Overview

Navigating the world of finance can often feel overwhelming, especially when it comes to understanding your options for borrowing. That’s why the article highlights the essential features of a HELOC (Home Equity Line of Credit) rates calculator, designed with your needs in mind. We know how challenging this can be, and this tool aims to simplify the process for you.

One of the key features is its user-friendly interface, allowing you to customize inputs according to your specific situation. This personalization helps you feel more in control of your financial decisions. Additionally, the comparison tool enables you to evaluate multiple lenders effortlessly, ensuring you find the best option for your family.

Understanding repayment structures is crucial, and the calculator provides an amortization schedule that breaks this down clearly. This transparency is vital for making informed choices. Furthermore, your personal information is handled securely, giving you peace of mind as you explore your borrowing options.

All these features work together to enhance your confidence in the borrowing process. We’re here to support you every step of the way, empowering you to make decisions that align with your financial goals.

Introduction

Navigating the complexities of home financing can feel overwhelming, especially for first-time homebuyers. We understand how challenging this can be. A Home Equity Line of Credit (HELOC) rates calculator is a vital tool that can help simplify your financial decisions and explore various borrowing options with ease.

With so many calculators available, you may wonder how to choose one that truly enhances your experience and offers the most value. This article will explore nine essential features of a HELOC rates calculator that not only streamline your decision-making process but also empower you to make informed choices about your home equity options.

We’re here to support you every step of the way.

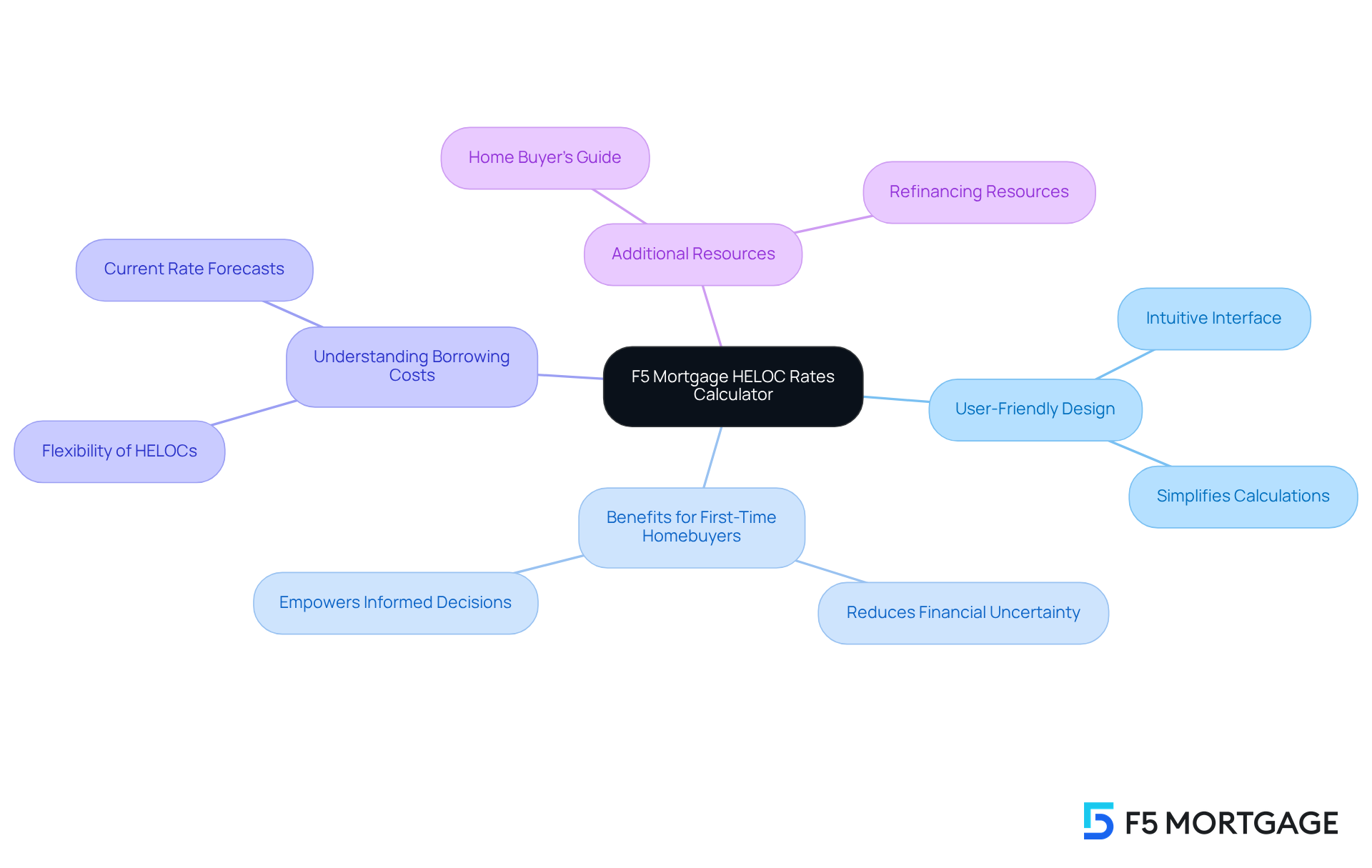

F5 Mortgage: User-Friendly HELOC Rates Calculator

At F5 Mortgage, we understand how overwhelming it can be to navigate the world of home financing. That’s why we provide a user-friendly heloc rates calculator, designed to simplify and clarify your potential borrowing costs. With its intuitive interface, you can easily enter your home value and current mortgage balance, making it especially welcoming for who may feel uncertain about financial calculations.

This tool is essential for anyone looking to explore their options without the stress of complicated economic jargon. As Dan Rafter wisely points out, “With a home equity line of credit, you only repay what you take out,” highlighting the flexibility this financial product offers. With home equity line of credit averages expected to remain around 8 percent until the end of 2025, utilizing the heloc rates calculator is more relevant than ever for those evaluating their home equity choices.

By providing such an accessible resource, F5 Mortgage empowers you to make informed decisions about your home equity options, enhancing your confidence as you navigate the mortgage landscape. Remember, we’re here to support you every step of the way. Additionally, you can benefit from our extensive home buyer’s guide and refinancing resources, which further aid your journey toward homeownership.

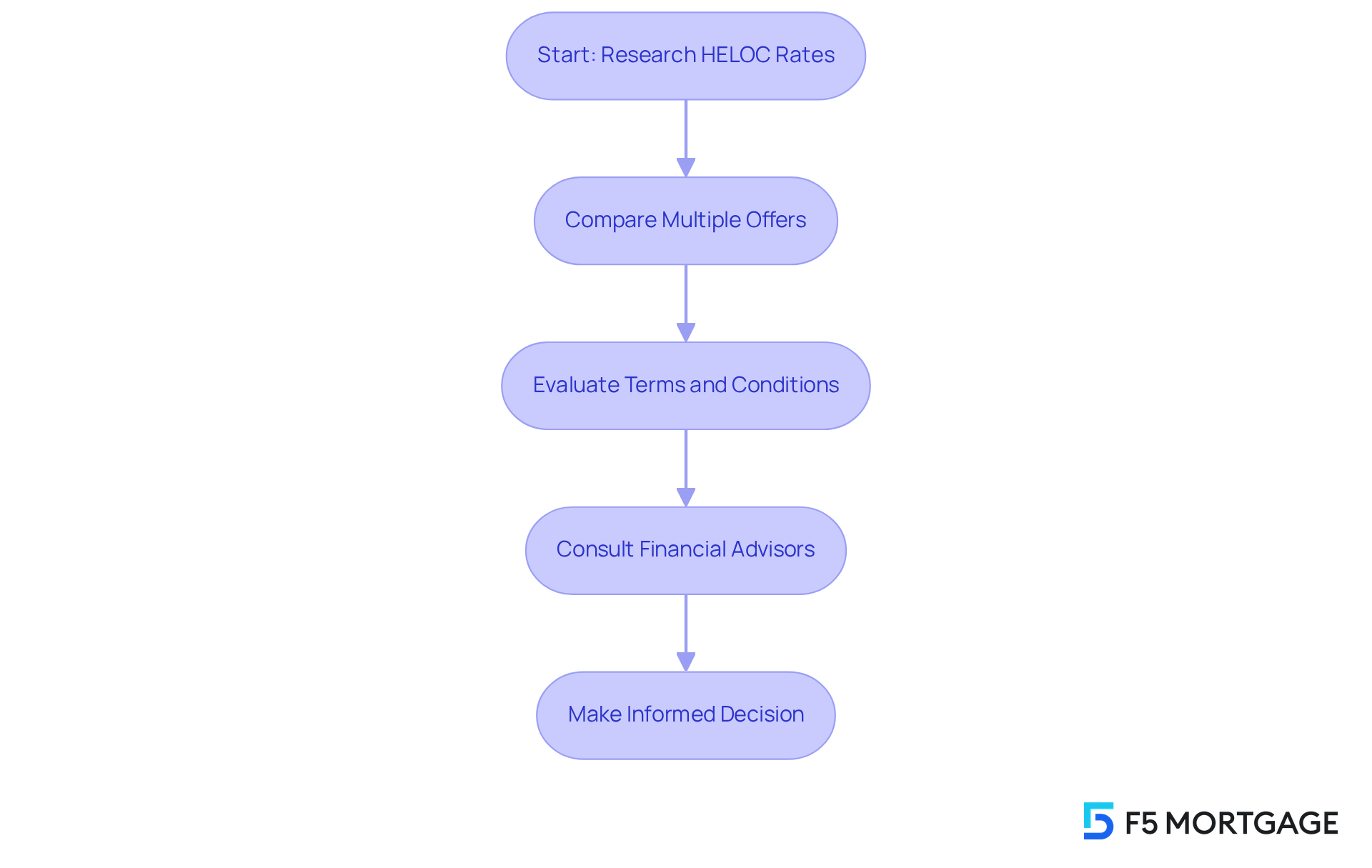

Comparison Tool: Evaluate Multiple HELOC Rates

Finding the right home equity line of credit can be overwhelming, but our heloc rates calculator features a powerful comparison tool that helps you evaluate multiple options from different lenders. This capability is crucial for families looking to find the most competitive rates available. Research indicates that over 60% of borrowers actively compare offers when seeking a home equity line of credit, a trend that is increasingly common today.

By examining these offers side by side, you can make informed decisions that align with your financial goals, ultimately securing the best terms for your needs. Financial advisors emphasize that using comparison tools not only enhances transparency but also empowers you to navigate the complexities of mortgage financing with confidence.

As Linda Bell, a certified home equity line of credit specialist, states, ‘Our mission is to provide readers with accurate and unbiased information, and we have editorial standards in place to ensure that happens.’ It’s important to remember that while applying for a home equity line of credit may lead to a minor decrease in your credit score, several applications within 45 days count as a single inquiry. This means you can compare options without significantly affecting your credit. We know how challenging this process can be, and we’re here to every step of the way.

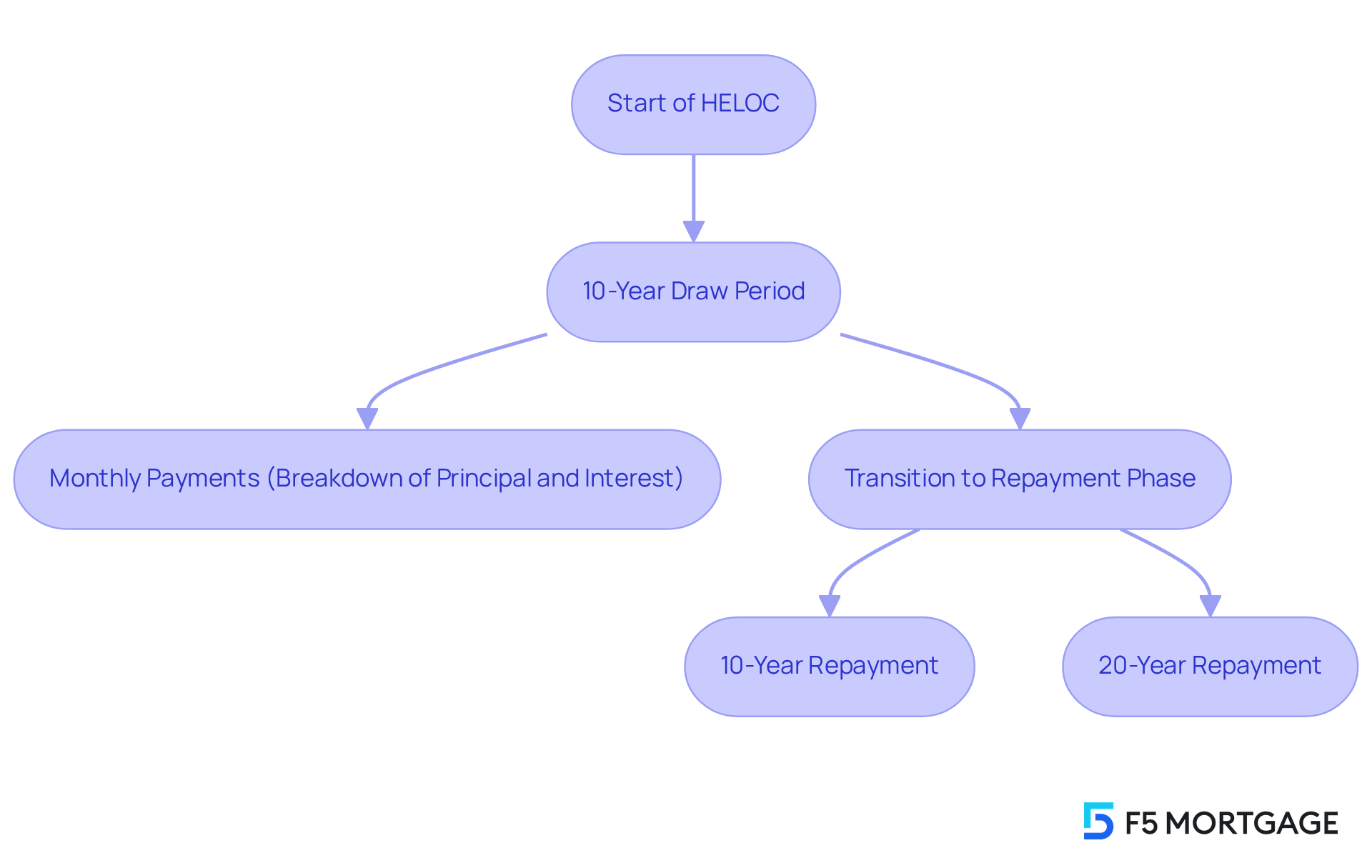

Amortization Schedule: Understand Your Repayment Structure

Navigating the world of Home Equity Lines of Credit (HELOC) can feel overwhelming, but we’re here to support you every step of the way. The HELOC rates calculator includes an amortization schedule that clearly outlines the repayment structure throughout the duration of the loan. This timetable provides a thorough analysis of your monthly payments, breaking down the contributions to both principal and interest. Understanding this structure is vital for efficient budgeting and planning, as it allows you to foresee future payments and manage your cash flow effectively.

For instance, with typical monthly payments for a $50,000 HELOC at roughly $612.47—similar to the payment for a $50,000 10-year home equity loan at 8.25% ($613.26)—you can better evaluate your obligations and make informed choices. Financial planning experts emphasize that a well-structured amortization schedule not only aids in tracking payments but also empowers you to strategize your finances, ensuring you stay on track to meet your long-term financial goals.

It’s also essential to consider that HELOCs typically feature a draw period of 10 years, followed by a repayment phase of 10 to 20 years. Remember, fluctuating interest rates can influence your payment amounts over time. We know how challenging this can be, but with a , you can approach your future with confidence.

Interest Rate Estimator: Quick Cost Insights

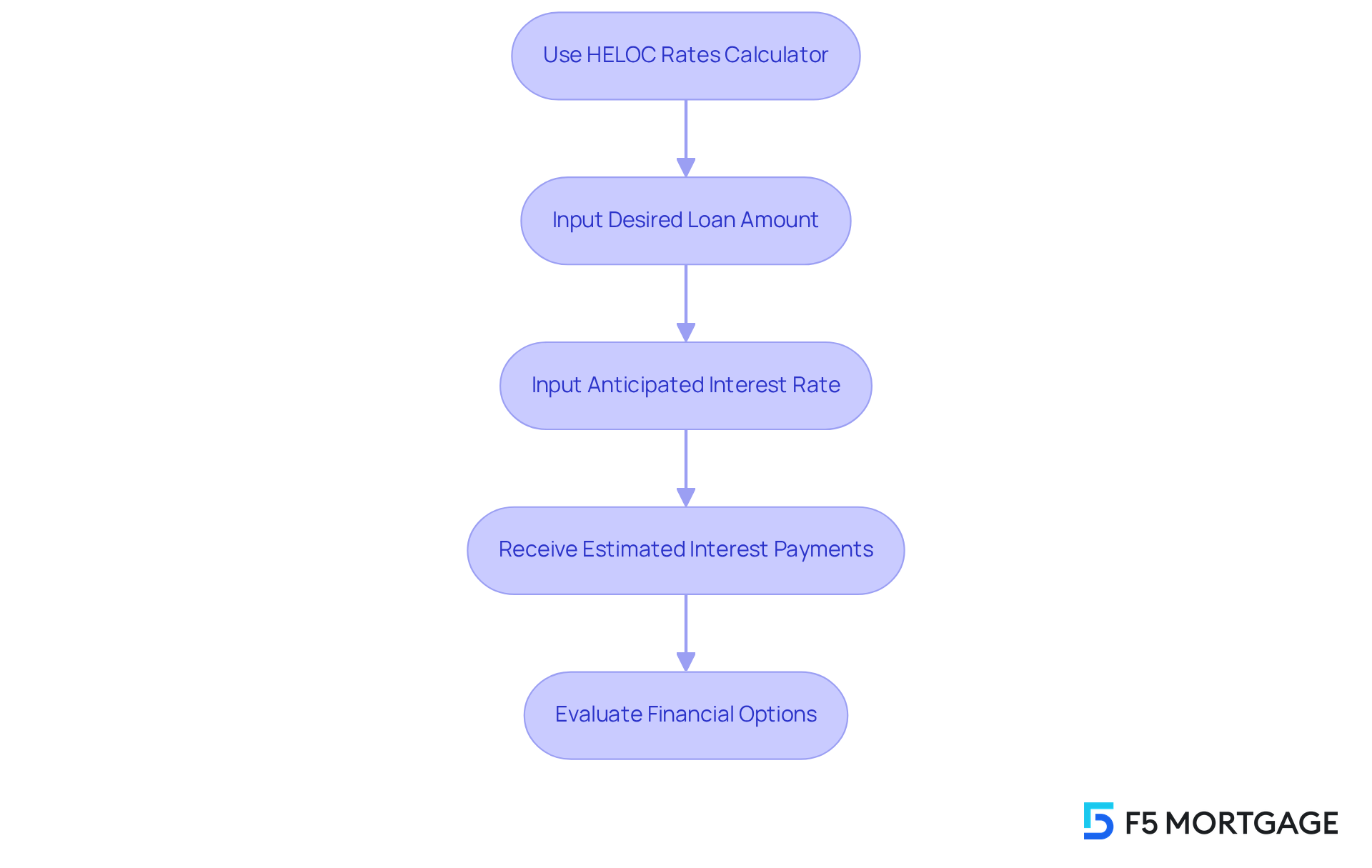

The interest cost estimator in the HELOC rates calculator offers borrowers valuable insights into potential expenses associated with their home equity line of credit. By simply using the HELOC rates calculator to input their desired loan amount and anticipated interest rate, users can quickly gauge their expected interest payments over time. This functionality is essential for clients who need to make prompt financing decisions, empowering them with the information necessary to evaluate their options effectively.

We understand how challenging it can be to navigate financial commitments. Statistics show that borrowers often make decisions rapidly when equipped with clear cost estimates; many rely on such tools to assess their financial responsibilities. With interest levels fluctuating, especially as predictions suggest that home equity line of credit costs might average 7.25% in 2025—compared to the current average of 8.26%— becomes increasingly important. Furthermore, HELOC withdrawals surged 22% in Q1 2025, reaching nearly $25 billion, highlighting a growing trend in home equity borrowing.

Financial experts emphasize that having quick access to cost insights can significantly influence mortgage decision-making. This allows homeowners to act decisively in a competitive market. Greg McBride, Bankrate’s chief economic analyst, notes that for homeowners with low-cost mortgages, home equity loans remain a viable option for accessing the value held in their properties.

Incorporating these quick cost insights not only aids in informed decision-making but also enhances the overall mortgage experience. It ensures that clients are prepared to navigate the complexities of home equity borrowing with confidence. However, it’s also essential for borrowers to be aware of the potential risks associated with HELOCs, including the possibility of foreclosure if payments are not made. We’re here to support you every step of the way as you explore your options.

Customizable Inputs: Tailor Calculations to Your Needs

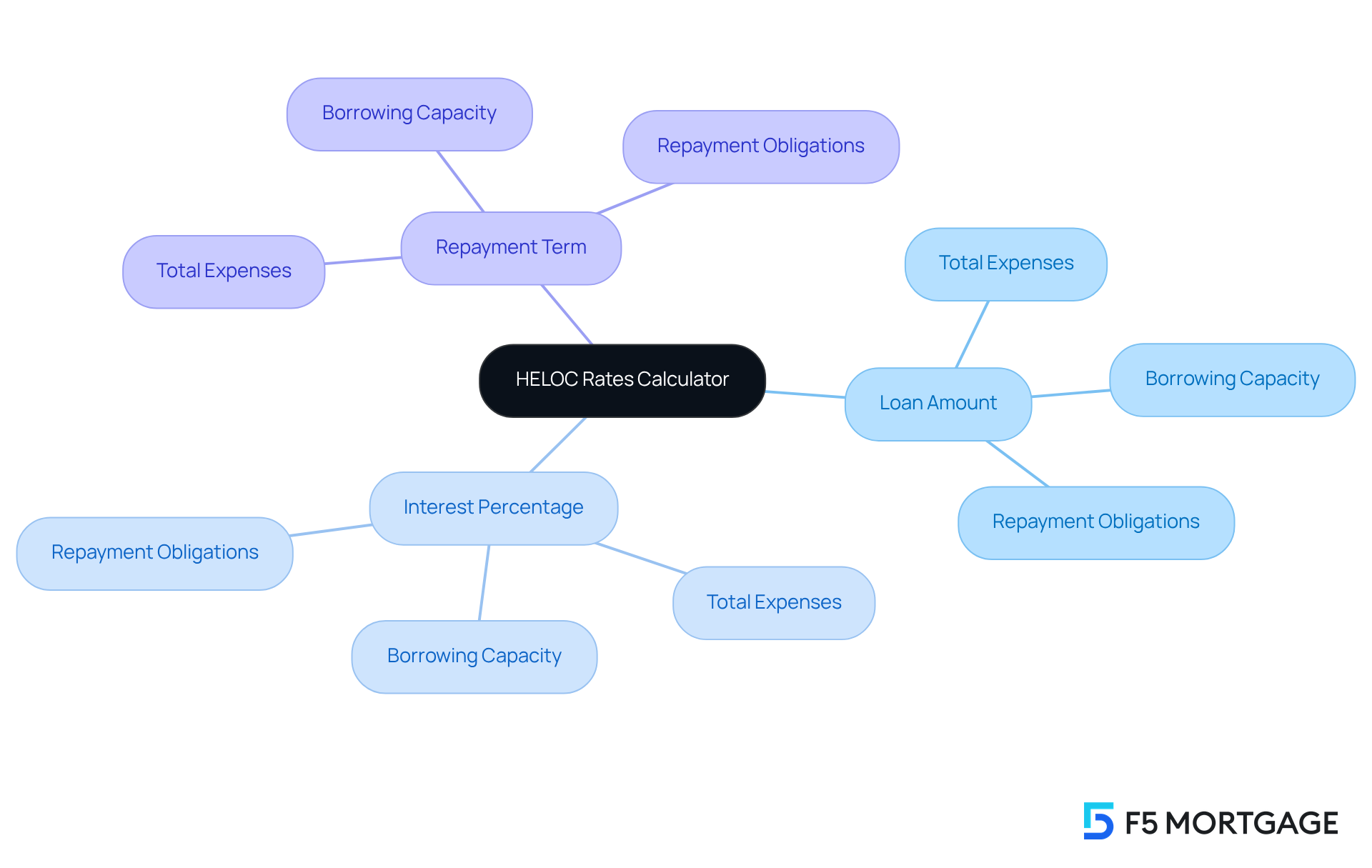

At F5 Mortgage, we understand how daunting financial decisions can be, and our HELOC rates calculator is designed to help you navigate this journey with confidence. You can based on your unique circumstances, adjusting key variables like loan amount, interest percentage, and repayment term. This personalization is crucial; in fact, 72% of consumers consider tailored experiences vital in their mobile banking applications.

By allowing you to see how different scenarios impact your total expenses, our calculator empowers you to grasp the implications of your borrowing capacity and repayment obligations. Research indicates that customers receiving personalized support report a remarkable 28% increase in confidence regarding their financial choices. We’re here to support you every step of the way.

Not only does our HELOC rates calculator streamline the mortgage process, but it also promotes a deeper understanding of your personal economic situation, leading to more empowered decision-making. Plus, with our efficient pre-approval process that delivers results in under an hour, you can quickly access the tailored financial solutions you need. Let us help you take the next step toward your financial goals.

Historical Rate Trends: Analyze Market Fluctuations

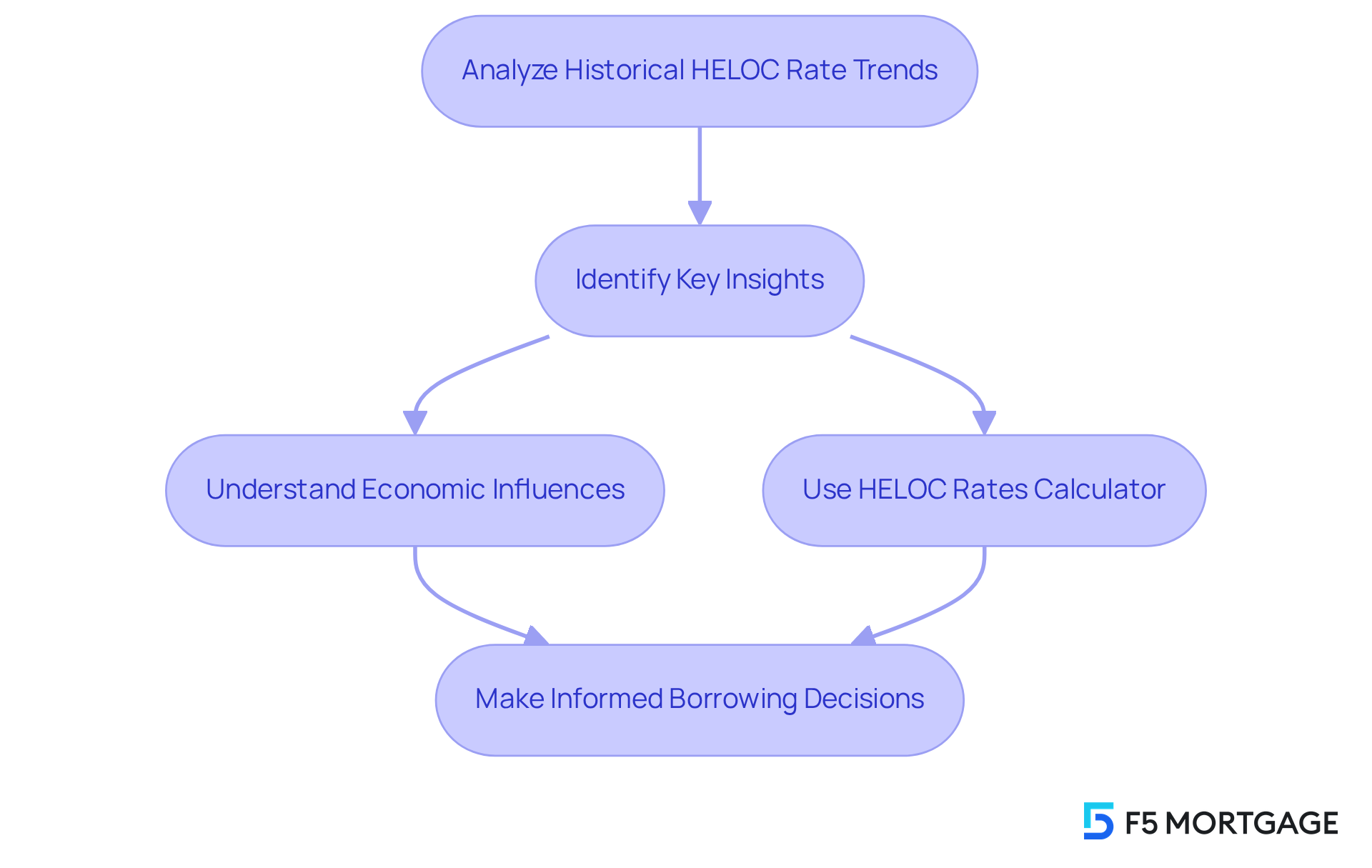

We understand how challenging navigating the world of Home Equity Lines of Credit (HELOCs) can be. That’s why it’s important to have a strong tool such as a HELOC rates calculator for examining historical trend patterns. By analyzing previous interest levels, you can uncover valuable insights into market variations. This knowledge empowers you to make informed forecasts about upcoming figures.

This analysis is essential for anyone considering a home equity line of credit and utilizing a HELOC rates calculator. It helps you pinpoint the best borrowing period and understand how broader economic factors—like national debt and the state of the U.S. economy—might influence loan terms. With hovering around 7%, which feels quite high compared to the pandemic-era lows of 2% to 3%, grasping these trends becomes even more crucial.

Financial analysts emphasize that historical data significantly shapes borrowing decisions, especially in a fluctuating market. By leveraging this information, you can navigate your borrowing strategies effectively, ensuring you are prepared to capitalize on favorable conditions when they arise. To optimize your advantages, consider using a HELOC rates calculator to consistently track economic indicators and trends. This proactive approach enables you to make timely choices regarding your home equity line of credit options.

Remember, we’re here to support you every step of the way as you make these important financial decisions.

Credit Score Integration: Assess Eligibility for HELOC Rates

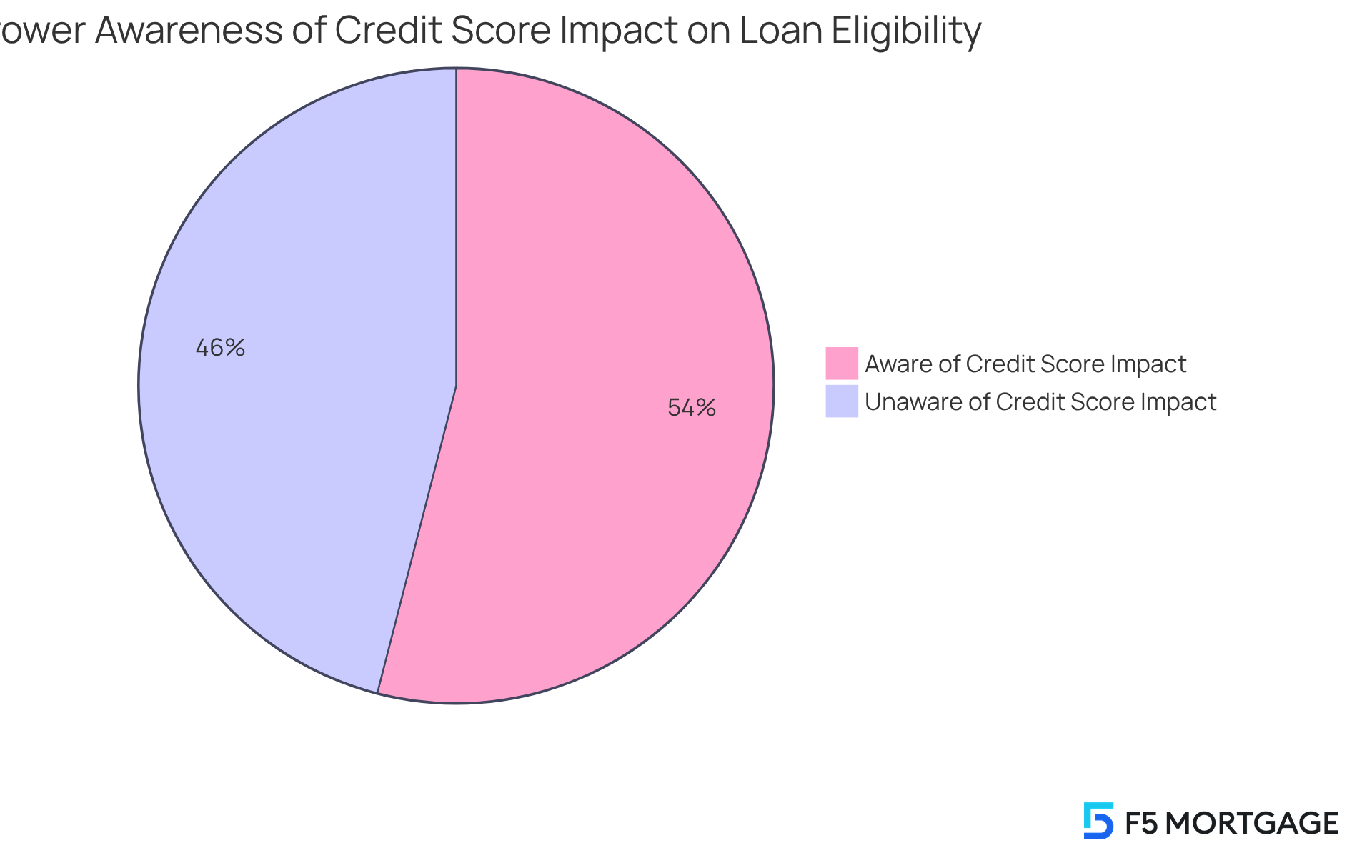

The heloc rates calculator is an invaluable tool for evaluating credit score assessments, helping you understand your eligibility for various interest levels. By simply entering your credit score, you can see how it impacts the rates you may qualify for, which is essential for grasping your borrowing capabilities. This feature empowers you to engage more effectively with lenders, ensuring you’re ready to secure the best possible terms.

In 2025, around 46% of borrowers are still unaware of how their credit scores influence loan eligibility. This highlights the importance of tools like this calculator. Since credit scores are a critical factor in mortgage eligibility, with a minimum score typically ranging from 660 to 680 for home equity loans, utilizing a HELOC rates calculator can help in understanding their implications, leading to better financial decisions and improved access to home equity options.

As Matt Richardson, Senior Managing Editor for CBSNews.com, wisely points out, “Homeowners should take a step back to assess the fluctuations in the broader interest environment.” This observation underscores the importance of being informed about credit scores and their impact on your borrowing options. We know how challenging this can be, and we’re here to .

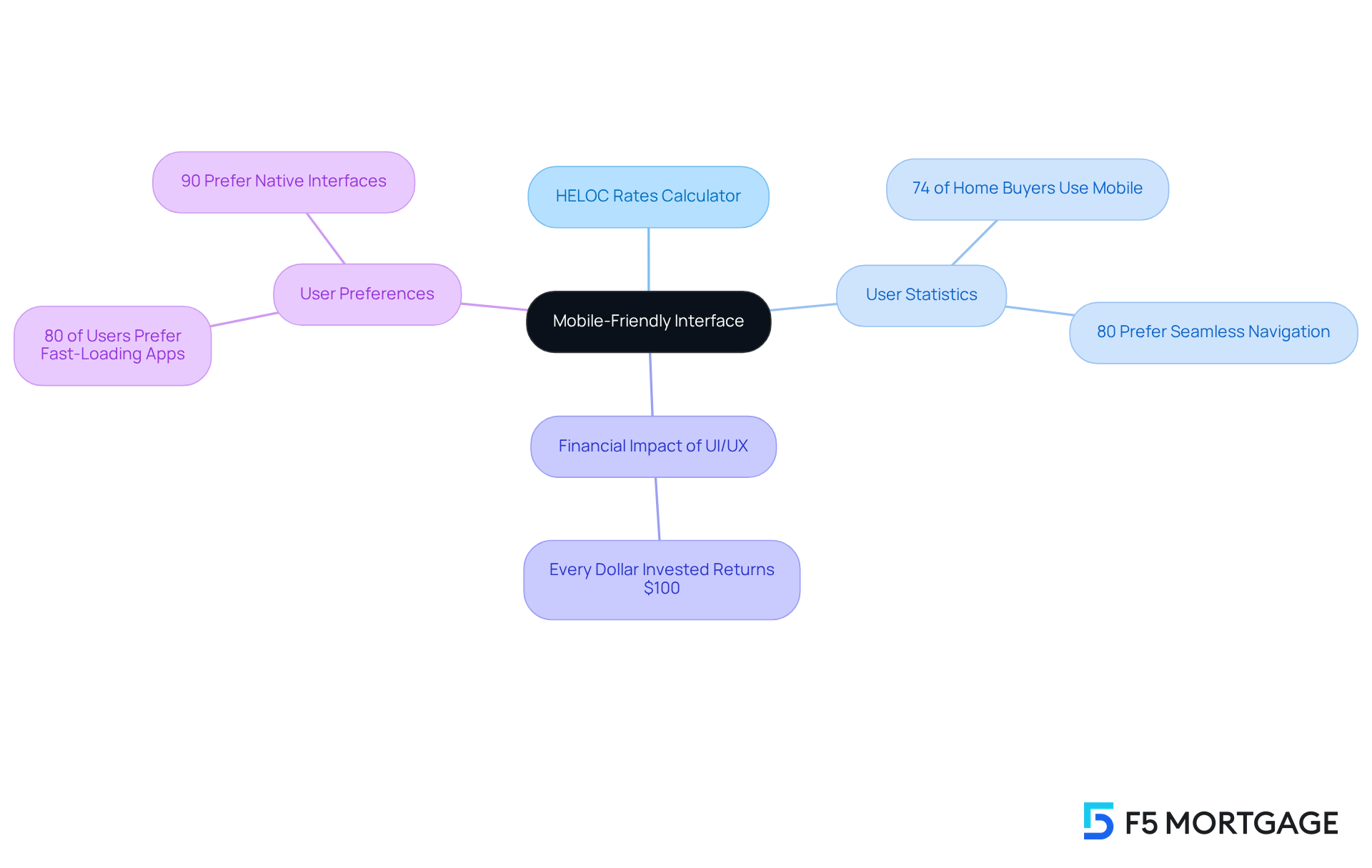

Mobile-Friendly Interface: Access Anytime, Anywhere

At F5 Mortgage, we understand how busy life can get, which is why our mobile-friendly interface includes a HELOC rates calculator. This allows you to access it anytime, anywhere—perfect for those moments when you need to calculate your options on the go. By optimizing our heloc rates calculator for mobile devices, we enhance your experience and empower you to make informed decisions at your convenience.

Moreover, our app offers a suite of tools and calculators designed to help you manage your loans effectively. Research shows that 74% of home buyers rely on mobile devices during their property search, highlighting the importance of mobile access in today’s fast-paced world. It’s clear that having the right tools at your fingertips can make a significant difference.

Additionally, consider this: for every dollar invested in user experience, there’s a return of $100. This statistic underscores the financial impact of good UI/UX design. Mobile accessibility not only enables quick calculations but also fosters greater customer engagement, leading to more confident decision-making among borrowers.

In fact, 80% of users prefer apps that offer seamless navigation and fast-loading times. This preference emphasizes the importance of , ensuring that you feel supported every step of the way as you navigate your mortgage options.

User Support Features: Navigate with Ease

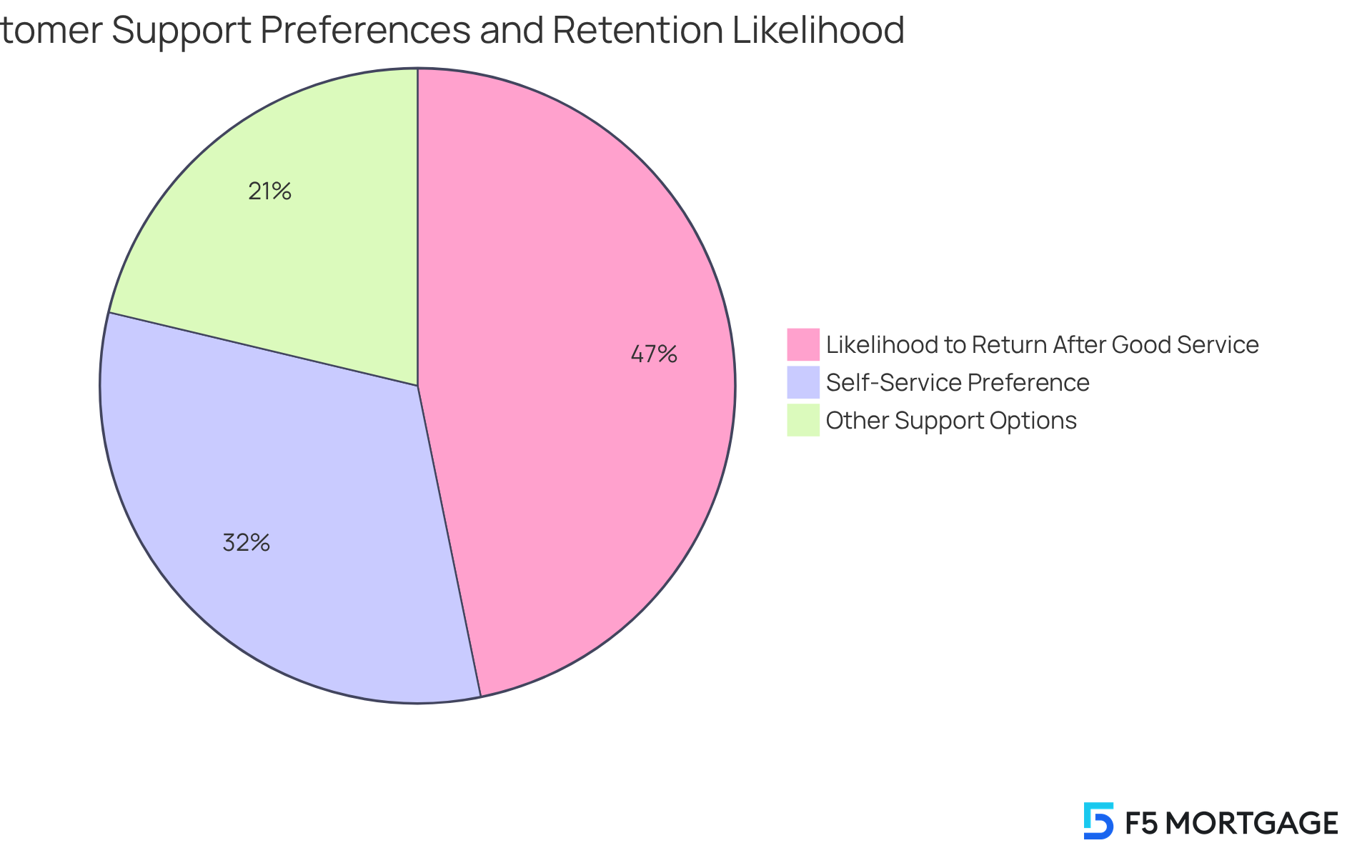

Navigating financial tools can feel overwhelming, but the calculator is here to support you every step of the way. Equipped with comprehensive user support features, including FAQs and live chat options, it is designed to assist you in using the tool seamlessly. These support mechanisms are crucial for minimizing confusion and frustration, allowing you to focus on what matters most—your financial decisions.

We know how . Research shows that 60% of customers prefer self-service options for resolving simple issues. This highlights the significance of accessible support in enhancing your experience. By prioritizing these features, F5 Mortgage demonstrates its commitment to your satisfaction, empowering you to make informed financial choices with confidence.

Moreover, 88% of customers are likely to return after receiving satisfactory customer service. This emphasizes the importance of strong support in nurturing long-term relationships. As Chris Jensen wisely states, “When self-service is done right, your customers can resolve problems faster, and your reps can focus their time and attention on higher-value tasks like revenue growth through upselling and cross-selling.” We are dedicated to providing you with the tools and support you need to thrive.

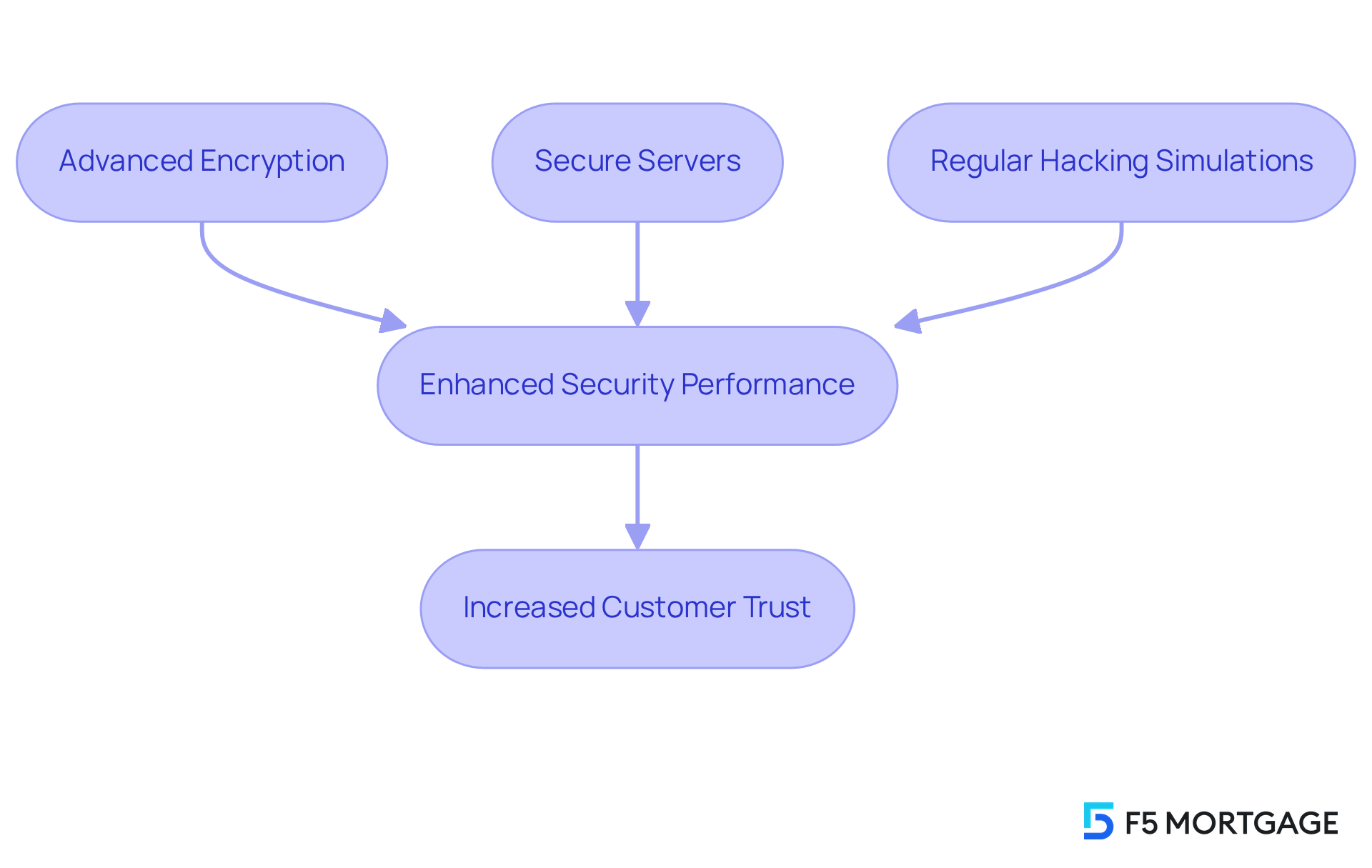

Secure Data Handling: Protect Your Personal Information

At F5 Mortgage, we understand how crucial it is to feel secure when utilizing financial tools, particularly our heloc rates calculator. That’s why we place a strong emphasis on secure data handling, ensuring your personal information remains protected. With and secure servers in place, you can use our calculator with confidence, knowing that your sensitive information is safe.

In today’s world, where fraudulent activity related to impersonation poses a staggering $200 billion threat, we take your security seriously. We employ robust measures to mitigate this risk, including regular hacking simulations that have enhanced our security performance by an impressive 30%. We know how challenging this can be, and we’re here to support you every step of the way.

Moreover, keeping you informed about our security protocols is vital to us. As Gary Beckham, our Marketing Specialist, emphasizes, “Customer data should be handled with caution.” By prioritizing data security and transparency, we not only protect you but also enhance your overall experience with our financial applications. This commitment ultimately strengthens our relationship with you, fostering trust and peace of mind as you navigate your mortgage journey.

Conclusion

The F5 Mortgage HELOC rates calculator is not just a tool; it’s a companion that simplifies the journey of evaluating home equity options. With its user-friendly interface and a variety of features, it empowers borrowers to make informed decisions with confidence. We understand how important it is to have a reliable calculator, as it helps clarify potential costs and enriches the overall mortgage experience.

In this article, we’ve highlighted key features of the HELOC rates calculator. From the comparison tool that allows you to weigh multiple rates to the detailed amortization schedule for effective repayment planning, every aspect is designed with your needs in mind. Customizable inputs ensure that calculations reflect your unique situation. Moreover, the integration of credit score assessments and secure data handling emphasizes our commitment to your support and safety, allowing you to navigate financial decisions with ease and peace of mind.

In today’s fast-paced financial landscape, leveraging tools like the F5 Mortgage HELOC rates calculator is essential for making timely and informed choices. As home equity borrowing continues to grow, staying informed about market trends and understanding your financial responsibilities will empower you to seize favorable conditions. Taking that first step toward financial clarity can lead to more confident decision-making, paving the way for successful home equity management. Remember, we’re here to support you every step of the way.

Frequently Asked Questions

What is the purpose of the F5 Mortgage HELOC rates calculator?

The F5 Mortgage HELOC rates calculator is designed to simplify and clarify potential borrowing costs for home equity lines of credit, making it especially user-friendly for first-time homebuyers.

How does the HELOC rates calculator assist users?

Users can easily enter their home value and current mortgage balance to evaluate their home equity options without the stress of complicated financial jargon.

What is a home equity line of credit (HELOC)?

A home equity line of credit allows homeowners to borrow against the equity in their home, and you only repay what you take out, providing flexibility in borrowing.

What are the expected average HELOC rates until the end of 2025?

Home equity line of credit averages are expected to remain around 8 percent until the end of 2025.

How does the comparison tool in the HELOC rates calculator work?

The comparison tool allows users to evaluate multiple HELOC options from different lenders side by side, helping them find the most competitive rates available.

Why is it important to compare offers when seeking a HELOC?

Over 60% of borrowers actively compare offers, which enhances transparency and empowers them to make informed decisions that align with their financial goals.

How does applying for a HELOC affect my credit score?

Applying for a HELOC may lead to a minor decrease in your credit score; however, multiple applications within 45 days count as a single inquiry, minimizing the impact on your score.

What information does the amortization schedule provide?

The amortization schedule outlines the repayment structure throughout the loan, detailing monthly payments and the contributions to both principal and interest.

How can understanding the amortization schedule benefit borrowers?

It aids in efficient budgeting and planning by allowing borrowers to foresee future payments and manage their cash flow effectively.

What is the typical structure of a HELOC repayment?

HELOCs typically feature a draw period of 10 years, followed by a repayment phase of 10 to 20 years, with fluctuating interest rates potentially influencing payment amounts over time.