Overview

The article highlights eight key benefits of a 15-year mortgage loan for families, focusing on how it can alleviate some of the financial pressures they face. Families can enjoy:

- Lower interest rates

- Faster equity accumulation

- Improved budgeting through fixed monthly payments

By comparing these advantages to 30-year loans, we see significant savings in total interest paid. Moreover, the emotional rewards of achieving homeownership sooner can foster a sense of security and stability. We know how challenging this can be, and these benefits collectively support families in their journey towards financial well-being.

Introduction

Choosing the right mortgage can be a pivotal moment for families, shaping their financial future and homeownership experience. We understand how challenging this decision can be, and we’re here to support you every step of the way.

A 15-year mortgage loan offers a unique blend of benefits that not only accelerates equity building but also provides substantial savings on interest payments. However, with higher monthly payments and the pressure of long-term financial commitments, many families may wonder if this option truly aligns with their economic goals.

What are the compelling advantages that make a 15-year mortgage an appealing choice for families in 2025? Let’s explore this together.

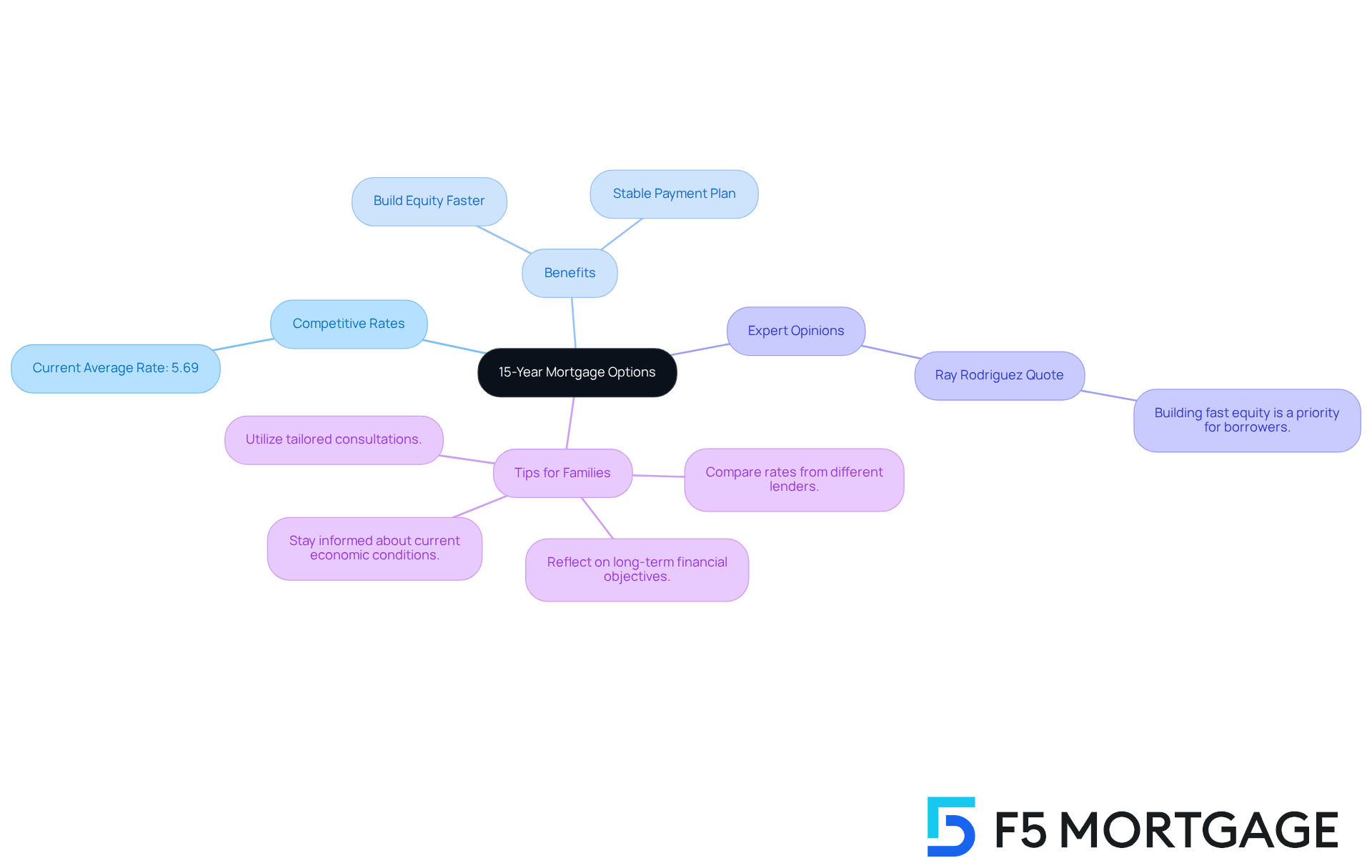

F5 Mortgage: Competitive 15-Year Mortgage Loan Options

F5 Mortgage LLC understands the diverse needs of households and offers a variety of . By partnering with over two dozen top lenders, we ensure that our clients have access to the most favorable rates and terms available in the market. Our tailored discussions help families navigate the complexities of loan financing, making the process smoother and more efficient.

As of August 2025, the national average interest rate for a fixed mortgage of fifteen years stands at 5.69%. This makes it an appealing option for those looking to establish a stable and predictable payment plan. Whether you’re a first-time homebuyer or seeking to refinance, our not only promote homeownership but also help you , aligning with your .

At F5 Mortgage, we pride ourselves on a . Our dedicated loan officers, equipped with extensive experience and a passion for helping families achieve their , are always just a call or message away. They combine outstanding communication with exceptional problem-solving skills to ensure your financing experience is efficient and stress-free.

Ray Rodriguez, Regional Mortgage Sales Manager with TD Bank, observes, “If constructing rapid equity is a priority for a borrower, frequently a shorter-term loan can be a faster method to achieve it than a longer-term loan.” This aligns perfectly with F5 Mortgage’s services, which not only facilitate homeownership but also help families build equity more swiftly, supporting their long-term economic aspirations.

Tips for Families Considering a 15-Year Mortgage:

- Compare rates from different lenders to find the best deal.

- Reflect on your long-term financial objectives and how a 15 year mortgage loan fits into them.

- Stay informed about , as loan rates are expected to gradually decrease through 2025.

- Utilize F5 Mortgage’s to gain a clearer insight into how a 15 year mortgage loan can effectively meet your specific needs.

Lower Interest Rates: Save More Over Time

A considerable benefit of a long-term loan is the reduced interest rates it generally provides in comparison to extended-term financing. On average, a has rates that are approximately 0.5% to 0.75% lower than those of . This reduction can translate into .

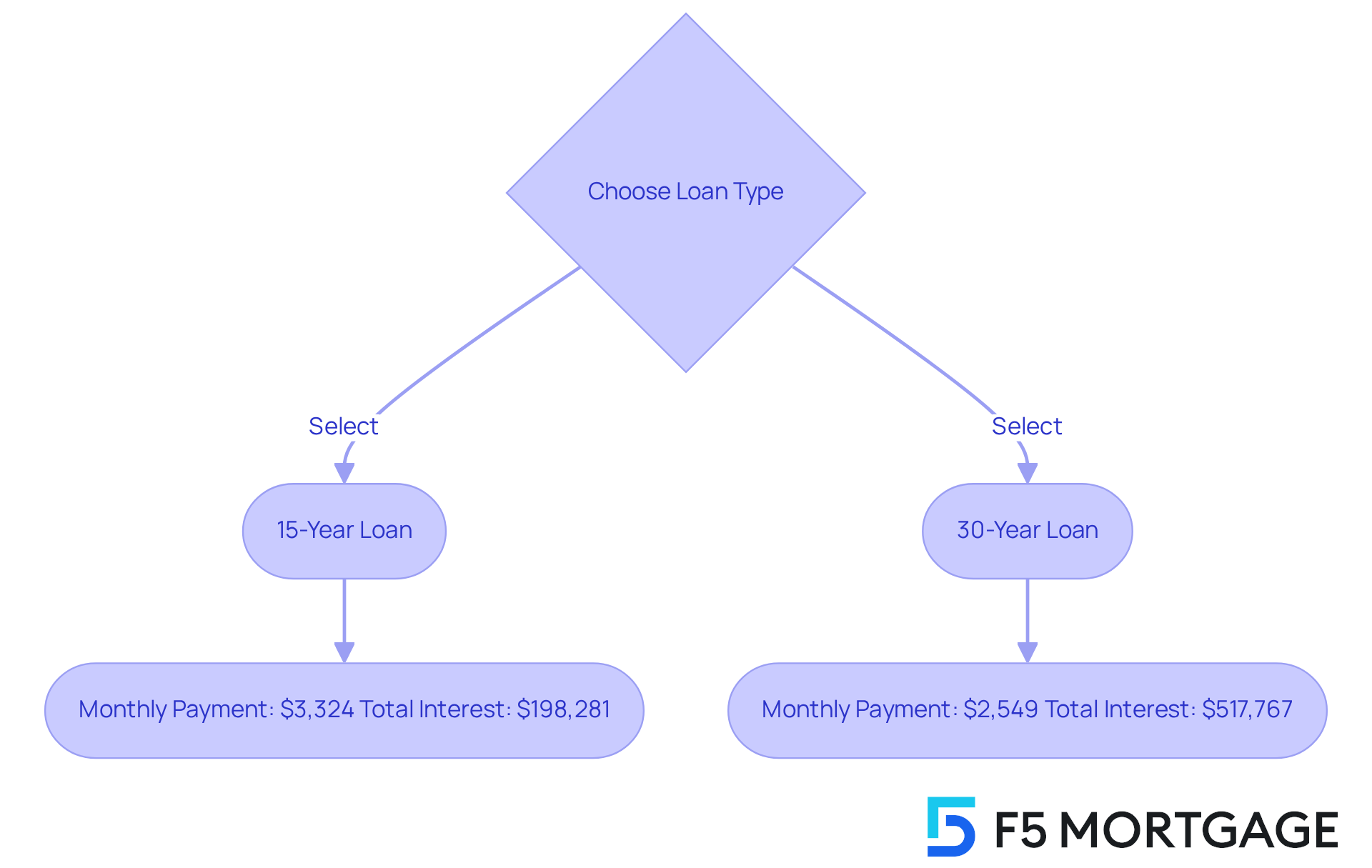

For example, on a $400,000 loan, selecting a term of leads to a monthly payment of roughly $3,324, whereas a 30-year loan at 6.58% would incur about $2,549 each month. Although the monthly installment for the shorter term option is greater, the overall interest paid throughout the duration of the loan is considerably less—$198,281 for the shorter term loan compared to $517,767 for the longer term loan. This means households can redirect the savings toward other financial objectives, such as funding education or enhancing retirement savings.

With the national average for currently at 5.69%, families have a unique opportunity to take advantage of these through , potentially saving thousands over the life of their 15 year mortgage loan financing. We know how challenging navigating the mortgage landscape can be, especially with traditional lenders often employing hard sales tactics and providing biased information. This can lead to families making uninformed decisions.

F5 Financing was established by Ryan McCallister to counter these practices, ensuring a transparent and consumer-focused approach to loan financing. Specialists suggest a if the payment is manageable, highlighting the significance of evaluating personal economic circumstances prior to reaching a conclusion. Families should consider their long-term financial goals and . We’re here to support you every step of the way.

Faster Equity Build-Up: Invest in Your Home Sooner

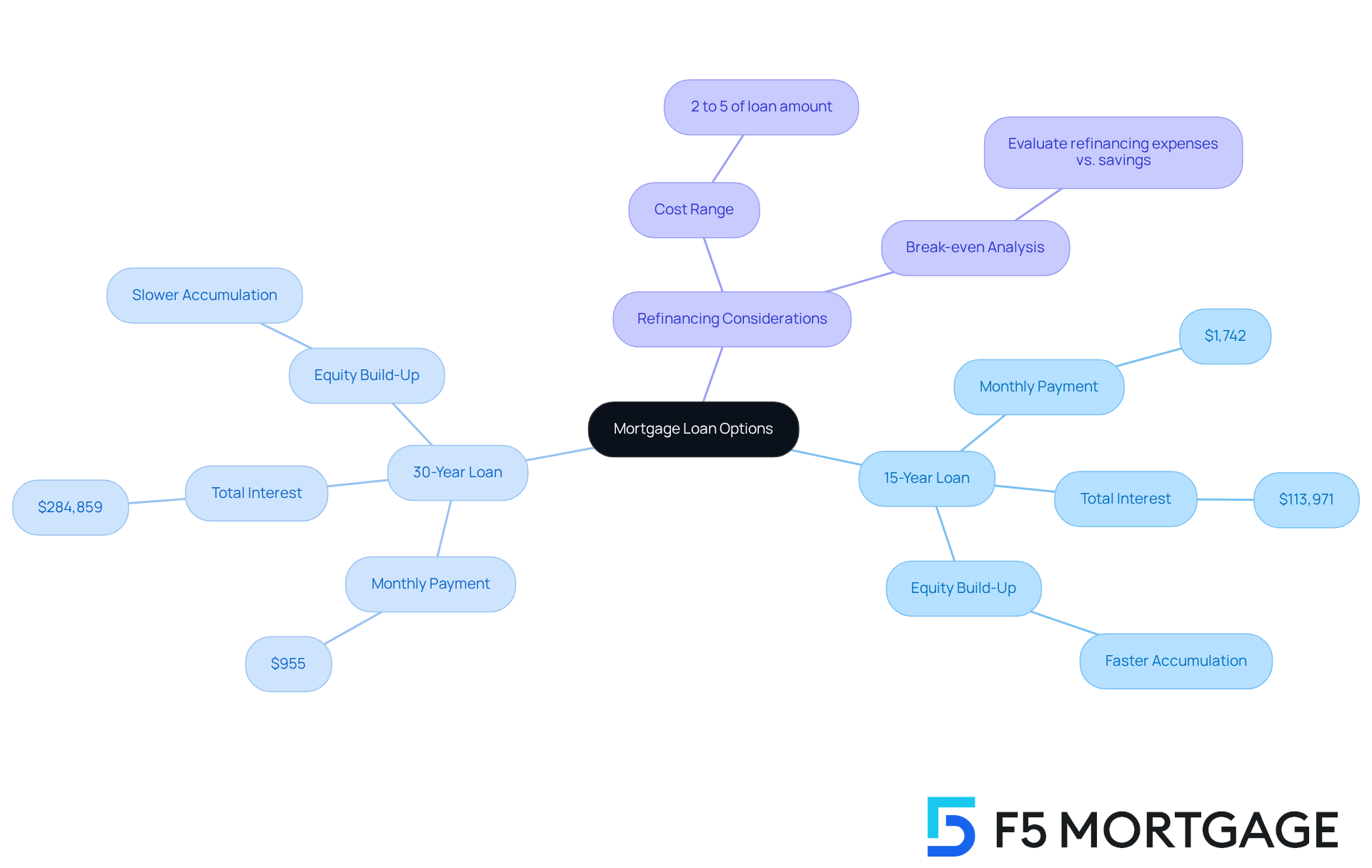

A shorter duration loan allows homeowners to than a longer duration loan. This is mainly due to the allocated to the principal amount. For example, a $200,000 mortgage at a 6.48 percent interest rate results in a monthly payment of approximately $1,742 for a . In contrast, the payment for a 30-year term at 7.07 percent is about $955. This accelerated equity accumulation enables households to invest in their homes sooner, improving their economic flexibility.

With a , families can for future investments, such as home improvements or additional property purchases. Furthermore, the throughout the duration of the loan—approximately $91,000 less in total interest for a 15 year mortgage loan compared to the $284,859 total interest paid on a 30-year loan—adds to the loan. We know how important it is to make , and understanding the expenses linked to refinancing is essential.

Refinancing costs generally vary from 2% to 5% of the loan amount. For instance, if you are considering refinancing a $300,000 loan, closing expenses could range from $6,000 to $15,000. Determining the break-even point by evaluating and monthly savings can assist households in assessing whether refinancing aligns with their monetary objectives.

By selecting a long-term loan, families not only ensure a more stable economic future but also position themselves to take advantage of their home equity more effectively. However, it is crucial to consider that the higher monthly payments may disqualify some . This makes it essential to evaluate individual financial situations before making a decision. Remember, we’re here to support you every step of the way.

Reduced Total Interest: Maximize Your Savings

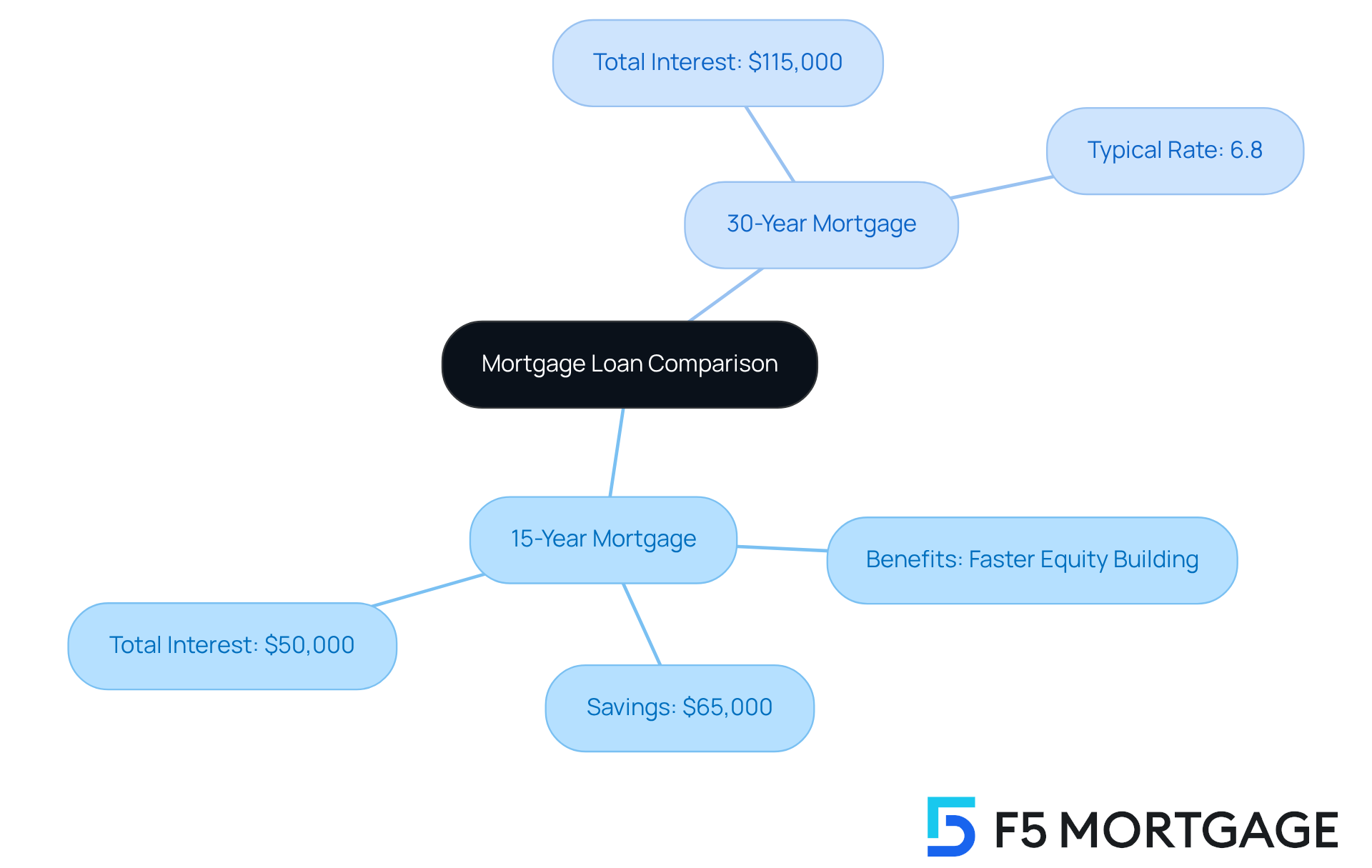

Choosing a can lead to substantial savings on throughout the financing period. For instance, a $300,000 loan at a 5% interest rate would result in approximately $115,000 in interest over 30 years. In contrast, the same loan would only accrue around $50,000 in interest over 15 years. This remarkable difference of $65,000 allows families to channel those savings into other vital , such as retirement savings or funding education.

Moreover, households that select a 15 year mortgage loan can , enhancing their financial security and future investment opportunities. As of 2025, the average total interest paid on a $400,000 home loan with a of 5.75% over a 15 year mortgage loan is approximately $207,577, showcasing the significant advantages of this 15 year mortgage loan option.

However, it’s important to consider the , which may impact your budget. With the typical hovering around 6.8% in 2025, many families are optimizing their savings by opting for the shorter-term option, especially in today’s market environment. We know how challenging these decisions can be, and we’re here to support you every step of the way.

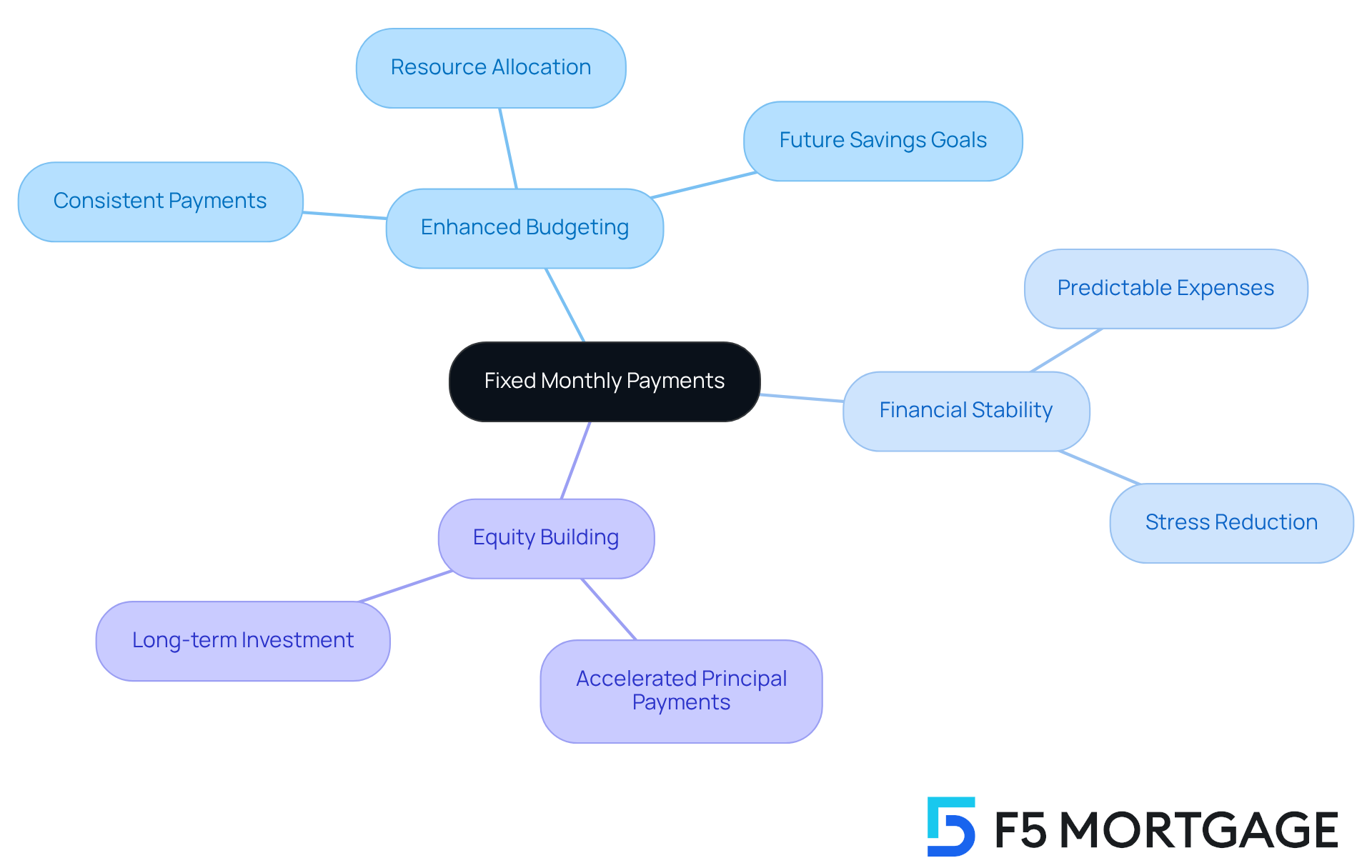

Fixed Monthly Payments: Simplify Your Budgeting

A offers families the comforting benefit of , greatly enhancing their budgeting capabilities. We understand how challenging it can be to manage finances, and with , families can plan their budgets without the stress of fluctuating interest rates. This stability not only helps in meeting monthly obligations but also allows for , empowering families to save for future needs.

For instance, families who choose a can truly appreciate the consistency of their payments, fostering a sense of . As industry experts point out, the is often comparable to that of a 30-year mortgage, but a larger portion goes toward the principal, which accelerates equity building. This predictability is especially beneficial for families aiming to effectively in 2025, as it enables them to maintain a budget that accommodates both current expenses and future savings goals.

Overall, the stable nature of these payments simplifies budgeting, making it easier for families to achieve their long-term financial aspirations. We’re here to support you every step of the way, guiding you toward a more .

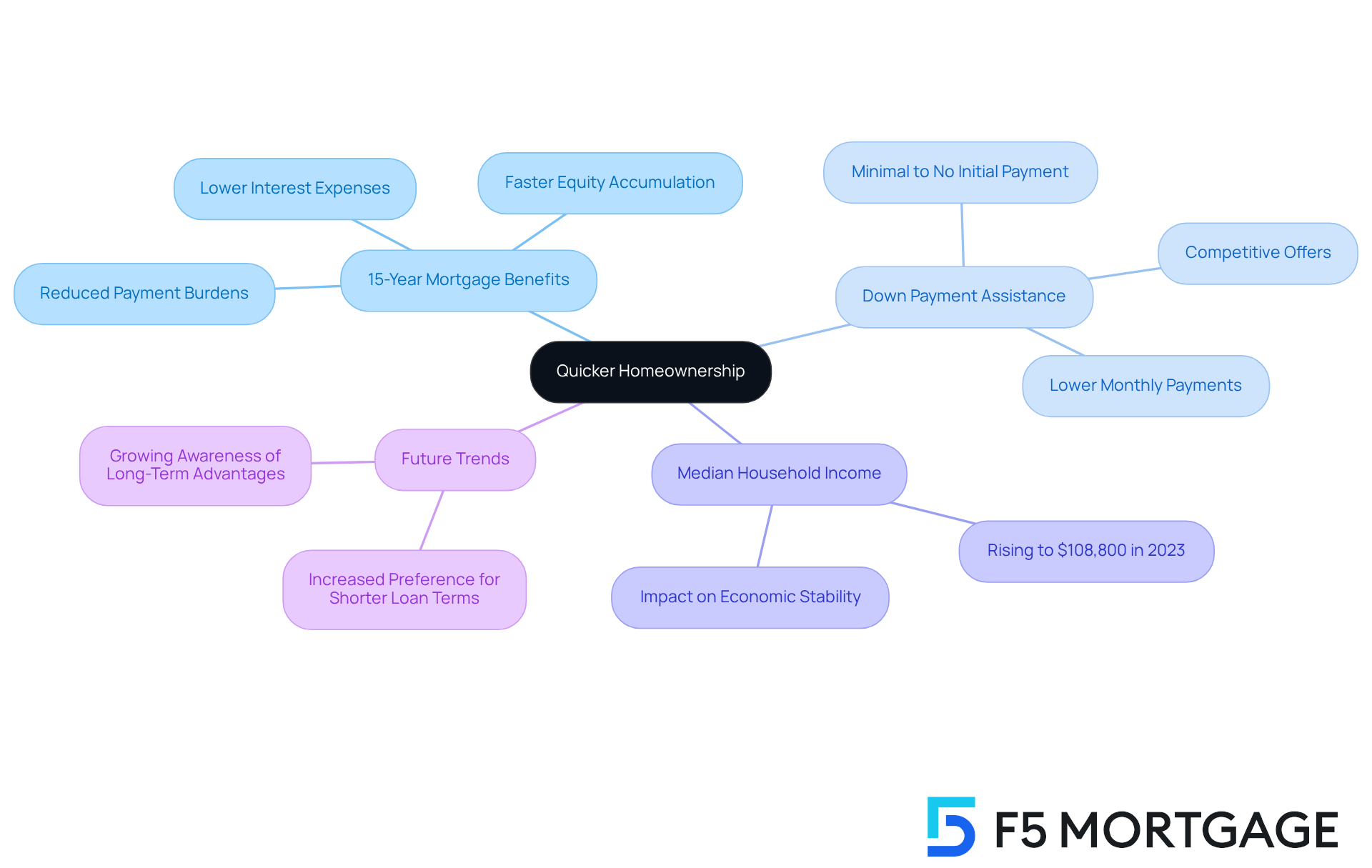

Quicker Homeownership: Achieve Your Dream Sooner

Choosing a can be a transformative decision for families, allowing them to achieve complete compared to a conventional 30-year loan. This quicker path eases payment burdens earlier, allowing households to redirect their resources towards essential areas like education and retirement savings.

We understand how challenging it can be to navigate the mortgage landscape. By utilizing , families can qualify for home loans with minimal to no initial payment. This creates more competitive offers, decreases loan amounts, and lowers monthly housing payments.

With the for average home purchasers rising to $108,800 in 2023, families are increasingly recognizing the importance of for enhancing . When mortgage obligations are removed sooner, households can focus on and securing their financial future.

Trends indicate that by 2025, families will prioritize to take advantage of the benefits of quicker homeownership. This shift reflects a growing awareness of the long-term advantages associated with a 15 year mortgage loan, such as and the ability to accumulate equity more rapidly—especially when paired with down payment support.

We’re here to support you every step of the way as you consider these options for a brighter financial future.

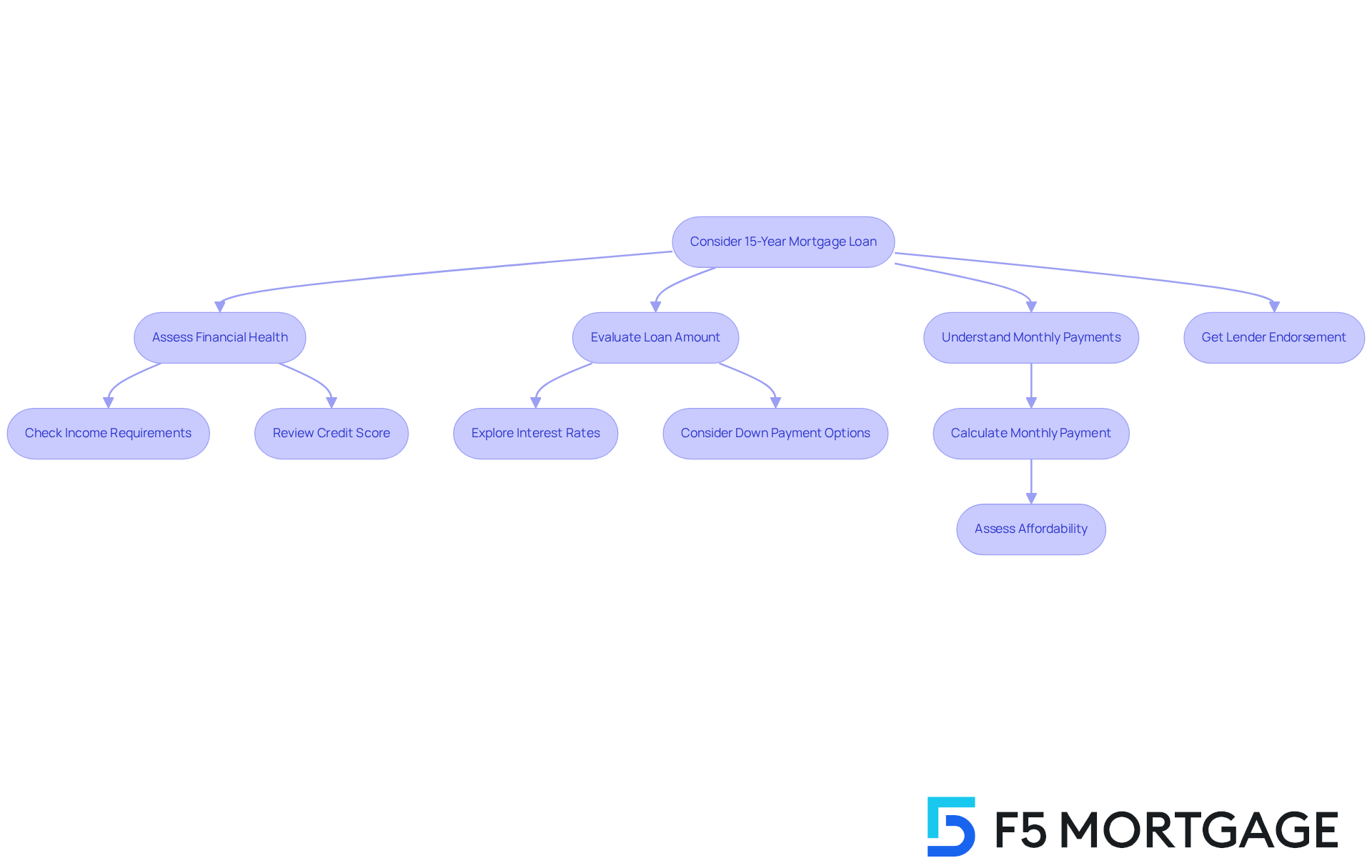

Lower Loan Amounts: Make Home Buying More Accessible

Choosing a can often feel like a daunting decision for families, especially because of the that come with it. However, this choice can significantly enhance your ability to purchase a home, as it encourages you to select properties that align with your . By focusing on cost-effectiveness, you can avoid the pitfalls of overextending your finances, ensuring that you can manage your housing payments comfortably while still enjoying the benefits of your new home.

In 2025, with the median home price at $422,400, many families are discovering that a 15 year mortgage loan not only allows for but also promotes a more . This emphasis on smaller loan amounts can pave the way for a more sustainable financial future, enabling you to without the burden of excessive debt.

Moreover, since early 2020, the income required to buy a home in over half the country has increased by 50 percent. This reality has made families more aware of the . With the hovering around 6.6%, it’s crucial to assess your financial health before committing to a loan, ensuring that you can manage your monthly payments effectively.

When a lender provides an endorsement, it signifies that, based on your financial information, you are a suitable candidate for a loan. This gives you a clearer picture of your borrowing capacity, interest rate, and potential monthly payments. Understanding the is vital as you weigh your options and make informed decisions about your home financing. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

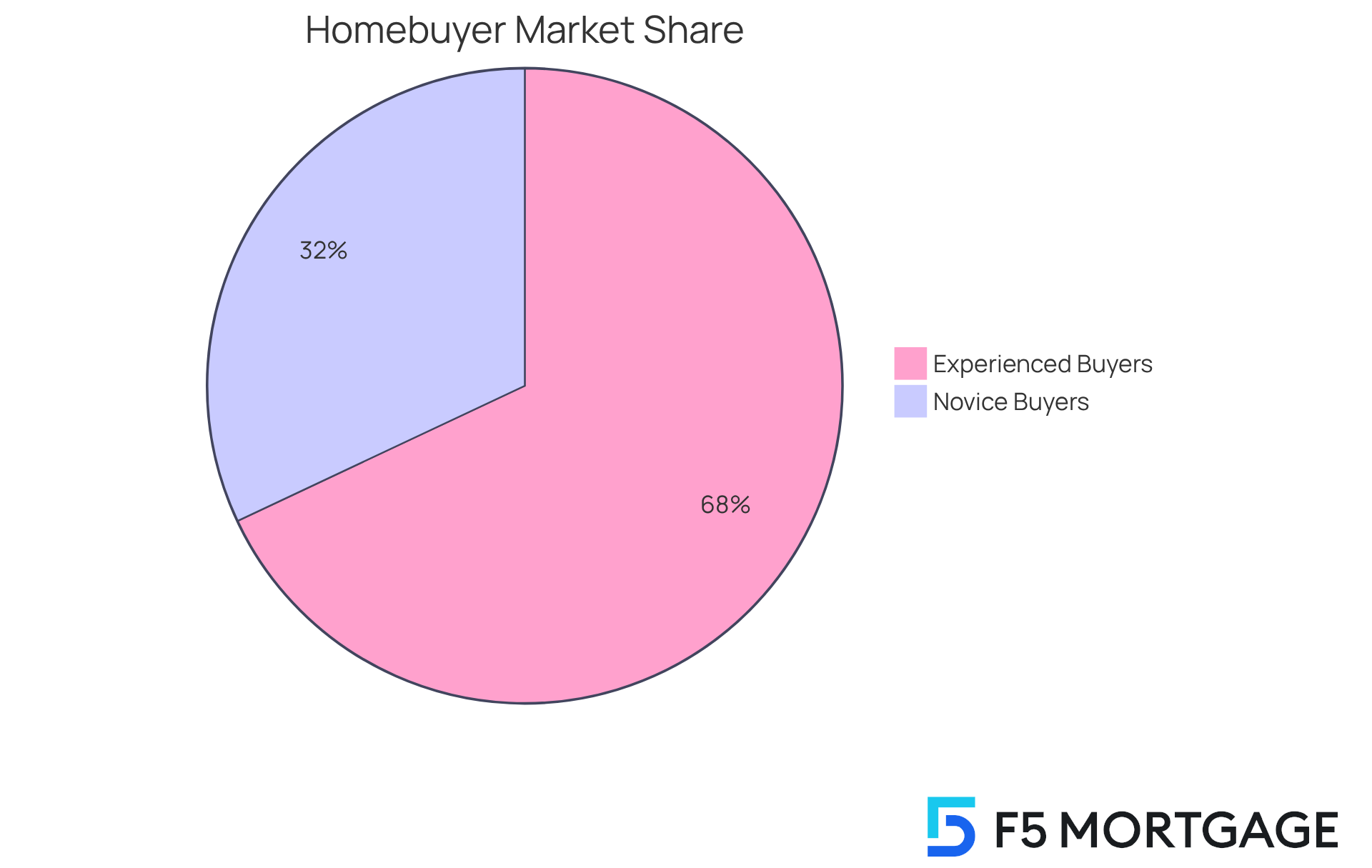

Ideal for First-Time Homebuyers: A Smart Start

For , a can be a wonderful choice, especially through . This type of loan encourages disciplined financial habits by requiring larger monthly payments, which can help you build equity faster and achieve homeownership more swiftly. With typical rates for around 6.29% as of early 2024, these loans often provide compared to their 30-year counterparts, making homeownership more accessible for families.

We know how challenging this can be, and according to Michael Dempster, ‘The typical rate for a 15 year mortgage loan is 6.29% as of February 22, 2024.’ This financial discipline not only aids in quicker repayment but also positions buyers to invest in their future sooner, fostering a sense of stability and security in their financial journey.

Moreover, with 32% of home purchasers being novice buyers in 2023, of a 15 year mortgage loan is essential for households looking to enhance their residences. F5 Mortgage is dedicated to revitalizing the loan process, ensuring without the stress of aggressive sales tactics. We’re here to support you every step of the way as you embark on your .

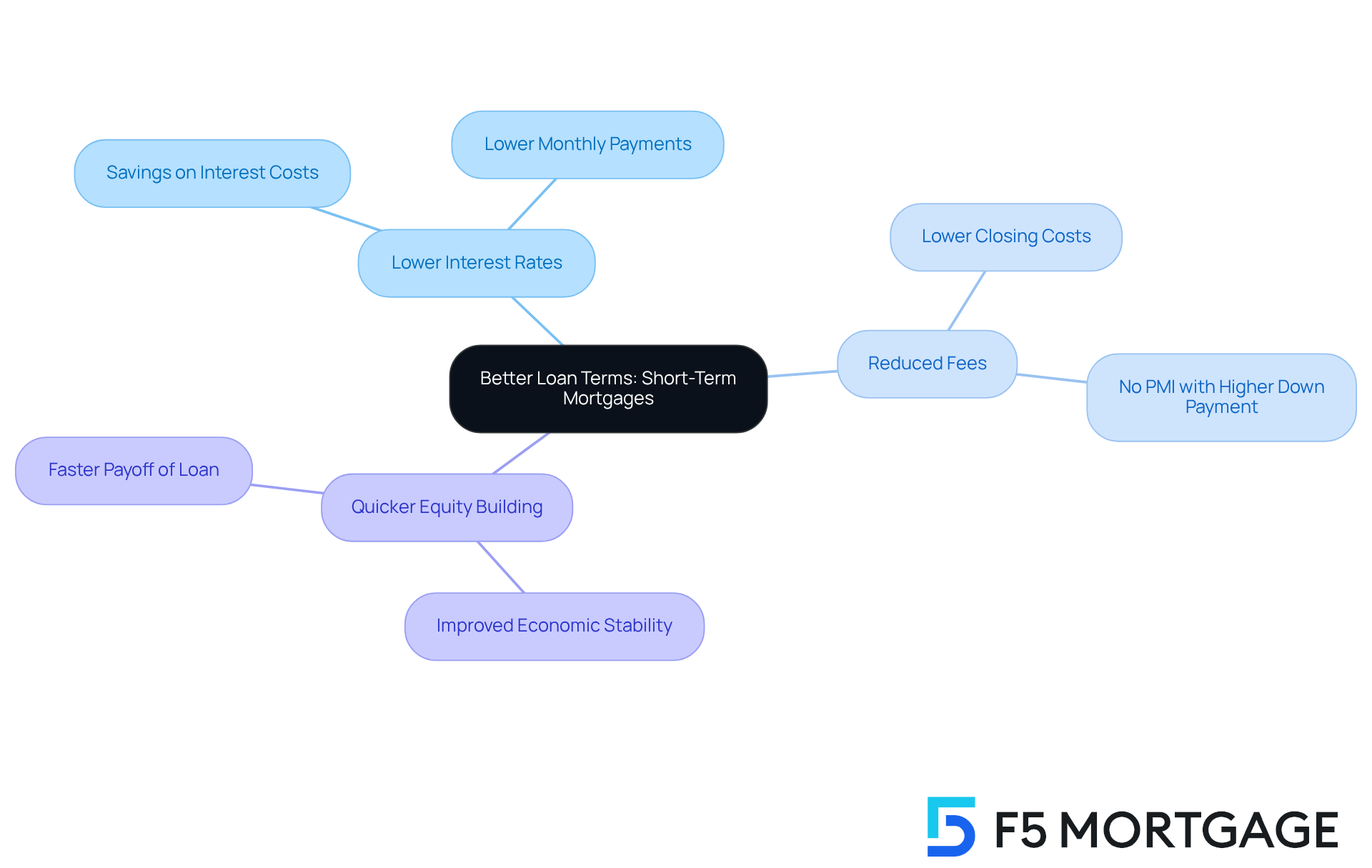

Better Loan Terms: Secure Favorable Conditions

Choosing a can be a smart move for families, offering improved loan conditions like and reduced fees. We understand how challenging the can be, and lenders often consider a less risky due to its shorter repayment period. This perspective can lead to , making it easier for families to access .

Imagine the over the life of your loan. For instance, households securing a 15 year mortgage loan can save significantly on interest costs compared to longer-term options. This makes the choice of a short-term mortgage not just practical but financially wise.

Moreover, committing to a shorter repayment timeframe allows more quickly. This can greatly enhance your , giving you the peace of mind you deserve. We’re here to as you navigate these important decisions.

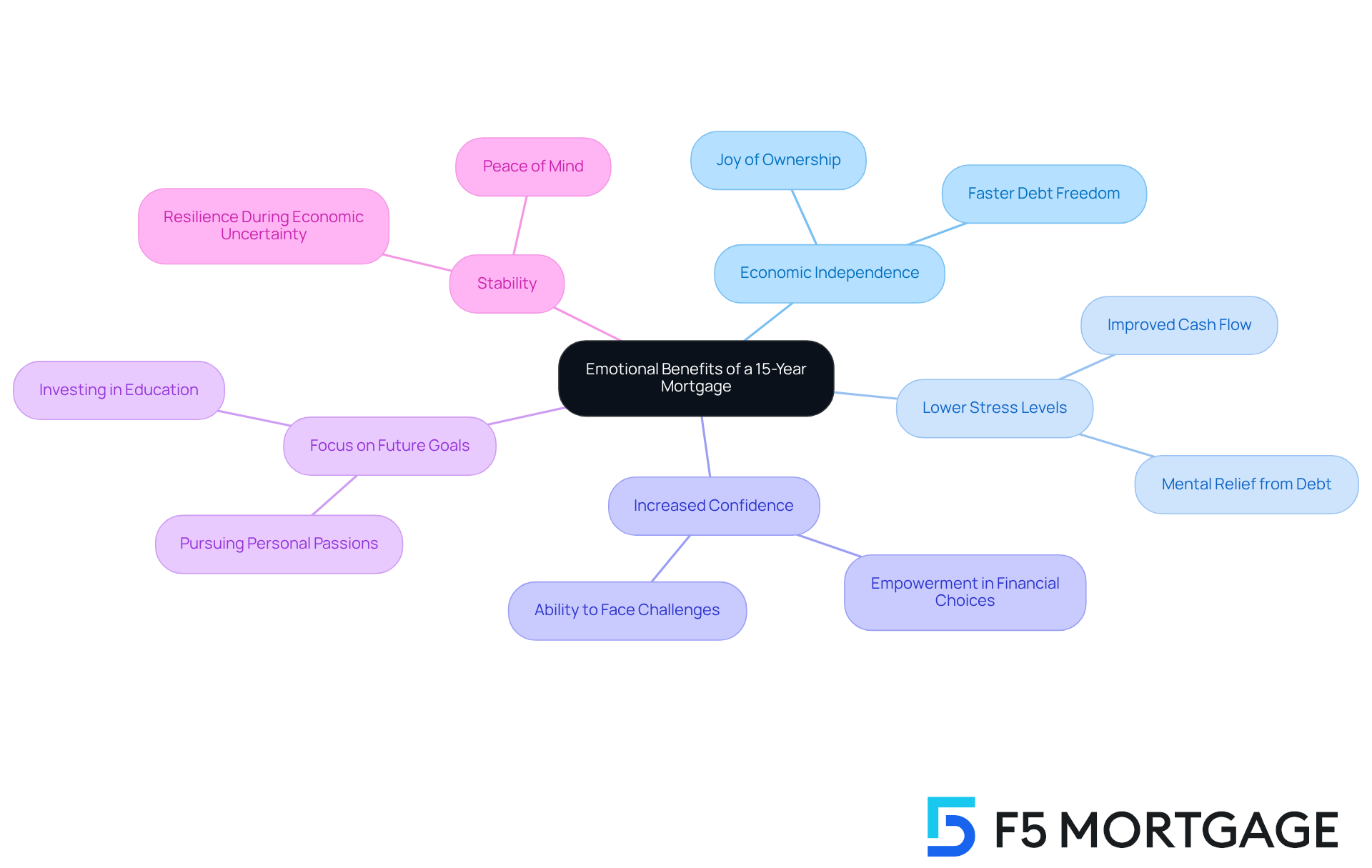

Emotional Benefits: Experience Financial Freedom Sooner

Choosing a can provide families with not only but also significant emotional rewards. By committing to pay off their home in half the time of a traditional 30-year mortgage, households can experience the joy of with a 15 year mortgage loan. This accomplishment often leads to lower stress levels and increased confidence in . With the weight of , families can focus on building a secure future, investing in their children’s education, or pursuing personal passions.

The are profound. Many families report feeling a deeper sense of stability and peace of mind, empowering them to face life’s challenges with renewed energy. As we look toward 2025, with economic uncertainties on the horizon, the importance of owning a home outright becomes even clearer. can weather economic storms more effectively, experiencing less impact from market fluctuations compared to stockholders.

This solid foundation not only enhances financial security but also instills confidence in making future investment decisions. At F5 Mortgage, we understand how challenging this process can be, and we are dedicated to educating borrowers about these benefits. Our goal is to ensure a smoother mortgage experience that combines advanced technology with , ultimately refreshing the mortgage process for families. We’re here to support you every step of the way.

Conclusion

Choosing a 15-year mortgage loan offers families a wonderful opportunity to enhance their financial future. This option not only accelerates homeownership but also allows for quicker equity accumulation and significant savings on interest payments. By opting for a shorter loan term, families can enjoy the benefits of fixed monthly payments, making budgeting more manageable and predictable.

Throughout this article, we’ve highlighted various advantages of a 15-year mortgage, including:

- Lower interest rates

- Faster equity build-up

- Reduced total interest paid

- Emotional benefits of achieving financial freedom sooner

These factors collectively underscore the practicality of this mortgage type, especially for first-time homebuyers eager to establish a stable financial foundation.

In summary, as you consider a 15-year mortgage, it’s important to weigh the long-term benefits against your immediate financial capabilities. With the support of F5 Mortgage and its competitive loan options, you can navigate the complexities of home financing with confidence. Embracing this mortgage type can lead to not just a home, but a pathway to greater financial security and peace of mind. Remember, we know how challenging this can be, and we’re here to support you every step of the way.

Frequently Asked Questions

What mortgage options does F5 Mortgage offer?

F5 Mortgage offers a variety of competitive long-term home loan choices, including 15-year mortgage loan options, through partnerships with over two dozen top lenders to provide favorable rates and terms.

What is the current national average interest rate for a 15-year fixed mortgage?

As of August 2025, the national average interest rate for a 15-year fixed mortgage is 5.69%.

What are the benefits of choosing a 15-year mortgage?

A 15-year mortgage promotes homeownership, helps build equity more quickly, and offers lower interest rates compared to longer-term loans, potentially saving thousands over the life of the loan.

How do interest rates for 15-year loans compare to 30-year loans?

On average, 15-year mortgage loans have interest rates that are approximately 0.5% to 0.75% lower than those of 30-year loans, leading to substantial savings over the life of the loan.

Can you provide an example of the cost difference between a 15-year and a 30-year mortgage?

For a $400,000 loan, a 15-year mortgage at a 5.76% interest rate results in a monthly payment of about $3,324, while a 30-year loan at 6.58% incurs about $2,549 monthly. However, the total interest paid is significantly less for the 15-year loan—$198,281 compared to $517,767 for the 30-year loan.

How does a 15-year mortgage help in building equity?

A shorter loan term allows homeowners to accumulate equity more rapidly due to higher monthly payments allocated to the principal amount, enabling families to invest in their homes sooner.

What are the potential savings when choosing a 15-year mortgage?

Choosing a 15-year mortgage can lead to approximately $91,000 less in total interest compared to a 30-year loan, allowing families to redirect those savings toward other financial goals.

What should families consider before refinancing?

Families should evaluate the refinancing costs, which typically range from 2% to 5% of the loan amount, and determine the break-even point by assessing refinancing expenses and monthly savings.

How does F5 Mortgage support families in the mortgage process?

F5 Mortgage provides tailored consultations and has dedicated loan officers who offer outstanding communication and problem-solving skills to ensure an efficient and stress-free financing experience.