Overview

A conventional loan is a type of mortgage that is not insured or guaranteed by the federal government. It is provided through private lenders and can be classified into conforming and non-conforming types. We understand how navigating mortgage options can feel overwhelming, but conventional loans can offer significant benefits for families like yours.

These loans often come with lower overall costs and greater flexibility in terms and conditions. For those who can provide a substantial down payment, there’s even the potential for reduced monthly payments. However, it’s important to remember that meeting credit score requirements is essential for qualification.

We know how challenging this can be, but we’re here to support you every step of the way. By exploring conventional loans, you may find a solution that aligns with your financial goals and helps you achieve the dream of homeownership.

Introduction

Navigating the complex landscape of home financing can be overwhelming, and understanding the intricacies of conventional loans is essential. These loans, primarily offered by private lenders and not backed by the government, present a unique opportunity for borrowers seeking flexibility and competitive rates. Yet, we know how challenging this can be. What factors should potential homeowners consider when deciding if a conventional loan is the right choice for them?

In this article, we’ll explore the defining features, advantages, and key considerations of conventional loans. Our goal is to provide insights that empower families to make informed financial decisions on their journey toward homeownership. We’re here to support you every step of the way.

Define Conventional Loan: Key Characteristics and Structure

What’s a refers to a type of mortgage that is not insured or guaranteed by the federal government, which sets it apart from government-backed options such as FHA or VA mortgages. These financial products are mainly provided by private lenders and can be classified into conforming and non-conforming types. Conforming mortgages follow the criteria set by government-sponsored entities like Fannie Mae and Freddie Mac. In contrast, non-conforming mortgages fail to meet these specifications, often leading to higher interest costs due to increased risk.

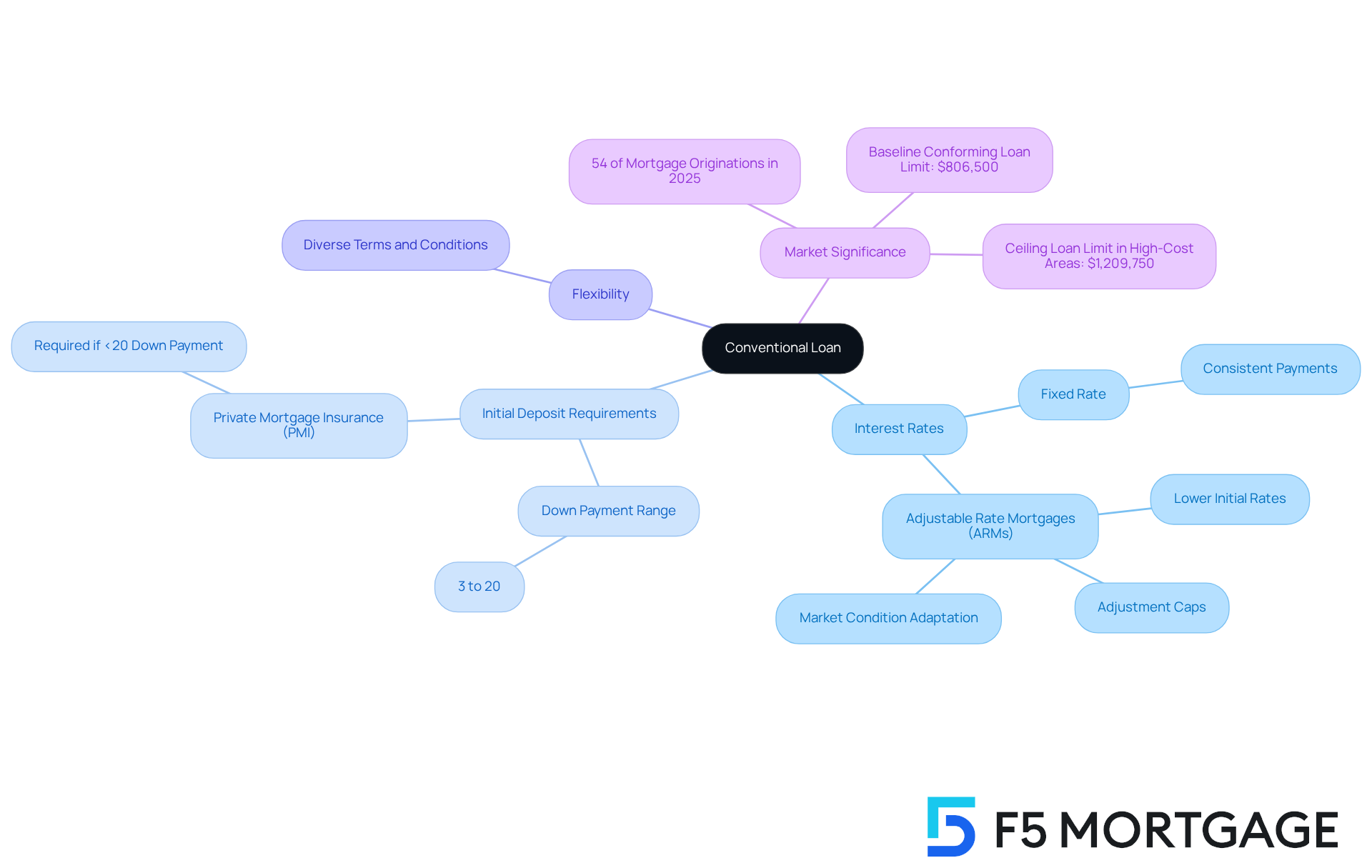

Key characteristics of conventional loans include:

- Interest Rates: Borrowers can choose between fixed or adjustable-rate mortgages (ARMs). ARMs generally begin with lower initial prices during a promotional phase. After this, the costs adapt to market conditions, typically every six months. This feature makes ARMs appealing for those who plan to pay off their mortgage quickly or refinance in a few years. However, the unpredictability of variable rates means that interest adjustment caps are crucial for protecting borrowers from significant rate increases.

- Initial Deposit Requirements: Initial deposits can vary from 3% to 20%, depending on the financing type. A down payment of less than 20% usually necessitates private mortgage insurance (PMI).

- Flexibility: The framework of traditional financing permits diverse terms and conditions, accommodating a varied borrower base.

In 2025, conventional mortgages represented roughly 54% of all mortgage originations in the U.S., showcasing their popularity relative to government-backed options. The Federal Housing Finance Agency (FHFA) has established the baseline conforming credit limit at $806,500, with elevated limits in high-cost regions reaching $1,209,750. This rise in borrowing limits allows homebuyers to finance pricier properties without turning to jumbo financing, which frequently has stricter qualification standards.

We know how challenging navigating financing options can be. Experts observe that what’s a conventional loan offers standard financing options that are especially attractive for borrowers with strong credit who can manage a significant down payment. They generally provide reduced interest rates and fewer limitations compared to FHA or VA alternatives. This flexibility makes traditional financing a viable option for many families looking to upgrade their homes or acquire new properties. We’re here to support you every step of the way.

Contextualize Conventional Loans: Importance in Home Financing

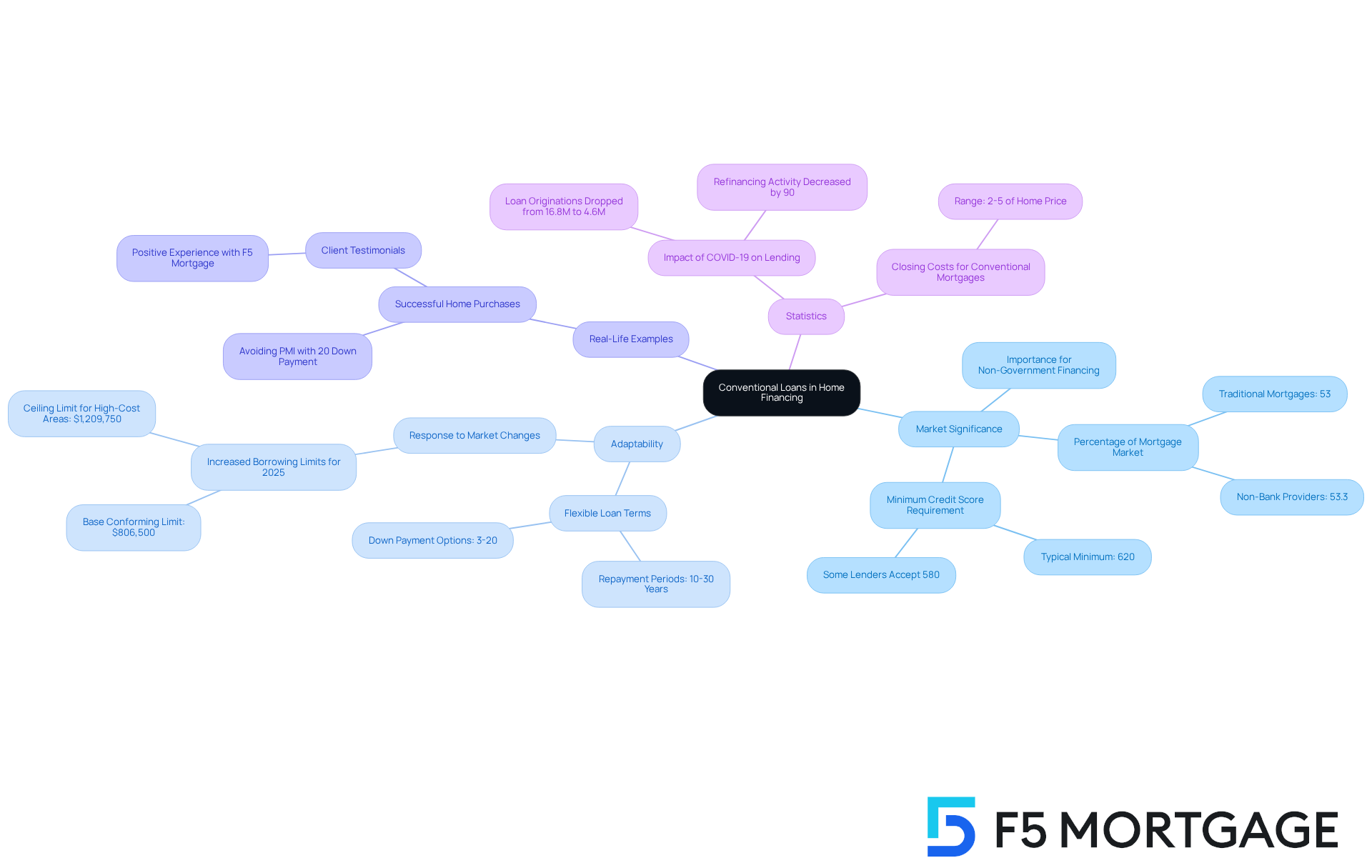

Traditional financing options are a cornerstone of the home funding landscape, representing a significant portion of the mortgage market. For many purchasers, these options are especially important, particularly for those who may not meet the criteria for government-supported financing, which often impose stricter credit requirements. We know how challenging this can be, as most lenders typically look for a . Standard mortgages provide a pathway for individuals with strong financial histories to secure funding. The adaptability of these financing options allows borrowers to choose from a variety of terms, including repayment periods ranging from 10 to 30 years, addressing diverse financial circumstances.

As the housing market continues to evolve, traditional financing options have shown a remarkable ability to adapt to shifting consumer needs. For instance, the recent increase in borrowing limits for 2025, with the base conforming limit rising to $806,500, reflects a response to the escalating costs of homes in various regions. This adjustment enables more buyers to access financing in higher-cost neighborhoods, thereby supporting homeownership across different demographics.

Real-life examples illustrate how traditional financing effectively facilitates home purchases. Many households have successfully utilized these financial products to navigate the complexities of the housing market, often avoiding private mortgage insurance (PMI) by providing a down payment of 20% or more. This strategy not only reduces monthly payments but also enhances overall financial stability. Testimonials from satisfied clients highlight the positive experiences with F5 Mortgage. One client shared, “I highly recommend the F5 Mortgage team. Everything went very smoothly!” This reflects the commitment to client satisfaction that F5 Mortgage embodies.

Statistics reveal that traditional mortgages comprise a significant portion of the mortgage industry, with non-bank providers originating over 53% of all home financing in recent years. This trend underscores the growing reliance on traditional financing as a viable option for homebuyers, especially in a context where total mortgage lending has experienced significant fluctuations since the COVID-19 pandemic. As borrowers increasingly seek personalized solutions, traditional financing options remain a reliable choice, offering competitive pricing and conditions tailored to individual needs.

Explore Features of Conventional Loans: Terms, Rates, and Eligibility

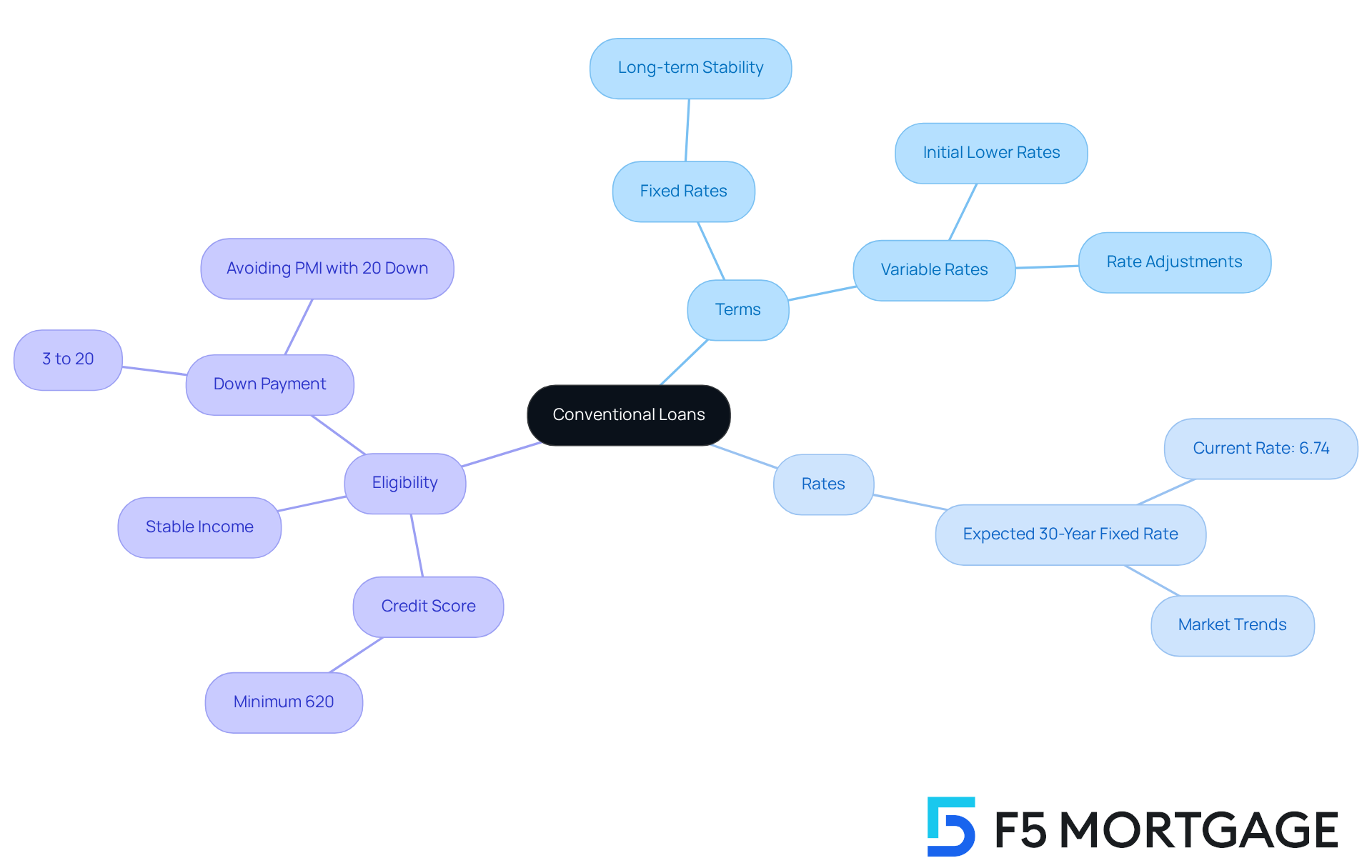

Navigating the world of traditional financing options, such as what’s a conventional loan, can be overwhelming, but we understand how important it is to find the right fit for your family’s needs. These financing options offer a range of features designed to accommodate various borrower requirements. You can choose between fixed or variable interest terms—fixed rates provide long-term stability, while adjustable rates often start lower but can change over time.

To understand what’s a conventional loan, it’s generally necessary to qualify with a credit score of at least 620, a stable income, and a down payment that ranges from 3% to 20%. If you can provide a down payment of 20% or more, you can avoid private mortgage insurance (PMI), which means lower monthly payments—a significant relief for many families.

As we look ahead to 2025, it’s important to understand what’s a conventional loan, as the typical interest rate for a 30-year fixed-rate mortgage is expected to be around 6.74%, reflecting current market trends. When considering , you might wonder what’s a conventional loan, which is a traditional mortgage that is versatile and can be used for various property types, including primary residences, second homes, and investment properties. This flexibility makes them an appealing choice for many homebuyers.

For instance, if you’re considering purchasing a $250,000 home with a 20% down payment, you would start with a mortgage balance of $200,000. This initial balance can significantly influence your monthly payment, depending on the interest rate you secure. Understanding these elements is crucial as you embark on this journey toward homeownership. Remember, we’re here to support you every step of the way.

Understand Why Conventional Loans Matter: Benefits and Considerations

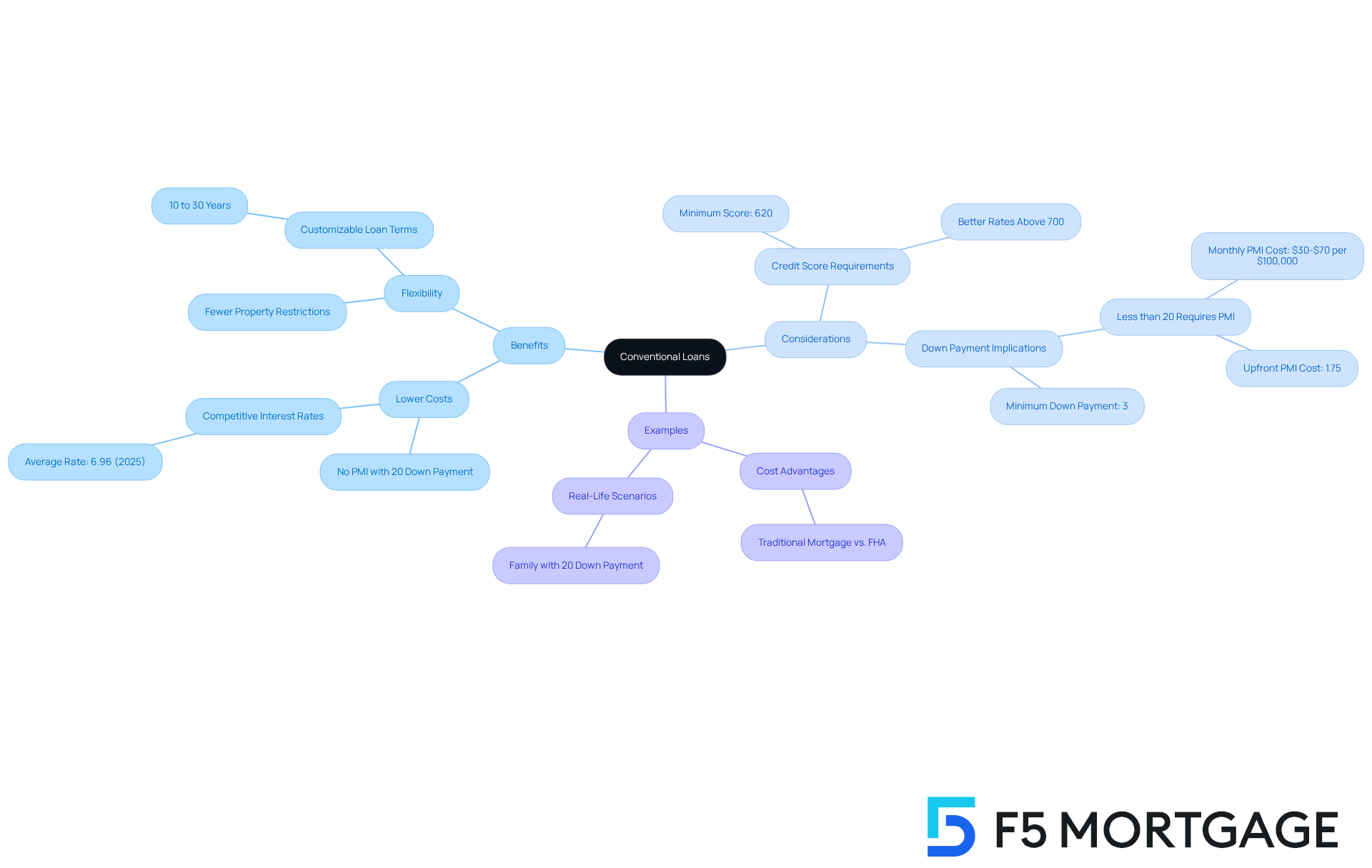

Traditional financing options offer various benefits that can truly resonate with homebuyers, especially those who have worked hard to build strong credit histories. One of the standout advantages is the potential for lower overall costs compared to government-backed loans. For instance, borrowers who can provide a 20% down payment not only start with significant equity but also eliminate the need for private mortgage insurance (PMI). This can save them hundreds of dollars annually. In 2025, the average interest rate for a 30-year standard mortgage is approximately 6.96%, a competitive rate that can lead to substantial savings over time.

Moreover, traditional financing typically enforces fewer limitations on property categories and applications, offering enhanced adaptability for purchasers. This flexibility is particularly beneficial for families looking to purchase a second home or an investment property. However, it’s important for potential borrowers to be mindful of the higher credit score requirements, with most lenders expecting a minimum score of 620 for conforming loans. Those with scores above 700 often enjoy even better rates and terms.

It’s also essential to consider the implications of a deposit less than 20%. In such cases, PMI becomes necessary, increasing the total expense of borrowing. Monthly PMI charges usually range from $30 to $70 for each $100,000 borrowed, which can accumulate significantly over the duration of the loan. PMI can also incur an upfront expense of 1.75% and yearly charges of 1.25%, further impacting the borrower’s financial responsibilities.

Real-life examples illustrate the cost advantages of traditional financing. For instance, a family obtaining a traditional mortgage with a 20% down payment can avoid PMI entirely, leading to reduced monthly payments compared to those choosing FHA mortgages, which require mortgage insurance for the life of the loan if the down payment is below 10%. This cost-effectiveness, coupled with the ability to customize financing terms—ranging from 10 to 30 years—makes traditional mortgages an appealing choice for families navigating the mortgage landscape.

In contrast to traditional lenders who often create pressure and urgency, F5 Mortgage enhances this experience by leveraging technology to provide ultra-competitive mortgage rates without the hassle of hard sales tactics. Families can benefit from a refreshing approach that prioritizes their needs, ensuring a stress-free process.

In summary, understanding what’s a conventional loan and its benefits and considerations is crucial for families aiming to make informed financial decisions. By weighing the advantages of lower costs and flexibility against the requirements for credit scores and down payments, borrowers can choose the mortgage solution that best aligns with their financial goals. Remember, we’re here to support you every step of the way, especially with the innovative assistance of F5 Mortgage.

Conclusion

Understanding the nature of conventional loans is essential for anyone navigating the home financing landscape. We know how challenging this can be. These loans, characterized by their independence from federal insurance or guarantees, provide a robust option for borrowers, particularly those with strong credit profiles. Their flexibility in terms of interest rates, down payment requirements, and eligibility criteria makes them a compelling choice for many aspiring homeowners.

Throughout this article, we have explored key features of conventional loans. These include:

- Competitive interest rates

- The potential for lower overall costs

- The ability to avoid private mortgage insurance with a substantial down payment

The increase in conforming loan limits reflects the evolving market and the need for accessible financing options in high-cost areas. Real-life examples and statistics further underline the significance of these loans, showcasing their role in facilitating home purchases across diverse demographics.

In conclusion, conventional loans stand as a vital component of the mortgage market, offering numerous benefits that can greatly enhance homeownership opportunities. For families looking to invest in property, understanding the advantages and considerations of conventional loans is crucial. As the market continues to shift, we’re here to support you every step of the way. Embracing the flexibility and cost-effectiveness of conventional loans can pave the way for a successful journey in homeownership.

Frequently Asked Questions

What is a conventional loan?

A conventional loan is a type of mortgage that is not insured or guaranteed by the federal government, distinguishing it from government-backed options like FHA or VA mortgages. These loans are primarily offered by private lenders.

What are the two types of conventional loans?

Conventional loans can be classified into two types: conforming and non-conforming loans. Conforming loans meet the criteria set by government-sponsored entities such as Fannie Mae and Freddie Mac, while non-conforming loans do not meet these specifications and often come with higher interest rates due to increased risk.

What are the key characteristics of conventional loans?

Key characteristics include: – Interest Rates: Borrowers can choose between fixed-rate and adjustable-rate mortgages (ARMs), with ARMs starting with lower initial rates that adjust to market conditions. – Initial Deposit Requirements: Down payments can range from 3% to 20%, with down payments less than 20% often requiring private mortgage insurance (PMI). – Flexibility: Conventional loans offer diverse terms and conditions, catering to a wide range of borrowers.

How popular are conventional loans compared to other mortgage options?

In 2025, conventional mortgages accounted for approximately 54% of all mortgage originations in the U.S., indicating their popularity in comparison to government-backed options.

What are the conforming credit limits for conventional loans?

The Federal Housing Finance Agency (FHFA) has set the baseline conforming credit limit at $806,500, with elevated limits in high-cost areas reaching up to $1,209,750. These higher limits allow homebuyers to finance more expensive properties without resorting to jumbo loans, which often have stricter qualification requirements.

Who benefits most from conventional loans?

Conventional loans are particularly attractive for borrowers with strong credit who can afford a significant down payment, as they typically offer lower interest rates and fewer restrictions compared to FHA or VA loans. This flexibility makes them a viable option for families looking to purchase new homes or upgrade their current properties.