Overview

We understand how challenging managing a mortgage can be. This article outlines four essential steps to help you make additional principal payments on your mortgage:

- Review your mortgage terms to understand your options.

- Decide on the amount you wish to pay extra; even small contributions can make a big difference.

- Consult with a financial advisor to provide you with tailored advice that suits your situation.

- Connect with your lender to ensure that your extra payments are effectively applied to reduce your principal balance.

These steps are crucial, as they not only help you save on interest but also lead to a quicker loan repayment period. Remember, we’re here to support you every step of the way.

Introduction

Making a mortgage payment is a routine task for homeowners, and we know how challenging this can be. However, understanding the potential benefits of additional principal payments can transform this mundane obligation into a strategic financial move. By contributing extra funds toward the principal, homeowners can significantly reduce their loan balance, save thousands in interest, and even shorten their repayment term.

Yet, navigating this process can be fraught with challenges. Misallocated funds and prepayment penalties may arise, creating obstacles on the path to financial freedom. So, how can homeowners overcome these hurdles? Together, we can explore ways to maximize savings and achieve financial freedom sooner.

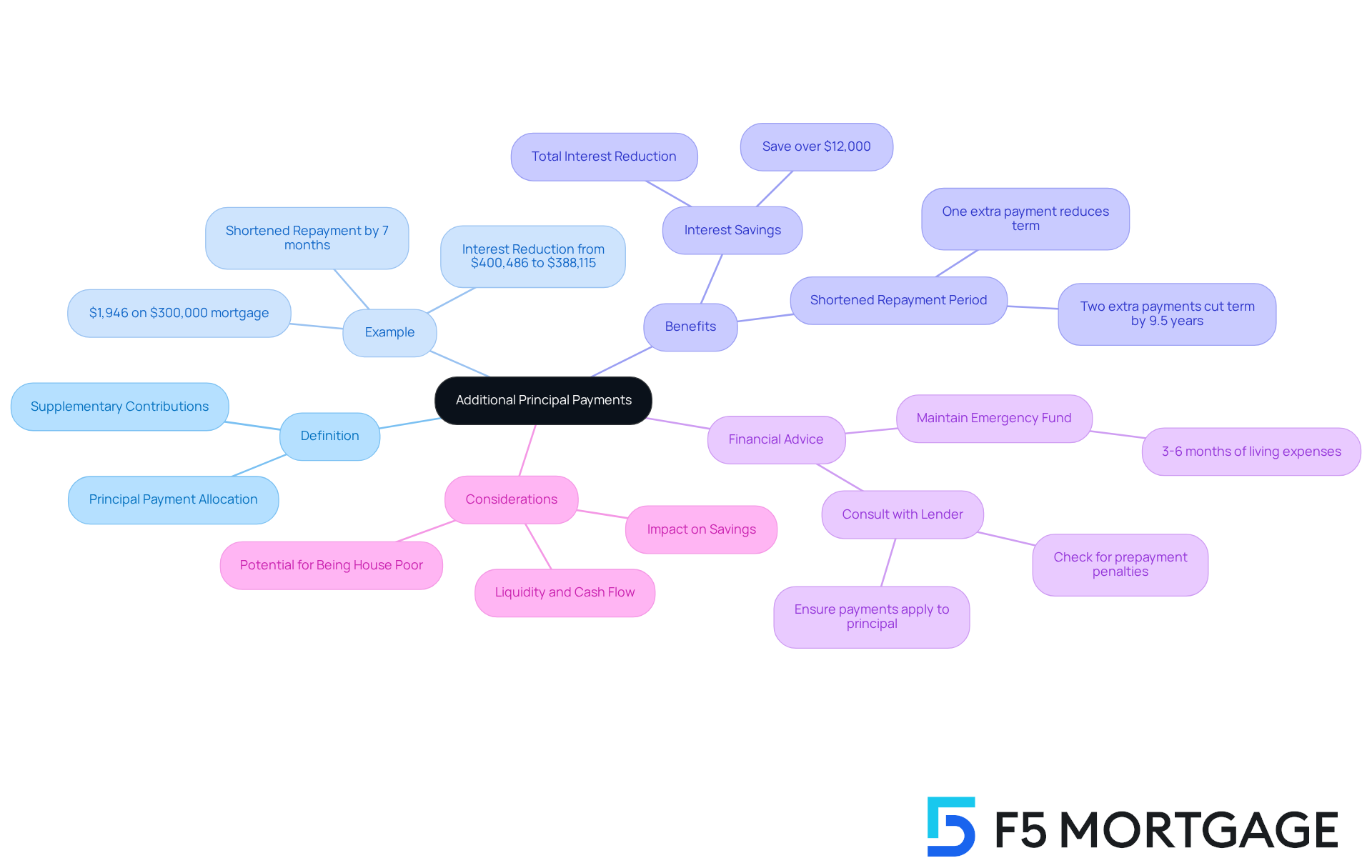

Understand Additional Principal Payments

Supplementary contributions refer to any you allocate towards the main balance of your mortgage, beyond your standard monthly contribution. This can be accomplished as a one-time lump sum or as recurring additional contributions. By making an additional principal payment, you , which decreases the amount of interest you will pay over the duration of the loan, as interest is calculated on the remaining balance.

For example, contributing an additional amount of $1,946 on a $300,000 mortgage at a 6.75% interest rate can reduce the total interest from $400,486 to $388,115. This means a saving of over $12,000, and it can even by seven months. We know how challenging managing a mortgage can be, so it’s crucial to engage with your lender to ensure that the additional are allocated accurately to the principal and not to upcoming dues or interest.

Before making these additional contributions, keeping an of three to six months’ worth of living costs. This safety net can provide peace of mind against unforeseen financial difficulties. Furthermore, while can lead to , it’s important to consider potential downsides, such as diminished liquidity and cash flow challenges.

By understanding how extra capital contributions operate and clearly indicating that these contributions are for debt reduction, homeowners can make informed choices that enhance their financial health. We’re here to in navigating these decisions.

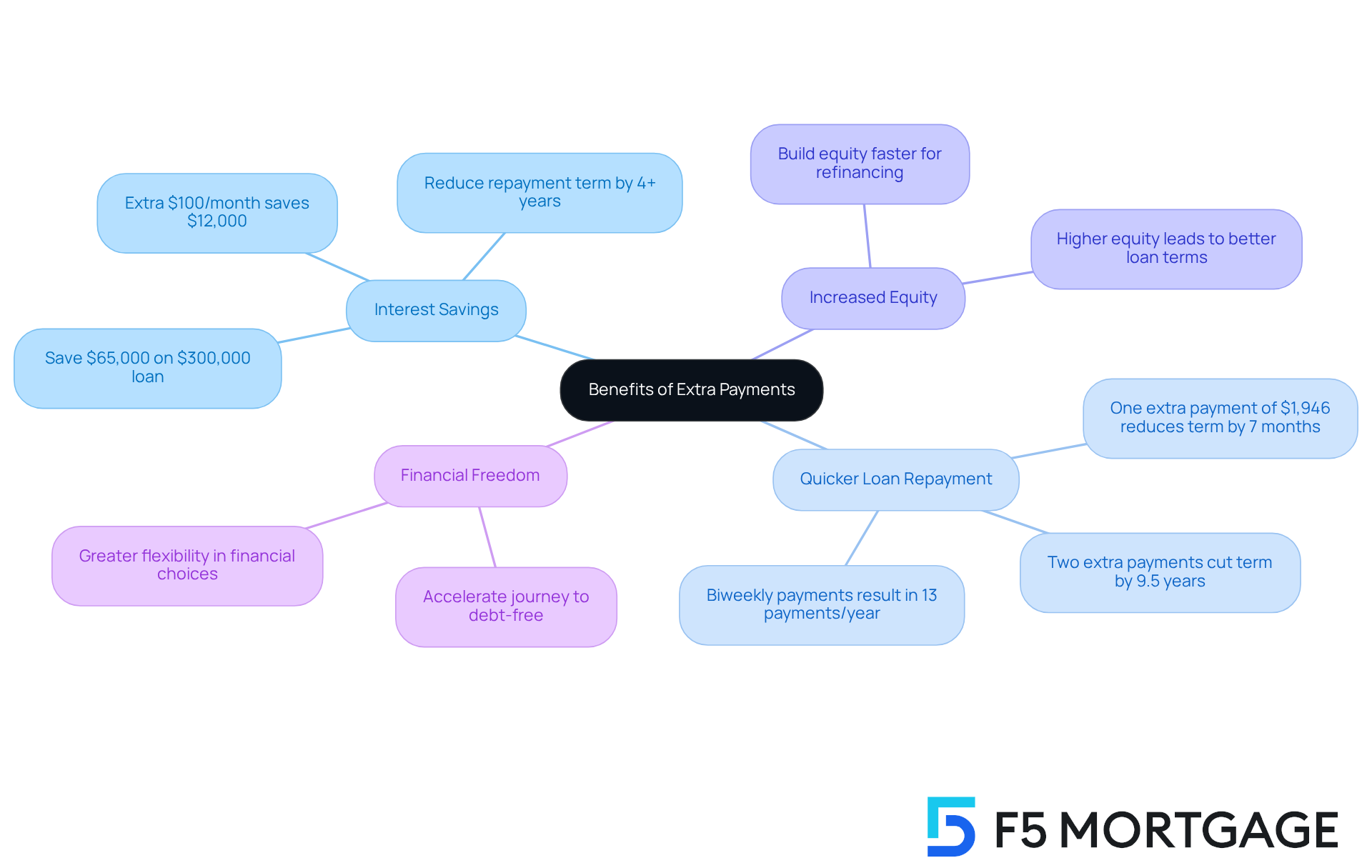

Explore the Benefits of Extra Payments

Making can lead to several significant benefits that truly matter to families navigating their :

- : We know how important it is to save money. Reducing the principal balance directly lowers the total interest paid over the life of the loan. For instance, if you add an extra $100 each month on a $300,000 loan at a 6.75% interest rate, you could save around $65,000 in interest and reduce your repayment period by more than four years. Moreover, rounding a monthly payment of $2,450 to $2,500 contributes an additional $600 toward the loan each year, offering a feasible way to boost your contributions.

- : Imagine settling your loan years sooner. Making an additional principal payment can help make this a reality. For example, contributing just one extra sum of $1,946 each year on a $300,000 mortgage at a 6.75% interest rate can shorten the term by seven months and save over $12,000 in interest. In fact, two extra payments can cut the term by over 9.5 years, saving more than $144,000 in interest.

- : Paying down the principal faster builds your more quickly. This is particularly advantageous if you plan to refinance or sell your home, as can lead to better loan terms and increased financial leverage.

- : Reducing your mortgage balance accelerates your journey to being debt-free, providing peace of mind and . Property owners who emphasize additional contributions often find themselves in a more advantageous financial situation, enabling greater flexibility in future monetary choices.

It’s essential to notify your lender that the additional principal payment should be allocated to the principal balance to ensure these contributions effectively decrease your loan. As we look ahead to 2025, the trend of making an additional principal payment continues to gain traction, with many families recognizing the long-term savings and advantages associated with this strategy. By consulting with , homeowners can customize their financing strategies to maximize savings and achieve their financial objectives more efficiently. We’re here to support you every step of the way.

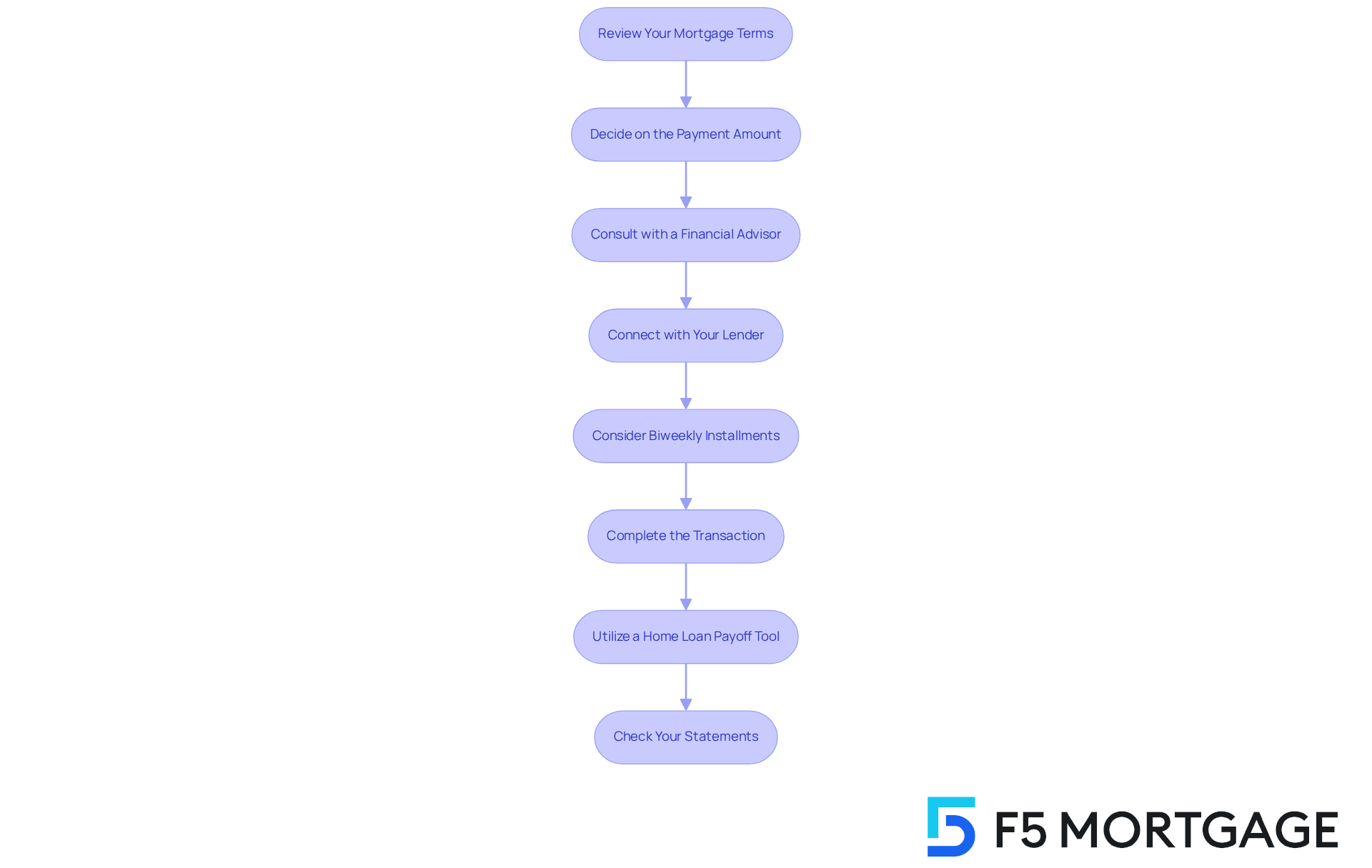

Follow Steps to Make Additional Principal Payments

To make additional principal payments, follow these steps:

- : We know how challenging this can be, so start by carefully reviewing your mortgage contract. Look for any prepayment penalties or specific guidelines regarding extra contributions. Confirming the absence of prepayment penalties is crucial to avoid unexpected fees. Understanding your lender’s guidelines is essential to ensure you can make an additional principal payment without incurring expenses.

- : Consider how much extra you can comfortably afford to pay. This could be a fixed amount each month, a lump sum from a bonus, or a percentage of your regular earnings. Reflect on your overall financial strategy to ensure this aligns with your goals, including the potential benefits of building equity faster and reducing long-term interest.

- : Before moving forward, it may be beneficial to consult with a financial advisor. They can explain your options and strategies for loan payoff, assisting you in making informed choices about your additional principal payment contributions.

- : Reach out to your mortgage servicer to inform them of your plan to make extra contributions to the balance. Clearly specify that these funds should be used as an additional principal payment to maximize the impact on your loan.

- : As an alternative, you might explore establishing a biweekly installment plan. This approach allows you to make smaller installments every two weeks, leading to 13 complete contributions each year instead of the typical 12. This strategy can significantly decrease your mortgage balance over time.

- : You can usually make extra contributions online, via mail, or over the phone. When submitting your payment, include a note indicating that it is for principal reduction to ensure proper allocation.

- : To discover how much earlier you can settle your house with an additional principal payment, consider using a home loan payoff tool. This tool can help you visualize the effect of your extra contributions on your loan duration.

- : After completing the transaction, take a moment to examine your upcoming mortgage statement. Verify that the additional amount was . This step is crucial to ensure that your efforts are effectively reducing your loan balance.

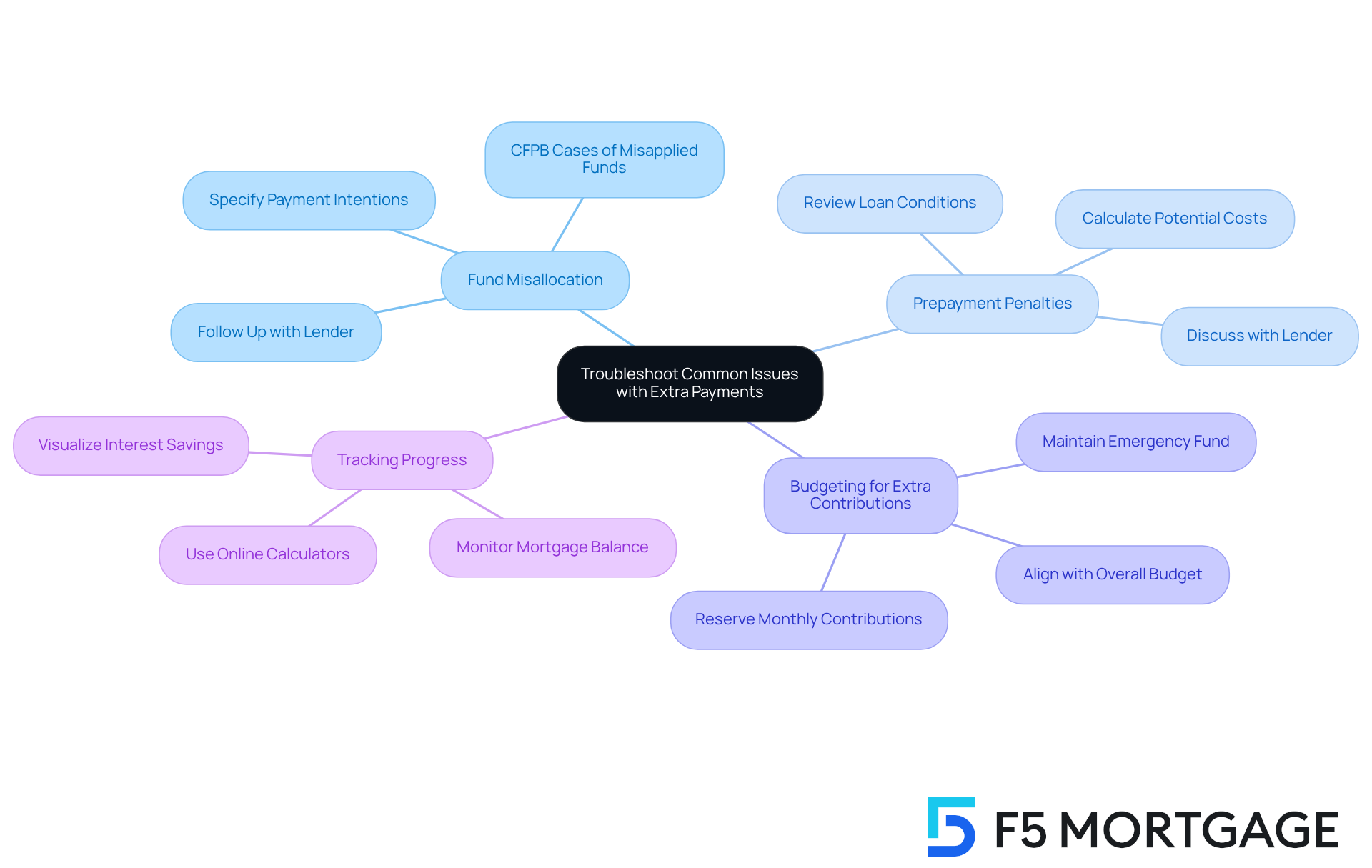

Troubleshoot Common Issues with Extra Payments

Homeowners may encounter several common issues that can feel overwhelming when making . We know how challenging this can be, and we’re here to support you every step of the way.

- : One concern is fund misallocation. Lenders occasionally misallocate funds intended for an additional principal payment, applying them to upcoming dues instead of lowering your balance. To prevent this, it’s essential to clearly specify that your contribution is intended for principal reduction. Following up with your lender is crucial to confirm that the fee is applied correctly. The has identified over 8,700 cases of misapplied funds, highlighting the significance of vigilance in this area and its broader implications for homeowners.

- : Another issue to consider is prepayment penalties. Certain loans impose penalties for early repayment, which can catch you off guard. It’s vital to examine your loan conditions thoroughly and discuss them with your lender to grasp any possible charges linked to making an additional principal payment. For instance, a 3% prepayment penalty on a $250,000 mortgage could cost you $7,500, significantly impacting your . This emphasizes the need for careful planning.

- Budgeting for Extra Contributions: Additionally, ensure that aligns with your overall budget. Consider reserving a certain sum each month or using unexpected gains, such as tax refunds or bonuses, to make an additional principal payment without putting pressure on your finances. Moreover, equivalent to three to six months’ worth of living costs is essential before focusing on making additional principal payments. This approach helps prevent financial hardship.

- Tracking Progress: Lastly, regularly and interest savings. Using can assist in visualizing how extra contributions influence your loan duration and overall interest paid. This monitoring can act as encouragement to keep making additional principal payments, as even minor contributions can lead to significant savings over time. Making one extra mortgage payment a year can eliminate several years from your mortgage term, reinforcing the benefits of diligent tracking.

Conclusion

Making additional principal payments on a mortgage is a powerful strategy for homeowners seeking to lighten their financial load and attain greater freedom. We understand how challenging this can be, but by grasping the mechanics of these payments and following a structured approach, you can effectively lower your principal balance, save on interest, and potentially shorten your loan term.

This article highlights several key benefits of making extra payments. You can achieve:

- Substantial interest savings

- Quicker loan repayment

- Increased home equity

- Enhanced financial flexibility

Clear communication with your lender is essential to ensure that these additional contributions are correctly applied to the principal. Additionally, maintaining an emergency fund is crucial, and we offer practical steps to navigate the process of making additional payments—from reviewing mortgage terms to tracking your progress.

In conclusion, the journey to financial health through additional principal payments is not only achievable but can lead to significant long-term benefits. We encourage you to take proactive steps, consult with financial advisors, and utilize available tools to maximize your savings. By committing to this strategy, you can pave the way toward a debt-free future, transforming the way you manage your mortgage and enhancing your overall financial well-being.

Frequently Asked Questions

What are additional principal payments in a mortgage?

Additional principal payments refer to any extra amount you pay towards the main balance of your mortgage beyond your standard monthly payment. This can be done as a one-time lump sum or as recurring payments.

How do additional principal payments affect my mortgage?

By making additional principal payments, you reduce the main balance of your mortgage, which decreases the total interest you will pay over the life of the loan since interest is calculated on the remaining balance.

Can you provide an example of the savings from making additional principal payments?

For instance, if you contribute an additional $1,946 on a $300,000 mortgage with a 6.75% interest rate, you could reduce the total interest from $400,486 to $388,115, saving over $12,000 and potentially shortening your repayment period by seven months.

What should I consider before making additional principal payments?

It is advisable to maintain an emergency fund of three to six months’ worth of living expenses before making additional payments. This provides a financial safety net against unforeseen circumstances.

Are there any downsides to making additional principal payments?

Yes, potential downsides include diminished liquidity and challenges with cash flow, as allocating extra funds towards the mortgage may limit available cash for other expenses or emergencies.

How can I ensure my additional payments are applied correctly?

It is crucial to engage with your lender to confirm that your additional principal payments are allocated accurately towards the principal balance rather than upcoming dues or interest.