Overview

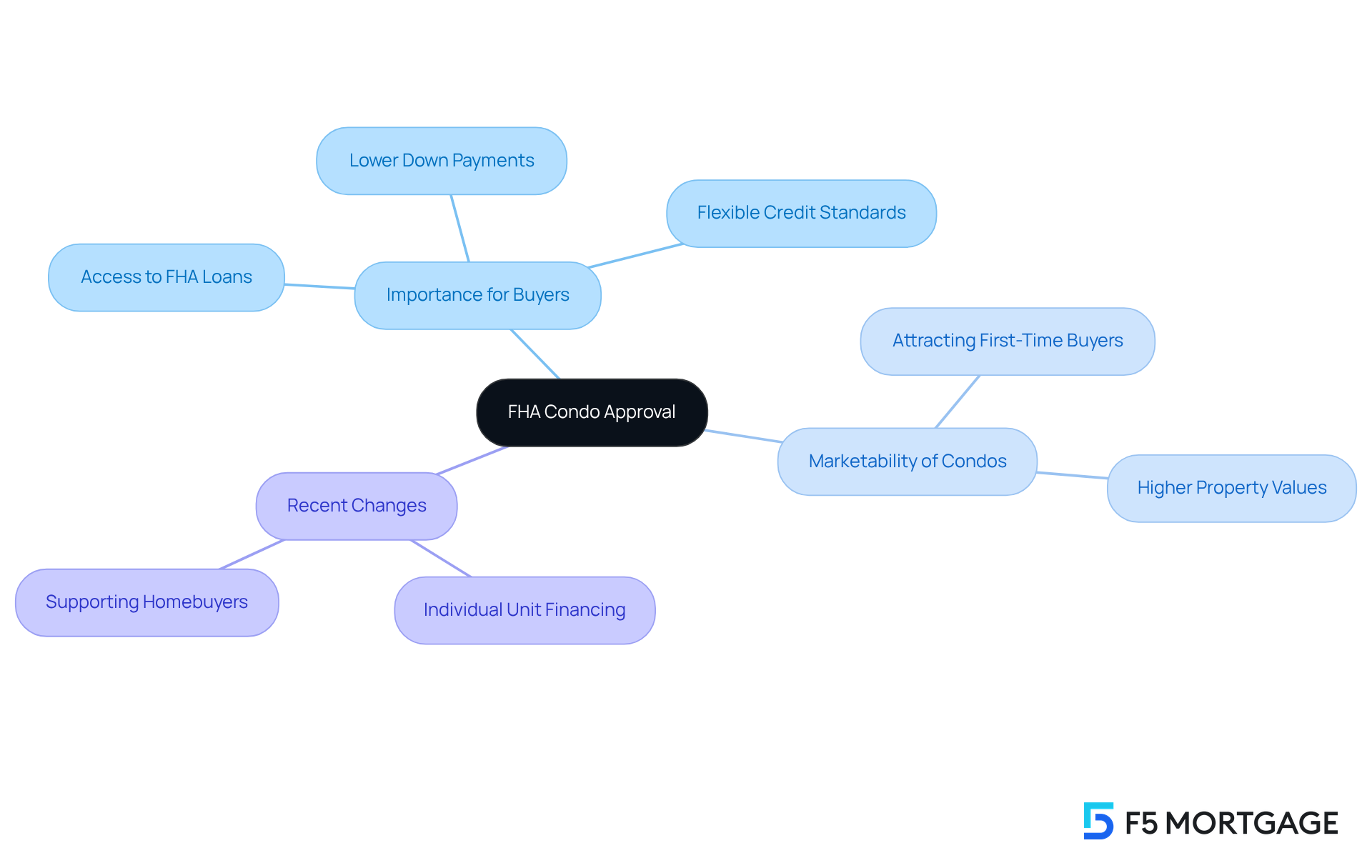

The FHA condo approval list plays a vital role in helping families navigate the complexities of purchasing a condominium. We know how challenging this can be, and this approval ensures that condominium projects meet specific financing criteria. As a result, buyers can access FHA-insured loans with favorable terms, making their dream of homeownership more attainable.

This approval not only enhances the marketability and property values of condos, but it also provides crucial financial stability and options for prospective buyers. For many, especially first-time homeowners, these options can make a significant difference in their journey toward securing a home. We’re here to support you every step of the way as you explore these opportunities.

Introduction

The FHA condo approval list is a vital resource for potential homebuyers, especially those embarking on their journey as first-time purchasers. It opens the door to favorable financing options through FHA-insured loans, which can make a significant difference in your home-buying experience. This important endorsement not only boosts the marketability of condominium projects but also reflects a commitment to quality that appeals to a diverse range of buyers.

However, we understand that navigating the complexities of FHA approval requirements can feel overwhelming. What are the essential steps and criteria that determine whether a condo qualifies? Recognizing these elements is crucial for anyone looking to make informed decisions in today’s competitive real estate landscape. We’re here to support you every step of the way as you explore your options and find the right home for you.

Define FHA Condo Approval and Its Importance

The FHA condo approval list is a crucial process where the Federal Housing Administration (FHA) evaluates and certifies that a condominium project meets specific financing criteria. This endorsement is vital because it opens the door for purchasers to access FHA-insured loans. These loans are particularly appealing to first-time homebuyers, as they often require a reduced down payment—sometimes as low as 3%—and offer more flexible credit standards. Without being included on the FHA condo approval list, prospective buyers may find their financing options limited, making the journey to acquire a condo more challenging.

Moreover, condos that are part of the FHA condo approval list tend to be more marketable. They attract a wider range of buyers, especially first-time homebuyers who benefit from lower financial barriers. The presence of the FHA condo approval list not only enhances the appeal of a condominium project but also signals a commitment to quality and stability. This can create a strategic advantage for communities striving to grow and thrive in the competitive real estate market.

Communities with FHA endorsement often see rising property values due to the larger pool of potential buyers. This can lead to higher sales prices for all unit owners, which is a positive outcome for everyone involved. As Ben Carter points out, ‘Communities with FHA endorsement often experience a rise in property values.’ This is largely attributed to the increased interest from buyers and the perception of quality and adherence to FHA standards. This dynamic underscores the importance of obtaining the FHA condo approval list, as it directly influences both marketability and financial stability for condominium developments.

Additionally, starting October 15, the FHA will begin insuring mortgages for individual condominium units in unapproved developments. This change is set to further expand financing options for buyers, making it easier for families to find their ideal home. We know how challenging this can be, and we’re here to support you every step of the way.

Outline FHA Approval Requirements for Condominiums

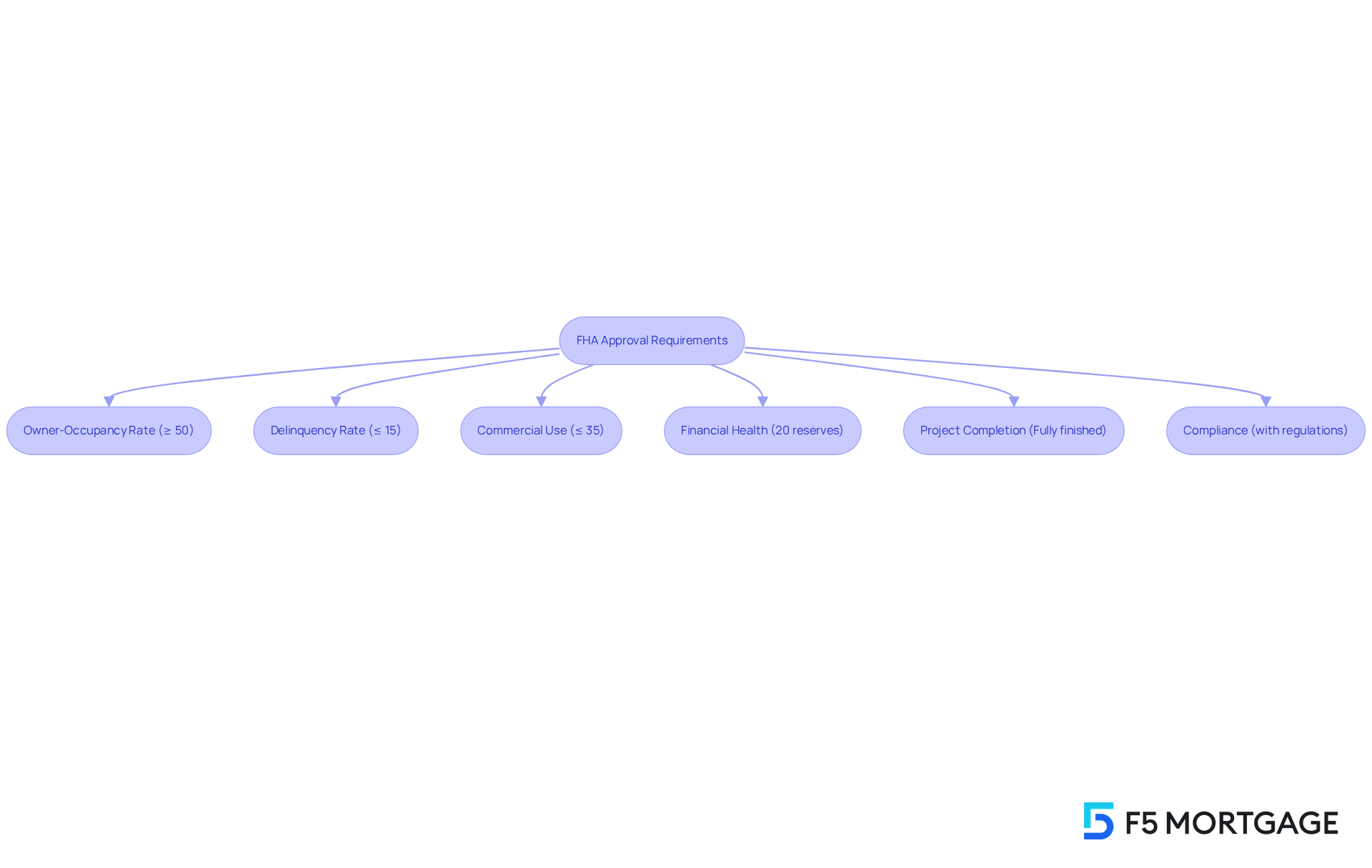

Securing FHA approval for a condominium project involves meeting several essential criteria, and we understand how important this is for you.

- Owner-Occupancy Rate: At least 35% of the units must be owner-occupied, with a minimum of 50% required for FHA approval. This ensures a stable community and reduces the risk of default on FHA-backed loans, which is vital for your peace of mind.

- Delinquency Rate: No more than 15% of owners can be more than 60 days delinquent on their homeowner dues. This helps maintain the financial health of the condominium association, ensuring a supportive environment for all residents.

- Commercial Use: The total commercial space within the development must not exceed 35% of the overall floor area. This preserves the residential character of the community, making it a comfortable place for families.

- Financial Health: The condominium association must demonstrate financial stability, including maintaining adequate reserve funds equal to 20% of the annual budget for ongoing maintenance and repairs. This is crucial for the long-term viability of your investment.

- Project Completion: The project must be fully finished, with all units prepared for occupancy. This ensures that you are investing in a livable environment, ready for you to call home.

- Compliance: The condominium must comply with local, state, and federal regulations to maintain FHA eligibility, giving you confidence in your purchase.

These guidelines are designed to safeguard both purchasers and lenders, fostering a stable living environment and encouraging sound investment in properties listed on the FHA condo approval list. We know how challenging this can be, but comprehending these requirements can greatly boost the confidence of owners and prospective purchasers, enabling smoother dealings in the competitive real estate market. We’re here to support you every step of the way.

Differentiate Between Single-Unit and Project FHA Approvals

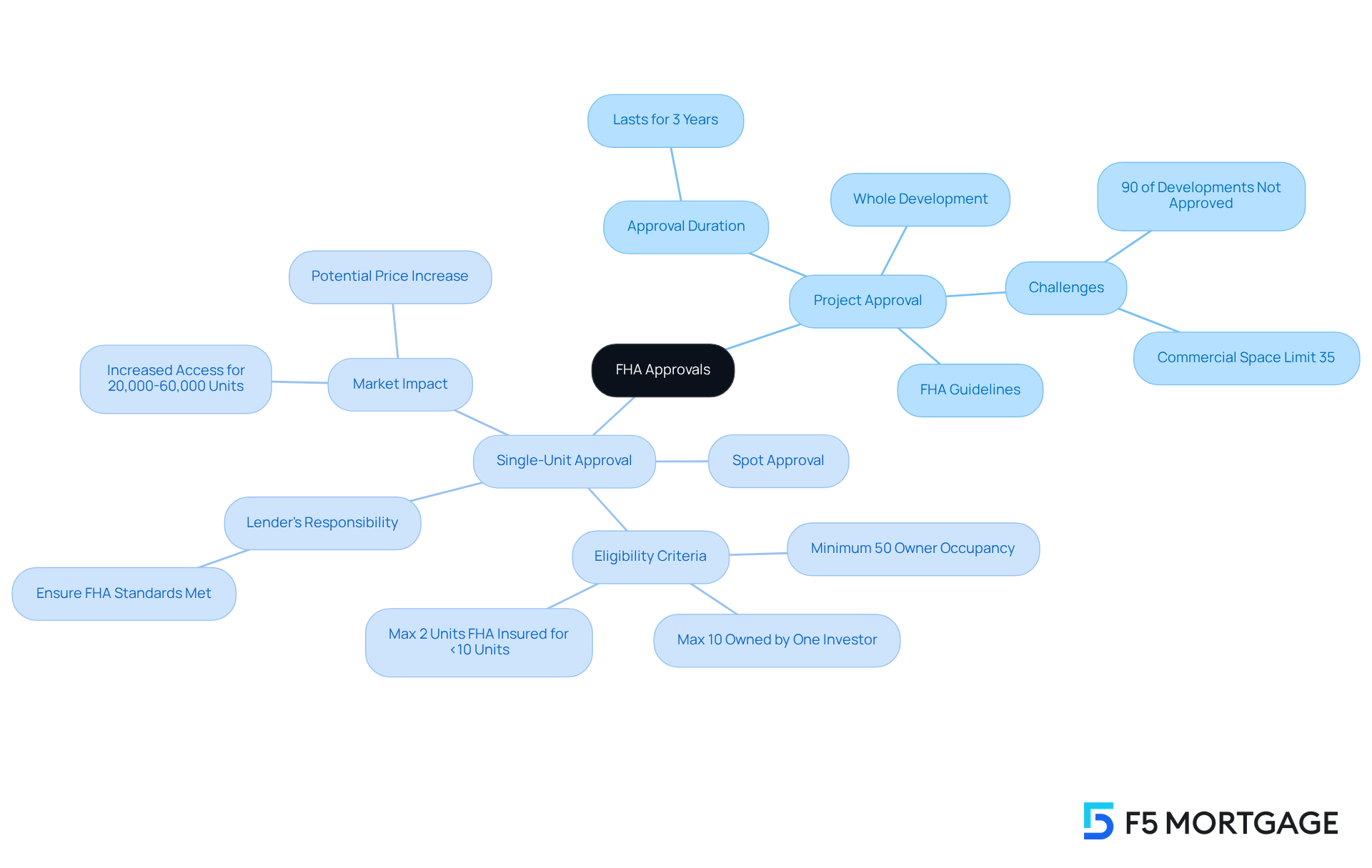

FHA authorizations can be divided into two categories: development authorizations and single-unit authorizations, each serving unique functions for purchasers. Understanding these distinctions is essential for navigating your financing options effectively.

-

Project Approval: This is the standard approval process for entire condominium developments. The whole undertaking must comply with FHA guidelines, and once approved, all units within that development can be financed with FHA loans. Notably, FHA Approval for the entire Condominium Association lasts for three years, providing a significant window for buyers to secure financing. However, we know how challenging it can be to find the right development, especially since over 90% of the nation’s 150,000 condominium developments do not appear on the FHA condo approval list due to restrictive regulations. This emphasizes the importance of understanding these types of endorsements.

-

Single-Unit Approval: Also referred to as ‘spot approval,’ this permits individual units in a non-FHA-approved development to qualify for FHA financing. This is particularly useful for buyers interested in a specific condo that does not appear on the FHA condo approval list. However, the lender must ensure that the unit meets FHA standards, and the development must still comply with certain criteria, such as a minimum of 50% owner occupancy and restrictions on the percentage of units owned by a single investor—no more than 10% of the units in a condo development may be owned by one investor or entity. Additionally, for projects with fewer than 10 units, a maximum of 2 units may be FHA insured.

With recent updates to FHA guidelines, including the potential for increased access to financing for an estimated 20,000 to 60,000 additional condominium units annually, the situation for condo purchasers is becoming more favorable. This shift is expected to stimulate demand and potentially raise prices in the condo market, making it an opportune time for buyers to explore their options. Moreover, the commercial/non-residential area within an accepted condominium development cannot surpass 35% of the total floor space, which is another essential factor of development criteria. We’re here to support you every step of the way as you navigate this process.

Guide to Verifying FHA Condo Approval Status

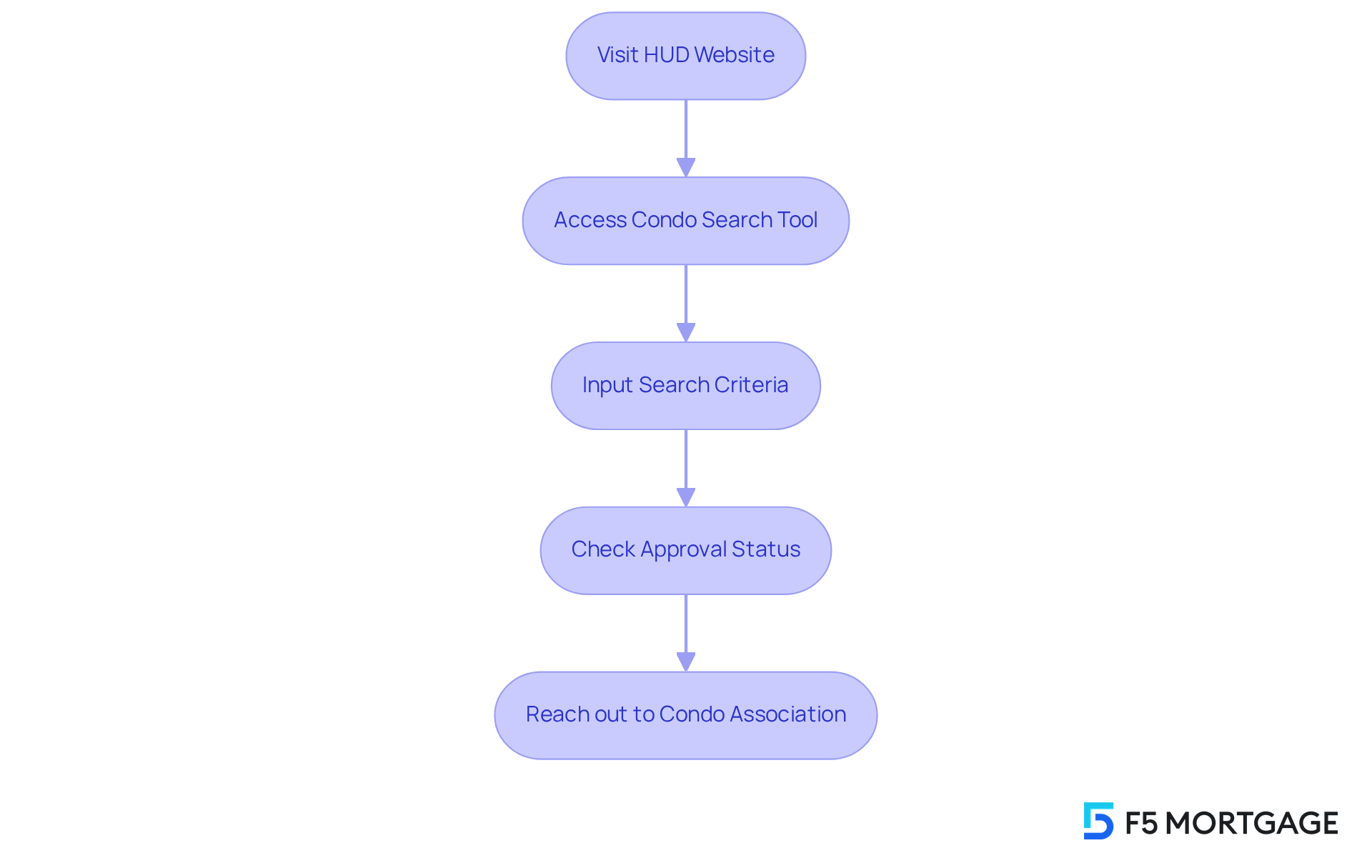

To verify the status on the FHA condo approval list for a condominium, we understand how important this process can be for you. Here are the steps to follow:

- Visit the HUD Website: Start by going to the U.S. Department of Housing and Urban Development (HUD) website.

- Access the Condo Search Tool: Navigate to the FHA condo approval list page, where you can search for authorized developments that meet your needs.

- Input Search Criteria: Enter the condo’s name, city, or ZIP code to find the specific project you’re interested in.

- Check Approval Status: Review the results to see if the condo is listed as ‘Approved.’ If it is, you can proceed with confidence in your financing options.

- Reach out to the Condo Association: If you have more inquiries, don’t hesitate to contact the condominium association for further details about their FHA endorsement status.

It’s important to note that the FHA condo approval list endorsement is valid for three years and requires re-certification to maintain eligibility. As of 2019, only 6.5% of condo complexes in the U.S. were included in the FHA condo approval list, underscoring the significance of this verification process. Furthermore, if a condo’s FHA certification has lapsed, the HOA must undergo the recertification process prior to selling to FHA purchasers. We know how challenging this can be, especially for families upgrading their homes. Understanding these details is crucial, as FHA approval directly impacts your financing options and overall home buying decisions. We’re here to support you every step of the way.

Conclusion

The FHA condo approval process is a crucial step in making condominium financing more accessible for families seeking to purchase their dream homes. By ensuring that a condominium project meets the Federal Housing Administration’s criteria, potential homeowners gain access to FHA-insured loans. This support significantly reduces the barriers to homeownership, allowing families to envision a brighter future. Moreover, this approval enhances the marketability of condos and cultivates a stable, welcoming community for both current and prospective residents.

We understand how daunting this process can be, and key insights from the article shed light on essential requirements for FHA approval. Maintaining a minimum owner-occupancy rate and ensuring the financial health of the condominium association are vital. Additionally, grasping the difference between project and single-unit approvals is important for families exploring their financing options. Recent updates to FHA guidelines further open doors for more buyers, potentially increasing demand and property values within the condo market.

Ultimately, the FHA condo approval process is not merely a bureaucratic hurdle; it is a gateway to homeownership for many individuals and families. By familiarizing themselves with the requirements and verification steps outlined, prospective buyers can confidently pursue their dream homes. Engaging with the FHA approval process can lead to smarter investment decisions and a thriving community. We encourage buyers to stay informed and proactive in their search for the perfect condominium, knowing that we are here to support you every step of the way.

Frequently Asked Questions

What is FHA condo approval?

FHA condo approval is the process by which the Federal Housing Administration evaluates and certifies that a condominium project meets specific financing criteria, allowing purchasers to access FHA-insured loans.

Why is FHA condo approval important?

FHA condo approval is important because it enables first-time homebuyers to access FHA-insured loans, which often require lower down payments and more flexible credit standards. Without this approval, buyers may face limited financing options.

How does FHA condo approval affect the marketability of a condominium?

Condominiums on the FHA condo approval list are generally more marketable, attracting a wider range of buyers, particularly first-time homebuyers. This can enhance the appeal of the project and signal quality and stability.

What are the potential benefits for communities with FHA endorsement?

Communities with FHA endorsement often experience rising property values due to increased buyer interest, leading to higher sales prices for all unit owners. This is beneficial for the overall market and stability of the community.

What change is set to occur on October 15 regarding FHA condo approval?

Starting October 15, the FHA will begin insuring mortgages for individual condominium units in unapproved developments, expanding financing options for buyers and making it easier for families to find homes.