexities of home buying with greater confidence and financial security.

In light of these insights, it is crucial for prospective homebuyers to actively pursue and negotiate seller concessions when considering a VA loan. By doing so, families not only reduce upfront costs but also preserve financial resources for future home improvements and unexpected expenses. Embracing these strategies will pave the way for a more manageable and fulfilling journey toward homeownership. We’re here to support you every step of the way.

Frequently Asked Questions

What are seller concessions in VA loans?

Seller concessions in VA loans refer to the monetary assistance provided by the vendor to help buyers cover closing costs or other expenses related to acquiring a property.

What types of costs can seller concessions cover?

Seller concessions can cover various costs, including loan origination fees, appraisal fees, title insurance, prepaid property taxes, and personal debt payments.

What is the maximum amount of seller concessions allowed in VA loans?

The maximum VA seller concessions are capped at 4% of the property’s purchase price, excluding standard closing expenses, which can be fully covered.

Are vendors required to provide seller concessions?

No, vendors are not required to provide these contributions, but discussing them can enhance the affordability of homeownership for families.

How can seller concessions impact the home buying process?

Seller concessions can make homeownership more affordable by reducing out-of-pocket expenses, which can also enhance the likelihood of securing financing by lowering upfront costs.

Can seller concessions be applied towards down payments?

No, seller concessions cannot be applied towards down payments; they are strictly for covering closing costs and other related expenses.

How can homebuyers ensure compliance with VA loan regulations regarding seller concessions?

Homebuyers should confirm classifications and totals on the Closing Disclosure to ensure compliance with VA loan regulations and maximize the seller concessions provided by vendor assistance.

What refinancing options are available for VA loan borrowers?

VA loan borrowers may explore refinancing options such as the VA Interest Rate Reduction Refinance Loan (IRRRL) and VA cash-out refinance to access equity and improve their financial situation.