Overview

VA loans for land purchases are here to support qualified veterans and service members in securing financing for both acquiring property and constructing their dream homes. Often, these loans do not require a down payment, which can alleviate some of the financial stress many face. We understand how challenging this can be, and that’s why it’s essential to highlight the competitive interest rates these loans offer, along with the absence of private mortgage insurance.

This makes VA loans an attractive option for veterans looking to build their ideal homes. Navigating the specific eligibility criteria and application processes can be daunting, but you are not alone. We’re here to support you every step of the way, ensuring that you have the guidance needed to make informed decisions.

Take the first step towards your dream home today. Explore the possibilities that VA loans can provide and empower yourself with the knowledge to move forward confidently.

Introduction

Navigating the complexities of property financing can feel overwhelming, especially for veterans and service members who are eager to build their dream homes. We understand how challenging this can be. VA loans for land purchases provide a unique opportunity, allowing eligible individuals to secure financing without the burden of a down payment and at competitive interest rates. Yet, we know that the process is not without its hurdles; understanding the specific eligibility criteria and application steps is crucial for success.

So, how can veterans leverage these benefits while overcoming potential obstacles on their journey to land ownership? We’re here to support you every step of the way.

Define VA Loans for Land Purchases

Navigating VA financing options for property acquisitions can feel overwhelming, but we’re here to support you every step of the way. These specialized programs, backed by the U.S. Department of Veterans Affairs (VA), are designed for qualified veterans and service members looking to secure real estate for their future homes. One of the most appealing aspects of these credits is that they typically do not require a down payment and offer competitive interest rates, making them an attractive choice for many.

However, it’s essential to understand that for land is specifically intended for property acquisitions where the borrower plans to build a residence. This means that the financing must cover both the purchase of the property and the subsequent construction of the home, distinguishing it from traditional financing options.

Industry experts emphasize the importance of knowing the specific criteria associated with VA financing. For example, while the VA does not impose acreage limits, individual lenders might set their own restrictions to minimize appraisal challenges. Properties with extensive land can present higher risks for lenders, often due to longer selling times and potential foreclosure complications. Therefore, we recommend connecting with lenders who are well-versed in VA financing procedures; this can help you navigate these complexities with confidence.

At F5 Mortgage, we understand how vital it is to find the right financing solution. That’s why we offer a variety of refinancing options, including FHA, VA, USDA, and conventional loans, tailored to meet your unique needs. VA loan for land provides a remarkable opportunity for former military personnel and service members to build their dream homes, as long as they meet the necessary criteria and understand the obligations involved.

Outline Eligibility Requirements for VA Loans

Navigating the process of qualifying for a VA loan for land can feel daunting, but understanding the eligibility criteria can help you move forward with confidence. Here’s what you need to know:

- Service Requirements: To access these benefits, you must have served in the active military, naval, or air service and been discharged under conditions other than dishonorable. This ensures that those who have fulfilled their service obligations can benefit from this program.

- Certificate of Eligibility (COE): Obtaining a COE is a crucial step in verifying your eligibility based on your service history. You can easily through the VA’s website or by collaborating with a VA-approved lender. Recent statistics show that about 90% of veterans successfully secure their COE, highlighting the efficiency of the VA program in promoting homeownership.

- Credit and Income Standards: While the VA does not set a minimum credit score, most lenders prefer a score of at least 620. It’s important to demonstrate sufficient income to cover loan payments and meet the lender’s debt-to-income ratio requirements, ensuring you can manage your financial obligations.

- Intended Use: The property you wish to purchase must be intended for residential purposes, with plans to construct a home within a reasonable timeframe. This requirement aligns with the VA’s mission to assist former service members in achieving homeownership.

In light of recent legislative actions aimed at broadening VA financing eligibility, including initiatives like the PATRIOTlink pilot program designed to ease resource navigation for veterans, understanding these eligibility criteria is vital. We know how challenging this can be, but this knowledge empowers you to navigate the process with confidence and clarity.

Explain the Application Process for VA Loans

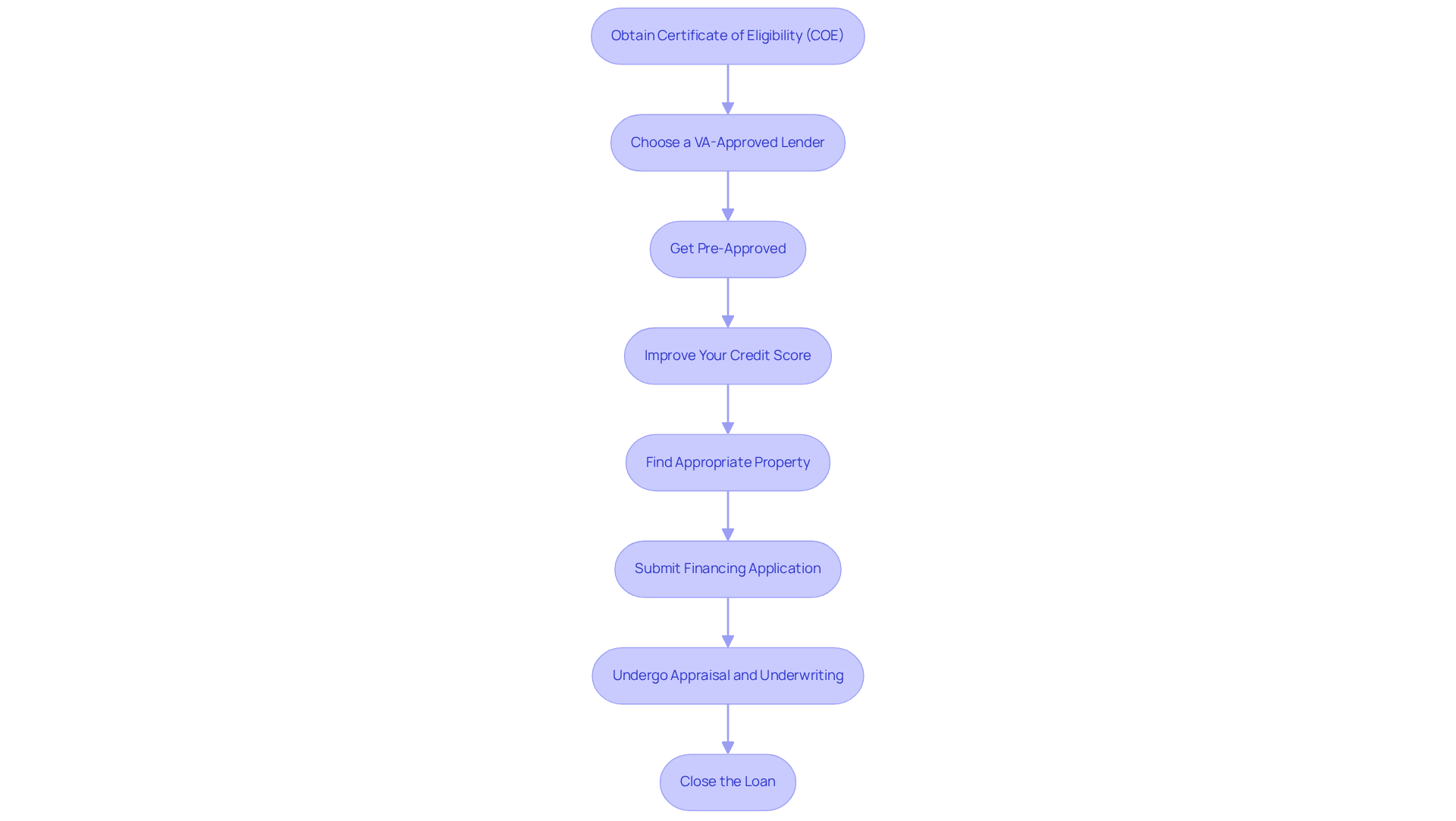

Applying for a VA loan for land purchases can feel overwhelming, but understanding the essential steps can make the process smoother and more manageable:

- Obtain Your Certificate of Eligibility (COE): Start by applying for your COE online through the VA’s website or with a paper application. This important document confirms your eligibility for VA benefits, providing a solid foundation for your journey.

- Choose a VA-Approved Lender: Selecting a lender experienced in VA financing is crucial. Their expertise will guide you through the process, helping you understand your options and empowering you to make informed decisions.

- Get Pre-Approved: Before diving into your land search, securing a pre-approval is a wise step. This not only clarifies your budget but also strengthens your position when making an offer. Sellers often prefer buyers who are pre-approved, and statistics show that pre-approved borrowers have a significantly higher success rate in securing loans.

- Improve Your Credit Score: Enhancing your mortgage opportunities starts with checking your credit report for errors. By paying down existing debts, you can lower your debt-to-income ratio. Additionally, using credit wisely—avoiding large purchases and making timely payments—will further boost your score.

- Find Appropriate Property: Look for a site that meets VA requirements and is designated for residential use. It’s essential to ensure the property is suitable for constructing a residence, as this is a key aspect of the approval process.

- Submit Your Financing Application: Once you’ve found the right property, submit your financing application along with necessary documentation, including your COE, income verification, and credit information. This comprehensive submission is vital for a smooth application process.

- Undergo Appraisal and Underwriting: Your lender will request an appraisal to evaluate the property’s value and ensure it meets VA standards. At the same time, the underwriting process will assess your financial situation and the viability of the financing. Effective communication with your lender during this phase is essential to avoid delays.

- Close the Loan: If your application is approved, you’ll move on to the closing phase. This involves signing the financing documents and completing the purchase, allowing you to proceed with your land acquisition.

Understanding these steps is crucial for a for land. Remember, collaborating with experienced lenders can greatly simplify the process, ensuring you navigate the intricacies of VA financing with confidence. As Chris Birk, Vice President of Mortgage Insight, emphasizes, finding a lender skilled in VA financing is key to optimizing your advantages. We know how challenging this can be, and we’re here to support you every step of the way.

Highlight Benefits of VA Loans for Land

VA loans for land purchases provide several significant benefits, particularly when arranged by F5 Mortgage, a company committed to transforming the mortgage experience through transparency and technology.

- No Down Payment: We know how challenging it can be to gather funds for a home. One of the most attractive features of a VA loan for land is that they typically do not require a down payment, making it easier for veterans and service members to finance their purchase.

- Competitive Interest Rates: Imagine saving money over the life of your loan. VA financing frequently offers reduced interest rates compared to traditional mortgages, potentially resulting in significant savings throughout the duration of the agreement.

- No Private Mortgage Insurance (PMI): We understand that every dollar counts. Unlike many traditional financing options, VA mortgages do not require PMI, which can further lower monthly payments.

- Flexible Credit Requirements: We’re here to support you every step of the way. The VA does not impose strict credit score requirements, allowing more veterans to qualify for financing.

- Streamlined Process: Navigating the mortgage process can feel overwhelming. The VA financing procedure is designed to be straightforward, with dedicated resources available to assist borrowers throughout their journey. F5 Mortgage enhances this experience by providing personal, no-pressure service, avoiding hard sales tactics that can intimidate borrowers.

- Capability to : Why juggle multiple loans? A VA loan for land enables borrowers to finance both the acquisition of property and the construction of a residence in a single financing option, streamlining the financial process and minimizing the necessity for several mortgages.

- Important Conditions: It is crucial to note that VA loans do not issue land-only loans by themselves; properties must have proper drainage and street access for cars or pedestrians. Additionally, if the property is located in a FEMA Special Flood Hazard Area, flood insurance is required.

These advantages collectively empower former service members to make informed choices regarding land ownership and construction, ultimately aiding their long-term financial objectives. With a customer satisfaction rate of 94%, F5 Mortgage is ready to assist veterans in navigating these opportunities, ensuring a stress-free and competitive mortgage experience. Testimonials from satisfied clients highlight the effectiveness of F5 Mortgage’s services, reinforcing their commitment to client empowerment and exceptional service.

Conclusion

Navigating the complexities of VA loans for land purchases presents a unique opportunity for veterans and service members to secure property for their future homes. We understand how challenging this process can be, and knowing the eligibility requirements, application process, and benefits associated with these loans is essential for making informed decisions. This knowledge helps maximize the advantages of this financing option.

Key insights highlight the importance of having a Certificate of Eligibility and the necessity of choosing a knowledgeable lender. A streamlined application process can significantly ease the journey toward homeownership. The benefits of VA loans—such as no down payment, competitive interest rates, and the ability to finance both land and construction in one package—underline the value these loans provide to those who have served.

Ultimately, leveraging the benefits of VA loans for land acquisition empowers veterans to achieve their dream of homeownership. It also reinforces our commitment to supporting those who have dedicated their lives to serving the nation. By staying informed and utilizing available resources, veterans can confidently navigate the path to owning land and building their future. We’re here to support you every step of the way.

Frequently Asked Questions

What are VA loans for land purchases?

VA loans for land purchases are specialized financing options backed by the U.S. Department of Veterans Affairs, designed for qualified veterans and service members looking to secure real estate for future homes. They typically do not require a down payment and offer competitive interest rates.

What is the primary purpose of a VA loan for land?

A VA loan for land is intended for property acquisitions where the borrower plans to build a residence. The financing must cover both the purchase of the property and the subsequent construction of the home.

Are there any acreage limits for VA loans for land?

The VA does not impose acreage limits for land purchases; however, individual lenders may set their own restrictions to minimize appraisal challenges.

Why might lenders impose restrictions on land acreage for VA loans?

Lenders may impose restrictions on land acreage to mitigate risks associated with properties that have extensive land, which can lead to longer selling times and potential foreclosure complications.

How can I find the right lender for a VA loan for land?

It is recommended to connect with lenders who are well-versed in VA financing procedures to help navigate the complexities involved in securing a VA loan for land.

What other financing options does F5 Mortgage offer?

F5 Mortgage offers a variety of refinancing options, including FHA, VA, USDA, and conventional loans, tailored to meet unique needs.