Overview

Navigating the world of mortgages can feel overwhelming, especially when considering a $500,000 mortgage payment. It’s essential to understand the key factors at play, such as:

- Principal

- Interest rates

- Loan terms

- Down payment requirements

We know how challenging this can be, and recognizing these components is crucial for making informed financial decisions.

Variations in interest rates and down payments can significantly impact your monthly payments and overall loan costs. By grasping these elements, you empower yourself to make choices that align with your financial goals. We’re here to support you every step of the way, ensuring you feel confident in your decisions.

As you embark on this journey, remember that understanding these factors not only helps in budgeting but also in planning for your future. Take the time to explore your options and ask questions, as this knowledge will serve you well in the long run.

Introduction

Understanding the intricacies of a $500,000 mortgage is crucial for potential homeowners like you, who are navigating the complex landscape of financing. We know how challenging this can be, especially with various factors influencing your monthly payments—such as interest rates, loan terms, and down payment requirements. These decisions can significantly impact your financial future.

How can you effectively master these components to ensure a sound investment while avoiding common pitfalls? This article delves into the key elements of managing a 500k mortgage payment, providing valuable insights and strategies to empower you in making informed decisions.

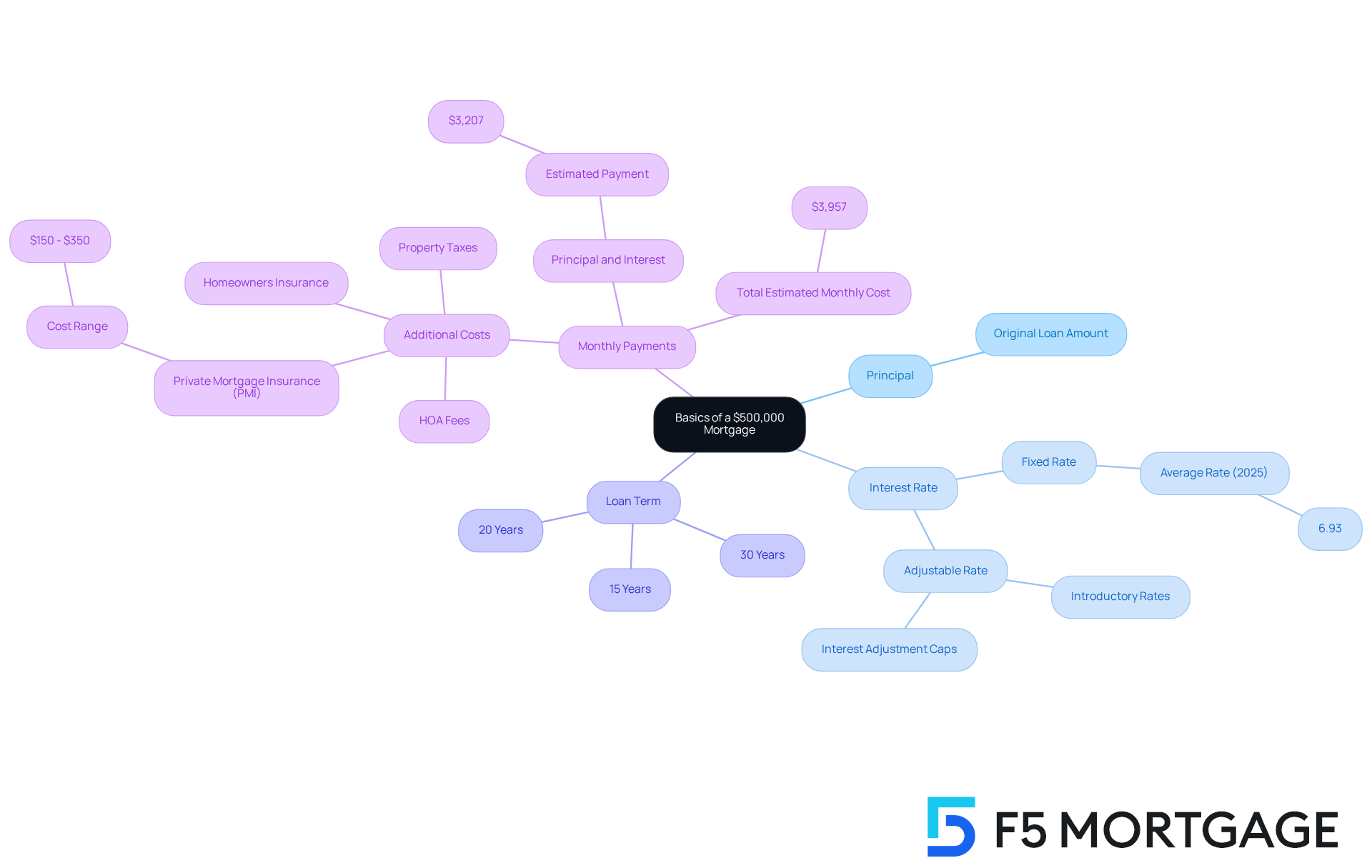

Explore the Basics of a $500,000 Mortgage

A 500k mortgage payment involves borrowing this amount to finance a home purchase, and understanding its key components is crucial for potential borrowers. We know how challenging this can be, and we’re here to support you every step of the way. Let’s explore the essential components together:

- Principal: This is the original loan amount, which in this case is $500,000.

- Interest Rate: The percentage charged on the loan can fluctuate based on market conditions and borrower qualifications. As of 2025, the average interest rate for a 30-year fixed loan is projected to be approximately 6.93%. For individuals contemplating adjustable-rate loans (ARMs), it’s vital to recognize that these usually commence with reduced introductory rates during an initial phase. Afterward, the rate changes according to market factors, leading to fluctuations in monthly costs. Interest adjustment caps help protect borrowers from significant increases.

- Loan Term: Typically, home loans are structured over 30 years, but options for 15 or 20 years are also available. The selection of term greatly affects monthly costs and the overall charges incurred throughout the duration of the loan.

- Monthly Payments: These include both principal and fees, along with possible extra charges such as property taxes, homeowners insurance, and private mortgage insurance (PMI). The estimated monthly principal and interest payment for a 500k mortgage payment on a $500,000 loan at a 6.63% interest rate is approximately $3,207. When factoring in other expenses, the , which includes the 500k mortgage payment, could reach approximately $3,957.

Once your application is approved, securing your loan rate with F5 Mortgage is essential to shield yourself from market fluctuations during the processing period. Grasping these basics allows borrowers to assess their financial preparedness and the long-term effects of assuming a loan of this magnitude. Financial consultants stress that understanding the fundamentals of loan elements is crucial for making informed choices in today’s variable market. Remember, we’re here to help you navigate this journey with confidence.

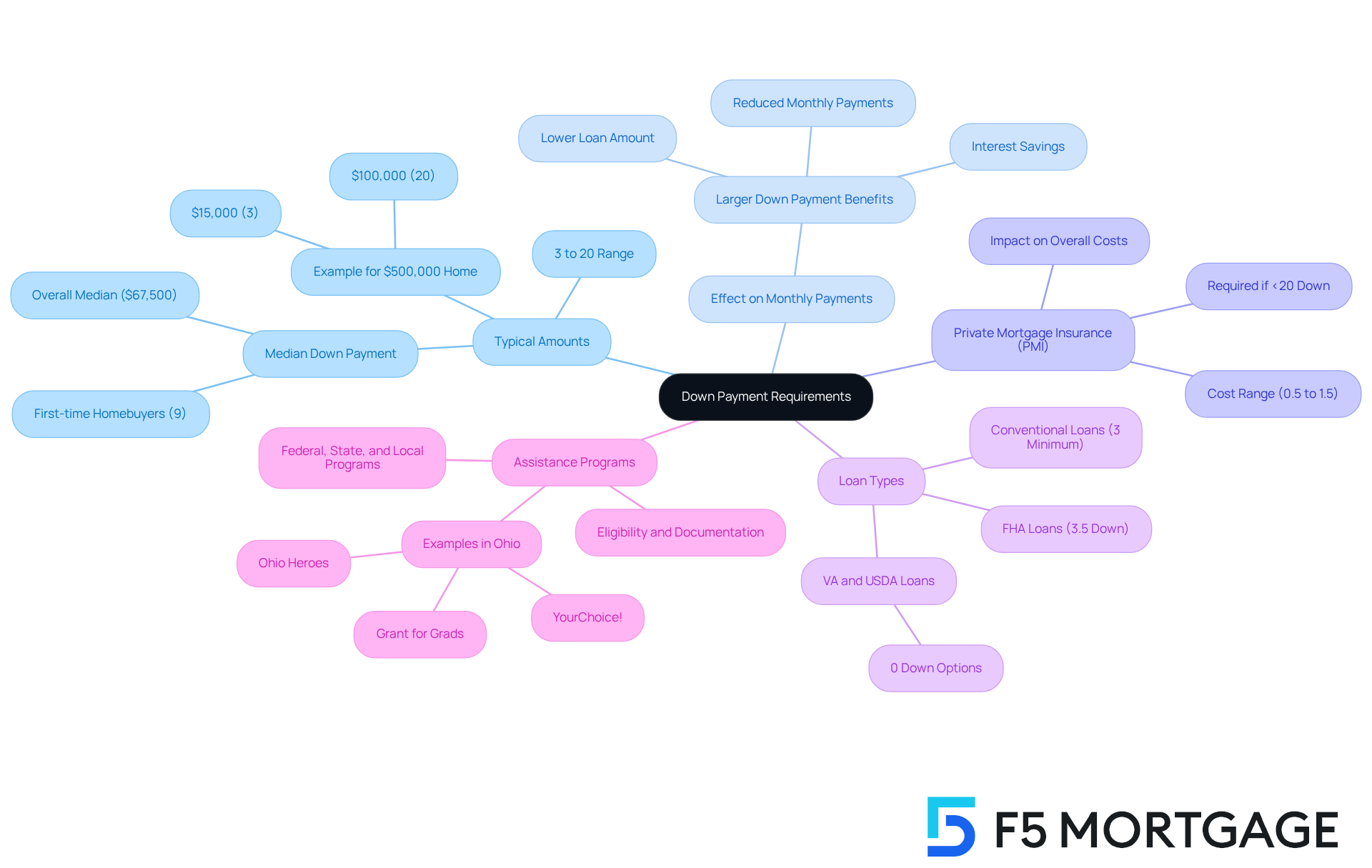

Understand Down Payment Requirements and Their Impact

The initial deposit is a vital aspect of securing a mortgage, and it significantly influences your overall financial planning. We understand how daunting this process can be, so here are some essential considerations to help you navigate it:

- Typical Down Payment Amounts: When looking at a $500,000 home, down payments generally range from 3% to 20%, which translates to $15,000 to $100,000. This variation reflects different credit profiles and borrower situations, and it’s important to find what works best for you.

- Effect on Monthly Installments: A larger down payment can directly reduce the amount you need to borrow, leading to lower monthly payments and overall expenses. For instance, putting down 20% on a $500,000 house lowers your loan to $400,000, which can significantly reduce your 500k mortgage payment and potentially save you thousands in interest over time compared to a smaller deposit.

- Private Mortgage Insurance (PMI): If your initial deposit is less than 20%, you’ll likely need to pay for PMI, which adds an extra monthly cost. This insurance safeguards the lender in case of default, but it can also increase your overall cost of homeownership, something to keep in mind as you plan.

- Loan Types: Different mortgage products come with varying deposit requirements. For example, FHA mortgages may allow deposits as low as 3.5%, making them a great option for first-time buyers. Traditional financing often requires at least 5% down, with many buyers opting for 20% to avoid PMI altogether.

- Assistance Programs: We encourage you to explore various available at federal, state, and local levels. In Ohio, programs like YourChoice!, Grant for Grads, and Ohio Heroes can offer significant financial support. These initiatives can provide grants and loans to help with down payments and closing costs, making homeownership more achievable. To get started, research the eligibility criteria, gather the necessary documentation, and consider partnering with a knowledgeable lender like F5 Mortgage to guide you through the application process.

Understanding these factors empowers you to make informed decisions about your finances and select the loan options that best suit your needs. By thoughtfully planning your down payment and exploring available assistance programs, you can enhance your loan experience and improve your overall financial well-being. Remember, we’re here to support you every step of the way.

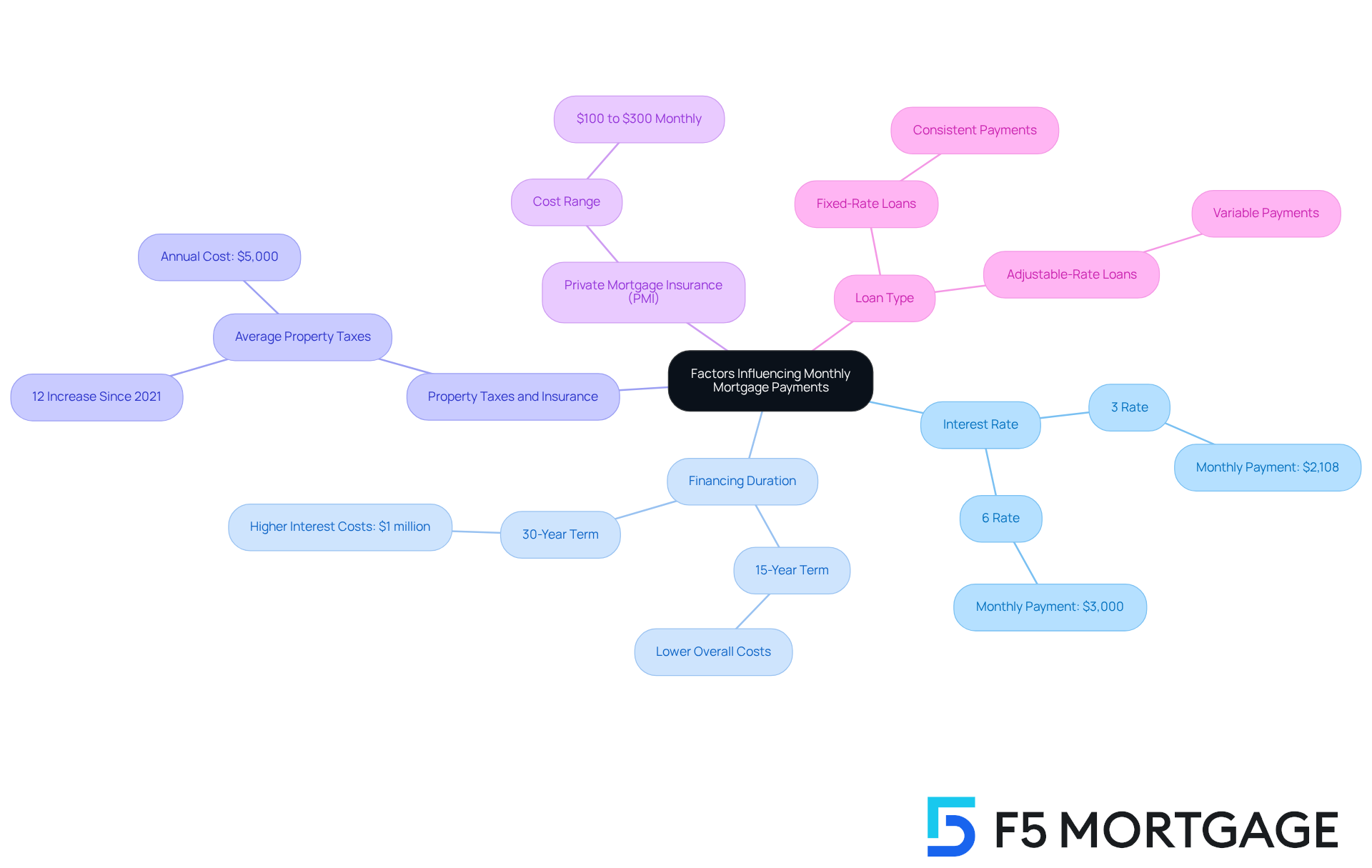

Analyze Factors Influencing Monthly Mortgage Payments

Several key factors significantly influence the monthly payment on a 500k mortgage payment, and we know how challenging this can be for families navigating these decisions.

- Interest Rate: The interest rate is a critical determinant of monthly payments. For instance, a mortgage with a 3% interest rate results in a monthly payment of approximately $2,108, while a 6% rate increases that payment to about $3,000. This difference can lead to considerable savings throughout the duration of the financing, emphasizing the significance of obtaining a .

- Financing Duration: The length of the financing also plays a vital role. Shorter loan durations, such as 15 years, generally lead to higher monthly expenses but yield lower overall financing costs compared to longer durations like 30 years. For example, a 30-year mortgage at 6% could cost over $1 million in interest, while a 15-year term at the same rate would total around $400,000.

- Property Taxes and Insurance: These expenses are often incorporated in monthly installments and can differ significantly depending on location and property value. In 2025, average property taxes have risen by 12% since 2021, adding to the financial burden. For a $500,000 home, the property taxes could amount to $5,000 annually, which is similar to the cost of a 500k mortgage payment translating to about $417 per month.

- Private Mortgage Insurance (PMI): If the initial contribution is less than 20%, PMI is generally necessary, increasing monthly expenses. For a 500k mortgage payment, PMI can vary from $100 to $300 monthly, based on the loan details.

- Loan Type: The kind of financing product selected—fixed-rate versus adjustable-rate—impacts both stability of installments and total amount. Fixed-rate loans offer consistent costs, whereas adjustable-rate loans may begin at a lower rate but can vary, affecting long-term financial planning.

By thoroughly examining these factors, borrowers can acquire a clearer insight into their financial obligations. Remember, we’re here to support you every step of the way as you make informed choices when preparing for a 500k mortgage payment.

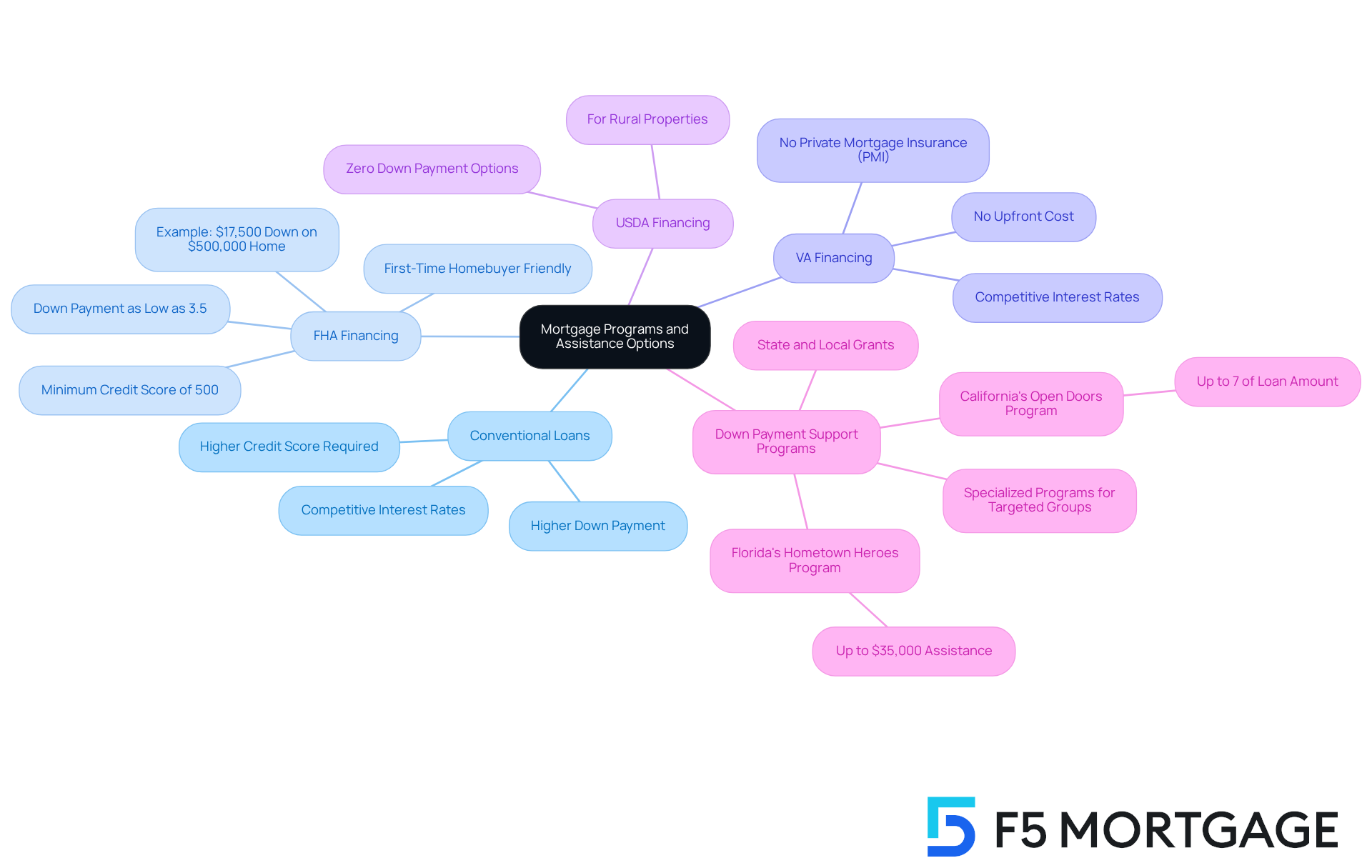

Discover Mortgage Programs and Assistance Options

Navigating the journey to homeownership can feel overwhelming, but numerous mortgage programs and assistance options are available to support you. Each option is designed to cater to different needs and financial situations, ensuring that there is something for everyone:

- Conventional Loans: These loans typically require a higher credit score and down payment, but they offer competitive interest rates. They are well-suited for borrowers with strong financial profiles who are ready to take the next step.

- FHA Financing: If you’re a first-time homebuyer, FHA financing could be the answer you’re looking for. With and more lenient credit score requirements, homeownership becomes attainable for many. For instance, a first-time buyer purchasing a $500,000 home could secure an FHA mortgage with a down payment of just $17,500, significantly easing initial financial burdens. As Abby Badach Doyle points out, FHA guidelines set a minimum credit score of 500 for those contributing at least 10% and 580 for those with a down payment between 3.5% and 10%.

- VA Financing: For veterans and active-duty service members, VA financing often requires no upfront cost and offers favorable terms, including competitive interest rates and no private mortgage insurance (PMI). This makes it an attractive option for those who have served our country.

- USDA Financing: If you’re considering a home in a rural area, USDA financing offers zero down payment options for qualifying properties, promoting homeownership in less populated regions.

- Down Payment Support Programs: Many states and local authorities provide grants or low-interest financing to assist with down costs and closing expenses. In California, for example, the Golden State Finance Authority’s Open Doors program offers up to 7% of the primary loan amount toward closing costs, while the MyHome Assistance Program provides up to 3% of the home’s purchase price. In Florida, the Hometown Heroes Housing Program can offer up to $35,000 in assistance, making it easier for first-time buyers to enter the market. Additionally, specialized programs exist for veterans, first responders, and educators, ensuring targeted groups receive the support they need to achieve homeownership.

At F5 Mortgage, we understand how challenging this process can be. We play a crucial role in guiding clients through these down payment assistance options, helping you navigate eligibility requirements and find the best programs suited to your financial situation. By exploring these options, you can identify programs that may significantly alleviate your financial burden and facilitate your journey to homeownership. Notably, first-time homebuyers accounted for 58% of agency purchase lending in the first quarter, highlighting the importance of these programs for this demographic. We’re here to support you every step of the way.

Conclusion

Understanding the complexities of a $500,000 mortgage payment is essential for anyone looking to finance their home purchase. We know how challenging this can be, but by grasping the key components—such as principal, interest rates, loan terms, and down payment requirements—you can navigate the mortgage landscape with greater confidence. This knowledge not only aids in assessing your financial readiness but also empowers you to make informed decisions that align with your long-term financial goals.

Several critical factors influence mortgage payments, including:

- Interest rates

- Loan duration

- Property taxes

- Private mortgage insurance (PMI)

Each of these elements plays a significant role in determining the overall cost of homeownership. Furthermore, various mortgage programs and assistance options are available to help buyers, especially first-time homeowners, alleviate financial burdens. Programs like FHA and VA loans can provide favorable terms and lower down payment requirements, making homeownership more accessible.

Ultimately, the journey to mastering a $500,000 mortgage payment requires careful consideration and planning. By exploring available resources and understanding the implications of each decision, you can enhance your financial well-being and pave the way for a successful homeownership experience. Taking proactive steps today can lead to a more secure and informed tomorrow in the realm of mortgage financing. We’re here to support you every step of the way.

Frequently Asked Questions

What is a $500,000 mortgage?

A $500,000 mortgage involves borrowing $500,000 to finance a home purchase.

What are the key components of a mortgage?

The key components of a mortgage include the principal (the original loan amount), interest rate, loan term, and monthly payments.

What is the principal in a mortgage?

The principal is the original loan amount, which in this case is $500,000.

How does the interest rate affect a mortgage?

The interest rate is the percentage charged on the loan and can fluctuate based on market conditions and borrower qualifications. As of 2025, the average interest rate for a 30-year fixed loan is projected to be approximately 6.93%.

What are adjustable-rate loans (ARMs)?

Adjustable-rate loans (ARMs) typically start with reduced introductory rates for an initial period and then adjust according to market factors, which can lead to fluctuations in monthly costs. Interest adjustment caps help protect borrowers from significant increases.

What is the typical loan term for a mortgage?

Home loans are typically structured over 30 years, but options for 15 or 20 years are also available.

How do loan terms affect mortgage payments?

The selection of loan term greatly affects monthly costs and the overall charges incurred throughout the duration of the loan.

What do monthly mortgage payments include?

Monthly payments include both principal and interest, along with possible extra charges such as property taxes, homeowners insurance, and private mortgage insurance (PMI).

What is the estimated monthly payment for a $500,000 mortgage at a 6.63% interest rate?

The estimated monthly principal and interest payment for a $500,000 loan at a 6.63% interest rate is approximately $3,207. Including other expenses, the total monthly housing cost could reach approximately $3,957.

Why is it important to secure a loan rate after application approval?

Securing your loan rate is essential to protect yourself from market fluctuations during the processing period.

Why is understanding mortgage basics important for borrowers?

Understanding the fundamentals of loan elements is crucial for making informed choices in today’s variable market and helps borrowers assess their financial preparedness and the long-term effects of assuming a loan.