Overview

This article offers essential insights into rural development loans for families, focusing on their accessibility and the benefits they provide in promoting homeownership in rural areas. We understand how challenging this can be, and we’re here to support you every step of the way.

Various loan programs, such as the USDA Rural Development Guaranteed Loan and Direct Home Loan programs, are outlined to help you navigate your options. These programs feature:

- No down payment

- Competitive interest rates

- Tailored assistance

These are designed to support low- to moderate-income households in achieving their homeownership dreams.

By exploring these opportunities, families can find the right solutions to overcome barriers and step into their new homes with confidence. We know that homeownership is more than just a roof over your head; it’s about building a future for you and your loved ones. Let’s take this journey together.

Introduction

Rural development loans are essential for transforming homeownership for families in underserved areas. These financial tools not only open doors to affordable housing but also empower households to invest in their communities, fostering growth and stability.

Yet, we know how challenging navigating the complexities of these loans can be. Many families may wonder how to effectively leverage these opportunities. What essential insights can guide you through the process of securing rural development loans and ultimately enhance your quality of life?

We’re here to support you every step of the way.

F5 Mortgage: Your Partner for Rural Development Loan Solutions

F5 Mortgage LLC is a compassionate partner for families seeking development financing, known for its unwavering commitment to client satisfaction and personalized mortgage services. We understand how challenging the mortgage process can be, which is why our brokerage offers customized consultations and a variety of financing options, particularly emphasizing rural development loans designed to promote homeownership in rural areas.

Our dedicated team of mortgage advisors brings unique expertise and a personal touch, always prioritizing your interests. We strive to ensure that families receive the best financing solutions tailored to their specific circumstances. By leveraging cutting-edge technology, F5 Mortgage simplifies the loan process, making your journey toward homeownership smoother and more accessible.

This commitment to personalized service and innovative solutions makes F5 Mortgage a trusted ally in navigating the complexities of rural development loans. Client testimonials reflect the exceptional service and satisfaction experienced by families, reinforcing our promise of a hassle-free mortgage process through user-friendly technology and tailored assistance.

As Agriculture Secretary Tom Vilsack expressed, ‘Rural America is a place everyone can call home,’ and at F5 Mortgage, we are here to support you every step of the way in making that dream a reality for your household.

USDA Rural Development Guaranteed Loan Program: Benefits and Eligibility

Navigating the journey to homeownership can be challenging, but rural development loans through the USDA Rural Development Guaranteed Loan Program are here to help. This program offers numerous benefits for eligible borrowers, such as:

- No down payment

- Competitive interest rates

- Flexible credit requirements

We understand that every family’s situation is unique, which is why applicants must meet specific income limits that vary by location and household size.

This program is designed to support low- to moderate-income households by offering rural development loans, making homeownership more attainable in eligible rural regions. We know how daunting it can feel to secure financing, and this initiative aims to alleviate those concerns. At F5 Mortgage, we are committed to providing a range of financing choices, ensuring that families have access to the solutions that best meet their needs.

We’re here to support you every step of the way, helping you find the right path to your dream home.

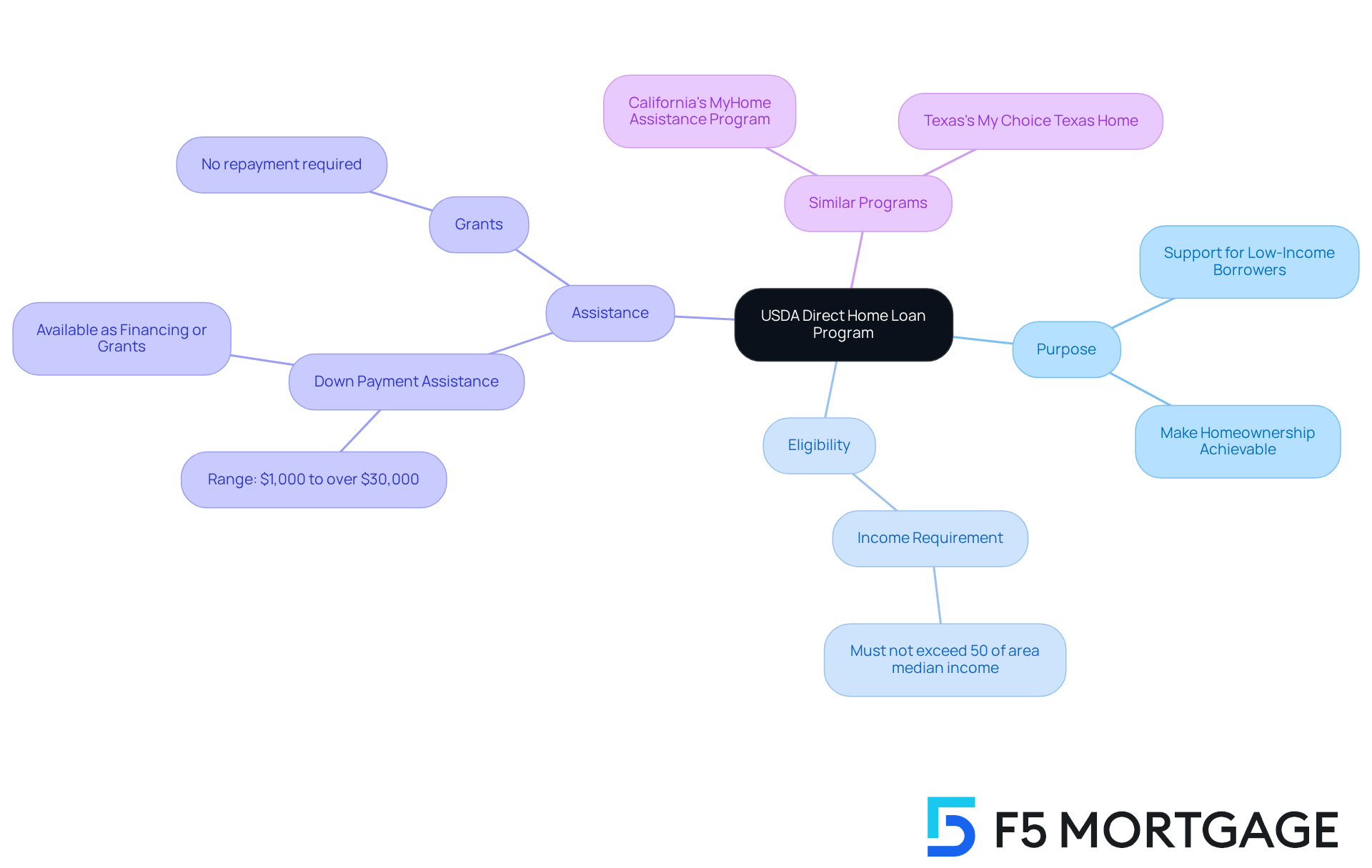

USDA Direct Home Loan Program: A Pathway for Low-Income Borrowers

The USDA Direct Home Loan Program is a compassionate initiative designed specifically for low-income borrowers, offering them a chance to purchase a home without overwhelming financial strain. This program provides vital payment assistance to help lower monthly mortgage costs, making the dream of homeownership more achievable. We understand how challenging this can be, and that’s why eligible applicants must have an income that does not exceed 50% of the area median income—ensuring that support reaches those who need it most.

In Ohio, down payment assistance can range from a few thousand dollars to over $30,000, available as either financing or grants. While some financial assistance may require repayment or forgiveness over time, grants stand out as they do not necessitate payback, making them an attractive option for first-time homebuyers.

Similar programs in other states include:

- California’s MyHome Assistance Program

- Texas’s My Choice Texas Home program

These options showcase the variety of assistance available and are tailored to meet the unique needs of families looking to upgrade their homes. We’re here to support you every step of the way as you navigate these opportunities.

USDA Loan Qualifications: Key Requirements for Applicants

Navigating the world of government-backed mortgages can feel overwhelming, but we’re here to support you every step of the way. To qualify, applicants must meet a few essential criteria. This includes:

- Being a U.S. citizen or lawful resident

- Having a stable income

- Demonstrating a satisfactory credit history

Additionally, the property must be located in an eligible countryside area to qualify for rural development loans, and your household income should fall within the limits set by the Department of Agriculture. We know how challenging this can be, but understanding these qualifications is crucial for families looking to take advantage of the benefits that government-backed financing offers.

Take the time to review these requirements, and remember, we’re here to help you achieve your homeownership dreams.

Property Eligibility for USDA Loans: What You Need to Know

If you’re considering rural development loans, it’s important to know that your property must be located in a designated rural zone as defined by the agency. We understand how overwhelming this process can feel, but rest assured, your home must serve as your primary residence and meet specific safety and structural standards. Additionally, it’s crucial to keep in mind that properties cannot exceed the maximum financing limits set by the agency, which vary by location.

To help you navigate this journey, potential purchasers can utilize the property eligibility map from the Department of Agriculture. This tool is designed to empower you by allowing you to check if a particular home meets these important standards. We’re here to support you every step of the way as you explore your options and make informed decisions.

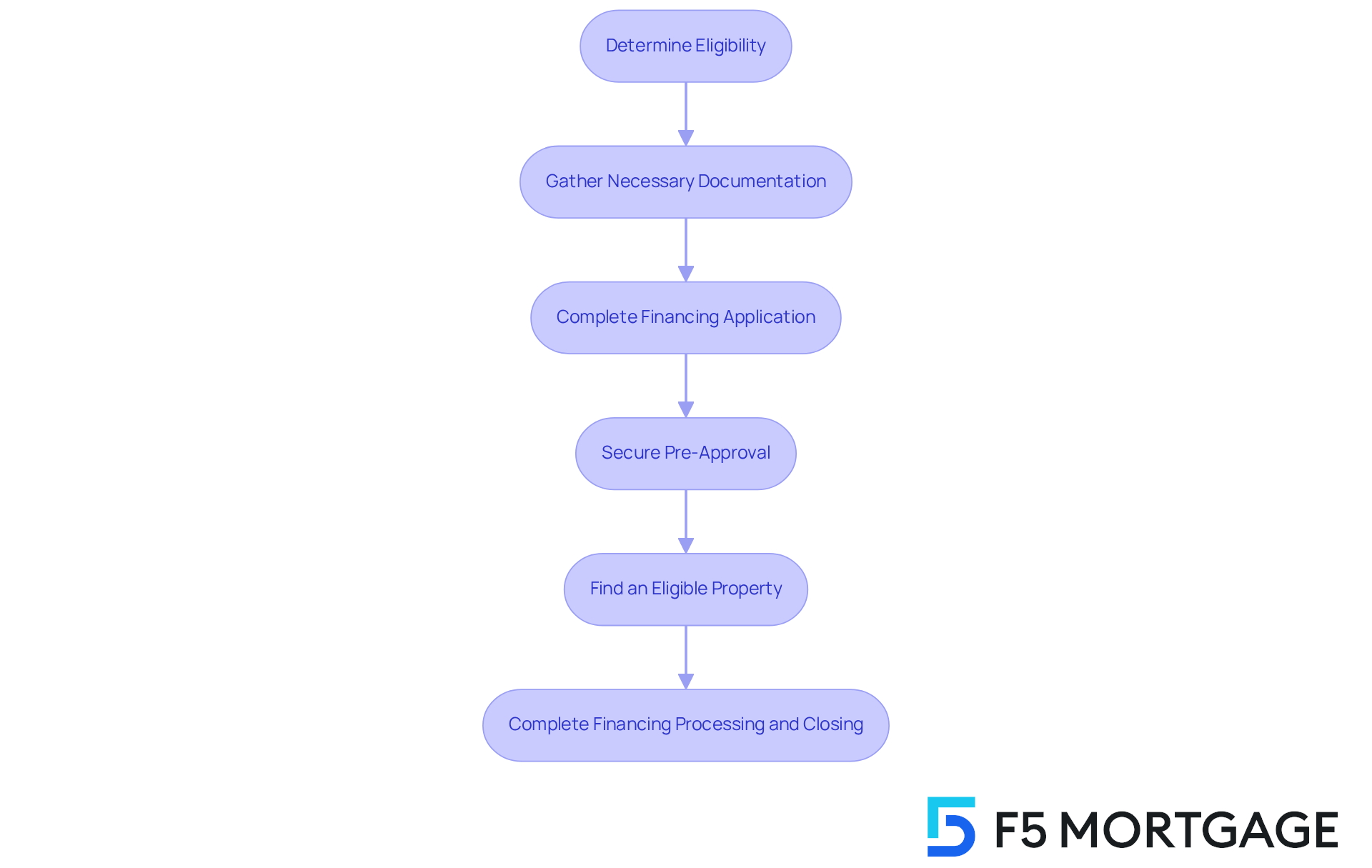

How to Apply for USDA Rural Development Loans: Step-by-Step Guide

Applying for rural development loans through USDA can feel overwhelming, but we’re here to support you every step of the way. Let’s break it down into manageable steps:

-

Determine your eligibility. Review income limits and property requirements. Remember, a maximum Debt-to-Income (DTI) ratio of 43% is typically required for home financing.

-

Gather necessary documentation. Collect proof of income, tax returns, and credit history. These documents are crucial for assessing your financial standing.

-

Complete the financing application. Work with an approved lender like F5 Mortgage, which offers a variety of standard and nontraditional options to suit your needs.

-

Secure pre-approval. Collaborating with your lender to get pre-approved can significantly enhance your chances of success in today’s competitive housing market.

-

Find an eligible property. Once you identify the right home, make your offer with confidence.

-

Complete the financing processing and closing steps. Following these steps can simplify the application process and increase your likelihood of approval.

We understand how challenging this can be, but utilizing the various financing options available through F5 Mortgage, such as rural development loans, can make a difference. Take these steps to empower yourself in the journey towards homeownership.

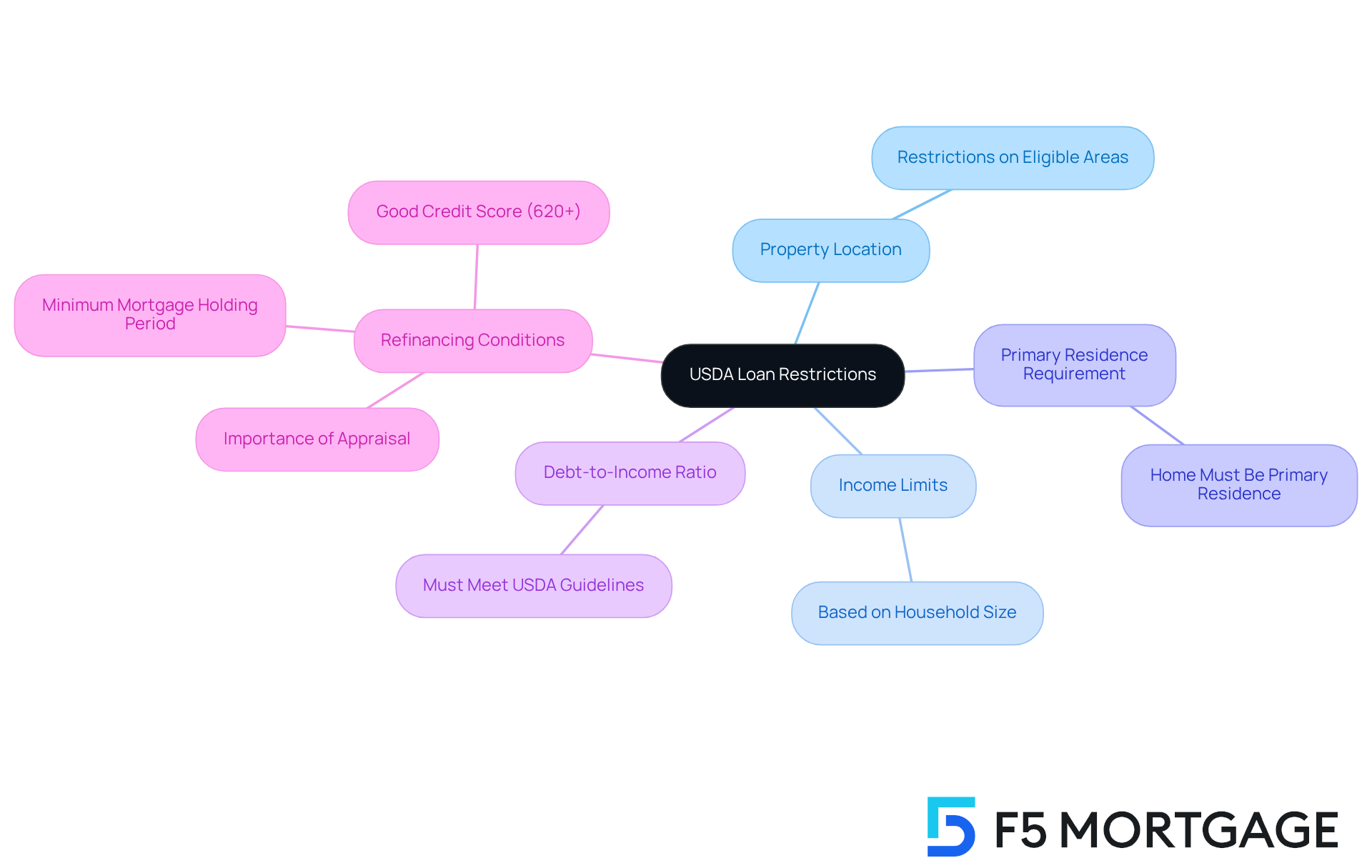

USDA Loan Restrictions: Important Considerations for Borrowers

While government-backed mortgages offer many advantages, it’s important for borrowers to recognize their limitations. These can include:

- Restrictions on where the property is located

- Income limits based on household size

- The requirement that the home serves as a primary residence

Additionally, to qualify, borrowers must maintain a debt-to-income ratio within USDA guidelines.

For families considering refinancing, understanding that eligibility criteria can vary by lender and type of financing is crucial. In Colorado, for instance, some lenders may require homeowners to have held their existing mortgage for a minimum period before refinancing. A good credit score, typically at least 620 for most lenders, is essential. Furthermore, an appraisal plays a critical role in the refinancing process, as it can influence eligibility.

Being aware of these restrictions and requirements can empower households to better prepare for the application process. We know how challenging this can be, and we’re here to support you every step of the way.

Personalized Mortgage Consultations: How F5 Mortgage Supports Your Journey

At F5 Mortgage, we understand how challenging it can be to navigate the complexities of securing rural development loans. That’s why we offer tailored mortgage consultations designed to meet the unique needs of each household. During these consultations, our clients receive personalized advice that reflects their individual financial situations and homeownership goals.

Our skilled team at F5 Mortgage, including dedicated financing officers like Alyssa and Jeff, takes the time to truly understand each client’s requirements. We ensure that you are well-informed about your options and the financing process, so you can make confident choices regarding your mortgage. This personalized approach not only empowers families but also highlights our commitment to exceptional customer satisfaction and a hassle-free experience.

Clients consistently praise our team for their attention to detail and supportive guidance, which contributes to a fast loan closing process—typically completed in under three weeks. Additionally, we offer down payment assistance programs to further support families in achieving their homeownership dreams. Remember, we’re here to support you every step of the way.

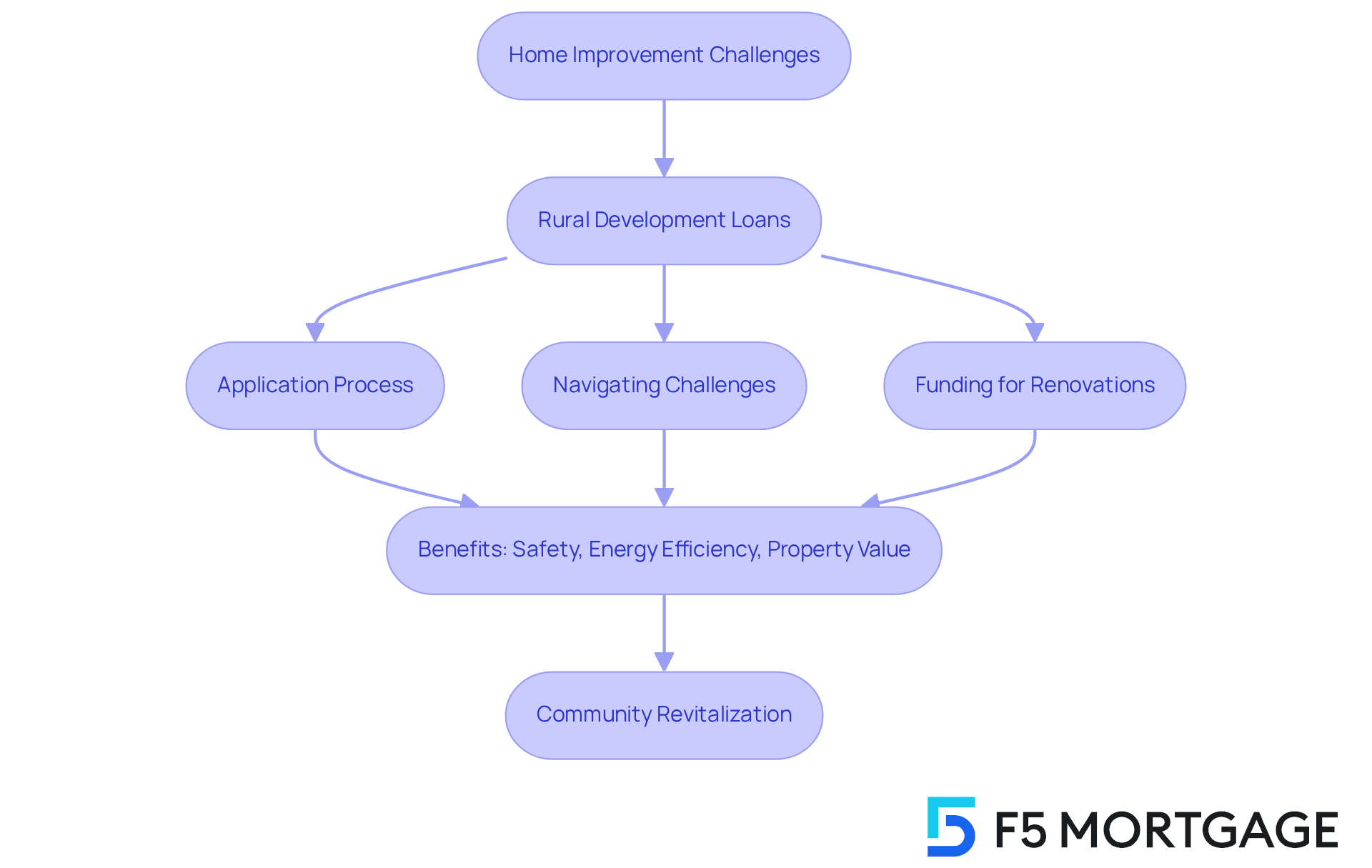

Overcoming Home Improvement Challenges with Rural Development Loans

Families in countryside regions often face considerable challenges regarding home enhancements. We understand how restricted funding choices and elevated expenses linked to renovations can weigh heavily on your shoulders. Rural development loans serve as an essential resource, providing funds specifically for necessary repairs and enhancements. These financial products empower borrowers to upgrade their homes, funding improvements that enhance safety, energy efficiency, and overall property value, ultimately fostering more comfortable and sustainable living environments.

The impact of USDA financing on home renovation projects is truly profound. Many families have successfully utilized these financial resources to transform outdated properties into modern, energy-efficient residences. This transformation not only improves the quality of life for residents but also contributes to the rejuvenation of local communities. As the countryside housing market is expected to see moderate growth, the role of government-backed financing becomes increasingly important in facilitating these improvements.

However, challenges remain. Property owners in rural areas often encounter unique hurdles, such as navigating intricate application procedures and collaborating with contractors who may be unfamiliar with specific financing criteria. Additionally, increased levels of poverty in these regions can limit housing demand, making it even more crucial for families to access these financial resources. Despite these obstacles, the benefits of securing government funding for renovations, such as rural development loans, far outweigh the difficulties, as it opens doors to vital improvements that might otherwise be financially unreachable.

Experts in home remodeling emphasize that USDA financing can significantly enhance the chances of successful renovations. Carl Holman, Communications Manager, notes, “Mortgage brokers can be at the forefront of these efforts, contributing not only to their clients’ success but also to the economic revitalization and long-term sustainability of America’s countryside.” By providing accessible funding, these financial products enable households to invest in their homes, fostering a sense of pride and stability within their communities. As more families seize these opportunities, the positive ripple effects on countryside housing markets become increasingly clear.

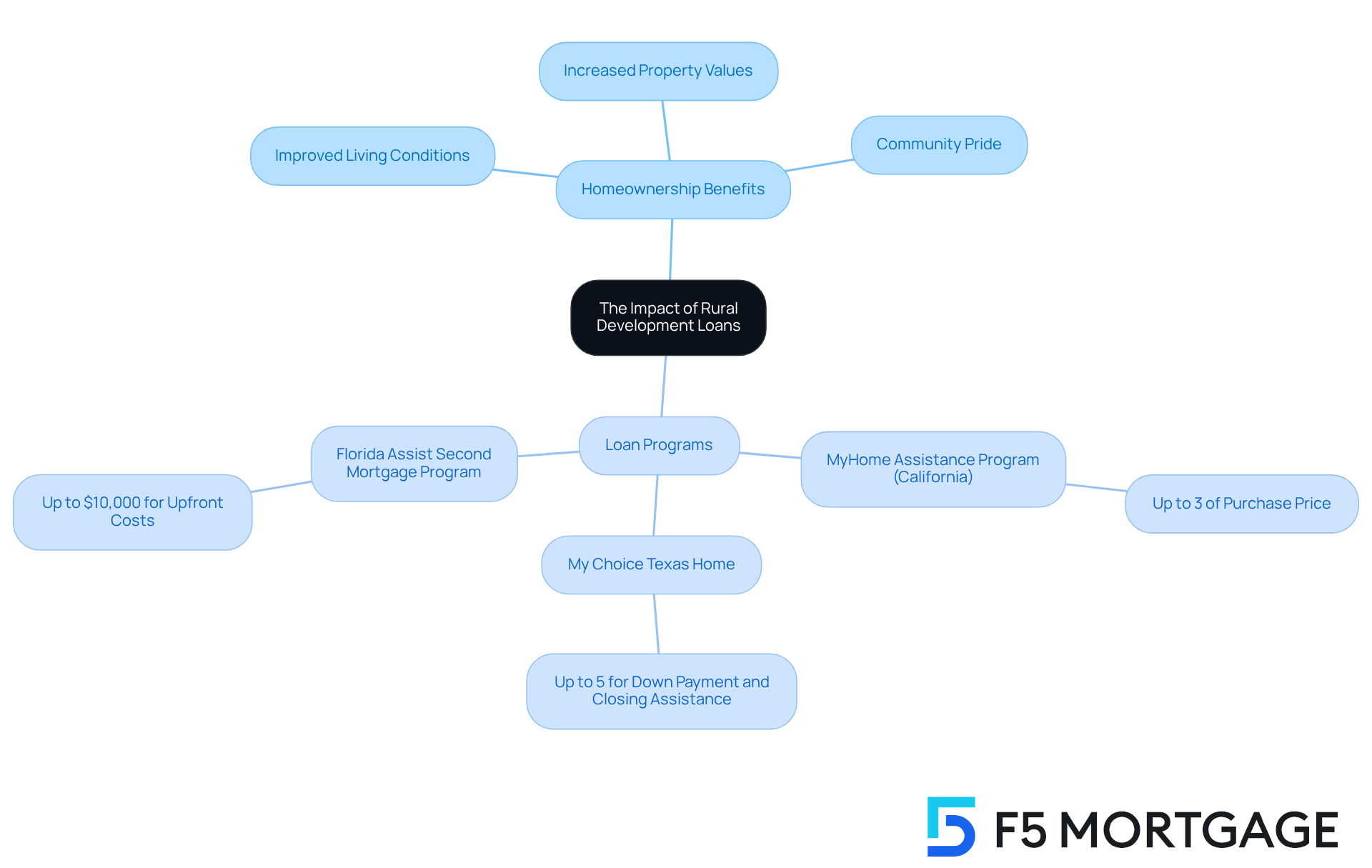

The Impact of Rural Development Loans: Building Stronger Communities

Rural development loans are essential in nurturing stronger communities by fostering homeownership and improving living conditions in rural areas. We understand how challenging this can be, and by providing access to affordable financing, these loans empower households to invest in their homes and communities.

F5 Mortgage offers various down payment assistance programs tailored to your needs. For instance:

- The MyHome Assistance Program in California provides up to 3% of the home’s purchase price.

- The My Choice Texas Home program offers up to 5% for down payment and closing assistance.

- In Florida, the Florida Assist Second Mortgage Program can provide up to $10,000 to help with upfront costs.

These initiatives significantly enhance home purchasing options for families, making it easier for them to secure stable housing. As families benefit from these programs, the overall economic health of rural regions flourishes, leading to increased property values and a greater sense of community pride.

The impact of rural development loans extends beyond individual recipients, fostering a sense of belonging and stability in rural communities. Our clients consistently express exceptional satisfaction, praising F5 Mortgage for its expert guidance and unwavering support throughout the loan process. We’re here to support you every step of the way, reinforcing our commitment to a client-centric approach in home financing.

Conclusion

Rural development loans play a pivotal role in empowering families and enhancing community stability by making homeownership more accessible. These financial solutions, particularly through programs like the USDA Guaranteed and Direct Home Loan Programs, are designed to alleviate the financial burdens that many families face. By enabling them to invest in their homes, these loans allow families to contribute positively to their neighborhoods.

In this article, we’ve shared key insights regarding the benefits and eligibility requirements of various rural development loan programs. With options like no down payment and flexible credit requirements, along with personalized consultations offered by F5 Mortgage, families are equipped with the knowledge and resources needed to navigate the complexities of securing a mortgage. Understanding property eligibility criteria and application processes further demystifies the journey toward homeownership, ensuring families can make informed decisions.

The broader implications of rural development loans extend beyond individual households. They foster a sense of belonging and community pride, contributing to the overall economic health of rural areas. As families seize these opportunities for homeownership, they not only transform their living conditions but also spark positive changes within their communities. Engaging with experts like F5 Mortgage provides invaluable support, making the dream of homeownership a reality for many.

Embracing these financial resources is a step toward building stronger, more resilient communities for the future. We know how challenging this can be, and we’re here to support you every step of the way. Take the first step toward homeownership today and explore the possibilities that await you.

Frequently Asked Questions

What is F5 Mortgage and what services do they offer?

F5 Mortgage LLC is a brokerage that specializes in providing personalized mortgage services, particularly focusing on rural development loans to promote homeownership in rural areas. They offer customized consultations and a variety of financing options to meet client needs.

How does F5 Mortgage simplify the loan process?

F5 Mortgage leverages cutting-edge technology to streamline the loan process, making the journey toward homeownership smoother and more accessible for families.

What is the USDA Rural Development Guaranteed Loan Program?

The USDA Rural Development Guaranteed Loan Program is designed to help eligible borrowers achieve homeownership by offering benefits such as no down payment, competitive interest rates, and flexible credit requirements.

Who is eligible for the USDA Rural Development Guaranteed Loan Program?

Eligibility for the USDA Rural Development Guaranteed Loan Program is based on specific income limits that vary by location and household size, primarily targeting low- to moderate-income households.

What is the USDA Direct Home Loan Program?

The USDA Direct Home Loan Program is aimed at low-income borrowers, providing vital payment assistance to lower monthly mortgage costs and making homeownership more achievable.

What are the income requirements for the USDA Direct Home Loan Program?

Eligible applicants for the USDA Direct Home Loan Program must have an income that does not exceed 50% of the area median income.

What kind of down payment assistance is available in Ohio?

In Ohio, down payment assistance can range from a few thousand dollars to over $30,000, offered as either financing or grants, with grants not requiring repayment.

Are there similar assistance programs available in other states?

Yes, similar assistance programs exist in other states, such as California’s MyHome Assistance Program and Texas’s My Choice Texas Home program, providing tailored options for families seeking to upgrade their homes.