Overview

This article highlights effective strategies to secure the best VA Interest Rate Reduction Refinance Loan (IRRRL) rates available today. We understand how overwhelming the refinancing process can be, especially for veterans. By leveraging personalized mortgage consultations, you can gain valuable insights tailored to your unique situation. Additionally, utilizing online tools for rate comparisons allows you to make informed decisions that can lead to significant savings.

Staying informed about current market trends is essential. We know how challenging this can be, but being aware of these trends can empower you to act at the right moment. Our goal is to streamline the refinancing process, ensuring that you feel supported every step of the way. Together, we can navigate these options, maximizing your savings and enhancing your financial well-being.

Introduction

Navigating the world of VA refinancing can feel overwhelming for veterans. We know how challenging this can be, especially when it comes to securing the best VA Interest Rate Reduction Refinance Loan (IRRRL) rates. With interest rates fluctuating and various lender options available, understanding how to optimize your financial benefits is essential.

This article explores seven effective strategies designed to empower service members like you to take control of your refinancing journey. Our goal is to ensure you capitalize on the most favorable terms available. But with so many choices and potential pitfalls, how can you confidently navigate this complex landscape to achieve your financial goals? We’re here to support you every step of the way.

F5 Mortgage: Personalized Solutions for Competitive VA IRRRL Rates

At , we understand how challenging it can be for veterans seeking the best . That’s why we excel in providing designed specifically for you. By collaborating with a , we ensure that you receive the that align with your . This customized approach not only simplifies the mortgage process but also empowers you to make informed choices about your financial restructuring options.

To further assist you, F5 Home Loans offers an easy-to-use loan calculator. This tool helps you assess possible savings, making it easier to navigate the complexities of the best VA IRRRL rates today. We know that time is of the essence, which is why we strive to finalize most loans in under three weeks. Our dedication is to ensure that you receive the support you need to achieve your .

We invite you to consult with F5 Mortgage to explore your . Don’t forget to utilize our for a clearer understanding of your potential savings. We’re here to .

Bankrate.com: Current VA IRRRL Rates and Eligibility Insights

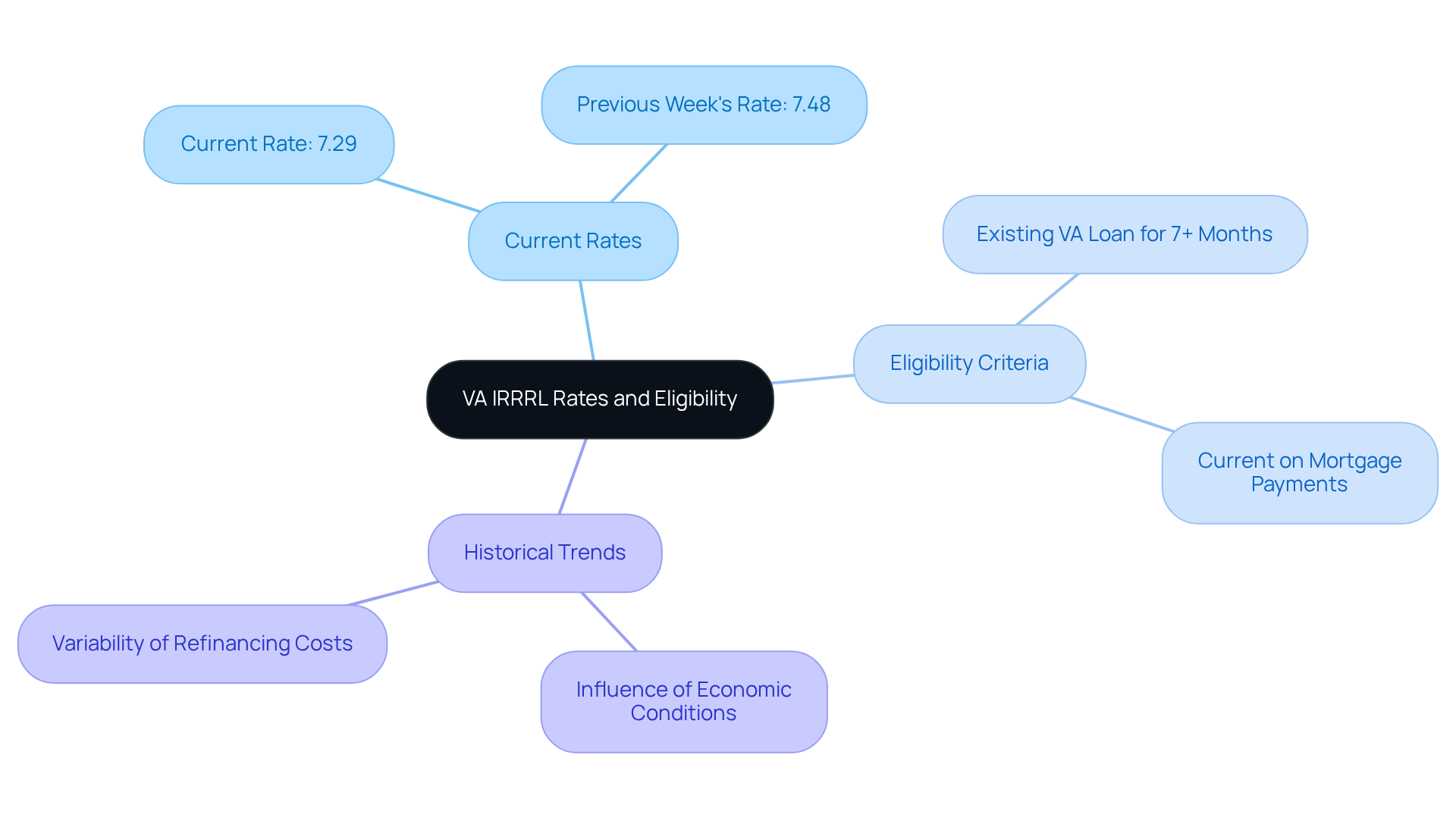

As of July 12, 2025, we know how important it is for you to stay informed about your financial options. The national average 30-year VA refinance interest rate now stands at 7.29%, which is considered the , marking a welcome decrease from last week’s rate of 7.48%. This change highlights the need for borrowers to remain vigilant regarding that can impact your financial well-being.

To qualify for a , former military personnel must have:

- An existing VA loan that has been active for at least seven months

- Must be current on their mortgage payments

We understand that navigating these can feel overwhelming, but they are essential for service members like you who want to take advantage of .

Historical trends show that VA refinancing costs can vary significantly, influenced by broader economic conditions and the best VA IRRRL rates today. Many former service members have successfully refinanced their loans during periods of declining interest rates, leading to meaningful savings on monthly payments. We’re here to support you every step of the way, and understanding the intricacies of and interest fluctuations is crucial for enhancing your loan options.

As you consider your , remember that staying informed and proactive can make a significant difference. We encourage you to explore your options and reach out for guidance—because you deserve to make the most of your financial opportunities.

MilitaryValoan.com: Comprehensive Guide to VA Refinance Options

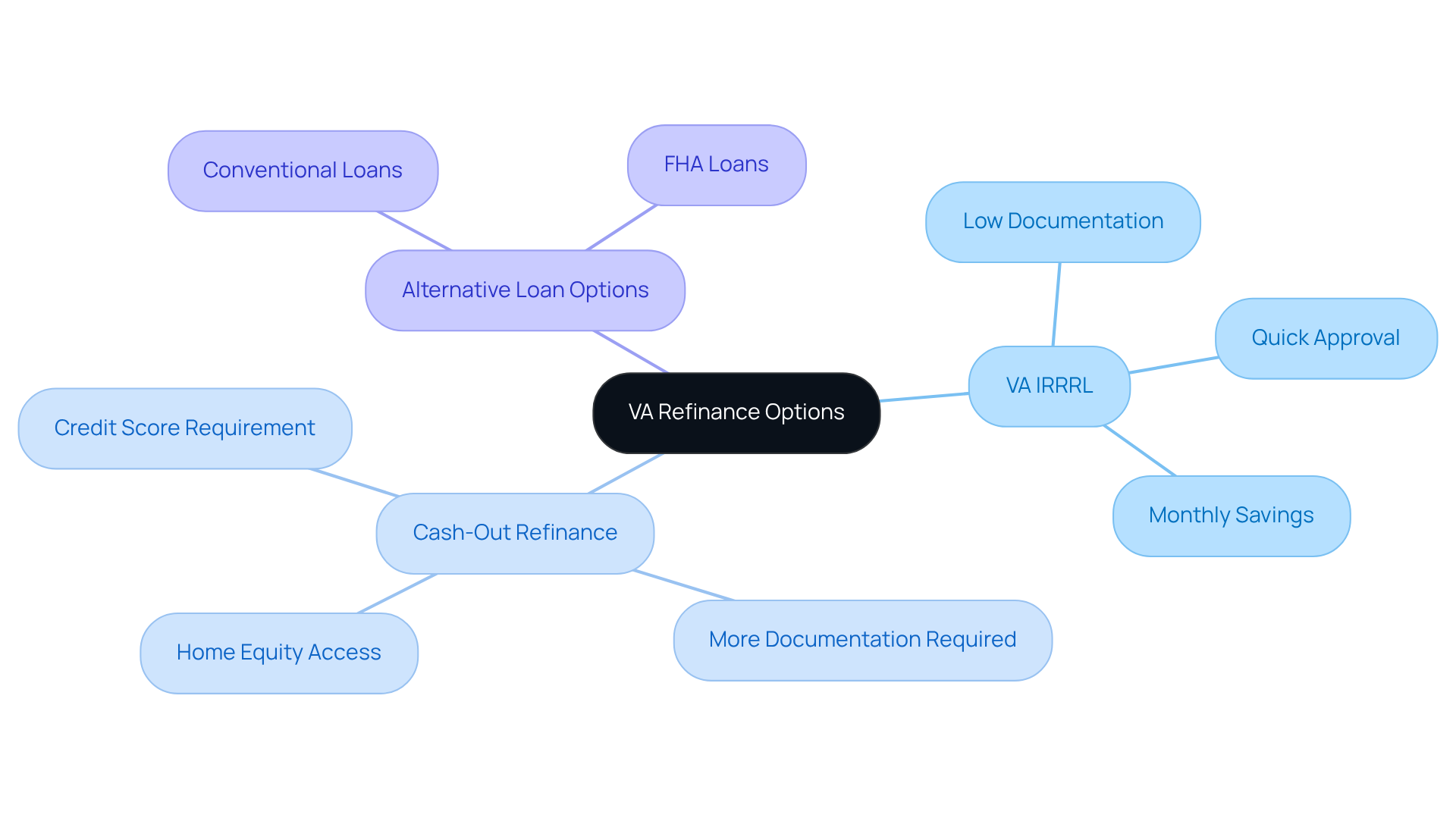

Veterans exploring refinancing options often face numerous challenges, and understanding the distinctions between the (IRRRL) and can provide clarity. The is designed for former service members who want to with minimal documentation and no appraisals required. This streamlined process allows for quicker approvals, often closing in less than 30 days, making it an appealing choice for those seeking immediate financial relief.

On the other hand, the cash-out refinance option enables service members to tap into their home equity, providing resources for various financial needs like home upgrades or debt consolidation. While this choice typically requires more documentation and an appraisal, it allows homeowners to . To qualify for a VA cash-out refinance, borrowers must meet service requirements and maintain a credit score of 620 or higher.

for veterans focused primarily on reducing monthly expenses and interest rates, particularly when looking for the in a low-interest environment. Conversely, the cash-out refinance is ideal for individuals who need liquidity from their home equity while still enjoying favorable terms.

In addition to VA loan options, Colorado residents also have access to conventional and . Conventional loans, issued by private lenders, usually require a good credit score and a low debt-to-income (DTI) ratio. FHA loans, backed by the government, are more accessible to those with lower credit scores, typically requiring a minimum score of 580. These options provide additional pathways for homeowners looking to refinance.

Statistics indicate a , with a remarkable 41% rise in in recent years. This surge is largely attributed to historically low borrowing costs, encouraging many veterans to explore restructuring as a viable financial strategy. For example, modifying a $200,000 mortgage from a 4.25% rate to a 3.25% rate could lead to monthly savings of $114, highlighting the potential benefits of the VA IRRRL.

Ultimately, understanding the advantages and distinctions among these loan options empowers service members to make informed choices that align with their financial objectives, such as securing the best VA IRRRL rates today to reduce monthly payments or obtain cash for urgent needs. Remember, we’re here to support you every step of the way as you navigate these options to find the best solution tailored to your individual needs.

Rocket Mortgage: Streamlined VA IRRRL Application Process

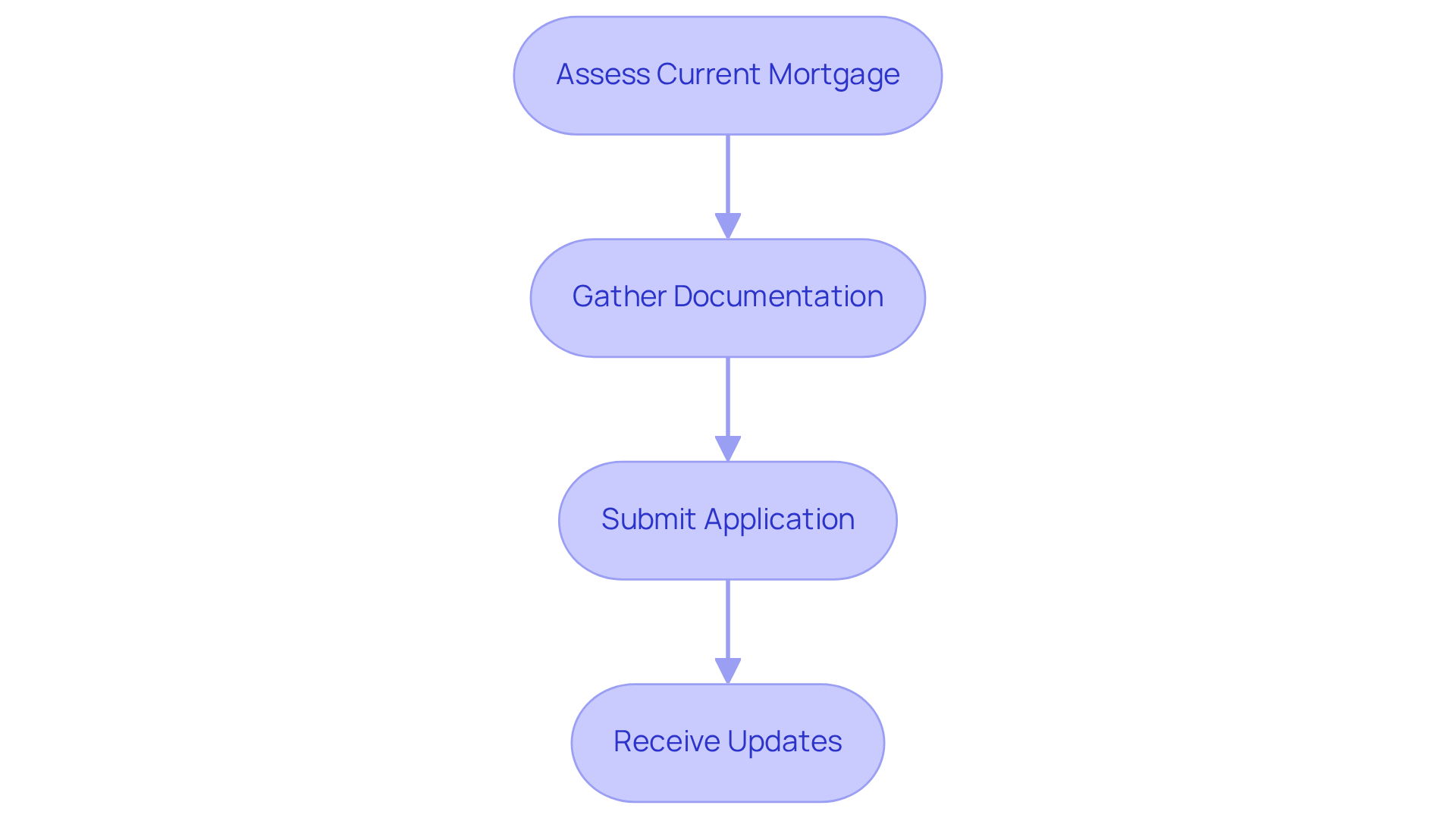

F5 Mortgage is here to transform the , providing service members with an efficient application platform that allows for quick and successful loan finalization. We understand that refinancing can be daunting, especially in California, where the process typically involves several key steps.

- First, it’s important to assess your current mortgage and determine your .

- Next, gather the necessary documentation, such as income verification and property information, which you can easily upload through our .

Once submitted, former service members receive real-time updates on their application status, keeping you informed every step of the way. This user-focused approach is particularly beneficial for those juggling hectic schedules, as it reduces paperwork and speeds up approvals. By leveraging technology, F5 Home Loans significantly enhances the loan modification experience, making it more accessible and efficient for those who have bravely served.

Our commitment to transparency and customer-centered service ensures that former service members can navigate the financial landscape without the stress of aggressive sales tactics. Additionally, with F5’s , eligible servicemen and women can secure a with no down payment required. It’s clear that .

The time it takes to finalize at the is decreasing, making it an appealing choice for former service members looking to improve their living situations. If you’re considering refinancing, and provide valuable insights into your options, including a detailed breakdown of potential costs involved. We’re here to , ensuring you feel confident and informed throughout your journey.

Veterans United: Understanding VA IRRRL Requirements and Benefits

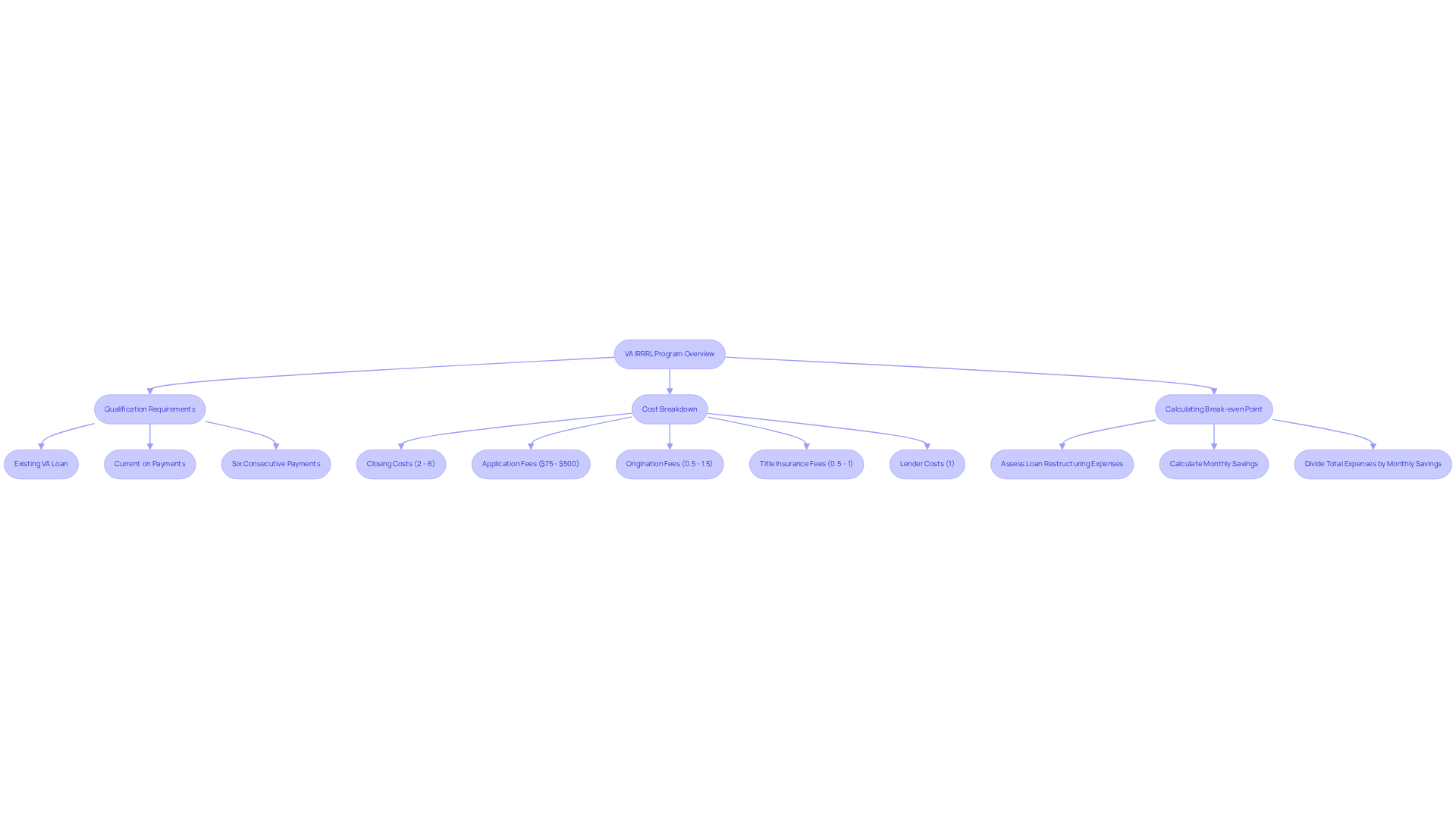

The provides access to , offering veterans a streamlined path to . We understand how overwhelming can be, and this program is designed to ease that burden. To qualify, borrowers must have an existing VA loan, be current on their payments, and have made at least six consecutive monthly payments. This program is particularly appealing due to its numerous benefits, including the best VA IRRRL rates today and . Notably, the IRRRL permits the alteration of loans without the requirement for a new home appraisal, greatly simplifying the process.

generally vary from 2% to 6%. This makes it an economical option compared to other loan alternatives. These costs often include:

- Application fees ranging from $75 to $500

- Origination fees between 0.5% and 1.5% of the loan amount

- Title insurance fees between 0.5% and 1% of the loan amount

- A fee of 1% of the loan amount to cover lender costs

This further emphasizes the affordability of this program.

To ensure that obtaining a new loan is beneficial, veterans should . We know how important it is to make informed decisions. This includes:

- Assessing their

- Calculating monthly savings by deducting the new monthly payment from the existing one

- Dividing the total expenses by the monthly savings

For example, if loan modification costs total $4,000 and monthly savings are $100, the break-even point would be 40 months. This calculation assists former service members in understanding how long it will take to recover their expenses through savings.

Veterans have realized by taking advantage of the best VA IRRRL rates today, leading to significant savings on monthly payments. Mortgage professionals highlight that the IRRRL is designed to provide a tangible net benefit. This ensures that borrowers make financially sound decisions when refinancing. This combination of lower costs and simplified processes positions the VA IRRRL as an advantageous option for veterans seeking to optimize their mortgage terms. We’re here to support you every step of the way as you navigate this important decision.

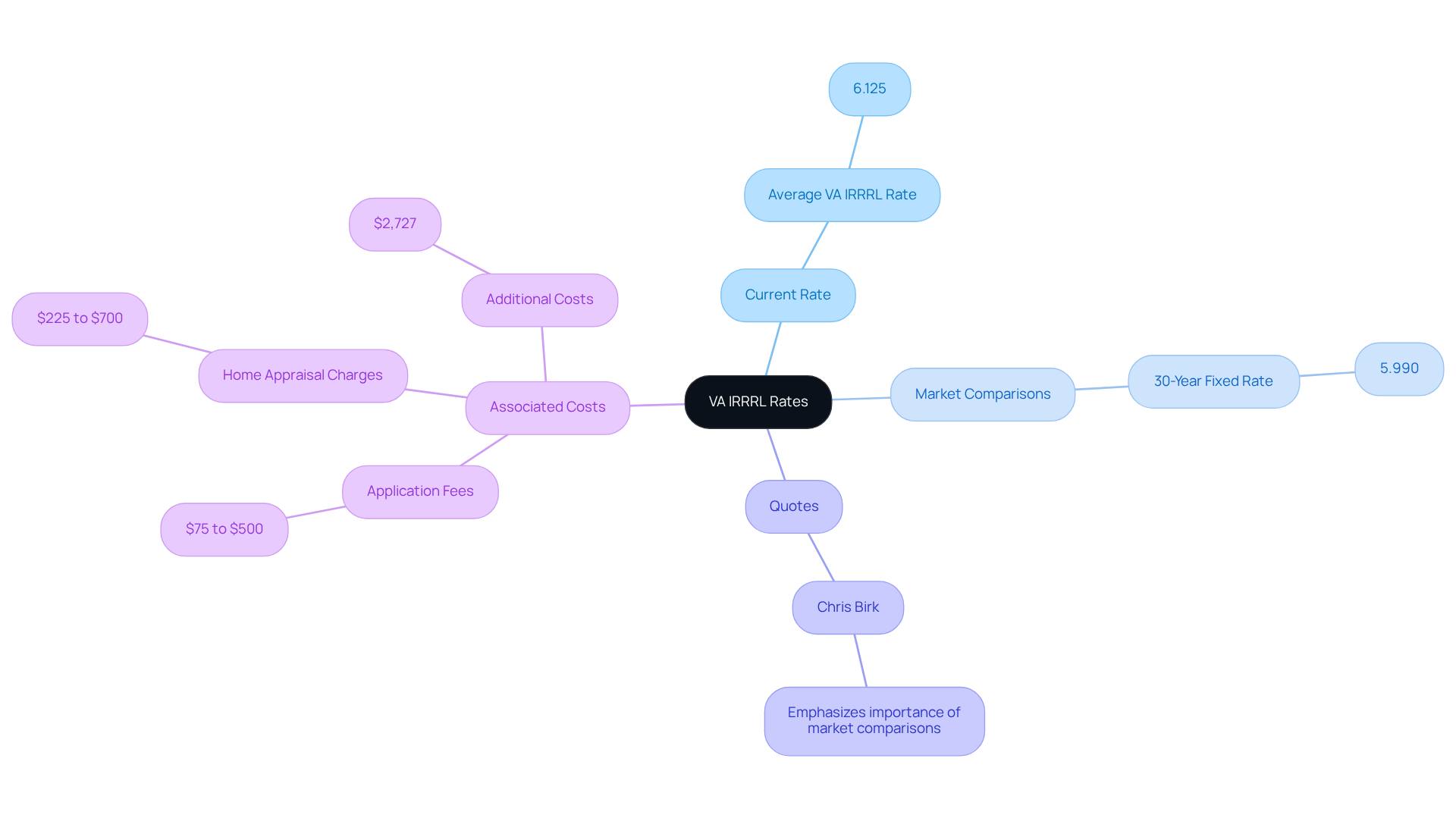

Rate.com: Current VA IRRRL Rates and Market Comparisons

As of July 12, 2025, the average (IRRRL) percentage stands at 6.125%. This reflects variations based on lender offerings and borrower qualifications. We understand how overwhelming this process can be, and is here to help. They are at the forefront of this transformation, leveraging technology to provide highly —without the hassle of aggressive sales tactics that often trouble the industry.

By utilizing platforms like Rate.com, former service members can compare the . This empowers them to make informed . Chris Birk, Vice President of Mortgage Insight, emphasizes the importance of this method. He mentions, ‘the is 5.990% — reduced in comparison to last week’s average.’ This comparative analysis is crucial for obtaining the best VA IRRRL rates today, enabling former service members to effectively assess their options.

Additionally, can lead to advantageous loan modifications. Many former service members have successfully utilized market comparisons to secure . Typical expenses related to a refinance in Georgia include:

- An application fee ranging from $75 to $500

- between $225 and $700

- Additional costs amounting to around $2,727

These are important considerations when devising your refinancing approach. Remember, we’re here to support you every step of the way.

Zillow: Tools for Comparing VA Refinance Rates

Navigating the complexities of can be overwhelming for former military members. Zillow understands these challenges and offers a comprehensive set of tools designed to help you easily compare the today for refinancing options. By providing your loan information, you can receive , allowing for side-by-side evaluations of prices and conditions.

This level of for you, empowering informed choices about your financial options. With Zillow’s resources, you can secure the best , ensuring you during the loan restructuring process.

We know how important it is to have . Zillow stands out as a vital resource, guiding you through the intricacies of VA refinancing. Moreover, the supportive role of further enhances your , ensuring you feel understood and supported every step of the way.

Benefits.va.gov: Advantages of VA Loans and IRRRL Program

F5 Mortgage understands the unique challenges faced by former service members seeking to refinance through and the . We know how important it is to find options that truly support your financial journey. Key advantages of working with us include:

- No private mortgage insurance (PMI)

- that make a real difference

The IRRRL program is designed specifically for service members, allowing you to with minimal documentation and no appraisal. This streamlined option can help you lower your monthly payments, providing relief when you need it most. At F5 Lending, we offer , ensuring that you and your family receive the most favorable terms and conditions.

With a dedicated team ready to support you at each stage, F5 is committed to of former military members. We aim to make the loan adjustment process effective and hassle-free. To get started, we encourage you to explore your options, submit an application, and navigate the underwriting process with confidence. Our extensive network of lenders is here to help you secure the today.

By leveraging technology, , allowing servicemen and women to focus on achieving their financial goals. Remember, we’re here to support you every step of the way.

Rocket Mortgage: Pros and Cons of VA Streamline Refinancing

The , or VA IRRRL, offers the , providing a wonderful opportunity for service members looking to ease their mortgage expenses. With key advantages like , this option can help you secure the best VA IRRRL rates today and lead to . The application process is designed to be straightforward, minimizing paperwork, which is a relief for many. For example, veterans can refinance without needing income verification or an appraisal, making it a more accessible choice. As one satisfied customer shared, ‘ and hassle-free, I couldn’t believe how swiftly everything was managed!’ This reflects F5’s commitment to providing exceptional service through a technology-focused approach that simplifies the loan modification experience.

However, it’s important to recognize some limitations. One significant drawback is that the VA IRRRL does not permit borrowers to tap into their home equity for cash, which can be crucial for those needing to finance other expenses. Additionally, eligibility is limited to those who already have a VA loan, meaning first-time homebuyers or those with conventional loans miss out on this program.

Understanding these pros and cons is vital for former service members as they explore the best VA IRRRL rates today for their refinancing options. Industry experts note that the VA IRRRL aims to deliver immediate financial benefits, like lower monthly payments, but it’s essential for borrowers to evaluate their unique financial situations before moving forward. With a , many former service members have successfully navigated this process, underscoring the importance of informed decision-making in achieving favorable outcomes. As another client expressed, ‘Thanks to F5, I was able to refinance without any hassle and save money each month!’ This emphasizes the transformative impact of F5 Mortgage’s services in .

MilitaryValoan.com: Trends in Current VA Refinance Rates

Current trends in show notable fluctuations, with rates ranging between 6.25% and 7.25% in recent months. We understand how challenging it can be to keep track of these changes, which underscores the critical need for veterans to closely. Timing is everything; refinancing during periods of lower costs can lead to significant savings. For instance, a drop in thousands over the life of their loans.

In Colorado, the average cost to refinance typically falls between 2% and 5% of the total loan amount. This is an important consideration for veterans looking to refinance. We encourage you to stay informed about these trends and consider restructuring when costs decrease, as this can strategically enhance your financial situation.

that understanding market dynamics and being financially prepared is essential for . By utilizing resources like and seeking guidance from experienced brokers at , former service members can navigate the complexities of loan modification and .

Moreover, , including conventional and , can open additional pathways for veterans to achieve their financial goals. Remember, we’re here to support you every step of the way as you make these important decisions.

Conclusion

Securing the best VA IRRRL rates today is essential for veterans who want to optimize their mortgage expenses. The VA Interest Rate Reduction Refinance Loan (IRRRL) program offers a streamlined approach, leading to significant savings on monthly payments. We understand how challenging this can be, and by grasping the benefits and eligibility requirements, service members can make informed decisions that align with their financial goals.

In this article, we have highlighted various resources and strategies to assist veterans in navigating the complexities of VA refinancing. From using tools like mortgage calculators to comparing rates on platforms such as Bankrate and Zillow, each element plays a vital role in achieving favorable loan terms. Understanding the differences between VA IRRRL and cash-out refinancing is also crucial. The importance of staying informed about market trends and leveraging personalized mortgage solutions, such as those offered by F5 Mortgage, cannot be overstated.

Ultimately, the journey to secure the best VA IRRRL rates today is not just about finding lower interest rates; it’s about empowering veterans to take control of their financial futures. By actively engaging with available resources and seeking professional guidance, service members can navigate the refinancing landscape with confidence. The potential for savings and improved financial stability is within reach. We’re here to support you every step of the way—take the necessary steps today to explore your options and make the most of the benefits available through the VA IRRRL program.

Frequently Asked Questions

What is the VA Interest Rate Reduction Refinance Loan (IRRRL)?

The VA IRRRL is a refinancing option designed for former service members to lower their current VA loan interest rates with minimal documentation and no appraisals required.

What are the eligibility requirements for a VA IRRRL?

To qualify for a VA IRRRL, former military personnel must have an existing VA loan that has been active for at least seven months and must be current on their mortgage payments.

How does the VA IRRRL differ from a cash-out refinance?

The VA IRRRL focuses on lowering interest rates and monthly payments with a streamlined process, while a cash-out refinance allows homeowners to access their home equity for various financial needs, typically requiring more documentation and an appraisal.

What are the benefits of using F5 Mortgage for VA IRRRL rates?

F5 Mortgage provides personalized mortgage consultations, collaborates with over two dozen top lenders to find the best VA IRRRL rates, and offers an easy-to-use loan calculator to help assess potential savings.

How quickly can loans be finalized through F5 Mortgage?

F5 Mortgage strives to finalize most loans in under three weeks.

What is the current national average VA refinance interest rate?

As of July 12, 2025, the national average 30-year VA refinance interest rate is 7.29%.

What factors influence VA refinancing costs?

VA refinancing costs can vary significantly based on broader economic conditions and changing interest rates.

What is the potential monthly savings from refinancing?

For example, modifying a $200,000 mortgage from a 4.25% rate to a 3.25% rate could lead to monthly savings of $114.

What additional loan options are available to Colorado residents?

In addition to VA loans, Colorado residents have access to conventional loans, which require a good credit score and low debt-to-income ratio, and FHA loans, which are more accessible to those with lower credit scores.

How has the use of VA refinance options changed recently?

There has been a 41% increase in VA-backed refinance loans in recent years, largely due to historically low borrowing costs encouraging veterans to explore refinancing options.