Overview

Navigating the world of VA loans can be challenging, but we want you to know that you can have two VA loans at the same time if you meet specific eligibility criteria. This includes having sufficient entitlement and the financial capacity to manage multiple mortgage payments. For many veterans, this opens up opportunities to leverage remaining benefits and secure additional loans.

Imagine relocating due to a Permanent Change of Station (PCS) while still wanting to retain your existing home as a rental property. This is where understanding the complexities of VA financing becomes crucial. We’re here to support you every step of the way, helping you explore your options and make informed decisions.

By recognizing your unique situation and addressing your needs, you can confidently navigate the VA loan process. Remember, you are not alone in this journey; we understand how challenging it can be, and we are committed to guiding you toward a successful outcome.

Introduction

Navigating the complexities of VA loans can feel overwhelming for many families. We understand how challenging this can be, especially when considering the possibility of holding multiple mortgages at once. However, the opportunity to secure not just one, but two VA loans opens up a world of flexibility in homeownership. This allows veterans to invest in their future while addressing their current housing needs.

Yet, this prospect raises vital questions about eligibility, financial management, and the implications of such a decision. Can families truly benefit from having two VA loans simultaneously? Or do the challenges outweigh the potential rewards? Exploring these facets is essential for veterans looking to maximize their benefits and achieve their homeownership dreams. We’re here to support you every step of the way as you navigate this journey.

F5 Mortgage: Your Partner for VA Loan Solutions

At F5 Mortgage LLC, we understand how challenging navigating VA financing can be for families. That’s why we are committed to making the process as stress-free as possible. By leveraging user-friendly technology, we simplify the mortgage experience, empowering you to make informed decisions about your options.

We know that every family’s needs are unique, which is why our brokerage offers personalized consultations tailored to your specific requirements. Our range of services includes pre-approval support and program education, ensuring you have the knowledge you need to move forward confidently.

With our expertise in VA financing, we guarantee competitive rates and terms, which raises the question: can you have at the same time, making securing a second VA mortgage seamless and efficient? We appreciate your time and finances, which is why our dedication to quick and effective closings means most agreements are completed in under three weeks.

Every interaction with our clients is viewed as an opportunity to build trust and loyalty. We position ourselves as your true partner for all your mortgage needs. Client testimonials highlight our exceptional service and satisfaction, reinforcing our commitment to providing a smooth mortgage experience. We’re here to support you every step of the way.

Eligibility Requirements for VA Loans

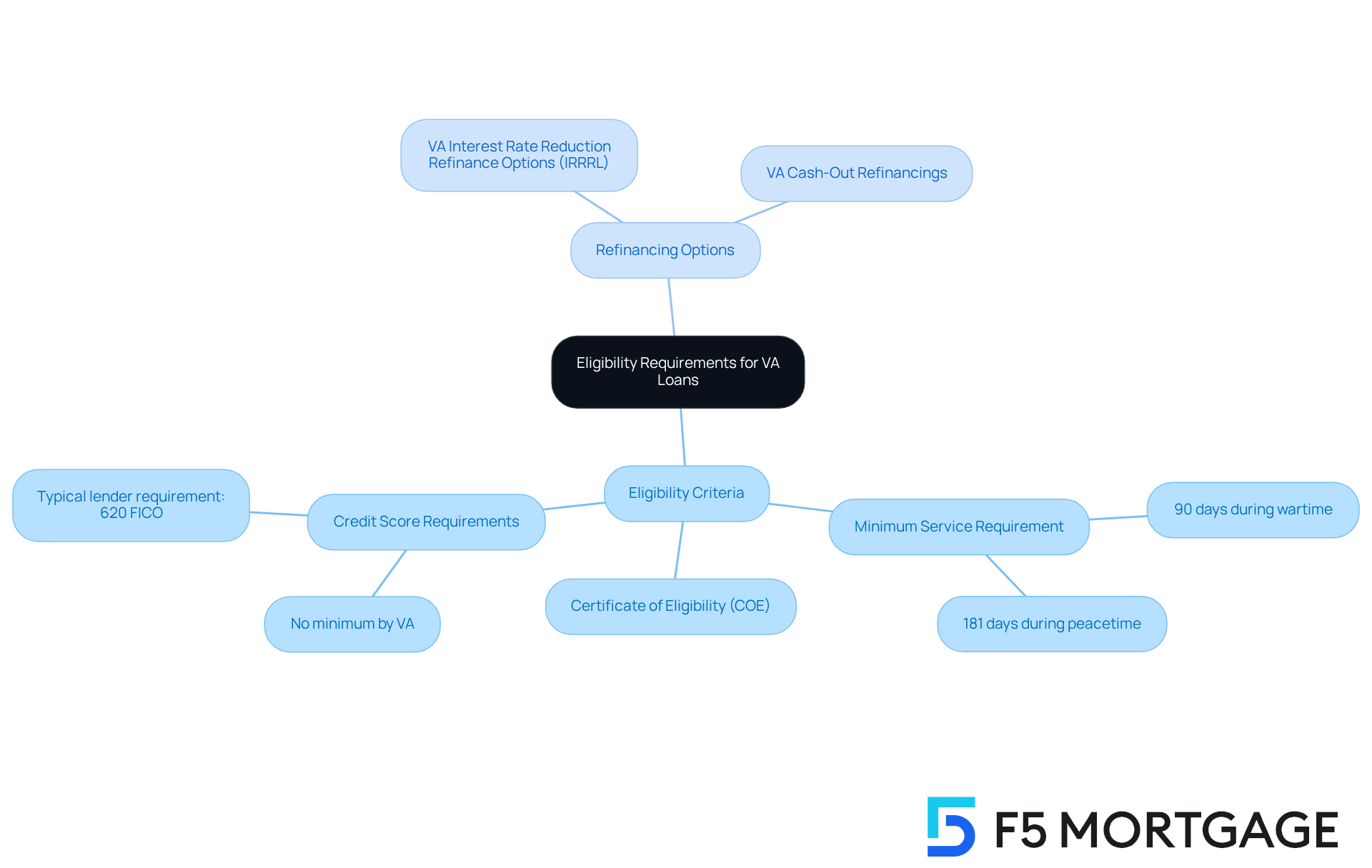

Navigating the VA mortgage process can feel overwhelming, but we’re here to support you every step of the way. To qualify for a VA mortgage, borrowers must meet specific eligibility criteria set by the Department of Veterans Affairs. This includes a minimum service requirement of:

- 90 days of active duty during wartime

- 181 days during peacetime

Additionally, veterans need to obtain a Certificate of Eligibility (COE), which verifies their entitlement to VA benefits.

One important aspect to note is that the VA does not establish a minimum credit score requirement for VA financing eligibility. This is crucial for families considering multiple VA financing options, particularly when they wonder, can you have two VA loans at the same time, as it opens up more possibilities for homeownership. Understanding the available is also essential for families looking to enhance their residences.

In California, refinancing can include various products, such as:

- VA Interest Rate Reduction Refinance Options (IRRRL)

- VA cash-out refinancings

These options allow homeowners to access their equity for significant expenses, providing financial flexibility.

By comprehending these requirements and options, families can assess their eligibility and make informed decisions about their home financing. Remember, we know how challenging this can be, but with the right information, you can confidently navigate your journey toward homeownership.

Understanding VA Loan Entitlement

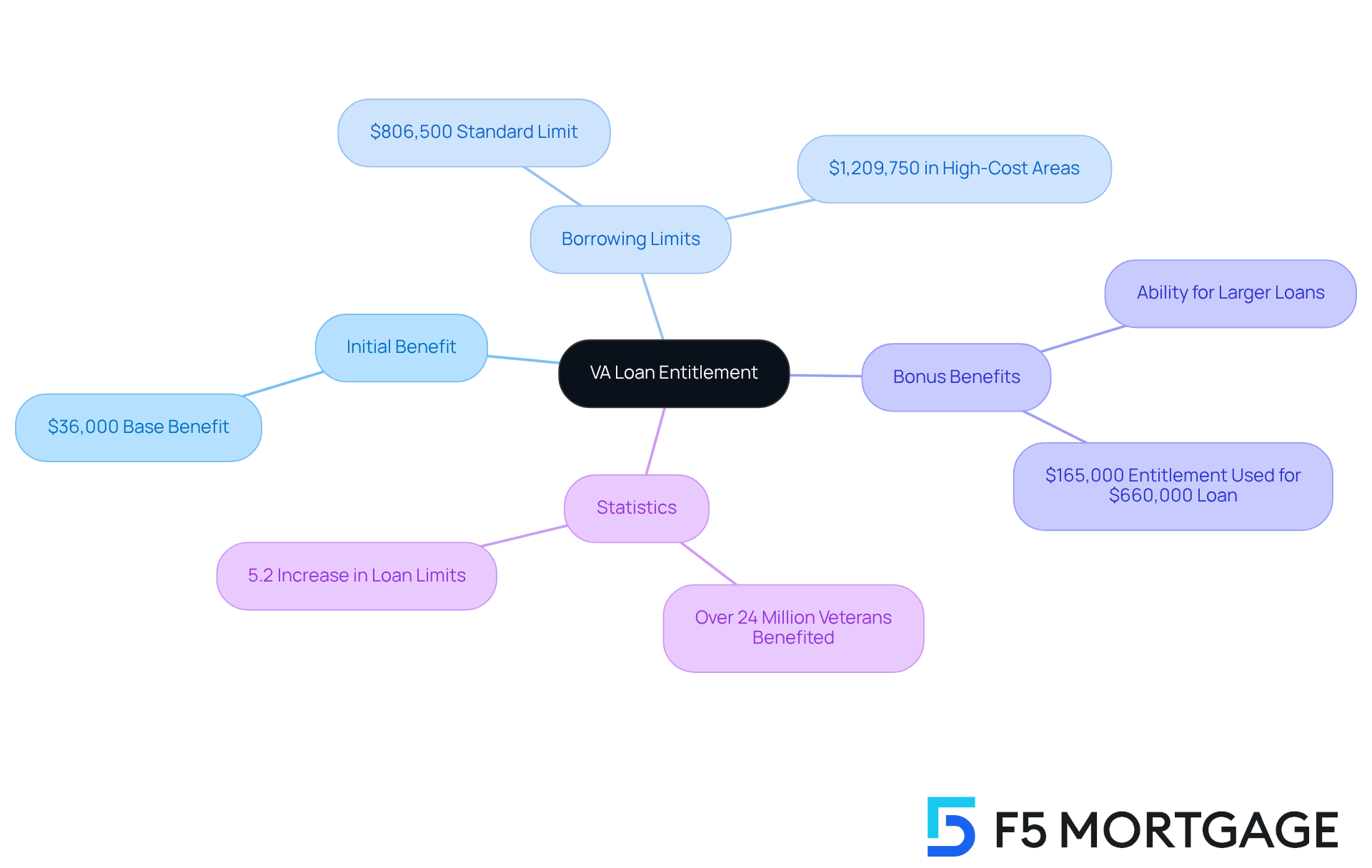

The VA guarantee represents a vital assurance provided by the VA to lenders in the event of default, playing an essential role in the home purchasing journey for our former service members. Each qualifying service member starts with a foundational benefit of $36,000, which can be increased with additional benefits based on the amount borrowed and the property’s location. For example, in 2025, the standard VA borrowing limit is set at $806,500, and in higher-cost areas, it can reach up to $1,209,750. This allows former service members to borrow significantly more without a down payment, provided they have sufficient benefits. This increase in borrowing limits, reflecting a 5.2% rise from the previous year, underscores the VA’s commitment to supporting veterans in achieving homeownership.

Understanding how benefits work is crucial for families asking, can you have two VA loans at the same time while considering multiple VA mortgages. Veterans can leverage bonus benefits for loans exceeding $144,000, enabling them to secure larger loan amounts. For instance, an experienced individual borrowing $660,000 would utilize $165,000 of their entitlement, with $129,000 classified as bonus entitlement. This flexibility empowers former service members to effectively manage multiple properties, enhancing their opportunities for homeownership.

Statistics show that over 24 million veterans have benefited from the VA Home Loan program since its inception in 1944, highlighting its importance in facilitating home purchases. Financial advisors emphasize the necessity of understanding VA entitlement, particularly when discussing can you have two VA loans at the same time, as it directly influences borrowing limits and the ability to utilize multiple credits. By grasping these concepts, families can make informed decisions about their mortgage options, ensuring they maximize the benefits earned through military service. We encourage for personalized assistance to navigate the complexities of the VA financing process. We’re here to support you every step of the way.

Conditions for Obtaining a Second VA Loan

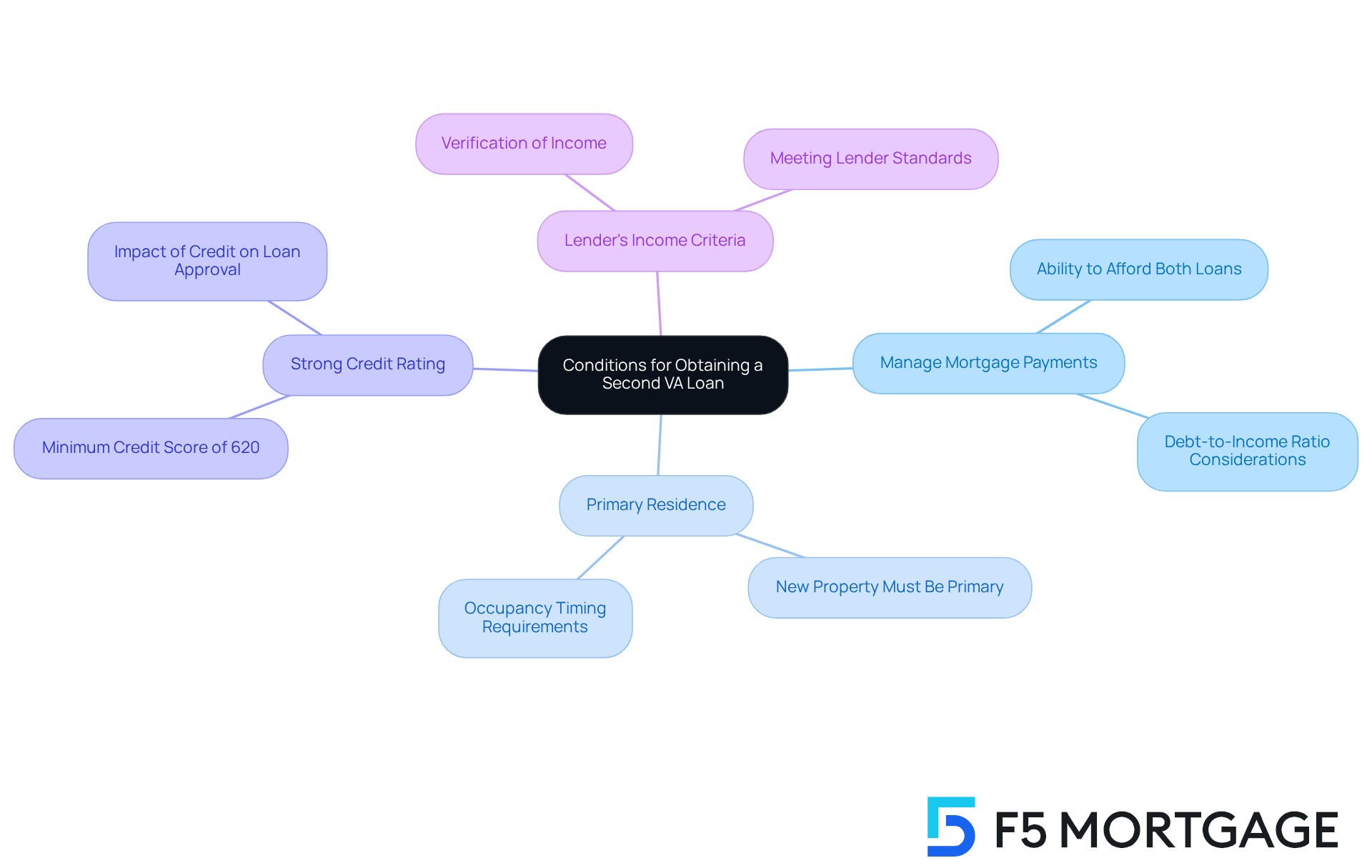

Veterans, we understand how important it is to secure your home. If you have remaining entitlement, you may wonder, can you have two VA loans at the same time, provided you meet certain conditions? Key requirements include:

- Demonstrating your ability to manage both mortgage payments.

- Ensuring that the new property will be your primary residence.

- Maintaining a strong credit rating; typically, servicemembers applying for several VA financing options have a credit score around 620 or above, which aligns with lender standards.

- Meeting the lender’s income criteria to qualify.

Many families have successfully navigated this process, effectively managing multiple VA financing options, which raises the question: can you have two VA loans at the same time to their advantage? For example, if a household is relocating due to a Permanent Change of Station (PCS) order, they might choose to rent out their current home while purchasing a new one, utilizing their remaining entitlement. This flexibility allows them to meet their housing needs while maximizing the benefits of VA financing. Understanding these conditions is vital for families aiming to make . We’re here to support you every step of the way.

Implications of Holding Two VA Loans

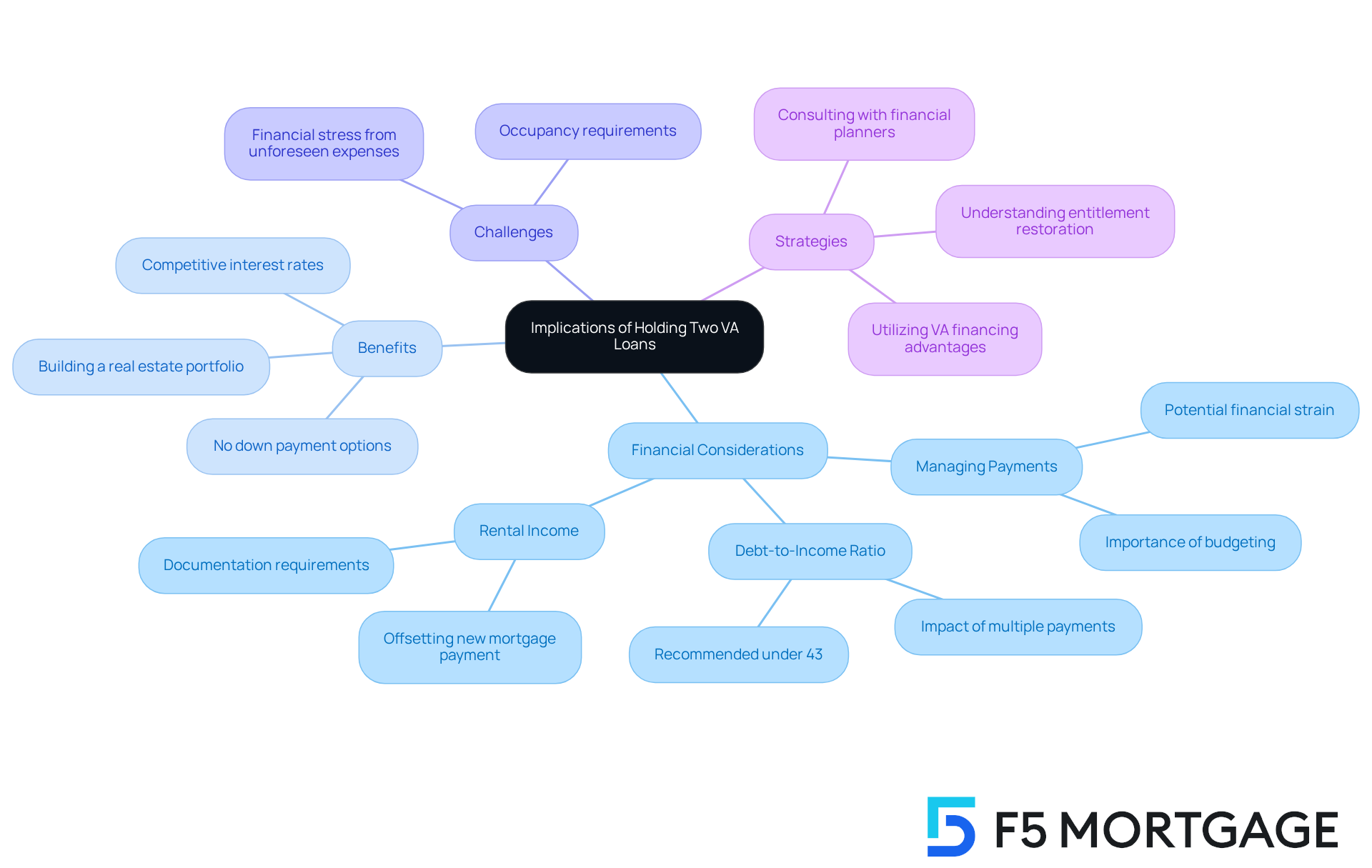

When considering whether you can have at the same time, it’s important to note that possessing two VA mortgages opens doors for former service members to expand their real estate investments, but it also brings important financial considerations. We understand how challenging this can be, and families must carefully evaluate their debt-to-income ratio. Managing multiple mortgage payments can lead to financial strain, but there are ways to ease the burden. For instance, veterans balancing two mortgages may find that rental income from their first property can help offset the new mortgage payment. However, it’s essential to ensure that both properties meet the VA’s occupancy requirements, which typically mandate that the borrower occupies the new home as their primary residence within 12 months.

Financial planners emphasize the importance of understanding how multiple mortgages can impact overall financial health. They frequently recommend that households keep a debt-to-income ratio under 43% to be eligible for extra credit, which can be difficult when managing several payments. Statistics indicate that households may wonder, can you have two VA loans at the same time, as they might encounter heightened financial stress, especially if unforeseen expenses arise.

We know that examples abound of veterans successfully navigating this landscape. For instance, a military household facing Permanent Change of Station (PCS) orders may retain their first home as a rental while purchasing a new primary residence. This strategy not only ensures housing stability but also utilizes the advantages of VA financing, such as no down payment and competitive interest rates.

Ultimately, understanding the implications of whether you can have two VA loans at the same time is crucial for families aiming to make informed decisions about their financing strategy. By carefully managing their finances and seeking guidance from informed lenders, former service members can maximize their VA financing advantages while minimizing potential risks. We’re here to support you every step of the way.

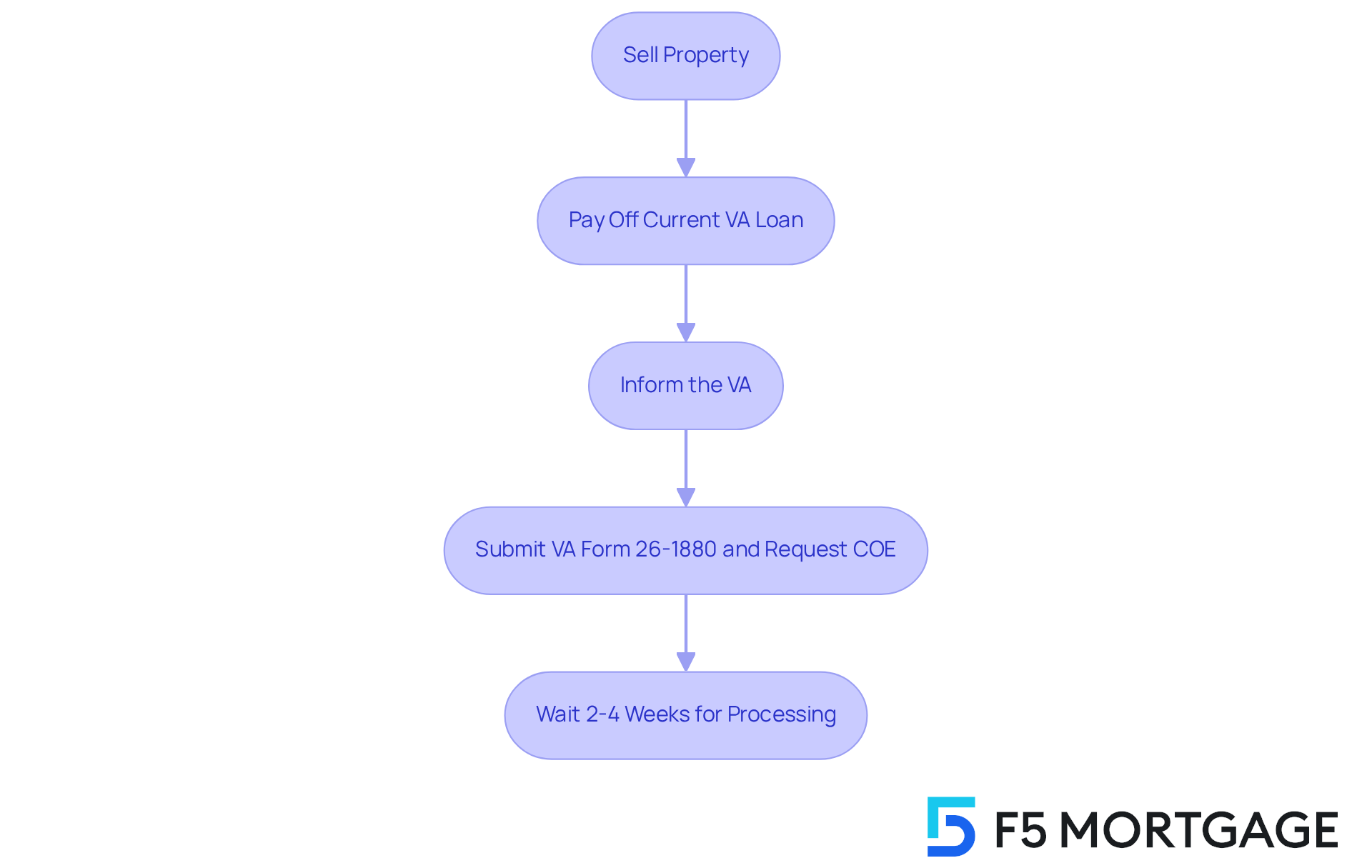

Restoring VA Loan Entitlement After Selling

Reinstating VA benefits after selling a property is a vital step for our former service members who wish to take advantage of their benefits for future home purchases. We understand how challenging this process can be, and we’re here to support you every step of the way. To begin, it’s essential to completely pay off your current VA loan and inform the VA. This involves submitting VA Form 26-1880 along with a request for a Certificate of Eligibility (COE), which verifies the restoration of your benefits. Typically, this takes about 2 to 4 weeks, depending on how complete your application is and the VA’s processing times.

Successfully restoring your rights allows you to access all your benefits, including the chance to purchase homes without a down payment. Imagine regaining access to competitive interest rates and favorable loan terms, making it easier to grow your real estate portfolio. In fact, many former service members successfully navigate this process, which leads to the question, can you have two VA loans at the same time, enabling them to acquire additional homes while preserving their financial benefits? This restoration not only supports your homeownership goals but also reinforces the VA’s commitment to providing valuable financial advantages to those who have served.

Common Scenarios for Multiple VA Loans

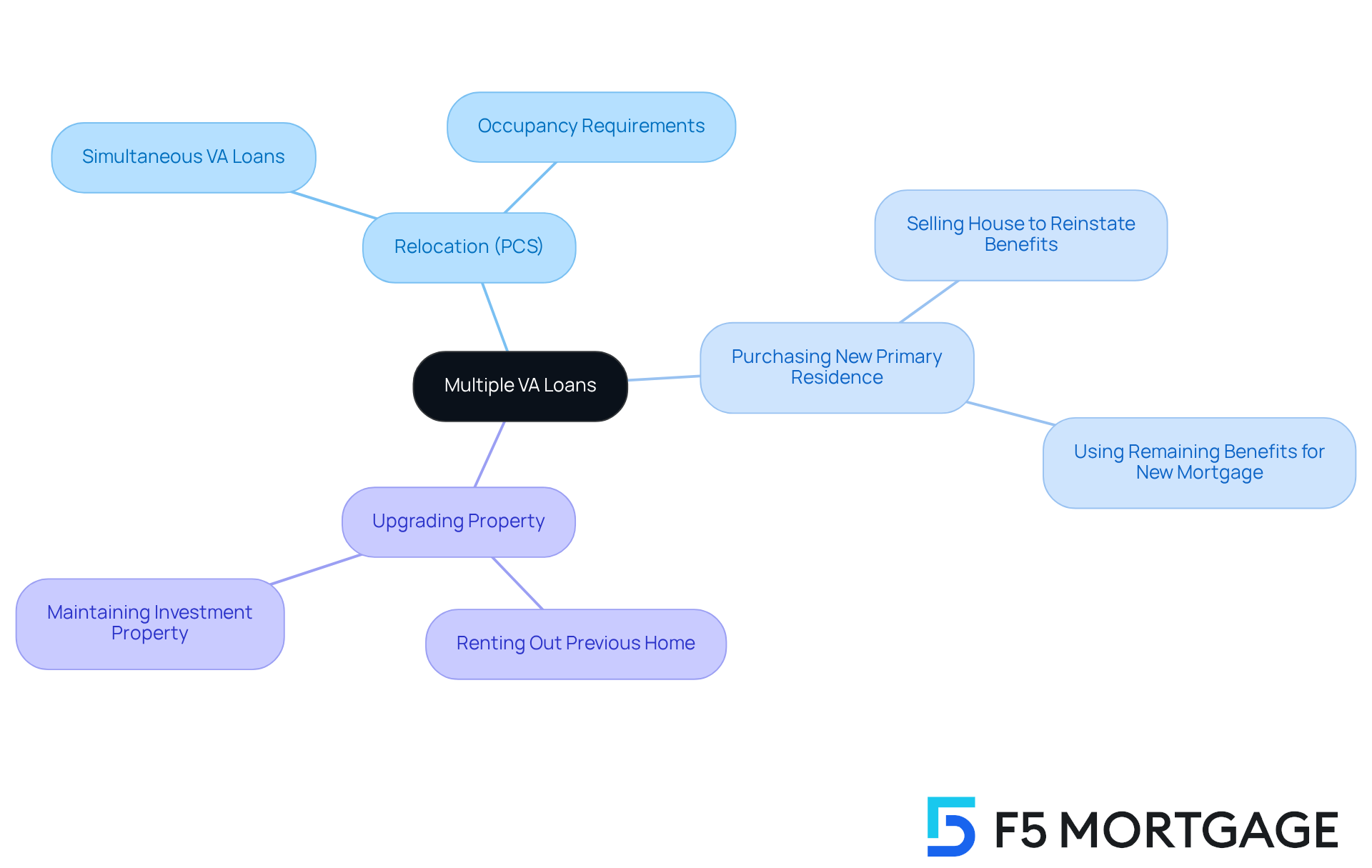

Veterans often find themselves in situations where utilizing multiple VA benefits can be incredibly advantageous, particularly when relocating due to a Permanent Change of Station (PCS). In fact, a significant number of former service members move for this very reason. Therefore, it is essential to understand how to effectively manage their VA benefits during these transitions. Common scenarios include:

- Purchasing a new primary residence while renting out the previous home

- Upgrading to a larger property as family needs evolve

For instance, a former service member might choose to sell their house and reinstate their benefits, allowing them to secure a new VA mortgage without needing a down payment. This flexibility helps families adjust to changing circumstances while maximizing their VA benefits. Mortgage brokers emphasize that as long as veterans have remaining benefits, they can utilize their VA financing multiple times, leading to the question: can you have two VA loans at the same time? Chris Birk, Vice President of Mortgage Insight, shares, “As long as you have remaining benefits, you typically always have the option to secure another VA mortgage.”

Understanding these scenarios empowers families to make informed choices about their home financing options. This ensures they can leverage their VA benefits to reach their homeownership dreams. It’s important to remember that VA mortgages are designed for primary residences only, and there are no lifetime limits on the use of VA benefits. This means veterans may wonder, can you have two VA loans at the same time, to tap into their entitlements multiple times throughout their lives. We know how challenging this can be, but we’re here to .

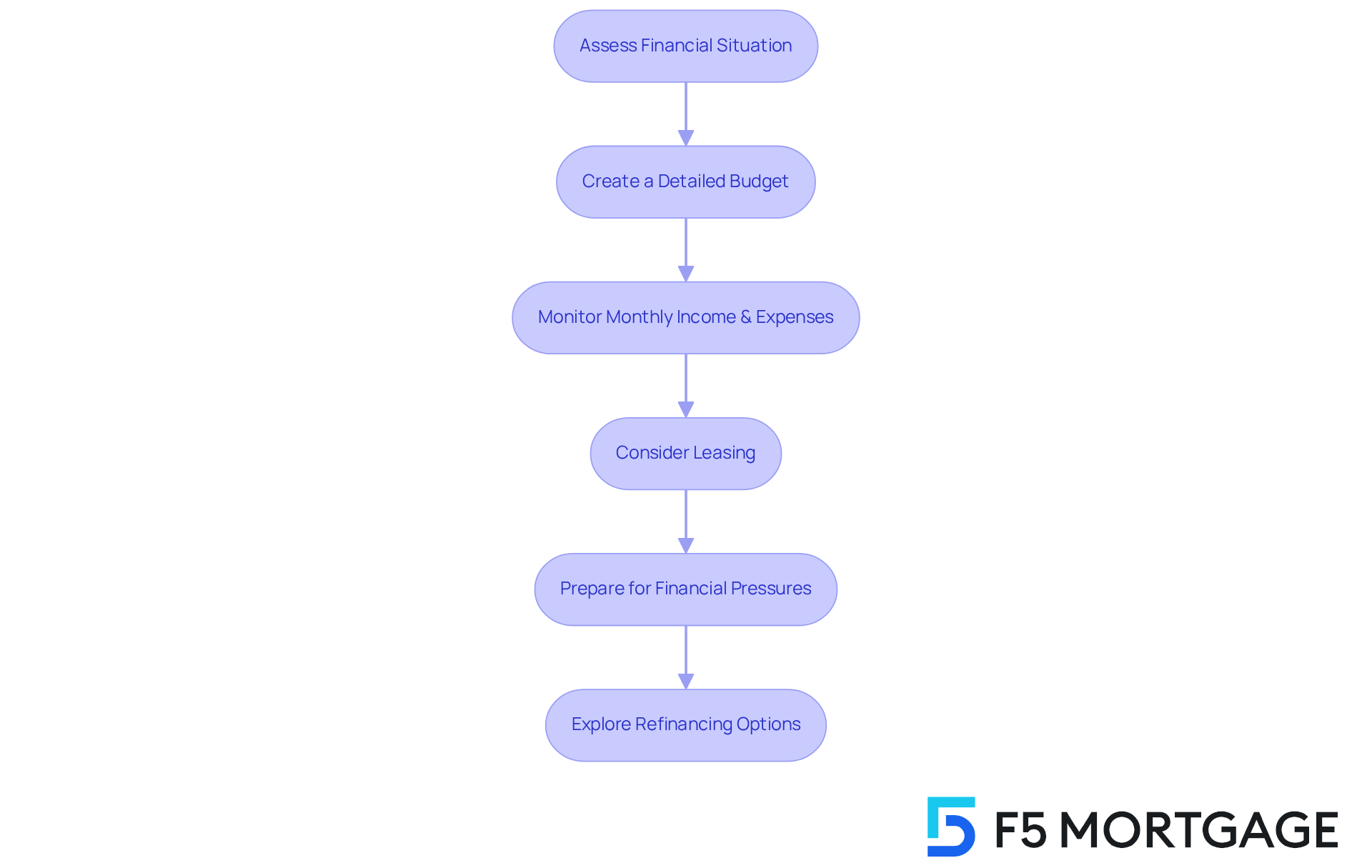

Challenges of Managing Two VA Loans

We understand how challenging it can feel to handle two VA mortgages, especially when you might be asking, ? It involves substantial financial responsibility and careful budgeting. Families must ensure they can comfortably manage both mortgage payments while keeping their debt-to-income (DTI) ratio within acceptable limits—typically a maximum of 43% for home financing. An improved DTI can lead to more competitive mortgage rates, which is essential for households looking to enhance their living situations.

To navigate this, a detailed budget is crucial. It should account for all monthly expenses, including:

- Property management fees

- Property taxes

- Maintenance costs

For instance, a household might wonder, can you have two VA loans at the same time, and if so, they might set aside money for each mortgage payment, along with a reserve for unforeseen costs. This proactive approach helps ensure financial stability.

Financial advisors emphasize the importance of creating a comprehensive budget that includes all potential costs associated with homeownership. Monitoring monthly income and expenses closely is a common strategy that allows households to adjust their spending habits as needed. For example, leasing one property can generate extra income, assisting in covering the mortgage on the second home. However, it’s vital to consider the VA’s occupancy requirements, which state that both properties must be primary residences unless certain conditions are met, particularly when exploring the question, can you have two VA loans at the same time.

Additionally, families should prepare for potential financial pressures, especially if one residence is leased. This situation can complicate budgeting due to additional variables like rental income and property management fees, which typically range from 8% to 10% of the rent. By anticipating these challenges and maintaining a clear financial strategy, families can effectively manage multiple VA mortgages, leading to the question of whether can you have two VA loans at the same time while securing their long-term financial well-being.

Moreover, exploring refinancing options, including traditional mortgages, FHA mortgages, and Colorado Streamline Refinance Programs, can provide families with opportunities to reduce their interest rates and improve their overall financial situation. We’re here to support you every step of the way as you navigate this journey.

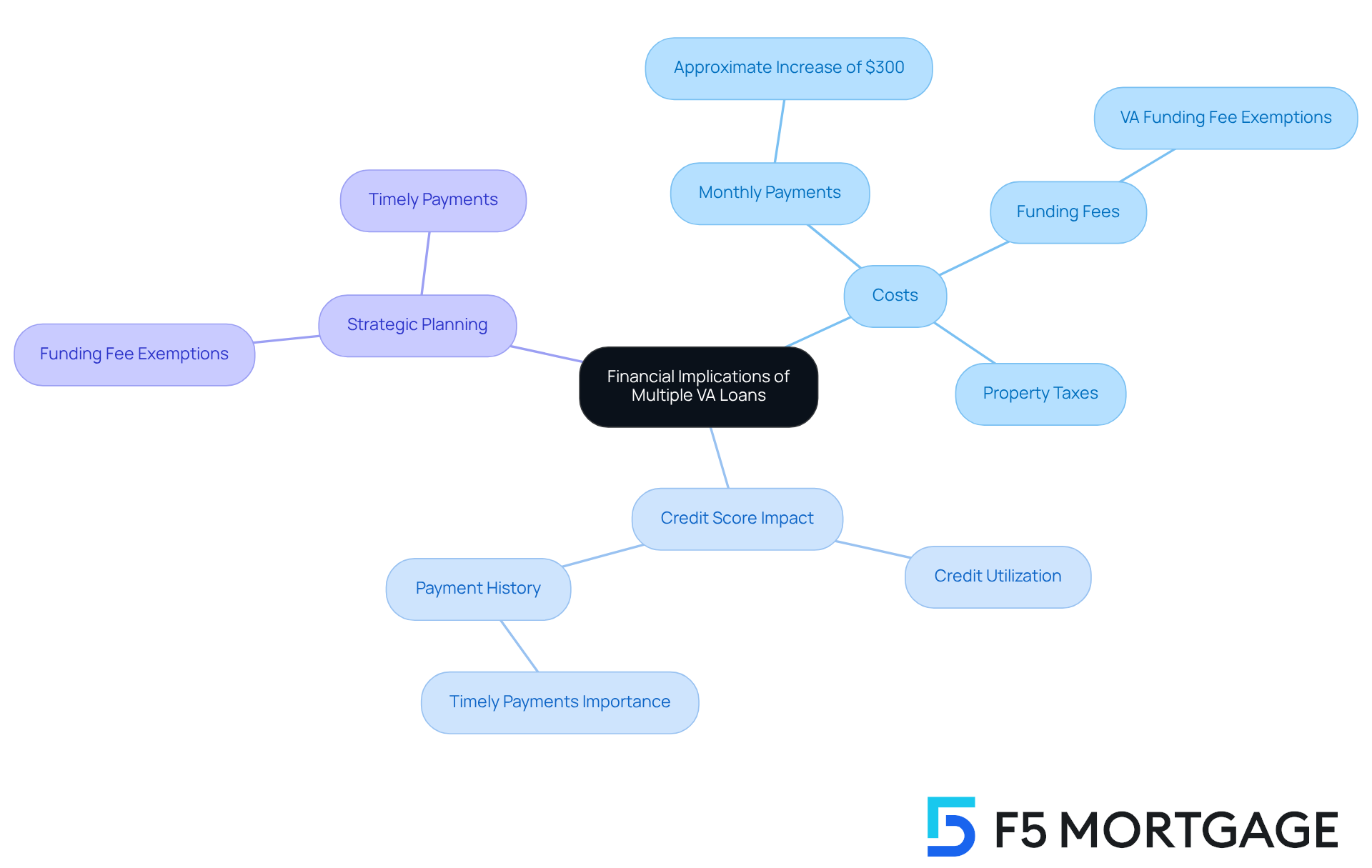

Financial Implications of Multiple VA Loans

When navigating multiple VA mortgages, many wonder, can you have two VA loans at the same time, as it can significantly impact a household’s financial landscape. Families often face key costs, such as increased monthly payments, funding fees, and property taxes. For instance, if you are wondering can you have two VA loans at the same time, those managing two VA mortgages might see their monthly payments rise by approximately $300. This increase can strain budgets if not carefully planned. While VA financing typically offers , the total costs can add up, necessitating a thorough evaluation of overall financial health.

Another crucial aspect to consider is the effect on credit scores. Various VA financing options can affect credit utilization and payment history, potentially influencing credit scores if payments are not managed well. Experts stress that timely payments are vital for maintaining credit health, especially since many lenders require a minimum credit score of 620 for VA financing. Alarmingly, about half of all Veterans are either unaware of the credit requirements for a VA mortgage or mistakenly believe they need much higher scores, leading to misconceptions about their eligibility.

Families facing these challenges can greatly benefit from strategic financial planning. For example, utilizing the VA’s funding fee exemptions for certain veterans can help lessen costs. As one mortgage specialist insightfully notes, ‘Understanding the intricacies of VA financing allows households to maximize their benefits while alleviating financial stress.’ Ultimately, while the financial implications of multiple VA mortgages may seem overwhelming, informed management can empower families to determine if they can have two VA loans at the same time, leveraging the advantages of VA mortgages to support their homeownership aspirations.

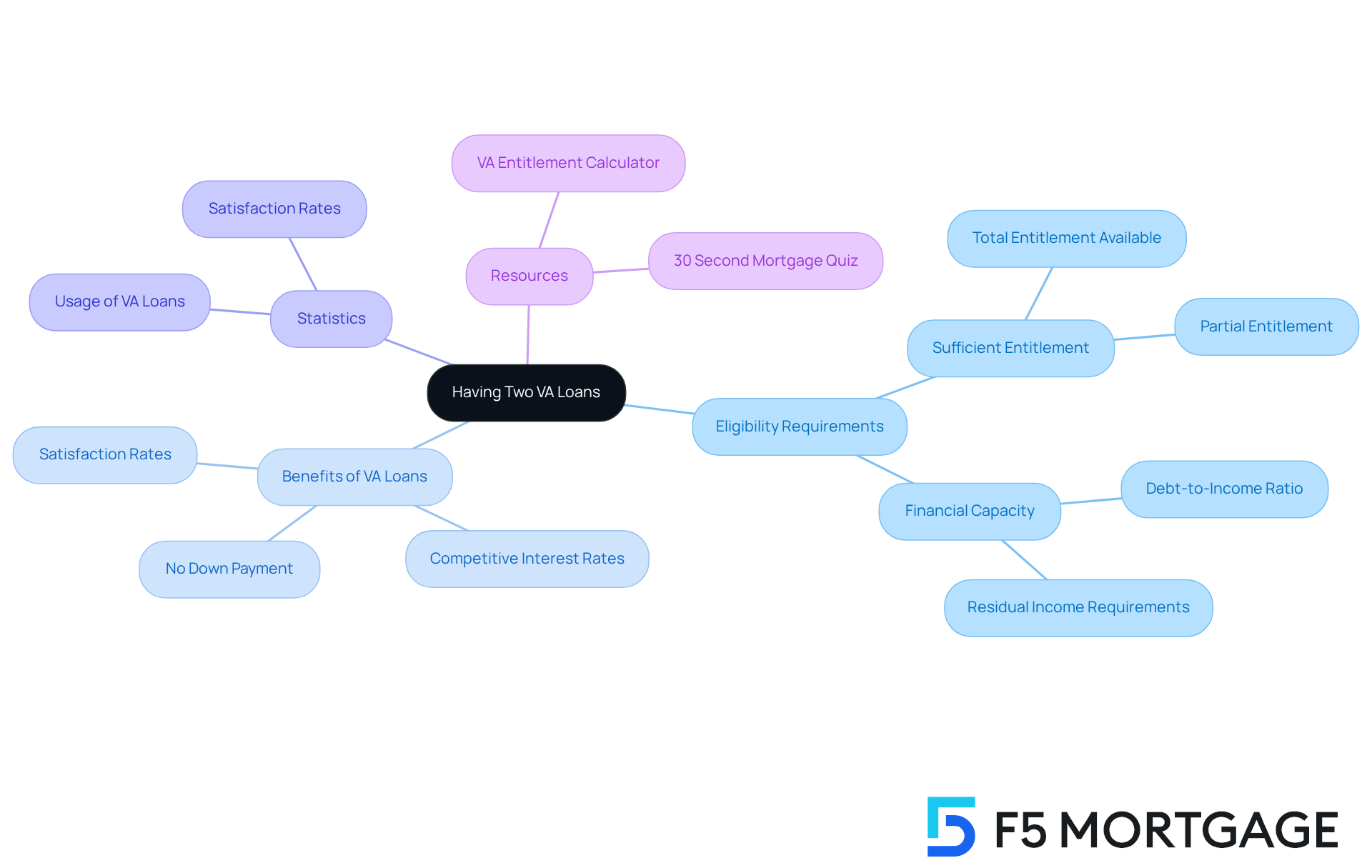

Key Takeaways on Having Two VA Loans

For households looking to enhance their homeownership prospects, a strategic decision may revolve around the question: can you have two VA loans at the same time? We understand how challenging this can be, and it’s crucial for families to be aware of the . These include having sufficient entitlement and the financial capacity to manage multiple mortgage payments. Understanding the implications of whether you can have two VA loans at the same time is essential; it can significantly influence your financial planning and future borrowing ability.

The VA financing program offers substantial advantages for households, such as no down payment options and competitive interest rates. In fact, approximately 94% of households utilizing VA benefits express satisfaction with their homeownership experience. This statistic highlights the program’s effectiveness in facilitating access to housing.

Mortgage brokers emphasize the importance of utilizing VA benefits to maximize homeownership potential. Carlos Scarpero, a mortgage officer, observes, “Utilizing your VA entitlement can create opportunities for acquiring a new primary residence while keeping your existing home as a rental, which raises the question, can you have two VA loans at the same time, offering both security and investment prospects.” This strategic approach allows families to retain their current home as an asset while exploring new options.

Statistics show that an increasing number of households are utilizing VA financing, with many effectively managing several agreements. For instance, after using $50,000 of allocated funds, around $151,625 remains accessible. This can greatly impact financial planning. A notable situation involved a veteran household in Mississippi that successfully managed three VA mortgages simultaneously, leading to the question of can you have two VA loans at the same time, and showcasing the program’s adaptability when sufficient benefits and income are present. This household was able to manage their mortgage payments while benefiting from rental income, demonstrating the potential for financial stability.

To assist families in evaluating their eligibility and potential borrowing amounts, the VA Entitlement Calculator is a valuable free resource. It can help establish maximum borrowing capacity based on your current VA financing status and entitlement. By being informed and prepared, families can effectively leverage their VA benefits to achieve their homeownership goals. We’re here to support you every step of the way, ensuring you make the most of the opportunities available through the VA loan program.

Conclusion

Navigating the complexities of VA loans can feel overwhelming, especially when contemplating the possibility of holding multiple loans at once. We understand how daunting this can be for families striving to maximize their homeownership potential. It’s essential to grasp the eligibility criteria and the implications of having two VA loans. With thoughtful planning and strategic financial management, it is indeed possible to secure two VA loans, opening up new avenues for homeownership and investment.

Key insights from this article emphasize the importance of understanding eligibility requirements, such as:

- Maintaining a sufficient entitlement

- Having the financial capacity to manage multiple mortgage payments

The benefits of VA loans—like no down payment and competitive interest rates—further highlight the program’s value for veterans. Real-life examples illustrate how families have successfully navigated this process, leveraging their benefits to improve their living situations while retaining existing properties as rental investments.

Ultimately, the journey toward homeownership with multiple VA loans is one filled with empowerment and opportunity. By understanding the intricacies of VA financing, families can make informed decisions that align with their unique circumstances. Engaging with knowledgeable lenders and utilizing resources like the VA Entitlement Calculator can further bolster this endeavor. Embracing these strategies not only fosters financial stability but also reinforces the significance of the VA loan program in realizing the American dream of homeownership for those who have served.

Frequently Asked Questions

What services does F5 Mortgage offer for VA loan solutions?

F5 Mortgage offers personalized consultations, pre-approval support, and program education to help families navigate the VA financing process.

What are the eligibility requirements for obtaining a VA loan?

To qualify for a VA loan, borrowers must meet a minimum service requirement of 90 days of active duty during wartime or 181 days during peacetime, and they must obtain a Certificate of Eligibility (COE) to verify their entitlement to VA benefits.

Is there a minimum credit score requirement for VA loans?

No, the VA does not establish a minimum credit score requirement for VA financing eligibility.

Can you have two VA loans at the same time?

Yes, it is possible to have two VA loans simultaneously, which can open up more opportunities for homeownership.

What refinancing options are available for VA loans?

VA refinancing options include VA Interest Rate Reduction Refinance Loans (IRRRL) and VA cash-out refinancing, allowing homeowners to access their equity for significant expenses.

What is VA loan entitlement?

VA loan entitlement is the guarantee provided by the VA to lenders in case of default. Each qualifying service member starts with a foundational benefit of $36,000, which can be increased based on the amount borrowed and the property’s location.

What are the borrowing limits for VA loans?

In 2025, the standard VA borrowing limit is set at $806,500, and in higher-cost areas, it can reach up to $1,209,750.

How can veterans leverage bonus benefits for larger loans?

Veterans can utilize bonus benefits for loans exceeding $144,000, allowing them to secure larger loan amounts while effectively managing multiple properties.

Why is understanding VA entitlement important?

Understanding VA entitlement is crucial as it influences borrowing limits and the ability to utilize multiple credits, impacting decisions about mortgage options.

How can families get personalized assistance with VA financing?

Families are encouraged to consult with a lender or VA financing specialist for personalized assistance to navigate the complexities of the VA financing process.