Overview

Understanding HELOC loan interest rates can feel overwhelming, but we’re here to support you every step of the way. It’s essential to recognize the key factors that influence these rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Lender policies

Acknowledging these elements can help you navigate the complexities of your loan.

To manage these rates effectively, consider strategies like:

- Monitoring market trends

- Negotiating with lenders

We know how challenging this can be, but taking these proactive steps can empower you to secure better terms. Remember, you have the ability to influence your financial future, and with the right approach, you can achieve your goals.

Introduction

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is essential for homeowners looking to leverage their property’s value. We know how challenging navigating financial options can be, especially with average interest rates currently around 8.05%. These flexible credit options can provide significant opportunities for home improvements or debt consolidation, but it’s important to consider how they can impact your financial well-being.

However, the variable nature of HELOC interest rates raises critical questions. How can homeowners effectively navigate these fluctuations? What strategies can they employ to secure the best possible terms? This article delves into the key factors influencing HELOC rates, offering actionable insights to help you manage them wisely. We’re here to support you every step of the way as you explore these valuable financial tools.

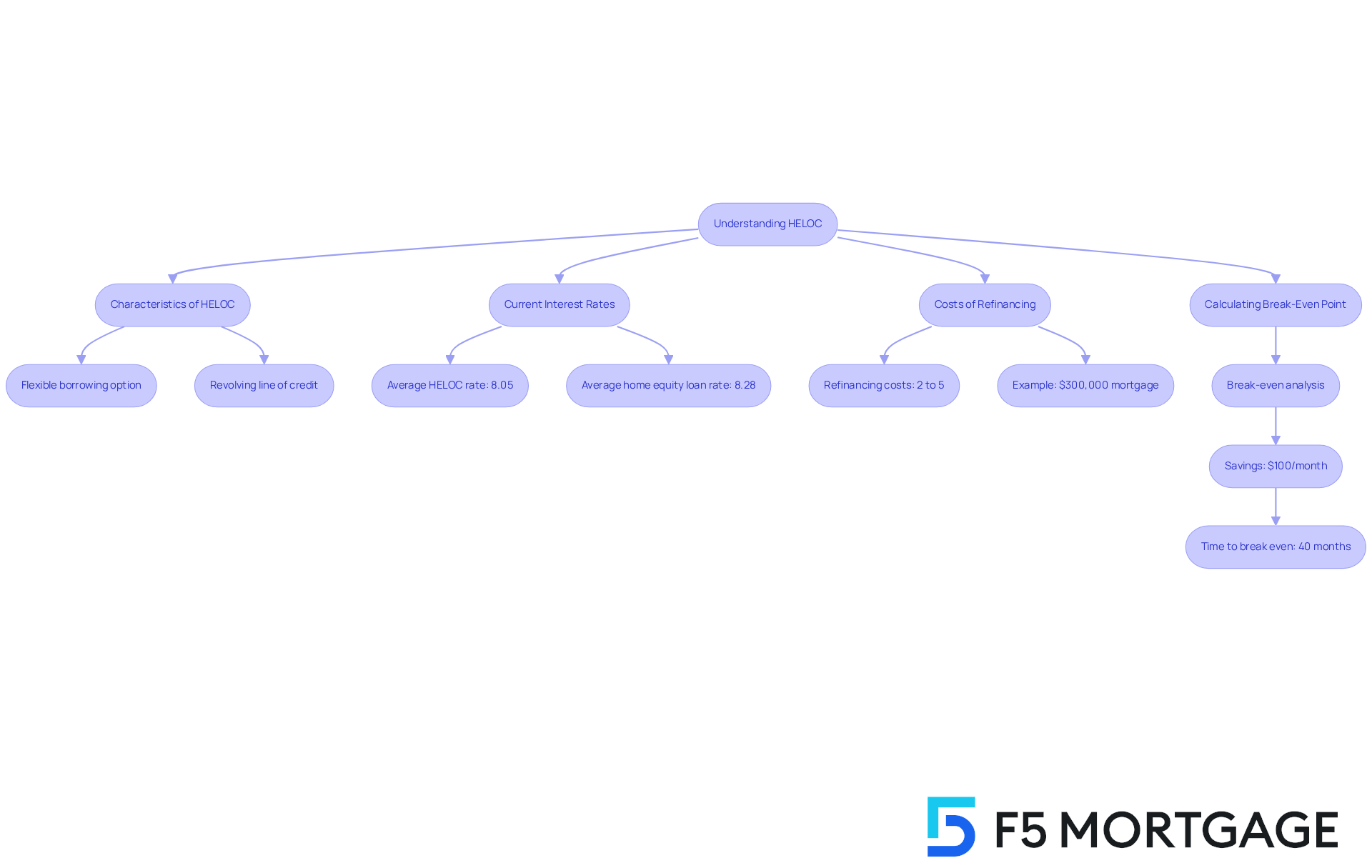

Define Home Equity Line of Credit (HELOC)

A Home Equity Line of Credit (HELOC) is a revolving line of credit backed by the equity in your home, providing homeowners with a flexible borrowing option. Unlike traditional home equity loans, which offer a lump sum, a HELOC allows you to withdraw funds as needed, up to a set limit. This flexibility can be particularly helpful for financing home improvements, consolidating debt, or managing unexpected expenses.

As of September 2025, the average HELOC loan interest rates have decreased to approximately 8.05%. This makes it a more affordable choice compared to home equity loans, which have HELOC loan interest rates averaging around 8.28%. However, it’s important to remember that HELOC loan interest rates typically have a variable nature that can change based on market conditions and lender terms. This variability can lead to unpredictable payments over time, so it’s a factor that homeowners should carefully consider when exploring their options.

We understand that navigating these dynamics can be challenging. Financial specialists emphasize the importance of comprehending how interest rates work to manage your home equity line of credit effectively and to make informed borrowing decisions. Additionally, be aware of the costs associated with refinancing, which can range from 2% to 5% of the loan amount. For instance, if you refinance a $300,000 mortgage, you might face closing costs between $6,000 and $15,000.

Calculating your break-even point is crucial in this process. If your refinancing costs are $4,000 and your monthly savings are $100, it would take 40 months to break even. This analysis can empower you to make informed financial choices regarding your home equity line of credit and refinancing options. Remember, we’re here to support you every step of the way.

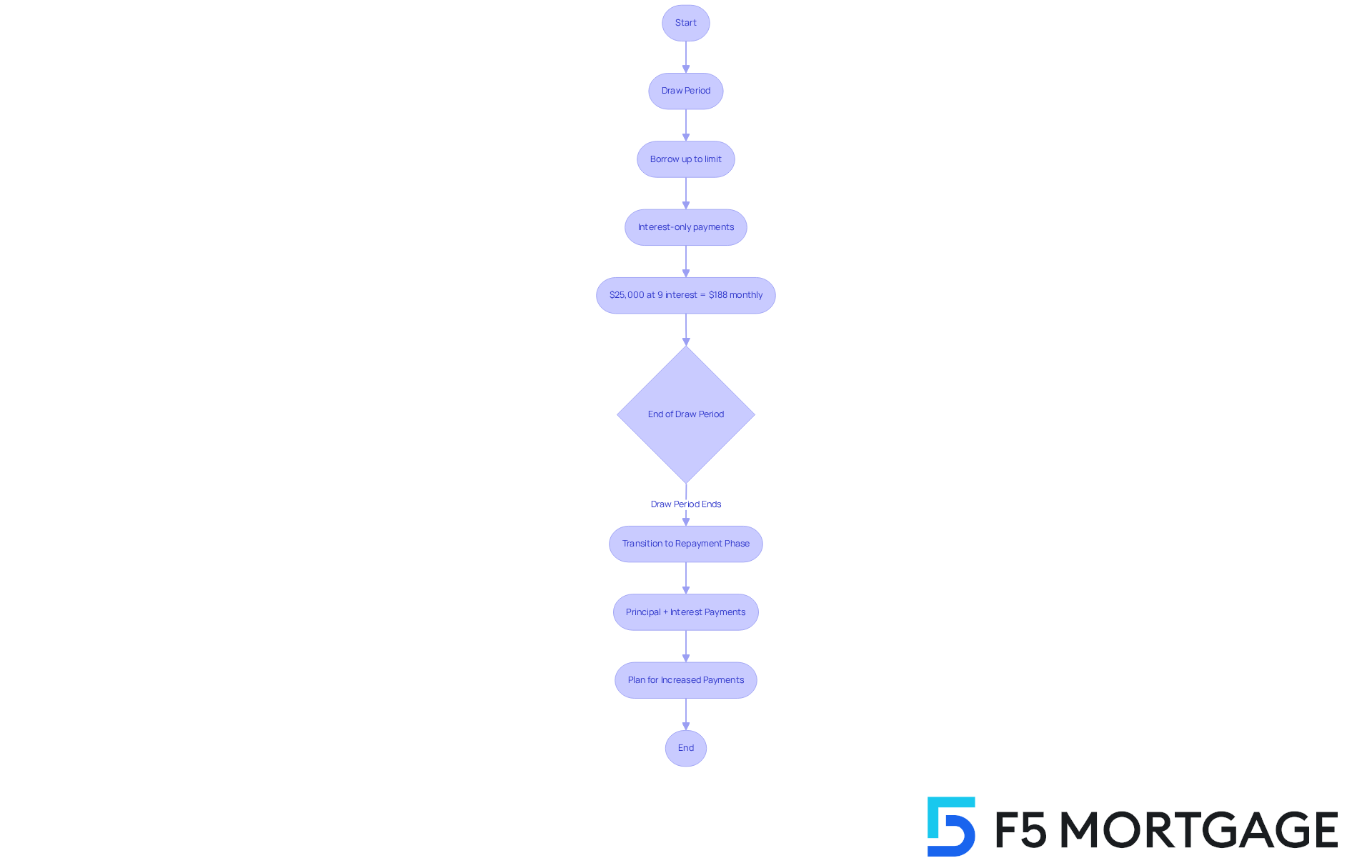

Explain How HELOCs Work

Home Equity Lines of Credit (HELOCs) function similarly to credit cards, allowing you to borrow against your home equity up to a specific limit during a draw period, typically lasting between 5 to 10 years. We understand how important it is for you to have access to funds when needed. During this phase, you can withdraw money as necessary and are generally required to make only interest payments on the amount drawn. For example, if you have a $25,000 HELOC loan interest rates at 9%, your monthly payment during the draw period would be around $188 if you draw the full amount.

Once the draw period ends, the loan shifts into a repayment phase lasting 10 to 20 years, where both principal and interest payments become necessary. This transition can significantly increase your monthly payments, which is why it’s essential to plan ahead. The borrowing limit is determined by your home’s appraised value minus any outstanding mortgage balance, often expressed as a loan-to-value (LTV) ratio. Currently, homeowners can access up to 90% of their home’s worth, depending on their equity and credit score.

Understanding these mechanics is crucial for anyone considering a home equity line of credit as a financing option. We know how challenging this can be, especially with recent trends showing a national increase in such balances by 6.3%. Being informed empowers you to make the best decisions for your financial future.

Identify Factors Affecting HELOC Interest Rates

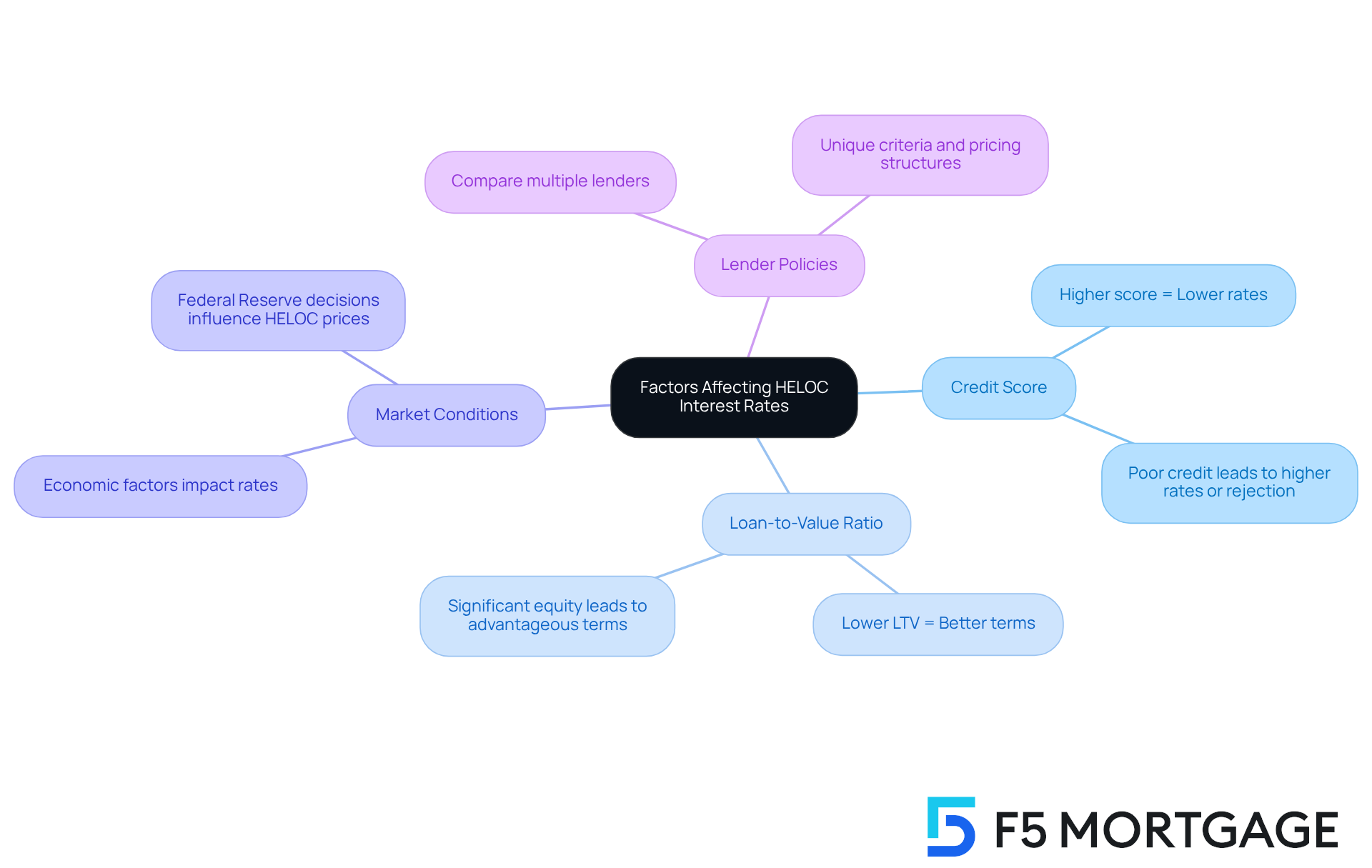

Several factors significantly influence HELOC loan interest rates, and understanding these rates can empower you in your borrowing journey.

-

Credit Score: We know how challenging it can be to manage your credit score. A higher score generally leads to lower interest rates, reflecting a lower risk profile for lenders. If your credit score is low, you may face higher charges or even rejection of your application. This highlights the importance of maintaining a positive credit history.

-

Loan-to-Value Ratio (LTV): The loan-to-value ratio is another essential measurement. A lower LTV suggests that you have significant equity in your home, which can lead to more advantageous terms. In 2025, average LTV ratios for HELOCs are expected to remain competitive, allowing you to leverage your equity effectively.

-

Market Conditions: Economic factors, especially the Federal Reserve’s interest decisions, play a crucial role in influencing HELOC prices. Recent variations in the prime interest level, which usually operates around three percentage points above the fed funds level, directly impact your borrowing expenses.

-

Lender Policies: Each lender has unique criteria and pricing structures, resulting in differences in their offerings. We encourage you to shop around and compare offers from multiple lenders to secure the best possible terms.

Understanding these factors is crucial for you as a borrower aiming to anticipate potential costs and negotiate better terms regarding HELOC loan interest rates. By improving your credit score and maintaining a favorable LTV, you can enhance your chances of securing lower interest terms, ultimately making your borrowing experience more beneficial. Remember, we’re here to support you every step of the way.

Discuss Strategies to Manage HELOC Interest Rates

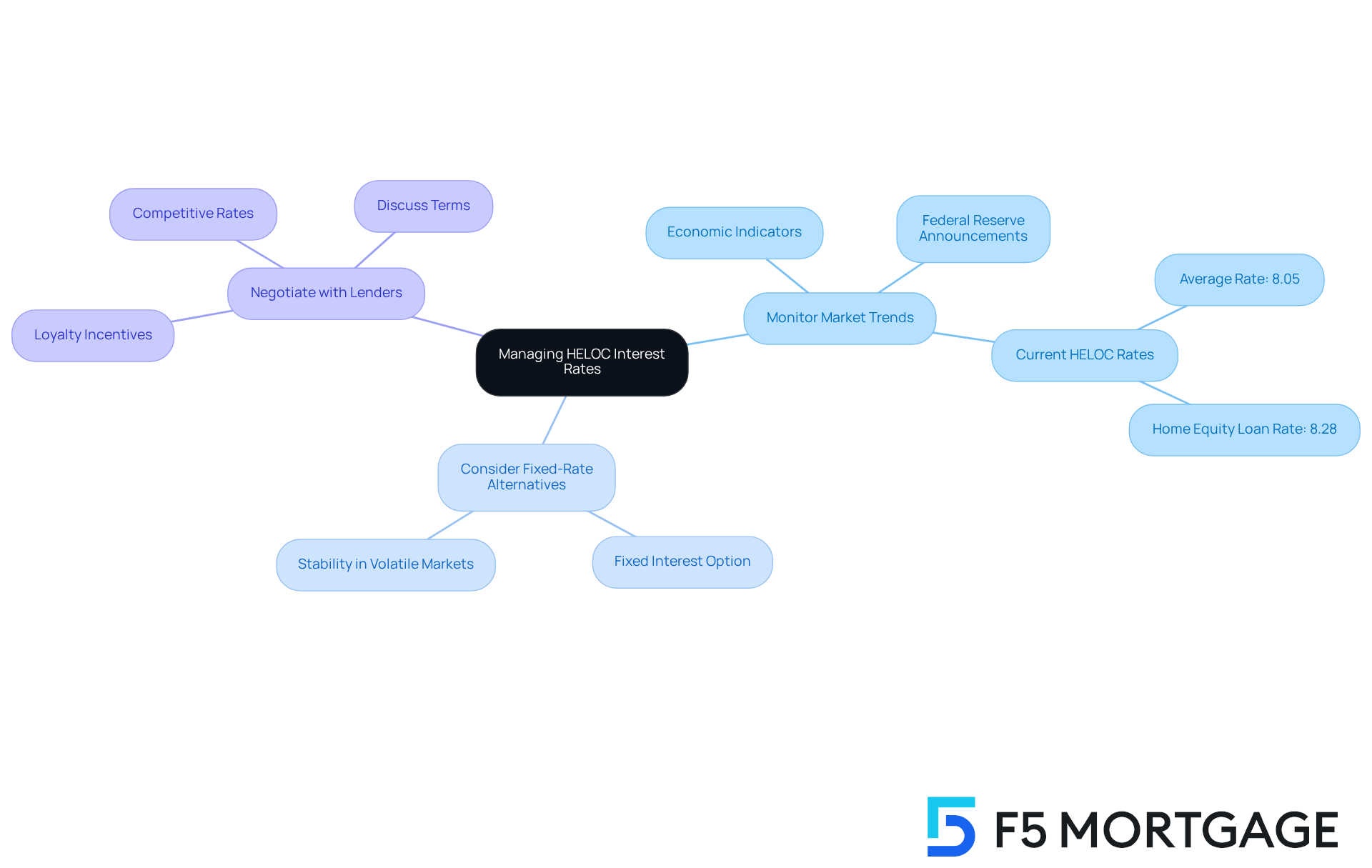

To effectively manage HELOC interest rates, we know how important it is to consider the following strategies:

-

Monitor Market Trends: Keeping an eye on economic indicators and Federal Reserve announcements can significantly impact interest rates. For instance, recent trends indicate that HELOC loan interest rates are presently averaging around 8.05 percent, while home equity loan percentages averaged 8.28 percent as of September 17. We anticipate fluctuations following Federal Reserve meetings, so staying informed is crucial for your financial well-being. We understand that enhancing your creditworthiness can lead to more favorable HELOC loan interest rates. Strategies such as reducing current debts, making timely payments, and challenging any errors in your report are essential. Homeowners who actively enhance their scores have experienced considerable advantages in securing better HELOC loan interest rates. For example, those who lowered their credit utilization ratio and regularly paid bills punctually have indicated improvements in their scores, helping them qualify for reduced loan terms.

-

Consider Fixed-Rate Alternatives: Some lenders offer the choice to change a part of your HELOC to a fixed interest rate. This option can provide stability against rising HELOC loan interest rates, which is especially advantageous in a volatile market. Knowing your options empowers you to make informed decisions.

-

Negotiate with Lenders: Engaging in discussions with your lender about your terms can be beneficial. Many lenders are willing to offer competitive rates or incentives for loyal customers, including favorable HELOC loan interest rates, leading to better overall borrowing conditions. As Chris Carter, Sales Manager at Univest Home Loans, states, “Now is an excellent time to secure a home equity line of credit. American homeowners possess record equity in their homes, and most have the luxury of a low-rate primary mortgage they would like to remain intact.”

By applying these strategies, you can navigate your home equity line of credit options more effectively. This ensures you make informed financial decisions that align with your long-term goals. However, we urge you to be cautious about using a HELOC for discretionary purchases, as this can lead to financial strain if not managed properly. Remember, we’re here to support you every step of the way.

Conclusion

Understanding the intricacies of Home Equity Lines of Credit (HELOCs) is essential for homeowners looking to leverage their property equity. We know how challenging this can be, but by grasping the mechanics, interest rates, and strategies associated with HELOCs, you can make informed decisions that align with your financial goals. This flexibility in borrowing can be a powerful tool when managed wisely.

The article delves into the various factors that influence HELOC loan interest rates, such as:

- Credit scores

- Loan-to-value ratios

- Market conditions

- Lender policies

It emphasizes the importance of maintaining a strong credit profile and understanding the economic landscape to secure favorable borrowing terms. Additionally, strategies like:

- Monitoring market trends

- Considering fixed-rate options

- Negotiating with lenders

are highlighted as effective ways to manage interest rates over time.

Ultimately, being proactive and informed about HELOCs can significantly impact your financial well-being. We’re here to support you every step of the way. Homeowners are encouraged to take charge of their financial futures by enhancing their creditworthiness and exploring all available options. By doing so, you can navigate the complexities of HELOCs and make choices that foster long-term financial health and stability.

Frequently Asked Questions

What is a Home Equity Line of Credit (HELOC)?

A HELOC is a revolving line of credit backed by the equity in your home, allowing homeowners to borrow funds as needed, up to a set limit, making it a flexible borrowing option.

How does a HELOC differ from a traditional home equity loan?

Unlike traditional home equity loans that provide a lump sum, a HELOC allows you to withdraw funds as needed, offering more flexibility for various financial needs.

What are the current average interest rates for HELOCs?

As of September 2025, the average HELOC loan interest rates have decreased to approximately 8.05%.

How do HELOC interest rates compare to traditional home equity loans?

HELOC interest rates average around 8.05%, while traditional home equity loans have average rates of about 8.28%, making HELOCs a more affordable option.

Are HELOC interest rates fixed or variable?

HELOC interest rates are typically variable, meaning they can change based on market conditions and lender terms, potentially leading to unpredictable payments.

What should homeowners consider when exploring HELOC options?

Homeowners should understand how interest rates work, the associated costs of refinancing, and the potential for variable payments when considering a HELOC.

What are the costs associated with refinancing a HELOC?

Refinancing costs can range from 2% to 5% of the loan amount. For example, refinancing a $300,000 mortgage might incur closing costs between $6,000 and $15,000.

How can I calculate my break-even point when refinancing?

To calculate your break-even point, divide your refinancing costs by your monthly savings. For instance, if your costs are $4,000 and your savings are $100 per month, it would take 40 months to break even.

Why is it important to understand the break-even point when refinancing?

Understanding the break-even point helps you make informed financial decisions regarding your home equity line of credit and whether refinancing is beneficial based on your savings and costs.