Overview

FHA loans in Florida are designed with your needs in mind. They feature essential requirements like:

- A minimum credit score of 500

- Low down payments starting at just 3.5%

- Flexible debt-to-income ratios

This makes homeownership a real possibility for low- to moderate-income families. We understand how challenging this journey can be, and these loans significantly reduce financial barriers.

By offering competitive interest rates and streamlined refinancing options, FHA loans empower families to achieve their homeownership dreams. Imagine the relief of stepping into your own home, knowing you have the support you need. We’re here to guide you every step of the way, ensuring that you have access to the resources that can help make your dream a reality.

Introduction

FHA loans have long served as a crucial lifeline for families striving for homeownership, especially in Florida, where the dream of owning a home can often feel just out of reach. We understand how challenging this can be. These government-backed mortgages not only offer low down payment options but also cater to those facing credit challenges, making them an accessible choice for many families.

However, navigating the various requirements and benefits can be daunting. Potential borrowers may wonder: how can they effectively leverage FHA loans to their advantage in today’s housing market? This article delves into the key requirements and benefits of FHA loans in Florida, providing essential insights to empower you as you take the next step toward homeownership. We’re here to support you every step of the way.

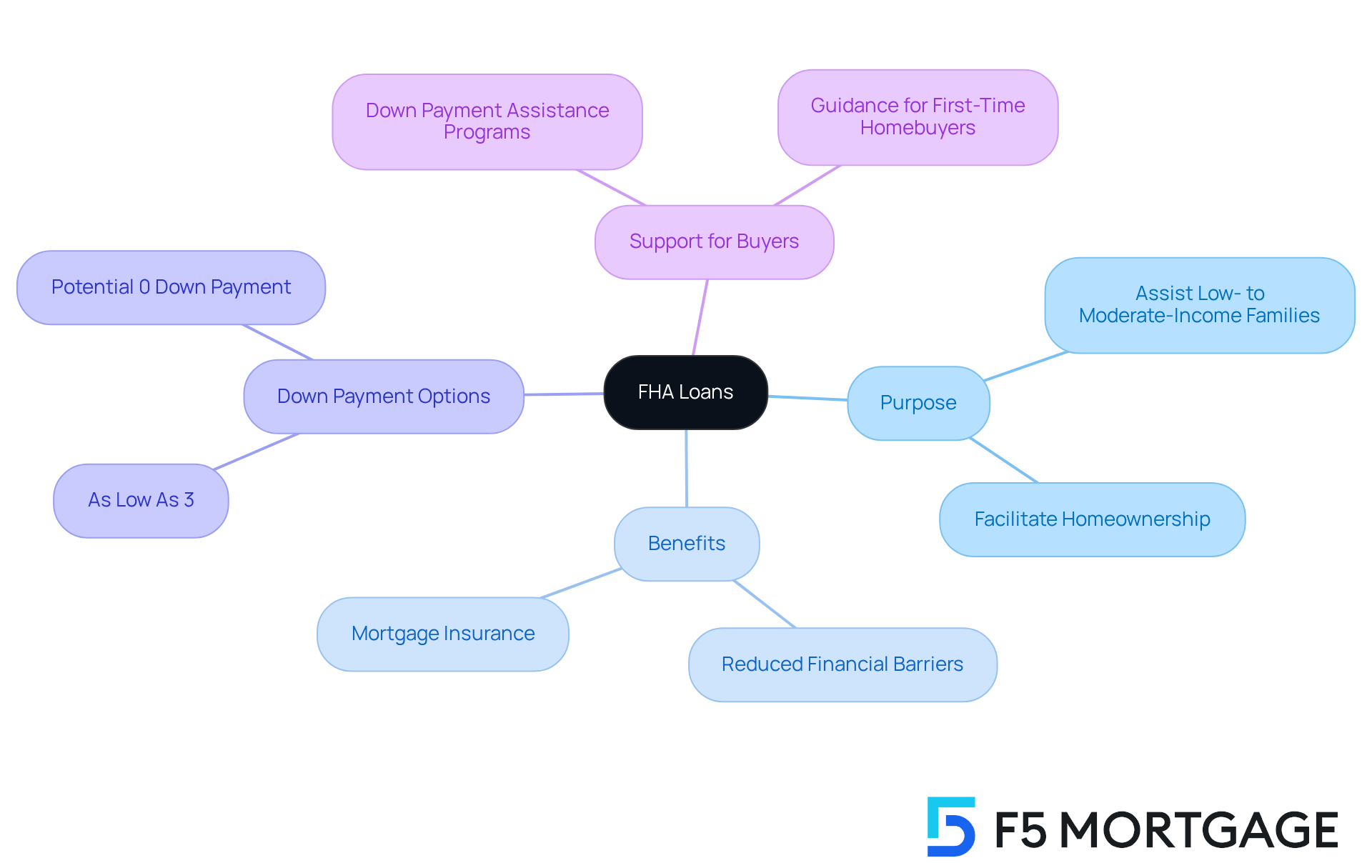

Define FHA Loans and Their Purpose

FHA mortgages, or Federal Housing Administration mortgages, are designed with your needs in mind. These government-supported financial products aim to assist low- to moderate-income families in achieving their dream of homeownership. Since their inception in 1934, FHA mortgages have helped countless families by offering reduced down payment options. For some eligible buyers, down payments can be as low as 3% or even 0%.

We understand how daunting the can be, especially for first-time homebuyers. This flexibility significantly lowers the financial barriers you may face. Additionally, FHA financing provides a safety net for lenders through mortgage insurance, which helps mitigate the risk of default. This makes FHA financing a viable option for individuals who might struggle to meet the criteria for conventional funding due to credit challenges or limited savings.

At F5 Mortgage, we are dedicated to supporting families on their home buying journey. We offer a variety of down payment assistance programs tailored to your needs. We know how challenging this can be, and we’re here to support you every step of the way. Let us help you navigate this process and find the right solution for your family.

Outline FHA Loan Requirements in Florida

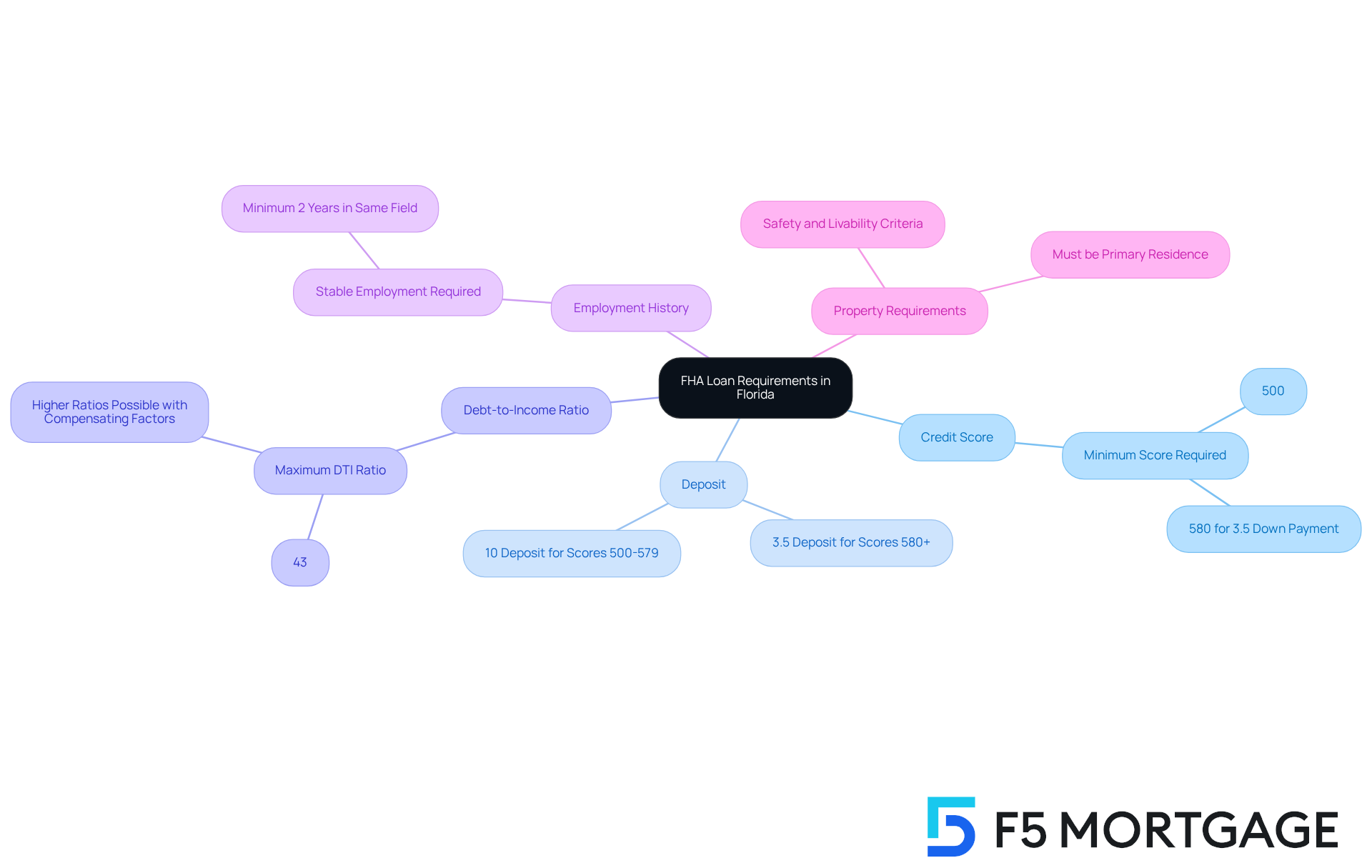

In Florida, we know how challenging it can be to navigate the requirements for securing an FHA loan max Florida mortgage. Understanding these key criteria is crucial for prospective homebuyers like you:

- Credit Score: A minimum credit score of 500 is required, but to qualify for the low initial cost of 3.5%, a score of at least 580 is necessary. FHA loans, particularly the fha loan max Florida, are especially advantageous for first-time home purchasers because of this reduced upfront cost alternative.

- Deposit: If your credit score is 580 or higher, you can make a deposit as low as 3.5% of the purchase price. For scores between 500 and 579, a 10% down payment is required, making FHA financing an accessible choice for many families.

- Debt-to-Income Ratio: The FHA typically allows a debt-to-income (DTI) ratio of up to 43%. However, some lenders may accept higher ratios with compensating factors, which can be beneficial for those with varying financial situations.

- Employment History: It’s important to demonstrate a stable employment history, typically requiring at least two years in the same field. This ensures that you have a reliable income source.

- Property Requirements: The property must meet specific safety and livability criteria established by the FHA, and it must be your primary residence. This ensures that families are investing in a safe and appropriate dwelling.

Additionally, understanding the fha loan max florida approval process is essential. An approval indicates that a lender has determined, based on your financial information, that you are a good candidate for a mortgage. This process can vary among lenders, and some may refer to it as a ‘preapproval’ or ‘prequalification’. Compared to VA options, FHA products provide distinct advantages, especially for first-time homebuyers, positioning them as a practical choice for families seeking to acquire a home. We’re here to support you every step of the way.

Detail Financial Criteria for FHA Loans

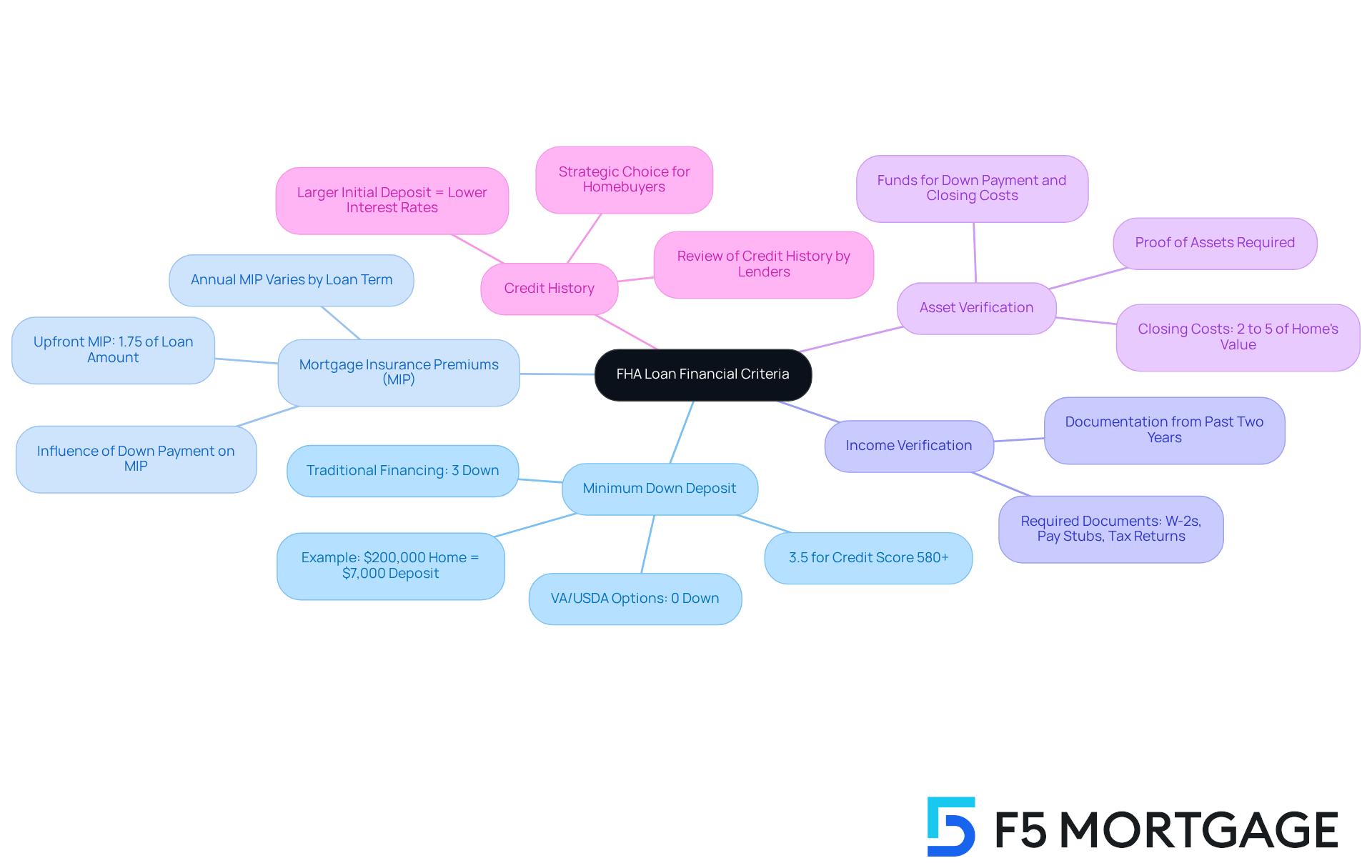

Navigating the can feel overwhelming, but we’re here to support you every step of the way. Let’s break down what you need to know:

- Minimum Down Deposit: For borrowers with a credit score of 580 or higher, a down payment of 3.5% is required. For example, if you’re looking to purchase a $200,000 home, this means a $7,000 deposit. It’s worth noting that traditional financing may require as little as 3% down for well-qualified buyers, and VA and USDA options can even allow for 0% down.

- Mortgage Insurance Premiums (MIP): FHA loans come with both an upfront MIP (1.75% of the loan amount) and an annual MIP, which can vary based on the loan term and amount. The amount of your down payment can influence the need for mortgage insurance, so it’s essential to consider this when planning your finances.

- Income Verification: To secure an FHA loan, you’ll need to provide documentation of your income. This includes W-2 forms, pay stubs, and tax returns from the past two years. We know how challenging this can be, but gathering these documents is a crucial step in the process.

- Asset Verification: Lenders may ask for proof of assets to ensure you have enough funds for the down payment and closing costs, which typically range from 2% to 5% of the home’s value. Having this information ready can ease some of the stress associated with the mortgage process.

- Credit History: While FHA financing is generally more lenient regarding credit scores, lenders will still review your credit history to assess your reliability in repaying debts. Remember, a larger initial deposit can lead to reduced interest rates and lower monthly payments, making it a strategic choice for many homebuyers.

By understanding these criteria, you’ll be better equipped to navigate the FHA loan process with confidence.

Explore Benefits of FHA Loans in Florida

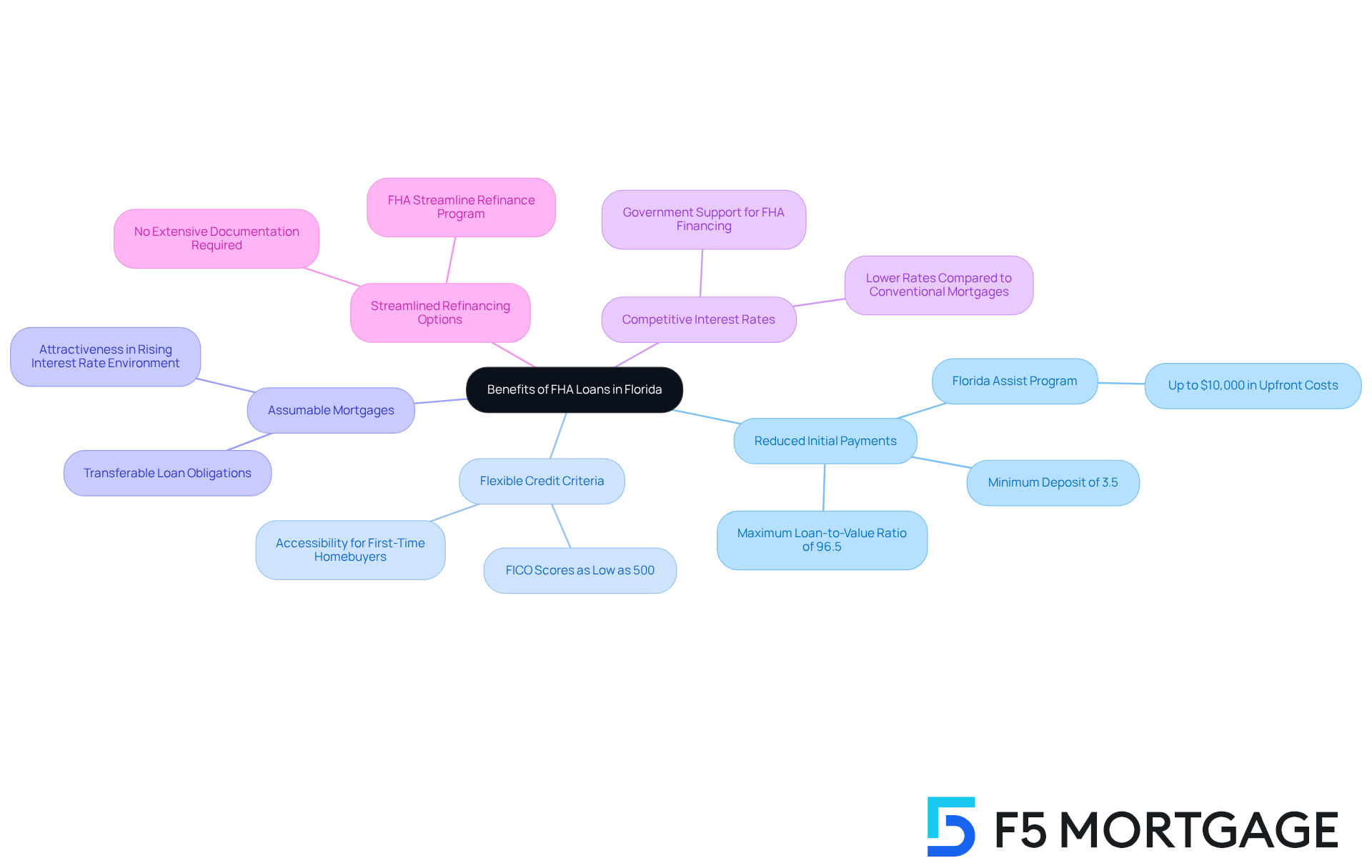

FHA loan max Florida provides numerous advantages for borrowers, making it an appealing choice for many families.

- Reduced Initial Payments: We understand how daunting it can be to save for a home. With a minimum deposit of just 3.5%, significantly reduce the barriers to property ownership. This accessibility has helped many families realize their dream of homeownership. The maximum loan-to-value ratio of 96.5% allows borrowers to finance a large portion of their home purchase. Programs like Florida Assist even provide up to $10,000 in upfront costs, enhancing affordability for homebuyers.

- Flexible Credit Criteria: We know that financial challenges can happen to anyone. FHA financing accommodates borrowers with imperfect credit, accepting FICO scores as low as 500. This flexibility opens doors for first-time homebuyers and those who may have faced difficulties in the past.

- Assumable Mortgages: One unique feature of FHA financing is their assumability. This means that if the original borrower sells the property, future purchasers can take over the obligation. In a rising interest rate environment, this can make homes more attractive to potential buyers, providing peace of mind to sellers.

- Competitive Interest Rates: We recognize the importance of managing long-term financial commitments. FHA mortgages generally offer lower interest rates compared to conventional mortgages, leading to significant savings over time. The government’s support of FHA financing contributes to these competitive rates, providing additional security for lenders.

- Streamlined Refinancing Options: Life can change unexpectedly, and the FHA’s streamlined refinancing program helps borrowers reduce their monthly expenses without extensive documentation or an appraisal. This allows homeowners to adjust their financial strategies as needed. Borrowers must utilize the funds to buy, construct, or refinance a primary residence, ensuring that resources are directed toward essential housing needs.

Real-life stories highlight the impact of these benefits. Families who once struggled to save a 20% down payment have successfully acquired properties with FHA assistance, showcasing how these resources can truly transform lives. Additionally, with over 2,000 homeownership assistance programs available to enhance FHA financing—like the MyHome Assistance Program from California and the My Choice Texas Home program—many borrowers can further decrease their expenses, making homeownership even more attainable.

In summary, the FHA loan max Florida not only provides crucial financial assistance but also empowers families in Florida to navigate the complexities of purchasing property with confidence and ease. The exceptional customer satisfaction reported by clients of F5 Mortgage underscores the effectiveness of these programs. Many have shared positive experiences in securing their homes with the support of dedicated professionals. We’re here to support you every step of the way.

Guide to Applying for an FHA Loan in Florida

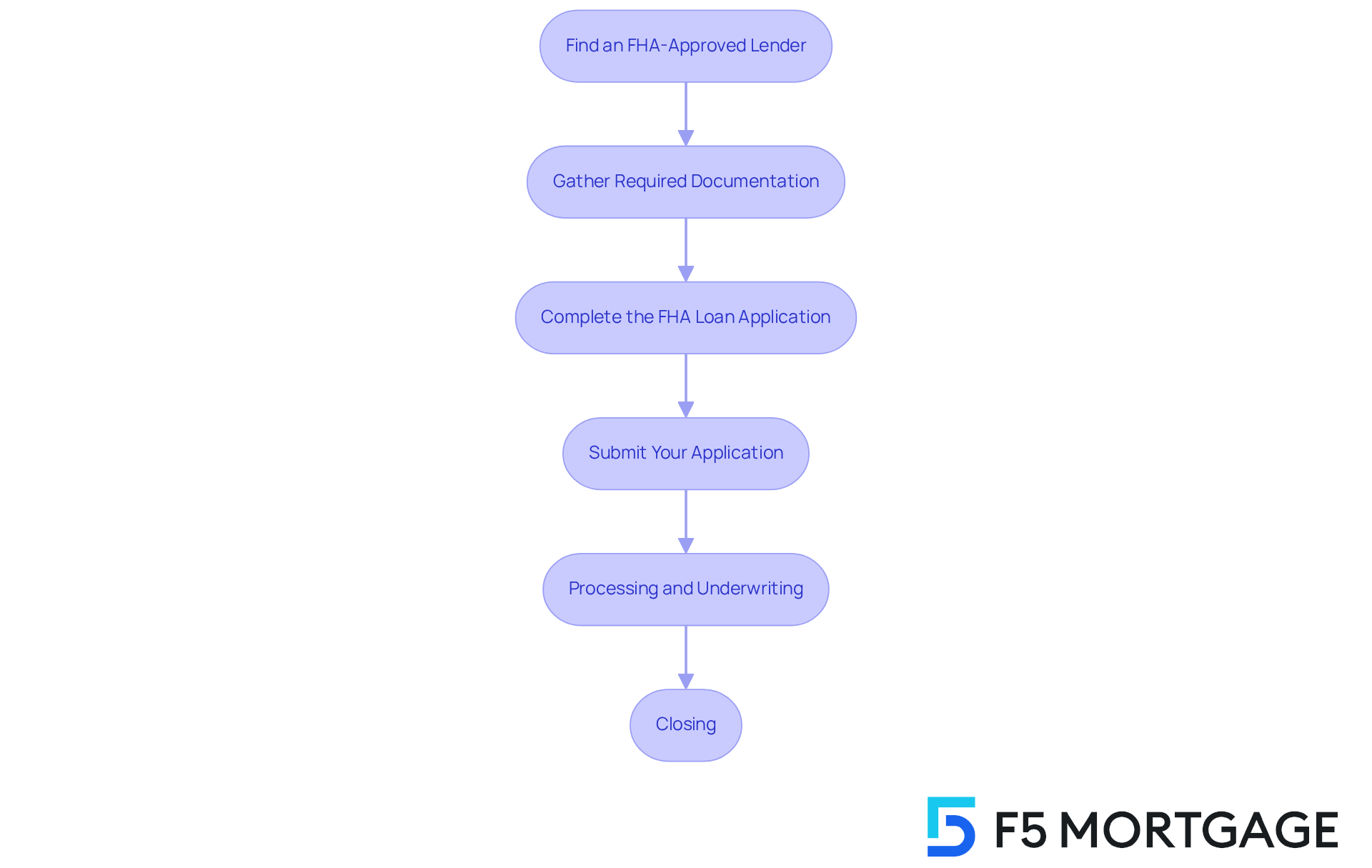

Applying for an FHA loan max Florida can feel overwhelming, but we are here to support you every step of the way. Here’s a simple guide to help you navigate the process with confidence:

- Find an FHA-Approved Lender: Start by researching and selecting a lender approved by the FHA. You can find a list of on the HUD website, making it easier to choose the right one for you.

- Gather Required Documentation: Prepare your financial documents, including proof of income, credit history, and asset verification. We know how challenging this can be, but having everything ready will streamline your application.

- Complete the FHA loan max Florida Financing Application: Fill out the FHA financing application form with accurate information about your financial situation and the property you wish to acquire. Take your time to ensure all details are correct.

- Submit Your Application: Once your application and required documentation are ready, submit them to your chosen lender. This is an important step, so double-check that everything is in order.

- Financing Processing and Underwriting: After submission, the lender will process your application, conduct an appraisal, and underwrite the financing to assess your eligibility. This stage can take some time, but it’s crucial for your approval.

- Closing: If approved, you will move on to the closing stage, where you’ll sign the necessary documents and finalize the loan. This is a significant milestone, and soon you’ll be on your way to homeownership!

Conclusion

FHA loans are a crucial resource for individuals and families aspiring to achieve homeownership, especially in Florida. We understand how daunting this journey can feel, but by familiarizing yourself with the requirements and benefits of these loans, you can navigate the financial landscape with renewed confidence. With lower down payment options and flexible credit criteria, FHA loans aim to dismantle barriers, making homeownership a reality for many.

In this article, we’ve explored key aspects of FHA loans, including essential requirements like credit scores, down payments, and debt-to-income ratios. The advantages of FHA financing—such as reduced initial payments, competitive interest rates, and streamlined refinancing options—underscore how these loans can significantly ease your path to owning a home. Real-life success stories highlight the transformative power of FHA loans for families who once thought homeownership was beyond their reach.

Considering these insights, it’s vital for potential homebuyers to view FHA loans as a viable option in their quest for homeownership. By leveraging these benefits and understanding the application process, families can take meaningful steps toward securing their dream homes. Remember, support from professionals, like those at F5 Mortgage, can enhance this journey, ensuring that every family has the opportunity to thrive in their new home.

Frequently Asked Questions

What are FHA loans and their purpose?

FHA loans, or Federal Housing Administration mortgages, are government-supported financial products designed to assist low- to moderate-income families in achieving homeownership. They offer reduced down payment options, with some eligible buyers able to put down as little as 3% or even 0%.

Who can benefit from FHA loans?

FHA loans are particularly beneficial for first-time homebuyers and individuals who may struggle to meet the requirements for conventional funding due to credit challenges or limited savings.

What are the key requirements for securing an FHA loan in Florida?

Key requirements for FHA loans in Florida include:

- A minimum credit score of 500, with at least 580 required for a 3.5% down payment.

- A down payment of 3.5% for credit scores of 580 or higher, and 10% for scores between 500 and 579.

- A debt-to-income (DTI) ratio of up to 43%, with some lenders accepting higher ratios under certain conditions.

- A stable employment history, typically requiring at least two years in the same field.

- The property must meet safety and livability criteria and must be the borrower’s primary residence.

What is the approval process for FHA loans in Florida?

The approval process for FHA loans involves lenders determining, based on your financial information, whether you are a good candidate for a mortgage. This process may be referred to as ‘preapproval’ or ‘prequalification’ and can vary among lenders.

How do FHA loans compare to VA loans?

FHA loans provide distinct advantages for first-time homebuyers compared to VA loans, making them a practical choice for families seeking to acquire a home.