Overview

This article seeks to understand Florida FHA limits and their importance for homebuyers, especially for first-time buyers who are looking for affordable financing options. We know how challenging the home-buying process can be, and that’s why it’s crucial to highlight the advantages of FHA loans.

With low down payment requirements and flexible credit standards, these loans help many families achieve their dream of homeownership in Florida. Statistics show that despite economic challenges, many families have successfully navigated the home purchasing process with the support of FHA loans.

We’re here to support you every step of the way as you explore these opportunities.

Introduction

Understanding the intricacies of FHA loans can truly be a game-changer for aspiring homeowners in Florida. We know how challenging the housing market can be as it continues to evolve. With the Federal Housing Administration’s backing, these loans provide a vital lifeline for many, especially first-time buyers who face daunting down payment requirements and credit score hurdles.

As you navigate the various county-specific limits and eligibility criteria, you might wonder: how can you leverage these insights to maximize your home-buying potential?

This article delves into the essential aspects of Florida FHA limits, offering clarity and guidance for those ready to embark on their journey to homeownership. We’re here to support you every step of the way.

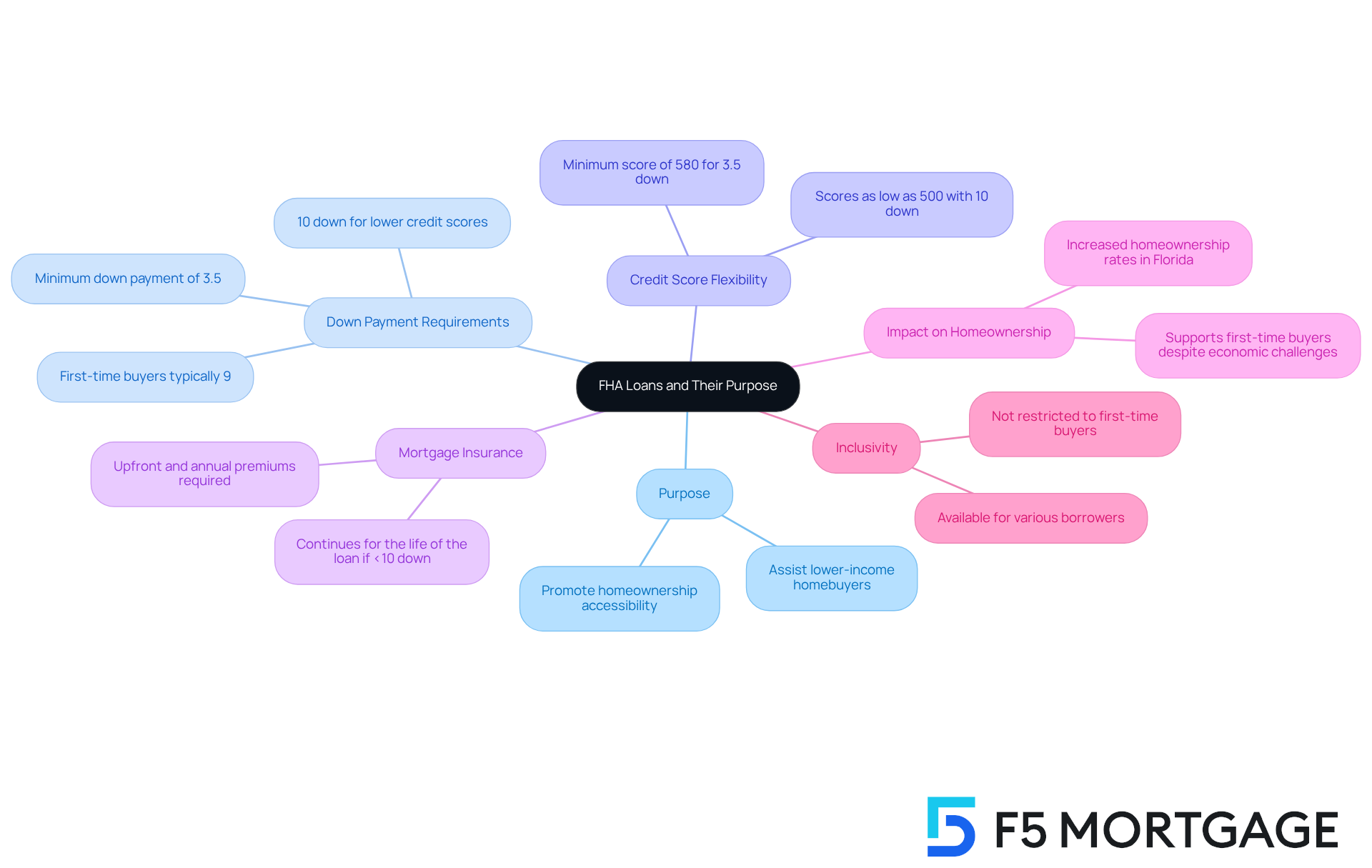

Define FHA Loans and Their Purpose

FHA products, or Federal Housing Administration mortgages, are government-backed financing options designed to assist lower-income and first-time homebuyers in securing home funding. We understand how challenging it can be to or navigate the complexities of credit ratings. That’s why FHA financing aims to enhance homeownership accessibility for a diverse range of borrowers. Unlike traditional financing options, FHA mortgages offer a minimum down payment requirement starting at just 3.5% and have more flexible credit score standards, allowing for scores as low as 580 in many cases. This flexibility makes the Florida FHA limits an appealing choice for many prospective homebuyers.

The impact of FHA financing, particularly the Florida FHA limits, on homeownership rates in Florida has been significant, especially for first-time buyers. Many families have successfully navigated the home purchasing process with FHA financing, realizing their dreams of homeownership despite economic challenges. Recent statistics show that first-time homebuyers typically make a down payment of around 9%, which aligns well with what FHA offers. It’s also important to note that FHA mortgages require both an upfront and annual mortgage insurance premium if the down payment is less than 10%. This additional cost can affect the overall affordability of the financing, making it a crucial consideration for potential borrowers. The FHA’s commitment to supporting lower-income families has led to increased homeownership rates across the state, in line with the Florida FHA limits, creating pathways for those who might otherwise feel excluded from the market.

Experts highlight that FHA financing isn’t just for first-time buyers; it’s available to a wide range of borrowers, including those who have owned homes in the past. This inclusivity is vital in addressing the housing needs of various demographics, especially in a market where affordability remains a pressing concern. As the housing landscape changes, FHA financing continues to play a crucial role in promoting equitable access to homeownership within the Florida FHA limits, making it a valuable option for many Floridians. We’re here to support you every step of the way in your journey toward homeownership.

Explore FHA Loan Limits in Florida by County

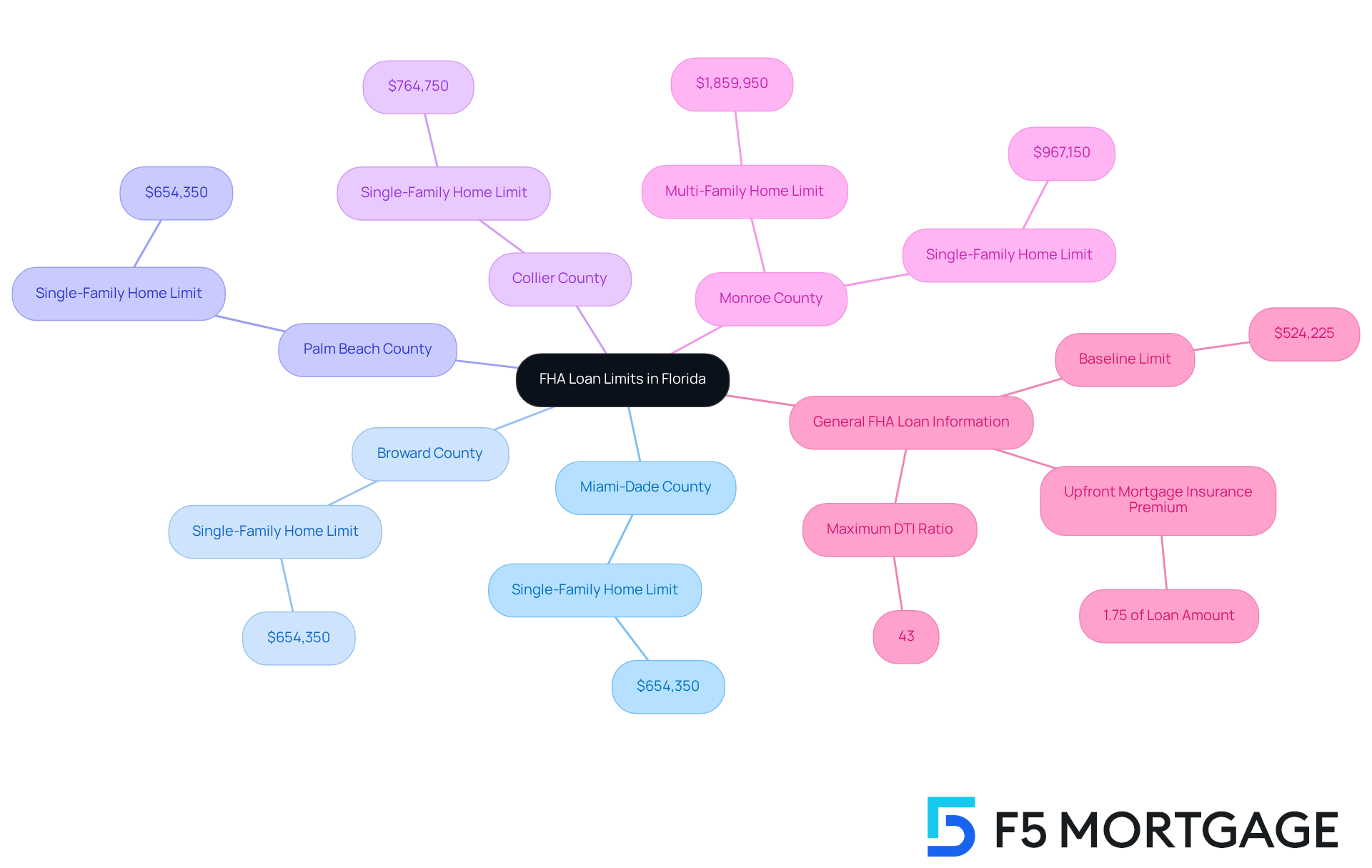

In Florida, understanding the [[Florida FHA limits](https://lendingtree.com/home/fha/fha-loan-limits-in-florida) for borrowing](https://fhahandbook.com/blog/florida-fha-loan-limits) can feel overwhelming, especially when they vary by county. For 2025, the baseline loan threshold for a single-family home is set at $524,225, a figure adjusted to reflect the rising home prices we see today. While this applies to many counties across Florida, it’s important to note that can have significantly different thresholds. For instance:

- In Miami-Dade, Broward, and Palm Beach counties, the threshold increases to $654,350.

- Collier County follows closely with a figure of $764,750.

- In contrast, counties with lower median property prices may have thresholds starting at $524,225.

We know how challenging it can be to navigate these county-specific restrictions, but they are crucial for homebuyers as they directly impact budgeting and the types of properties available within your price range. For example, first-time buyers in Monroe County can access [FHA loan thresholds](https://f5mortgage.com/7-essential-fha-loan-florida-insights-for-2025-borrowers) as high as $967,150 for single-family homes, providing a wealth of financing options. This flexibility empowers buyers to explore various property types, including multi-family residences, where thresholds can reach up to $1,859,950 for four-unit buildings.

Real estate professionals emphasize the importance of recognizing the Florida FHA limits when evaluating a property purchase. As Phil Ganz, a seasoned mortgage specialist, notes, “Grasping FHA borrowing thresholds is essential for making informed choices in the home purchasing process.” Additionally, potential borrowers should be aware of the upfront mortgage insurance premium of 1.75% of the borrowed amount and the maximum debt-to-income (DTI) ratio of 43% for FHA mortgages—key factors in determining eligibility. By checking the Florida FHA limits for your desired county, you can more effectively navigate the FHA financing landscape and secure funding that aligns with your goals. We’re here to support you every step of the way.

Outline Key FHA Loan Requirements for Florida Borrowers

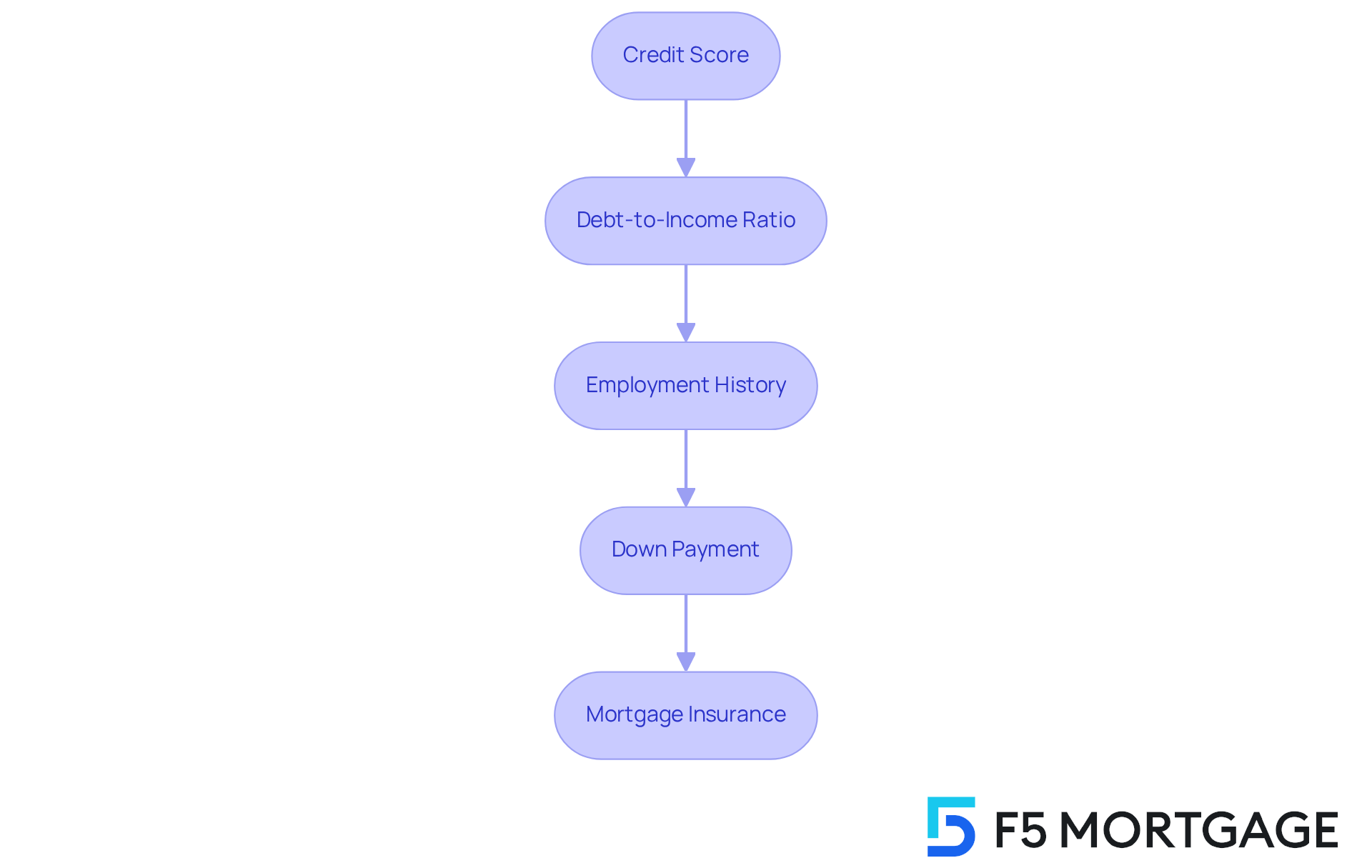

Navigating the journey to qualify for an FHA mortgage in Florida, considering the Florida FHA limits, can feel overwhelming, but we’re here to support you every step of the way. Understanding the essential requirements can empower you to take action with confidence.

- Credit Score: To unlock the 3.5% down payment option, a minimum credit score of 580 is generally necessary. If your score falls between 500 and 579, don’t worry—though a higher down payment of at least 10% is required, there are still paths available for you.

- Debt-to-Income Ratio: It’s important to maintain a debt-to-income (DTI) ratio not exceeding 43%. However, some lenders may allow up to 50% if you have compensating factors, so it’s worth discussing your situation with them.

- Employment History: A stable employment history of at least two years in the same field is preferred. You can verify this through , which help lenders understand your financial stability.

- Down Payment: A minimum down payment of 3.5% is essential. This can come from personal savings, family gifts, or approved assistance programs, making it more manageable for you.

- Mortgage Insurance: FHA financing requires both upfront and annual mortgage insurance premiums. These premiums protect lenders against defaults, providing peace of mind.

We know how challenging this can be, but comprehending the Florida FHA limits is crucial for your success in the application process. By understanding these steps, you can navigate the FHA financing process effectively and work towards securing your dream home.

Highlight Benefits of FHA Loans for Florida Homebuyers

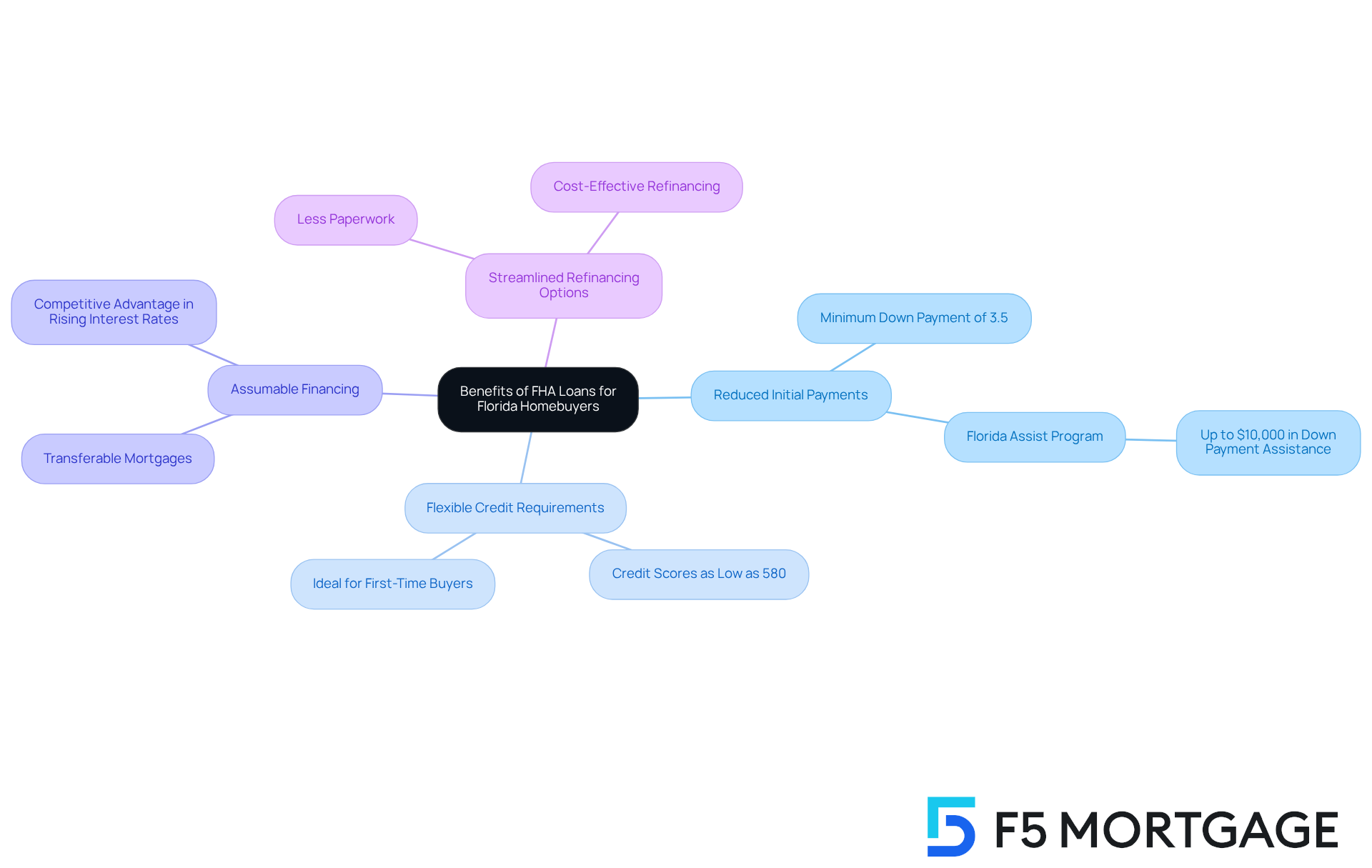

FHA financing provides numerous benefits for home purchasers in Florida, particularly due to the Florida FHA limits, making it an attractive choice for first-time buyers. We know how challenging this can be, and we’re here to support you every step of the way. Key benefits include:

- Reduced Initial Payments: With a minimum down payment of merely 3.5%, FHA financing significantly decreases the obstacle to homeownership. This enables individuals with limited savings to access the housing market. Programs like Florida Assist offer up to $10,000 in , further easing the financial burden for buyers.

- Flexible Credit Requirements: These financial products are accessible to borrowers with credit scores as low as 580, making them ideal for first-time buyers or those recovering from financial difficulties.

- Assumable Financing: FHA mortgages can be taken over by subsequent purchasers, offering a competitive advantage in the market, particularly if interest rates rise.

- Streamlined Refinancing Options: Current FHA borrowers gain from streamlined refinancing, which lessens paperwork and expenses, enabling smoother transitions to improved financing terms.

Success stories abound, with many first-time buyers achieving homeownership through FHA financing. As one satisfied client noted, “The F5 Mortgage team made the process so smooth and easy!” Furthermore, the Florida FHA limits set the baseline loan limit at $524,225, which underscores the program’s effectiveness in helping families realize their dreams of owning a home, supported by the exceptional service and expertise of the F5 Mortgage team.

Conclusion

FHA loans are a crucial resource for many homebuyers in Florida, especially those who find traditional financing options challenging. By offering accessible borrowing limits and flexible requirements, these loans enable a diverse range of individuals to achieve homeownership, enriching the housing landscape in our state.

We understand how daunting the journey to homeownership can be. Key insights include:

- A minimum down payment of just 3.5%

- Varying loan limits across counties

- The importance of grasping eligibility criteria like credit scores and debt-to-income ratios

FHA loans benefit not only first-time buyers but also accommodate various demographics, ensuring that more Floridians can secure suitable housing despite economic hurdles.

The importance of Florida FHA limits truly cannot be overstated. As home prices continue to climb, these loans provide an essential pathway for many aspiring homeowners. With the right guidance and support, navigating the FHA financing process can fulfill the dream of homeownership. We encourage potential buyers to explore their options and take actionable steps towards securing their future.

Frequently Asked Questions

What are FHA loans?

FHA loans, or Federal Housing Administration mortgages, are government-backed financing options designed to assist lower-income and first-time homebuyers in securing home funding.

What is the purpose of FHA loans?

The purpose of FHA loans is to enhance homeownership accessibility for a diverse range of borrowers, particularly those who may struggle with significant down payments or credit rating complexities.

What is the minimum down payment required for FHA loans?

The minimum down payment for FHA loans starts at just 3.5%.

What are the credit score requirements for FHA loans?

FHA loans have more flexible credit score standards, allowing for scores as low as 580 in many cases.

How do FHA loans impact homeownership rates in Florida?

FHA loans have significantly increased homeownership rates in Florida, especially for first-time buyers, enabling many families to achieve homeownership despite economic challenges.

What is the typical down payment made by first-time homebuyers?

Recent statistics show that first-time homebuyers typically make a down payment of around 9%, which aligns well with what FHA loans offer.

Are there additional costs associated with FHA loans?

Yes, FHA mortgages require both an upfront and annual mortgage insurance premium if the down payment is less than 10%, which can affect overall affordability.

Who can apply for FHA loans?

FHA loans are not just for first-time buyers; they are available to a wide range of borrowers, including those who have owned homes in the past.

Why is FHA financing important in the current housing market?

FHA financing plays a crucial role in promoting equitable access to homeownership, addressing the housing needs of various demographics in a market where affordability is a pressing concern.