Overview

We understand how challenging the journey to homeownership can be, especially when it comes to credit scores. The minimum credit score for FHA loan approval is typically set at 580, which allows borrowers to access a low down payment of just 3.5%. For those with scores between 500 and 579, there’s still hope; you can qualify, but a larger down payment of 10% will be required.

These flexible credit requirements make FHA loans particularly appealing for:

- First-time homebuyers

- Individuals who have faced financial difficulties in the past

We’re here to support you every step of the way, helping you achieve your dream of homeownership despite having lower credit scores. Remember, you’re not alone in this process; many families have successfully navigated these challenges and found their way home.

Introduction

Navigating the world of home financing can feel overwhelming, especially for first-time buyers or those facing credit challenges. We understand how daunting this process can be. The Federal Housing Administration (FHA) stands as a beacon of hope, offering flexible loan options that cater to a variety of financial situations. In this article, we will explore the minimum credit score required for FHA loan approval, showing how even those with lower scores can still pursue their dream of homeownership.

However, it’s important to consider the hidden costs and challenges that may accompany these seemingly accessible loans. What can potential borrowers do to prepare themselves for success? By understanding the landscape and taking proactive steps, you can secure the most favorable terms possible. We’re here to support you every step of the way.

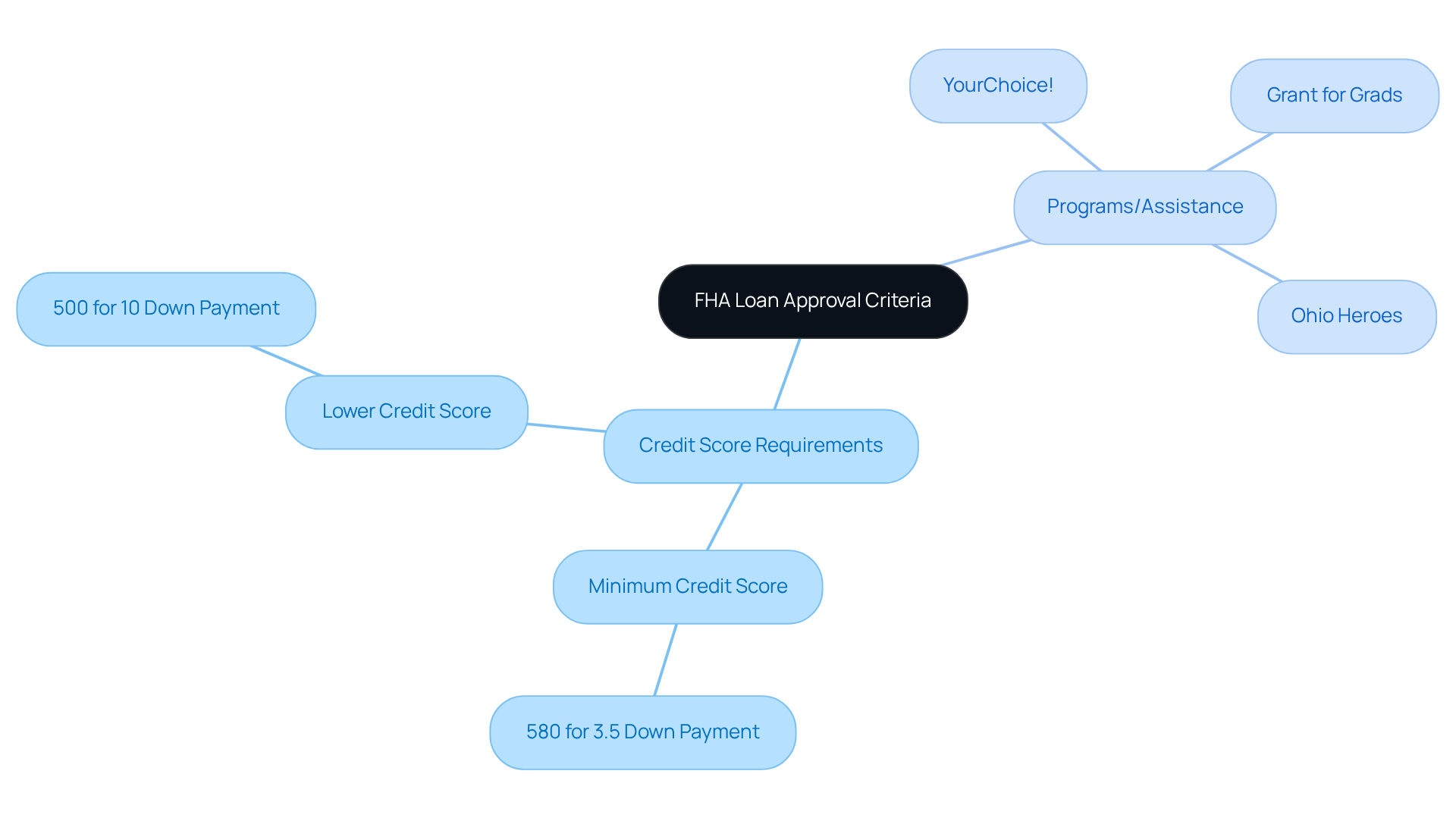

Define Minimum Credit Score for FHA Loan Approval

If you’re considering an FHA mortgage, it’s important to know that the minimum credit score is usually set at 580. This allows you to benefit from a low down payment of just 3.5%. However, even if your score is as low as 500, which is below the minimum credit score for FHA loan, you can still qualify for an FHA mortgage, but it will require a higher down payment of 10%. This flexibility in credit requirements makes FHA mortgages particularly appealing for first-time homebuyers and those who may have faced financial difficulties in the past.

The FHA is committed to broadening homeownership opportunities for many families, ensuring that more individuals can access affordable housing options. In 2025, this initiative continues to thrive, supporting those who might have struggled financially before. With the ability to qualify with lower credit scores and various down payment assistance programs available in Ohio, FHA options become a realistic solution for many aspiring homeowners.

Programs like:

- YourChoice!

- Grant for Grads

- Ohio Heroes

provide crucial financial support, making the dream of homeownership more attainable. Partnering with a knowledgeable lender, such as F5 Mortgage, can significantly enhance your chances of securing down payment assistance and navigating the application process with ease.

It’s essential to be aware, though, that FHA mortgages come with ongoing mortgage insurance premiums (MIP), which can increase your overall financing costs. While FHA financing offers flexibility, it may also result in higher expenses compared to traditional options due to these insurance premiums. Therefore, it’s vital to weigh the benefits against the costs when considering FHA financing. We understand how challenging this can be, and we’re here to support you every step of the way.

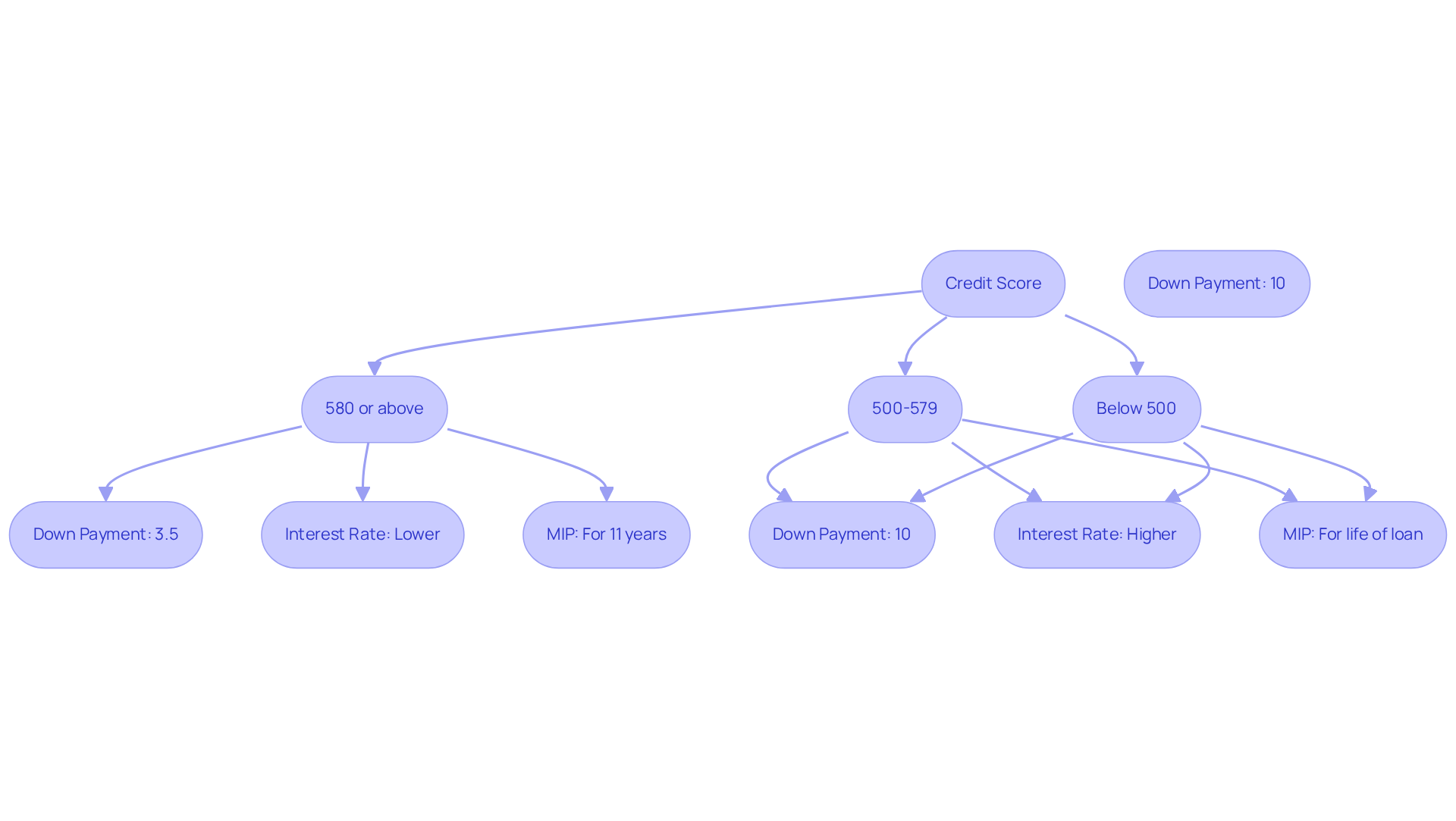

Explain the Importance of Credit Scores in FHA Loans

Credit ratings play a crucial role in the FHA financing approval process, as they help determine if a borrower meets the minimum credit score for FHA loan, indicating their creditworthiness and repayment ability. We know how challenging navigating this can be, and an elevated financial rating greatly improves the likelihood of loan approval. It also enables borrowers to obtain more advantageous conditions, such as lower interest rates and diminished down payment requirements. For instance, borrowers with a rating of 580 or above can qualify for a minimum down payment of only 3.5%. In contrast, those with ratings between 500 and 579 need to provide at least 10%. This difference can lead to substantial savings on upfront costs.

On the other hand, reduced ratings can lead to elevated interest rates and extra expenses, like higher mortgage insurance premiums (MIP). FHA loans require MIP for the life of the loan if the down payment is less than 10%. For example, borrowers with outstanding ratings (above 740) generally qualify for the most affordable private mortgage insurance (PMI) rates. Meanwhile, those with average or low ratings (below 670) encounter considerably higher premiums. This disparity highlights the significance of maintaining a healthy financial profile.

In 2023, 82% of FHA purchase financing was obtained by first-time buyers, many of whom benefited from the program’s adaptable qualification standards. The FHA’s policies have developed to support borrowers with lesser financial ratings, making homeownership more attainable. Understanding how borrowing ratings affect financing conditions is essential for prospective borrowers, as it directly impacts their financial responsibilities and overall affordability.

We want to emphasize that enhancing an individual’s rating can help meet the minimum credit score for FHA loan, leading to more favorable mortgage conditions such as decreased interest rates and lower total borrowing expenses. Therefore, potential FHA financing applicants should prioritize financial management strategies to improve their monetary profiles and attain the minimum credit score for FHA loan eligibility. This preparation ensures they are well-positioned to obtain the most favorable mortgage conditions. Furthermore, approaches detailed in the case study ‘Maximizing FHA Mortgage Rates’ can offer practical applications for borrowers seeking to enhance their ratings and secure advantageous loan terms.

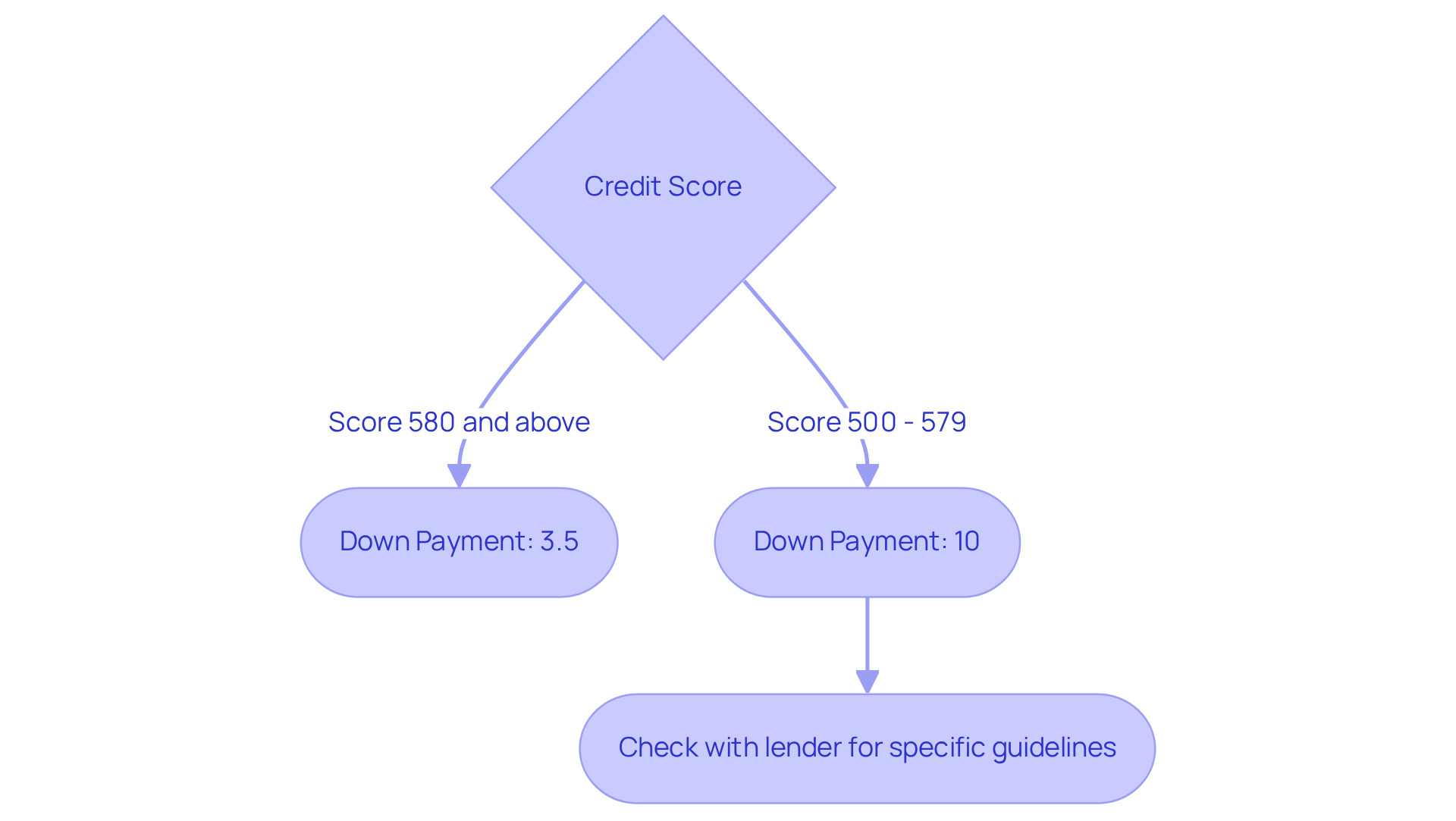

Outline FHA Credit Score Requirements and Guidelines

FHA eligibility criteria for 2025 are designed to promote homeownership for a diverse group of borrowers, and we understand how important this is for many families. To qualify for a down payment of just 3.5%, applicants need to meet the minimum credit score for FHA loan of 580. If your score falls between 500 and 579, don’t worry—FHA mortgages are still available, but they require a larger down payment of 10%. It’s essential to remember that individual lenders may have stricter criteria, so we encourage you to reach out to your chosen lender for specific guidelines.

Maintaining a stable income and a debt-to-income ratio of 43% or less is crucial for improving your chances of approval. The FHA guidelines emphasize the importance of a strong financial profile, which includes not only credit scores but also your payment history and overall financial behavior. With recent policy changes, many lenders have adjusted the minimum credit score for FHA loan requirements, potentially allowing more families to qualify for FHA financing.

In practice, borrowers with various credit scores have successfully obtained FHA financing, demonstrating the program’s adaptability. For instance, individuals with a score of 580 or above can take advantage of reduced down payment options, while those with lower scores still have pathways to homeownership, albeit with higher initial costs. This accessibility makes FHA financing a vital resource for first-time homebuyers and those with less-than-ideal financial histories. We know how challenging this can be, but we’re here to support you every step of the way.

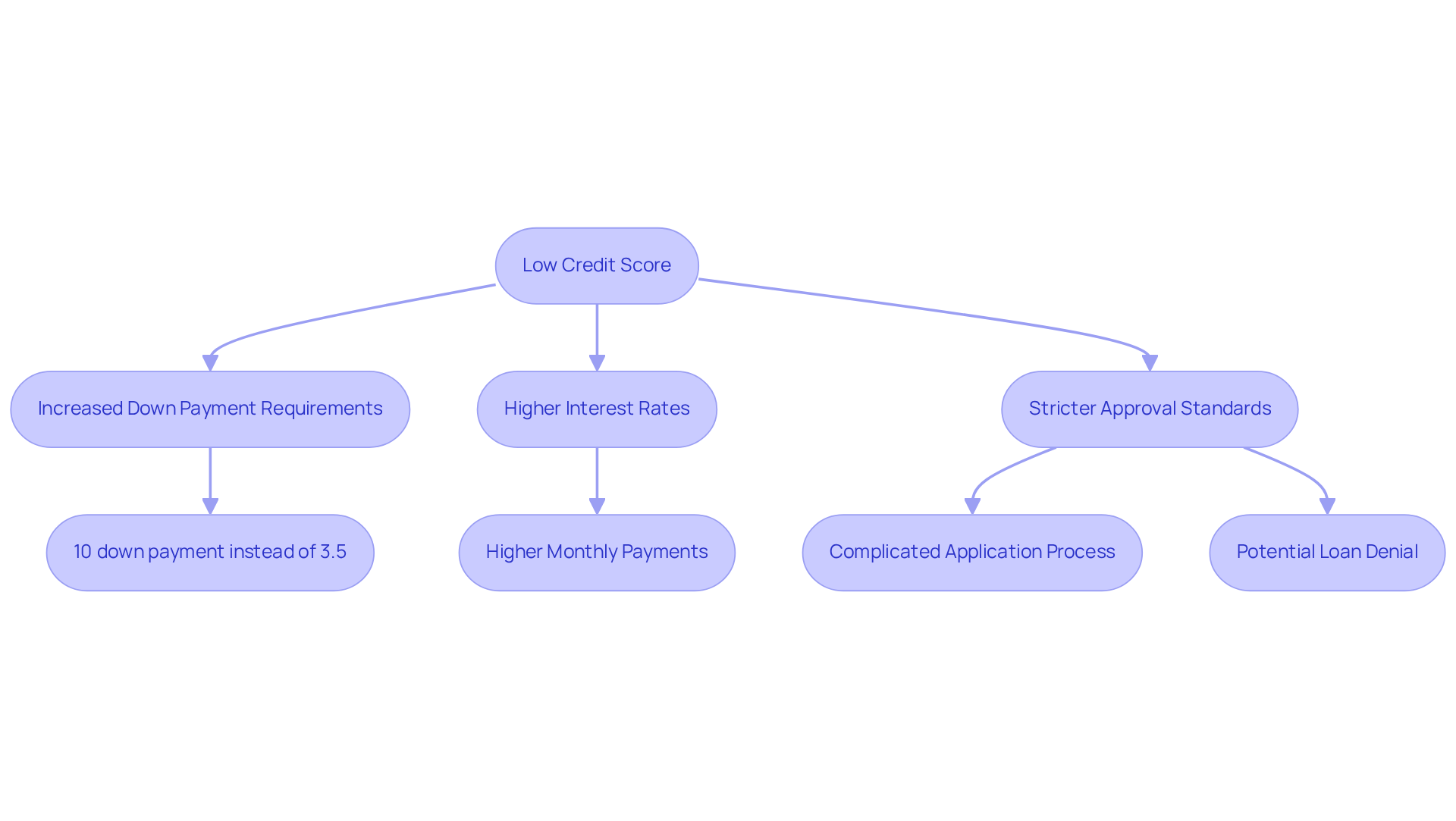

Discuss Implications of Low Credit Scores for FHA Loan Applicants

Poor financial ratings can significantly impact FHA mortgage applicants in several ways. We know how challenging this can be. Borrowers with ratings below 580 often face increased down payment requirements, typically needing to provide 10% instead of the standard 3.5%. This higher barrier can deter many first-time homebuyers from pursuing their dreams of homeownership. Moreover, reduced ratings frequently lead to higher interest rates, which can considerably increase the total cost of the loan. As a result, borrowers may encounter higher monthly payments, creating a greater financial burden over time.

Additionally, applicants with poor financial ratings may struggle to obtain approval from lenders, as many enforce stricter standards than the minimum credit score for FHA loan requirements. For instance, while the FHA allows borrowers with ratings as low as 500 to qualify, certain lenders may impose overlays that require higher ratings or additional documentation. This discrepancy can complicate the application process for those already facing financial difficulties.

Real-life scenarios illustrate these challenges effectively. For example, individuals who have gone through bankruptcy may find FHA financing more accessible than traditional options. Yet, they must still meet specific requirements, such as a waiting period and proof of restored financial standing. Furthermore, consistent, timely payments can positively influence ratings, enhancing the chances of mortgage approval. Therefore, understanding the implications of credit scores, particularly the minimum credit score for FHA loan, is crucial for FHA loan applicants, as it directly affects their ability to secure financing and the terms of their loans. We’re here to support you every step of the way.

Conclusion

Understanding the minimum credit score for FHA loan approval is essential for prospective homebuyers who are navigating the complexities of the mortgage landscape. We know how challenging this can be, but with the FHA’s commitment to making homeownership accessible, individuals can qualify for loans even with less-than-perfect credit. This flexibility empowers many to pursue their dreams of owning a home, especially first-time buyers who may have faced financial hurdles in the past.

This article highlights key aspects of FHA loan credit score requirements:

- A score of 580 allows for a low down payment of 3.5%.

- Scores between 500 and 579 necessitate a higher down payment of 10%.

It’s important to maintain a healthy credit profile, as higher scores can lead to lower interest rates and reduced overall borrowing costs. We also discuss the implications of low credit scores, including increased financial burdens and potential challenges in securing approval from lenders.

Ultimately, understanding the minimum credit score for FHA loan approval equips potential borrowers with the knowledge needed to navigate their options. It encourages proactive steps in improving financial health. By prioritizing credit management and exploring available assistance programs, aspiring homeowners can enhance their chances of securing favorable loan terms and making their homeownership dreams a reality. Embracing this journey with informed strategies can significantly impact financial futures, making the path to homeownership more attainable for many.

Frequently Asked Questions

What is the minimum credit score required for FHA loan approval?

The minimum credit score for FHA loan approval is usually set at 580, allowing for a low down payment of just 3.5%.

Can I qualify for an FHA mortgage with a credit score below 580?

Yes, you can qualify for an FHA mortgage with a credit score as low as 500, but it will require a higher down payment of 10%.

Who benefits from FHA mortgages?

FHA mortgages are particularly appealing for first-time homebuyers and individuals who may have faced financial difficulties in the past.

What initiatives does the FHA support to broaden homeownership opportunities?

The FHA is committed to broadening homeownership opportunities by providing access to affordable housing options and supporting individuals who may have struggled financially.

What down payment assistance programs are available in Ohio for FHA loans?

In Ohio, programs such as YourChoice!, Grant for Grads, and Ohio Heroes provide crucial financial support for down payments.

How can partnering with a knowledgeable lender help in securing an FHA loan?

Partnering with a knowledgeable lender, like F5 Mortgage, can enhance your chances of securing down payment assistance and help navigate the application process.

Are there any additional costs associated with FHA mortgages?

Yes, FHA mortgages come with ongoing mortgage insurance premiums (MIP), which can increase your overall financing costs.

What should I consider when evaluating FHA financing?

It’s vital to weigh the benefits of FHA financing against the costs, including higher expenses due to mortgage insurance premiums compared to traditional options.