Overview

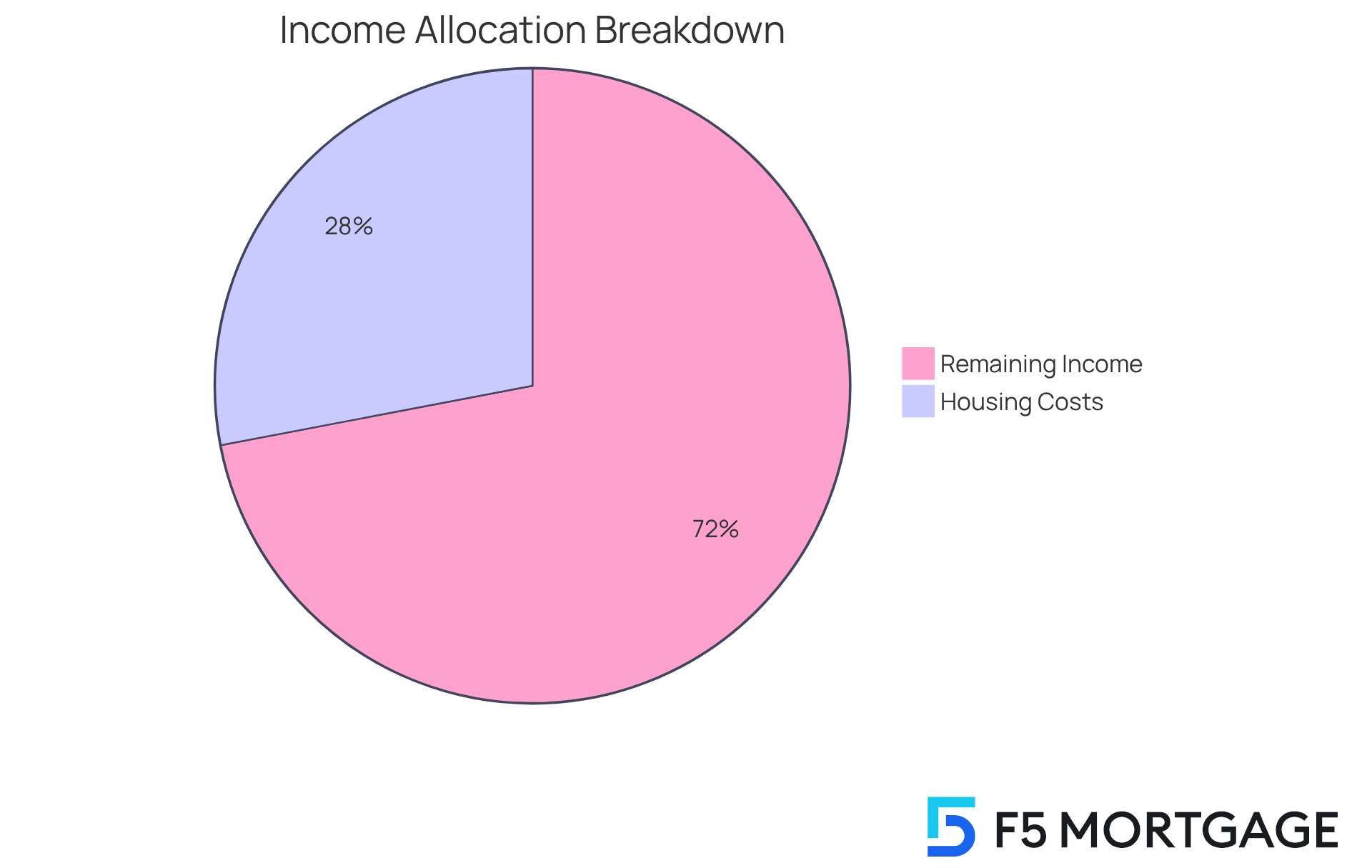

Understanding the front end ratio can be a game changer in your mortgage journey. This crucial metric shows how much of your gross monthly income is dedicated to housing costs. Ideally, keeping this ratio under 28% can enhance your mortgage eligibility. We know how challenging this can be, and that’s why it’s important to grasp this concept fully.

A lower front end ratio not only reflects manageable living expenses but also opens the door to favorable loan terms. Imagine the peace of mind that comes from knowing your housing costs are well within reach. This article provides a simple calculation method to help you assess your financial health effectively, empowering you to make informed decisions.

As you navigate the mortgage process, remember that we’re here to support you every step of the way. By understanding and managing your front end ratio, you can take significant strides toward securing a mortgage that fits your family’s needs.

Introduction

Understanding the nuances of mortgage financing can be overwhelming, and we know how challenging this can be. One critical metric stands out as a cornerstone of financial health: the front end ratio. This essential figure not only reflects how much of a borrower’s income is devoted to housing costs but also serves as a key indicator of their mortgage eligibility and potential loan terms.

However, many lenders advocate for a front end ratio below 28%. This guideline can feel restrictive, but it’s important to remember that there are ways to navigate these complexities. By understanding your options and seeking favorable financing, you can find a path that works for you and your family.

We’re here to support you every step of the way as you explore your mortgage possibilities.

Define the Front-End Ratio: A Key Metric in Mortgage Financing

Understanding the front end ratio, which reflects living expenses, is vital for anyone navigating the mortgage process. This important financial indicator, the front end ratio, reveals how much of your gross monthly income goes toward housing costs, including mortgage payments, property taxes, homeowners insurance, and mortgage insurance premiums. In 2025, many lenders recommend maintaining a front end ratio that keeps this expense under 28%, meaning that no more than 28% of your gross income should be allocated to these essential costs. We know how challenging this can be, but understanding the front end ratio of this initial expense can significantly impact your mortgage eligibility and the terms you may receive.

Consider this real-world scenario: if your gross monthly income is $5,000, it’s ideal to keep your living expenses below $1,400 to ensure your front end ratio stays within the 28% guideline. However, many lenders may still approve loans even if your front end ratio exceeds this threshold, especially if you can demonstrate strong financial stability through other means. This flexibility can be reassuring as you explore your options.

In 2025, a significant number of lenders continue to prefer a debt-to-income ratio below 28%. This guideline not only reflects your ability to manage housing expenses but also ensures that your front end ratio is aligned with your overall financial health. Understanding and managing the front end ratio is crucial for anyone aiming to successfully secure a mortgage. We’re here to every step of the way in this journey.

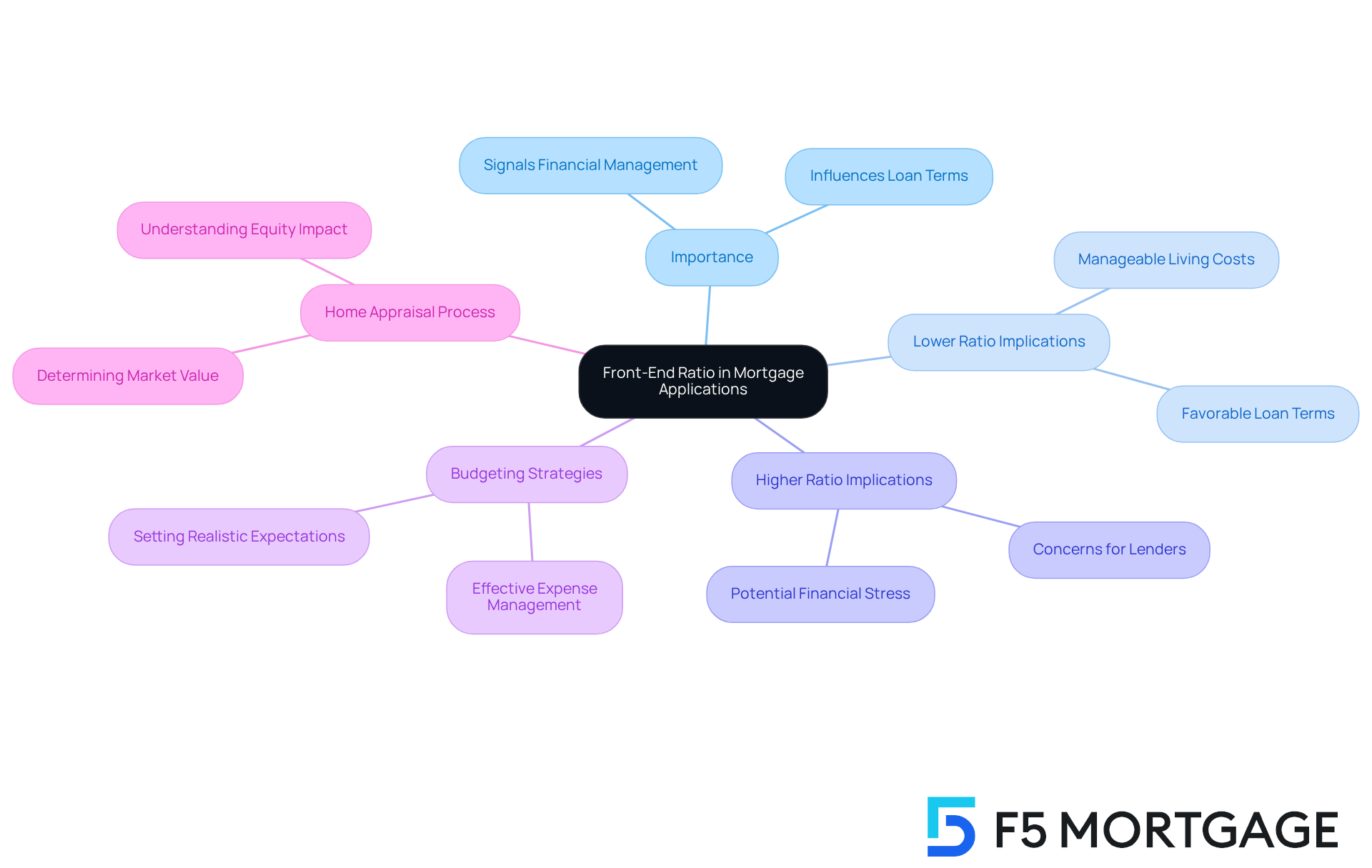

Explore the Importance of the Front-End Ratio in Mortgage Applications

Understanding the initial payment proportion is crucial as you navigate your mortgage application. This figure signals your ability to manage housing expenses relative to your income. A lower front end ratio suggests that you maintain a manageable level of living costs, which can lead to more favorable loan terms and interest rates. Conversely, a higher proportion may raise concerns for lenders, hinting at potential financial stress.

We know how challenging this can be, and grasping this proportion can help you set realistic expectations for your mortgage journey. It encourages effective budgeting for your living expenses, which is essential for your peace of mind. When comparing lenders, consider working with F5 Mortgage, where we’re committed to providing tailored to your unique needs.

Additionally, your lender will arrange for a home appraisal to determine the current market value of your property. This step is vital in understanding how much equity you possess, which can significantly impact your rates. By familiarizing yourself with the appraisal process, you can better strategize your mortgage approach, ensuring you make informed decisions every step of the way.

Calculate Your Front-End Ratio: Steps and Considerations

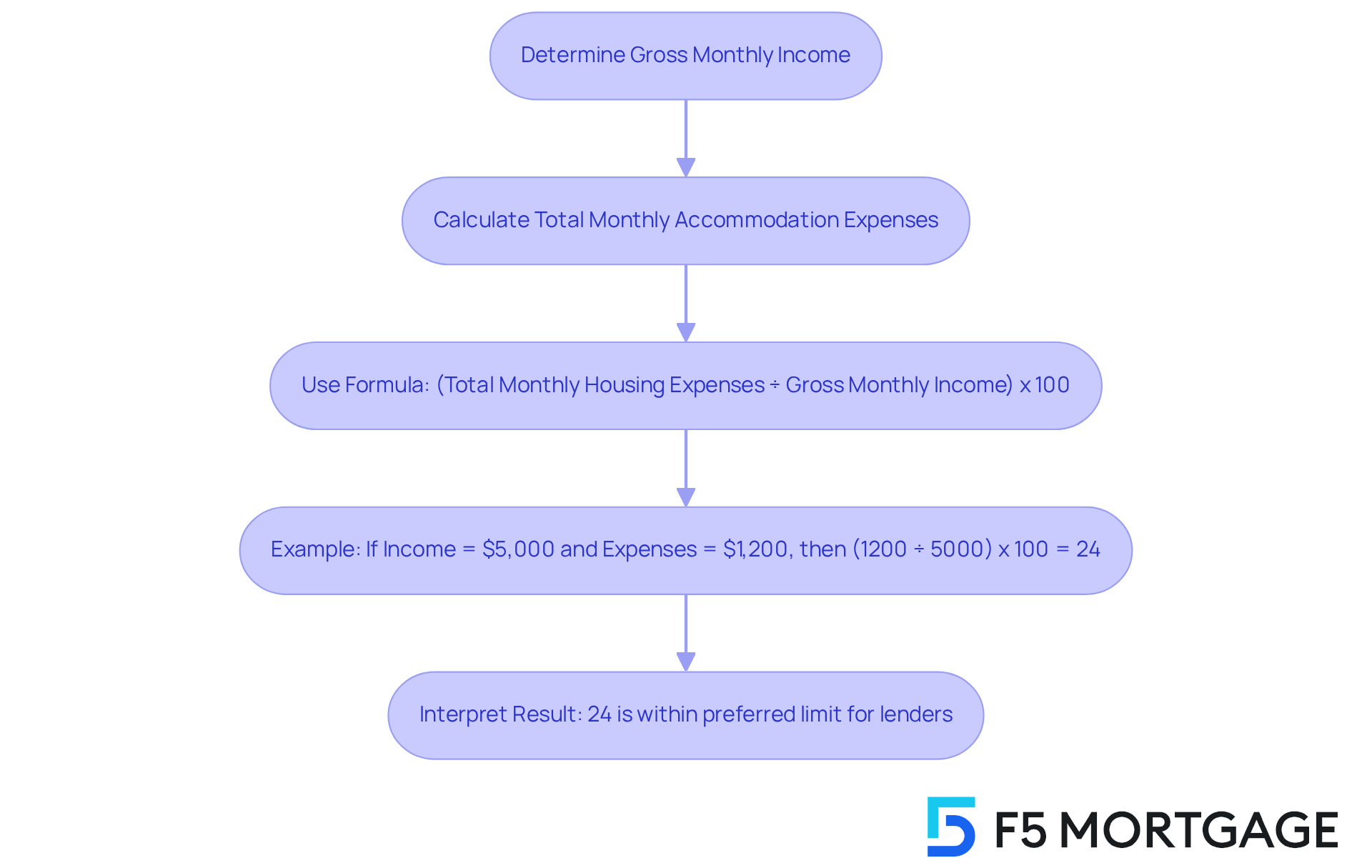

Determining your initial proportion can feel overwhelming, but we’re here to support you every step of the way. Start by following these steps:

- Determine your gross monthly income: This is your total income before taxes and deductions. Knowing this figure is essential as it lays the foundation for your calculations.

- Calculate your total monthly accommodation expenses: Include your expected mortgage payment, property taxes, homeowners insurance, and any mortgage insurance. This step is crucial in .

The front end ratio is an important metric in evaluating financial health. Use the formula: the front end ratio is calculated as (Total Monthly Housing Expenses ÷ Gross Monthly Income) x 100. For instance, if your total monthly earnings are $5,000 and your overall accommodation costs are $1,200, your initial calculation would be (1200 ÷ 5000) x 100 = 24%.

This calculation indicates that 24% of your income is designated for accommodation expenses. This percentage is within the preferred limit for most lenders, which can give you peace of mind as you navigate this process. Remember, we know how challenging this can be, but taking these steps one at a time can empower you to make informed decisions.

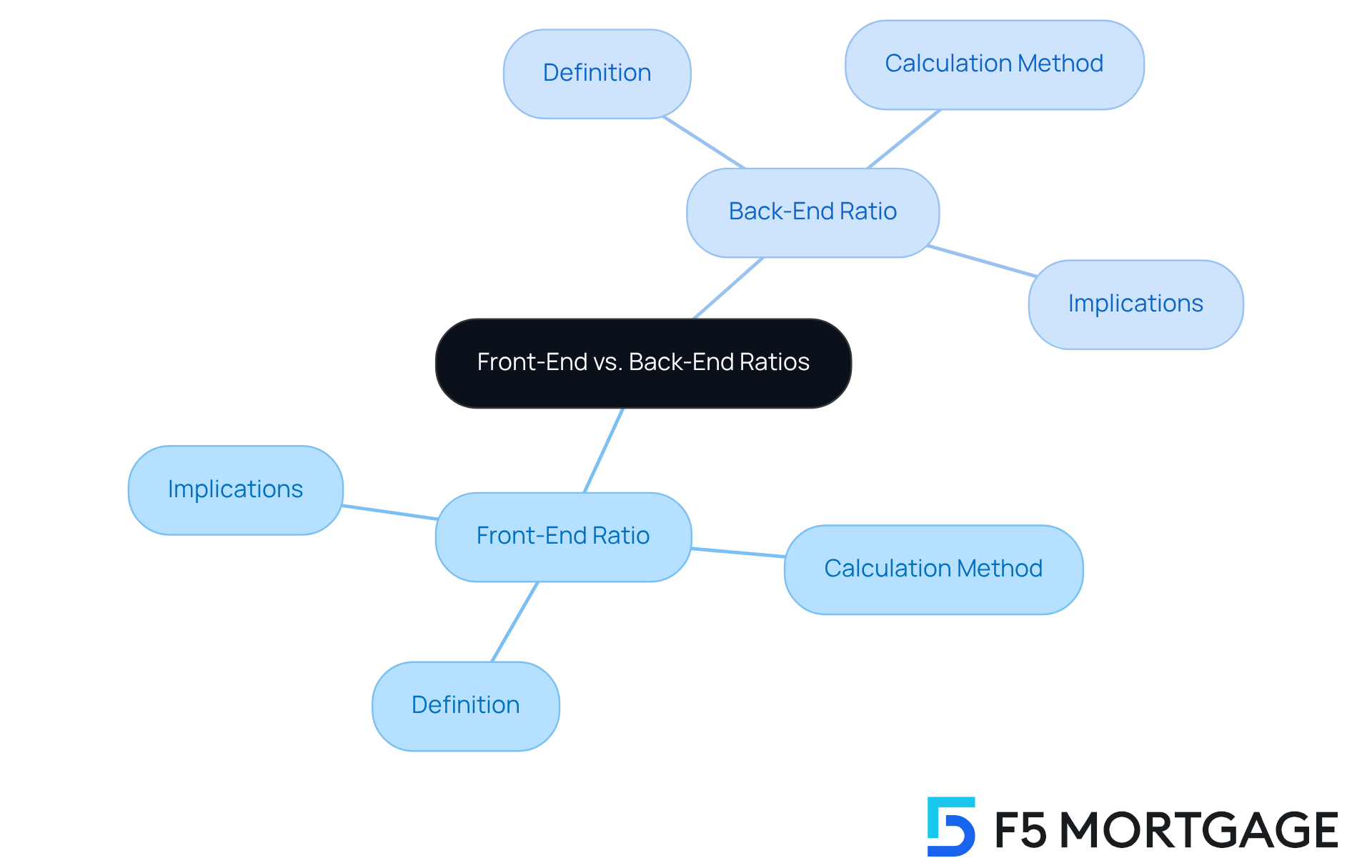

Differentiate Between Front-End and Back-End Ratios: Understanding Their Roles

Understanding your financial landscape is crucial, especially when it comes to housing expenses and overall debt. While the front end ratio focuses solely on housing costs, the calculation for the back end takes into account all —this includes credit card payments, car loans, and other loans. It’s important to know that the back-end proportion is calculated by dividing total monthly debt payments by your gross monthly income. Generally, lenders prefer a back-end proportion of no more than 36%.

We know how challenging this can be, but grasping both metrics is essential for anyone seeking a loan. They provide a complete perspective on your financial well-being. For instance, an individual might have a low front end ratio while maintaining a high back-end ratio, which could indicate potential financial strain from other debts. This distinction is key; it helps lenders assess a borrower’s overall ability to manage debt effectively.

By understanding these concepts, you empower yourself to make informed decisions. We’re here to support you every step of the way as you navigate your financial journey.

Conclusion

Understanding the front end ratio is essential for anyone looking to secure a mortgage successfully. We know how challenging this can be, and this critical metric not only reflects your housing expenses relative to your income but also plays a significant role in determining your mortgage eligibility and the terms you may receive. By keeping your front end ratio ideally below 28%, you position yourself favorably in the eyes of lenders. This can lead to better loan options and peace of mind throughout your mortgage journey.

The article emphasizes several key points, including:

- How to calculate the front end ratio

- Its implications for budgeting

- The distinction between front end and back end ratios

By following a straightforward calculation process, you can assess your financial health and make informed decisions that align with your long-term goals. Additionally, understanding how lenders evaluate these ratios can provide clarity and confidence as you navigate the complexities of mortgage applications.

Ultimately, grasping the importance of the front end ratio is not just about meeting lender requirements; it’s about empowering yourself to achieve financial stability and security. As you embark on this journey, consider leveraging the insights shared here to establish a solid foundation for your mortgage application. Taking proactive steps to manage your housing expenses can lead to not only successful approval but also a more sustainable financial future.

Frequently Asked Questions

What is the front-end ratio in mortgage financing?

The front-end ratio is a key financial indicator that reflects how much of your gross monthly income goes toward housing costs, including mortgage payments, property taxes, homeowners insurance, and mortgage insurance premiums.

What is the recommended front-end ratio for lenders in 2025?

In 2025, many lenders recommend maintaining a front-end ratio that keeps housing expenses under 28% of your gross monthly income.

How does the front-end ratio impact mortgage eligibility?

Understanding the front-end ratio can significantly impact your mortgage eligibility and the terms you may receive, as it reflects your ability to manage housing expenses.

Can I still get approved for a mortgage if my front-end ratio exceeds 28%?

Yes, many lenders may still approve loans even if your front-end ratio exceeds 28%, especially if you can demonstrate strong financial stability through other means.

What is an example of calculating the front-end ratio?

For instance, if your gross monthly income is $5,000, it is ideal to keep your housing expenses below $1,400 to ensure your front-end ratio stays within the 28% guideline.

Why is managing the front-end ratio important?

Managing the front-end ratio is crucial for anyone aiming to secure a mortgage, as it ensures that your housing costs are aligned with your overall financial health.