Overview

Escrow is a financial arrangement in real estate that can feel daunting. It involves a neutral third party who manages funds and documents until all transaction conditions are met. This process is designed to ensure security and trust for both buyers and sellers, easing some of the worries you may have.

We understand how challenging it can be to navigate real estate transactions. That’s why escrow is so important—it reduces the risks of fraud and misrepresentation. It also facilitates communication and compliance with contractual obligations, making the entire transaction smoother and more transparent.

By choosing escrow, you’re not just protecting your investment; you’re also taking a significant step toward a more secure and trustworthy transaction experience. We’re here to support you every step of the way, ensuring that your journey in real estate is as seamless as possible.

Introduction

We know how daunting it can feel to navigate the complexities of real estate transactions, especially when financial agreements are involved. Escrow plays a vital role in this journey, serving as a neutral holding area for funds and documents until all parties fulfill their contractual obligations. This article explores the essential function of escrow, illustrating how it not only protects the interests of both buyers and sellers but also simplifies the entire process.

However, many still grapple with misconceptions about its complexity and cost. What are the true benefits of utilizing escrow in real estate transactions? We’re here to support you every step of the way as we uncover the answers together.

Define Escrow: Understanding Its Role in Real Estate Transactions

We understand how challenging navigating financial agreements can be. What is escrow? It is a financial arrangement where a trusted third party manages and oversees the payment of funds for two parties engaged in . In the realm of real estate, this means having a neutral holding area for funds and documents until all sale conditions are met. This process is vital; it ensures that both the buyer and seller fulfill their obligations before finalizing the transaction, providing a layer of security and trust.

At F5 Mortgage, we recognize the importance of the holding account in reducing risks associated with real estate transactions. It acts as a safeguard, protecting both parties from potential fraud or misrepresentation. Our commitment to transparency means we are here to assist you through every phase of the transaction process. We want you to feel knowledgeable and confident in your choices.

We believe that an educated borrower is a satisfied borrower. That’s why we strive to equip you with the knowledge you need for a smoother mortgage experience. We’re here to support you every step of the way, ensuring that you feel informed and empowered in your journey.

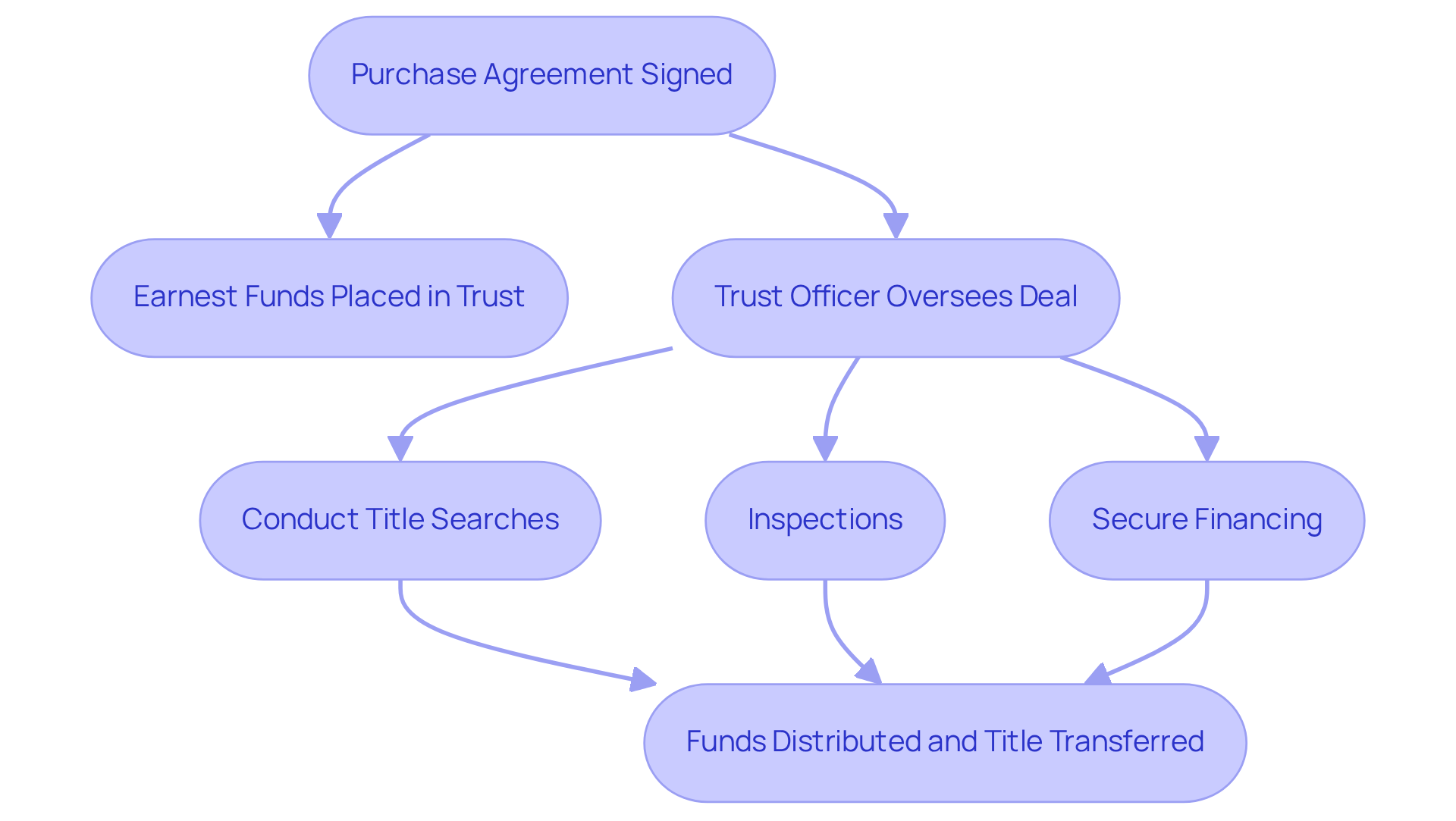

Explain How Escrow Works: The Process and Key Participants

The holding procedure typically begins once a purchase agreement is signed. We understand that this can be a significant moment for you, and it involves key participants such as the purchaser, seller, real estate agents, and an intermediary officer or firm. As the purchaser, you will place earnest funds into the trust account, demonstrating your commitment to the acquisition. This is a vital step in the process.

The trust officer then takes on the important role of overseeing the deal. They ensure that all necessary documents are gathered and that all conditions are met. This includes:

- Conducting title searches

- Inspections

- Securing financing

We know how crucial it is to have everything in order, and it’s worth noting that lenders may also order inspections. This helps guarantee that the property is in good condition, as homes needing major repairs might not qualify for refinance loans.

Once all requirements are fulfilled, the transaction officer will distribute the funds to the seller and convey the property title to you, the purchaser, finalizing the agreement. This structured process is designed to support you and ensure that all parties are aware of what is escrow and adhere to the . Remember, we’re here to support you every step of the way, especially considering how property inspections can impact refinancing eligibility.

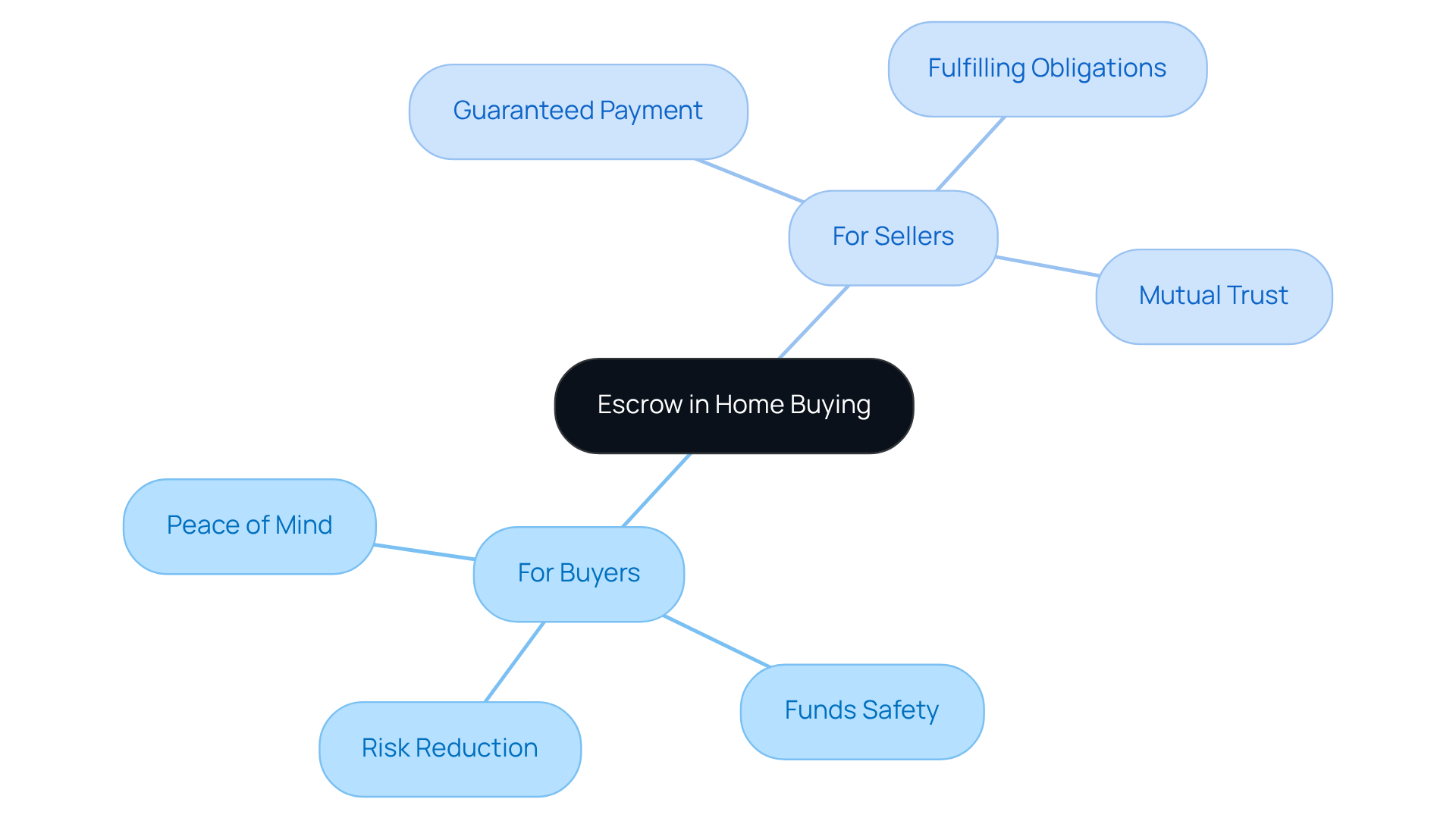

Discuss Escrow in Home Buying: Importance for Buyers and Sellers

In the home purchasing journey, understanding what is escrow is crucial, as a trust account serves as a vital system that protects the interests of both purchasers and sellers. For purchasers, this account offers peace of mind, as understanding what is escrow ensures that their funds remain safe until all contractual terms are met. This significantly reduces the risk of losing their deposit, which is especially important in today’s competitive market where investors may feel anxious about their investments.

On the seller’s side, the arrangement defines what is escrow by guaranteeing that payment is disbursed only after the buyer fulfills their obligations, such as securing financing and completing necessary inspections. This mutual protection not only fosters trust between the parties but also streamlines the exchange process.

Moreover, the trust account adeptly manages contingencies, such as repairs or financing challenges, ensuring that everyone is on the same page before closing. Recent surveys indicate that many consumers trust secure service options, recognizing their role in enhancing safety during transactions. Property specialists emphasize that understanding what is escrow and utilizing a trust account is essential for protecting both purchasers and vendors, reinforcing the notion that a well-structured trust agreement is the cornerstone of successful real estate dealings. We know how challenging this can be, and we’re here to .

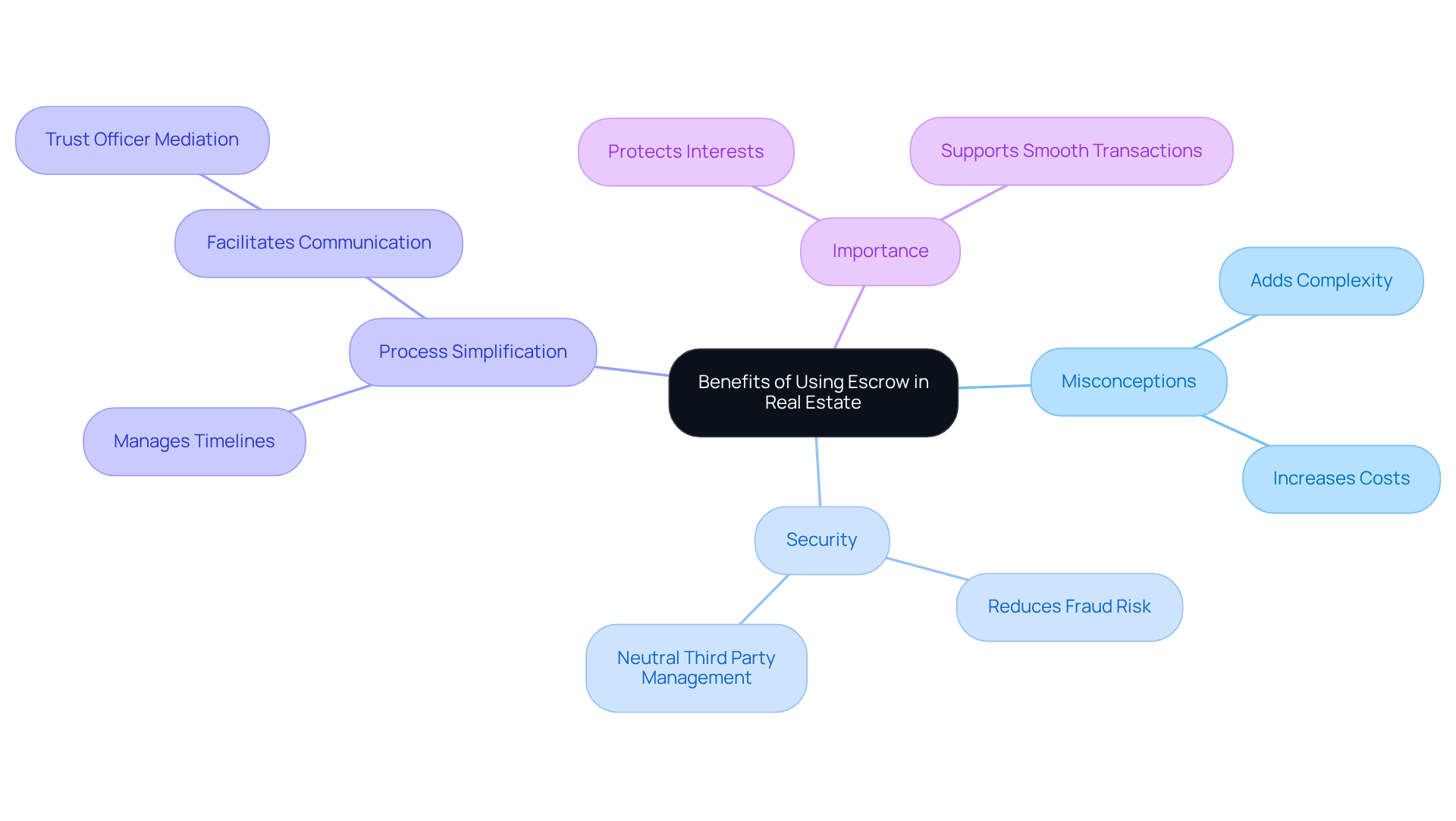

Clarify Misconceptions: Benefits of Using Escrow in Real Estate

Many families may feel overwhelmed by the holding process, often believing it adds unnecessary complexity or costs to a transaction. However, we know how challenging this can be, and we want to reassure you that understanding what is escrow reveals essential benefits that far outweigh these concerns. It enhances security by ensuring that funds and documents are managed by a neutral third party, which significantly reduces the risk of fraud.

Moreover, escrow simplifies the process by effectively managing timelines and ensuring that all conditions are met before closing. Picture this: a trust account can facilitate open communication between purchasers and vendors, with the trust officer acting as a mediator to help resolve any issues that may arise. This support is invaluable during a potentially stressful time.

Overall, what is escrow highlights not just a procedural step; it is a vital component of real estate transactions that protects the interests of everyone involved. We’re here to , ensuring that your experience is as smooth and secure as possible.

Conclusion

Understanding escrow is essential for anyone navigating the complexities of real estate transactions. We know how challenging this can be, and this financial arrangement safeguards both buyers and sellers by ensuring that funds and documents are held securely until all contractual obligations are fulfilled. By acting as a neutral third party, escrow mitigates risks, fosters trust, and streamlines the entire process, making it a cornerstone of secure real estate dealings.

The article has outlined the critical components of escrow, emphasizing its role in protecting both parties involved in a transaction. Key insights include:

- The importance of earnest funds

- The responsibilities of the trust officer

- How escrow handles contingencies such as repairs and inspections

Additionally, it dispels common misconceptions about escrow being overly complex or costly, highlighting its benefits as a facilitator of communication and security.

Ultimately, understanding what escrow entails is not just about grasping a procedural step; it is about empowering buyers and sellers to engage in real estate transactions with confidence. As the landscape of real estate continues to evolve, recognizing the significance of escrow will remain vital. Embracing this knowledge can lead to a smoother, more secure home buying or selling experience. We’re here to support you every step of the way, and engaging with trusted professionals throughout this process can further enhance peace of mind, ensuring that every step is handled with care and expertise.

Frequently Asked Questions

What is escrow in real estate transactions?

Escrow is a financial arrangement where a trusted third party manages and oversees the payment of funds for two parties engaged in a specific deal, providing a neutral holding area for funds and documents until all sale conditions are met.

Why is escrow important in real estate transactions?

Escrow is important because it ensures that both the buyer and seller fulfill their obligations before finalizing the transaction, providing a layer of security and trust.

How does escrow reduce risks in real estate transactions?

Escrow acts as a safeguard, protecting both parties from potential fraud or misrepresentation by holding funds and documents until all conditions of the sale are met.

What role does F5 Mortgage play in the escrow process?

F5 Mortgage is committed to transparency and assists clients through every phase of the transaction process, ensuring they feel knowledgeable and confident in their choices.

How does F5 Mortgage support borrowers?

F5 Mortgage strives to equip borrowers with the knowledge they need for a smoother mortgage experience, supporting them every step of the way to ensure they feel informed and empowered.