Overview

In today’s financial landscape, many homeowners face the challenge of accessing their home equity. Two popular options are cash-out refinancing and Home Equity Lines of Credit (HELOC). Understanding the differences and similarities between these choices is essential for making an informed decision that suits your unique situation.

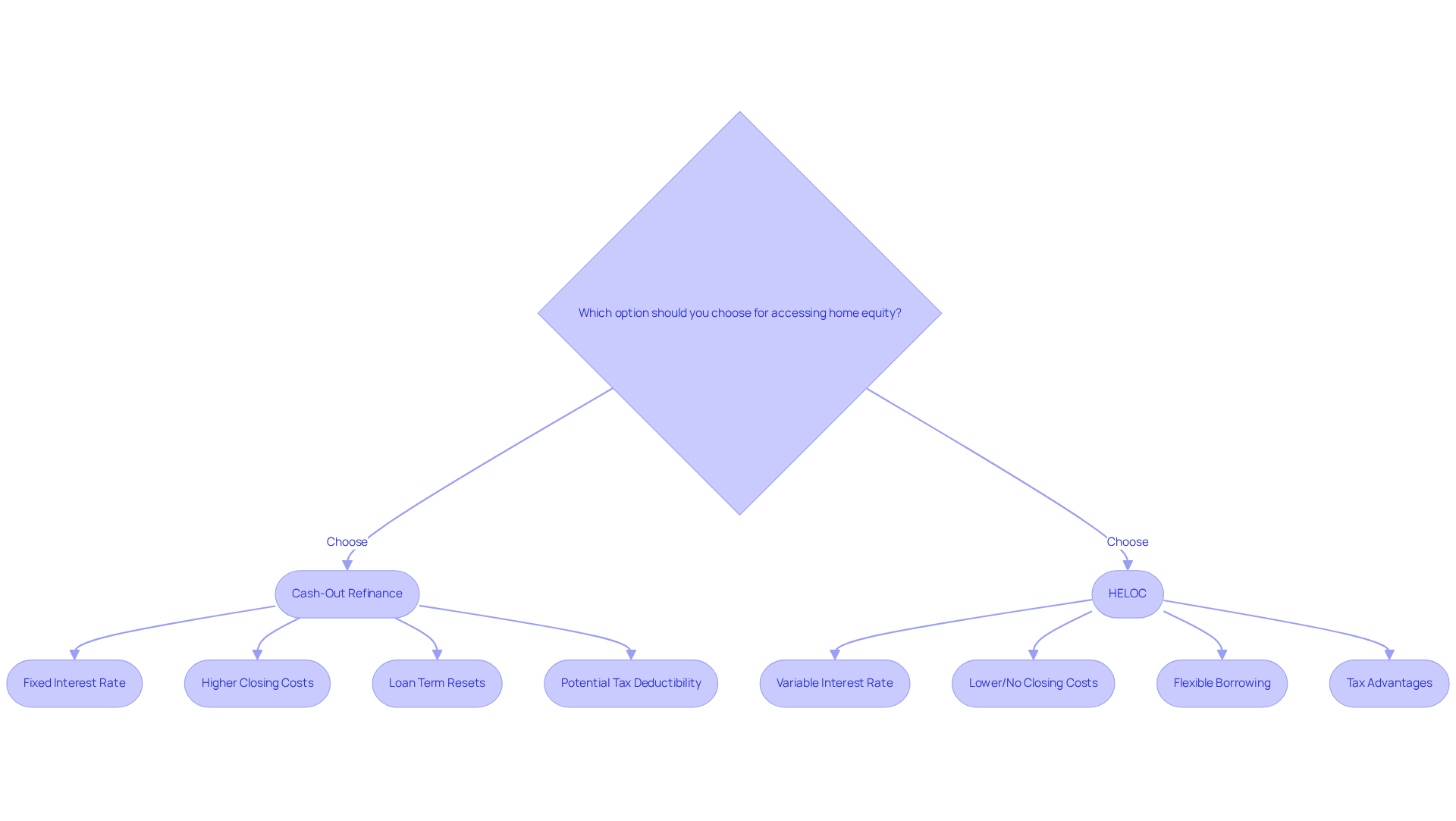

Cash-out refinancing involves replacing your existing mortgage with a larger one. This option often comes with a fixed interest rate, providing stability in your monthly payments. On the other hand, a HELOC operates like a revolving credit line, typically featuring variable rates. This flexibility can be appealing, but it’s crucial to consider how these options align with your financial goals.

We know how challenging it can be to navigate these choices. It’s important to weigh the costs, risks, and suitability of each option based on your individual financial needs. By understanding these key differences, you can take the necessary steps toward accessing your home equity with confidence. Remember, we’re here to support you every step of the way as you explore the best path for your family.

Introduction

Navigating the financial landscape of home equity can feel overwhelming for homeowners. We understand how challenging this can be, especially when considering options like cash-out refinancing and Home Equity Lines of Credit (HELOCs). Both avenues offer unique benefits for accessing funds, whether for renovations, debt consolidation, or unexpected expenses. However, they come with distinct features and implications that deserve careful consideration.

As you weigh your choices, a pressing question arises: which option truly aligns with your financial goals and circumstances? Understanding the nuances between cash-out refinancing and HELOCs is crucial. We’re here to support you every step of the way in making informed decisions that can significantly impact your long-term financial health.

Define Cash-Out Refinance and HELOC

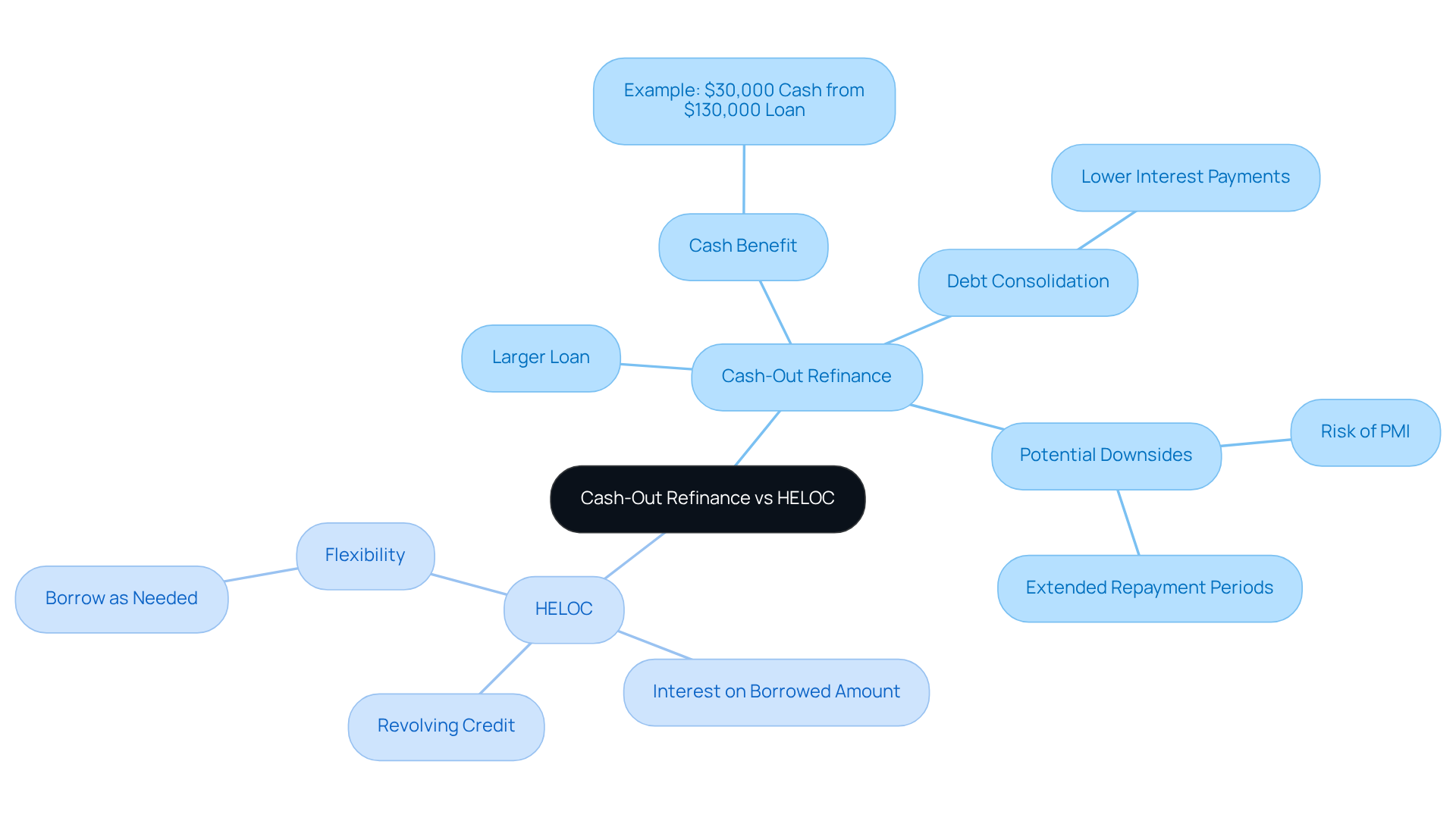

A cash-out refinance vs HELOC can be a valuable option for homeowners looking to replace their current loan with a new, larger one. Imagine your home is valued at $400,000, and you have $100,000 left on your mortgage. By refinancing for $130,000, you could receive $30,000 in cash. This cash can be a lifeline for various needs, whether it’s for home improvements or consolidating debt.

In contrast, a Home Equity Line of Credit (HELOC) offers a revolving line of credit secured by the equity in your home, which can be compared to a cash out refinance vs HELOC. Think of it as a credit card that allows you to borrow against your home equity as needed, up to a set limit, with interest only on the amount you draw.

Mortgage experts emphasize the benefits of tapping into your equity. It can help you merge high-interest debts into one manageable, lower-interest payment. Currently, equity extraction loans make up about 13% of all loan locks, indicating their growing popularity. However, it’s essential to weigh potential downsides, such as the risk of private mortgage insurance (PMI) and extended repayment periods.

As interest rates stabilize, the cash out refinance vs HELOC options are expected to become even more popular for mortgage restructuring. Homeowners may find themselves utilizing their equity for larger renovation projects. We understand how challenging these decisions can be, and grasping these options is crucial for homeowners aiming to make informed financial choices in 2025. Remember, we’re here to support you every step of the way.

Explore Similarities Between Cash-Out Refinancing and HELOCs

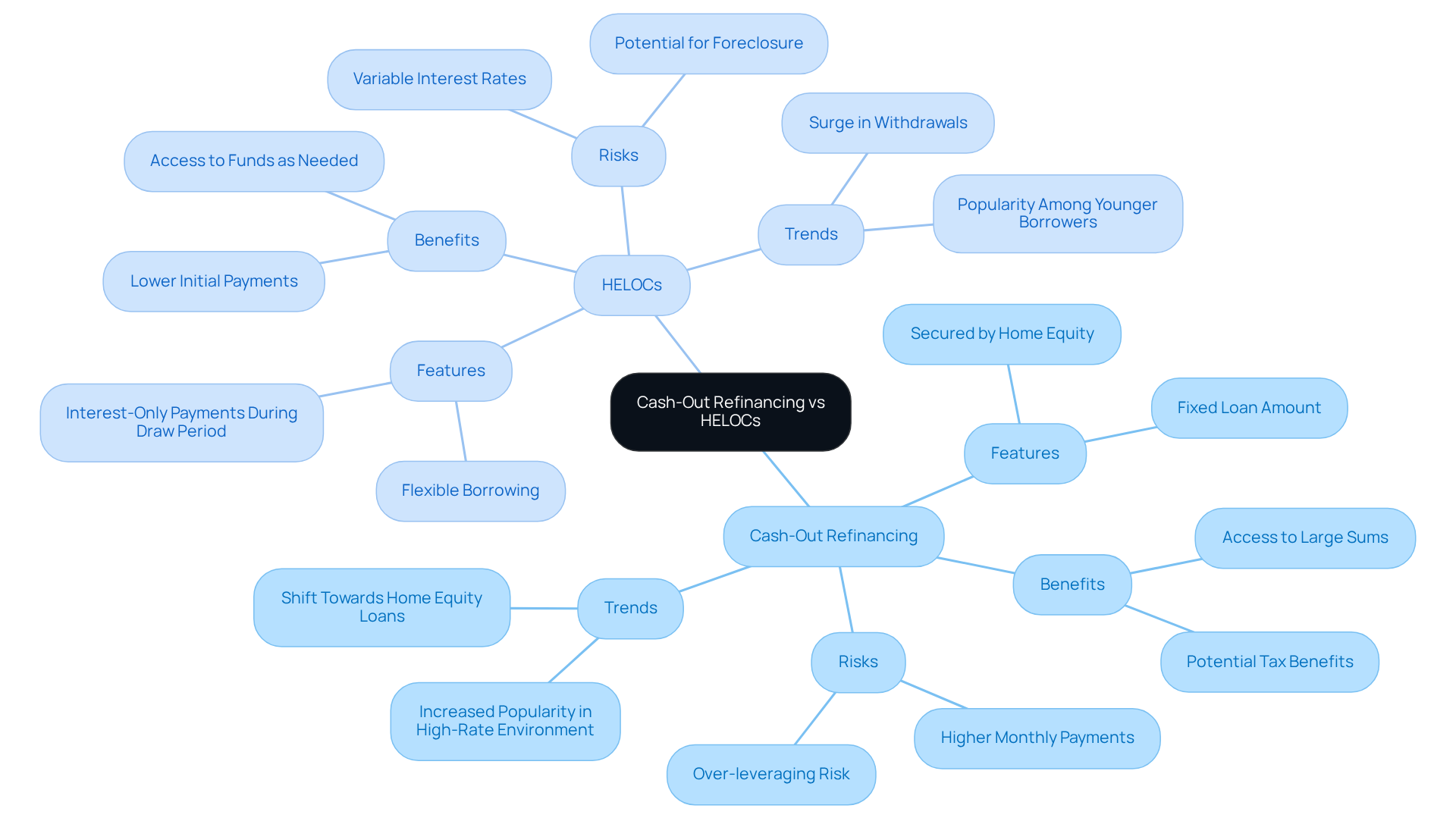

Homeowners looking to tap into their home equity often consider the options of cash out refinance vs HELOC, both of which can be valuable tools. We understand how important it is to have access to funds for various financial needs, whether it’s for home renovations, debt consolidation, or managing unexpected expenses. These options are secured by your home, meaning your property acts as collateral for the loan.

In 2025, property owners had access to approximately $11.5 trillion in home equity, presenting a significant opportunity for those wanting to leverage their property’s value. Collectively, homeowners are sitting on nearly $30 trillion in home equity, further highlighting the potential to use this asset wisely. Importantly, when considering cash out refinance vs HELOC, both options may offer potential tax benefits, as the interest paid could be tax-deductible, depending on how you use the funds.

Recent trends show a growing preference for these financial products. For instance, in 2022, originations of HELOCs and home equity loans surged by 50% compared to two years earlier, largely driven by home renovations. Notably, HELOC withdrawals reached the highest level in 17 years during the first quarter of 2025, indicating that more property owners are utilizing their home equity to fund improvements and manage higher-interest debt.

Experts suggest that tapping into home equity for financial needs can be a strategic move, especially in today’s interest rate environment. With loan rates hovering around 7%, many homeowners find HELOCs appealing due to their flexibility, allowing for interest-only payments during the draw period, which typically lasts five to ten years. However, it’s crucial to approach these options with care. Over-leveraging can lead to financial strain, particularly if property values decline. As Susan Allen noted, HELOCs often gain popularity when prevailing interest rates exceed a homeowner’s first mortgage rate, reinforcing this current trend. It’s also vital to consider the risks associated with HELOCs, such as the potential for foreclosure if payments are not maintained.

Overall, both cash out refinance vs HELOC provide feasible options for homeowners to access funds. Each has its unique benefits and considerations, and we’re here to support you every step of the way as you navigate these important financial decisions.

Analyze Differences Between Cash-Out Refinancing and HELOCs

Understanding the essential differences between cash out refinance vs HELOC can be crucial for your financial journey. A cash-out refinance replaces your current loan with a new one, often at a fixed interest rate. This can lead to reduced monthly payments if the new rate is more favorable than the previous one. However, it does require at least a 20% equity stake in your home, which is an important eligibility requirement.

On the other hand, a HELOC typically operates with a variable interest rate that can fluctuate over time. This might lead to higher payments as rates increase, which is something to consider when making your decision.

Moreover, cash-out loan restructuring generally involves elevated closing expenses, ranging from 2% to 6% of the loan amount—similar to conventional home loans. In contrast, when considering cash out refinance vs HELOC, HELOCs often come with lower or even no closing costs, making them more accessible for homeowners looking to tap into their equity without significant upfront expenses. This comparison highlights the cost differences between cash out refinance vs HELOC options.

It’s also worth noting that withdrawing equity through mortgage restructuring resets your loan term, potentially prolonging the repayment duration and increasing the total interest paid over time. Conversely, a HELOC provides flexible borrowing and repayment options within a specified draw period, typically lasting up to 10 years, followed by a repayment period that can extend up to 20 years. This flexibility can be especially beneficial for homeowners who need to manage their cash flow carefully.

Additionally, the interest on cash withdrawal restructuring may be tax-deductible if used for home improvements, while HELOCs also offer similar tax advantages under specific conditions. However, both options carry risks, including the potential for foreclosure if payments are not maintained. With approximately 250,000 families entering foreclosure every three months, it’s essential to approach these options with careful financial planning.

Case studies show that homeowners seeking predictable payments and reduced overall debt may prefer options related to cash out refinance vs HELOC. In contrast, those needing immediate access to funds for various expenses might find a cash out refinance vs HELOC to be more suitable. Ultimately, the choice between these options should align with your individual financial needs and long-term goals. We know how challenging this can be, and we’re here to support you every step of the way.

Evaluate Pros and Cons of Cash-Out Refinancing and HELOCs

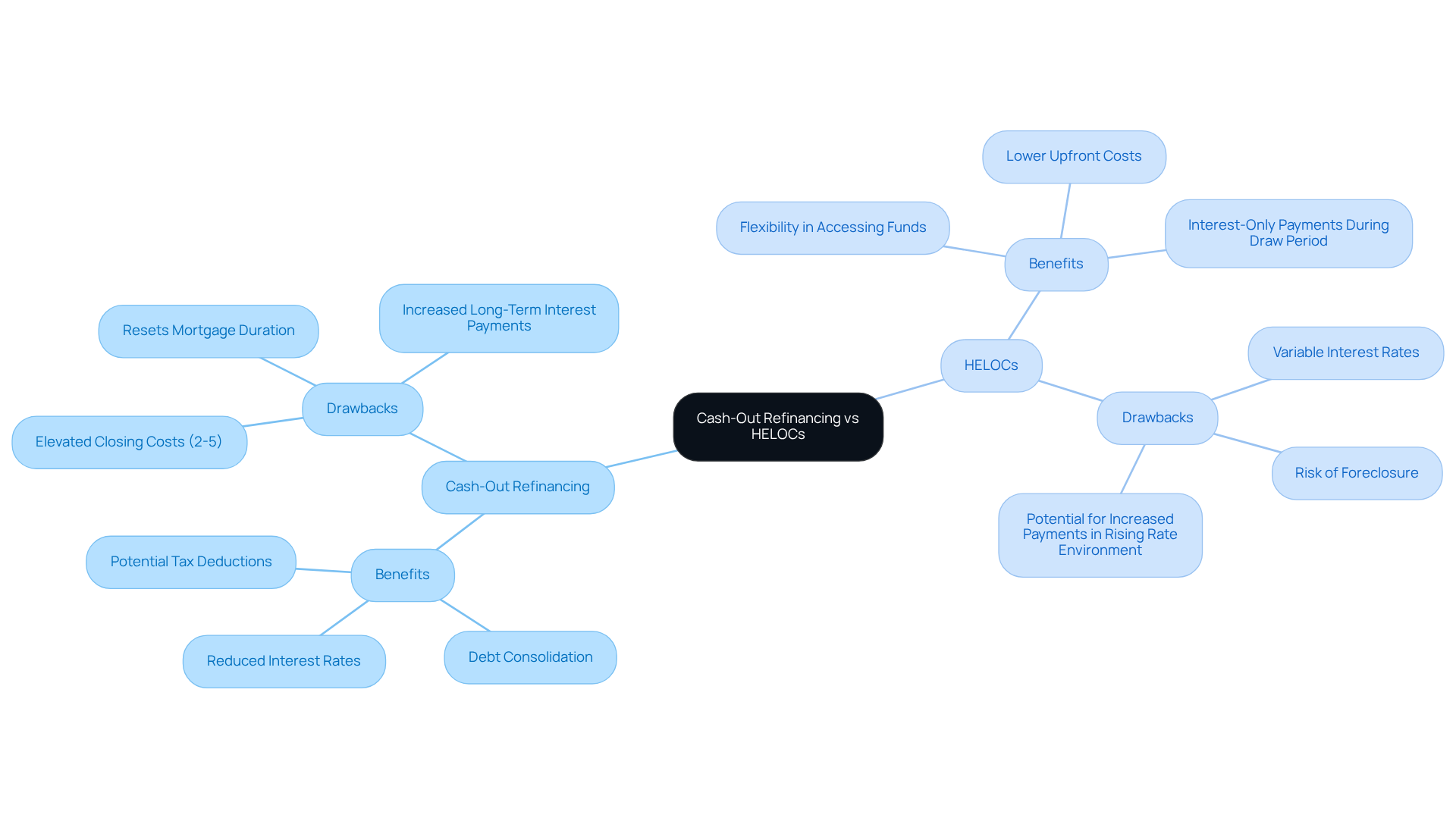

When considering cash-out loan restructuring, it’s important to evaluate cash out refinance vs HELOC, as both can offer significant benefits for families navigating their financial options. It may provide reduced interest rates compared to HELOCs, allow for the consolidation of various debts into a single fixed-rate loan, and even offer potential tax deductions on interest payments. However, it’s essential to recognize that the cash out refinance vs HELOC approach often comes with elevated closing costs, typically ranging from 2% to 5% of the new loan value. Additionally, it resets the mortgage duration, which could lead to increased long-term interest payments. We know how challenging this can be, especially when considering the impact on credit scores. Utilizing home equity loans to pay off credit card debt can indeed enhance credit scores by lowering the credit utilization ratio, a crucial factor in credit scoring.

On the other hand, in the discussion of cash out refinance vs HELOC, HELOCs provide substantial flexibility, allowing homeowners to access funds as needed during a draw period that usually lasts between 5 to 15 years. They typically have lower upfront costs, making them an appealing choice for those who require immediate cash. However, it’s important to be aware of the differences in cash out refinance vs HELOC, as HELOCs come with variable interest rates, which can result in unpredictable monthly payments. This is particularly concerning in a rising interest rate environment, where rates have surged from around 3% in early 2022 to over 9% currently. Such variability can create financial strain if not managed carefully, as we’ve seen in case studies where borrowers faced increased payments during the repayment phase.

Moreover, the risk of foreclosure is a critical consideration with HELOCs. Failing to make payments can lead to lenders repossessing the property used as collateral. Therefore, while HELOCs offer flexibility and reduced initial expenses, it’s essential for homeowners to compare the benefits of cash out refinance vs HELOC against the associated risks. We’re here to support you every step of the way as you navigate these important decisions.

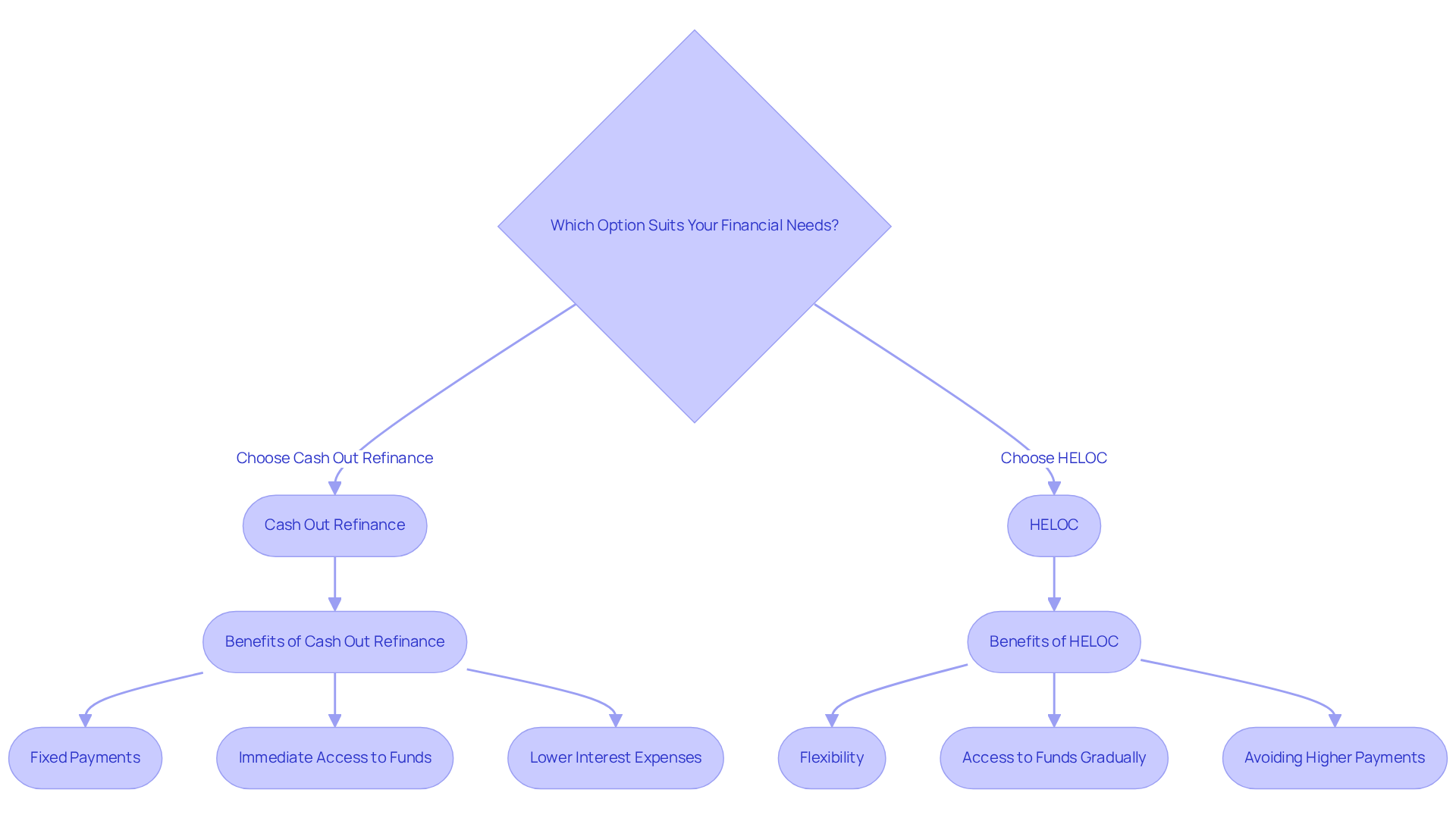

Determine Which Option Suits Your Financial Needs

Choosing between a cash out refinance vs HELOC can feel overwhelming. We understand how important it is to evaluate your financial objectives, current loan rates, and personal situation carefully. For property owners seeking a lump sum for a specific project, cash out refinance vs HELOC often highlights the predictability of fixed payments, making it a suitable option. This choice allows you to replace your current loan with a new one, giving you immediate access to funds while potentially lowering your total interest expenses.

However, if flexibility and ongoing access to funds are what you need, you may want to consider the options of cash out refinance vs HELOC as the better path for you. This secondary loan lets you borrow against your equity as needed, which is perfect for those who may not require a large amount upfront but want the ability to access funds gradually. It’s also wise to consider your current loan interest rate; if it’s low, opting for a HELOC can help you avoid resetting your loan term and facing higher payments.

Ultimately, we encourage you to consult with a mortgage professional. They can provide personalized insights tailored to your unique financial situation, ensuring you make informed decisions that align with your long-term goals. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the distinctions between cash-out refinancing and HELOCs is essential for homeowners looking to leverage their equity effectively. We know how challenging this can be, and each option presents unique advantages and challenges that can significantly impact your financial decisions. By carefully considering these differences, you can make informed choices that align with your financial goals and circumstances.

Cash-out refinancing allows you to replace your existing mortgage with a larger loan, providing a lump sum of cash. On the other hand, HELOCs offer a flexible line of credit against your home equity. Key points to consider include:

- The benefits of lower interest rates

- Potential tax deductions

- The risks associated with variable rates

- The risk of foreclosure

It’s crucial to weigh the predictability of fixed payments against the flexibility of accessing funds as needed.

Ultimately, the choice between cash-out refinancing and a HELOC should be based on your individual financial needs and long-term objectives. Engaging with a mortgage professional can provide personalized guidance, ensuring that you navigate these options wisely. By understanding the implications of each choice, you can take proactive steps towards achieving your financial aspirations and making the most of your home equity. We’re here to support you every step of the way.

Frequently Asked Questions

What is a cash-out refinance?

A cash-out refinance involves replacing your current mortgage with a new, larger loan, allowing you to take out cash from your home’s equity. For example, if your home is valued at $400,000 and you owe $100,000, refinancing for $130,000 would provide you with $30,000 in cash.

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit secured by the equity in your home, similar to a credit card. It allows homeowners to borrow against their home equity as needed, up to a set limit, with interest only charged on the amount drawn.

What are the benefits of tapping into home equity?

Tapping into home equity can help consolidate high-interest debts into one lower-interest payment, fund home improvements, or manage unexpected expenses. It can also offer potential tax benefits, as the interest paid may be tax-deductible depending on the use of the funds.

How popular are cash-out refinances and HELOCs?

Equity extraction loans, which include cash-out refinances and HELOCs, make up about 13% of all loan locks, indicating their growing popularity. In 2022, the originations of HELOCs and home equity loans surged by 50% compared to two years earlier, largely driven by home renovations.

What are the risks associated with cash-out refinancing and HELOCs?

Potential downsides include the risk of private mortgage insurance (PMI), extended repayment periods, and the possibility of foreclosure if payments on a HELOC are not maintained. Over-leveraging can also lead to financial strain, especially if property values decline.

How do current interest rates affect the appeal of HELOCs?

With loan rates hovering around 7%, many homeowners find HELOCs appealing due to their flexibility, which allows for interest-only payments during the draw period, typically lasting five to ten years. This trend is reinforced when prevailing interest rates exceed a homeowner’s first mortgage rate.

What should homeowners consider before choosing between a cash-out refinance and a HELOC?

Homeowners should weigh the unique benefits and considerations of each option, including their financial needs, the potential for tax benefits, the risks of over-leveraging, and the current interest rate environment before making a decision.