Overview

Navigating a no-cost mortgage refinance can feel overwhelming, but we’re here to support you every step of the way. This article outlines five essential steps to help you successfully manage this process:

- Understanding the refinance journey

- Preparing your financial information

- Researching lenders

- Evaluating offers

- Closing the refinance

We know how challenging this can be, and each step emphasizes the importance of careful planning and informed decision-making. By taking the time to understand your options, you can avoid potential long-term costs associated with rolling closing costs into your loan or opting for higher interest rates.

As you embark on this journey, remember that informed decisions can empower you and your family. Let’s explore these steps together, ensuring you feel confident and prepared as you move forward.

Introduction

Navigating the world of mortgage refinancing can feel overwhelming, especially when considering the tempting option of no-cost refinancing. This approach allows homeowners to refinance without upfront closing costs, making it an appealing choice for those who may be feeling financially stretched. Yet, we know how important it is to consider the potential long-term implications of this decision.

It can raise questions about whether this financial strategy truly serves your best interests. How can you, as a homeowner, ensure that you make informed decisions that align with your financial goals while avoiding hidden pitfalls? We’re here to support you every step of the way.

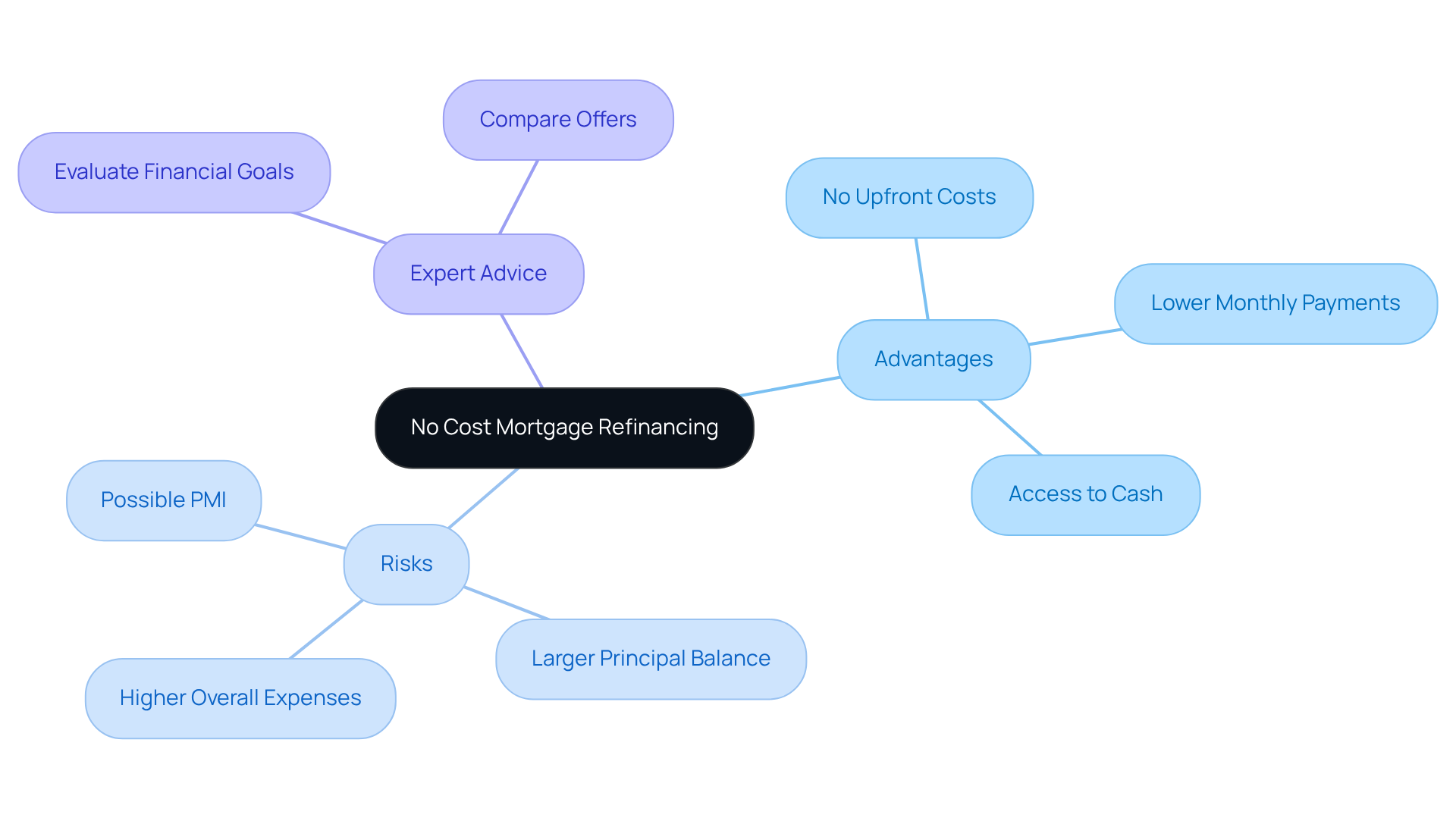

Understand No Cost Mortgage Refinancing

No-cost mortgage refinance enables homeowners to refinance their existing mortgage without the burden of upfront closing costs. Instead of paying these costs out of pocket, they are typically rolled into the new loan amount or offset by a higher interest rate. This option can be particularly appealing for those who may not have sufficient cash for closing costs. However, it’s important to approach this choice with caution, as it can lead to higher overall expenses over the life of the loan. While a no-cost refinance may simplify short-term monetary obligations, it often results in higher monthly payments and a larger principal balance, which can accrue more interest over time.

In 2025, many homeowners are choosing a no-cost mortgage refinance, reflecting a growing trend in the market. This decision is often driven by the desire to lower monthly payments or access cash without the immediate financial strain. At F5 Mortgage, we offer competitive rates, user-friendly technology, and rapid closing times, helping families navigate this process effectively. Yet, is essential. For instance, rolling closing costs into the loan can ease immediate cash flow, but it may also trigger private mortgage insurance (PMI) requirements if the equity falls below 20%. This could add an extra $30 to $70 per $100,000 borrowed to monthly payments.

Financial advisors emphasize the importance of assessing both the advantages and risks of a no-cost mortgage refinance. While it can provide temporary relief, homeowners should consider their long-term financial goals and the potential for rising expenses. Case studies show that homeowners planning to sell or refinance within a few years may find this option beneficial, while those intending to stay in their homes longer might face significant costs over time.

Ultimately, homeowners should thoughtfully evaluate their financial circumstances and consult with mortgage experts at F5 Mortgage to determine if a no-cost mortgage refinance aligns with their objectives. By comparing offers from multiple lenders, including F5 Mortgage, clients can discover competitive rates and terms that suit their needs. We invite you to get your free quote today to ensure a well-informed refinancing decision.

Prepare Your Financial Information

Before you embark on your journey toward a no cost mortgage refinance with F5 Mortgage, it’s important to gather the necessary financial documents. This preparation can help streamline your application process and ease any worries you may have. Here’s a checklist to consider:

- Recent pay stubs (last 30 days)

- W-2 forms or 1099s (last two years)

- Tax returns (last two years)

- Bank statements (last two months)

- Current mortgage statement

- Any additional documentation related to debts or assets.

We understand how challenging this can be, but once you’ve and collected these documents, you can start exploring your options for a no cost mortgage refinance. This includes comparing multiple lenders and loan options to find the best rates and terms that suit your needs.

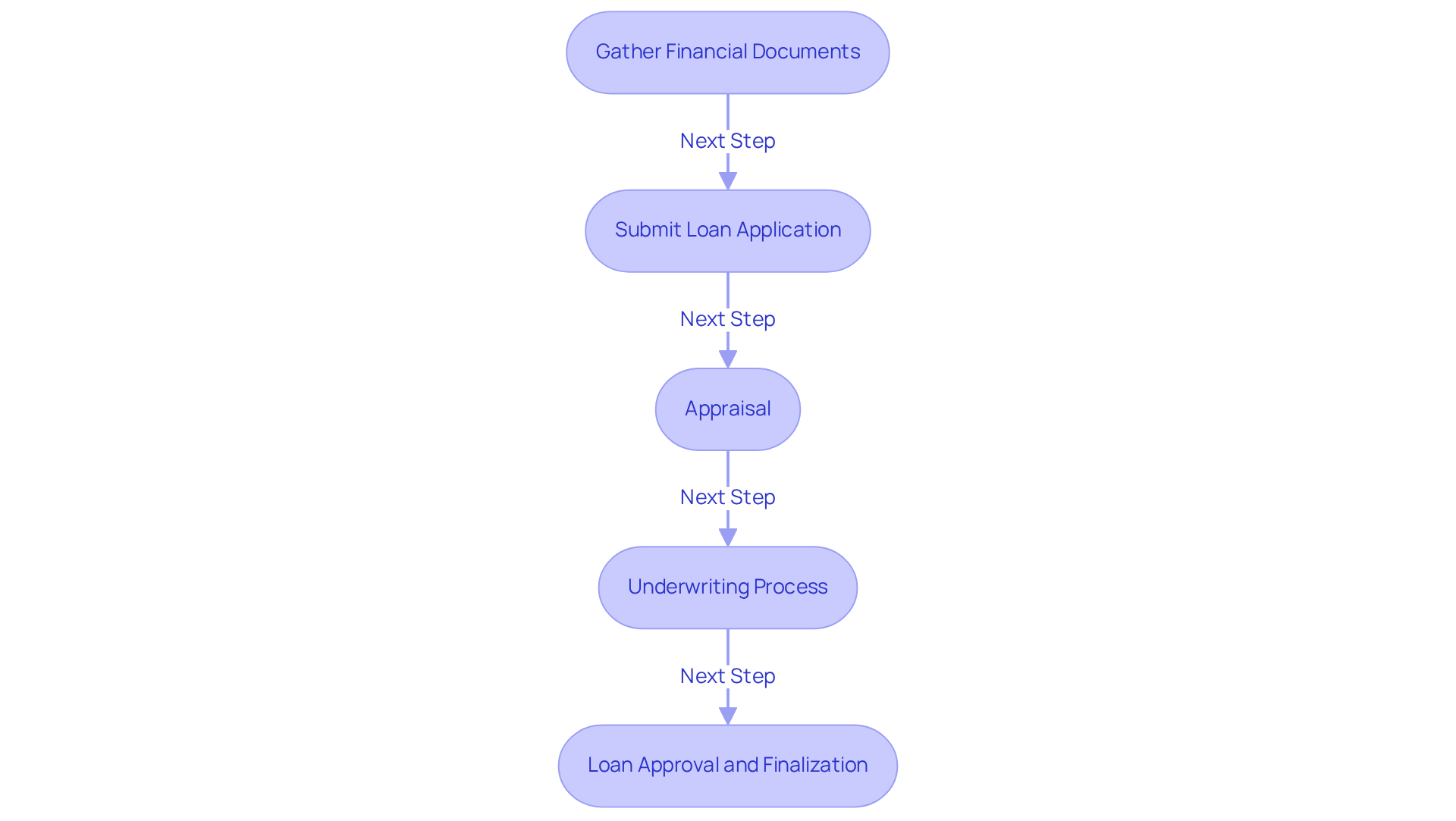

After choosing a lender, you’ll present a loan application that requires details about your property and financial documents. Following this, an appraisal will assess your property’s current value, leading to the underwriting process where your application will be reviewed. Ultimately, once your application is approved, you can finalize your new loan, sign the necessary documents, and pay any closing costs.

This thorough preparation will assist lenders in accurately assessing your financial situation, enabling a smoother loan adjustment process. Remember, we’re here to support you every step of the way.

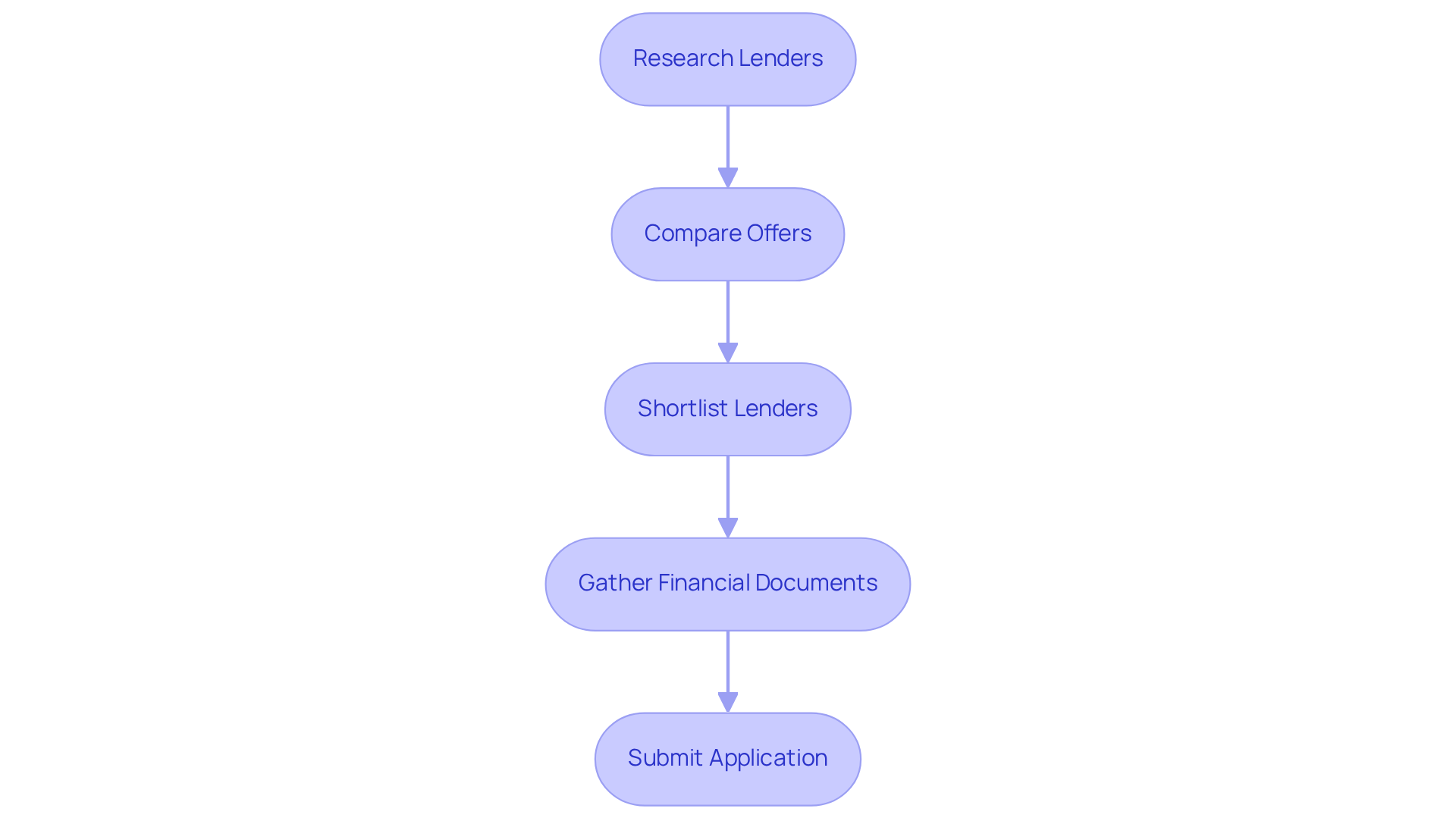

Research Lenders and Apply for Refinancing

Begin your journey by conducting thorough research on lenders specializing in no cost mortgage refinance. It’s essential to focus on those with strong reputations and competitive pricing, as these factors significantly influence your refinancing experience. For instance, F5 Mortgage boasts an impressive customer satisfaction level of 94%, supported by numerous 5-star reviews on platforms like Lending Tree, Google, and Zillow. Many clients have shared their positive experiences, praising the exceptional service and personalized mortgage solutions that F5 Mortgage provides. They highlight how the through the entire process.

Utilizing online comparison tools can greatly simplify your evaluation of various offers. This allows you to effectively assess interest rates, fees, and customer satisfaction ratings. Once you’ve created a shortlist of potential lenders, it’s time to submit your application. Remember to gather the financial documents you prepared earlier. Many lenders, including F5 Mortgage, offer the convenience of online applications and promise pre-approval in under an hour, making the process even more manageable.

This proactive approach not only streamlines your experience but also empowers you to secure the most favorable loan conditions available. Notably, most loans at F5 Mortgage close in less than three weeks, enhancing the efficiency of your refinancing journey. We know how challenging this process can be, and we’re here to support you every step of the way.

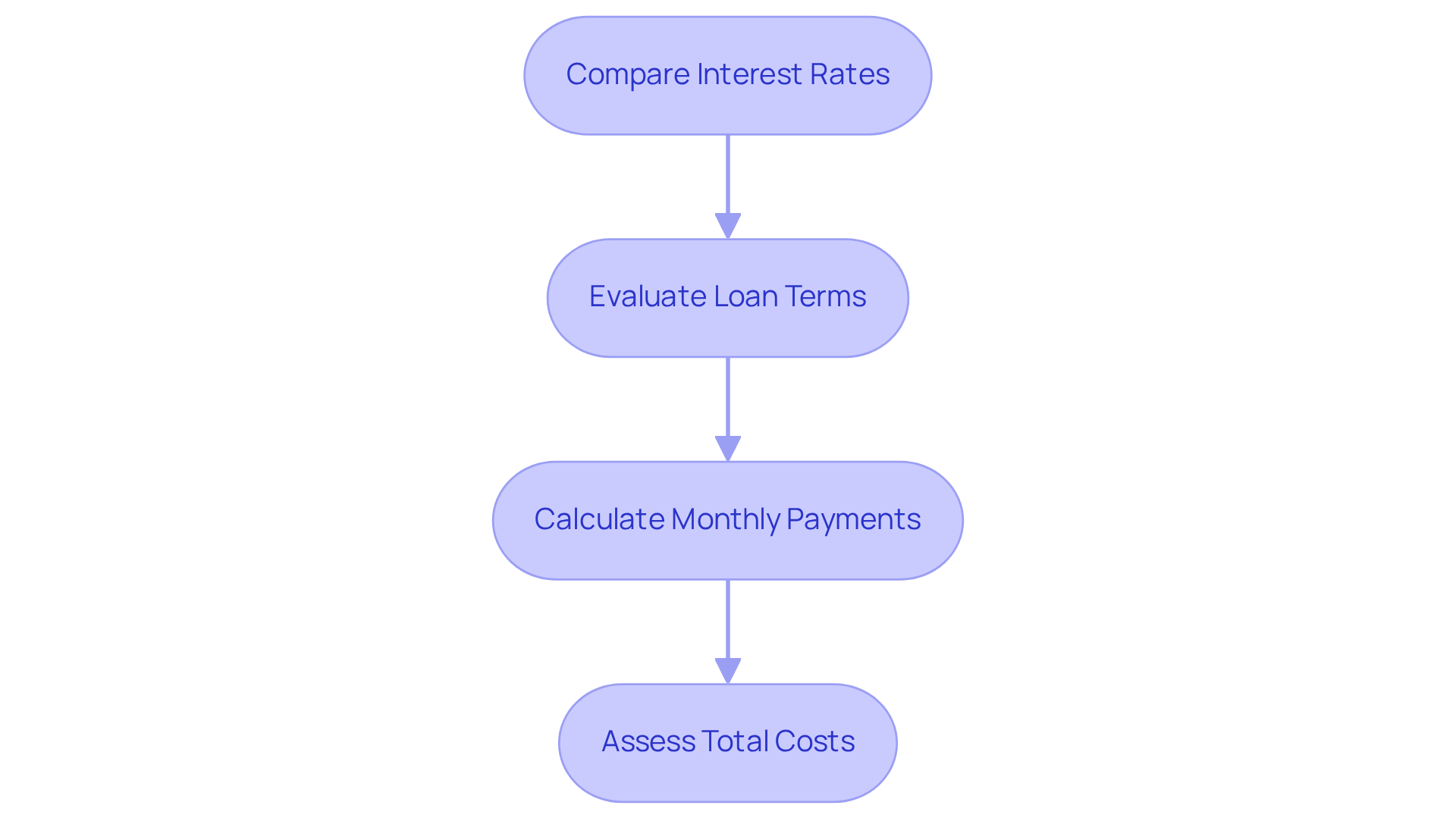

Evaluate Offers and Choose the Best Option

When you receive offers from various lenders, it’s important to take a moment to . We understand how overwhelming this process can be, but addressing some key factors can help you make the best choice for your family.

- Interest Rates: Start by comparing the rates offered by different lenders. Right now, the average refinance percentage for a 30-year fixed mortgage is 6.80%, while the 15-year fixed percentage is around 5.85%. Knowing these figures can help you identify the most competitive offers available.

- Loan Terms: Look closely at the duration of the loan and any penalties for early repayment. Refinancing can come with costs ranging from 2% to 6% of the loan amount, so understanding the terms can save you money in the long run.

- Monthly Payments: Calculate your new monthly payment based on the provided rates. For instance, at the current average level, borrowers will pay about $653.26 monthly for every $100,000 borrowed on a 30-year loan.

- Total Costs: Even if there are no upfront costs with a no cost mortgage refinance, it’s crucial to consider the long-term economic implications of each offer. This means understanding how the interest rates and loan terms will influence your overall payment over time.

By thoughtfully considering these elements, you can choose the loan option that aligns best with your financial goals and comfort level. Remember, we’re here to support you every step of the way.

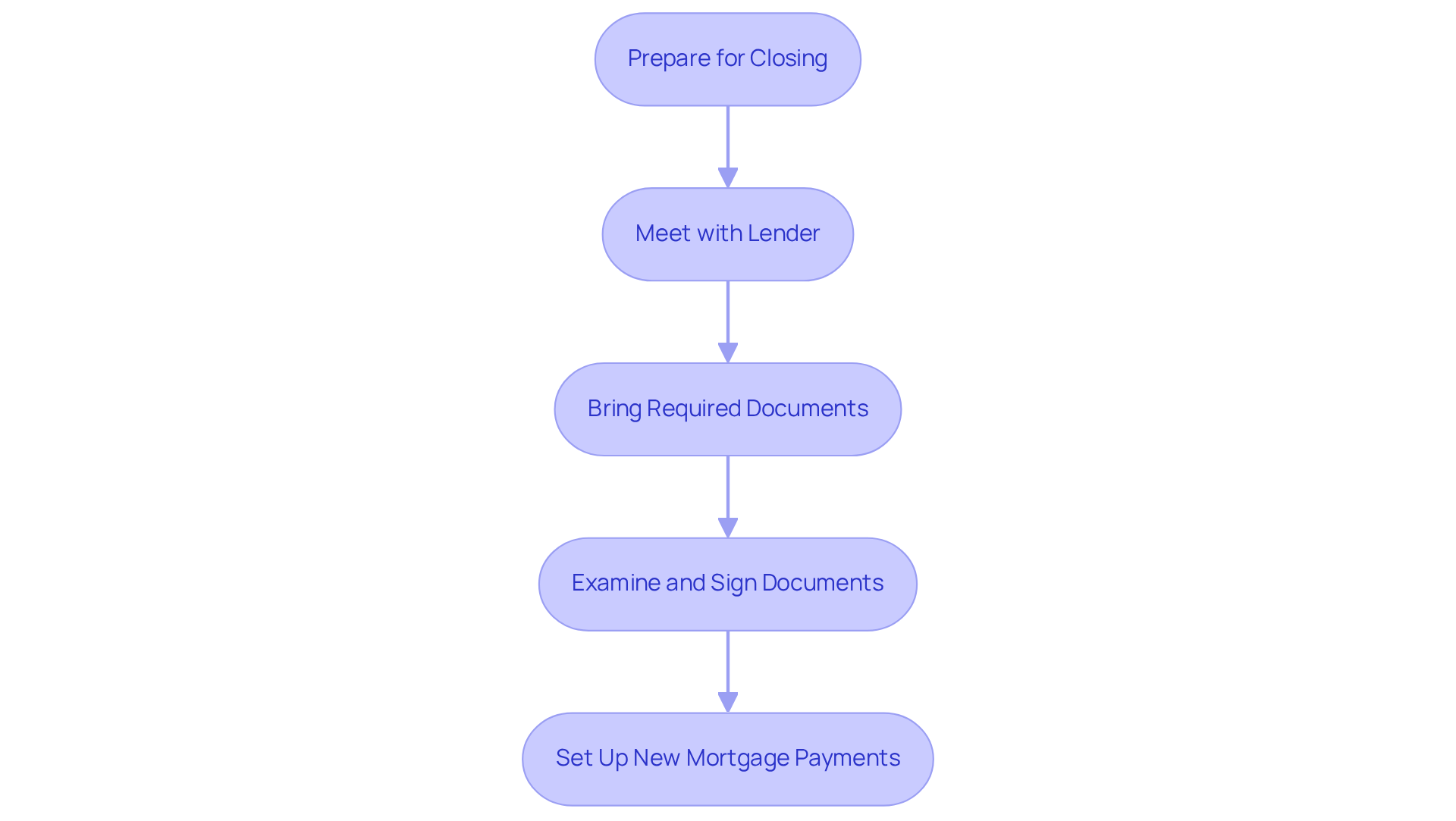

Close the Refinance and Transition Smoothly

On closing day, we understand how important it is for you to feel prepared and confident. You will meet with your lender or a representative to finalize the refinance, and to ensure a smooth process, please bring the following essential items:

- Valid identification

- Any required documents that were not previously submitted

- Proof of homeowners insurance, which is crucial for verifying adequate coverage on your property.

During the closing, you will carefully examine and sign various documents, including the new loan agreement and the Closing Disclosure, which details the financial specifics of your transaction. After closing, it’s important to set up your new mortgage payments promptly. We know how challenging this can be, so keeping all closing documents in a secure location will help you feel organized. This preparation will facilitate a seamless transition into your new loan through a no cost mortgage refinance, allowing you to focus on enjoying the benefits of your refinancing. Remember, we’re here to support you every step of the way.

Conclusion

Navigating a no-cost mortgage refinance can be a strategic move for homeowners seeking to ease immediate financial pressures without the burden of upfront closing costs. We know how challenging this can be, so it’s crucial to approach this option with a clear understanding of its implications, including potential long-term expenses and the impact on overall loan costs.

This article outlines a comprehensive five-step process to successfully execute a no-cost mortgage refinance. Key points include:

- Understanding the trade-offs involved

- Preparing necessary financial documentation

- Researching reputable lenders

- Evaluating offers based on interest rates and loan terms

- Ensuring a smooth closing process

Each step is designed to empower homeowners to make informed decisions that align with their financial goals.

Ultimately, the decision to pursue a no-cost mortgage refinance should be made with careful consideration of both short-term relief and long-term financial health. We’re here to support you every step of the way, and we encourage homeowners to consult with mortgage experts and explore multiple offers to secure the best possible terms. By taking these proactive steps, individuals can navigate their refinancing journey with confidence, setting themselves up for a more stable financial future.

Frequently Asked Questions

What is a no-cost mortgage refinance?

A no-cost mortgage refinance allows homeowners to refinance their existing mortgage without paying upfront closing costs. These costs are typically rolled into the new loan amount or offset by a higher interest rate.

Why might homeowners choose a no-cost mortgage refinance?

Homeowners may choose a no-cost mortgage refinance to lower monthly payments or access cash without the immediate financial strain of paying closing costs out of pocket.

What are the potential downsides of a no-cost mortgage refinance?

While it can simplify short-term monetary obligations, a no-cost refinance often results in higher monthly payments and a larger principal balance, which can accrue more interest over time.

What should homeowners consider before opting for a no-cost mortgage refinance?

Homeowners should assess their long-term financial goals and the potential for rising expenses, as well as the possibility of triggering private mortgage insurance (PMI) requirements if equity falls below 20%.

What financial documents should be prepared before applying for a no-cost mortgage refinance?

Homeowners should gather recent pay stubs, W-2 forms or 1099s, tax returns, bank statements, current mortgage statements, and any additional documentation related to debts or assets.

What is the process after gathering financial documents for a no-cost mortgage refinance?

After collecting the necessary documents, homeowners can compare multiple lenders and loan options, present a loan application, undergo an appraisal, and then go through the underwriting process before finalizing the new loan.

How can F5 Mortgage assist homeowners with no-cost mortgage refinancing?

F5 Mortgage offers competitive rates, user-friendly technology, and rapid closing times to help families navigate the refinancing process effectively and encourages clients to compare offers from multiple lenders.