Overview

Navigating the world of mortgages can feel overwhelming, but we’re here to support you every step of the way. This article offers a step-by-step guide to help you understand your mortgage payment, shedding light on key components like principal, interest, and additional costs such as property taxes and insurance.

We know how challenging it can be to grasp these concepts, which is why we detail the calculation process, including a straightforward formula for determining your monthly payments. By breaking it down, we aim to empower you with the knowledge you need.

Moreover, budgeting and pre-approval are crucial steps in your home-buying journey. Understanding these elements can significantly ease the process, ensuring you feel confident and prepared as you move forward. Remember, taking control of your financial future starts with understanding your mortgage options.

Introduction

Navigating the intricacies of mortgage payments can often feel like traversing a complex maze, especially for first-time homebuyers. We understand how overwhelming this process can be, and that’s why this guide is here to help. By demystifying the essential components of mortgage calculations, we aim to provide you with the tools needed to make informed financial decisions.

However, with fluctuating interest rates and hidden fees lurking in the fine print, how can you truly feel prepared to tackle your mortgage obligations? We’re here to support you every step of the way, ensuring that you have the knowledge and confidence to navigate this important journey.

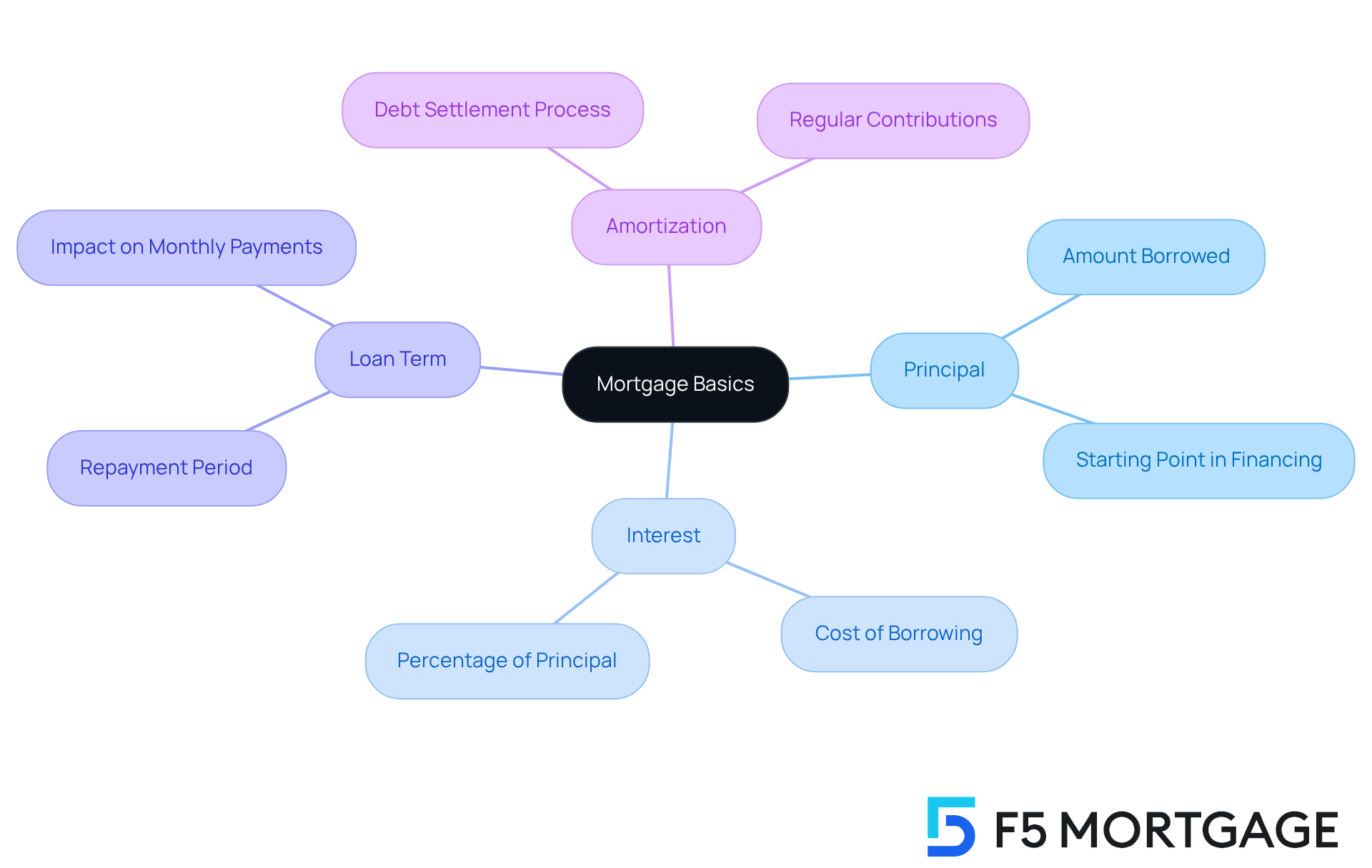

Understand Your Mortgage Basics

Understanding how to figure out mortgage payment can be a daunting task, but we’re here to help you navigate this journey. Let’s break down the key components of a mortgage together:

- Principal: This is the amount of money you borrow from the lender to purchase your home, a crucial starting point in your financial journey.

- Interest: Think of this as the cost of borrowing the principal, expressed as a percentage of the borrowed amount. It’s important to know how this affects your overall payment.

- Loan Term: This refers to the period during which you agree to repay the amount borrowed, typically lasting 15, 20, or 30 years. Choosing the right term can make a significant difference in your monthly payments.

- Amortization: This is the process of settling your debt over time through regular contributions, which include both principal and interest. Understanding this can help you plan your finances better.

At F5 Mortgage, we want you to know that we do not manage financing directly. Once your loan is finalized, you will provide funds to the lender who manages your loan. If you have any questions after closing or need assistance, please reach out to us at 1-888-459-0483 or email info@f5mortgage.com. We understand how challenging this can be, and grasping these terms will empower you to and make informed choices about your financing.

Calculate Key Financial Elements

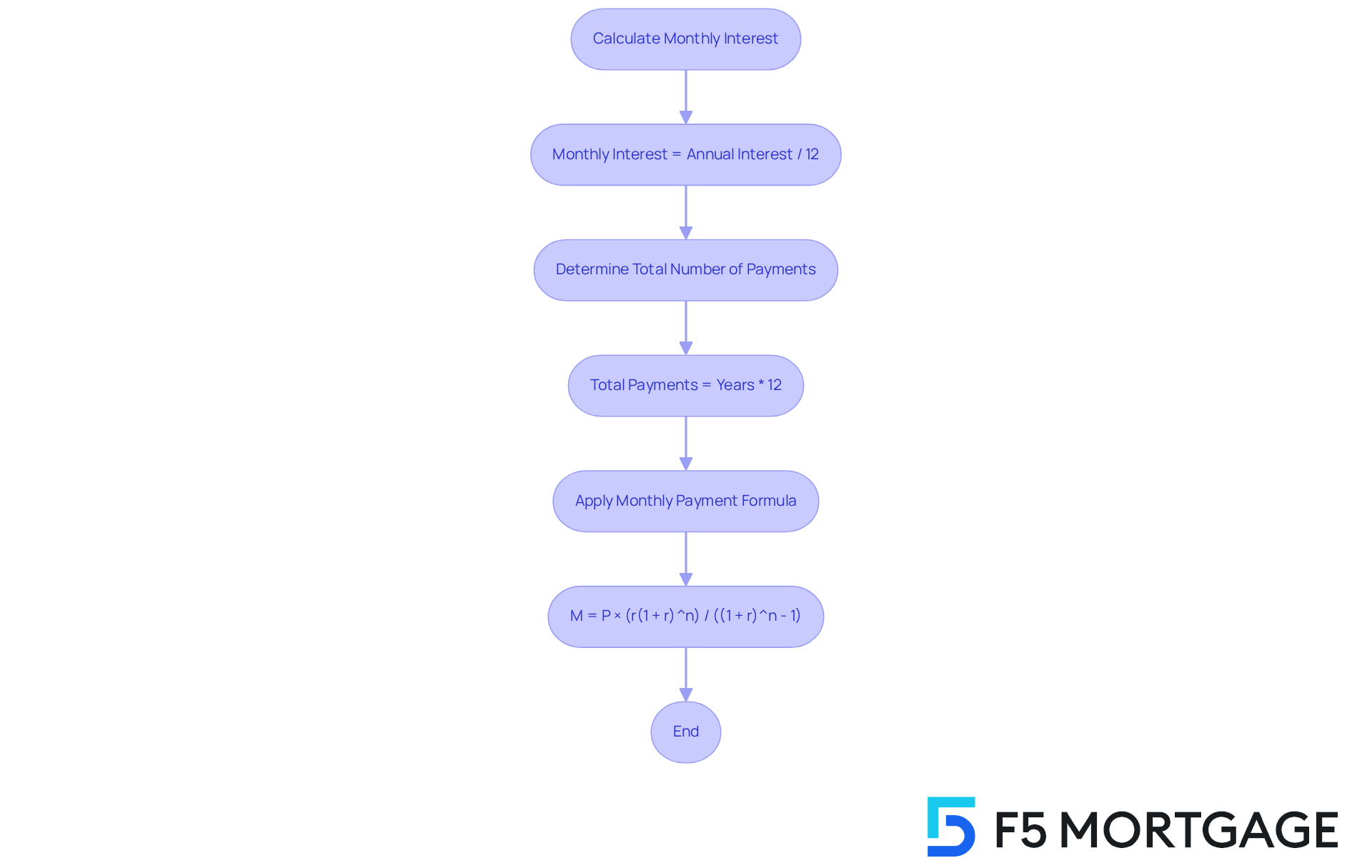

Calculating your monthly mortgage payment to figure out mortgage payment and navigating the refinancing process can feel overwhelming. But don’t worry; we’re here to guide you through each step with care and clarity.

First, let’s look at your monthly interest. To find this, simply divide your annual interest figure by 12. For example, if your annual rate is 4%, your monthly rate becomes 0.33% (4% / 12).

Next, determine the total number of payments. Multiply the number of years in your financing term by 12. If you have a 30-year loan, that leads to 360 installments.

Now, let’s dive into the monthly payment formula:

M = P × (r(1 + r)^n) / ((1 + r)^n - 1)

Where:

- M = total monthly mortgage payment

- P = principal loan amount

- r = monthly interest rate (as a decimal)

- n = number of payments (loan term in months)

For instance, imagine you have a loan of $200,000 at a 4% interest rate over 30 years. Here’s how the calculation unfolds:

- Monthly interest rate = 0.04 / 12 = 0.00333

- Total payments = 30 × 12 = 360

- M = 200,000 × (0.00333(1 + 0.00333)^360) / ((1 + 0.00333)^360 – 1)

- M ≈ $954.83

This calculation gives you a clear view of your principal and interest payment, which is essential for budgeting and financial planning. We understand how crucial it is to grasp these components, especially in a market where loan costs can fluctuate significantly, impacting your affordability and borrowing choices.

Moreover, restructuring your loan with F5 Mortgage could help you qualify for more favorable interest terms, making your monthly costs more manageable. As financial expert David McMillin points out, ‘Refinancing is a common practice, and it tends to increase when interest rates decline.’ This highlights the importance of staying informed about as you determine your loan installment. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Incorporate Additional Costs and Fees

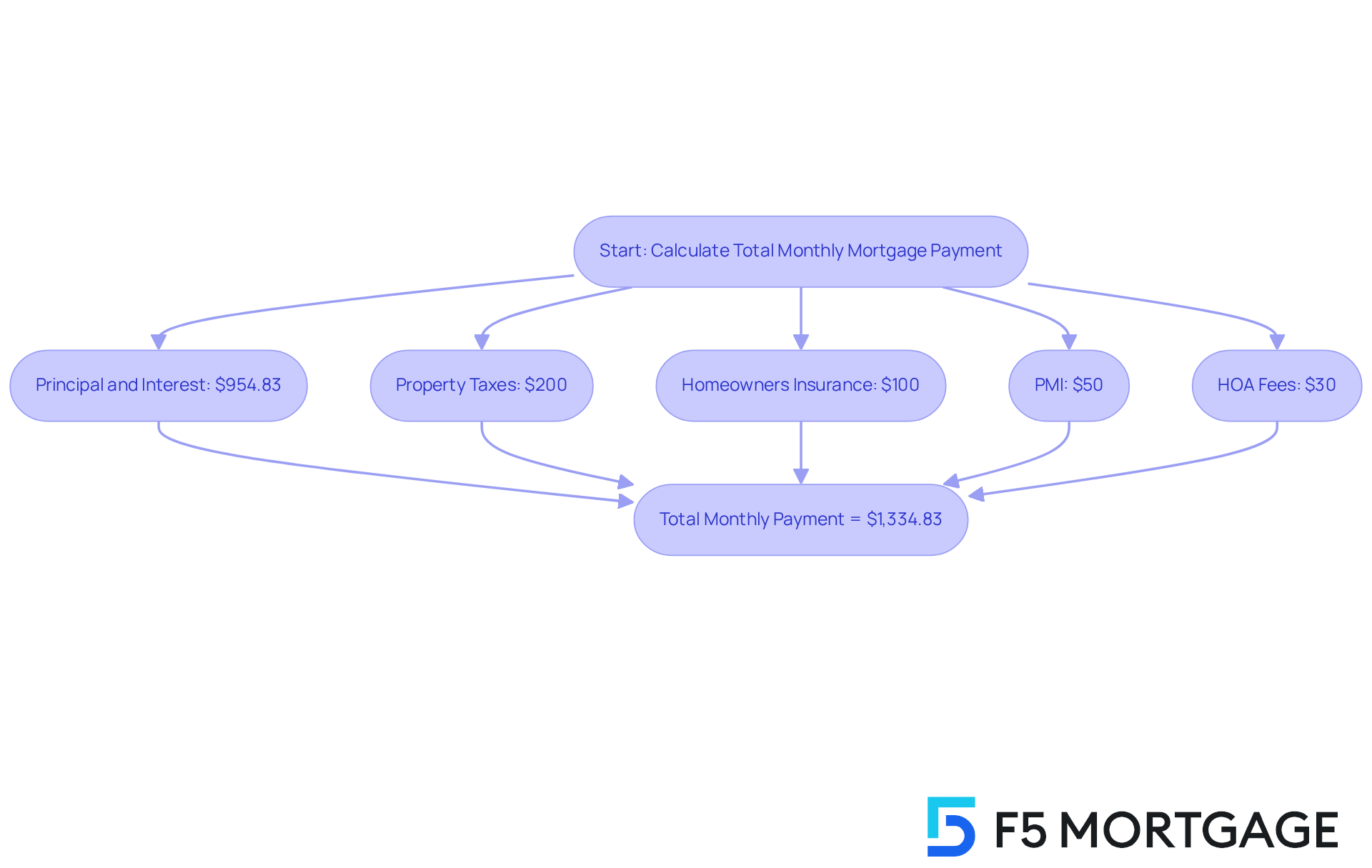

When trying to figure out mortgage payment, we understand how challenging it can be to navigate the numbers. To figure out mortgage payment, it’s essential to include additional costs beyond just principal and interest. Let’s explore the common components that can affect your financial commitment:

- Property Taxes: Typically assessed annually, property taxes can significantly impact your monthly payment. To estimate your monthly cost, simply divide your annual property tax bill by 12. For instance, in 2023, the average property tax paid across the U.S. was approximately $1,889, translating to about $157 per month. Effective property tax percentages can differ significantly by state; for example, New Jersey had the highest effective property tax percentage at 2.23% in 2023, while Illinois stood at 2.07%. Be sure to check with your local tax authority for specific figures.

- Homeowners Insurance: This insurance protects your home and belongings from various risks. The average annual cost of homeowners insurance in 2025 is projected to be around $2,927, or about $244 per month. Homeowners with good credit typically pay around $2,110, while those with poor credit may pay as much as $3,620. To find the best rate, obtain quotes from multiple insurers and divide the annual premium by 12. Additionally, opting for a higher deductible can lead to savings on your premiums.

- Private Mortgage Insurance (PMI): If your deposit is less than 20%, you may be required to pay PMI, which typically ranges from 0.5% to 1% of the loan amount annually. For instance, on a $300,000 loan, PMI could increase your monthly costs by roughly $125 to $250.

- Homeowners Association (HOA) Fees: If your property is part of an HOA, it’s important to include these monthly fees in your calculations. HOA fees can vary significantly based on the community and amenities offered.

Example of Total Monthly Payment Calculation:

- Principal and Interest: $954.83 (from previous calculation)

- Property Taxes: $200

- Homeowners Insurance: $100

- PMI: $50

- HOA Fees: $30

Total Monthly Payment = $954.83 + $200 + $100 + $50 + $30 = $1,334.83

By factoring in these additional costs, including the potential impact of natural disasters on homeowners insurance, you can gain a clearer understanding of your total monthly financial commitment. We’re here to support you every step of the way, ensuring you are .

Take Action: Next Steps After Calculation

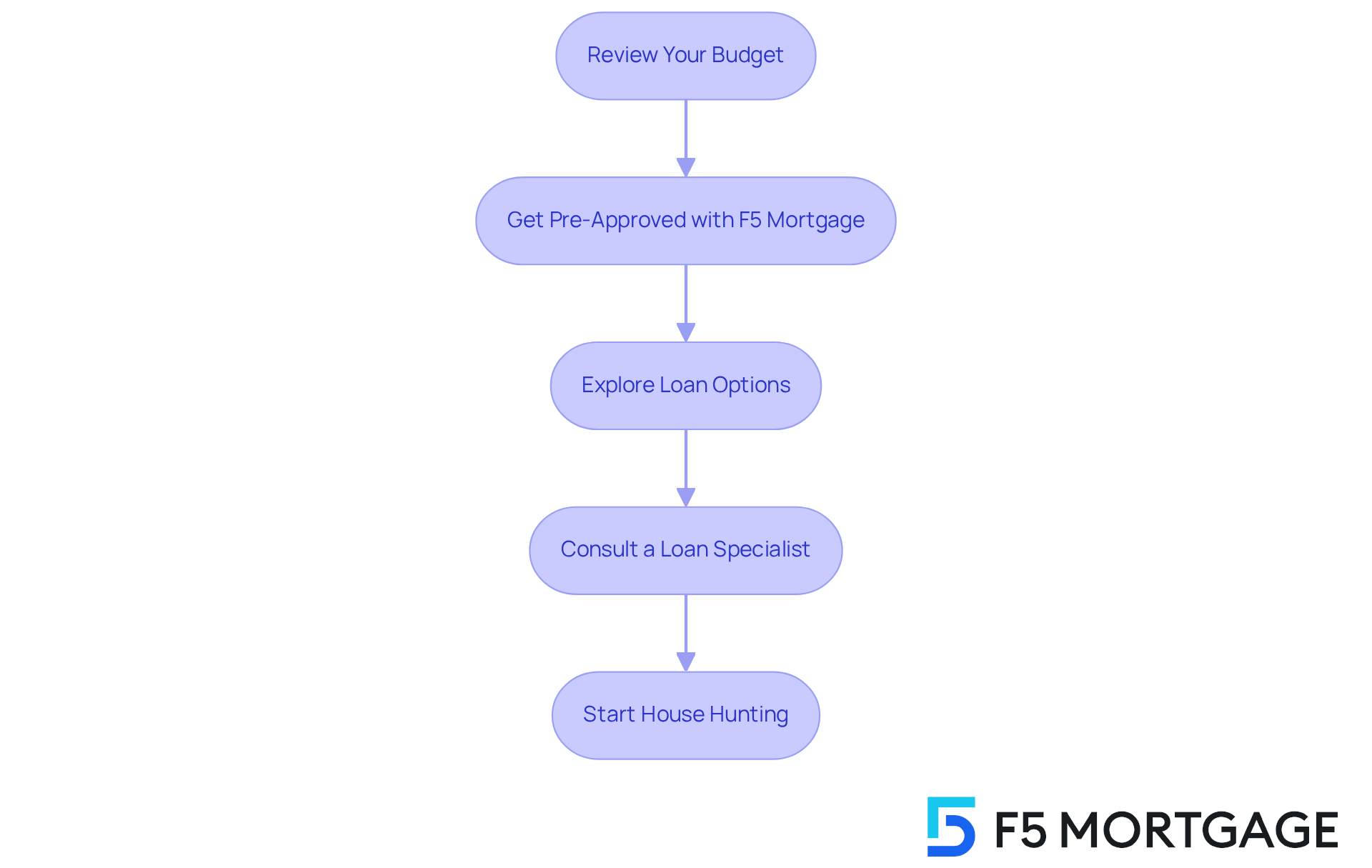

After figuring out mortgage payment, we know how important it is to take the next steps with confidence. Here’s how to move forward:

- Review Your Budget: Take a moment to ensure that your calculated monthly payment fits comfortably within your overall budget. Aiming to spend no more than 28% of your gross monthly income on housing costs is a widely recommended guideline for maintaining your financial health.

- Get Pre-Approved with F5 Mortgage: Reach out to F5 Mortgage to secure pre-approval for your loan. This essential step not only clarifies how much you can borrow but also provides insight into the interest terms available to you. Statistics show that borrowers who secured pre-approval were more likely to close on their homes efficiently, experiencing a streamlined process.

- Explore Loan Options: It’s beneficial to research various types of financing options, such as fixed-rate, FHA, and VA loans, to find the best fit for your financial situation. F5 Mortgage offers adaptable financing options designed to help you acquire your ideal home more quickly.

- Consult a Loan Specialist: Working with a loan specialist can be incredibly helpful. They possess the knowledge to navigate the lending landscape and connect you with favorable offers suited to your needs. Brokers often emphasize that having multiple loan offers can lead to better terms and lower rates.

- Start House Hunting: Now that you have your budget and pre-approval from F5 Mortgage, it’s time to begin your search for homes that meet your criteria. This proactive approach not only empowers you as a buyer but also positions you favorably in a competitive market.

By taking these thoughtful steps, you can confidently advance in your home buying journey. You’ll have a clear understanding of how to figure out mortgage payment and your overall financial picture, all while being supported by F5 Mortgage’s .

Conclusion

Figuring out your mortgage payment is an essential step in the home-buying journey. We know how challenging this can be, and having a clear understanding of key components like principal, interest, loan terms, and amortization can significantly ease the process. By simplifying these concepts, we aim to empower you to make informed decisions about your financial commitments.

Throughout this guide, we’ve discussed vital calculations, such as determining monthly interest and total payments, while also incorporating additional costs like property taxes, homeowners insurance, and PMI. These elements play a crucial role in shaping your total monthly payment and influencing your overall budgeting. To support you further, we’ve highlighted actionable next steps, including getting pre-approved and consulting with loan specialists, ensuring a smooth transition into homeownership.

In conclusion, understanding how to calculate mortgage payments is more than just crunching numbers; it’s about preparing for a significant financial commitment that can impact your future. By taking the necessary steps to educate yourself and seek professional guidance, you can navigate this journey with confidence. Embracing this knowledge will not only lead to better financial decisions but also pave the way for a fulfilling homeownership experience. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the principal in a mortgage?

The principal is the amount of money you borrow from the lender to purchase your home.

What does interest mean in the context of a mortgage?

Interest is the cost of borrowing the principal, expressed as a percentage of the borrowed amount, which affects your overall payment.

What is a loan term?

A loan term refers to the period during which you agree to repay the amount borrowed, typically lasting 15, 20, or 30 years.

How does the loan term affect my mortgage payments?

Choosing the right loan term can make a significant difference in your monthly payments.

What is amortization?

Amortization is the process of settling your debt over time through regular contributions, which include both principal and interest.

How can understanding these mortgage terms help me?

Grasping these terms will empower you to figure out mortgage payment options and make informed choices about your financing.

Does F5 Mortgage manage financing directly?

No, F5 Mortgage does not manage financing directly. Once your loan is finalized, you will provide funds to the lender who manages your loan.

Who can I contact if I have questions after closing my loan?

You can reach out to F5 Mortgage at 1-888-459-0483 or email info@f5mortgage.com for assistance.