Overview

Navigating the world of mortgage brokerage can feel overwhelming, but understanding its key concepts and services can make the borrowing process smoother for you and your family. Mortgage brokerages act as trusted intermediaries between borrowers and lenders, offering personalized consultations tailored to your unique situation. They provide access to a variety of loan options, ensuring you have choices that fit your needs.

We know how challenging this can be, and that’s why educational resources are also available to empower you. These resources help you make informed financial decisions, enhancing your overall borrowing experience. Remember, we’re here to support you every step of the way, guiding you through this important journey.

Introduction

Navigating the complex world of home financing can often feel like an uphill battle, especially for first-time buyers. We know how challenging this can be. Mortgage brokerages emerge as vital allies in this landscape, acting as intermediaries that connect borrowers with a diverse array of lenders to secure the best possible loan terms. As the industry evolves, we’re here to support you every step of the way.

Projections indicate that a significant majority of borrowers will seek the expertise of brokers. Therefore, understanding the unique services and advantages these professionals offer becomes essential.

What challenges do consumers face in the traditional lending process?

How can mortgage brokerages effectively address them?

These are important questions that can guide you toward a smoother home financing experience.

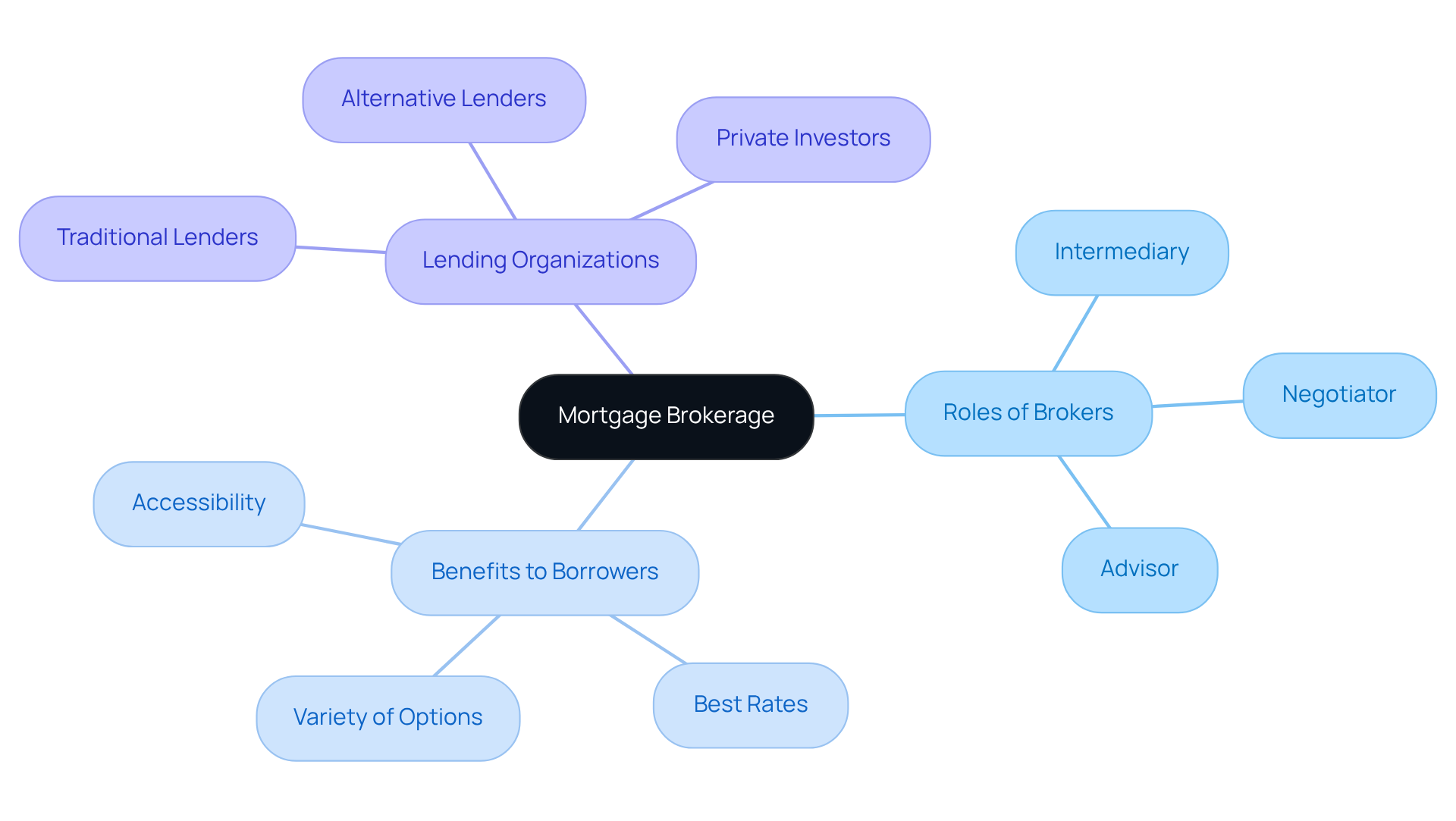

Defining Mortgage Brokerage: Core Concepts and Functions

Navigating the mortgage landscape can be overwhelming, but a mortgage brokerage provides a supportive path. Licensed experts step in as intermediaries, connecting borrowers like you with lenders ready to provide the necessary funds. Unlike traditional financial institutions, these don’t use their own resources; instead, they open doors to a variety of lending organizations tailored to your unique financial situation.

In fact, by 2025, it’s expected that around 70% of borrowers will turn to loan brokers, marking a significant shift away from relying solely on direct lenders. Brokers take the time to understand your financial profile, gather essential documentation, and negotiate with lenders on your behalf to secure the best rates and terms available.

This approach is not just about finding a loan; it’s about ensuring that families can discover options that truly meet their needs—whether you’re a first-time homebuyer or looking to refinance. By emphasizing accessibility to a diverse range of financial products, effective mortgage brokerage models enhance your borrowing experience and foster a more competitive lending environment.

Ultimately, this benefits you, the consumer, as it empowers you with choices. Remember, we know how challenging this process can be, and we’re here to support you every step of the way.

The Role of Mortgage Brokerages in Home Financing: Importance and Impact

Navigating the home financing process can feel overwhelming, and is here to help. They play a crucial role in simplifying the loan application and approval journey for borrowers, offering customized consultations that guide individuals through the complexities of financing options. Whether you’re considering fixed-rate loans, FHA loans, VA loans, or jumbo loans, brokerages are equipped to assist you.

By leveraging relationships with over two dozen top lenders, including those associated with F5 Mortgage, these brokerages can provide you with competitive rates and terms that may not be available through conventional banks. This intermediary role not only saves you time and effort but also empowers you with choices that align with your financial goals.

Additionally, brokerages frequently offer educational materials, such as F5 Mortgage’s comprehensive home buyer’s guides and refinancing details. These resources enhance your understanding of the lending process, ensuring you feel informed and supported. Research from Polygon Research shows that consumers working with independent brokers save an average of $10,662 over the duration of their financing, highlighting significant financial benefits.

F5 Mortgage stands out for its commitment to a hassle-free loan process, with most agreements finalizing in under three weeks. Their client-centered strategy connects you with leading realtors and secures the best financing options available. This dedication establishes brokerages as reliable allies in your journey toward homeownership, and we know how important that is for you. Remember, we’re here to support you every step of the way.

The Evolution of Mortgage Brokerages: A Historical Perspective

The development of loan brokerage services has undergone significant changes since their inception. Initially, home loan lending was largely confined to banks and financial institutions, which limited borrowers’ options and created a less competitive environment. However, as the housing market expanded and consumer demand for diverse funding alternatives increased, the role of loan advisors began to evolve. The 1980s and 1990s marked pivotal decades, characterized by deregulation and technological advancements that empowered brokers to connect with multiple lenders. This shift not only enhanced competition but also provided borrowers with a broader range of choices, fundamentally transforming the landscape of home financing.

Today, are essential to the home financing ecosystem. Companies like F5 Mortgage, founded by Ryan McCallister, are at the forefront of this transformation, leveraging technology to ensure highly competitive loan rates while offering a no-pressure, personalized service that prioritizes clients’ needs. F5 Mortgage’s commitment to transparency and ethical principles sets it apart, as it strives to educate borrowers and support them throughout the loan process.

The integration of advanced verification technologies has significantly reduced the time required for loan approvals, enabling agents to deliver quicker and more efficient services. Additionally, the rise of digital platforms has allowed agents to reach a wider audience, making the loan process more accessible than ever before. F5 Mortgage exemplifies this trend by offering exceptional wholesale lending options across various states, ensuring customers receive the best rates and service available.

As the industry continues to evolve, mortgage brokerage professionals remain vital in navigating the complexities of home financing, ensuring that clients receive tailored assistance and competitive rates that suit their unique financial situations. However, challenges such as high-interest rates and complicated paperwork still exist, highlighting the necessity for agents to maintain a client-focused approach that emphasizes education and support throughout the mortgage journey.

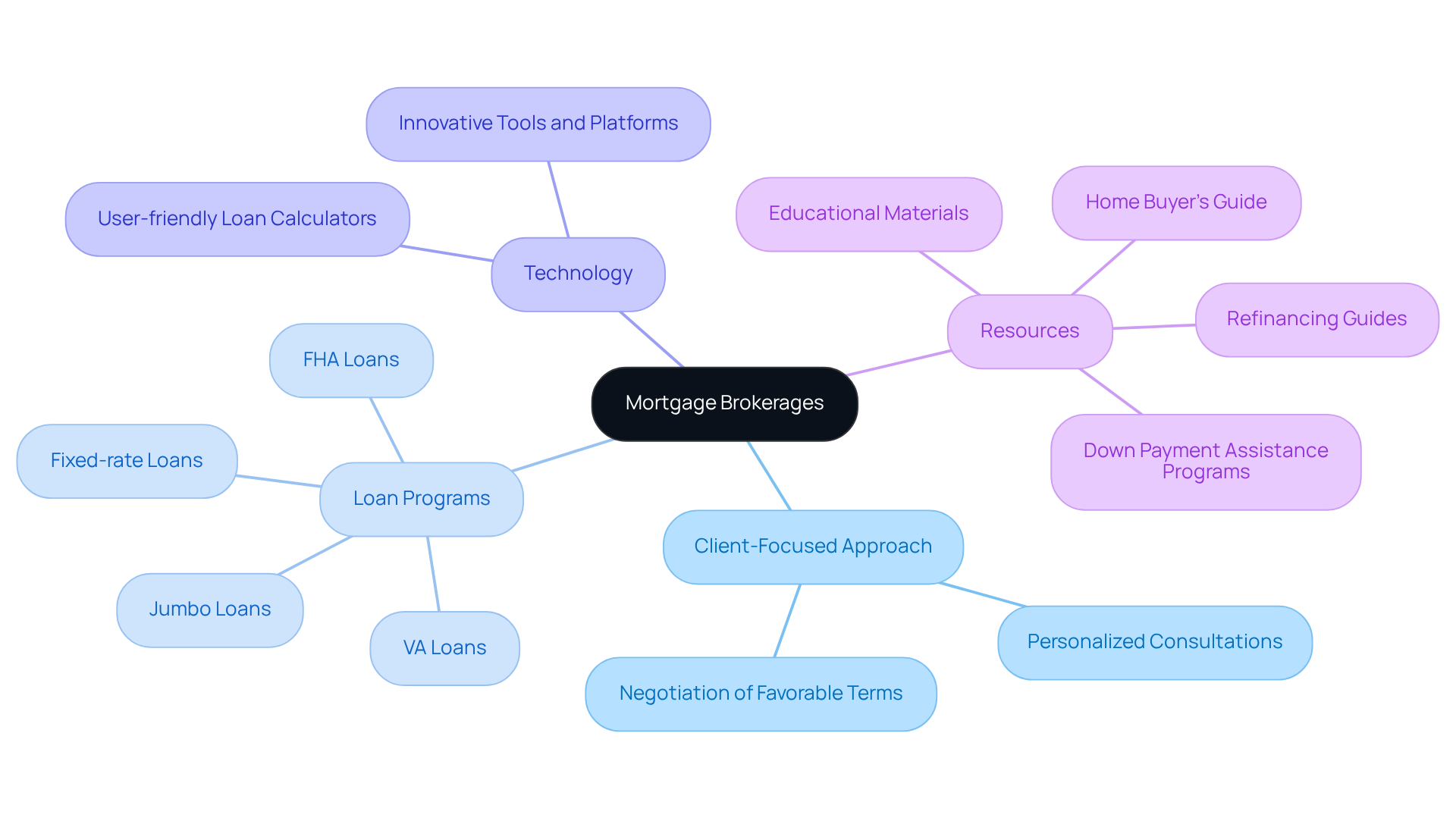

Key Characteristics and Services of Mortgage Brokerages

Mortgage brokerage firms stand out because they prioritize a client-focused approach and offer a diverse range of services. We understand how daunting the mortgage process can be, which is why are at the heart of what we do. These consultations are designed to address your unique needs, allowing brokers to negotiate favorable terms on your behalf.

As we look ahead to 2025, mortgage brokerage services will provide access to a wide variety of loan programs, including:

- Fixed-rate loans

- FHA loans

- VA loans

- Jumbo loans

This ensures that you have choices that align with your financial circumstances, giving you the flexibility you deserve.

Sophisticated technology plays a crucial role in enhancing your experience. For instance, user-friendly loan calculators can help you navigate your options effectively, making the process less overwhelming. We’re here to support you every step of the way.

Additionally, mortgage brokerages offer valuable resources such as down payment assistance programs and educational materials tailored to specific states. These tools empower you to make informed decisions, simplifying the mortgage process. Ultimately, this comprehensive service model not only eases your journey but also fosters confidence as you explore your financing options.

Conclusion

Navigating the complexities of mortgage brokerage can feel overwhelming, but it reveals a vital resource for borrowers seeking financial solutions tailored to their needs. We know how challenging this can be, and that’s why this article highlights how mortgage brokers serve as essential intermediaries. They connect clients with a diverse array of lenders while offering personalized support throughout the loan process. By prioritizing your experience and leveraging technology, brokers enhance accessibility to financing options, ultimately empowering homebuyers like you.

Key insights discussed include:

- The significant shift towards using mortgage brokers

- The historical evolution of the industry

- The comprehensive services they provide

From personalized consultations to access to competitive rates and educational resources, mortgage brokerages play a crucial role in simplifying your home financing journey. Furthermore, the financial benefits associated with working with brokers demonstrate their value in today’s lending landscape.

In conclusion, the importance of mortgage brokerages cannot be overstated. They not only facilitate access to essential financial products but also foster a more competitive lending environment that ultimately benefits you, the consumer. As the industry continues to evolve, embracing the support of a mortgage broker can lead to informed decisions and a smoother path to homeownership. Engaging with these professionals is a proactive step toward securing the best financing options available, ensuring that every borrower can find a solution that aligns with their financial goals.

Frequently Asked Questions

What is a mortgage brokerage?

A mortgage brokerage is a service that connects borrowers with lenders, acting as intermediaries to help find suitable loan options without using their own funds.

How do mortgage brokers assist borrowers?

Mortgage brokers assist borrowers by understanding their financial profiles, gathering necessary documentation, and negotiating with lenders to secure the best rates and terms available.

What is the expected trend in borrowing by 2025?

By 2025, it is expected that around 70% of borrowers will turn to loan brokers instead of relying solely on direct lenders.

Who can benefit from using a mortgage broker?

Both first-time homebuyers and individuals looking to refinance can benefit from using a mortgage broker, as they provide access to a variety of lending options tailored to individual needs.

What advantages do mortgage brokers provide in the lending environment?

Mortgage brokers enhance the borrowing experience by offering access to a diverse range of financial products, fostering a more competitive lending environment, and empowering consumers with choices.